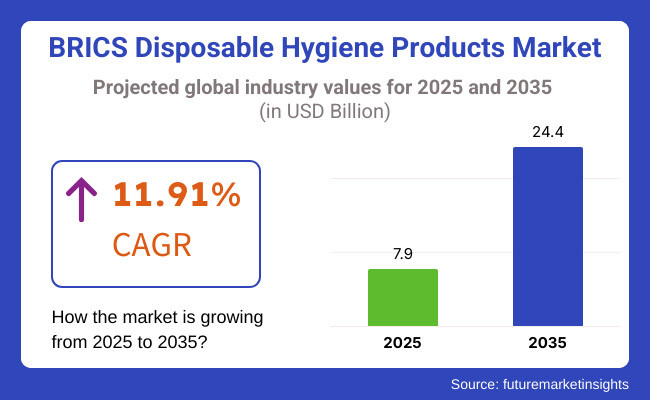

The BRICS disposable hygiene products market is projected to experience a massive growth from USD 7.9 billion in 2025 to USD 24.4 billion by 2035, representing a significant CAGR of 11.91%. The industry is expected to develop significantly between 2025 and 2035, covering Brazil, Russia, India, China, and South Africa. The main factors include growing personal hygiene awareness, increasing disposable income, and developing new product technology.

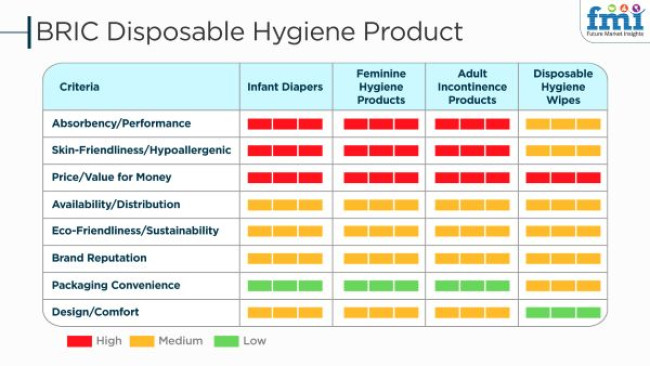

Disposables like baby diapers, sanitary napkins, adult incontinence products, and wet wipes will be among the major products, which will be in demand the most due to factors such as rapid urbanization, enhanced healthcare infrastructure, and the growing participation of women in the workforce. Besides, sustainability is regarded as a core of the sector, with material technologies that are biodegradable and friendly to the environment being at the center of product development and consumer preference.

Considering the massive populations and per capita income growth in China and India, they dominate the market, while Brazil and Russia will cautiously recover because of a demographic shift and customer spending on hygiene products. South Africa, besides, is to see a hail of demand, which will be mainly based on governmental actions advocating hygiene education and enhancing the distribution of hygiene products.

Despite this, the territory has some challenges with respect to environmental sustainability and waste management. The greater consumption of disposable hygiene products has pulled up the plastic waste and landfill pollution issues, which has led to governments and environmental activists seeking the introduction of rules and eco-friendly methods of production.

The enterprises take part in the in-memory hygiene market in BRICS that require the implementation of practical solutions, which include but are not limited to recyclable packaging, the application of water-saving production techniques, and the use of biodegradable materials to cope with the sustainability guidelines and the consumer expectations.

There are substantive business possibilities embedded in the creation of smart and environment-friendly hygiene solutions. The requirement for intelligent hygiene products like sensor-enabled diapers, antibacterial sanitary pads, and ultra-absorbent incontinence products is spiralling to the roof. Moreover, the use of organic and plant-based materials has raised the prominence of bamboo fiber diapers and chemical-free sanitary napkins among consumers who are environmentally conscious.

The development of online retail and direct-to-consumer sales models is an additional factor reshaping the BRICS disposable hygiene market, where brands can come to the market with more personal hygiene solutions. Subscription-based services and digital marketing operationalizing mainly on customers have become mainstays of consumer engagement and brand loyalty.

As the market keeps on transforming, those manufacturers who emphasize innovation, sustainability, and access will reap the benefits from a rapidly growing demand for disposable hygiene products across the BRICS nations. The trajectory of this market will further be identified by technological advancements, environmental responsibility, and consumer-led product development thus ensuring constant growth and success for the industry in the long run.

The baby care segment is slated to capture largest share in 2025. Disposable hygiene items are commonly employed in infant care because of their convenience, sanitary advantage, and capacity to give baby superior comfort. Parents prefer disposable diapers, wipes, and changing pads since they present instant and convenient ways of keeping clean, especially in hectic lifestyles.

In contrast to reusable options, disposable items take away the need for constant washing, making them a convenient option for working parents and individuals always on the move. Their heavy absorbency and moisture-locking capability keep a baby's skin dry, thus lowering the occurrence of rashes and infections.

The diapers segment accounts for the largest share, supported by rising birth rates and mounting disposable incomes. Biodegradable alternatives drive innovation, and parents seek high-absorptivity and skin-friendliness along with eco-friendliness. The industry is also dominated by global brands like Pampers, Huggies, and Mamy Poko, which are capitalizing on their reputation as quality manufacturers to expand across BRICS countries.

Local brands deliver localized and cost-competitive options that deeply resonate with consumers. Urban demand is shifting toward premium baby care products that offer wetness indicators, breathable layers, and overnight protection. This trend mirrors a global shift toward convenience in baby care solutions in response to rapidly urbanizing populations looking for greater performance in value-added products.

Soft and flexible disposable baby care products are commonly bought because they are more comfortable, adaptable, and convenient. They come in the form of stretchy diapers, pull-up pants, and ultra-soft wipes and are made to fit snugly but comfortably to enable babies to move around freely without any discomfort.

The structural flexibility and material versatility ensure that the product conforms to a baby's body shape to avoid leaks without compromising on minimizing the risk of skin irritation. Parents find such products more attractive since they have improved performance over the conventional rigid ones, maximizing both the baby's comfort as well as hygiene in general.

From 2020 to 2024, the industry for disposable hygiene products grew as people became more aware of their health, their disposable incomes increased, and enhanced demand for easy-to-use, single-use solutions. The COVID-19 pandemic spurred the use of personal hygiene products, such as baby diapers, feminine hygiene products, and adult incontinence products.

Because of environmental concerns, people were preferring biodegradable materials, plant-based fibers, and looked for products having lower plastic content in disposable products. Consumers were also preferring subscription services for sanitary products and diapers. Price sensitivity and regulatory pressure were some challenges.

Between 2025 and 2035, the industry will witness innovations in biodegradable and compostable hygiene products due to more stringent environmental regulations and consumer pressure for sustainability. Intelligent hygiene products, including sensor-enabled diapers and sanitary pads with period-tracking features, will become popular.

Antimicrobial and skin-friendly material developments will improve comfort and safety. Refillable and reusable hybrid solutions will also appear, finding a balance between convenience and eco-friendliness, defining the next stage of disposable hygiene product innovation.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Companies introduced biodegradable and organic hygiene products, including plant-based diapers and sanitary napkins. Hypoallergenic and dermatologically tested materials gained traction. | AI-driven customization allows consumers to select personalized hygiene products based on skin sensitivity and lifestyle. Biodegradable superabsorbent materials become industry standard. |

| Brands reduced plastic use in packaging and introduced compostable wraps. Reusable and hybrid hygiene solutions gained presence. | Zero-waste hygiene products dominate the industry. Smart packaging solutions with usage tracking and refillable options become widespread. |

| Smart diapers and sanitary products with wetness alarms and real-time monitoring were launched. Digital health monitoring combined with hygiene solutions. | Hygiene products with AI adapt absorption levels to user requirements. IoT-based tracking offers health information through linked apps. |

| Urban demand increased with an increasing inclination towards premium and eco-friendly offerings. E-commerce and DTC sales channels expanded significantly. | Rural markets witness significant penetration with affordable sustainable options. AI-driven consumer education platforms enhance awareness and adoption. |

| Stricter regulations on disposable hygiene waste management influenced product development. Increased focus on ethical sourcing and manufacturing transparency. | Government policies mandate fully biodegradable hygiene products. Blockchain-enabled supply chain transparency ensures ethical sourcing. |

| Brands partnered with healthcare professionals and sustainability advocates to promote eco-friendly hygiene products. Social media campaigns drove awareness. | Virtual influencers and metaverse-based product trials enhance consumer engagement. Gamified sustainability initiatives drive brand loyalty and adoption. |

| Consumers prioritized safety, sustainability, and comfort. Demand increased for fragrance-free, chemical-free, and hypoallergenic products. | Biohacking-inspired hygiene solutions emerge, integrating with wearable health devices. Consumers embrace holistic well-being through multifunctional hygiene products. |

The BRICS disposable hygiene industry (Brazil, Russia, India, and China) is comparatively more ambiguous, growing rapidly, yet producing set problems within the respective region. Awareness of hygiene is low, while taboos are prevalent, especially in rural India, and this poses a significant risk to the acceptance of disposable sanitary napkins and diapers, which would otherwise be convenient.

In places where disposables are uncommon, for example, cloth diapers dominate simply because it’s how things have always been done and education about disposables isn’t widely available. Economic barriers also serve to inhibit market penetration, as high prices lend themselves to making these products a luxury good for many rural consumers.

Lack of infrastructure, such as stable supply chains and waste disposal, makes the environmental situation worse. Rivalry from behemoths such as Procter Gamble and nimble domestic players like Unicharm drive price wars and low margins, while fake goods undermine consumer trust. Regulatory changes too--India’s has gone from high GST all the way down to 0%, currency volatility (Brazil and Russia, for example) adds complexity. Demographic trends, with an aging population in China and a youthful base in India, need management.

Disposable hygiene products are priced to leverage affordability contra value. A common strategy is the ‘sachet’ approach, where small packs-often containing 5, or 10 units-are sold at low prices to appeal to cost-sensitive consumers. For example, in India, selling 5 or 10 diaper packs enables families to try disposable options without a large upfront expense, even though the per-unit cost is higher.

As incomes rise, brands encourage consumers to trade up to larger, more economical packs. Urban segments also access premium tiers; in China, basic domestic brands coexist with imported Japanese and premium Pampers options. Promotional tactics such as “Buy 2, get 1 free” in Brazil and bonus units in packs help lock in new customers.

E-commerce sales during events like Singles’ Day in China or Diwali in India, along with subscription models and geographic pricing adjustments, reinforce a balanced, tiered strategy, thus ensuring sustained growth across diverse segments.

Brazil disposable hygiene market is driven by rising middle-class income and increasing awareness of hygiene products. Demand for baby diapers, feminine hygiene, and adult incontinence products is growing. Sustainability concerns are pushing brands toward biodegradable and eco-friendly options, while online retail and convenience stores are boosting accessibility.

Russian market benefits from high demand for premium hygiene products and consumer preference for quality and comfort. Economic fluctuations and affordability concerns affect product choices, leading to growth in private-label brands. E-commerce expansion and retail chains are major distribution channels, with biodegradable hygiene solutions gaining traction.

Indian industry is experiencing rapid growth due to population size, urbanization, and increasing hygiene awareness. Government initiatives promoting sanitary pads and infant care are boosting demand. Affordability and accessibility are key factors, with low-cost and eco-friendly products gaining momentum in both urban and rural markets.

Chinese disposable hygiene market thrives on strong consumer spending, premiumization, and digital retail expansion. Increasing preference for organic and skin-friendly materials is driving demand. Advanced manufacturing and innovation in biodegradable products are shaping the industry, with brands leveraging smart retail and AI-driven recommendations.

South Africa’s USD 752.50 million market is supported by growing awareness of hygiene and improving distribution networks. While affordability remains a concern, government programs and international brand investments are increasing accessibility. The demand for biodegradable and budget-friendly hygiene products is rising, particularly in feminine and infant care segments.

Per Capita Spending on Disposable Hygiene Products - BRICS Countries

| Countries | Estimated Per Capita Spending (USD) |

|---|---|

| Brazil | 12.5 |

| Russia | 15.7 |

| India | 8.2 |

| China | 10.4 |

| South Africa | 11.3 |

The disposable hygiene product industry in BRICS is growing rapidly, driven by rising hygiene awareness, increasing urbanization, and demand for cost-effective yet high-quality personal care solutions. A survey of 250 respondents across Brazil, Russia, India, China, and South Africa highlights key consumer trends shaping purchasing behavior.

70% of respondents prioritize skin-friendly and chemical-free disposable hygiene products, with 65% in China and India preferring hypoallergenic and dermatologically tested options. 50% of consumers in Brazil and Russia seek affordable, high-absorbency products, particularly sanitary pads and baby diapers. 45% of respondents in South Africa favor eco-friendly and biodegradable alternatives, aligning with sustainability concerns.

Pricing sensitivity varies across markets, with 55% of Chinese and Indian respondents willing to pay premium prices (USD 10+) for high-quality hygiene products, while only 35% in Brazil and South Africa opt for high-end options. 40% of BRICS consumers expect hygiene products to be priced within 10-15% of regular alternatives, indicating demand for cost-effective yet high-performance solutions.

E-commerce is emerging as a dominant sales channel, with 60% of respondents in China and India purchasing disposable hygiene products online via Tmall, Flipkart, and Amazon. 50% of Russian and Brazilian consumers still prefer supermarkets and pharmacies, valuing convenience and accessibility. 35% of South African respondents rely on social media reviews and influencer recommendations for product selection.

Sustainability is influencing purchasing decisions, with 50% of respondents in Brazil and South Africa preferring biodegradable diapers, pads, and wipes. 40% of Indian and Chinese consumers favor recyclable packaging and refillable hygiene products, while 45% of Russian respondents consider fragrance-free and toxin-free formulations a key factor in their choices.

Premium hygiene products (USD 10+) are in high demand in China and India, while affordable options dominate in Brazil, Russia, and South Africa. E-commerce is expanding across BRICS, making online distribution and digital marketing crucial for brands. Local and global players must focus on affordability, eco-conscious innovations, and skin-friendly formulations to stay competitive. The BRICS disposable hygiene product market is evolving rapidly, with opportunities to capitalize on sustainability, digital engagement, and value-driven innovation.

| Countries | CAGR |

|---|---|

| Brazil | 5.9% |

| Russia | 4.7% |

| India | 7.2% |

| China | 6.8% |

| South Africa | 5.5% |

The industry in Brazil is accelerating with the rising awareness of hygiene, urbanization, and higher disposable incomes. Needs of baby diaper, female hygiene, and adult incontinence are emerging at a strongly high rate. Major Retailers/Multi-Brand Outlets: Carrefour, Walmart Brazil, and internet retailers like Mercado Livre make the market reach plausible. FMI is of the opinion that the Brazil disposable hygiene products market is set to register 5.9% CAGR during the study period.

Growth Drivers in Brazil

| Key Drivers | Details |

|---|---|

| Government Increased Adoption | Government initiatives toward hygiene are met with rising adoption of the product. |

| More Retail and E-commerce Channels | Web channels are giving convenient access to products. |

| Expansion of Demand for Eco-Friendly and Biodegradable | Consumers are calling for biodegradable and environmentally friendly disposable hygienic products. |

The industry is growing in Russia owing to growth in consumer expenditures on personal care, growth in older population, and growth in demand for high-quality hygienic products. Magnit, Auchan, and others, are big supermarket retail chain stores, and e-tailers such as Ozon and Wildberries are monopolistic retailers. FMI is of the opinion that the Russian industry is expected to observe 4.7% CAGR during the forecast period.

Growth Drivers in Russia

| Key Drivers | Details |

|---|---|

| Growth in Middle-Class Consumption of Personal Hygiene | Convenience and accessibility of hygienic products. |

| Growing demand for premium and organic hygiene products | Driven by green consumers. |

| Growing population of age Group Boosts demand for Adult Incontinence Products | Related elderly care segment is growing well too. |

India's disposable hygiene products industry is expanding healthily with an increasing population, increased awareness of menstrual health, and government programs in the form of Swachh Bharat Abhiyan. Increasing availability from online platforms such as Flipkart and Amazon India and retailing through Big Bazaar, and others are few of the key drivers. FMI is of the opinion that the Indian industry is set to witness 7.2% CAGR during the forecast period.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Government Policies in favor of Sanitation and Hygiene | Policies in favor of menstrual health education propel demand. |

| Urbanization and Lifestyle Shift | Growing disposable incomes render the product more penetrable. |

| E-commerce Revolution Increased Product Reach | E-commerce channel is the strongest product dissemination channel. |

China's disposable hygiene industry is expanding on the strength of rising middle-class numbers, higher spending on personal cleanliness, and technology advancements in environmental products. The industry for selling products is controlled by online leaders JD.com and Tmall, and products are readily available in rural and urban areas. FMI is of the opinion that the industry in China is set to occupy 6.8% CAGR during the study period.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Rising Trend towards Eco-Friendly, Biodegradable Products | Clean green hygiene products gaining popularity across the board. |

| Channel and Internet Extensions | Extended distribution of products as online shopping malls. |

| Baby and Women's Hygiene Product Awareness Increase | Positive demand for quality and organic products. |

South African disposable hygiene business is growing with urbanization, rising disposable incomes, and aging population and incontinence requirements. Multi-outlet mass merchandising chains like Pick n Pay and Checkers, and internet channels, provide industry reach. FMI is of the opinion that the South African industry is set to obtain 5.5% CAGR during the study period.

Growth Drivers in South Africa

| Key Drivers | Details |

|---|---|

| Hygiene and Sanitation Awareness | Personal hygiene awareness is driven by marketing through campaigns. |

| Affordable Hygiene Solutions | Economically priced disposable hygiene solutions are needed. |

| Demand for Baby and Female Hygiene Products | Rise in working women leads to sales. |

Highly competitive in nature, the industry features both international and local players. Some of the important companies involved include Procter &Gamble, Kimberly-Clark Corporation, Unicharm Corporation, Essity AB, and Hengan International Group Co.

These major players have considerable presence in the BRICS nations with their various product ranges and their respective well-known brands that have gained huge industry shares. Their modus operandi often contemplates continuous product development, increased reach of their distribution network, and strategic partnerships, thereby gaining a competitive advantage in its position.

Market Share Analysis by Company

| Company Name | Estimated Share (%) |

|---|---|

| Procter & gamble co. | 15-20% |

| Kimberly-clark corporation | 12-16% |

| Unicharm corporation | 10-14% |

| Hengan international group co., ltd. | 8-12% |

| Essity AB | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Procter & Gamble Co. | Offers a wide range of disposable hygiene products under brands like Pampers and Always. Focuses on product innovation and sustainability initiatives to cater to diverse consumer needs across BRICS nations. |

| Kimberly-Clark Corporation | Sells products such as Huggies diapers and Kotex feminine hygiene products. Invests in research and development to introduce high-quality, comfortable, and eco-friendly products tailored for emerging industries. |

| Unicharm Corporation | Provides disposable hygiene products under brands like mamypoko and Sofy. Emphasizes affordability and accessibility, expanding its presence in rural and urban areas within BRICS countries. |

| Hengan International Group Co., Ltd. | A leading Chinese manufacturer offering products like Anerle diapers and Space 7 sanitary napkins. Focuses on leveraging local market knowledge to cater to consumer preferences in BRICS nations. |

| Essity AB | Offers products under brands such as Libero and Libresse. Prioritizes sustainability by developing biodegradable products and reducing environmental impact, appealing to environmentally conscious consumers. |

Key Company Insights

Procter & Gamble Corp. (15-20%)

Procter & Gamble dominates BRICS with its extensive product portfolio in disposable hygiene products such as Pampers and Always. Along with investments in product innovation focusing on comfort and skin health, the company focuses on sustainable eco-friendly products and reduces carbon footprints. P&G develops its distribution both in urban and rural areas to reach the fullest capacity.

Kimberly-Clark Corporation (12-16%)

Kimberly-Clark has almost a niche market capture with products like Huggies and Kotex. The company invests in constant research and development for its innovative and quality comfortable, and ecofriendly products. The localized marketing strategies and joint partnerships emphasized developing its presence in the BRICS countries.

Unicharm Corporation (10-14%)

Unicharm is recognized for the affordability and accessibility of brands like MamyPoko and Sofy. The company increases presence in both rural and urban areas in BRICS countries. Investment in local manufacturing and distribution networks taking its systemi "a business" beyond their markets for improving its position.

Hengan International Group Co., Ltd. (8-12%)

Hengan uses its local knowledge for customizing products according to consumer preferences in the BRICS. The firm offers Anerle diapers and Space 7 sanitary napkins. It focuses on product diversification and improvement of quality to meet different consumer needs.

Essity AB (6-10%)

Essity takes product sustainability first and backs it with names like Libero and Libresse. The company works on making biodegradable products and runs various initiatives to reduce the negative impact on the environment. Awareness of hygiene and sustainability will build brand loyalty among consumers from the BRICS.

Other Key Players (30-40% Combined)

Several new entrants and local players are catalyzing this industry by emphasizing affordability and accessibility, with consideration for regional preference differences.

Based on the age group, the industry is segmented into adult care, feminine care, and baby care.

By product, the industry is divided into nappies, diapers, toilet paper, wipes, sanitary protection, kitchen towels, paper tableware, and cotton pads and buds.

Under packaging, the industry is divided into rigid and flexible.

Geographically, the industry is segmented into Brazil, Russia, India, China, and South Africa.

The industry is projected to witness USD 24.4 billion by 2035 end.

The industry is estimated to be USD 7.9 billion in 2025.

Diapers are widely purchased in BRICS.

India, poised to grow at 7.2% CAGR during the forecast period, is slated to witness fastest growth.

The key players include Dispowear Sterite Company, Kimberley Clark Corporation, Disposable Hygiene Products Ltd, BOSTIK SA, BAHP, UNICHARM Corporation, Kao Corporation, Procter & Gamble Company, and Svenska Cellulosa Aktiebolaget SCA.

Table 1: Market Value (US$ Million) Forecast by Region,2019 to 2034

Table 2: Market Volume (Units) Forecast by Region,2019 to 2034

Table 3: Market Value (US$ Million) Forecast by Age-group,2019 to 2034

Table 4: Market Volume (Units) Forecast by Age-group,2019 to 2034

Table 5: Market Value (US$ Million) Forecast by Product Type,2019 to 2034

Table 6: Market Volume (Units) Forecast by Product Type,2019 to 2034

Table 7: Brazil Market Value (US$ Million) Forecast by Region,2019 to 2034

Table 8: Brazil Market Volume (Units) Forecast by Region,2019 to 2034

Table 9: Brazil Market Value (US$ Million) Forecast by Age-group,2019 to 2034

Table 10: Brazil Market Volume (Units) Forecast by Age-group,2019 to 2034

Table 11: Brazil Market Value (US$ Million) Forecast by Product Type,2019 to 2034

Table 12: Brazil Market Volume (Units) Forecast by Product Type,2019 to 2034

Table 13: Russia Market Value (US$ Million) Forecast by Region,2019 to 2034

Table 14: Russia Market Volume (Units) Forecast by Region,2019 to 2034

Table 15: Russia Market Value (US$ Million) Forecast by Age-group,2019 to 2034

Table 16: Russia Market Volume (Units) Forecast by Age-group,2019 to 2034

Table 17: Russia Market Value (US$ Million) Forecast by Product Type,2019 to 2034

Table 18: Russia Market Volume (Units) Forecast by Product Type,2019 to 2034

Table 19: India Market Value (US$ Million) Forecast by Region,2019 to 2034

Table 20: India Market Volume (Units) Forecast by Region,2019 to 2034

Table 21: India Market Value (US$ Million) Forecast by Age-group,2019 to 2034

Table 22: India Market Volume (Units) Forecast by Age-group,2019 to 2034

Table 23: India Market Value (US$ Million) Forecast by Product Type,2019 to 2034

Table 24: India Market Volume (Units) Forecast by Product Type,2019 to 2034

Table 25: China Market Value (US$ Million) Forecast by Region,2019 to 2034

Table 26: China Market Volume (Units) Forecast by Region,2019 to 2034

Table 27: China Market Value (US$ Million) Forecast by Age-group,2019 to 2034

Table 28: China Market Volume (Units) Forecast by Age-group,2019 to 2034

Table 29: China Market Value (US$ Million) Forecast by Product Type,2019 to 2034

Table 30: China Market Volume (Units) Forecast by Product Type,2019 to 2034

Table 31: South Africa Market Value (US$ Million) Forecast by Region,2019 to 2034

Table 32: South Africa Market Volume (Units) Forecast by Region,2019 to 2034

Table 33: South Africa Market Value (US$ Million) Forecast by Age-group,2019 to 2034

Table 34: South Africa Market Volume (Units) Forecast by Age-group,2019 to 2034

Table 35: South Africa Market Value (US$ Million) Forecast by Product Type,2019 to 2034

Table 36: South Africa Market Volume (Units) Forecast by Product Type,2019 to 2034

Figure 1: Market Value (US$ Million) by Age-group, 2024 to 2034

Figure 2: Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 3: Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Market Value (US$ Million) Analysis by Region,2019 to 2034

Figure 5: Market Volume (Units) Analysis by Region,2019 to 2034

Figure 6: Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Market Value (US$ Million) Analysis by Age-group,2019 to 2034

Figure 9: Market Volume (Units) Analysis by Age-group,2019 to 2034

Figure 10: Market Value Share (%) and BPS Analysis by Age-group, 2024 to 2034

Figure 11: Market Y-o-Y Growth (%) Projections by Age-group, 2024 to 2034

Figure 12: Market Value (US$ Million) Analysis by Product Type,2019 to 2034

Figure 13: Market Volume (Units) Analysis by Product Type,2019 to 2034

Figure 14: Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 15: Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 16: Market Attractiveness by Age-group, 2024 to 2034

Figure 17: Market Attractiveness by Product Type, 2024 to 2034

Figure 18: Market Attractiveness by Region, 2024 to 2034

Figure 19: Brazil Market Value (US$ Million) by Age-group, 2024 to 2034

Figure 20: Brazil Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 21: Brazil Market Value (US$ Million) by Region, 2024 to 2034

Figure 22: Brazil Market Value (US$ Million) Analysis by Region,2019 to 2034

Figure 23: Brazil Market Volume (Units) Analysis by Region,2019 to 2034

Figure 24: Brazil Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 25: Brazil Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 26: Brazil Market Value (US$ Million) Analysis by Age-group,2019 to 2034

Figure 27: Brazil Market Volume (Units) Analysis by Age-group,2019 to 2034

Figure 28: Brazil Market Value Share (%) and BPS Analysis by Age-group, 2024 to 2034

Figure 29: Brazil Market Y-o-Y Growth (%) Projections by Age-group, 2024 to 2034

Figure 30: Brazil Market Value (US$ Million) Analysis by Product Type,2019 to 2034

Figure 31: Brazil Market Volume (Units) Analysis by Product Type,2019 to 2034

Figure 32: Brazil Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 33: Brazil Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 34: Brazil Market Attractiveness by Age-group, 2024 to 2034

Figure 35: Brazil Market Attractiveness by Product Type, 2024 to 2034

Figure 36: Brazil Market Attractiveness by Region, 2024 to 2034

Figure 37: Russia Market Value (US$ Million) by Age-group, 2024 to 2034

Figure 38: Russia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 39: Russia Market Value (US$ Million) by Region, 2024 to 2034

Figure 40: Russia Market Value (US$ Million) Analysis by Region,2019 to 2034

Figure 41: Russia Market Volume (Units) Analysis by Region,2019 to 2034

Figure 42: Russia Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 43: Russia Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 44: Russia Market Value (US$ Million) Analysis by Age-group,2019 to 2034

Figure 45: Russia Market Volume (Units) Analysis by Age-group,2019 to 2034

Figure 46: Russia Market Value Share (%) and BPS Analysis by Age-group, 2024 to 2034

Figure 47: Russia Market Y-o-Y Growth (%) Projections by Age-group, 2024 to 2034

Figure 48: Russia Market Value (US$ Million) Analysis by Product Type,2019 to 2034

Figure 49: Russia Market Volume (Units) Analysis by Product Type,2019 to 2034

Figure 50: Russia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 51: Russia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 52: Russia Market Attractiveness by Age-group, 2024 to 2034

Figure 53: Russia Market Attractiveness by Product Type, 2024 to 2034

Figure 54: Russia Market Attractiveness by Region, 2024 to 2034

Figure 55: India Market Value (US$ Million) by Age-group, 2024 to 2034

Figure 56: India Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 57: India Market Value (US$ Million) by Region, 2024 to 2034

Figure 58: India Market Value (US$ Million) Analysis by Region,2019 to 2034

Figure 59: India Market Volume (Units) Analysis by Region,2019 to 2034

Figure 60: India Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 61: India Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 62: India Market Value (US$ Million) Analysis by Age-group,2019 to 2034

Figure 63: India Market Volume (Units) Analysis by Age-group,2019 to 2034

Figure 64: India Market Value Share (%) and BPS Analysis by Age-group, 2024 to 2034

Figure 65: India Market Y-o-Y Growth (%) Projections by Age-group, 2024 to 2034

Figure 66: India Market Value (US$ Million) Analysis by Product Type,2019 to 2034

Figure 67: India Market Volume (Units) Analysis by Product Type,2019 to 2034

Figure 68: India Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 69: India Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 70: India Market Attractiveness by Age-group, 2024 to 2034

Figure 71: India Market Attractiveness by Product Type, 2024 to 2034

Figure 72: India Market Attractiveness by Region, 2024 to 2034

Figure 73: China Market Value (US$ Million) by Age-group, 2024 to 2034

Figure 74: China Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 75: China Market Value (US$ Million) by Region, 2024 to 2034

Figure 76: China Market Value (US$ Million) Analysis by Region,2019 to 2034

Figure 77: China Market Volume (Units) Analysis by Region,2019 to 2034

Figure 78: China Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 79: China Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 80: China Market Value (US$ Million) Analysis by Age-group,2019 to 2034

Figure 81: China Market Volume (Units) Analysis by Age-group,2019 to 2034

Figure 82: China Market Value Share (%) and BPS Analysis by Age-group, 2024 to 2034

Figure 83: China Market Y-o-Y Growth (%) Projections by Age-group, 2024 to 2034

Figure 84: China Market Value (US$ Million) Analysis by Product Type,2019 to 2034

Figure 85: China Market Volume (Units) Analysis by Product Type,2019 to 2034

Figure 86: China Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 87: China Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 88: China Market Attractiveness by Age-group, 2024 to 2034

Figure 89: China Market Attractiveness by Product Type, 2024 to 2034

Figure 90: China Market Attractiveness by Region, 2024 to 2034

Figure 91: South Africa Market Value (US$ Million) by Age-group, 2024 to 2034

Figure 92: South Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 93: South Africa Market Value (US$ Million) by Region, 2024 to 2034

Figure 94: South Africa Market Value (US$ Million) Analysis by Region,2019 to 2034

Figure 95: South Africa Market Volume (Units) Analysis by Region,2019 to 2034

Figure 96: South Africa Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 97: South Africa Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 98: South Africa Market Value (US$ Million) Analysis by Age-group,2019 to 2034

Figure 99: South Africa Market Volume (Units) Analysis by Age-group,2019 to 2034

Figure 100: South Africa Market Value Share (%) and BPS Analysis by Age-group, 2024 to 2034

Figure 101: South Africa Market Y-o-Y Growth (%) Projections by Age-group, 2024 to 2034

Figure 102: South Africa Market Value (US$ Million) Analysis by Product Type,2019 to 2034

Figure 103: South Africa Market Volume (Units) Analysis by Product Type,2019 to 2034

Figure 104: South Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 105: South Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 106: South Africa Market Attractiveness by Age-group, 2024 to 2034

Figure 107: South Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 108: South Africa Market Attractiveness by Region, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Disposable Hygiene Products Market Analysis by Product Type, Sales Channel, and Region through 2025 to 2035

Disposable Hygiene Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Disposable Hygiene Footwear Market

Disposable Incontinence Products Market Growth - Trends & Forecast 2025 to 2035

Clinical Hand Hygiene Products Market – Trends, Growth & Forecast 2025 to 2035

Men's Intimate Hygiene Products Market Size and Share Forecast Outlook 2025 to 2035

Disposable Medical Gowns Market Size and Share Forecast Outlook 2025 to 2035

Disposable Drills Market Size and Share Forecast Outlook 2025 to 2035

BRICS Tourism Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Disposable Food Containers Market Size and Share Forecast Outlook 2025 to 2035

Disposable Protective Apparel Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plates Market Size and Share Forecast Outlook 2025 to 2035

Disposable Umbilical Cord Protection Bag Market Size and Share Forecast Outlook 2025 to 2035

Disposable E-Cigarettes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Pen Injectors Market Size and Share Forecast Outlook 2025 to 2035

Disposable Trocars Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

BRICS Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Disposable Cups Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Disposable Electric Toothbrushes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA