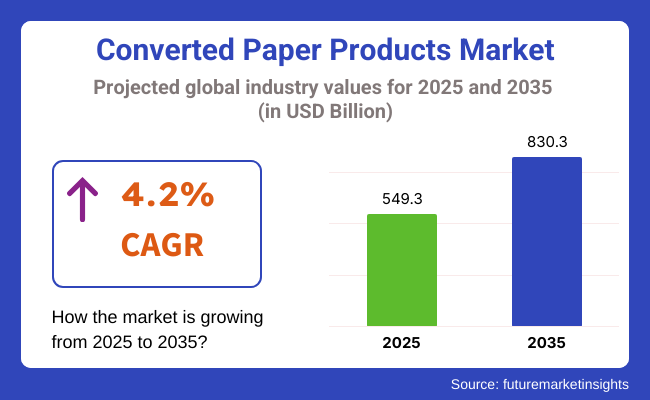

The converted paper products market stands at USD 549.3 billion in 2025 and is expected to expand at a 4.2% CAGR from 2025 to 2035. The industry size of the global converted paper products is expected to reach USD 830.3 billion by 2035.

Improved demand for sustainable packaging and hygienic products owing to heightened environmental awareness and shifts in consumer behavior are some of the major drivers fueling the industry's growth. Converted paper products hygiene and tissue products via packaging boards and stationery are witnessing robust demand in developed and emerging economies.

The increasing consumer awareness about personal hygiene and sanitation, particularly post-pandemic, is driving the demand for disposable paper-based items such as toilet rolls, napkins, and face tissues at a quicker rate. The trend has been driven by growing urbanization and per capita spending on hygienic items.

The packaging industry is a leading end-use industry wherein converted paperboard and corrugated paper solutions are rapidly replacing plastics. The spillover of e-commerce and regulatory actions on single-use plastics are contributing significantly to the change.

Companies are formulating lightweight, recyclable, and durable paper solutions to meet strength and regulation demands across various industries like food and beverages, electronics, and consumer durables. Technological advancements in the paper conversion processes like precision cutting, laminating, coating, and embossing are enhancing the quality, cost savings, and visual appeal of paper products. Automation and smart manufacturing methods also simplify production lines, reduce waste, and enable real-time customization for brand uniqueness.

Asia Pacific industry is led by a gigantic customer base, huge industrialization, and increased e-commerce. The North American and European regions continue to invest in green technology and circular economy methodology. With heightened global emphasis on sustainability, converted paper product industries are likely to expand incrementally, powered by the convergence between functional usability, environmental protection standards, and customer-driven change.

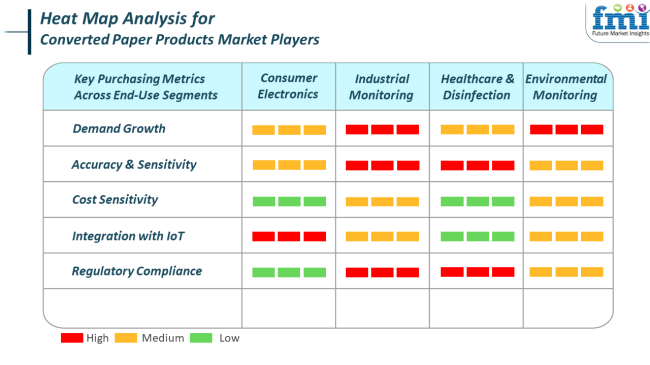

Consumer electronics industries increasingly demand protective and sustainable packaging solutions in the nature of converted paper to replace foam and plastic inserts. Paper-based offerings have the double advantage of meeting the environment and brand-friendly presentation, commanding strong growth in demand and moderate cost sensitivity.

Industrial monitoring involves the use of converted paper products for packaging, labeling, and specialty insulation. It has to be coated and precision-cut, and regulatory compliance and precision needs are of high priority. Compatibility with IoT-based logistics platforms and real-time inventory monitoring affect purchasing.

In sanitation and medicine, paper-based products for hygiene, like sterility product packaging, medical-standard tissues, and wipes, are critical. They have high sanitation standards and are sensitive to buying specifications. Monitoring of the environment uses paper modified for use in sample packs, test kits, and filtration systems where sustainability and conformity are issues.

The industry operates in an evolving material availability, environmental policy, and consumer demand environment-each with a different set of risk factors. The largest is the fluctuation in the price of raw materials, mainly pulp and recovered fiber. A disruption to world supplies or forest effects due to climate can dramatically affect the cost of production and margins.

Another key threat is regulatory exposure. As countries raise environmental standards on deforestation, emissions, and recyclability, manufacturers must rapidly adapt to new regimes of compliance. Failure to meet emerging certifications or environmental standards can hinder industry access and erode brand confidence, particularly with institutional buyers and green consumers.

Technological disruption is a threat and an opportunity. Companies lagging in automation, digital printing, or low-impact processing technology may be at a disadvantage versus more agile competitors. Moreover, any lag in keeping up with sustainability trends biodegradable coatings or water-based adhesives, for example will lead to obsolescence in product lines. Future success will rest on the ability of the industry to keep innovation, cost competitiveness, and environmental responsibility in balance.

Between 2020 and 2024, the industry witnessed consistent growth due to mounting demand for environmentally friendly packaging products and the rise of e-commerce. Both customers and companies moved towards alternatives of plastic, thereby creating a massive demand for paper-based packaging items.

The growth of purchasing online generated greater demand for materials to pack goods in, fueling the industry even more. Further, there was increased green awareness and regulative pressures, which encouraged producers to go green by adopting eco-friendly practices such as the reuse of materials and reducing wastage.

During the years before 2025 to 2035, the company will stick to its growth line with a shift towards greenness and innovation. Development of paper technology will allow the production of biodegradable and compostable items that will capture green-aware consumers' demand. Personalization and customization of packages will become more prominent, with customer preferences and marketing campaigns driving them.

Additionally, incorporating digital technologies like smart packages and automated manufacturing processes will boost efficiency and enhance product attractiveness. As global awareness of environmental issues grows, the demand for sustainable converted paper products is anticipated to rise significantly.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing demand for sustainable packaging and growth in e-commerce. | Rise in biodegradable product innovation and environment consciousness. |

| Shift towards adoption of recycled material and rudimentary automation. | Use of advanced manufacturing technology and development in intelligent packaging. |

| Recyclability and green-friendly packaging product focus. | Focus on biodegradable, compostable, and tailored products. |

| Asia-Pacific expansion according to size in production. | Expansion of emerging industries and increasing demand in developed industries. |

| Green product trend to ecological products. | Need for tailored, green, and technology-based packaging. |

Paperboard is the leading segment in Converted Paper Products, consuming about 28% of the industry in 2025; this is followed by paper bags and sacks with 18%. This shows that across industries, there has been a growing consumer preference and regulatory shift toward sustainable, biodegradable packaging options.

Paperboard dominates the industry owing to huge end-use applications in packaging for food and beverages, cosmetic products, pharmaceuticals, and consumer electronics. Lightweight and yet sturdy, paperboard is a preferred material for primary and secondary packaging due to its good printability and recyclability properties.

International Paper and WestRock are major suppliers in this segment. For instance, International Paper produces various grades of coated and uncoated paperboards that are very useful in retail and food-service packaging. WestRock manufactures highly customizable and sustainable folding cartons and containerboards that have gained popularity among CPG (Consumer Packaged Goods) brands to meet eco-conscious consumer demand.

Paper bags and sacks are also becoming increasingly popular, as countries are now enforcing bans on single-use plastics and urging businesses to adopt environmentally friendly alternatives for packaging. They have been utilized in grocery stores, fashion retail, and food deliveries.

For instance, Novolex has manufactured paper shopping bags for stores serving restaurant outlets, department stores, and grocery stores, many of which are blended with recycled content. Another heavyweight player in the league is Mondi Group, a manufacturer of industrial paper sacks for construction materials and agriculture-based products, with sustainable sources of paper and lightweight design that minimize emissions at the time of transport.

Demand for both paperboard and paper bags will continue to rise, boosted by the shifting paradigm of sustainability and regulatory compliance.

In the industry, end-use segmentation shows the food and beverage industry to dominate the maximum share of 30% in 2025, followed by the retail and consumer goods industry with 22%. This data speaks volumes about how regulatory shifts and changing perceptions of consumers are reshaping the packaging demands across prominent sectors.

The most heavily paper-oriented packaging category is food and beverage, wherein packaging items include cartons, trays, cups, wrappings, and sleeves. The demand for takeaway food has increased, while the obligations by various nations to phase out plastic in convenience packaging are also forcing manufacturers to look at recyclable and compostable paper products.

Among the frontrunners in this area is Graphic Packaging International, which makes available its sustainable paperboard solutions for ready-to-eat meals, frozen foods, and beverages. They also include folding cartons made from recycled fiber and renewable materials, along with major food chains like McDonald's and Nestlé-motivated transitions toward green packaging.

The retail and consumer goods industry revolves around utilitarian purposes as well as embellishments, where paper packagings serve not only to beautify but also to comply with mandates of green packaging. This is most evident in most apparel and cosmetic companies, which are now switching to the use of paperboard boxes, hang tags, and branded paper bags.

For instance, H&M now sources all its paper bags for its global retail operations from sustainably sourced fiber, eliminating plastic bags in line with its sustainability commitments. Similarly, L'Oréal jointly worked with the likes of Stora Enso to co-develop consciously designed paper-based packaging that minimizes the plastic content in a system of beauty product containers.

These trends, taken together, also show how sustainability pressure shapes new ideas on paper product innovation and drives demand in the most successful consumer industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

| UK | 5.2% |

| France | 5% |

| Germany | 5.1% |

| Italy | 4.8% |

| South Korea | 5.6% |

| Japan | 4.9% |

| China | 6.2% |

| Australia-NZ | 5% |

The USA industry is expected to grow at 5.9% CAGR during the forecast period. Increased demand for industrial-grade, packaging, and hygiene paper products fuels growth. Rising environmental issues and the transition towards sustainable packaging have compelled large consumer goods firms to replace plastic with paper-based alternatives, driving consistent demand.

Additionally, a well-established base for manufacturing and investment in green production processes are expected to propel the industry through the forecast period.

Increased consumption of tissue products, paperboard containers, and converted office papers for institutional and domestic uses continues to drive production. Packaging for retail use, which is driven by expansion in Internet commerce, presents another stable source of application opportunity.

The American nation is increasing the adoption of recycling and biodegradable materials much more aggressively as the world leans towards sustainability. Big businesses are adding automated solutions in a quest to improve efficiency and reduce operations costs, making it easier again to increase American competitiveness.

The UK industry is projected to increase at 5.2% CAGR during the analysis period. Sustained demand for paper-based hygiene products, food service disposables, and eco-friendly packaging is propelling growth. Food chains and retailers are progressively shifting towards compostable paper solutions in response to effective government policies related to minimizing plastic waste. These policy frameworks have been promoting innovation and the development of bio-based converted paper products.

Furthermore, the demand for ethically sourced and sustainable products has also become one of the drivers of the UK's industry trend. Digitization and internet shopping are creating demand for corrugated and specialty packaging products.

The paper sector in the UK is changing gradually with the introduction of energy-efficient production practices and improved recycling facilities. Growth is also stimulated by the commercial industry's use of high-quality paper towels, napkins, and cartons to meet hygiene and branding needs.

France is expected to register a 5% CAGR during the forecast period. The demand is driven by growing green awareness and increased usage of paper products in the healthcare, hospitality, and retail industries. Shifts toward recyclable and biodegradable packaging are gaining strong momentum, prominently so in the food and beverages industry. Converted paper products such as trays, wraps, and folding cartons become increasingly popular at the cost of single-use plastic.

Government initiatives to reduce landfill waste and encourage sustainable packaging are stimulating industry take-up. The French commercial paper and print industry is continuing to decline through substitution by digital, but this is being offset by increasing demand for household tissue, specialty paper, and packaging grades. Producers are embracing automation and clean technologies as a way of trying to reduce emissions and fit into the circular economy ethos, which supports longer-term industry sustainability.

The German industry is expected to increase at 5.1% CAGR during the period of research. Germany's strong industrial base and emphasis on sustainability are a good environment for the innovation of converted paper products.

The packaging industry, especially corrugated and molded fiber utilization, is fueled by high demand across automobile, electronics, and consumer goods sectors. With companies replacing plastic packaging with renewable resources, the industry is experiencing transformative growth.

Foodservice and hygiene paper products also record steady growth due to increased health awareness and changing consumer trends. Environmental conformity policy enforced by the government in Germany spurs the production of reusable and recyclable materials.

Emerging production technologies and digitalization of processes are supporting declining energy use and optimizing waste recycling. Having a built-in culture for recycling and increased demand for environmentally efficient packaging, Germany is going to show steady growth until 2035.

The Italian industry will expand at 4.8% CAGR during the research period. The demand for converted paper in Italy is mainly concentrated on packaging and tissue applications. Consumer growth patterns fueled by growing interest in sustainable home products and shifting food service consumption towards sustainable packaging and wraps and the effect of government policies aimed at reducing plastic waste are both helping to fuel the growth trend.

The country's small and medium-sized enterprises are gradually enhancing production technology to meet quality and environmental standards. Though Italy lags behind Germany and France in terms of automation, it has good growth prospects in specialized applications such as craft packaging and bespoke paper items. The tourism and hospitality sectors provide consistent consumption of tissue, napkins, and disposables, and the industry is thus well-supported during the forecast period.

The South Korean industry is predicted to achieve a growth of 5.6% CAGR during the study period. The industry is driven by high urbanization, increasing health and hygiene awareness, and growing e-commerce penetration.

Paper-based food packaging and personal care solutions are gaining popularity due to the fact that consumer demand is increasing for low-impact and aesthetic alternatives to plastic. South Korea boasts a prime digital commerce platform that enables frequent use of corrugated packaging and specialty cartons.

Biodegradability and recyclability are priority matters where manufacturers are working actively through design research in fiber sourcing and product design. Regulatory policies promoting circular economy processes and waste reduction are supporting shifts in consumer behavior to fuel growth even more. Tissue and hygiene remain leading contributors, making use of aged population dynamics along with growing retail off-take of premium paper-based products.

The Japanese industry will grow at 4.9% CAGR during the research period. Premium consumer demands, quality manufacturing standards, and strong sustainability emphasis dictate Japanese industries. Paper consumption in traditional sectors like printing has decelerated, but converted paper goods for hygiene, packaging, and food service continue to grow progressively. Small packaging systems and disposable food-grade containers are becoming more popular in urban and aging population settings.

Biodegradable coating, water-resistant liners, and molded pulp packaging innovation are creating new prospects for domestic manufacturers. Cleanliness and beauty-based cultural values are driving the adoption of high-end paper-based disposables.

Regulatory support in Japan for single-use plastic alternatives and technological advancements in automation are also facilitating manufacturers to enhance efficiency while lessening environmental impact. The growing convergence of smart packaging with QR-coded paper labels also suggests marketplace readiness for paper-tech hybrid solutions.

The China industry is expected to grow at 6.2% CAGR during the study period. China dominates the global industry on the back of rising urbanization, a high consumer base, and rapid growth in internet-based shopping. The consumption of corrugated packaging, molded fiber offerings, and tissue paper is expanding in commercial and residential markets. Rising environmental regulation and growing consumer awareness are compelling a transition away from plastic toward environmentally friendly paper alternatives.

The country's paper-making industry is one of the world's largest, and investments in high-speed, automated conversion technology are maximizing output. Government policy toward waste elimination and local manufacturing has encouraged innovation in recyclable and compostable paper products.

Domestic industry demand is complemented by export business, with Chinese manufacturers selling eco-packaging and disposable products worldwide. A strategic focus on sustainability will likely extend to maintain China's leadership in global volume and industry share.

The Australia-New Zealand industry is expected to expand by 5% CAGR during the study period. Growth in the demand of the region is propelled by greater environmental regulations, public pressure to consume green products, and expanding replacement of plastic with paper packaging.

Paper items like takeaway boxes, napkins, and packaging boards are increasingly being used in the hospitality, retail, and logistics sectors. Online shopping also experienced the growing use of corrugated boxes and mailer envelopes.

The area has witnessed greater rates of adoption of biodegradable materials and more stringent compliance with waste reduction goals. Domestic manufacturers are making investments in sustainable manufacturing, including closed-loop recycling and carbon-neutral production lines.

While the industry itself is comparatively smaller in scale, there is immense potential here through innovative applications and specialty packaging solutions. Greater demand for locally produced, low-impact products will likely drive steady growth in the paper conversion industry through 2035.

The industry is seeing a greater emphasis on sustainability, spearheaded by International Paper Company, WestRock Company, and Georgia-Pacific LLC on truly innovative green solutions. These companies are tapping into their extensive manufacturing capabilities and R&D in a bid to push the limits of paper products with respect to performance, recyclability, and environmental footprint.

Some salient examples include High-performance recyclable packaging from WestRock and eco-friendly packaging solutions by International Paper, which are addressing the rising demand in the consumer products industry.

Circular economy initiatives are also shaping the industry, with organizations such as DS Smith focusing on recyclable packaging. At the same time, Kimberly-Clark Corporation and Georgia-Pacific concentrate on minimizing waste and enhancing the sustainability of their product portfolios.

The flip side is that Mondi Group and Smurfit Kappa Group, classified as European and North American firms, are also actively pursuing strengthening their positions through the continued development of sustainable paper-based solutions as well as strategic expansion.

The growing consumer demand for alternatives that are friendlier to the environment has led these companies to invest in newer technologies in order to keep pushing down their carbon footprints and maintain an overall environmentally sustainable approach. The surge in interest is creating a competitive edge across the world and thus fostering innovations in product offerings like biodegradable and recyclable packaging solutions.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| International Paper Company | 18-22% |

| WestRock Company | 15-19% |

| Georgia-Pacific LLC | 12-16% |

| DS Smith Plc | 10-14% |

| Kimberly-Clark Corporation | 8-12% |

| Other Players | 24-28% |

| Company Name | Offerings & Activities |

|---|---|

| International Paper Company | Leading in sustainable packaging, expanding portfolio with innovative eco-friendly paper products. |

| WestRock Company | Focus on high-performance recyclable packaging and paperboard products for consumer goods. |

| Georgia-Pacific LLC | Diversified paper offerings from tissue to industrial packaging with a strong focus on sustainability. |

| DS Smith Plc | Increased focus on recyclable paper products and packaging solutions to support the circular economy. |

| Kimberly-Clark Corporation | A g lobal leader in paper-based products, including tissue, with a focus on sustainable production. |

Key Company Insights

International Paper Company (18-22%)

Dominates the industry with a diverse and eco-friendly product range, pushing for significant advancements in sustainable paper solutions.

WestRock Company (15-19%)

Leading in recyclable and high-performance paper products, with a strategic focus on consumer goods packaging, ensuring high sustainability standards.

Georgia-Pacific LLC (12-16%)

A major player in tissue and industrial paper products, investing heavily in diversification and sustainability, aligning with consumer demand for eco-conscious alternatives.

DS Smith Plc (10-14%)

Continues to lead in recycled paper packaging solutions, with a growing presence in Europe and North America, expanding its circular economy-driven product lines.

Kimberly-Clark Corporation (8-12%)

Focuses on a wide range of consumer paper products, with sustainability embedded in its manufacturing processes, ensuring minimal environmental impact.

Other Key Players

By product type, the industry is segmented into paperboard, paper bags and sacks, tissue paper, paper cups and containers, folding cartons, envelopes, and other.

By end use industry, the industry is segmented into food and beverage, retail and consumer goods, healthcare and personal care, e-commerce and logistics, printing and publishing, industrial packaging, and others.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by End to Use Industry, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End to Use Industry, 2018 to 2033

Table 7: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by End to Use Industry, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End to Use Industry, 2018 to 2033

Table 13: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by End to Use Industry, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End to Use Industry, 2018 to 2033

Table 19: Western Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ million) Forecast by End to Use Industry, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End to Use Industry, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ million) Forecast by End to Use Industry, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End to Use Industry, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ million) Forecast by End to Use Industry, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End to Use Industry, 2018 to 2033

Table 37: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ million) Forecast by End to Use Industry, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End to Use Industry, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ million) Forecast by End to Use Industry, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End to Use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ million) by End to Use Industry, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y to Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y to Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ million) Analysis by End to Use Industry, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End to Use Industry, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End to Use Industry, 2023 to 2033

Figure 15: Global Market Y to Y Growth (%) Projections by End to Use Industry, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End to Use Industry, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ million) by End to Use Industry, 2023 to 2033

Figure 21: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y to Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y to Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ million) Analysis by End to Use Industry, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End to Use Industry, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End to Use Industry, 2023 to 2033

Figure 33: North America Market Y to Y Growth (%) Projections by End to Use Industry, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End to Use Industry, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ million) by End to Use Industry, 2023 to 2033

Figure 39: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y to Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y to Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ million) Analysis by End to Use Industry, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End to Use Industry, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End to Use Industry, 2023 to 2033

Figure 51: Latin America Market Y to Y Growth (%) Projections by End to Use Industry, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End to Use Industry, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ million) by End to Use Industry, 2023 to 2033

Figure 57: Western Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y to Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y to Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ million) Analysis by End to Use Industry, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End to Use Industry, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End to Use Industry, 2023 to 2033

Figure 69: Western Europe Market Y to Y Growth (%) Projections by End to Use Industry, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End to Use Industry, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ million) by End to Use Industry, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y to Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y to Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ million) Analysis by End to Use Industry, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End to Use Industry, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End to Use Industry, 2023 to 2033

Figure 87: Eastern Europe Market Y to Y Growth (%) Projections by End to Use Industry, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End to Use Industry, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ million) by End to Use Industry, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y to Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y to Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ million) Analysis by End to Use Industry, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End to Use Industry, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End to Use Industry, 2023 to 2033

Figure 105: South Asia and Pacific Market Y to Y Growth (%) Projections by End to Use Industry, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End to Use Industry, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ million) by End to Use Industry, 2023 to 2033

Figure 111: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y to Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y to Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ million) Analysis by End to Use Industry, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End to Use Industry, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End to Use Industry, 2023 to 2033

Figure 123: East Asia Market Y to Y Growth (%) Projections by End to Use Industry, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End to Use Industry, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ million) by End to Use Industry, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y to Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y to Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ million) Analysis by End to Use Industry, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End to Use Industry, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End to Use Industry, 2023 to 2033

Figure 141: Middle East and Africa Market Y to Y Growth (%) Projections by End to Use Industry, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End to Use Industry, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The industry is projected to be valued at USD 549.3 billion in 2025.

By 2035, the industry is expected to reach USD 830.3 billion.

China is projected to grow at a 6.2% CAGR.

Paperboard holds the largest industry share due to its extensive use in consumer goods packaging, shipping containers, and display units.

Major players include International Paper Company, WestRock Company, Georgia-Pacific LLC, DS Smith Plc, Kimberly-Clark Corporation, Mondi Group, Smurfit Kappa Group, Stora Enso Oyj, Oji Holdings Corporation, and Sappi Limited.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA