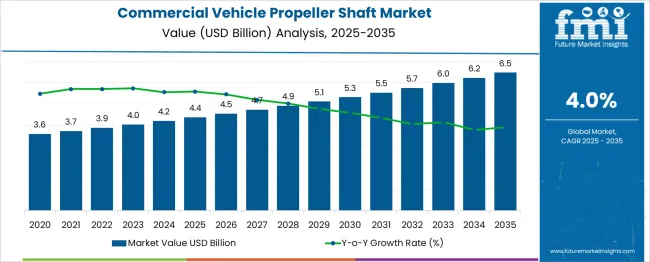

The commercial vehicle propeller shaft market is expected to grow steadily from USD 3.6 billion in 2020 to USD 6.5 billion by 2035, with a compound annual growth rate (CAGR) of 4.0%. This growth reflects increasing demand for durable and efficient drivetrain components in commercial vehicles worldwide. The absolute dollar opportunity, which represents the incremental market growth over the 15-year period, amounts to USD 2.9 billion. This notable increase is driven by expanding commercial vehicle fleets, ongoing infrastructure development, and rising focus on vehicle performance and safety. From 2020 to 2025, the market grows from USD 3.6 billion to USD 4.4 billion, marking an early growth phase supported by increasing commercial transportation needs and replacement of older components. Between 2025 and 2035, the market further expands by USD 2.1 billion to reach USD 6.5 billion. This later period benefits from technological enhancements in materials and design, improving the efficiency and longevity of propeller shafts. Overall, the market offers a promising opportunity for manufacturers and suppliers aiming to capitalize on the growing commercial vehicle sector.

| Metric | Value |

|---|---|

| Commercial Vehicle Propeller Shaft Market Estimated Value in (2025 E) | USD 4.4 billion |

| Commercial Vehicle Propeller Shaft Market Forecast Value in (2035 F) | USD 6.5 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The Commercial Vehicle Propeller Shaft market is undergoing significant transformation, driven by rising demand for durable driveline components and the expansion of commercial vehicle fleets worldwide. Growth is being supported by ongoing developments in material engineering, increasing load-carrying requirements, and the push for fuel efficiency in transportation logistics. Emerging markets are witnessing accelerated urbanization and infrastructure development, which is contributing to the rise in sales of heavy-duty and light commercial vehicles.

Additionally, regulations related to emission control and vehicle safety are influencing design innovation in propeller shafts, especially with a focus on weight reduction and torque handling. Manufacturers are emphasizing materials that balance cost, strength, and performance while enhancing vehicle lifespan and serviceability.

The future outlook remains positive as advancements in electric and hybrid commercial vehicles are opening new avenues for propeller shaft designs optimized for alternative powertrains. With strong demand from logistics, construction, and industrial sectors, the market is expected to maintain stable growth momentum over the forecast period..

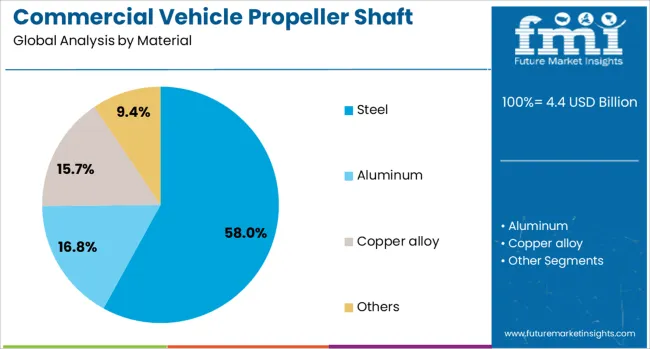

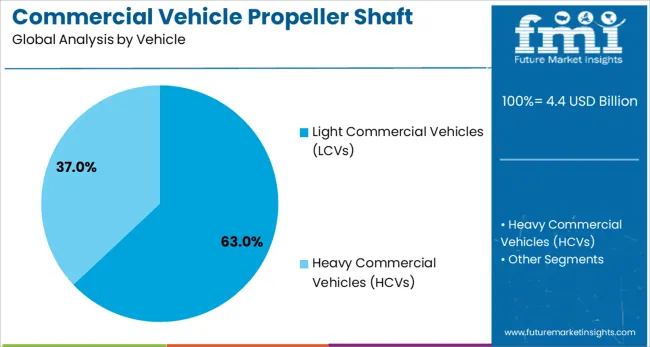

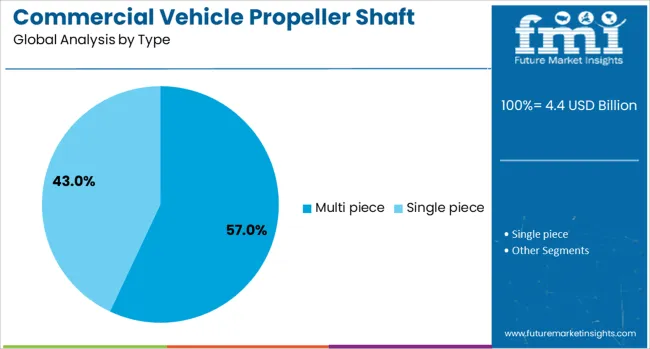

The commercial vehicle propeller shaft market is segmented by material, vehicle type, drive type, and geographic region. By material, the market is divided into steel, aluminum, copper alloy, and others. By vehicle type, it is classified into light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs). Based on drive type, the market is segmented into rear-wheel drive (RWD), front-wheel drive (FWD), and all-wheel drive (AWD). By shaft type, it is categorized into single-piece and multi-piece. Regionally, the commercial vehicle propeller shaft industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The steel material segment is projected to account for 58% of the Commercial Vehicle Propeller Shaft market revenue share in 2025, making it the leading material category. This dominance has been driven by the high strength, fatigue resistance, and affordability of steel in heavy-duty vehicle applications. Steel has been widely adopted due to its ability to withstand extreme torque transmission, making it ideal for commercial vehicles operating under high load conditions.

Manufacturers have continued to rely on steel for its structural reliability and cost-effectiveness in high-volume production. Additionally, the availability of advanced high-strength steel variants has improved weight efficiency without compromising durability, further enhancing its appeal.

The recyclability and supply chain maturity of steel have also contributed to its widespread use across global markets. As commercial vehicle operators seek components that balance longevity and maintenance costs, the steel segment has continued to deliver dependable performance, securing its dominant position in material selection for propeller shafts..

The light commercial vehicles segment is expected to hold 63% of the Commercial Vehicle Propeller Shaft market revenue share in 2025, representing the most dominant vehicle category. This segment's growth has been attributed to the increasing demand for last-mile delivery solutions, urban freight transport, and intra-city logistics. Light commercial vehicles have been widely deployed due to their agility, fuel efficiency, and lower operational costs, especially in densely populated urban centers.

Propeller shafts in this category are designed for frequent start-stop usage and require optimized weight distribution for efficient performance. The expanding e-commerce ecosystem and the rise of small and medium enterprises have further stimulated production and sales of light commercial vehicles globally.

Moreover, regional governments have supported this growth through incentives, infrastructure development, and relaxed regulatory norms for light-duty commercial transportation. These factors have collectively driven the increased production and integration of propeller shafts tailored to the operational needs of this vehicle class..

The multi piece type segment is anticipated to capture 57% of the Commercial Vehicle Propeller Shaft market revenue share in 2025, establishing itself as the leading configuration type. The preference for multi piece propeller shafts has been influenced by their ability to efficiently transmit torque across extended wheelbases, which is common in larger commercial vehicles. This design has enabled enhanced flexibility, reduced vibration, and greater structural support, especially in vehicles with longer chassis.

The segment’s growth has also been supported by its ability to accommodate changes in driveline angles and reduce stress on transmission components. Multi piece shafts are being integrated into applications that demand operational reliability and improved drivability under diverse load conditions.

Manufacturers have continued to optimize this design to meet higher torque requirements while minimizing component wear and maintenance needs. The compatibility of multi piece configurations with various suspension systems and drivetrain layouts has further reinforced their role as a preferred type in the evolving commercial vehicle landscape..

The commercial vehicle propeller shaft market is expanding as demand for reliable and durable driveline components rises with growing freight transportation and commercial vehicle production globally. Propeller shafts transmit torque from the engine to the axle, playing a crucial role in vehicle performance and efficiency. Increasing adoption of heavy-duty trucks, buses, and utility vehicles, especially in developing regions, fuels market growth. Advances in materials and manufacturing processes improve shaft strength and reduce weight, enhancing fuel efficiency and durability. North America, Europe, and Asia-Pacific lead market activity, supported by expanding logistics and construction sectors.

Propeller shafts for commercial vehicles differ in length, diameter, and joint types depending on vehicle specifications and load requirements. Common designs include one-piece, two-piece, and multi-piece shafts to accommodate vehicle frame length and articulation. Materials range from traditional steel to lightweight alloys and composites, balancing strength, torsional rigidity, and weight reduction. Advanced manufacturing techniques like precision forging and heat treatment enhance fatigue resistance. Differences in balancing methods and coatings affect vibration reduction and corrosion protection. Suppliers offering customized solutions aligned with vehicle applications and operating conditions gain competitive advantage.

Commercial vehicle operators demand propeller shafts that withstand high torque loads, shock, and harsh environmental conditions. Enhanced shaft durability minimizes maintenance frequency and reduces downtime, critical in logistics and transportation sectors. Use of advanced materials and surface treatments improve resistance to wear, corrosion, and fatigue failure. Innovations in universal joint design and vibration dampers enhance ride comfort and driveline efficiency. Real-world testing and quality control ensure reliable performance over extended service life. Manufacturers investing in robust engineering and validation processes strengthen reputation and market share.

The expanding global commercial vehicle fleet, driven by urbanization, e-commerce growth, and infrastructure development, increases demand for drivetrain components including propeller shafts. Emerging markets in Asia-Pacific, Latin America, and Africa show rapid growth due to rising transportation needs and industrialization. OEMs and aftermarket suppliers cater to new vehicle production and replacement requirements. Regulations promoting vehicle efficiency and emission reduction encourage use of lightweight, high-performance components. Supply chain improvements and local manufacturing reduce lead times and costs, further supporting market expansion.

The propeller shaft market faces supply chain issues such as raw material price volatility, particularly steel and alloy costs, impacting manufacturing expenses. Seasonal fluctuations in vehicle production and aftermarket demand affect inventory management. Market competition is intense with established OEM suppliers and new entrants offering cost-effective alternatives. Differentiation through product quality, customization, and technical support is key to winning contracts. Some manufacturers invest in vertical integration or partnerships with vehicle producers to secure consistent orders. Balancing cost pressures with quality and delivery reliability remains a critical challenge affecting growth trajectories.

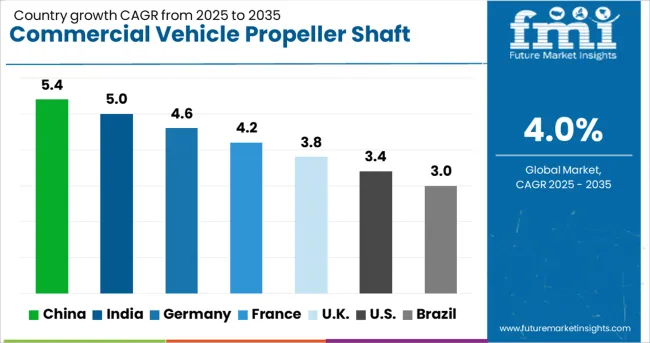

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The global commercial vehicle propeller shaft market is growing at a 4.0% CAGR, supported by increasing production and maintenance of commercial vehicles worldwide. Among BRICS nations, China leads with 5.4% growth, driven by a robust automotive manufacturing base. India follows at 5.0%, fueled by expanding commercial vehicle fleets and aftermarket demand. In the OECD region, Germany records 4.6% growth, reflecting high-quality standards and technological advancements. The United Kingdom grows at 3.8%, supported by commercial transport sector needs. The United States, a mature market, shows 3.4% growth, shaped by stringent safety regulations and replacement cycles. These countries collectively shape market dynamics through manufacturing capabilities, regulatory frameworks, and transportation industry demand. This report includes insights on 40+ countries; the top countries are shown here for reference.

The commercial vehicle propeller shaft market in China is growing steadily at a rate of 5.4%, driven by the expansion of the logistics and transportation sectors. Demand is fueled by increased manufacturing of heavy-duty commercial vehicles and modernization of existing fleets. Compared to India, China benefits from a well-established automotive supply chain and advanced production facilities that enhance product quality. The market also sees rising interest in lightweight yet durable propeller shafts to improve fuel efficiency and vehicle performance. Infrastructure growth supports higher commercial vehicle usage, further boosting market growth.

India commercial vehicle propeller shaft market is expanding at 5.0%, supported by growing freight transportation and infrastructure development. Compared to Germany, India faces challenges related to inconsistent road quality but benefits from rising commercial vehicle production and government initiatives promoting transport modernization. Local manufacturers are increasing production capacity to meet domestic and export demand. Emphasis is placed on cost-effective designs that suit Indian road and load conditions. The growth of e-commerce and logistics industries further encourages market expansion.

Germany commercial vehicle propeller shaft market grows at 4.6%, reflecting steady demand from established automotive manufacturers and commercial fleet operators. Compared to the United Kingdom, Germany emphasizes high-quality materials and precision engineering for longer-lasting shafts. The market benefits from innovations focused on reducing vibration and improving torque transmission. Demand comes from logistics companies upgrading fleets to meet emission standards and performance requirements. Aftermarket services also contribute to market revenue through maintenance and replacement parts.

The United Kingdom commercial vehicle propeller shaft market is growing moderately at 3.8%, influenced by steady freight and logistics activities. Compared to the United States, the United Kingdom market faces more stringent regulations on commercial vehicle emissions, encouraging efficient drivetrain components. Manufacturers focus on producing shafts that meet durability standards while minimizing weight to improve fuel efficiency. Replacement demand remains stable as commercial fleets maintain and upgrade vehicles. Partnerships between suppliers and vehicle makers support product development and timely delivery.

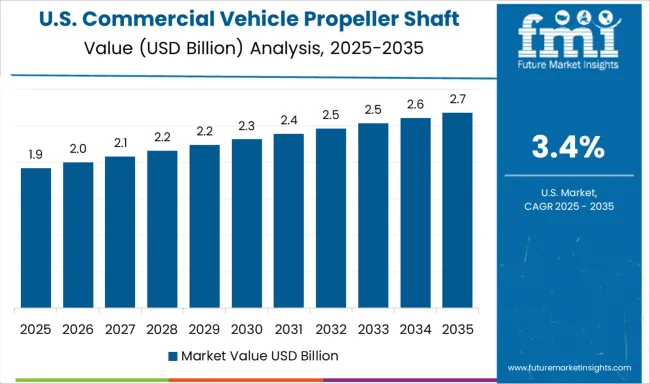

United States commercial vehicle propeller shaft market grows at 3.4%, reflecting gradual fleet modernization and steady freight transport demand. Compared to China, growth is slower due to a larger variety of vehicle powertrain options and regional regulatory differences. Market players focus on lightweight materials and robust designs to meet performance and emission goals. Aftermarket parts and repair services form a significant portion of the market. The expanding e-commerce sector is a key factor driving commercial vehicle use and related component demand.

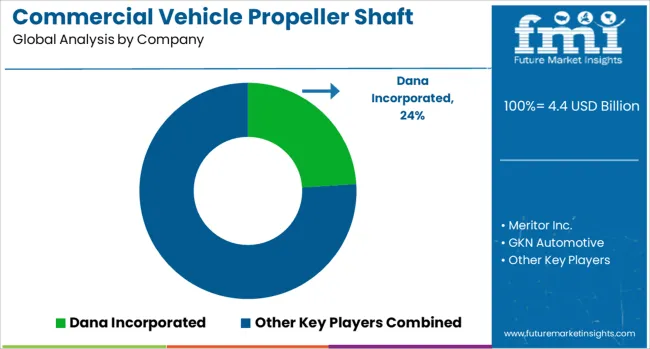

The commercial vehicle propeller shaft market is dominated by established automotive component manufacturers known for delivering durable, high-performance drivetrain solutions that withstand heavy loads and harsh operating conditions. Dana Incorporated leads with its advanced engineering capabilities and global footprint, offering lightweight yet robust propeller shafts designed to improve fuel efficiency and vehicle performance. Cummins Meritor complements this with a strong focus on drivetrain innovation, providing tailored propeller shaft systems that enhance reliability and reduce maintenance costs in commercial trucks and trailers. GKN Automotive brings expertise in precision manufacturing and materials technology, supplying propeller shafts that optimize torque transfer and vibration reduction for a smoother ride.

Showa Corporation focuses on high-quality production processes and innovative designs that meet stringent safety and performance standards in commercial vehicles. Hyundai WIA rounds out the market with competitive pricing and a growing presence in Asia, leveraging its integration within Hyundai Motor Group to supply propeller shafts for a range of commercial vehicles. Competition in this market centers on advancements in material science, weight reduction, and enhanced durability to support the evolving demands of commercial vehicle manufacturers seeking to improve efficiency and operational longevity.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Material | Steel, Aluminum, Copper alloy, and Others |

| Vehicle | Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs) |

| Type | Multi piece and Single piece |

| Drive | Rear-Wheel Drive (RWD), Front-Wheel Drive (FWD), and All-Wheel Drive (AWD) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Dana Incorporated, Meritor Inc., GKN Automotive, Showa Corporation, and Hyundai WIA |

| Additional Attributes | Dollar sales in the Commercial Vehicle Propeller Shaft Market vary by vehicle type including light and heavy commercial vehicles, material such as steel, aluminum, and composites, application in on-road and off-road vehicles, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising commercial vehicle production, demand for lightweight components, and increasing focus on durability and fuel efficiency. |

The global commercial vehicle propeller shaft market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the commercial vehicle propeller shaft market is projected to reach USD 6.5 billion by 2035.

The commercial vehicle propeller shaft market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in commercial vehicle propeller shaft market are steel, aluminum, copper alloy and others.

In terms of vehicle, light commercial vehicles (lcvs) segment to command 63.0% share in the commercial vehicle propeller shaft market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle SCR Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Remote Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Telematics Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Retarder Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Electronic Service Tools EST Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Urea Tank Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Automotive Thermal System Market Analysis by Application, Vehicle Type, Propulsion Type, Component, and Region Through 2035

CFRP Propeller Shaft Market

Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Heavy Commercial Vehicle Eps Market Size and Share Forecast Outlook 2025 to 2035

MENASA Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Electric Commercial Vehicle Traction Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Commercial Vehicle MRO Market Growth – Trends & Forecast 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA