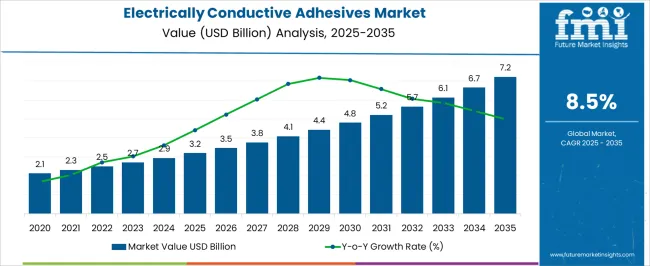

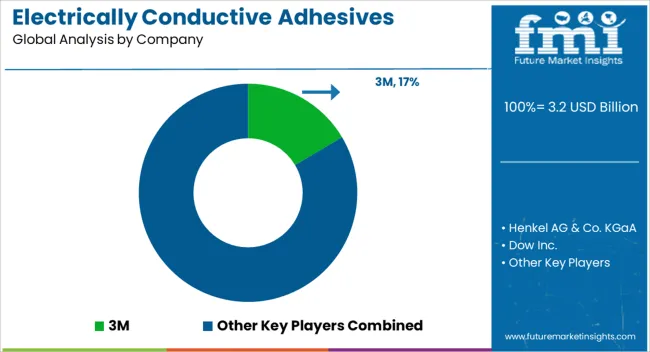

The Electrically Conductive Adhesives Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 7.2 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

| Metric | Value |

|---|---|

| Electrically Conductive Adhesives Market Estimated Value in (2025 E) | USD 3.2 billion |

| Electrically Conductive Adhesives Market Forecast Value in (2035 F) | USD 7.2 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The Electrically Conductive Adhesives market is showing robust growth, driven by the rising demand for lightweight, reliable, and cost-effective bonding solutions across multiple industries. Unlike traditional soldering methods, these adhesives provide superior flexibility, reduce stress on delicate components, and allow for miniaturization of electronic devices. Expanding applications in automotive electronics, consumer electronics, and medical devices are contributing to market expansion, particularly as design trends shift toward smaller, more efficient components.

Innovations in nanotechnology and advanced filler materials are further improving conductivity, thermal stability, and mechanical strength, enabling these adhesives to be used in more demanding environments. Regulatory trends promoting lead-free and environmentally friendly materials are also encouraging the replacement of soldering with conductive adhesives.

With industries emphasizing energy efficiency, sustainability, and high-performance bonding, electrically conductive adhesives are becoming a preferred choice for manufacturers worldwide Growing investments in electric vehicles, 5G infrastructure, and advanced wearable technologies are expected to support continuous adoption, making this market an important contributor to the broader electronics and materials ecosystem in the coming decade.

The electrically conductive adhesives market is segmented by type, application, filler, product type, and geographic regions. By type, electrically conductive adhesives market is divided into Epoxy, Polyurethane, Silicone, Acrylic, and Others. In terms of application, electrically conductive adhesives market is classified into Automotive, Consumer Electronics, Aerospace, Bio-Science, and Others. Based on filler, electrically conductive adhesives market is segmented into Silver, Copper, Carbon, and Others. By product type, electrically conductive adhesives market is segmented into Isotropic Conductive Adhesives and Anisotropic Conductive Adhesives. Regionally, the electrically conductive adhesives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

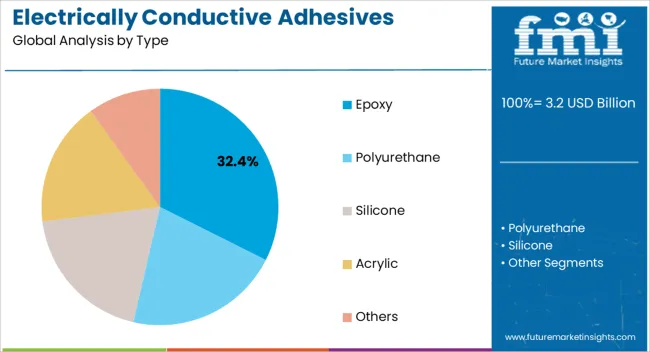

The epoxy type segment is expected to account for 32.4% of the Electrically Conductive Adhesives market revenue in 2025, making it the leading type category. Epoxy adhesives are widely used due to their exceptional bonding strength, thermal stability, and compatibility with diverse substrates including metals, ceramics, and plastics. Their strong adhesion properties ensure reliability in harsh environments, making them particularly suitable for automotive, aerospace, and electronics applications where durability and conductivity are critical.

Epoxy formulations can be tailored to meet specific performance requirements, including enhanced flexibility, resistance to moisture, and improved thermal conductivity. The increasing use of epoxy-based adhesives in printed circuit boards, sensors, and microelectronic assemblies further supports their market dominance.

Cost efficiency, long shelf life, and adaptability in various production processes make epoxy adhesives a preferred choice for manufacturers As demand rises for high-performance bonding materials in next-generation electronic devices and vehicles, epoxy adhesives are expected to maintain their leadership, driven by technological advancements and consistent reliability across multiple applications.

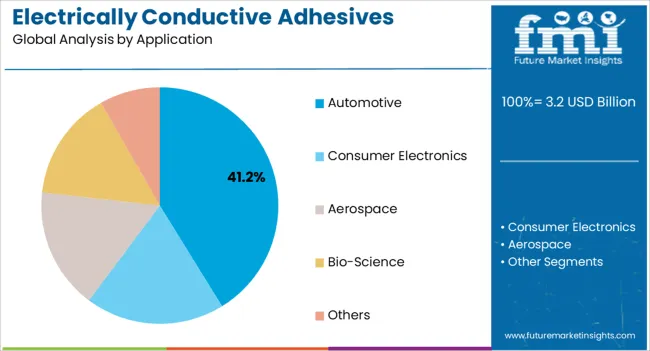

The automotive application segment is projected to hold 41.2% of the Electrically Conductive Adhesives market revenue share in 2025, highlighting its role as the dominant application area. Growth in this segment is supported by the increasing electrification of vehicles, rising adoption of advanced driver assistance systems, and demand for lightweight materials. Electrically conductive adhesives are replacing traditional soldering methods in automotive electronics due to their ability to provide durable, flexible, and thermally stable connections.

They are particularly valuable in bonding sensors, control units, and battery management systems, where consistent electrical conductivity is vital. The adhesives also enable miniaturization and integration of complex circuits, aligning with the industry’s push toward compact and efficient designs. With the global surge in electric vehicle production and stricter environmental regulations, manufacturers are increasingly adopting conductive adhesives as sustainable alternatives to lead-based solder.

Their role in supporting safety systems, connectivity features, and energy efficiency continues to strengthen their market share The automotive industry’s focus on innovation and sustainability is expected to ensure long-term growth for this application segment.

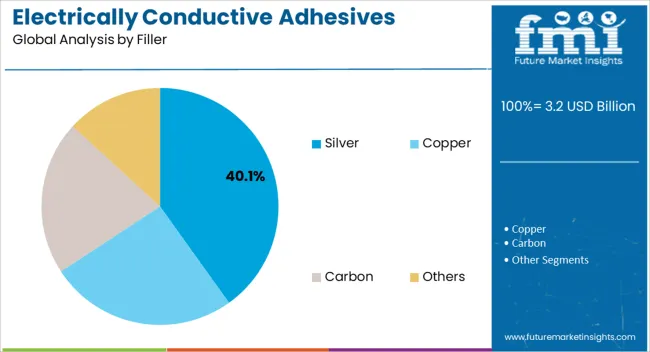

The silver filler segment is anticipated to represent 40.1% of the Electrically Conductive Adhesives market revenue in 2025, making it the largest filler material segment. Silver is widely used as a filler due to its superior electrical conductivity, thermal stability, and chemical resistance, which enhance the performance of adhesives in demanding applications. Its ability to provide reliable electrical pathways ensures that adhesives filled with silver are suitable for high-performance electronics, medical devices, and automotive components.

Despite being more expensive than alternatives such as carbon or copper, the exceptional conductivity and stability offered by silver justify its widespread adoption in critical applications. The rising demand for precision electronics, wearable devices, and medical implants has further reinforced the preference for silver fillers.

Continuous improvements in particle size reduction and dispersion techniques are enabling higher efficiency and reduced material usage, addressing cost concerns As industries move toward more advanced and reliable electronics, silver fillers are expected to remain the primary choice, sustaining their leadership in the filler segment.

The materials used to join electrical and electronic wires and circuits without hampering the conductivity of the circuit are referred to as electrically conductive adhesives. Inducing conductivity in a polymeric matrix and dispersing metallic particles are further uses of electrically conductive adhesives. Acetates, epoxies, silicones, and polyimides are a few of the types that are often used as electrically conductive adhesives. Polyurethane is another. They are extensively utilized in electronic touch panels, coatings, RFID chips, and light-emitting diode mounting (LEDs).

They display a number of beneficial traits, including low curing temperatures, compatibility with non-solderable materials, superior adhesion, improved fatigue resistance, and increased moisture resistance. Additionally, they have the ability to prevent the electromagnetic radiation that different modern gadgets release. These adhesives are therefore widely employed in a variety of sectors, including aircraft, medicine, the automobile industry, and electronics.

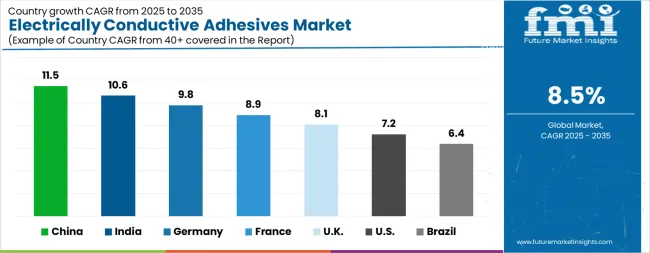

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

The Electrically Conductive Adhesives Market is expected to register a CAGR of 8.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.5%, followed by India at 10.6%. Developed markets such as Germany, France, and the Uk continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.4%, yet still underscores a broadly positive trajectory for the global Electrically Conductive Adhesives Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.8%. The USA Electrically Conductive Adhesives Market is estimated to be valued at USD 1.1 billion in 2025 and is anticipated to reach a valuation of USD 2.2 billion by 2035. Sales are projected to rise at a CAGR of 7.2% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 162.3 million and USD 91.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 Billion |

| Type | Epoxy, Polyurethane, Silicone, Acrylic, and Others |

| Application | Automotive, Consumer Electronics, Aerospace, Bio-Science, and Others |

| Filler | Silver, Copper, Carbon, and Others |

| Product Type | Isotropic Conductive Adhesives and Anisotropic Conductive Adhesives |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Henkel AG & Co. KGaA, Dow Inc., MG Chemicals, HB Fuller, Aremco, Master Bond Inc., Parker Hannifin Corp., Creative Materials Inc., Permabond, Panacol-Elosol GmbH, and HITEK Electronic Materials Ltd |

The global electrically conductive adhesives market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the electrically conductive adhesives market is projected to reach USD 7.2 billion by 2035.

The electrically conductive adhesives market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in electrically conductive adhesives market are epoxy, polyurethane, silicone, acrylic and others.

In terms of application, automotive segment to command 41.2% share in the electrically conductive adhesives market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrically Conductive Coating Market Size and Share Forecast Outlook 2025 to 2035

Adhesives for Electric Vehicle Power Batteries Market Forecast and Outlook 2025 to 2035

Conductive Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymer Coating Market Size and Share Forecast Outlook 2025 to 2035

Electrically-Driven Heavy-Duty Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Electrically Actuated Micro Robots Market Size and Share Forecast Outlook 2025 to 2035

Conductive Inks Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymer Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Adhesives And Sealants Market Size and Share Forecast Outlook 2025 to 2035

Conductive Silicone Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymers Market Size and Share Forecast Outlook 2025 to 2035

Conductive Fluted Sheets Market Size and Share Forecast Outlook 2025 to 2035

Conductive Cardboard Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Conductive Bags Market from 2025 to 2035

Understanding Market Share Trends in Conductive Inks

Conductive Plastics Market Growth - Trends & Forecast 2025 to 2035

Conductive Foam Market Growth – Trends & Outlook 2024-2034

Conductive Fiber Market Growth – Trends & Forecast 2024-2034

Conductive Ink Printer Market Trends & Industry Growth Forecast 2024-2034

Conductive Textile Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA