The Flame Resistant Fabrics Market is estimated to be valued at USD 7.0 billion in 2025 and is projected to reach USD 13.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period. The growth curve shows a two-phase pattern with early acceleration between 2025 and 2030, when the market rises by USD 2.5 billion, fueled by industrial safety regulations, increased PPE adoption, and demand from oil & gas and manufacturing sectors. This period aligns with strong policy enforcement and capital allocation for workforce protection in emerging economies.

An inflection point appears after 2030, where YoY growth gradually declines despite consistent value gains. The late phase from 2031 to 2035 adds USD 3.5 billion, reflecting expansion driven by advanced materials such as aramid fibers and modacrylic blends, offering enhanced thermal resistance and lightweight properties. This shift highlights innovation-led growth as volume-based expansion slows.

Cyclicality remains minimal as demand for flame-resistant fabrics correlates with regulatory mandates and workplace safety priorities, which are non-discretionary. However, regional volatility in industrial projects can influence short-term procurement patterns. Future adoption will hinge on smart textiles, sustainability-driven manufacturing, and nanotechnology-based coatings, creating new profitability pools for high-performance applications in defense, transportation, and utilities.

| Metric | Value |

|---|---|

| Flame Resistant Fabrics Market Estimated Value in (2025 E) | USD 7.0 billion |

| Flame Resistant Fabrics Market Forecast Value in (2035 F) | USD 13.0 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The flame resistant fabrics market is undergoing steady expansion, driven by the rising emphasis on industrial safety, regulatory compliance, and protective performance across high-risk operational sectors. Government mandates and occupational safety norms have significantly influenced the adoption of flame-resistant textiles, particularly in defense, utilities, and manufacturing.

Ongoing innovations in fiber engineering and textile chemistry have improved fabric durability, breathability, and thermal protection, enhancing their applicability in both harsh and everyday work environments. The industry is also witnessing a growing shift toward lightweight and comfortable materials, as employers and procurement agencies prioritize user well-being alongside compliance.

Increased global spending on defense modernization and energy infrastructure, alongside workforce safety awareness, is expected to further reinforce demand. As circular economy goals become more pronounced, the integration of recyclable and sustainable flame-resistant materials is likely to shape future procurement strategies across end-use sectors..

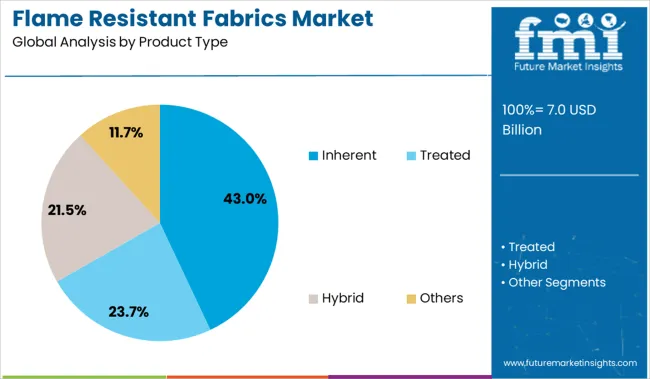

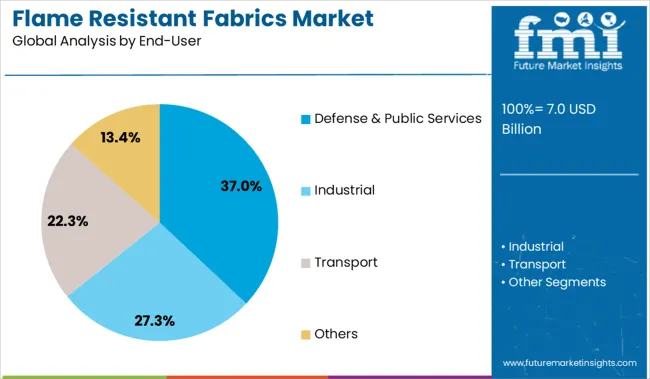

The market is segmented by product type, end-user, and region. By product type, it includes inherent, treated, hybrid, and other types, representing different material compositions and performance characteristics. In terms of end-users, the segmentation comprises defense and public services, industrial, transport, and other sectors, highlighting its diverse application across critical industries. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Inherent flame resistant fabrics are anticipated to contribute 43.0% of the total revenue in the market by 2025, making them the leading product type. Their dominance is supported by the permanent nature of their fire-resistant properties, which are engineered at the molecular level rather than through surface treatments.

This characteristic ensures consistent performance throughout the fabric’s lifecycle, even after repeated laundering or mechanical wear. Inherent fabrics are widely preferred in sectors requiring long-term protection and minimal maintenance, particularly in hazardous industrial and military environments.

Advancements in polymer science and fiber blends have enabled the production of inherently flame-resistant materials that offer both high thermal stability and comfort, making them suitable for continuous wear. Furthermore, their ability to meet stringent international safety standards without secondary treatments makes them a cost-effective and reliable solution for institutional buyers..

The defense and public services sector is expected to generate 37.0% of the total revenue share in 2025, emerging as the dominant end-user segment for flame resistant fabrics. This growth is being driven by increasing global defense budgets, homeland security initiatives, and the need for flame protection in combat, tactical, and emergency response operations.

Personnel operating in these environments require advanced textile solutions that offer flame resistance, durability, moisture management, and ergonomic fit. The demand for multi-functional uniforms that protect against fire, heat, and chemical exposure has further supported the uptake of flame-resistant fabrics in this sector.

Government procurement policies favoring certified and domestically sourced textiles have strengthened market penetration. Additionally, heightened focus on personal protective equipment (PPE) standards and soldier survivability is reinforcing continuous adoption across armed forces, firefighting units, and law enforcement agencies..

The flame resistant fabrics market operates within a highly regulated environment influenced by industrial safety mandates and cross-sector compliance requirements. Protective apparel usage has intensified across oil and gas, electrical utilities, metalworking, and defense applications. This has been driven by heightened enforcement of PPE standards and certification norms for thermal, arc, and flame resistance. Inherently flame-resistant fibers and chemically treated substrates remain central to procurement decisions. Standardization of multi-hazard workwear has accelerated demand for certified textiles compatible with industry-specific risks. Continuous developments in fiber blending, barrier layering, and functional coatings are reshaping material performance, particularly in applications requiring low heat stress, high breathability, and long-duration thermal protection.

Procurement of flame resistant fabrics has been reinforced by elevated safety enforcement in hazardous industries. Employers across oil refineries, foundries, electric utilities, and chemical processing units have adopted certified flame-resistant garments aligned with standards such as NFPA 2112, EN ISO 11612, and ASTM F1506. Inherently flame-resistant materials like aramid and modacrylic fibers are being prioritized for long-duration usage, while chemically treated cotton blends remain common in lower-risk operational environments. Regulatory inspections now emphasize multi-layered thermal barrier apparel and documented PPE compliance. Public and private sector buyers have shifted toward branded flame-resistant uniforms, performance auditing tools, and contract-based garment pools, reflecting broader institutional risk mitigation strategies. This has contributed to sustained demand across critical infrastructure and industrial sectors.

Opportunities in the flame resistant fabrics market have been shaped by demand for lighter, multifunctional protective textiles that offer both comfort and regulatory compliance. Hybrid fabric constructions combining flame resistance with arc flash mitigation, chemical splash control, and antistatic performance are gaining acceptance across aerospace maintenance, defense deployment, and transit systems. Fabric variants used in vehicle seating and confined technical spaces require dual compliance with safety and upholstery protocols. In high-growth regions, movement from informal workwear to certified protective clothing has raised localized demand for treated flame-resistant fabrics. Emerging adoption in battery storage, electric vehicle manufacturing, and server farm environments has further diversified application areas. Suppliers offering certified lifecycle guarantees, high-wash durability, and integrated leasing programs are increasingly preferred in long-term procurement cycles.

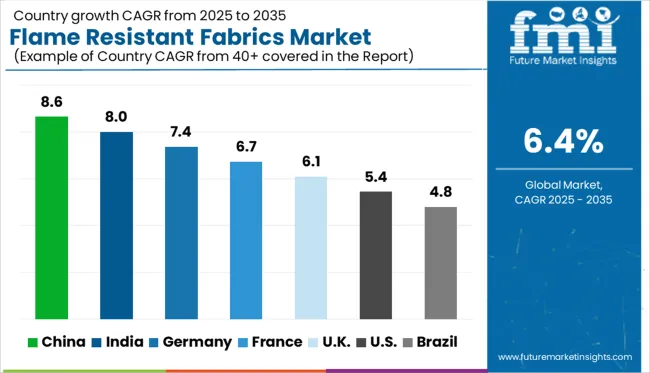

| Country | CAGR |

|---|---|

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

| Brazil | 4.8% |

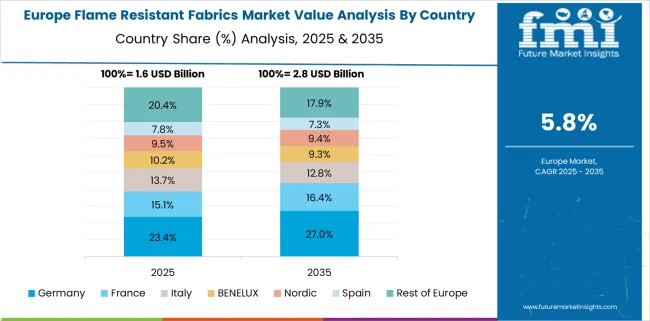

The global flame resistant fabrics market is projected to grow at a 6.4% CAGR from 2025 to 2035, shaped by stricter fire safety codes, industrial compliance, and rising deployment across defense, energy, and transport sectors. China leads with an 8.6% CAGR, anchored in uniform manufacturing for utilities, mining, and petrochemicals.

India follows at 8.0%, supported by construction PPE demand and localized garment stitching hubs. Germany records 7.4%, with protective wear adoption in manufacturing, welding, and firefighting services. France grows at 6.7%, driven by public procurement for transport, defense, and aerospace maintenance.

The United Kingdom, growing at 6.1%, focuses on low-smoke textiles and multi-layered barrier fabrics. The USA lags slightly at 5.4%, with demand shaped by regulatory alignment and energy-sector-specific usage. These countries form strategic anchors in a broader 40+ nation market review.

China is expected to grow at an 8.6% CAGR through 2035, driven by uniform production for industrial safety, power grid maintenance, and mining operations. Large-scale procurement by SOEs and energy contractors is fueling bulk orders for arc-rated and heat-retardant garments. Domestic textile clusters are scaling aramid blending and finishing lines, while exporters cater to Asia and Africa.

Growth is supported by safety mandates in petrochemical zones and stricter enforcement of high-visibility FR workwear standards. Regional manufacturers have begun backward integration into FR-treated cotton and modacrylic to reduce import reliance. China’s position as a BRICS manufacturing nucleus accelerates its influence in regional PPE markets

Demand for flame resistant fabrics in India is expanding at an 8.0% CAGR, well above the global average, supported by industrial regulation and expanding export capabilities. Construction firms, welding contractors, and power distribution companies are adopting FR garments at higher rates.

Surat, Ludhiana, and Ahmedabad have emerged as hubs for FR fabric finishing and blending, especially for modacrylic-cotton and aramid-cotton hybrids. The government’s emphasis on workplace safety compliance under OSH Code 2020 has led to inclusion of FR PPE in public tenders. India’s textile exporters are also serving Middle East and African defense contractors. Demand from smart city infrastructure and high-rise construction projects adds volume to FR workwear.

France is projected to grow at a 6.7% CAGR, with steady adoption in aerospace maintenance, transport networks, and fire services. Rail workers, energy engineers, and aircraft ground staff are major end users. Flame resistant cotton, Nomex blends, and antistatic fabrics dominate usage in national procurement.

Flame resistant barriers in public vehicles and high-speed trains are gaining importance under updated EU transport safety regulations. Textile finishers in northern France are expanding partnerships with aerospace MRO contractors and defense logistics firms. Low-smoke, self-extinguishing materials are preferred for closed, high-risk environments. The French market values Euro Norm compliance, stitching durability, and thermal resistance ratings over unit volume expansion.

The United Kingdom is projected to grow at a 6.1% CAGR, slightly below the global average, shaped by demand from offshore energy, construction, and emergency services. Flame resistant fabrics are increasingly specified in oil rig PPE, airport fire services, and tunnel maintenance uniforms.

Procurement across Scotland and the North Sea basin emphasizes multi-risk protection including arc flash and chemical splash. Modacrylic-cotton and Nomex blends are preferred in areas with harsh temperature fluctuations. Domestic FR finishing capabilities remain limited, prompting higher fabric imports. Government tenders focus on BS EN ISO 14116 and ISO 11611 compliance. The UK market emphasizes safety layering, flame spread resistance, and repair-friendly designs.

Flame resistant fabrics demand in the United States is expanding at a 5.4% CAGR, lagging behind global growth, but stabilized by specialized industrial usage. Fire-resistant textiles are predominantly used in electrical utility, oilfield, and defense-related applications. Contractors in California and Texas drive the largest volumes in construction and refinery sectors.

OEMs in the Midwest prioritize UL-certified and NFPA 70E-compliant garments. Arc-rated suits, flash fire protection gear, and anti-static coveralls are being manufactured for utility crews under OSHA compliance. Domestic FR fiber blending is concentrated in North Carolina and Georgia. USA buyers emphasize thermal performance, compliance labeling, and after-wear reusability over low-cost, import-led options.

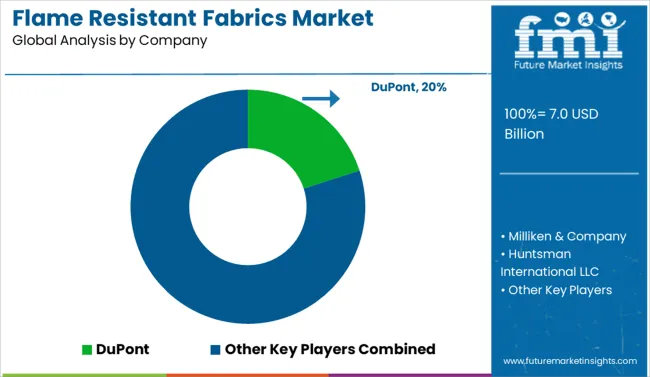

The flame resistant fabrics market is anchored by dominant players with deep material science capabilities and established safety credentials across multiple industrial verticals. DuPont leads, driven by the widespread deployment of its Nomex and Kevlar fiber platforms in aerospace, utility, and defense-grade garments.

Milliken & Company supplies tailored flame resistant fabrics meeting NFPA and ISO standards, with strong engagement in industrial safety and military procurement programs. Huntsman International LLC leverages specialty dye chemistries and durable finishes to extend protective properties under repeated laundering cycles. LENZING AG supports the European market through low-smoke, cellulosic fiber solutions integrated into firefighter and transit wear.

Solvay and Evonik Industries AG contribute functional polymer additives that improve thermal shielding and moisture control. TOYOBO CO., LTD serves the Japanese market with high-performance textiles suited for rail and construction PPE. Across this landscape, differentiation is shaped by proprietary chemistry, system compatibility, and compliance with multi-hazard certifications, rather than commodity pricing.

In December 2024, Milliken announced Milliken Assure™, North America’s first non PFAS, non halogenated moisture barrier for firefighter turnout gear. Certified to exceed NFPA 1971 2018 standards, it offers a complete PFAS-free solution across all protective gear layers.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.0 Billion |

| Product Type | Inherent, Treated, Hybrid, and Others |

| End-User | Defense & Public Services, Industrial, Transport, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DuPont, Milliken & Company, Huntsman International LLC, LENZING AG, Evonik Industries AG, Solvay, and TOYOBO CO., LTD |

| Additional Attributes | Dollar sales by material type (aramid, modacrylic, treated cotton), share by end-use sector (utilities, metals, defense), rising demand for breathable multi-risk fabrics, expansion of certified garment production by OEMs and CDMOs, regional shift toward EU and NFPA-compliant solutions, growing role of Middle East in bulk uniform procurement. |

The global flame resistant fabrics market is estimated to be valued at USD 7.0 billion in 2025.

The market size for the flame resistant fabrics market is projected to reach USD 13.0 billion by 2035.

The flame resistant fabrics market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in flame resistant fabrics market are inherent, treated, hybrid and others.

In terms of end-user, defense & public services segment to command 37.0% share in the flame resistant fabrics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flame Detector Market Size and Share Forecast Outlook 2025 to 2035

Flameproof Equipment Market Size and Share Forecast Outlook 2025 to 2035

Flame Barrier Market Size and Share Forecast Outlook 2025 to 2035

Flame Retardant Masterbatch Market Size and Share Forecast Outlook 2025 to 2035

Flame Photometer Market Size and Share Forecast Outlook 2025 to 2035

Flame Ionization Detectors Market Size and Share Forecast Outlook 2025 to 2035

Flame Proof Lighting Market Growth 2025 to 2035

Flame Retardant Chemicals Market Growth - Trends & Forecast 2025 to 2035

Flame Retardant Film Market Analysis & Forecast 2024-2034

Flame Retardant Market Growth – Trends & Forecast 2024-2034

Flame Arrester Market

Bromine Flame Retardant Market Growth – Trends & Forecast 2024-2034

Inorganic Flame Retardants Market

North America Flame Retardant Thermoplastics Market Size and Share Forecast Outlook 2025 to 2035

Non-Halogenated Flame Retardants Market- Growth & Demand 2025 to 2035

Resistant Starch Market Analysis by Product Type, Source, End Use and Region Through 2035

PD1 Resistant Head and Neck Cancer Market Size and Share Forecast Outlook 2025 to 2035

Oil Resistant Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Oil-Resistant Packaging Providers

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA