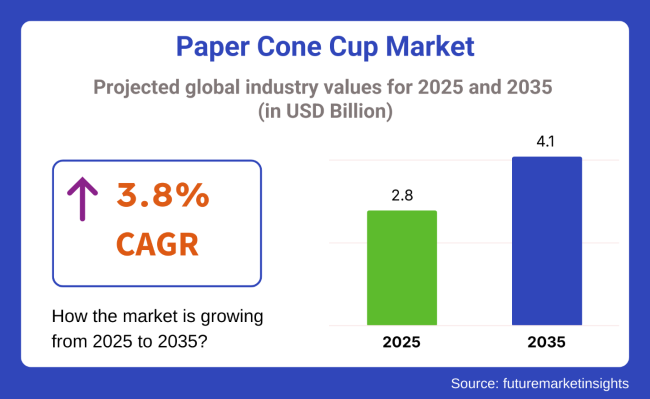

The paper cone cup market is projected to grow from USD 2.8 billion in 2025 to USD 4.1 billion by 2035, registering a CAGR of 3.8% during the forecast period. Sales in 2024 reached USD 2.7 billion, reflecting steady demand across various sectors.

This growth is driven by increasing environmental concerns, shifting consumer preferences towards sustainable packaging, and heightened hygiene awareness, especially in public and commercial spaces.

Leading companies in the paper products industry are focusing on innovation and sustainability. For instance, Huhtamaki Oyj, a global provider of sustainable packaging solutions, has emphasized the importance of eco-friendly and recyclable products. Huhtamaki launches recyclable single coated paper cups for yogurt and dairy.

"Our team has identified a varnish to replace the outer polyethylene layer which maintains a paper-like feel with a matt finish and provides a high moisture barrier for products stored in chilled conditions. This is important for manufacturers, retailers and consumers, ensuring that our unique product delivers the functional performance of traditional paper cups with a lower plastic content, while still being fully recyclable”, says Fredrik Davidsson, President of Fiber Foodservice Europe-Asia-Oceania at Huhtamaki.

The shift towards eco-friendly and biodegradable materials is a significant driver in the paper cone cup market. Manufacturers are investing in coating technologies that enhance the durability of paper cups without compromising their composability.

Additionally, the integration of digital printing allows for customization, catering to branding needs and consumer engagement. These innovations not only meet environmental standards but also offer functional benefits to end-users.

By 2035, the paper cone cup market is expected to create an incremental opportunity of USD 1.3 billion, growing 1.5 times its current value. The market's expansion is supported by regulatory measures against single-use plastics and the increasing adoption of sustainable practices by businesses. Companies that prioritize innovation, sustainability, and customization are well-positioned to capitalize on emerging opportunities in this sector.

The below table presents the expected CAGR for the global paper cone cup market over several semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 | 1.8% (2024 to 2034) |

| H2 | 3.2% (2024 to 2034) |

| H1 | 2.6% (2025 to 2035) |

| H2 | 4.1% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2033, the business is predicted to surge at a CAGR of 1.8%, followed by a slightly higher growth rate of 3.2% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 2.6% in the first half and remain relatively moderate at 4.1% in the second half. In the first half (H1) the market witnessed a decrease of 80 BPS while in the second half (H2), the market witnessed an increase of 90 BPS.

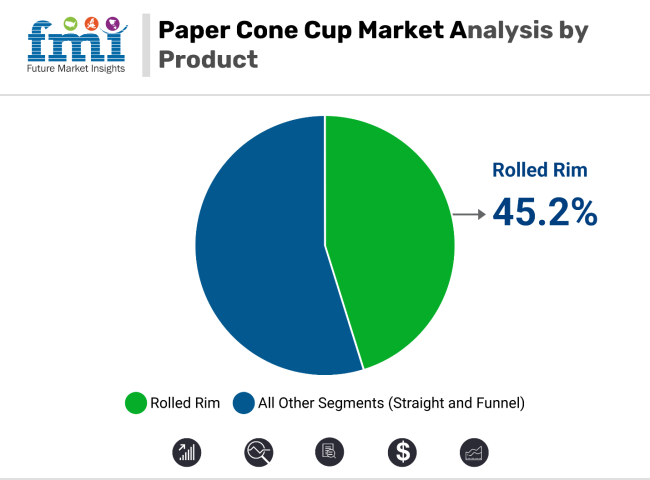

Rolled paper cone cup rims are projected to account for 45.2% of the product-type segment in the paper cone cup market by 2035, fueled by their superior user experience, spill resistance, and compatibility with both commercial and institutional dispensing systems.

The rolled rim design-featuring a tightly curled top edge enhances the structural integrity of the cup, reducing the risk of leaks, collapses, or paper delamination during use. These cups are widely used in high-traffic environments such as corporate offices, healthcare facilities, gyms, and educational institutions where water dispensers and single-use hygiene standards are prioritized.

The smooth, rounded rim offers a more comfortable drinking interface compared to straight-edged alternatives, which can feel sharp or flimsy. Additionally, rolled rim cups are more stackable and compatible with cone cup dispensers, streamlining restocking and minimizing handling.

Manufacturers are increasingly offering these cups in biodegradable or compostable paperboard variants, aligning with the global shift toward eco-friendly single-use products. Their ability to offer a balance between convenience, hygiene, and environmental consciousness has made them a preferred choice across sectors.

As organizations continue to invest in sanitary hydration solutions post-pandemic, the demand for rolled rim paper cone cups is expected to remain strong, especially in institutional and corporate settings.

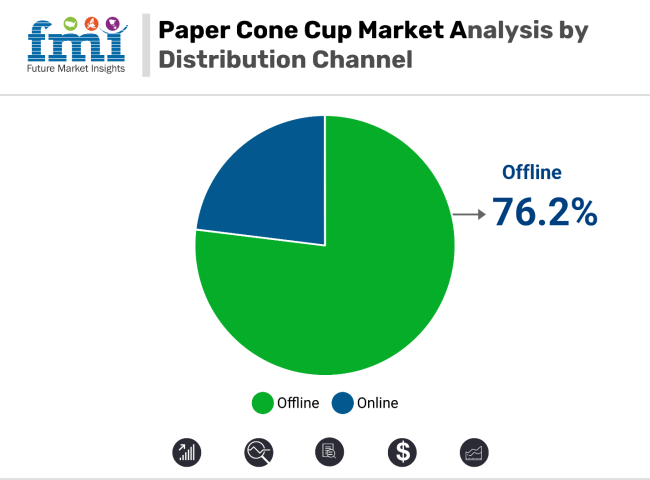

Offline distribution channels are anticipated to capture a commanding 76.2% share of the paper cone cup market by 2035, supported by large-volume procurement from commercial buyers and the continued reliance of institutional purchasers on direct sales and supplier partnerships.

Key sectors such as healthcare, education, fitness centers, and foodservice chains prefer to source paper cone cups through traditional offline channels to ensure consistent supply, bulk pricing, and personalized vendor support.

Distributors and wholesalers play a critical role in offline sales by offering tailored logistics, inventory management, and payment terms that are more flexible for large enterprises. These relationships are particularly valued in regulated industries where procurement policies favor established supply contracts over digital marketplaces.

Furthermore, regional distributors often provide shorter lead times and better compliance with local hygiene and environmental standards. Despite the rise of e-commerce, many businesses still rely on in-person demos, vendor audits, and negotiated contracts to assess quality and sustainability credentials.

Offline channels also allow for bundling of products-such as dispensers, signage, and janitorial supplies-into unified service packages. As long as paper cone cups remain a staple in health-conscious, high-volume environments, offline distribution will continue to dominate, bolstered by trust, customization, and logistical reliability.

Increase Focus on Hygiene & Safety Drives Demand for Single Use Paper Cone Cups Globally

The increased hygiene concern, particularly during the post-COVID-19 crisis, has gained more prominence with respect to hygiene awareness in worldwide paper cone cups. Individuals, as well as companies, begin to prefer disposal items that show a minimum number of cross-contaminations in communities. Paper cones are being largely used for drinking water at cooling towers in places such as school campuses, workstations, hospitals, and institutions.

Paper cone cups are single-user cups, so they are sent for dumping immediately after use. This makes them safe and hygienic. Their lightweight and ability to be stacked properly without much effort further make them easily transportable and disposed of. Rising interest in public health and sanitation has, globally, made their demand high. Paper cone cups meet those requirements while fulfilling sustainability objectives as well, thereby further increasing their uptake in diverse sectors.

Government Restrictions to Curb Plastic Usage Spurs Demand for Eco-friendly Paper Cone Cups

In most regions, governments are adopting strict measures to minimize plastic waste, and this is highly turning the spotlight towards eco-friendly alternatives. In Europe, the use of plastic cups and plastic cutlery is forbidden by the European Union's Single-Use Plastics Directive, forcing firms to seek environmentally friendly alternatives such as paper cone cups.

Furthermore, India's Plastic Waste Management Rules work to reduce plastic usage and waste, which promotes the usage of paper-based products. The policies favor the paper cone cups since they are biodegradable, and the source of the materials used is renewable.

The governments provide tax benefits and subsidies to firms that adopt environmental-friendly packaging; therefore, encouraging the manufacturing and use of paper cone cups. This makes paper cone cups appealing to business firms with respect to compliance with environmental regulations.

Consumer Perception for Paper Cone Cups less Strength & Durability May Hinder Market Growth

Quality perception can impact demand for paper cone cups because some customers perceive them as less sturdy or of lower quality than alternatives such as plastic or ceramic cups. These customers may fear that paper cups will tear, leak, or collapse more easily, especially when holding hot or liquid-heavy beverages.

This perception brings the business and consumer to the attention of plastic or reusable options, which are perceived to be stronger and more reliable than paper cone cups. Hence the concerns over the durability of paper cone cups may hinder the growth paper cone cups market even if it appears so to be eco-friendly.

Tier 1 companies comprise market leaders capturing significant market share in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Smurfit Westrock plc, Amcor plc, DS Smith plc, Mondi plc among others.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach.

Prominent companies in tier 2 include H-PACK Packaging UK Ltd, Hotpack Packaging Industries LLC, Fujian Nanwang Environment Protection Scien-Tech Co., Ltd, Freshening Industries Pte Ltd, SOLO® Cup Company and Castle EU Limited.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the future forecast for the paper cone cup market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is anticipated to remain at the forefront in North America, with a CAGR of 2.4% through 2035. In Europe, Germany is projected to witness a CAGR of 1.5% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 2.4% |

| Germany | 1.5% |

| China | 4.2% |

| UK | 1.8% |

| Spain | 1.7% |

| India | 5.2% |

| Canada | 2.0% |

The healthcare and educational sectors are currently on the growth curve in Canada. The demand for disposable products like paper cone cups is subsequently increasing. Hospitals, clinics, and other related medical facilities require hygienic and clean practices for patients in hospitals. Since paper cone cups are single-use, they serve best in the medical field with no risk of spreading germs.

Similarly, in institutions of learning like schools and colleges, students spend a lot of time in areas such as cafeterias and fountains. The demand for hygienic disposable products for both sectors drives the popularity of paper cone cups, which happen to be easy, safe, and environmentally friendly alternatives to reusing cups in both sectors.

Germany is at the forefront of taking measures to achieve a circular economy, mainly by recycling and reducing waste. Concerning plastic, Germany has made commitments to further develop sustainable alternatives for dealing with plastic. Because of such initiatives there has been increasing demand for recyclable paper cups.

With an increased number of individuals and businesses opting for greener options, cone paper cups that can be easily recycled are experiencing an increase in demand. Germany's recycling systems are fully developed. This makes it easy for the paper cup to be recycled as well as reused. The country's policy about not having excessive plastic usage to keep the earth safe and alive in the next generation is pushing the demand for paper cone cups.

In terms of product type, the market for paper cone cup is segmented into rolled paper cone cup rims, straight paper cone cup rims and funnel paper cone cups.

In terms of capacity, the market for paper cone cup is segmented into 4 Oz paper cone cups, 4. 5 Oz paper cone cups and 5 Oz paper cone cups.

Several applications of paper cone cup include paper cone cups for foodservice outlets, paper cone cups for quick service restaurants, paper cone cups for cafes, paper cone cups for institutional applications, paper cone cups for offices, paper cone cups for households and paper cone cups for theaters & malls.

Paper cone cups are sold via multiple distribution channels such as offline and online. Offline includes hypermarkets, supermarkets and convenience stores. Online includes e-commerce and brand websites.

Key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa are covered.

The paper cone cup industry is projected to witness CAGR of 3.8% between 2025 and 2035.

The global paper cone cup industry stood at USD 2.7 billion in 2024.

Global paper cone cup industry is anticipated to reach USD 4.1 billion by 2035 end.

South Asia & Pacific is set to record a CAGR of 6.9% in assessment period.

The key players operating in the paper cone cup industry are include Dart Container Corporation, VWR International, LLC., Genpak, Tycoon Packaging among others.

Table 01: Global Paper Cone Cup Market Value (US$ Mn) Forecast by Region, 2015-2032

Table 02: Global Paper Cone Cup Market Volume (Units) Forecast by Region, 2015-2032

Table 03: Global Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, 2015-2032

Table 04: Global Paper Cone Cup Market Volume (Units) Forecast by Coating, 2015-2032

Table 05: Global Paper Cone Cup Market Value (US$ Mn) Forecast by Capacity, 2015-2032

Table 06: Global Paper Cone Cup Market Volume (Units) Forecast by Capacity, 2015-2032

Table 07: Global Paper Cone Cup Market Value (US$ Mn) Forecast by End-user, 2015-2032

Table 08: Global Paper Cone Cup Market Volume (Units) Forecast by End-user, 2015-2032

Table 09: North America Paper Cone Cup Market Value (US$ Mn) Forecast by Country, 2015-2032

Table 10: North America Paper Cone Cup Market Volume (Units) Forecast by Country, 2015-2032

Table 11: North America Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, 2015-2032

Table 12: North America Paper Cone Cup Market Volume (Units) Forecast by Coating, 2015-2032

Table 13: North America Paper Cone Cup Market Value (US$ Mn) Forecast by Capacity, 2015-2032

Table 14: North America Paper Cone Cup Market Volume (Units) Forecast by Capacity, 2015-2032

Table 15: North America Paper Cone Cup Market Value (US$ Mn) Forecast by End-user, 2015-2032

Table 16: North America Paper Cone Cup Market Volume (Units) Forecast by End-user, 2015-2032

Table 17: Latin America Paper Cone Cup Market Value (US$ Mn) Forecast by Country, 2015-2032

Table 18: Latin America Paper Cone Cup Market Volume (Units) Forecast by Country, 2015-2032

Table 19: Latin America Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, 2015-2032

Table 20: Latin America Paper Cone Cup Market Volume (Units) Forecast by Coating, 2015-2032

Table 21: Latin America Paper Cone Cup Market Value (US$ Mn) Forecast by Capacity, 2015-2032

Table 22: Latin America Paper Cone Cup Market Volume (Units) Forecast by Capacity, 2015-2032

Table 23: Latin America Paper Cone Cup Market Value (US$ Mn) Forecast by End-user, 2015-2032

Table 24: Latin America Paper Cone Cup Market Volume (Units) Forecast by End-user, 2015-2032

Table 25: Europe Paper Cone Cup Market Value (US$ Mn) Forecast by Country, 2015-2032

Table 26: Europe Paper Cone Cup Market Volume (Units) Forecast by Country, 2015-2032

Table 27: Europe Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, 2015-2032

Table 28: Europe Paper Cone Cup Market Volume (Units) Forecast by Coating, 2015-2032

Table 29: Europe Paper Cone Cup Market Value (US$ Mn) Forecast by Capacity, 2015-2032

Table 30: Europe Paper Cone Cup Market Volume (Units) Forecast by Capacity, 2015-2032

Table 31: Europe Paper Cone Cup Market Value (US$ Mn) Forecast by End-user, 2015-2032

Table 32: Europe Paper Cone Cup Market Volume (Units) Forecast by End-user, 2015-2032

Table 33: East Asia Paper Cone Cup Market Value (US$ Mn) Forecast by Country, 2015-2032

Table 34: East Asia Paper Cone Cup Market Volume (Units) Forecast by Country, 2015-2032

Table 35: East Asia Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, 2015-2032

Table 36: East Asia Paper Cone Cup Market Volume (Units) Forecast by Coating, 2015-2032

Table 37: East Asia Paper Cone Cup Market Value (US$ Mn) Forecast by Capacity, 2015-2032

Table 38: East Asia Paper Cone Cup Market Volume (Units) Forecast by Capacity, 2015-2032

Table 39: East Asia Paper Cone Cup Market Value (US$ Mn) Forecast by End-user, 2015-2032

Table 40: East Asia Paper Cone Cup Market Volume (Units) Forecast by End-user, 2015-2032

Table 41: South Asia Paper Cone Cup Market Value (US$ Mn) Forecast by Country, 2015-2032

Table 42: South Asia Paper Cone Cup Market Volume (Units) Forecast by Country, 2015-2032

Table 43: South Asia Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, 2015-2032

Table 44: South Asia Paper Cone Cup Market Volume (Units) Forecast by Coating, 2015-2032

Table 45: South Asia Paper Cone Cup Market Value (US$ Mn) Forecast by Capacity, 2015-2032

Table 46: South Asia Paper Cone Cup Market Volume (Units) Forecast by Capacity, 2015-2032

Table 47: South Asia Paper Cone Cup Market Value (US$ Mn) Forecast by End-user, 2015-2032

Table 48: South Asia Paper Cone Cup Market Volume (Units) Forecast by End-user, 2015-2032

Table 49: Oceania Paper Cone Cup Market Value (US$ Mn) Forecast by Country, 2015-2032

Table 50: Oceania Paper Cone Cup Market Volume (Units) Forecast by Country, 2015-2032

Table 51: Oceania Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, 2015-2032

Table 52: Oceania Paper Cone Cup Market Volume (Units) Forecast by Coating, 2015-2032

Table 53: Oceania Paper Cone Cup Market Value (US$ Mn) Forecast by Capacity, 2015-2032

Table 54: Oceania Paper Cone Cup Market Volume (Units) Forecast by Capacity, 2015-2032

Table 55: Oceania Paper Cone Cup Market Value (US$ Mn) Forecast by End-user, 2015-2032

Table 56: Oceania Paper Cone Cup Market Volume (Units) Forecast by End-user, 2015-2032

Table 57: MEA Paper Cone Cup Market Value (US$ Mn) Forecast by Country, 2015-2032

Table 58: MEA Paper Cone Cup Market Volume (Units) Forecast by Country, 2015-2032

Table 59: MEA Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, 2015-2032

Table 60: MEA Paper Cone Cup Market Volume (Units) Forecast by Coating, 2015-2032

Table 61: MEA Paper Cone Cup Market Value (US$ Mn) Forecast by Capacity, 2015-2032

Table 62: MEA Paper Cone Cup Market Volume (Units) Forecast by Capacity, 2015-2032

Table 63: MEA Paper Cone Cup Market Value (US$ Mn) Forecast by End-user, 2015-2032

Table 64: MEA Paper Cone Cup Market Volume (Units) Forecast by End-user, 2015-2032

Table 65: U.S. Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, Capacity, and End-user (2022(E) & 2032(F))

Table 66: Canada Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, Capacity, and End-user (2022(E) & 2032(F))

Table 67: Brazil Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, Capacity, and End-user (2022(E) & 2032(F))

Table 68: Mexico Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, Capacity, and End-user (2022(E) & 2032(F))

Table 69: Germany Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, Capacity, and End-user (2022(E) & 2032(F))

Table 70: Italy Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, Capacity, and End-user (2022(E) & 2032(F))

Table 71: France Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, Capacity, and End-user (2022(E) & 2032(F))

Table 72: Spain Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, Capacity, and End-user (2022(E) & 2032(F))

Table 73: U.K. Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, Capacity, and End-user (2022(E) & 2032(F))

Table 74: Russia Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, Capacity, and End-user (2022(E) & 2032(F))

Table 75: China Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, Capacity, and End-user (2022(E) & 2032(F))

Table 76: Japan Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, Capacity, and End-user (2022(E) & 2032(F))

Table 77: India Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, Capacity, and End-user (2022(E) & 2032(F))

Table 78: GCC Countries Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, Capacity, and End-user (2022(E) & 2032(F))

Table 79: Australia Paper Cone Cup Market Value (US$ Mn) Forecast by Coating, Capacity, and End-user (2022(E) & 2032(F))

Figure 01: Global Paper Cone Cup Market Value (US$ Mn) by Coating, 2022-2032

Figure 02: Global Paper Cone Cup Market Value (US$ Mn) by Capacity, 2022-2032

Figure 03: Global Paper Cone Cup Market Value (US$ Mn) by End-user, 2022-2032

Figure 04: Global Paper Cone Cup Market Value (US$ Mn) by Region, 2022-2032

Figure 05: Global Paper Cone Cup Market Value (US$ Mn) Analysis by Region, 2015-2021

Figure 06: Global Paper Cone Cup Market Volume (Units) Analysis by Region, 2015-2032

Figure 07: Global Paper Cone Cup Market Value Share (%) and BPS Analysis by Region, 2022 & 2032

Figure 08: Global Paper Cone Cup Market Y-o-Y Growth (%) Projections by Region, 2022-2032

Figure 09: Global Paper Cone Cup Market Value (US$ Mn) Analysis by Coating, 2015-2021

Figure 10: Global Paper Cone Cup Market Volume (Units) Analysis by Coating, 2015-2032

Figure 11: Global Paper Cone Cup Market Value Share (%) and BPS Analysis by Coating, 2022 & 2032

Figure 12: Global Paper Cone Cup Market Y-o-Y Growth (%) Projections by Coating, 2022-2032

Figure 13: Global Paper Cone Cup Market Value (US$ Mn) Analysis by Capacity, 2015-2021

Figure 14: Global Paper Cone Cup Market Volume (Units) Analysis by Capacity, 2015-2032

Figure 15: Global Paper Cone Cup Market Value Share (%) and BPS Analysis by Capacity, 2022 & 2032

Figure 16: Global Paper Cone Cup Market Y-o-Y Growth (%) Projections by Capacity, 2022-2032

Figure 17: Global Paper Cone Cup Market Value (US$ Mn) Analysis by End-user, 2015-2021

Figure 18: Global Paper Cone Cup Market Volume (Units) Analysis by End-user, 2015-2032

Figure 19: Global Paper Cone Cup Market Value Share (%) and BPS Analysis by End-user, 2022 & 2032

Figure 20: Global Paper Cone Cup Market Y-o-Y Growth (%) Projections by End-user, 2022-2032

Figure 21: Global Paper Cone Cup Market Attractiveness by Coating, 2022-2032

Figure 22: Global Paper Cone Cup Market Attractiveness by Capacity, 2022-2032

Figure 23: Global Paper Cone Cup Market Attractiveness by Application, 2022-2032

Figure 24: Global Paper Cone Cup Market Attractiveness by End-user, 2022-2032

Figure 25: Global Paper Cone Cup Market Attractiveness by Region, 2022-2032

Figure 26: North America Paper Cone Cup Market Value (US$ Mn) by Coating, 2022-2032

Figure 27: North America Paper Cone Cup Market Value (US$ Mn) by Capacity, 2022-2032

Figure 28: North America Paper Cone Cup Market Value (US$ Mn) by End-user, 2022-2032

Figure 29: North America Paper Cone Cup Market Value (US$ Mn) by Country, 2022-2032

Figure 30: North America Paper Cone Cup Market Value (US$ Mn) Analysis by Country, 2015-2021

Figure 31: North America Paper Cone Cup Market Volume (Units) Analysis by Country, 2015-2032

Figure 32: North America Paper Cone Cup Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 33: North America Paper Cone Cup Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 34: North America Paper Cone Cup Market Value (US$ Mn) Analysis by Coating, 2015-2021

Figure 35: North America Paper Cone Cup Market Volume (Units) Analysis by Coating, 2015-2032

Figure 36: North America Paper Cone Cup Market Value Share (%) and BPS Analysis by Coating, 2022 & 2032

Figure 37: North America Paper Cone Cup Market Y-o-Y Growth (%) Projections by Coating, 2022-2032

Figure 38: North America Paper Cone Cup Market Value (US$ Mn) Analysis by Capacity, 2015-2021

Figure 39: North America Paper Cone Cup Market Volume (Units) Analysis by Capacity, 2015-2032

Figure 40: North America Paper Cone Cup Market Value Share (%) and BPS Analysis by Capacity, 2022 & 2032

Figure 41: North America Paper Cone Cup Market Y-o-Y Growth (%) Projections by Capacity, 2022-2032

Figure 42: North America Paper Cone Cup Market Value (US$ Mn) Analysis by End-user, 2015-2021

Figure 43: North America Paper Cone Cup Market Volume (Units) Analysis by End-user, 2015-2032

Figure 44: North America Paper Cone Cup Market Value Share (%) and BPS Analysis by End-user, 2022 & 2032

Figure 45: North America Paper Cone Cup Market Y-o-Y Growth (%) Projections by End-user, 2022-2032

Figure 46: North America Paper Cone Cup Market Attractiveness by Coating, 2022-2032

Figure 47: North America Paper Cone Cup Market Attractiveness by Capacity, 2022-2032

Figure 48: North America Paper Cone Cup Market Attractiveness by End-user, 2022-2032

Figure 49: North America Paper Cone Cup Market Attractiveness by Country, 2022-2032

Figure 50: Latin America Paper Cone Cup Market Value (US$ Mn) by Coating, 2022 & 2032

Figure 51: Latin America Paper Cone Cup Market Value (US$ Mn) by Capacity, 2022-2032

Figure 52: Latin America Paper Cone Cup Market Value (US$ Mn) by End-user, 2022-2032

Figure 53: Latin America Paper Cone Cup Market Value (US$ Mn) by Country, 2022-2032

Figure 54: Latin America Paper Cone Cup Market Value (US$ Mn) Analysis by Country, 2015-2021

Figure 55: Latin America Paper Cone Cup Market Volume (Units) Analysis by Country, 2015-2032

Figure 56: Latin America Paper Cone Cup Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 57: Latin America Paper Cone Cup Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 58: Latin America Paper Cone Cup Market Value (US$ Mn) Analysis by Coating, 2015-2021

Figure 59: Latin America Paper Cone Cup Market Volume (Units) Analysis by Coating, 2015-2032

Figure 60: Latin America Paper Cone Cup Market Value Share (%) and BPS Analysis by Coating, 2022 & 2032

Figure 61: Latin America Paper Cone Cup Market Y-o-Y Growth (%) Projections by Coating, 2022-2032

Figure 62: Latin America Paper Cone Cup Market Value (US$ Mn) Analysis by Capacity, 2015-2021

Figure 63: Latin America Paper Cone Cup Market Volume (Units) Analysis by Capacity, 2015-2032

Figure 64: Latin America Paper Cone Cup Market Value Share (%) and BPS Analysis by Capacity, 2022 & 2032

Figure 65: Latin America Paper Cone Cup Market Y-o-Y Growth (%) Projections by Capacity, 2022-2032

Figure 66: Latin America Paper Cone Cup Market Value (US$ Mn) Analysis by End-user, 2015-2021

Figure 67: Latin America Paper Cone Cup Market Volume (Units) Analysis by End-user, 2015-2032

Figure 68: Latin America Paper Cone Cup Market Value Share (%) and BPS Analysis by End-user, 2022 & 2032

Figure 69: Latin America Paper Cone Cup Market Y-o-Y Growth (%) Projections by End-user, 2022-2032

Figure 70: Latin America Paper Cone Cup Market Attractiveness by Coating, 2022-2032

Figure 71: Latin America Paper Cone Cup Market Attractiveness by Capacity, 2022-2032

Figure 72: Latin America Paper Cone Cup Market Attractiveness by End-user, 2022-2032

Figure 73: Latin America Paper Cone Cup Market Attractiveness by Country, 2022-2032

Figure 74: Europe Paper Cone Cup Market Value (US$ Mn) by Coating, 2022-2032

Figure 75: Europe Paper Cone Cup Market Value (US$ Mn) by Capacity, 2022-2032

Figure 76: Europe Paper Cone Cup Market Value (US$ Mn) by End-user, 2022-2032

Figure 77: Europe Paper Cone Cup Market Value (US$ Mn) by Country, 2022-2032

Figure 78: Europe Paper Cone Cup Market Value (US$ Mn) Analysis by Country, 2015-2021

Figure 79: Europe Paper Cone Cup Market Volume (Units) Analysis by Country, 2015-2032

Figure 80: Europe Paper Cone Cup Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 81: Europe Paper Cone Cup Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 82: Europe Paper Cone Cup Market Value (US$ Mn) Analysis by Coating, 2015-2021

Figure 83: Europe Paper Cone Cup Market Volume (Units) Analysis by Coating, 2015-2032

Figure 84: Europe Paper Cone Cup Market Value Share (%) and BPS Analysis by Coating, 2022 & 2032

Figure 85: Europe Paper Cone Cup Market Y-o-Y Growth (%) Projections by Coating, 2022-2032

Figure 86: Europe Paper Cone Cup Market Value (US$ Mn) Analysis by Capacity, 2015-2021

Figure 87: Europe Paper Cone Cup Market Volume (Units) Analysis by Capacity, 2015-2032

Figure 88: Europe Paper Cone Cup Market Value Share (%) and BPS Analysis by Capacity, 2022 & 2032

Figure 89: Europe Paper Cone Cup Market Y-o-Y Growth (%) Projections by Capacity, 2022-2032

Figure 90: Europe Paper Cone Cup Market Value (US$ Mn) Analysis by End-user, 2015-2021

Figure 91: Europe Paper Cone Cup Market Volume (Units) Analysis by End-user, 2015-2032

Figure 92: Europe Paper Cone Cup Market Value Share (%) and BPS Analysis by End-user, 2022 & 2032

Figure 93: Europe Paper Cone Cup Market Y-o-Y Growth (%) Projections by End-user, 2022-2032

Figure 94: Europe Paper Cone Cup Market Attractiveness by Coating, 2022-2032

Figure 95: Europe Paper Cone Cup Market Attractiveness by Capacity, 2022-2032

Figure 96: Europe Paper Cone Cup Market Attractiveness by End-user, 2022-2032

Figure 97: Europe Paper Cone Cup Market Attractiveness by Country, 2022-2032

Figure 98: East Asia Paper Cone Cup Market Value (US$ Mn) by Coating, 2022-2032

Figure 99: East Asia Paper Cone Cup Market Value (US$ Mn) by Capacity, 2022-2032

Figure 100: East Asia Paper Cone Cup Market Value (US$ Mn) by End-user, 2022-2032

Figure 101: East Asia Paper Cone Cup Market Value (US$ Mn) by Country, 2022-2032

Figure 102: East Asia Paper Cone Cup Market Value (US$ Mn) Analysis by Country, 2015-2021

Figure 103: East Asia Paper Cone Cup Market Volume (Units) Analysis by Country, 2015-2032

Figure 104: East Asia Paper Cone Cup Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 105: East Asia Paper Cone Cup Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 106: East Asia Paper Cone Cup Market Value (US$ Mn) Analysis by Coating, 2015-2021

Figure 107: East Asia Paper Cone Cup Market Volume (Units) Analysis by Coating, 2015-2032

Figure 108: East Asia Paper Cone Cup Market Value Share (%) and BPS Analysis by Coating, 2022 & 2032

Figure 109: East Asia Paper Cone Cup Market Y-o-Y Growth (%) Projections by Coating, 2022-2032

Figure 110: East Asia Paper Cone Cup Market Value (US$ Mn) Analysis by Capacity, 2015-2021

Figure 111: East Asia Paper Cone Cup Market Volume (Units) Analysis by Capacity, 2015-2032

Figure 112: East Asia Paper Cone Cup Market Value Share (%) and BPS Analysis by Capacity, 2022 & 2032

Figure 113: East Asia Paper Cone Cup Market Y-o-Y Growth (%) Projections by Capacity, 2022-2032

Figure 114: East Asia Paper Cone Cup Market Value (US$ Mn) Analysis by End-user, 2015-2021

Figure 115: East Asia Paper Cone Cup Market Volume (Units) Analysis by End-user, 2015-2032

Figure 116: East Asia Paper Cone Cup Market Value Share (%) and BPS Analysis by End-user, 2022 & 2032

Figure 117: East Asia Paper Cone Cup Market Y-o-Y Growth (%) Projections by End-user, 2022-2032

Figure 118: East Asia Paper Cone Cup Market Attractiveness by Coating, 2022-2032

Figure 119: East Asia Paper Cone Cup Market Attractiveness by Capacity, 2022-2032

Figure 120: East Asia Paper Cone Cup Market Attractiveness by End-user, 2022-2032

Figure 121: East Asia Paper Cone Cup Market Attractiveness by Country, 2022-2032

Figure 122: South Asia Paper Cone Cup Market Value (US$ Mn) by Coating, 2022-2032

Figure 123: South Asia Paper Cone Cup Market Value (US$ Mn) by Capacity, 2022-2032

Figure 124: South Asia Paper Cone Cup Market Value (US$ Mn) by End-user, 2022-2032

Figure 125: South Asia Paper Cone Cup Market Value (US$ Mn) by Country, 2022-2032

Figure 126: South Asia Paper Cone Cup Market Value (US$ Mn) Analysis by Country, 2015-2021

Figure 127: South Asia Paper Cone Cup Market Volume (Units) Analysis by Country, 2015-2032

Figure 128: South Asia Paper Cone Cup Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 129: South Asia Paper Cone Cup Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 130: South Asia Paper Cone Cup Market Value (US$ Mn) Analysis by Coating, 2015-2021

Figure 131: South Asia Paper Cone Cup Market Volume (Units) Analysis by Coating, 2015-2032

Figure 132: South Asia Paper Cone Cup Market Value Share (%) and BPS Analysis by Coating, 2022 & 2032

Figure 133: South Asia Paper Cone Cup Market Y-o-Y Growth (%) Projections by Coating, 2022-2032

Figure 134: South Asia Paper Cone Cup Market Value (US$ Mn) Analysis by Capacity, 2015-2021

Figure 135: South Asia Paper Cone Cup Market Volume (Units) Analysis by Capacity, 2015-2032

Figure 136: South Asia Paper Cone Cup Market Value Share (%) and BPS Analysis by Capacity, 2022 & 2032

Figure 137: South Asia Paper Cone Cup Market Y-o-Y Growth (%) Projections by Capacity, 2022-2032

Figure 138: South Asia Paper Cone Cup Market Value (US$ Mn) Analysis by End-user, 2015-2021

Figure 139: South Asia Paper Cone Cup Market Volume (Units) Analysis by End-user, 2015-2032

Figure 140: South Asia Paper Cone Cup Market Value Share (%) and BPS Analysis by End-user, 2022 & 2032

Figure 141: South Asia Paper Cone Cup Market Y-o-Y Growth (%) Projections by End-user, 2022-2032

Figure 142: South Asia Paper Cone Cup Market Attractiveness by Coating, 2022-2032

Figure 143: South Asia Paper Cone Cup Market Attractiveness by Capacity, 2022-2032

Figure 144: South Asia Paper Cone Cup Market Attractiveness by End-user, 2022-2032

Figure 145: South Asia Paper Cone Cup Market Attractiveness by Country, 2022-2032

Figure 146: Oceania Paper Cone Cup Market Value (US$ Mn) by Coating, 2022-2032

Figure 147: Oceania Paper Cone Cup Market Value (US$ Mn) by Capacity, 2022-2032

Figure 148: Oceania Paper Cone Cup Market Value (US$ Mn) by End-user, 2022-2032

Figure 149: Oceania Paper Cone Cup Market Value (US$ Mn) by Country, 2022-2032

Figure 150: Oceania Paper Cone Cup Market Value (US$ Mn) Analysis by Country, 2015-2021

Figure 151: Oceania Paper Cone Cup Market Volume (Units) Analysis by Country, 2015-2032

Figure 152: Oceania Paper Cone Cup Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 153: Oceania Paper Cone Cup Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 154: Oceania Paper Cone Cup Market Value (US$ Mn) Analysis by Coating, 2015-2021

Figure 155: Oceania Paper Cone Cup Market Volume (Units) Analysis by Coating, 2015-2032

Figure 156: Oceania Paper Cone Cup Market Value Share (%) and BPS Analysis by Coating, 2022 & 2032

Figure 157: Oceania Paper Cone Cup Market Y-o-Y Growth (%) Projections by Coating, 2022-2032

Figure 158: Oceania Paper Cone Cup Market Value (US$ Mn) Analysis by Capacity, 2015-2021

Figure 159: Oceania Paper Cone Cup Market Volume (Units) Analysis by Capacity, 2015-2032

Figure 160: Oceania Paper Cone Cup Market Value Share (%) and BPS Analysis by Capacity, 2022 & 2032

Figure 161: Oceania Paper Cone Cup Market Y-o-Y Growth (%) Projections by Capacity, 2022-2032

Figure 162: Oceania Paper Cone Cup Market Value (US$ Mn) Analysis by End-user, 2015-2021

Figure 163: Oceania Paper Cone Cup Market Volume (Units) Analysis by End-user, 2015-2032

Figure 164: Oceania Paper Cone Cup Market Value Share (%) and BPS Analysis by End-user, 2022 & 2032

Figure 165: Oceania Paper Cone Cup Market Y-o-Y Growth (%) Projections by End-user, 2022-2032

Figure 166: Oceania Paper Cone Cup Market Attractiveness by Coating, 2022-2032

Figure 167: Oceania Paper Cone Cup Market Attractiveness by Capacity, 2022-2032

Figure 168: Oceania Paper Cone Cup Market Attractiveness by End-user, 2022-2032

Figure 169 Oceania Paper Cone Cup Market Attractiveness by Country, 2022-2032

Figure 170: MEA Paper Cone Cup Market Value (US$ Mn) by Coating, 2022-2032

Figure 171: MEA Paper Cone Cup Market Value (US$ Mn) by Capacity, 2022-2032

Figure 172: MEA Paper Cone Cup Market Value (US$ Mn) by End-user, 2022-2032

Figure 173: MEA Paper Cone Cup Market Value (US$ Mn) by Country, 2022-2032

Figure 174: MEA Paper Cone Cup Market Value (US$ Mn) Analysis by Country, 2015-2021

Figure 175: MEA Paper Cone Cup Market Volume (Units) Analysis by Country, 2015-2032

Figure 176: MEA Paper Cone Cup Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 177: MEA Paper Cone Cup Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 178: MEA Paper Cone Cup Market Value (US$ Mn) Analysis by Coating, 2015-2021

Figure 179: MEA Paper Cone Cup Market Volume (Units) Analysis by Coating, 2015-2032

Figure 180: MEA Paper Cone Cup Market Value Share (%) and BPS Analysis by Coating, 2022 & 2032

Figure 181: MEA Paper Cone Cup Market Y-o-Y Growth (%) Projections by Coating, 2022-2032

Figure 182: MEA Paper Cone Cup Market Value (US$ Mn) Analysis by Capacity, 2015-2021

Figure 183: MEA Paper Cone Cup Market Volume (Units) Analysis by Capacity, 2015-2032

Figure 184: MEA Paper Cone Cup Market Value Share (%) and BPS Analysis by Capacity, 2022 & 2032

Figure 185: MEA Paper Cone Cup Market Y-o-Y Growth (%) Projections by Capacity, 2022-2032

Figure 186: MEA Paper Cone Cup Market Value (US$ Mn) Analysis by End-user, 2015-2021

Figure 187: MEA Paper Cone Cup Market Volume (Units) Analysis by End-user, 2015-2032

Figure 188: MEA Paper Cone Cup Market Value Share (%) and BPS Analysis by End-user, 2022 & 2032

Figure 189: MEA Paper Cone Cup Market Y-o-Y Growth (%) Projections by End-user, 2022-2032

Figure 190: MEA Paper Cone Cup Market Attractiveness by Coating, 2022-2032

Figure 191: MEA Paper Cone Cup Market Attractiveness by Capacity, 2022-2032

Figure 192: MEA Paper Cone Cup Market Attractiveness by End-user, 2022-2032

Figure 193 MEA Paper Cone Cup Market Attractiveness by Country, 2022-2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Paper Release Liners Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Materials Market Size and Share Forecast Outlook 2025 to 2035

Paper Pigments Market Size and Share Forecast Outlook 2025 to 2035

Paper Honeycomb Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Paper Paperboard Wood Recycling Market Size and Share Forecast Outlook 2025 to 2035

Paper Goods Market Size and Share Forecast Outlook 2025 to 2035

Paper-based Blister Packs Market Analysis Size and Share Forecast Outlook 2025 to 2035

Paperboard Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA