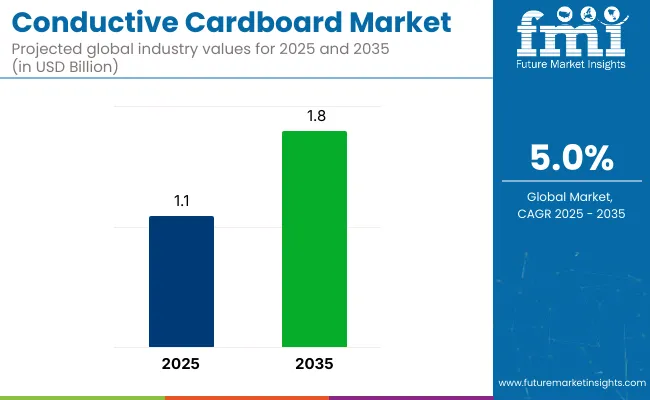

The global conductive cardboard market is expected to increase from USD 1.1 billion in 2025 to USD 1.8 billion by 2035, growing at a CAGR of 5% throughout the forecast period. Industry expansion is expected to be largely driven by the rising demand for anti-static and electrostatic discharge (ESD)-safe packaging in the electronics industry.

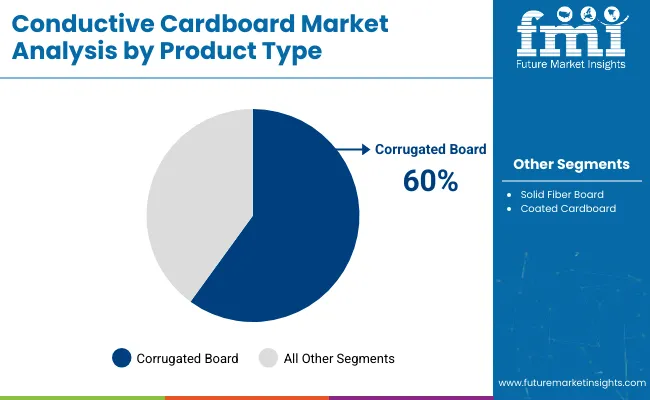

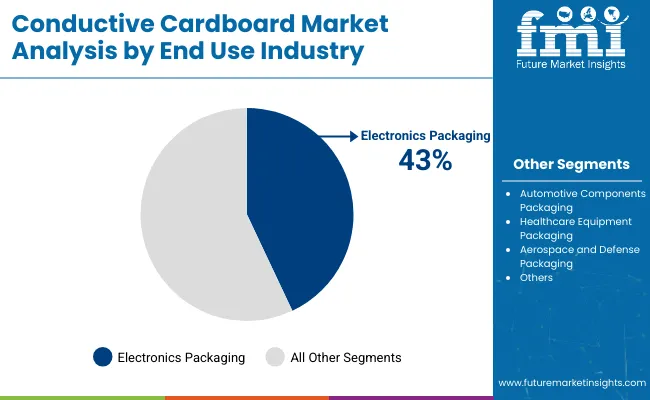

Corrugated board is expected to remain the dominant material, accounting for nearly 60% of the total industry by 2035. Electronics Packaging is likely to lead the end-use category, accounting for approximately 43% share in 2025. These segments are predicted to shape industry development significantly over the coming years.

In January 2025, Conductive Containers, Inc. (CCI) announced the appointment of Séamus Lafferty as its new Chief Executive Officer and member of the Board of Directors, following the retirement of Brad Ahlm, who served since 1993. Lafferty, formerly President of Barry-Wehmiller Packaging Systems, brings over two decades of leadership in packaging materials and equipment to the role.

This strategic leadership change is part of CCI’s broader plan to expand its industry presence in ESD-safe conductive packaging solutions. The development was officially disclosed through Business Wire (January 9, 2025) and marks a notable transition within the conductive packaging industry.

The industry holds a specialized share within its parent markets. In the packaging market, it accounts for approximately 1-2%, as conductive cardboard is a niche solution used primarily for protecting sensitive electronic components. Within the electronics and electrical components market, the share is around 3-4%, due to its critical role in packaging and transporting electronic goods.

In the sustainable packaging market, its share is about 2-3%, driven by the increasing demand for eco-friendly, recyclable packaging materials. In the conductive materials market, the share is around 1-2%, as the cardboard is a specific application of conductive materials for packaging. In the industrial packaging market, its share is approximately 4-5%, used in the safe shipping of electronic and industrial equipment.

The industry is expected to grow significantly by 2025, with corrugated board, electronics packaging, anti-static conductive cardboard, and single-wall layers leading the way. Corrugated board is projected to dominate with a 60% industry share, while electronics packaging will capture 43%, and anti-static conductive cardboard will hold 50%. Single-wall is expected to lead the layer segment with a 55% share.

Corrugated board is anticipated to remain the dominant material in the industry, holding nearly 60% of the industry share by 2035. Its excellent durability and cushioning properties are critical for protecting sensitive electronic components during long-distance transportation. The multi-layer design of corrugated board ensures maximum protection, particularly for printed circuit boards, semiconductors, and server parts.

Electronics manufacturers such as Intel and Samsung prefer corrugated cardboard to protect against electrostatic discharge (ESD) risks. Leading packaging suppliers like Smurfit Kappa and DS Smith provide advanced corrugated solutions tailored to the electronics sector, combining high strength, light weight, and cost-effectiveness.

The electronics packaging segment is expected to capture 43% of the industry share in 2025. The need for reliable anti-static protection of delicate hardware in electronics manufacturing drives this industry. As electronics miniaturization increases, the risk of electrostatic discharge (ESD) damage also rises, making ESD-safe packaging essential.

Companies like Foxconn and Apple emphasize the importance of anti-static packaging for devices such as smartphones, laptops, and servers. The growing global electronics export industry further fuels the adoption of the cardboard packaging. Conductive cardboard boxes ensure compliance with international shipping standards, strengthening their necessity in this sector.

Anti-static cardboard is projected to capture 50% of the industry share in 2025 due to its widespread use in electronics and electrical component packaging. This material prevents charge accumulation, making it suitable for packaging printed circuit boards, IC chips, and sensors. Electronics manufacturers prefer anti-static variants for both storage and transportation due to their cost-effectiveness and proven efficacy in preventing ESD damage.

The automotive and healthcare industries are also adopting anti-static packaging for electronic control units and sensitive devices. Companies like Pregis and Conductive Containers Inc. continue to provide tailored anti-static solutions, reinforcing its dominance in the industry.

Single-wall cardboard is expected to lead the layer segment with a 55% industry share in 2025. This material is favored for its light weight and cost advantage, particularly for packaging smaller electronic components, sensors, and lightweight modules that do not require heavy-duty protection. Single-wall layers are preferred for low to medium-risk shipments where basic electrostatic protection is sufficient.

Its affordability and simplicity make it the first choice for packaging mass-produced circuit boards and consumer electronics accessories. Industry players like Smurfit Kappa are designing single-wall solutions customized for both domestic and international logistics, ensuring continued dominance in the segment.

The industry is expanding due to rising demand for ESD protection in electronics and automotive sectors. Innovation in eco-friendly, recyclable materials and the shift towards biodegradable alternatives are driving growth, alongside advancements in electrical shielding technologies.

Growing ESD Protection Requirements in Electronics and Automotive Sectors

The rising demand for electrostatic discharge (ESD) protection in the electronics and automotive sectors is significantly driving the industry. As the risk of static damage to sensitive components increases, packaging that complies with ESD protection standards is becoming mandatory for electronics manufacturers and automotive suppliers.

The cardboard is increasingly preferred over traditional ESD packaging due to its recyclability and cost-effectiveness. In regions like North America, Asia, and Europe, ESD cardboard is being widely adopted for shipping PCBs and semiconductors. Manufacturers are innovating to create moisture-resistant and multi-layer variants of the cardboard, further boosting its adoption.

Pressure from Environmental Responsibility and Circular Economy Driving Material Innovation

Environmental responsibility and circular economy goals are pushing innovation in conductive cardboard materials. Companies are using recycled fibers and conductive coatings to maintain protection standards while reducing environmental impact. With growing regulatory pressure on single-use plastics, there is a shift toward biodegradable cardboard alternatives for electronics packaging.

Advancements in flexible conductive board layers using graphene and carbon fiber additives are providing enhanced electrical shielding. Efforts to certify eco-friendly ESD board formats through standardization bodies and recycling programs are further supporting the adoption of sustainable cardboard.

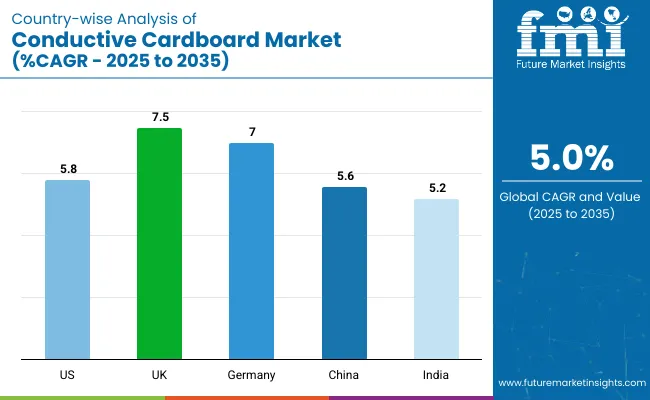

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

| United Kingdom | 7.5% |

| Germany | 7% |

| China | 5.6% |

| India | 5.2% |

The industry demand is projected to rise at a 5% CAGR from 2025 to 2035. Of the five profiled countries out of the 40 covered, the United Kingdom leads at 7.5%, followed by Germany at 7% and the United States at 5.8%, while China records 5.6% and India posts 5.2%. These rates translate to a growth premium of +50% for the United Kingdom, +40% for Germany, and +16% for the United States versus the baseline, whereas China and India trail slightly with -0.4% and -0.6%, respectively.

Divergence reflects local catalysts: rising demand for eco-friendly and efficient packaging solutions in the UK and Germany, along with steady growth in the USA driven by expanding applications in electronics, and a more moderate pace of adoption in emerging industries like China and India.

The industry in the United States is set to record a CAGR of 5.8% from 2025 to 2035. Expansion is being driven by demand for recyclable, high-performance ESD-safe packaging across electronics, healthcare, and semiconductor supply chains. Data centers, circuit-board producers, and OEMs have integrated anti-static packaging as part of quality and compliance protocols.

USA-based packaging firms are introducing biodegradable liners and plant-derived conductive coatings to align with sustainability mandates. Federal procurement policies are gradually shifting toward eco-certified packaging solutions.

The sales of the industry in the United Kingdom are projected to grow at a CAGR of 7.5% through 2035. National R&D programs and university-industry collaborations have advanced ESD material engineering, supporting electronics and EV battery exports.

The HFSS packaging tax has pushed firms toward recyclable ESD-grade corrugated options. Localized packaging production reduces carbon-intensive imports and speeds supply timelines. Export-focused sectors-telecom hardware, control systems, and wearable devices-are adopting single-wall conductive formats for reliability.

The industry in Germany is expected to grow at a CAGR of 7% from 2025 to 2035. Adoption has been anchored in industrial precision manufacturing, where OEMs require consistent ESD protection for exports. Corrugated board with anti-static lamination has been widely adopted in automation, optics, and EV drive-unit assembly lines.

German firms are leading the shift toward fluorine-free coatings and recyclable structural layers. Export regulations within the EU reinforce the need for compliant, static-dissipative solutions.

Demand for the industry in China is estimated to grow at a CAGR of 5.6% through 2035. Electronics output-ranging from smartphones to 5G infrastructure-has maintained large-scale need for static-safe export cartons. Packaging suppliers are automating coating and converting lines to meet OEM lead times.

Provincial governments are offering grants for recycled-material integration, replacing traditional polystyrene-based inserts. Foreign firms continue to co-invest in anti-static board production hubs in Guangdong and Jiangsu.

The industry in India is projected to grow at a CAGR of 5.2% between 2025 and 2035. Demand is being lifted by expansion of electronics manufacturing clusters in Tamil Nadu, Uttar Pradesh, and Telangana. Regulatory alignment with global RoHS and ESD standards is encouraging domestic producers to integrate carbon-dispersive liners into lightweight corrugated structures.

Packaging formats for PCB modules, camera sensors, and power converters are being redesigned for cost-efficient static protection. Government support under Make in India and PLI schemes strengthens the manufacturing base.

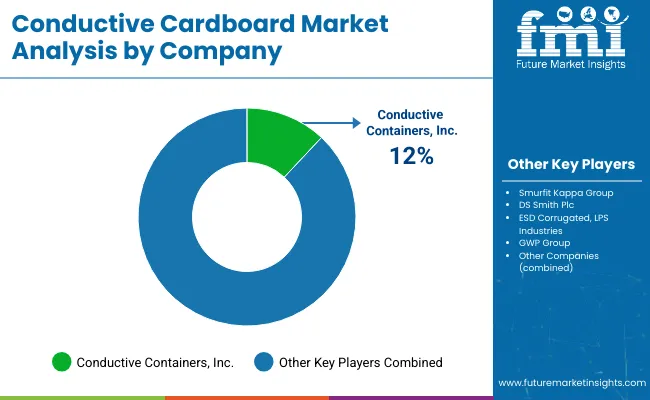

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as Antistat Inc., Conductive Containers Inc. (CCI), and GWP Conductive lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across electronics, automotive, and aerospace sectors.

Key players including Kiva Container Company, Utz Group, and Stephen Gould offer specialized solutions tailored to specific applications and regional industries. Emerging players, such as Artpol, Wuxi HengHong Plastic Science & Technology Co., Ltd., and Z-Mar Technology, focus on innovative technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Industry News

In November 2023, Conductive Containers, Inc. (CCI)officially acquired Crestline Plastics, a New Mexico-based specialist in thermoformed packaging solutions. Verified by a Business Wire press release, the acquisition aims to strengthen CCI’s capabilities in optical, electronics, and precision packaging industries. Crestline’s team, led by Derek Hermann, now operates as the “CCI-Crestline Division,” enhancing CCI’s product offerings in conductive corrugated and thermoformed packaging solutions.

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 1.1 billion |

| Projected Industry Size (2035) | USD 1.8 billion |

| CAGR (2025 to 2035) | 5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million square meters for volume |

| Product Types Analyzed (Segment 1) | Corrugated Board, Solid Fiber Board, Coated Cardboard |

| End Use Industries Analyzed (Segment 2) | Electronics Packaging, Automotive Components Packaging, Healthcare Equipment Packaging, Aerospace and Defense Packaging, Others (Semiconductors, Energy Devices) |

| Conductivity Types Analyzed (Segment 3) | Anti-Static Conductive Cardboard, Static Dissipative Conductive Cardboard, Shielding Conductive Cardboard |

| Layer Types Analyzed (Segment 4) | Single-Wall Conductive Cardboard, Double-Wall Conductive Cardboard, Triple-Wall Conductive Cardboard |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Taiwan, Brazil, Mexico, South Africa, UAE, Saudi Arabia |

| Key Players influencing the Industry | Antistat Inc., Conductive Containers Inc. / Corstat ® (CCI), GWP Conductive, Kiva Container Company, Utz Group, Stephen Gould, Artpol, Wuxi HengHong Plastic Science & Technology Co., Ltd., Z-Mar Technology. |

| Additional Attributes | Dollar sales, share by product and conductivity type, increasing demand for electronics and defense packaging, expansion in anti-static packaging for semiconductors, innovations in multilayer cardboard technology, regional supply trends |

By product type, the industry is segmented into corrugated board,solid fiber boardcoated cardboard.

By end use industry, the industry includes, electronics packaging, automotive components packaging, healthcare equipment packaging, aerospace and defense packaging, andothers (semiconductors, energy devices).

By conductivity type, the industry is divided into anti-static conductive cardboard, static dissipative conductive cardboard, and shielding conductive cardboard.

By layer type, the industry is segmented into single-wall conductive cardboard, double-wall conductive cardboard, andtriple-wall conductive cardboard.

By region, the industry is analyzed across North America, Europe, Asia Pacific, Latin America, andMiddle East & Africa.

The industry is valued at USD 1.1 billion in 2025.

It is forecasted to reach USD 1.8 billion by 2035.

The industry is anticipated to grow at a CAGR of 5% over the forecast period.

Antistat Inc is the leading company in the industry with a 25% industry share.

Corrugated board leads product demand with a 60% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Conductive Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymer Coating Market Size and Share Forecast Outlook 2025 to 2035

Conductive Inks Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymer Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Conductive Silicone Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymers Market Size and Share Forecast Outlook 2025 to 2035

Conductive Fluted Sheets Market Size and Share Forecast Outlook 2025 to 2035

Conductive Bags Market from 2025 to 2035

Understanding Market Share Trends in Conductive Inks

Conductive Plastics Market Growth - Trends & Forecast 2025 to 2035

Conductive Foam Market Growth – Trends & Outlook 2024-2034

Conductive Fiber Market Growth – Trends & Forecast 2024-2034

Conductive Ink Printer Market Trends & Industry Growth Forecast 2024-2034

Conductive Textile Market

Anisotropic Conductive Liquid Paste Market Size and Share Forecast Outlook 2025 to 2035

Transparent Conductive Films Market Size and Share Forecast Outlook 2025 to 2035

Stretchable Conductive Material Analysis by Material, Fillers, Stretching Mechanism, Fabrication, Function, Application, End-User and Region - Forecast for 2025 to 2035

Electrically Conductive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Coating Market Size and Share Forecast Outlook 2025 to 2035

Cardboard Flask Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA