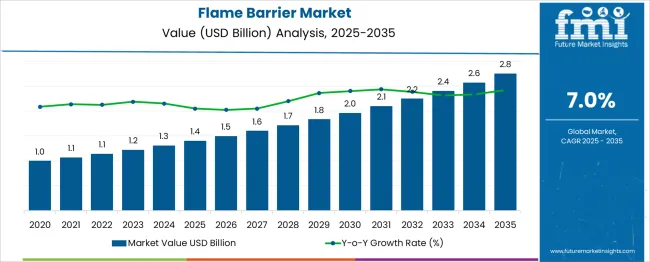

The Flame Barrier Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period. Year-on-Year (YoY) growth analysis based on values from 2020 to 2035 shows a consistent upward trajectory with mild acceleration in later years. From 2020 to 2021, the market increased from USD 1.0 billion to 1.1 billion, reflecting 10.0% growth, followed by a flat increase to 1.1 billion in 2022 (0.0%), and then 9.1% in 2023 as values reached 1.2 billion. In 2024, the growth rate was 8.3%, pushing the market to USD 1.3 billion, while 2025 recorded 7.7%, achieving 1.4 billion.

From 2026 onward, YoY gains stabilize between 6.7% and 7.1%, with values rising from 1.5 billion in 2026 to 1.6 billion in 2027 (6.7%), and then 6.3% in 2028 as the market hits 1.7 billion. The pace strengthens again post-2030, when annual increases hover around 8.3% to 8.7%, lifting the market to 2.8 billion by 2035. Overall, the YoY pattern reveals early variability followed by steady, predictable growth, and later-phase acceleration driven by stricter fire safety regulations, construction sector expansion, and rising use of high-performance flame-resistant materials across industrial and automotive applications.

| Metric | Value |

|---|---|

| Flame Barrier Market Estimated Value in (2025 E) | USD 1.4 billion |

| Flame Barrier Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The flame barrier market is progressing through a clear maturity trajectory influenced by regulatory frameworks, technological development, and regional demand diversification. The initial adoption phase was marked by slow uptake due to cost considerations and limited awareness, but advancements in material science have accelerated penetration in critical applications such as electric vehicle batteries, aerospace systems, and renewable energy infrastructure.

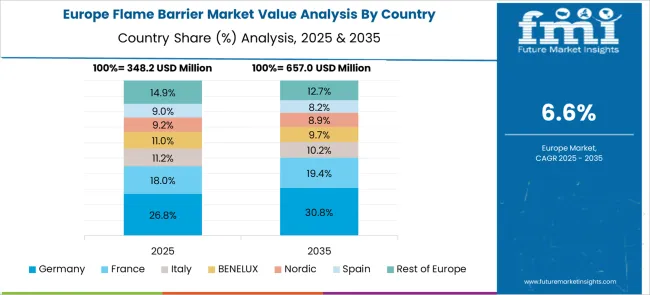

These segments remain in a growth phase, driven by safety compliance requirements and rising investments in high-performance thermal protection. Emerging economies, particularly in Asia-Pacific, are demonstrating rapid adoption fueled by industrial expansion and evolving fire safety regulations. In contrast, mature markets in Europe and North America are approaching saturation in traditional applications like building insulation and cable protection, where competitive differentiation now depends on innovation in recyclability, eco-certifications, and multifunctional performance.

Market analysis indicates a transition toward integrated solutions offering durability, heat resistance, and sustainability as procurement priorities shift toward compliance with global standards. The strategic emphasis is expected to remain on technological advancements that balance performance with environmental objectives, positioning flame barriers as essential components in energy infrastructure, transportation safety, and next-generation construction frameworks, ensuring consistent growth as electrification and renewable integration reshape global safety requirements.

The flame barrier market is witnessing consistent growth fueled by increasing awareness of fire safety, stricter building codes, and a heightened emphasis on protecting lives and property. Manufacturers and end users are prioritizing materials and solutions that not only comply with evolving regulations but also enhance durability and thermal resistance.

Demand is being supported by the expansion of urban infrastructure and commercial real estate, where fire protection standards are becoming more stringent. Advances in material science and installation techniques are improving the effectiveness and cost efficiency of flame barriers, paving the way for wider adoption across diverse settings.

Future opportunities are expected to emerge from sustainable and lightweight flame barrier solutions that cater to green building initiatives and energy-efficient designs, signaling a positive trajectory for the market.

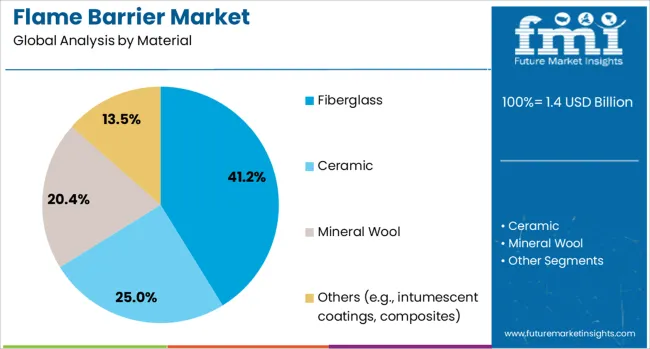

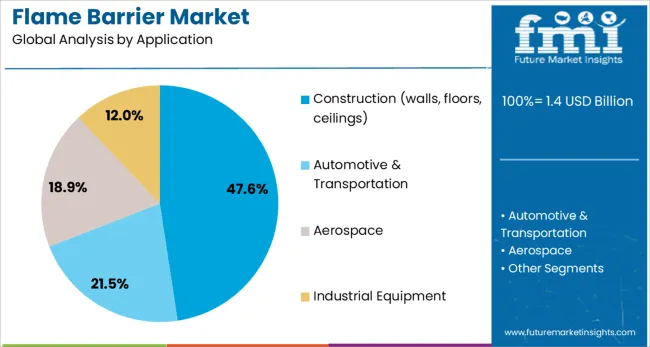

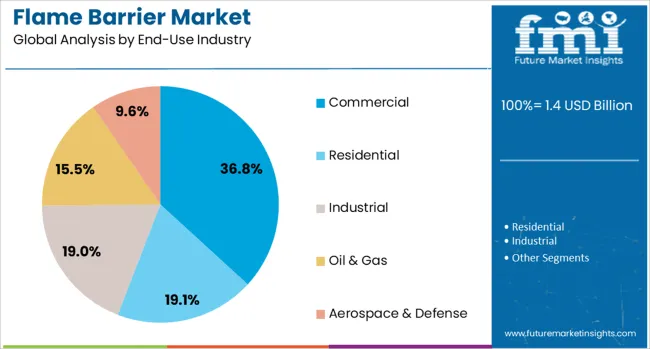

The flame barrier market is segmented by material, application, and end-use industry and geographic regions. By material of the flame barrier market is divided into Fiberglass, Ceramic, Mineral Wool, and Others (e.g., intumescent coatings, composites). In terms of application of the flame barrier market is classified into Construction (walls, floors, ceilings), Automotive & Transportation, Aerospace, and Industrial Equipment. Based on end-use industry of the flame barrier market is segmented into Commercial, Residential, Industrial, Oil & Gas, and Aerospace & Defense. Regionally, the flame barrier industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by material, fiberglass is projected to hold 41.20% of the total market revenue in 2025, positioning it as the leading material. This leadership has been driven by its superior thermal resistance, non-combustibility, and cost effectiveness compared to alternative materials.

Fiberglass has been favored for its ability to withstand high temperatures while maintaining structural integrity, which has made it highly suitable for applications demanding stringent fire performance. Its ease of installation and versatility across various architectural configurations have further contributed to its dominance.

Additionally, innovations in fiberglass composites, enhancing strength-to-weight ratios and reducing installation costs, have solidified its position as the material of choice in demanding environments.

In terms of application, construction walls floors ceilings are anticipated to capture 47.6% of the market revenue share in 2025, establishing it as the top application segment. This prominence has been supported by the necessity of incorporating flame barriers within structural elements to meet fire safety codes and protect building occupants.

Increased urbanization and the rise of high-rise buildings have intensified focus on fire-resistant walls, floors, and ceilings as integral components of passive fire protection systems. The segment’s leadership has been further strengthened by advancements in design practices and materials that enable seamless integration without compromising aesthetics or space utilization.

Contractors and developers have increasingly specified flame barriers in these applications to mitigate liability, enhance safety ratings, and comply with stringent standards, ensuring sustained demand for the segment.

When segmented by end use industry, commercial is expected to account for 36.8% of the market revenue in 2025, maintaining its status as the leading end use segment. This dominance has been underpinned by the scale and complexity of commercial buildings, where fire protection measures are paramount to safeguard occupants and assets.

Office complexes, shopping centers, hospitals, and educational facilities have increasingly incorporated advanced flame barriers to comply with safety regulations and to attract tenants by demonstrating commitment to occupant safety. The ability of flame barriers to improve risk profiles for insurers and enhance building certifications has reinforced their adoption in the commercial sector.

As commercial developers continue to emphasize safety, sustainability, and regulatory compliance, the segment’s leadership is expected to remain strong.

Flame barriers are protective materials designed to prevent fire spread and maintain structural integrity in buildings, vehicles, electrical systems, and industrial equipment. They are commonly manufactured using mica sheets, fiberglass, ceramic composites, and high-performance polymers. These barriers are applied in aerospace, automotive, construction, and energy sectors where high thermal resistance is required. Rising demand for fire safety compliance and increasing use of lightweight materials with higher flammability have influenced the adoption of advanced flame barrier systems. Manufacturers offering materials with high heat resistance, minimal smoke generation, and easy integration into complex assemblies are positioned to meet diverse industry requirements effectively.

The demand for flame barriers has been driven by stringent fire safety requirements across construction, transportation, and manufacturing environments. Industries operating under high heat exposure, such as power generation and petrochemical facilities, have reinforced adoption to reduce hazards associated with fire incidents. Automotive and aerospace sectors have prioritized flame-resistant components to meet safety certifications and enhance passenger protection. Construction applications have relied on barriers to maintain fire ratings for structural assemblies and electrical enclosures. Lightweight composites that maintain thermal integrity under extreme conditions have gained traction. Consistent investment in protective solutions designed for high-risk zones has increased reliance on flame barriers across multiple industry segments.

Market expansion has faced limitations due to the elevated cost of high-performance flame barrier materials such as advanced ceramics and specialized composites. Price sensitivity in construction and general manufacturing sectors has restrained widespread adoption of premium-grade solutions. Performance consistency remains a challenge, as improper installation or substandard raw materials can reduce thermal resistance and flame-retardant properties. Supply disruptions for key materials have added volatility to manufacturing costs. Regulatory compliance testing for fire safety standards is complex and time-consuming, increasing development timelines for new products. Limited awareness in small and mid-scale industries regarding correct barrier applications has further slowed penetration in emerging markets.

Opportunities have emerged in developing lightweight flame barrier solutions for electric vehicle battery systems, where thermal runaway prevention has become critical. Expanded use of advanced ceramics, glass fibers, and composite laminates offers scope for innovation in high-temperature resistance without adding excessive weight. Retrofitting existing infrastructure with upgraded flame-resistant panels and linings has created a strong aftermarket potential. Partnerships between material suppliers and equipment manufacturers for customized flame protection systems have opened new growth channels. Increasing demand for compact flame barriers that can integrate with electronic assemblies and sensitive circuits provides additional avenues for suppliers aiming to address energy storage and mobility applications.

The industry has seen a transition toward multi-layered flame barriers combining thermal insulation, low smoke emission, and structural reinforcement within a single solution. Fire-resistant coatings integrated with flexible substrates are gaining attention for electronics and lightweight equipment applications. Recyclable and halogen-free material options have become more widely adopted, addressing environmental compliance and safer disposal practices. Demand for barriers designed for modular systems in aerospace and rail transport has increased due to the need for efficient assembly and maintenance. Suppliers focusing on compact, high-strength solutions that deliver prolonged flame resistance without significant bulk are influencing purchasing decisions across automotive and energy infrastructure projects.

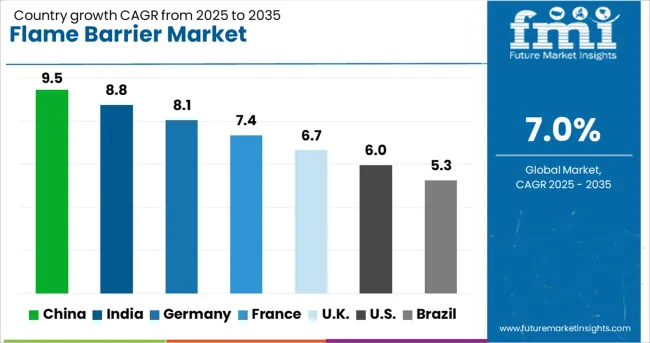

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The flame barrier market is projected to expand at a CAGR of 7.0% between 2025 and 2035, driven by demand for advanced fire-resistant materials across construction, automotive, electronics, and energy storage applications. China, part of BRICS, leads with 9.5% CAGR, supported by large-scale infrastructure and EV battery production. India, also in BRICS, follows at 8.8%, driven by building safety norms and industrial projects. Germany posts 8.1%, emphasizing automotive electrification and insulation technologies. France records 7.4%, driven by stringent regulatory compliance in aerospace and defense. The United Kingdom grows at 6.7%, supported by retrofitting of old structures and the adoption of advanced safety materials. The analysis includes over 40 countries, with the top five detailed below.

China is expected to achieve a 9.5% CAGR, significantly above the global average of 7.0%. Demand for flame barriers is soaring due to rapid growth in electric vehicle battery manufacturing, large-scale infrastructure development, and compliance with updated building codes. These materials are also being integrated into renewable energy systems for enhanced safety. Chinese manufacturers dominate global supply by offering cost-effective, durable solutions suitable for construction and electronics. Export-oriented strategies expand China’s reach to Asia-Pacific and European markets. Advanced production automation and development of multilayer flame-resistant composites ensure superior performance and scalability.

India is projected to post 8.8% CAGR, driven by nationwide construction programs, stricter building codes, and industrial modernization efforts. Demand for flame barriers is rising in metro projects, high-rise buildings, and data center installations. The push for electric mobility and energy storage systems creates additional growth avenues in thermal safety solutions. Domestic manufacturers are focusing on cost-efficient yet high-performance materials to meet regulatory standards and international quality norms. Increased investment in research for lightweight, heat-resistant composites positions India as a key supplier for Asia and the Middle East.

Germany is forecasted to achieve an 8.1% CAGR, supported by the strong adoption of flame-resistant materials in electric vehicles, industrial insulation systems, and aerospace applications. Flame barriers play a critical role in meeting EU-mandated safety regulations across the construction and mobility sectors. German manufacturers are pioneering eco-compliant solutions with recyclable components and improved thermal stability. Increased R&D in multifunctional composites supports innovation for high-heat environments such as battery housings and defense systems. Export markets in Europe and North America reinforce Germany’s reputation for precision-engineered flame protection products.

France is expected to grow at a 7.4% CAGR, driven by aerospace production, defense modernization, and retrofitting of commercial buildings. Flame barriers are integral for ensuring safety in aircraft interiors, engine compartments, and military vehicles. Increased use in energy storage facilities and transportation systems highlights their versatility. French firms are focusing on modular, lightweight designs that meet fire resistance and performance standards while reducing material weight. EU-supported research projects promote the development of sustainable flame-retardant materials, creating new opportunities for specialized suppliers.

The United Kingdom is forecasted to grow at 6.7% CAGR, slightly below the global average, yet supported by high-value infrastructure and energy projects. Flame barriers are widely deployed in retrofitting older structures, enhancing compliance with fire safety codes. Adoption in energy storage systems and renewable projects such as solar and wind farms is also increasing. Local manufacturers are focusing on recyclable materials and modular installation designs to meet environmental and efficiency goals. Integration of smart fire detection and monitoring systems further enhances market demand.

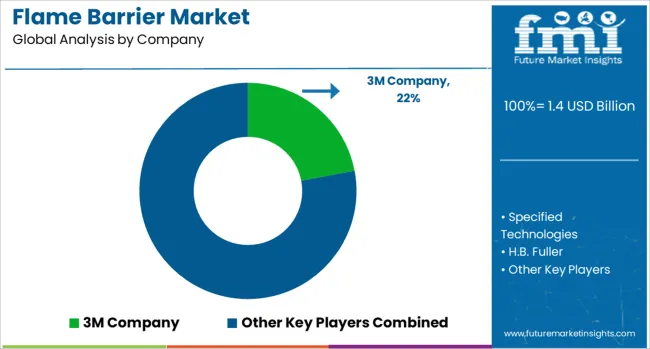

The flame barrier market is dominated by key global players such as 3M Company, Specified Technologies, H.B. Fuller, Metacaulk (Balco), Trafalgar Passive Fire Protection Systems, and Everbuild Building Products Limited (Sika AG). These companies focus on delivering advanced fire protection solutions across construction, automotive, aerospace, and industrial sectors, where flame resistance and thermal performance are critical for safety and regulatory compliance. 3M leads the market with an extensive portfolio of passive fire protection products that combine fire resistance with acoustic and thermal properties.

Specified Technologies and Trafalgar Passive Fire Protection Systems specialize in penetration seals, joint fire barriers, and modular firestop systems tailored for both new construction and retrofit applications. H.B. Fuller emphasizes high-performance adhesives and sealants with flame-retardant properties, while Everbuild (Sika AG) and Metacaulk provide fire-rated sealants and intumescent coatings for commercial and industrial projects. Competitive differentiation is based on fire rating certifications, ease of application, compatibility with multiple substrates, and reliability under extreme conditions.

Entry barriers remain high due to stringent testing standards and building code compliance requirements across global markets. Industry rivalry is increasing as manufacturers invest in R&D for improved fire endurance, lighter materials, and multi-functional performance features. Future growth will be supported by stricter safety mandates in high-rise buildings, transportation systems, and energy infrastructure. Companies enhancing product performance through innovations in intumescent technology, improved adhesion, and extended durability under varying environmental conditions are expected to maintain leadership positions in this critical safety market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Material | Fiberglass, Ceramic, Mineral Wool, and Others (e.g., intumescent coatings, composites) |

| Application | Construction (walls, floors, ceilings), Automotive & Transportation, Aerospace, and Industrial Equipment |

| End-Use Industry | Commercial, Residential, Industrial, Oil & Gas, and Aerospace & Defense |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M Company, Specified Technologies, H.B. Fuller, Metacaulk (Balco), Trafalgar Passive Fire Protection Systems, and Everbuild Building Products Limited (Sika AG) |

| Additional Attributes | Dollar sales segmented by application (construction joints, electrical penetrations, industrial enclosures, and transportation systems) and material type (intumescent coatings, fire-rated sealants, and composite barriers), with demand driven by stricter building safety codes, industrial expansion, and retrofitting projects. Regional trends indicate strong adoption in North America and Europe due to regulatory enforcement, while Asia-Pacific shows rapid growth from large-scale infrastructure development. Innovation focuses on advanced intumescent formulations, enhanced thermal performance, and improved installation efficiency to meet the growing demand for reliable flame protection solutions. |

The global flame barrier market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the flame barrier market is projected to reach USD 2.8 billion by 2035.

The flame barrier market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in flame barrier market are fiberglass, ceramic, mineral wool and others (e.g., intumescent coatings, composites).

In terms of application, construction (walls, floors, ceilings) segment to command 47.6% share in the flame barrier market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Barrier System Market Forecast Outlook 2025 to 2035

Barrier Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Coated Papers Market Size and Share Forecast Outlook 2025 to 2035

Barrier Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Resins Market Size and Share Forecast Outlook 2025 to 2035

Flame Detector Market Size and Share Forecast Outlook 2025 to 2035

Flameproof Equipment Market Size and Share Forecast Outlook 2025 to 2035

Barrier Material Market Size and Share Forecast Outlook 2025 to 2035

Flame Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Flame Retardant Masterbatch Market Size and Share Forecast Outlook 2025 to 2035

Flame Photometer Market Size and Share Forecast Outlook 2025 to 2035

Flame Ionization Detectors Market Size and Share Forecast Outlook 2025 to 2035

Flame Proof Lighting Market Growth 2025 to 2035

Flame Retardant Chemicals Market Growth - Trends & Forecast 2025 to 2035

Barrier Shrink Bags Market Analysis - Size, Share, and Forecast 2025 to 2035

Barrier Coated Paper Industry Analysis in Europe - Demand, Growth & Future Outlook 2025 to 2035

Key Players & Market Share in the Barrier Coated Paper Industry

Market Share Insights for Barrier Shrink Bag Providers

Barrier Coatings for Packaging Market Trends - Growth & Forecast 2025 to 2035

Competitive Landscape of Barrier Packaging Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA