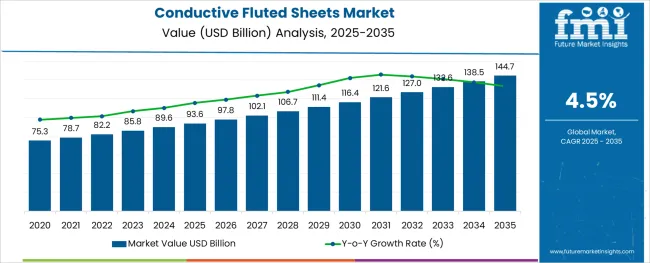

The Conductive Fluted Sheets Market is estimated to be valued at USD 93.6 billion in 2025 and is projected to reach USD 144.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The conductive fluted sheets market is experiencing sustained growth propelled by rising demand for electrostatic discharge safe packaging in electronics, automotive, and industrial sectors. The need to protect sensitive components from static damage during storage and transportation has positioned conductive fluted sheets as an essential packaging material. Material innovation, particularly the increasing use of polypropylene (PP), has enhanced product durability, chemical resistance, and recyclability, aligning with environmental regulations and sustainability targets.

The preference for mid-range thicknesses supports an ideal balance between strength and lightweight characteristics, optimizing both protection and shipping costs. Applications have expanded beyond electronics to include boxes and totes used in manufacturing and warehousing, driven by the need for reusable, durable, and conductive packaging solutions.

Additionally, integration of conductive fluted sheets in automated packaging lines has improved operational efficiencies. Future growth will be driven by further material enhancements, expanded industrial adoption, and increasing emphasis on sustainable protective packaging.

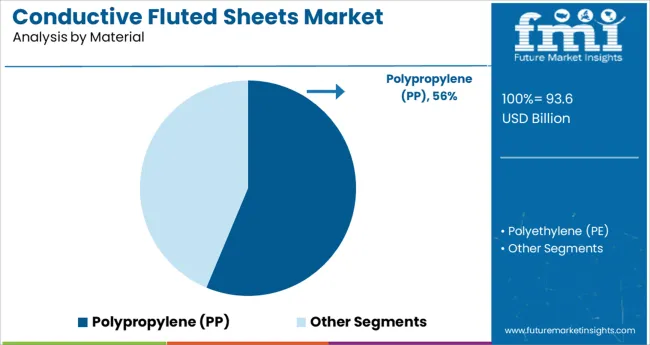

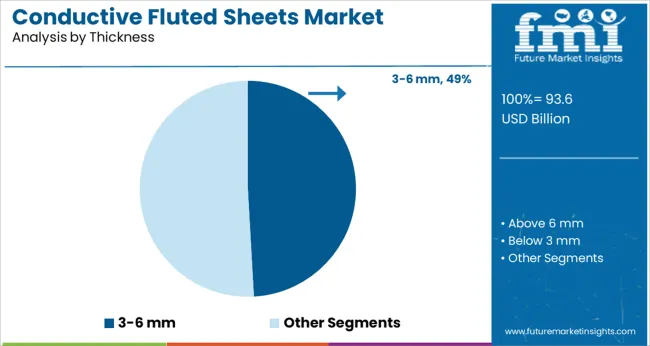

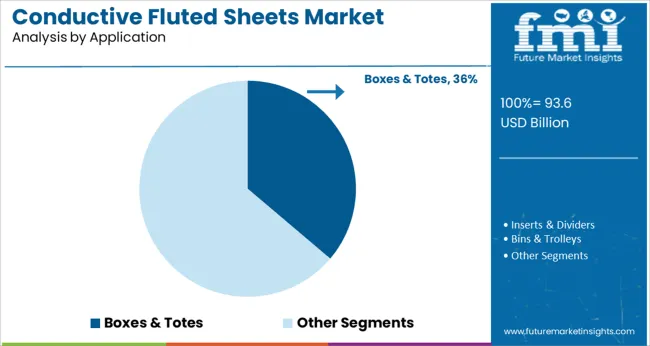

The market is segmented by Material, Thickness, and Application and region. By Material, the market is divided into Polypropylene (PP) and Polyethylene (PE). In terms of Thickness, the market is classified into 3-6 mm, Above 6 mm, and Below 3 mm. Based on Application, the market is segmented into Boxes & Totes, Inserts & Dividers, Bins & Trolleys, and Liners. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polypropylene material segment is expected to hold 56.3% of the market revenue share in 2025, making it the dominant material choice. This dominance is due to polypropylene’s excellent mechanical strength, chemical resistance, and lightweight nature, which improve handling and reduce transportation costs.

Additionally, polypropylene’s recyclability aligns with growing environmental regulations and corporate sustainability initiatives. The material’s ability to be easily processed into conductive fluted sheets with consistent quality has facilitated its wide adoption across industries requiring static protection.

Its compatibility with various additives to enhance conductivity and durability has further reinforced its position as the preferred material in this market.

The 3 to 6 millimeter thickness segment is projected to capture 49.1% of market revenue in 2025, leading the thickness categories. This range has gained favor due to its optimal balance between protective cushioning and weight efficiency.

Sheets within this thickness provide sufficient rigidity to shield sensitive products from mechanical shocks while maintaining lightness to reduce freight costs. The ease of handling and compatibility with automated packaging systems have further encouraged adoption.

The thickness range is particularly suited for boxes and totes applications where durability and repeated use are required, driving its sustained market share.

The boxes and totes application segment is anticipated to hold 36.2% of the conductive fluted sheets market revenue in 2025, establishing it as the leading application. This growth has been driven by the expanding use of conductive fluted sheets for reusable and durable packaging solutions in electronics, automotive parts, and industrial logistics.

The ability of these packaging formats to protect sensitive components from electrostatic discharge during handling and transport has been critical. Additionally, the trend toward sustainable and returnable packaging systems has increased demand for sturdy boxes and totes made from conductive fluted sheets.

Their integration into warehouse and distribution operations for efficient stacking, transport, and storage has further supported market expansion.

Growing demand for products such as TV, MP3 players, cameras, laptops, and others have generated a requirement for an efficient packaging system, which boosts the market significantly. In addition, spurred demand for all-weather protective packaging for fragile electronic products like network servers, routers, and sensors enhance the demand for electronic packaging, as a result, boosting demand for conductive fluted sheets.

On the other hand, increasing need for advanced quality military-grade packaging in the aerospace and defense sector for satellite communication, naval warships, and aircraft guidance-control assemblies is projected to propel the industry significantly. Moreover, growing initiatives of players to sustainable packaging are likely to offer remunerative opportunities to the market.

In September 2024, Heinz Partners, along with WestRock replaced shrink-wrapped multipacks of Heinz Beanz, Heinz soups, and Heinz pasta varieties on supermarket shelves with recyclable paperboard developed by WestRock. In another occurrence, the Mondi group launched seven new sustainable packaging solutions for expanding online grocery delivery across Central Europe. All boxes in the eGrocery portfolio are 100% recyclable.

The prominent raw material for conductive fluted sheets are trees and other eco-friendly products. Since its manufacturing involves a considerable felling of trees, environmentalists have raised concerns regarding its impact on the environment. This factors is likely to hamper market growth.

With the escalating momentum of the “Save the Forest” movements, the industry may suffer during the forecast period. Moreover, piling up paperboard waste due to the low rate of recycling can further hinder the expansion of the industry.

The Fiber Box Association, a non-profit organization representing and serving the corrugated industry, claims that 90% of packaging gets recycled, whereas 10% adds up to the environmental waste. This is expected to impede the market rise in the forecast period.

According to the analysis, the market in China is projected to expand at a CAGR of 7% during the forecast period. The market is principally influenced by the increasing per capita income, changing demographics, and social atmosphere. Consequently, new packaging processes, new materials, and forms demand is generated.

During the assessment period, the expansion of e-commerce giant players like Alibaba is predicted to play a crucial role in propelling the conductive fluted sheets market. For instance, as per Alibaba, the Chinese spent about USD 139 Billion during Single’s day fest. This generated enormous demand for inventory and storage of several goods and enhanced demand for conductive fluted sheets for packaging.

Australia’s Department of Agriculture and Water Resources has raised concerns about China’s ability to accomplish the rising demand for food supply from domestic production. Therefore, there is an urgent need for the government to import food items, which is likely to present avenues of opportunities to the propelling conductive fluted sheets market. Expanding e-commerce, growing urbanization, and enhanced population awareness are other factors that will add to the market expansion in China.

As per the analysis, the conductive fluted sheets market in India is expected to record a CAGR of 8% during the forecast period. Rapid urbanization and industrialization are the major causes bolstering the market in India. Growing demand for effective packaging solutions in architecture and packaging solutions have positively impacted the market.

The construction industry in India is projected to secure about USD 1.4 Trillion by 2025, claims Invest India. The sector also obtained the highest FDI during the tenure of 2000-2024. As a result, the construction sector, real estate, and urban development will be potential consumers of the conductive fluted sheets market throughout the forecast period.

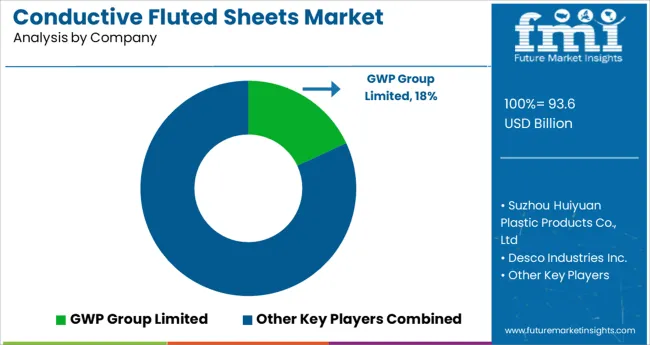

Key players of the global conductive fluted sheets market include GWP Group Limited, Desco Industries Inc., Corlite Packaging Industries Sdn Bhd, Shreeram Polymers Inc., Shish Industries Limited, Protech, Coroplast, among others.

Coroplast® is North America’s largest manufacturer of conductive fluted sheets that are ideal for outdoor and indoor applications in screen printing with premium colors for graphics.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.45% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Material, Thickness, Applications, End-Uses, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; APEJ; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | GWP Group Limited; Desco Industries Inc.; Corlite Packaging Industries Sdn Bhd; Shreeram Polymers Inc.; Shish Industries Limited; Protech; Coroplast |

| Customization | Available Upon Request |

The global conductive fluted sheets market is estimated to be valued at USD 93.6 billion in 2025.

It is projected to reach USD 144.7 billion by 2035.

The market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types are polypropylene (pp) and polyethylene (pe).

3-6 mm segment is expected to dominate with a 49.1% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Conductive Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymer Coating Market Size and Share Forecast Outlook 2025 to 2035

Conductive Inks Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymer Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Conductive Silicone Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymers Market Size and Share Forecast Outlook 2025 to 2035

Conductive Cardboard Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Conductive Bags Market from 2025 to 2035

Understanding Market Share Trends in Conductive Inks

Conductive Plastics Market Growth - Trends & Forecast 2025 to 2035

Conductive Foam Market Growth – Trends & Outlook 2024-2034

Conductive Fiber Market Growth – Trends & Forecast 2024-2034

Conductive Ink Printer Market Trends & Industry Growth Forecast 2024-2034

Conductive Textile Market

Anisotropic Conductive Liquid Paste Market Size and Share Forecast Outlook 2025 to 2035

Transparent Conductive Films Market Size and Share Forecast Outlook 2025 to 2035

Stretchable Conductive Material Analysis by Material, Fillers, Stretching Mechanism, Fabrication, Function, Application, End-User and Region - Forecast for 2025 to 2035

Electrically Conductive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Coating Market Size and Share Forecast Outlook 2025 to 2035

Fluted Carton Trays Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA