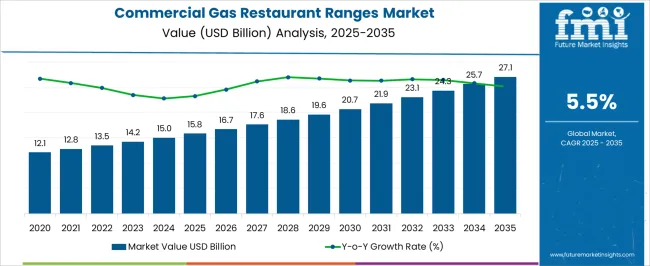

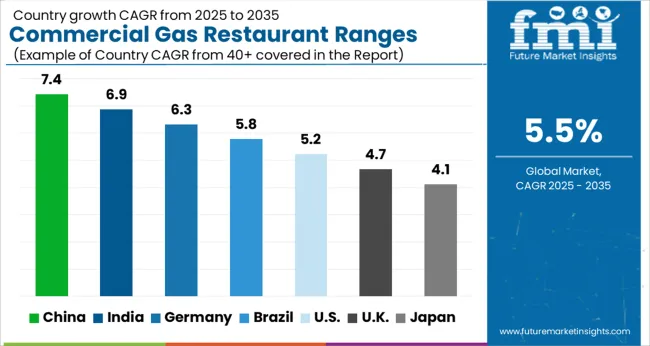

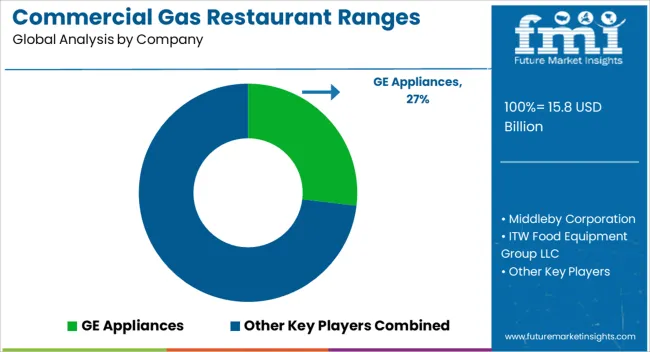

The Commercial Gas Restaurant Ranges Market is estimated to be valued at USD 15.8 billion in 2025 and is projected to reach USD 27.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Commercial Gas Restaurant Ranges Market Estimated Value in (2025 E) | USD 15.8 billion |

| Commercial Gas Restaurant Ranges Market Forecast Value in (2035 F) | USD 27.1 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The commercial gas restaurant ranges market is expanding steadily, supported by rising demand for efficient cooking equipment, energy savings, and the growing foodservice industry worldwide. Increasing investments in restaurants, hotels, and institutional kitchens have driven the need for high performance ranges that combine durability with consistent cooking results.

Regulatory focus on energy efficiency and safety compliance has encouraged adoption of modern gas based ranges that meet stringent operational standards. Advancements in burner technology and material durability have further enhanced product life cycles, reducing long term ownership costs for commercial users.

The outlook remains favorable as the hospitality industry continues to recover and expand globally, with operators prioritizing equipment that improves kitchen productivity while meeting environmental and cost saving benchmarks.

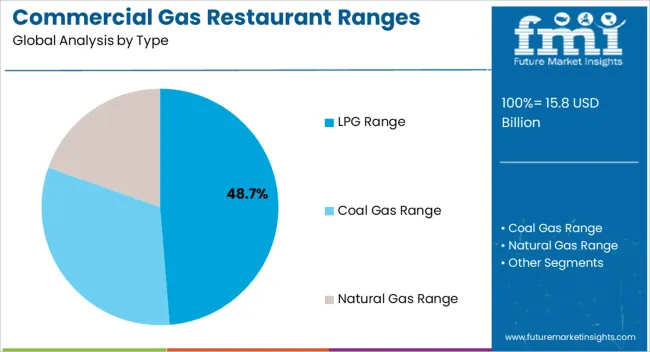

The LPG range segment is expected to represent 48.70% of total market revenue by 2025 within the type category, positioning it as the leading segment. This dominance is attributed to its availability in areas with limited piped gas infrastructure, flexibility in installation, and suitability for small to medium scale commercial kitchens.

LPG ranges provide strong flame control, efficient heating, and lower installation complexity, making them a preferred choice across diverse foodservice establishments. Their portability and adaptability to various kitchen layouts have further supported their adoption.

As restaurant operators seek reliable and cost effective cooking solutions, LPG ranges remain the dominant type within the commercial gas restaurant ranges market.

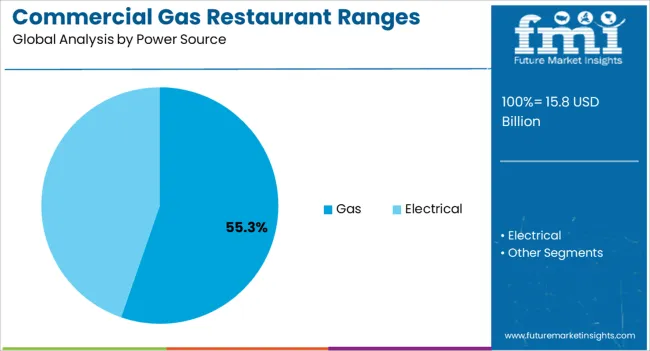

The gas power source segment is projected to account for 55.30% of total revenue by 2025 under the power source category, establishing itself as the leading option. Its growth is driven by the widespread availability of natural gas infrastructure, stable energy costs compared to electricity, and consistent performance in high volume cooking environments.

Gas powered ranges enable chefs to exercise precise temperature control, ensuring better cooking outcomes and operational efficiency. Reduced operational costs and long term energy savings have further motivated adoption in professional kitchens.

These advantages have reinforced the position of gas as the most widely adopted power source for commercial restaurant ranges.

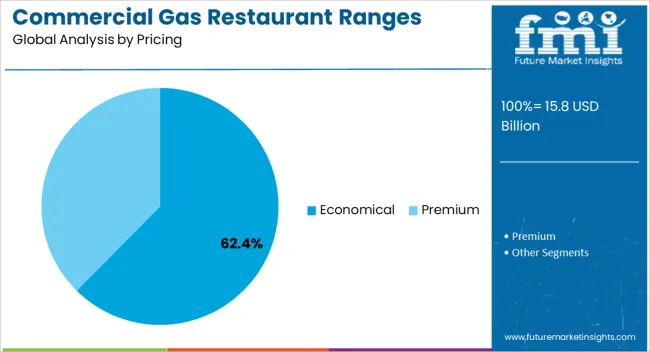

The economical pricing segment is anticipated to hold 62.40% of overall market revenue by 2025 within the pricing category, positioning it as the largest segment. Strong demand for cost effective equipment in small and mid sized restaurants, cafes, and catering services has fueled this growth.

Budget conscious buyers are prioritizing ranges that balance functionality with affordability while still meeting safety and efficiency requirements. Additionally, the availability of durable yet competitively priced models has expanded adoption among emerging markets where initial cost remains a key purchasing criterion.

This consistent demand for value driven solutions has cemented the dominance of the economical pricing segment in the commercial gas restaurant ranges market.

From 2020 to 2025, sales of commercial gas restaurant ranges witnessed significant growth, registering a CAGR of 4.5%. Glass top cooking ranges are a popular choice among commercial kitchens because of their visual aesthetics.

With a demand for innovative designs, colors, and other features on products, the market is expected to gain a competitive advantage and be capable of providing superior products to customers. Due to the top-notch technology and easy installation, the market is expected to grow in the coming years.

Brand awareness is the key to increasing traffic and product discovery on the e-commerce platform. Increasing demand for portable commercial gas ranges for restaurants will further contribute to the market's growth.

Growing Demand for Small to Large-Scale Restaurants has Pushed the Market for Commercial Gas Restaurant Ranges

A wide range of technological innovations, such as more energy-efficient and inexpensive appliances for commercial kitchens, and the launch of new and advanced products, is expected to open new opportunities for market growth in the future.

Increasing home cooking and the popularity of home restaurants in developing regions have further propelled the growth of commercial gas restaurant ranges. With the growth of online sales and free delivery services by a wide range of business sectors, it is expected that the market will continue to grow.

A broad range of manufacturers will offer maintenance and service opinions to increase market demand. As easy-to-clean and customizable options are introduced to the market, the market is likely to expand.

Manufacturers will increase their provision of thermostats with adjustable temperature settings, which is expected to drive market growth. Commercial gas stoves have the advantage of evenly spreading the heat through the entire cooking area, increasing the range of dishes that can be prepared. As a result, cooking preparation for these machines is greatly reduced since the central part can be heated very quickly. Hence the market is expected to grow.

Gas Restaurant Ranges with Premium Features will Provide a Lucrative Market Opportunity

Culinary adventurers who are constantly searching for new techniques will find commercial-style ranges a great tool in the market. Premium commercial gas ranges are expected to grow in popularity in the restaurant business due to the demand for adjustable grates that will suit a variety of cooking techniques in the restaurant business.

Therefore, commercial gas restaurant ranges are in high demand due to a growing demand for high-quality, durable, and efficient cooking equipment. In recent years, the market for commercial gas restaurant ranges has grown rapidly due to consumers' growing demands for customizable gas ranges.

The High Development Costs of Commercial Gas Restaurant Ranges are Inhibiting Growth in the Industry

In recent years, the development of electric kitchens in commercial facilities as well as the need for cost-effective solutions has hindered the growth of commercial gas restaurants in the market. With the limited availability of control and accessory components which are easily available in electric stoves like tops, fans, and bottom grills, these limitations will further hinder the market growth.

Government initiatives to reduce environmental impacts and increasing demand to reduce greenhouse gases further impede market development. In New York City, for example, in 2024, a bill was passed requiring the use of gas in the construction of new buildings beginning in 2025 for those under seven stories and continuing in 2035 for buildings higher than seven stories. According to the UN, buildings emit about 70% of global greenhouse gases, hence this bill was passed in an effort to reduce carbon emissions.

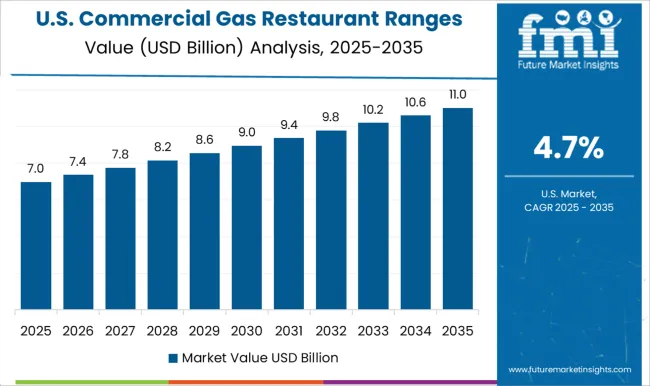

Expansion of the Restaurant Businesses in the USA Will Drive the Adoption of Commercial Gas Restaurant Ranges

Due to the high consumer demand for restaurant food in North America, this region accounted for 40% of the market share for commercial gas restaurant ranges in 2025.

As restaurants become more and more aware of the importance of the restaurant market and demand for aesthetic designs in restaurants has fueled the market for commercial gas restaurant ranges. FMI projects that by 2025, the market shares of commercial gas restaurants rages reached 33.30% in the United States.

It is expected that the market will continue to grow due to the wide choice of available products, including open burner, French top, and griddle configurations, including double convection ovens.

Growing Food Chain Business in Asia Pacific has Led to a Surge in Demand for Commercial Gas Restaurant Ranges

Asia Pacific region is expected to grow at the fastest rate during the forecast period. Increasing disposable income, availability of a large population, and increasing focus on small food businesses have contributed to the growth of the market.

In countries like India and China, restaurants will be able to choose from a variety of styles, shapes, and designs, which will in turn positively affect demand for commercial gas restaurant ranges. Gas restaurant ranges for commercial use are expected to grow at a CAGR of 6.20% in China and India.

Due to the region's dynamic food service industry and increasing demand for high-quality cooking equipment, commercial gas restaurant ranges in the Asia Pacific region are expected to grow in the coming years.

The Asia Pacific region is home to key players such as Rational AG, Middleby Corporation, and Ali Group. The company offers a range of products specific to the needs of the regional food service market which has a diverse range of products to choose from.

LPG Range is expected to grow at a Significant Rate

LPG range is expected to grow at a faster pace and reach a market value of 55% during the forecast period. Among all commercial gas ranges, LPG units are the most popular, as they offer the most efficient and consistent heating source.

Since gas is so beneficial to cooking, commercial kitchens are increasingly using gas as their main energy source. Cooking with LPG is one of the most common uses of gas. Gas fuels like LPG (Liquefied Petroleum Gas) are perfect for cooking, heating, driving, and industrial use. Hence demand LPG gas ranges is expected to grow demand for commercial gas ranges in the market.

Experienced chefs and kitchens in commercial settings need to work fast. In order to be efficient, they often deal with many customers at once. Besides providing heat faster, gas also cools faster, so chefs can control cooking temperatures much more easily for faster meal preparation. Hence the market is expected to grow in demand for LPG ranges.

Demand for Commercial Gas Restaurant Ranges in Hotels & Restaurants to Gain Traction

The hotel & restaurant segment accounted for the largest share of the market with 40.8% in 2025, driven by the increasing demand for fast food restaurants in the market. Commercial gas burner demand is increasing globally as luxury hotels and restaurants become more prevalent.

Due to space and capital limitations, hotels increasingly rely on commercial gas ranges to cook. Demand for hotels fluctuates with the seasons, and the price-setting process needs to take the responsiveness of the demand into consideration.

Food chain business competition and government initiatives to ensure hygienic restaurants further drive the growth of this market. As appliances become safer and regulations become more stringent, demand on the market will continue to increase.

Gas Ranges for Commercial Restaurants are Dominant in the Deck and Convention Oven Segments

The deck & convection oven segment dominated the applications market for commercial gas restaurant ranges accounting for 23% of the market value in 2025. Pizza popularity and increasing demand for Italian restaurants are expected to drive the deck oven market.

The popularity of bakeries and an increase in savory chefs are expected to increase sales of deck ovens in commercial gas restaurant ranges. This equipment can accommodate multiple convection chambers and decks, making it ideal for bakeries, restaurants, and retail stores seeking to use both the deck and convection baking techniques in the market. In addition to these models, proofing chambers are also available to order as an option.

Since Deck ovens have the advantage of being able to cook on the top or bottom of the oven, they are more versatile than convection ovens. Additionally, they quickly heat up, facilitating the cooking process in a timely manner.

It's common to find convection ovens that have a number of racks that can hold different kinds of food, as well as a broil setting to speed up the cooking process above the grilling setting, as well as a fan that circulates air throughout the oven. All these factors are expected to grow in demand for deck & conventional ovens.

Some of the start-ups in the commercial gas restaurant range market include

The global market is flooded with new advanced products and services being introduced by key players. Stainless steel cooktops and innovative technologies are used by these companies to reduce cleaning work.

Modern gas restaurant ranges will use miniature designs and digital technology to enhance their performance. Mergers, acquisitions, partnerships, and product launches will further be emphasized by market players.

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 15.8 billion |

| Market Value in 2035 | USD 27.1 billion |

| Growth Rate | CAGR of 5.50% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Type, Power Source, Pricing, End-User, Application, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, United kingdom, France, Spain, Italy, China, Japan, South Korea, Singapore, Thailand, Indonesia, Australia, New Zealand, GCC, South Africa, Israel |

| Key Companies Profiled | GE Appliances; Middleby Corporation; ITW Food Equipment Group LLC; Electrolux AB; Comstock-Castle Stove Co., Inc.; Elica SPA; Whirlpool Corporation; Elster GmbH; Comet Kitchen Company; Kanteen India Equipments Co.; Jindal Gas Appliances Pvt. Ltd.; Shree Ambica Industries |

| Customization | Available Upon Request |

The global commercial gas restaurant ranges market is estimated to be valued at USD 15.8 billion in 2025.

The market size for the commercial gas restaurant ranges market is projected to reach USD 27.1 billion by 2035.

The commercial gas restaurant ranges market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in commercial gas restaurant ranges market are lpg range, coal gas range and natural gas range.

In terms of power source, gas segment to command 55.3% share in the commercial gas restaurant ranges market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Solar Cable Market Size and Share Forecast Outlook 2025 to 2035

Commercial Food Refrigeration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Commercial Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA