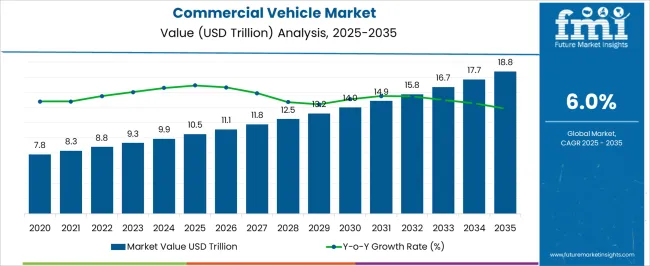

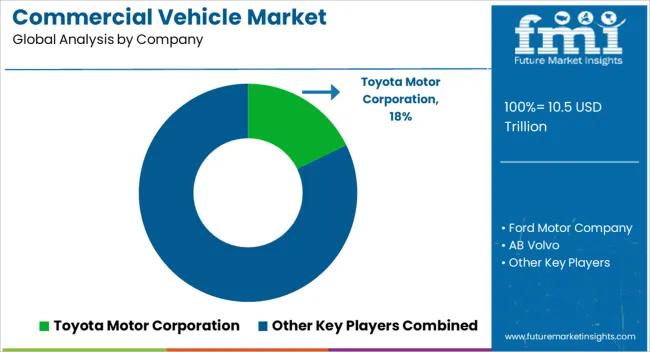

The commercial vehicle market is projected to grow from USD 10.5 trillion in 2025 to USD 18.8 trillion by 2035, reflecting a CAGR of 6.0%. This anticipated growth reflects a combination of increasing demand for goods transportation, infrastructure expansion, and evolving fleet modernization strategies across regions. Between 2025 and 2027, the market climbs from USD 10.5 trillion to USD 11.1 trillion, supported by rising investments in last-mile delivery, logistics networks, and urban freight solutions.

From 2028 to 2031, revenue advances from USD 11.8 trillion to USD 14.0 trillion, as commercial fleets are upgraded to meet stricter emission standards, fuel efficiency requirements, and safety regulations. The period from 2032 to 2035 sees further acceleration, reaching USD 18.8 trillion, driven by e-commerce growth, global trade expansion, and adoption of connected and electrified vehicle technologies.

Price contributions remain moderate, while volume expansion through increased fleet size, higher vehicle utilization, and replacement cycles dominates market growth. Regional dynamics, including infrastructure projects in the Asia-Pacific, fleet renewal programs in Europe, and logistics modernization in North America, shape adoption patterns.

OEM strategies focusing on modular vehicle platforms, advanced telematics, and after-sales service networks enhance market penetration.

The commercial vehicle market is strongly shaped by several interconnected parent markets, each contributing distinctly to overall demand and revenue generation. The freight and logistics market holds the largest share at 40%, as trucking, long-haul transport, and last-mile delivery services drive demand for commercial trucks, vans, and specialized cargo vehicles.

This segment relies on fleet expansion, vehicle durability, and operational efficiency to meet increasing e-commerce and industrial shipping needs. The construction and infrastructure market contributes 20%, with demand for heavy-duty trucks, concrete mixers, and dump trucks rising alongside global infrastructure projects and urban development initiatives.

The public transport and municipal services market accounts for 15%, with buses, sanitation trucks, and emergency vehicles requiring optimized fleet management and reliable vehicle platforms to maintain service continuity. The automotive rental and leasing market holds a 15% share, supporting demand for commercial vans, trucks, and multipurpose vehicles used by small and medium enterprises, logistics operators, and seasonal businesses.

The specialty vehicle market, including refrigerated transport, tankers, and utility vehicles, represents 10%, catering to niche sectors requiring tailored vehicle solutions. Collectively, freight, construction, and public transport segments account for 75% of total demand, highlighting that operational efficiency, capacity, and reliability remain primary growth drivers, while leasing, rental, and specialty vehicles provide incremental market expansion opportunities worldwide.

| Metric | Value |

|---|---|

| Commercial Vehicle Market Estimated Value in (2025 E) | USD 10.5 trillion |

| Commercial Vehicle Market Forecast Value in (2035 F) | USD 18.8 trillion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The commercial vehicle market is advancing steadily, underpinned by rising demand in logistics, infrastructure development, and expanding trade activities across global economies. Market growth is being reinforced by the continuous modernization of vehicle fleets, stringent emission regulations encouraging new purchases, and the integration of advanced telematics and safety features. Competitive intensity is being shaped by the transition towards alternative fuel technologies, though internal combustion engines continue to hold the dominant share due to their established infrastructure and operational cost advantages.

Regional expansion in emerging economies is being driven by urbanization, e-commerce growth, and the expansion of last-mile delivery networks. In mature markets, replacement demand and compliance with environmental standards are catalyzing steady sales.

Supply chain normalization post-pandemic and the scaling of manufacturing capacities are expected to stabilize lead times and pricing Over the forecast period, strategic alliances, electrification initiatives, and targeted investments in efficiency-enhancing technologies are projected to sustain market resilience and foster long-term revenue growth.

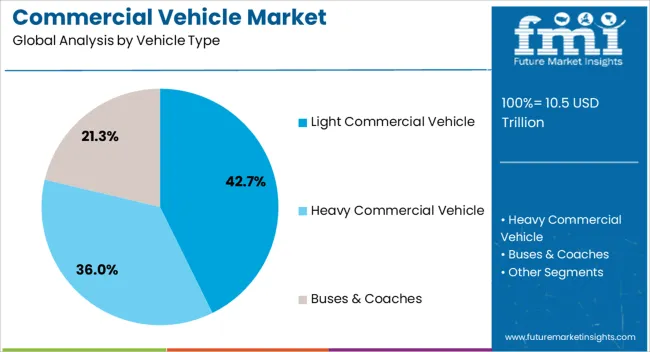

The commercial vehicle market is segmented by vehicle type, drive type, end-use industry, and geographic regions. By vehicle type, commercial vehicle market is divided into Light Commercial Vehicle, Heavy Commercial Vehicle, and Buses & Coaches.

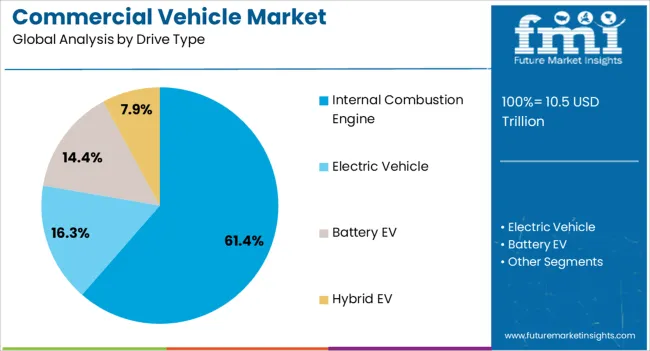

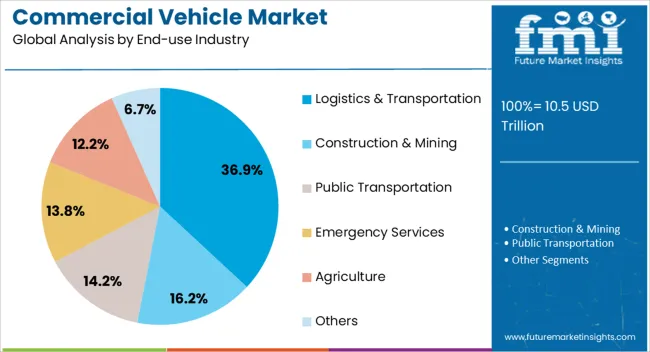

In terms of drive type, commercial vehicle market is classified into Internal Combustion Engine, Electric Vehicle, Battery EV, and Hybrid EV. Based on end-use industry, commercial vehicle market is segmented into Logistics & Transportation, Construction & Mining, Public Transportation, Emergency Services, Agriculture, and Others. Regionally, the commercial vehicle industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The light commercial vehicle category, holding 42.7% of the vehicle type segment, has been leading market demand due to its adaptability in urban and regional transport applications. Its share is being supported by the surge in e-commerce and last-mile delivery operations, where maneuverability, lower operating costs, and flexible load capacities offer clear operational advantages.

Fleet operators have been prioritizing light commercial vehicles for their balance of efficiency and payload, especially in high-density metropolitan areas. This segment’s position has been further strengthened by favorable financing options, availability of varied body configurations, and ongoing improvements in fuel economy.

Manufacturers have been enhancing durability and incorporating advanced driver-assistance systems to improve operational safety, aligning with evolving regulatory frameworks. The growing use of these vehicles in sectors such as retail distribution, service operations, and municipal utilities is anticipated to maintain their competitive advantage and ensure sustained adoption in both emerging and mature markets.

The internal combustion engine category, accounting for 61.4% of the drive type segment, has retained its leadership due to well-established fueling infrastructure, lower upfront acquisition costs, and proven operational reliability across varied terrains and load conditions. Market preference has been reinforced by the wide availability of service networks, ease of maintenance, and the adaptability of internal combustion engines to different commercial applications.

While the market is witnessing gradual electrification and the introduction of hybrid alternatives, adoption rates for these newer technologies are being moderated by infrastructure limitations and higher capital costs. Diesel-powered internal combustion engines continue to dominate in heavy-duty and long-haul operations, providing the torque and range needed for efficiency in demanding use cases.

Regulatory measures targeting emissions have prompted manufacturers to invest in cleaner engine technologies, improving fuel efficiency and reducing particulate output. This combination of infrastructure readiness, technological refinement, and economic feasibility is expected to sustain the segment’s significant market share over the forecast horizon.

The logistics and transportation category, representing 36.9% of the end-use industry segment, has emerged as the primary demand driver for commercial vehicles due to the rapid growth of supply chain networks and the expansion of global trade. Demand has been accelerated by the e-commerce boom, increased cross-border freight movement, and the diversification of distribution models requiring both long-haul and last-mile capabilities.

Fleet operators in this sector are investing in vehicles that offer higher load capacities, fuel efficiency, and reliability to optimize operational costs. The segment’s prominence is being reinforced by infrastructure investments in highways, ports, and logistics hubs, which are improving turnaround times and enabling larger-scale fleet deployment.

Technology integration, including GPS tracking, load optimization software, and telematics, has been widely adopted to improve efficiency and meet tight delivery schedules. The ongoing trend of outsourcing logistics functions to specialized operators, along with rising consumer expectations for faster delivery, is anticipated to drive sustained growth in this end-use category.

Commercial vehicle growth is primarily driven by freight, construction, and public transport demand. Leasing, rental, and specialty vehicles provide additional incremental growth opportunities globally.

The commercial vehicle market is witnessing substantial growth driven by the freight and logistics sector, which accounts for a significant portion of overall demand. E-commerce, retail, and industrial shipping requirements are expanding the need for heavy-duty trucks, vans, and cargo transport vehicles. Operators are increasingly seeking vehicles with high payload capacity, fuel efficiency, and durability to optimize delivery timelines and reduce operating costs. Seasonal demand fluctuations, regional distribution requirements, and last-mile delivery challenges are also shaping fleet purchasing decisions. Manufacturers are responding with versatile vehicle portfolios that accommodate varied cargo types, including refrigerated, flatbed, and containerized trucks. Partnerships with logistics providers and leasing companies are further accelerating adoption, as reliable vehicle availability becomes critical for operational continuity.

Infrastructure development and construction activities are major drivers for commercial vehicle demand, particularly for heavy-duty trucks, mixers, dumpers, and specialized utility vehicles. Governments and private sector projects focusing on roadways, bridges, and urban infrastructure are expanding fleet requirements, pushing manufacturers to deliver high-performance, durable vehicles capable of handling harsh terrains and continuous operational use. Project timelines, regional construction booms, and contractor needs influence vehicle specifications, leading to customization in payload, suspension, and drivetrain options. Leasing and rental models are also supporting small and mid-sized contractors who cannot invest heavily in fleet ownership. The construction sector’s contribution to commercial vehicle sales highlights the importance of reliability, load-handling capacity, and total cost of ownership in procurement decisions, ensuring sustained market growth over the next few years.

Public transportation, municipal services, and government fleets play a vital role in shaping commercial vehicle demand, contributing to about 15–20% of the market. Buses, sanitation trucks, emergency vehicles, and utility vans require consistent performance, maintenance support, and compliance with regulatory standards. Fleet operators prioritize vehicles with lower downtime, easy serviceability, and optimized operational efficiency to serve urban and regional populations effectively. Procurement cycles are influenced by government funding, service contracts, and regional infrastructure plans. Moreover, retrofitting and replacement programs for older municipal fleets drive aftermarket demand. The segment underscores the importance of reliability, safety compliance, and lifecycle management in commercial vehicle design, positioning public and municipal operations as long-term contributors to market expansion.

Leasing, rental, and specialty commercial vehicles form a dynamic growth segment, meeting needs of SMEs, seasonal businesses, and niche industries requiring refrigerated transport, tankers, or multipurpose vans. Operators prefer flexible procurement models that reduce upfront investment and allow fleet scaling based on demand. Tailored configurations, payload optimization, and adherence to regulatory standards drive specialty vehicle demand. Manufacturers and service providers are offering integrated solutions, including vehicle customization, maintenance packages, and fleet tracking to attract clients seeking operational efficiency. This segment highlights the growing preference for asset-light models, risk mitigation strategies, and cost management in fleet operations. Together, leasing, rental, and specialized vehicles provide incremental adoption opportunities, complementing the dominant freight, construction, and municipal segments.

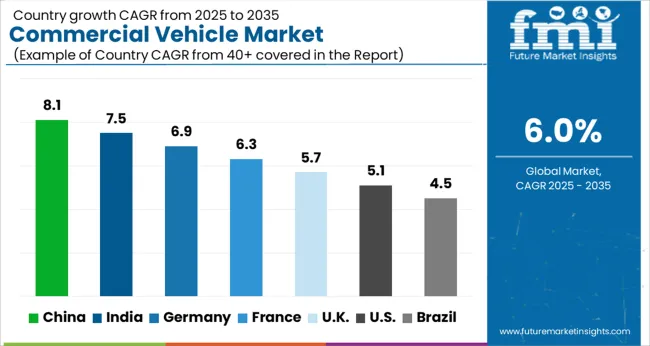

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

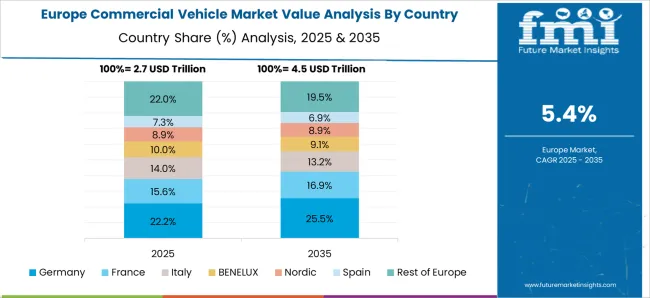

The global commercial vehicle market is projected to grow at a CAGR of 6.0% from 2025 to 2035. China leads at 8.1%, followed by India at 7.5%, Germany at 6.9%, the UK at 5.7%, and the USA at 5.1%. Growth is driven by rising demand from freight, logistics, construction, and public transport sectors. China and India exhibit rapid adoption due to expanding e-commerce, infrastructure projects, and urban mobility requirements.

Europe and North America focus on regulatory compliance, emissions standards, and fleet modernization for efficiency and safety. Heavy-duty trucks, buses, and utility vehicles are increasingly integrated with advanced telematics, fuel management, and predictive maintenance systems. Leasing, rental, and specialized vehicles further accelerate market penetration. The analysis spans over 40+ countries, with the leading markets shown below.

The commercial vehicle market in China is projected to grow at a CAGR of 8.1% from 2025 to 2035, fueled by rapid industrialization, expanding logistics networks, and infrastructure development. Heavy-duty trucks, buses, and light commercial vehicles are witnessing strong demand from freight operators, construction projects, and urban public transport initiatives. Fleet operators are increasingly investing in vehicles equipped with advanced telematics, fuel optimization systems, and predictive maintenance solutions to reduce operating costs and enhance efficiency.

Domestic manufacturers are expanding production capabilities while forming strategic alliances with global OEMs to integrate advanced components and meet rising quality standards. Government policies promoting road expansion, highway networks, and emission regulations further drive demand for modern commercial vehicles, while after-sales service networks support fleet reliability and operational continuity.

The commercial vehicle market in India is expected to grow at a CAGR of 7.5% from 2025 to 2035, driven by expanding e-commerce, urban delivery networks, and highway infrastructure projects. Demand for light, medium, and heavy-duty trucks, buses, and specialized transport vehicles is rising across logistics, construction, and passenger transport segments. Fleet operators are adopting telematics, vehicle monitoring systems, and fuel management technologies to optimize operations and reduce maintenance costs.

Domestic manufacturers, in collaboration with international suppliers, are producing vehicles compliant with Bharat Stage emission standards and incorporating safety features for driver and passenger protection. Government initiatives to develop national highways, ports, and urban transit networks further support market growth, while financing schemes and leasing programs enable easier fleet acquisition for small and medium enterprises.

Germany’s commercial vehicle market is projected to grow at a CAGR of 6.9% from 2025 to 2035, supported by strong manufacturing, logistics, and urban mobility sectors. Heavy-duty trucks and vans are in demand for freight transport, while buses serve urban and intercity passenger networks. Fleet operators increasingly integrate telematics, fleet management software, and predictive maintenance systems to improve efficiency, reduce fuel consumption, and comply with EU regulatory standards.

OEMs focus on producing energy-efficient vehicles, including hybrid and alternative fuel options, to meet environmental regulations and emission targets. Aftermarket service networks, leasing programs, and maintenance contracts further encourage fleet modernization, while smart transportation initiatives and connected logistics solutions promote operational reliability and long-term cost savings.

The commercial vehicle market in the UK is expected to grow at a CAGR of 5.7% from 2025 to 2035, driven by expanding urban transport, e-commerce logistics, and regional freight services. Light and medium-duty trucks, buses, and specialized vehicles are increasingly adopted for last-mile delivery and public transport applications. Fleet operators are implementing GPS tracking, route optimization, and predictive maintenance solutions to enhance operational efficiency, reduce downtime, and ensure regulatory compliance.

OEMs are investing in hybrid, electric, and low-emission vehicles to meet UK government targets for environmental sustainability. Leasing, rental, and financing programs support fleet expansion for SMEs and municipal authorities. Digital platforms and connected vehicle solutions further improve fleet utilization and driver safety.

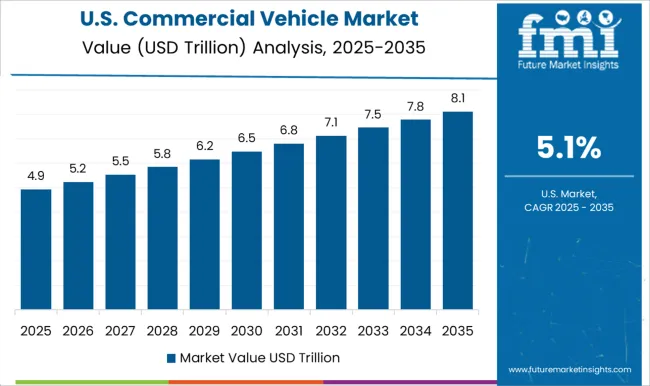

The commercial vehicle market in the USA is projected to grow at a CAGR of 5.1% from 2025 to 2035, fueled by demand from freight logistics, construction, and public transportation sectors. Heavy-duty trucks, vans, and buses are increasingly deployed across intercity and regional transport networks. Fleet operators adopt telematics, automated diagnostics, and predictive maintenance platforms to improve fuel efficiency, reduce operational costs, and enhance driver safety.

OEMs are focusing on producing alternative fuel vehicles, including electric and hybrid models, to meet stringent EPA emission standards. Leasing, rental, and fleet financing options support the modernization of corporate and municipal fleets. Additionally, smart logistics and connected vehicle solutions enable real-time fleet tracking, route optimization, and improved compliance with safety regulations.

Competition in the commercial vehicle market is defined by vehicle performance, fuel efficiency, durability, and integration with advanced fleet management solutions. Toyota Motor Corporation leads through a diverse portfolio of light, medium, and heavy-duty commercial vehicles, emphasizing reliability, low total cost of ownership, and compliance with emission regulations. Ford Motor Company differentiates itself with technologically advanced trucks and vans, integrating telematics, safety features, and fuel-efficient powertrains designed for logistics, construction, and municipal operations. AB Volvo competes in heavy-duty trucks and buses with a focus on electrification, autonomous driving readiness, and driver comfort, while General Motors provides connected vehicle technologies and versatile commercial vehicle platforms suited for North American and global markets. Paccar Inc. specializes in Class 8 trucks, offering telematics, predictive maintenance, and aftermarket support services to enhance fleet reliability and operational efficiency.

BYD Motors focuses on electric commercial vehicles, including buses and trucks, targeting urban mobility and sustainable logistics applications, leveraging battery technology and integrated fleet management systems. Scania AB differentiates through modular heavy-duty trucks, customizable drivetrains, and connected vehicle services for predictive maintenance and optimized fuel consumption. Dongfeng Motor Corporation serves the Asian market with a wide range of trucks and vans, emphasizing affordability, fleet scalability, and compatibility with telematics solutions. Strategies across these players emphasize regulatory compliance, emission reduction, durability testing, and lifecycle support. OEM partnerships with telematics providers, IoT integrators, and software developers accelerate the deployment of connected fleet solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.5 Trillion |

| Vehicle Type | Light Commercial Vehicle, Heavy Commercial Vehicle, and Buses & Coaches |

| Drive Type | Internal Combustion Engine, Electric Vehicle, Battery EV, and Hybrid EV |

| End-use Industry | Logistics & Transportation, Construction & Mining, Public Transportation, Emergency Services, Agriculture, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toyota Motor Corporation, Ford Motor Company, AB Volvo, General Motors, Paccar Inc, BYD Motors, Scania AB, and Dongfeng Motor Corporation |

| Additional Attributes | Dollar sales, share, CAGR, top regions, fleet adoption trends, fuel type demand (diesel, electric, hybrid), regulatory impacts, aftermarket services, telematics integration, and competitor strategies, enabling informed production, investment, and expansion decisions. |

The global commercial vehicle market is estimated to be valued at USD 10.5 trillion in 2025.

The market size for the commercial vehicle market is projected to reach USD 18.8 trillion by 2035.

The commercial vehicle market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in commercial vehicle market are light commercial vehicle, heavy commercial vehicle and buses & coaches.

In terms of drive type, internal combustion engine segment to command 61.4% share in the commercial vehicle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle SCR Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Remote Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Telematics Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Retarder Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Propeller Shaft Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Electronic Service Tools EST Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Urea Tank Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Automotive Thermal System Market Analysis by Application, Vehicle Type, Propulsion Type, Component, and Region Through 2035

Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Heavy Commercial Vehicle Eps Market Size and Share Forecast Outlook 2025 to 2035

MENASA Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Electric Commercial Vehicle Traction Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Commercial Vehicle MRO Market Growth – Trends & Forecast 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Electric Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA