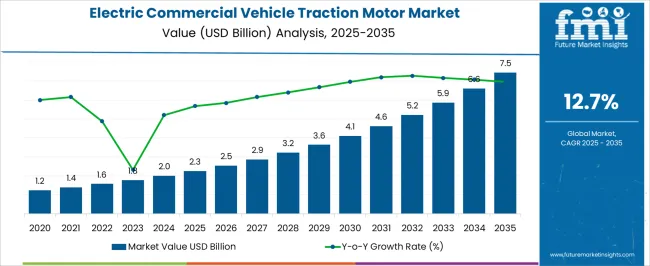

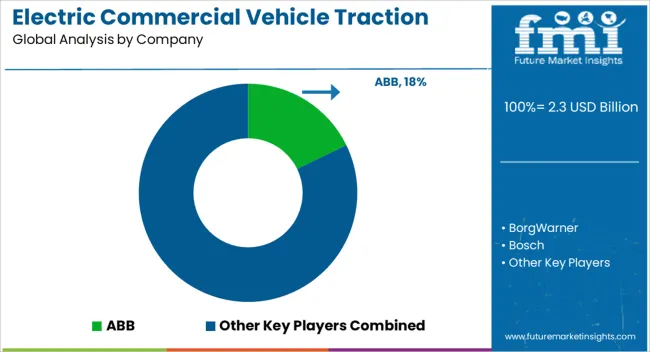

The electric commercial vehicle traction motor market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 7.5 billion by 2035, registering a compound annual growth rate (CAGR) of 12.7% over the forecast period.

The expansion is primarily influenced by the increasing adoption of electric commercial vehicles across logistics, public transport, and last-mile delivery sectors. Over the forecast period, the market is projected to witness consistent year-on-year growth, supported by rising investments in high-efficiency traction motor systems and the integration of advanced powertrain solutions. Market participants are strategically positioning themselves to leverage the growing preference for electric mobility in commercial applications, driving overall revenue expansion. During the 2025–2035 period, the electric commercial vehicle traction motor market is likely to experience variations in demand across regions, reflecting changes in fleet electrification policies, fuel cost considerations, and competitive dynamics.

Incremental market opportunities are anticipated as manufacturers enhance motor performance, improve thermal management systems, and optimize production processes to meet rising customer expectations. The cumulative market value is projected to expand steadily, highlighting the significance of robust supply chains and targeted market strategies. Overall, the market trajectory indicates a continued rise in adoption, with the sector capturing a larger share of the global commercial vehicle propulsion market.

| Metric | Value |

|---|---|

| Electric Commercial Vehicle Traction Motor Market Estimated Value in (2025 E) | USD 2.3 billion |

| Electric Commercial Vehicle Traction Motor Market Forecast Value in (2035 F) | USD 7.5 billion |

| Forecast CAGR (2025 to 2035) | 12.7% |

The electric commercial vehicle traction motor market is estimated to hold a notable proportion within its parent markets, representing approximately 15-18% of the electric vehicle market, around 8-10% of the commercial vehicle market, close to 25-28% of the automotive traction motor market, about 10-12% of the electric powertrain market, and roughly 5-6% of the heavy-duty vehicle market. Collectively, the cumulative share across these parent segments is observed in the range of 63-74%, reflecting the growing importance of traction motors in enabling electrification of commercial transport and heavy-duty mobility. The market has been influenced by the increasing adoption of electric commercial vehicles to improve efficiency, reduce operating costs, and enhance performance under varying load conditions.

Adoption is guided by procurement decisions that prioritize motor efficiency, torque density, reliability, and integration with battery and powertrain systems. Market participants have focused on developing traction motors that provide high performance while ensuring durability and minimal maintenance, addressing the rigorous demands of commercial operations. As a result, the electric commercial vehicle traction motor market has not only captured a significant share within electric vehicle and traction motor markets but has also influenced commercial vehicle electrification, electric powertrain design, and heavy-duty vehicle sectors, emphasizing its role in accelerating the shift toward electric mobility in commercial transport, improving operational efficiency, and reducing dependency on traditional fuel systems.

The electric commercial vehicle traction motor market is experiencing significant growth, driven by the accelerating adoption of electric buses, trucks, and commercial fleet vehicles as governments and industries focus on reducing carbon emissions. Rising regulatory pressures to achieve zero-emission transport targets, combined with the need to lower operational costs, are motivating fleet operators to transition from conventional combustion engines to electric drivetrains. Technological advancements in motor efficiency, power density, and thermal management are improving vehicle performance and reliability.

Growing investments in charging infrastructure and supportive policies, such as subsidies for electric commercial vehicles, are also facilitating market expansion. The trend toward modular and scalable motor designs allows manufacturers to tailor solutions for diverse vehicle sizes and power requirements, enhancing flexibility in deployment.

As commercial fleets increasingly prioritize sustainability and long-term cost efficiency, the market is positioned for continued growth The integration of smart motor control systems, regenerative braking, and energy optimization technologies is expected to further propel adoption across multiple regions, particularly in urban and high-density transport networks.

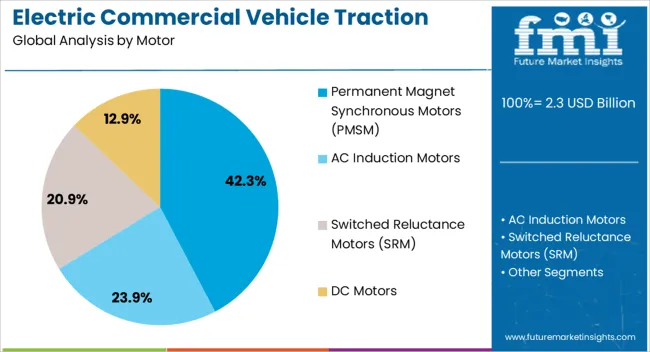

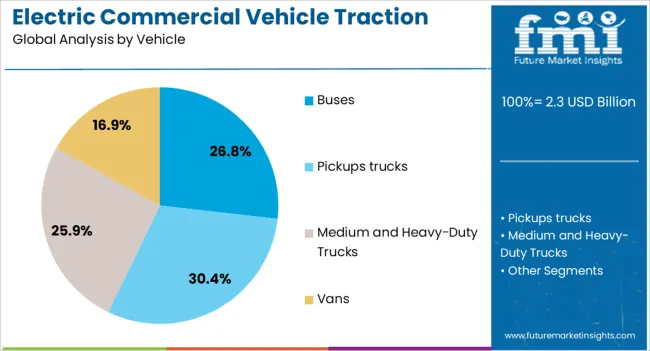

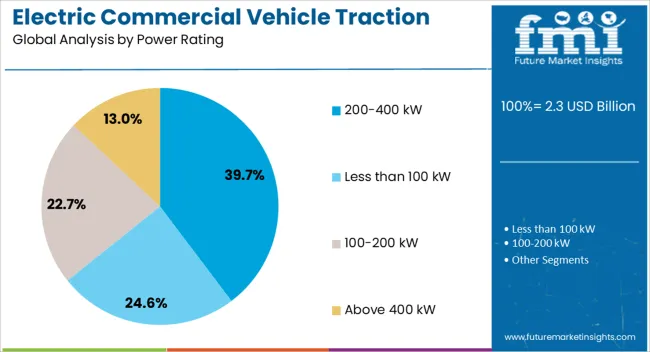

The electric commercial vehicle traction motor market is segmented by motor, vehicle, power rating, axle architecture, transmission, design, and geographic regions. By motor, electric commercial vehicle traction motor market is divided into permanent magnet synchronous motors (PMSM), AC induction motors, switched reluctance motors (SRM), and DC motors. In terms of vehicle, electric commercial vehicle traction motor market is classified into buses, pickups trucks, medium and heavy-duty trucks, and vans. Based on power rating, electric commercial vehicle traction motor market is segmented into 200-400 kW, less than 100 kW, 100-200 kW, and above 400 kW. By axle architecture, electric commercial vehicle traction motor market is segmented into integrated and central drive unit. By transmission, electric commercial vehicle traction motor market is segmented into single-speed drive and multi-speed drive. By design, electric commercial vehicle traction motor market is segmented into radial flux and axial flux. Regionally, the electric commercial vehicle traction motor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The permanent magnet synchronous motors PMSM segment is projected to hold 42.3% of the electric commercial vehicle traction motor market revenue share in 2025, making it the leading motor type. This leadership is being supported by the motors’ high power density, efficiency, and ability to deliver strong torque across a wide speed range, which is critical for commercial vehicle operation. PMSM motors offer lower energy losses and superior performance in regenerative braking systems, reducing operational energy consumption.

The integration of advanced control systems allows for precise torque management and enhanced vehicle drivability. Adoption is further being driven by increased demand for long-range electric buses and trucks, where weight reduction and energy efficiency are essential.

Manufacturers are also benefiting from improvements in rare-earth magnet technology, which have enhanced performance while controlling costs The segment’s prominence is reinforced by growing fleet electrification programs in urban transport and commercial logistics, where high-performance and reliable motor solutions are increasingly required to meet both operational efficiency and sustainability objectives.

The pickup trucks segment is anticipated to represent 30.4% of the electric commercial vehicle traction motor market revenue share in 2025, making it the dominant application category. Electric commercial vehicle traction motors are widely used in pickup trucks because they deliver high torque at low speeds, which is essential for hauling, towing, and off-road performance.

Unlike internal combustion engines, traction motors provide instant power delivery, enabling better acceleration even under heavy loads. They are also more efficient, reducing operating costs for fleet operators, and support regenerative braking to extend driving range. Their compact design allows for flexible integration into pickup platforms, while their durability and low maintenance make them ideal for commercial use. Combined with growing demand for zero-emission vehicles, they are a preferred choice in pickups.

The 200-400 kW power rating segment is expected to hold 39.7% of the electric commercial vehicle traction motor market revenue share in 2025, establishing it as the leading power category. This dominance is being driven by the suitability of this power range for heavy-duty commercial applications, including city and intercity buses, delivery trucks, and medium-sized freight vehicles.

Motors in this category are capable of delivering high torque and efficiency while ensuring operational reliability over extended driving cycles. Adoption is being supported by the need to balance performance with battery size and vehicle weight constraints, which is critical for achieving long-range operation and minimizing energy consumption.

The segment’s growth is further reinforced by standardization trends in motor design, enabling manufacturers to optimize production costs while meeting diverse vehicle specifications The ability of 200-400 kW traction motors to provide scalable solutions for varying commercial vehicle requirements is driving their widespread use, making this power rating segment a central contributor to the overall market growth.

The electric commercial vehicle traction motor market is being driven by increasing fleet electrification, cost efficiency demands, and regulatory incentives. Opportunities are emerging from advanced motor designs, modular integration, and aftermarket services, while trends emphasize electrification, torque optimization, and energy efficiency. Challenges related to supply chain constraints, material availability, and performance standardization are shaping strategic priorities. Overall, the market is being positioned at the intersection of efficiency-driven electrification, system integration, and operational reliability, reflecting a transformation in commercial vehicle propulsion solutions.

The electric commercial vehicle traction motor market is being significantly influenced by the accelerating adoption of electric trucks, buses, and vans across multiple regions. Demand is being propelled by fleet operators aiming to reduce operational costs through lower energy consumption and maintenance requirements compared with traditional internal combustion engines. The push toward cleaner transport alternatives is also being reinforced by government incentives, subsidies, and mandates that favor electrified commercial mobility. Fleet electrification is being positioned as a strategic move for reducing long-term expenditure, enhancing energy efficiency, and complying with regional emission standards. Market growth is also being supported by the diversification of commercial vehicles, ranging from urban delivery vans to long-haul electric trucks, which increases traction motor requirements. Moreover, partnerships between motor manufacturers and OEMs are being leveraged to optimize performance, durability, and integration with battery management systems. Overall, the rising deployment of electric commercial vehicles is shaping demand patterns and influencing production capacities in the traction motor sector.

Significant opportunities are being created in the electric commercial vehicle traction motor market through advanced motor designs, high-efficiency components, and modular integration solutions. Traction motors with improved power-to-weight ratios, optimized torque, and enhanced thermal management are being positioned as critical differentiators to increase vehicle range and performance. Modular motor solutions are being adopted by OEMs for easier integration across multiple vehicle types, allowing cost reduction and faster assembly processes. Collaboration with battery and inverter manufacturers is creating opportunities to develop integrated propulsion systems that improve energy utilization and extend lifecycle performance. Additionally, aftermarket services such as predictive maintenance and retrofitting existing fleets with upgraded traction motors are being explored to capture incremental revenue streams. Opportunities are also being strengthened by government programs promoting fleet electrification in commercial logistics and public transport, which is expanding the market for high-performance traction motors. Collectively, these factors are establishing a framework for innovation-led growth and strategic positioning in the competitive electric commercial vehicle sector.

The electric commercial vehicle traction motor market is being shaped by trends focused on electrification, efficiency optimization, and system-level integration. Motors are being increasingly designed to deliver higher torque density, reduced weight, and better thermal stability, meeting the performance demands of heavy-duty applications. Electrification of urban delivery fleets and public transit vehicles is being driven by regulatory incentives and consumer awareness of operational efficiency, leading to expanded motor adoption. In addition, software-enabled motor control systems and regenerative braking integration are being utilized to enhance energy recapture and improve overall system efficiency. Emerging trends also include collaborative development between motor suppliers and vehicle manufacturers to produce scalable, standardized motor modules that reduce complexity and cost. The emphasis on reliability, long service life, and low maintenance requirements is influencing design strategies, while growing attention to lifecycle cost and fleet total cost of ownership is redefining market priorities. These trends collectively reinforce the market’s trajectory toward higher adoption, optimized operations, and strategic fleet electrification.

The electric commercial vehicle traction motor market faces challenges arising from supply chain constraints and the need for standardization in performance and compatibility. Limited availability of high-grade rare-earth materials, semiconductors, and advanced components is causing production delays and cost fluctuations. OEMs and motor suppliers are being pressured to meet stringent performance, reliability, and thermal management standards while addressing variability across vehicle types and duty cycles. Additionally, high initial capital costs and integration complexities for fleet operators are impacting large-scale adoption in certain regions. Addressing these challenges requires robust supplier networks, quality assurance, and harmonized engineering standards to ensure motor compatibility across different commercial vehicle platforms. Furthermore, fluctuations in raw material prices and regulatory uncertainties in energy policies can create financial and operational pressures, highlighting the need for proactive risk management and strategic collaboration between manufacturers, OEMs, and logistics operators.

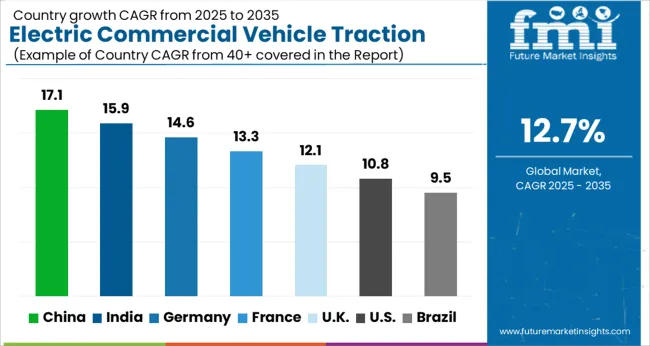

| Country | CAGR |

|---|---|

| China | 17.1% |

| India | 15.9% |

| Germany | 14.6% |

| France | 13.3% |

| UK | 12.1% |

| USA | 10.8% |

| Brazil | 9.5% |

The global electric commercial vehicle traction motor market is projected to grow at a CAGR of 12.7% from 2025 to 2035. China leads with a growth rate of 17.1%, followed by India at 15.9%, and France at 13.3%. The United Kingdom records a growth rate of 12.1%, while the United States shows a comparatively moderate growth of 10.8%. Market expansion is driven by increasing adoption of electric commercial vehicles, stricter emission regulations, and rising urban logistics demand. Emerging economies like China and India benefit from expanding fleets, government incentives, and investments in charging infrastructure. Developed markets such as France, UK, and USA are focusing on electrification, efficiency improvements, and integrating smart mobility solutions to strengthen traction motor adoption globally. This report includes insights on 40+ countries; the top markets are shown here for reference.

The electric commercial vehicle traction motor market in China is growing at a CAGR of 17.1%, reflecting the country’s aggressive push toward electrification of commercial fleets. China’s urban logistics sector is expanding rapidly, increasing the demand for electric trucks, buses, and delivery vehicles. Government incentives, subsidies, and supportive policies are accelerating fleet electrification and reducing the total cost of ownership for electric vehicles. Domestic manufacturers are investing heavily in high-efficiency traction motors, battery integration, and smart vehicle systems to meet rising demand. Additionally, the growth of charging infrastructure and R&D in energy-efficient technologies is further driving the adoption of electric commercial vehicle traction motors across the country.

The electric commercial vehicle traction motor market in India is growing at a CAGR of 15.9%. Market expansion is supported by government incentives under FAME II, favorable policies, and growing investments in EV charging infrastructure. Indian logistics and last-mile delivery sectors are adopting electric trucks and vans to improve sustainability and reduce operational costs. Domestic manufacturers and startups are actively developing efficient traction motors and battery systems for commercial applications. Additionally, rising environmental awareness and emission reduction targets are pushing fleet operators to transition toward electric mobility solutions. These factors collectively contribute to India’s rapid growth in electric commercial vehicle traction motor adoption.

The electric commercial vehicle traction motor market in France is expanding at a CAGR of 13.3%. Growth is driven by government regulations supporting zero-emission commercial vehicles, urban emission reduction mandates, and incentives for fleet electrification. Logistics operators and municipalities are increasingly adopting electric buses, trucks, and delivery vans. French manufacturers and global OEMs are investing in energy-efficient traction motor technologies, integrating smart vehicle systems and lightweight components to enhance efficiency. Additionally, infrastructure expansion, such as public charging stations, is facilitating the adoption of electric commercial vehicles. The market is also being shaped by EU-level environmental policies and emission standards that further encourage fleet electrification across France.

The electric commercial vehicle traction motor market in the United Kingdom is growing at a CAGR of 12.1%. Market growth is driven by the UK government’s commitment to reduce emissions, including the ban on new diesel and petrol commercial vehicles by 2040. Fleet operators are increasingly transitioning to electric trucks, vans, and buses to comply with environmental regulations and reduce operational costs. British manufacturers and technology providers are focusing on high-efficiency traction motors, battery optimization, and integration of connected systems. Expansion of charging infrastructure and incentives for zero-emission fleets are further accelerating market adoption in the UK.

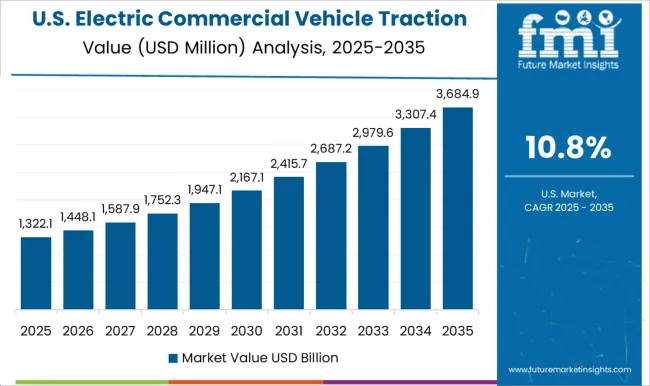

The electric commercial vehicle traction motor market in the United States is growing at a CAGR of 10.8%. Market expansion is driven by increasing fleet electrification across logistics, delivery, and public transportation sectors. Federal and state-level incentives for electric commercial vehicles are encouraging adoption, while emission reduction targets and sustainability initiatives are shaping corporate fleet strategies. USA manufacturers are investing in high-efficiency traction motors, lightweight designs, and battery integration to enhance vehicle performance and reduce energy consumption. Expansion of charging networks, along with consumer and fleet operator awareness, is further supporting market growth in electric commercial vehicle traction motors across the country.

The electric commercial vehicle traction motor market is witnessing rapid growth as the global transportation sector increasingly shifts toward electrification to meet stringent emission regulations and sustainability goals. Leading industry players such as ABB, BorgWarner, and Bosch are spearheading innovations in high-efficiency traction motors, focusing on improving power density, thermal management, and reliability for commercial vehicles. Companies like Dana, Delta, and Hitachi Automotive are investing heavily in research and development to produce lightweight, compact, and energy-efficient motors suitable for buses, trucks, and other heavy-duty electric commercial vehicles.

The market is driven by the rising adoption of battery-electric and hybrid commercial vehicles across urban logistics, last-mile delivery, and public transportation sectors. With increasing government incentives, policy support, and emission reduction mandates, manufacturers are leveraging these opportunities to expand production capacities and enter strategic collaborations, thereby enhancing their footprint in both mature and emerging markets. The competitive landscape is further intensified by players such as Magna, Nidec, and ZF, who are emphasizing modular motor designs, integrated power electronics, and improved regenerative braking systems to optimize performance and reduce operational costs. The push for electrification is also fueling partnerships between OEMs and motor manufacturers to accelerate commercialization of electric commercial vehicles, enhance range capabilities, and improve battery efficiency.

The market is expected to experience sustained growth, driven by urbanization, the need for clean mobility solutions, and technological advancements in electric powertrains. With ongoing investments in smart manufacturing, digital twin simulations, and advanced materials, companies like ABB, BorgWarner, and Bosch are poised to lead the transformation of the electric commercial vehicle traction motor market. The integration of innovative motor architectures and system-level optimization will continue to support market expansion, making electrification a central focus for the future of commercial mobility worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 billion |

| Motor | Permanent Magnet Synchronous Motors (PMSM), AC Induction Motors, Switched Reluctance Motors (SRM), and DC Motors |

| Vehicle | Buses, Pickups trucks, Medium and Heavy-Duty Trucks, and Vans |

| Power Rating | 200-400 kW, Less than 100 kW, 100-200 kW, and Above 400 kW |

| Axle Architecture | Integrated and Central Drive Unit |

| Transmission | Single-speed drive and Multi-speed drive |

| Design | Radial Flux and Axial Flux |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, BorgWarner, Bosch, Dana, Delta, Hitachi Automotive, Magna, Nidec, and ZF |

| Additional Attributes | Dollar sales by motor type (AC, DC, permanent magnet, induction) and application (buses, trucks, delivery vans) are key metrics. Trends include rising demand for energy-efficient and high-torque motors, growth in electric commercial vehicle adoption, and increasing integration with advanced drivetrain systems. Regional adoption, technological advancements, and regulatory incentives are driving market growth. |

The global electric commercial vehicle traction motor market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the electric commercial vehicle traction motor market is projected to reach USD 7.5 billion by 2035.

The electric commercial vehicle traction motor market is expected to grow at a 12.7% CAGR between 2025 and 2035.

The key product types in electric commercial vehicle traction motor market are permanent magnet synchronous motors (pmsm), ac induction motors, switched reluctance motors (srm) and dc motors.

In terms of vehicle, pickup trucks segment to command 30.4% share in the electric commercial vehicle traction motor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electrically-Driven Heavy-Duty Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Electrically Actuated Micro Robots Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA