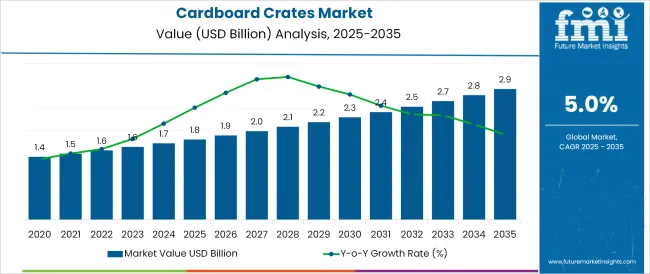

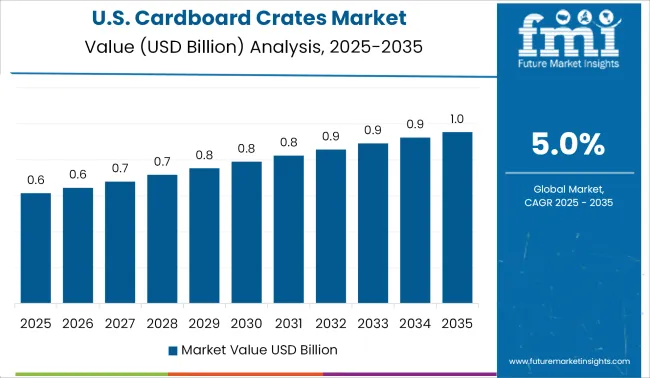

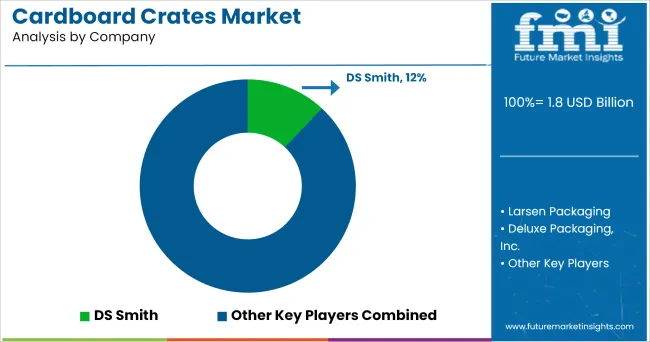

The Cardboard Crates Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The cardboard crates market is witnessing consistent growth as industries prioritize sustainable, lightweight, and cost effective packaging solutions over traditional alternatives. Rising regulatory pressure on reducing plastic usage and increasing consumer inclination toward eco friendly materials have accelerated the adoption of cardboard crates across sectors.

The market is being shaped by innovations in corrugated material strength, recyclability, and customization capabilities that align with diverse logistical and branding needs. Future expansion is expected to be supported by technological advancements in manufacturing processes, such as water resistant coatings and improved structural integrity, which are enhancing the usability of cardboard crates in demanding environments.

Additionally, the convergence of retail, e-commerce, and globalized supply chains is fostering wider application, with companies seeking to minimize environmental impact while maintaining efficiency and brand visibility through sustainable packaging strategies.

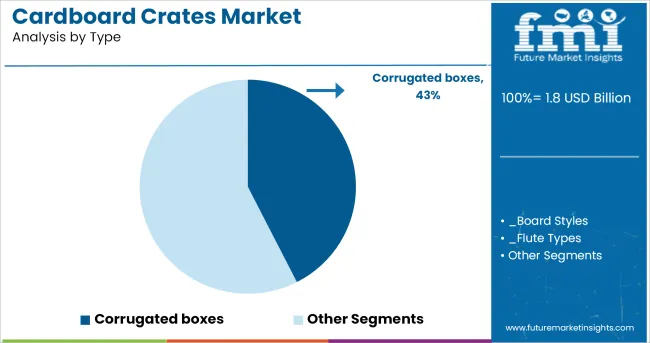

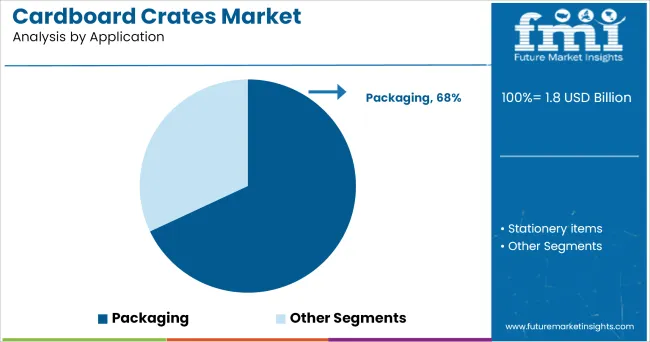

The market is segmented by Type, Application, and End-user and region. By Type, the market is divided into Corrugated boxes, Board Styles, Flute Types, and Paperboard boxes. In terms of Application, the market is classified into Packaging and Stationery items.

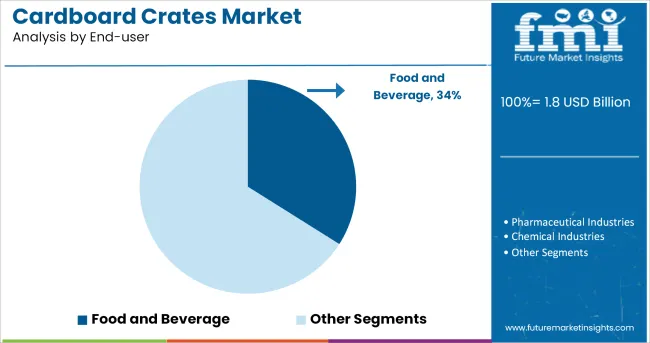

Based on End-user, the market is segmented into Food and Beverage, Pharmaceutical Industries, Chemical Industries, Glassware Industries, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, corrugated boxes are projected to account for 42.5% of the total market revenue in 2025, establishing themselves as the leading type segment. This leadership is attributed to the superior durability, stackability, and protective qualities of corrugated designs, which make them indispensable for secure product transportation.

Their lightweight construction and high strength to weight ratio have enabled widespread adoption in logistics and storage environments where cost savings and load efficiency are prioritized. Customizability and printability have also played a significant role in reinforcing their dominance, allowing brands to integrate marketing and functional needs seamlessly.

The ability of corrugated boxes to meet rigorous environmental and regulatory standards while maintaining operational convenience has ensured their sustained preference over alternative packaging types in high volume and long distance applications.

Segmented by application, packaging is forecast to capture 68.0% of the market revenue in 2025, positioning it as the foremost application segment. This prominence has been driven by the central role of packaging in protecting, presenting, and facilitating the transport of goods in modern supply chains.

The increasing need for safe, sustainable, and cost efficient packaging solutions has positioned cardboard crates as the preferred choice across industries. Companies have embraced cardboard packaging to meet sustainability targets, comply with regulatory bans on plastics, and appeal to environmentally conscious consumers.

The versatility of cardboard crates in accommodating a wide range of product shapes and weights while offering recyclability and ease of handling has further entrenched their position. Growth in retail, e-commerce, and export activities has also reinforced packaging as the dominant application, as organizations seek scalable and eco-friendly solutions to meet rising demand.

When segmented by end-user, food and beverage is projected to hold 34.0% of the market revenue in 2025, marking it as the leading end-user segment. This dominance stems from the sector’s stringent requirements for hygienic, durable, and sustainable packaging to protect perishable and delicate products throughout the supply chain.

Cardboard crates have been increasingly utilized by food and beverage companies to maintain product integrity, support branding through custom printing, and comply with food safety and sustainability standards.

The segment’s leadership is further reinforced by the growing popularity of fresh, organic, and ready-to-eat products that demand secure and eco-friendly transport solutions. The ability of cardboard crates to accommodate varying temperature, moisture, and weight conditions while remaining cost-effective and recyclable has solidified their role as the preferred packaging choice within this sector.

The cardboard crates market is driven by the growing technological enhancement in the paper products industry. The growing technical advancement such as the attachment of durable plastic wraps around them is increasing the cardboard crates demand in recent years.

Packaging of products with cardboard is talk of the town as it protects nature from the non-biodegradable waste which is plastic. The potential idiosyncratic of crates that provide an opportunity for the market growth is increasing awareness and preventive measures by the government for a reduction in global warming. The alarming cases of animal and human health has resulted in the replacement of old packing techniques.

On the other hand, the restraint for the market is the usability of the crates is limited as compared to the other packaging material. The potential for being discovered across a wide range of industries, including biological, pharmaceutical, chemical, food, and beverage industries, is driving up demand on a global scale.

Expected development in end-use sectors would certainly accelerate demand, leading to rapid penetration. On the back of the aforementioned factors, the market is predicted to open up massive potential opportunities.

In the latest report by FMI the prominent region included in North America, Latin America, Europe, East Asia, South Asia & Oceania and MEA.

The Asia Pacific has the largest and fastest-growing region in the packaging market. The region is poised to hold a market share of more than 50% over the forecast year. China holds a major chunk of Asia Pacific market revenue share followed by India and Japan due to high demand for sustainable packaging, rising environmental awareness among the urban population and growing e-commerce.

China, Japan and India are holding approximately two-third of the Asia Pacific market share. Europe is following the footsteps of Asia Pacific due to the high demand for fresh food and beverages, logistics, personal and home appliances and electronic goods. In Europe, Germany is the world’s largest exporter of paper and cardboard.

North America is anticipated to grow in the impending years as according to the American Chemistry Council, the higher demand in the paper products market is predicted from the large amount capacity being sold in the export market. USA is holding a stable position in North America in comparison with Canada owing to the reason the USA has the largest paper company in the world. In 2024, International Paper reported revenue of more than USD 20 Billion.

While the Middle East and Africa, as well as Latin America, are expected to develop at a modest rate and account for a small part of the worldwide market share of cardboard crates market throughout the projection period.

USA and China are the prominent countries in the demand and supply of cardboard crates. As half of the volume generated in USA municipalities for solid waste comes from paper and paperboards.

The largest paper consuming countries are China which has consumed approximately 1.4 million metric tons of paper in the year 2020. This was followed USA and Japan consuming 70.6 million tons and 25.5 million tons respectively in the same year.

The prominent player manufacturing cardboard crates

The market is crowded, with many players. Players are aggressively targeting a large part of the market, frequently employing both organic and inorganic expansion techniques. The key aims were alliances, acquisitions, and steadily building their global internet sales and distribution network.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global cardboard crates market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the cardboard crates market is projected to reach USD 2.9 billion by 2035.

The cardboard crates market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in cardboard crates market are corrugated boxes, board styles, flute types and paperboard boxes.

In terms of application, packaging segment to command 68.0% share in the cardboard crates market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Cardboard Crates Manufacturers

Cardboard Flask Market Size, Share & Forecast 2025 to 2035

Cardboard Trays Market Size, Share & Forecast 2025 to 2035

Cardboard Filler Market Trends – Size, Demand & Forecast 2024-2034

Cardboard Tubs Market

Composite Cardboard Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Composite Cardboard Tubes Market from 2025 to 2035

Breaking Down Market Share in Composite Cardboard Tube Packaging

Conductive Cardboard Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Crates Market Report - Industry Trends & Demand Forecast 2025 to 2035

Crates And Pallets Packaging Market

Metal Crates Market

Plastic Crates Market Size and Share Forecast Outlook 2025 to 2035

Folding Plastic Crates Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA