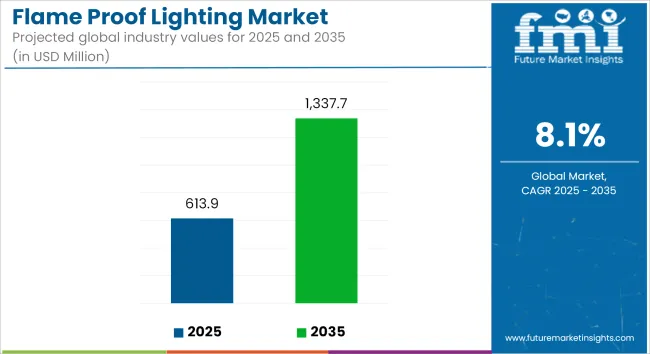

The global flame proof lighting market is estimated at USD 613.9 million in 2025 and is forecast to grow to USD 1,337.7 million by 2035, advancing at a CAGR of 8.1%. Growth is largely fueled by stricter industrial safety regulations, expanding hazardous workplace infrastructure, and rising adoption of energy-efficient, explosion-proof lighting technology.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 613.9 million |

| Industry Value (2035F) | USD 1,337.7 million |

| CAGR (2025 to 2035) | 8.1% |

The global flame proof lighting market is gaining momentum as safety requirements and modernization initiatives reshape industrial infrastructure. Industries such as oil & gas, mining, chemical manufacturing, and power generation are adopting explosion-proof lighting to comply with ATEX, IECEx, and OSHA regulations.

These zones known for explosive vapors, flammable dust, and extreme operational conditions, demand rugged, long-lasting illumination systems. LED technology has transformed the market by enabling better energy efficiency, longer operational life, and minimal maintenance compared to traditional fluorescent or incandescent systems.

Flame proof LED lights offer faster startup times, better resistance to vibration and shocks, and suitability for integration with smart systems such as IoT sensors and remote diagnostics. These benefits align with Industry 4.0 standards and are pushing global facility managers to invest in scalable, compliant, and intelligent lighting systems. Asia-Pacific continues to show high demand, supported by expanding industrial bases in India, China, and Southeast Asia.

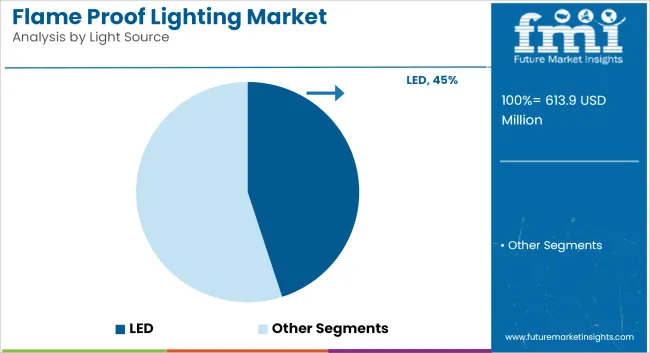

LED flame proof lighting is projected to account for 45% of the global market share in 2025, expanding at a CAGR of 9% through 2035. These systems are rapidly replacing traditional light sources like HID and fluorescent fixtures in hazardous locations. LEDs provide higher efficiency, longer lifespan, better durability against vibration and corrosion, and instant-on functionality-critical in emergency or confined environments.

They also emit less heat, minimizing ignition risks in combustible zones. With stricter energy efficiency mandates and the global phase-out of high-wattage legacy lighting, demand for certified flame proof LEDs is rising in oil refineries, offshore rigs, paint booths, and gas processing plants.

Furthermore, advancements in smart lighting control, integrated sensors, and wireless diagnostics are enhancing functionality, safety, and maintenance scheduling. Key manufacturers are focusing on modular, scalable, and ATEX/IECEx-certified LED systems to support fast deployment in both permanent and temporary installations.

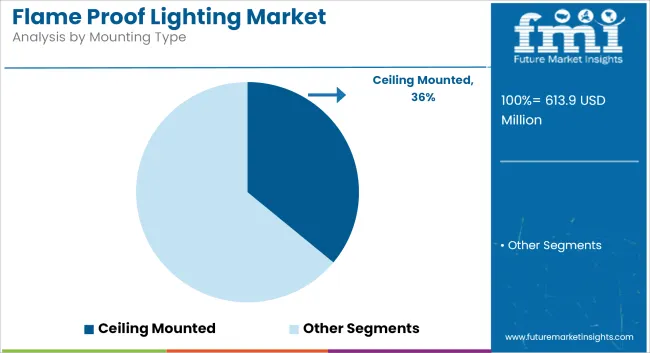

Ceiling mounted flame proof lighting is expected to hold approximately 36% market share in 2025, growing at a CAGR of 8.3% through 2035. Ceiling-mounted systems are the preferred configuration across large industrial facilities, warehouses, and marine terminals due to their ability to provide uniform illumination while remaining securely out of reach of operational hazards.

These fixtures support high mounting heights and wide light dispersion, making them ideal for dusty, high-ceiling environments. They also offer flexible integration with lighting control systems and emergency battery backups. Ceiling-mounted flame proof lights are increasingly being adopted in both greenfield and retrofit industrial projects due to their ease of maintenance and compliance with global safety standards.

New models come with corrosion-resistant housings, thermal cut-offs, and vibration-proof brackets, ensuring durability in harsh environments. As safety codes become more stringent across global construction and energy sectors, ceiling-mounted solutions are emerging as the most widely deployed fixture format.

High Initial Costs and Complexity in Installation

The flame proof lighting market is facing one of the major restraints in the high installation and maintenance cost associated with flame proof lights. This makes them more expensive than conventional lighting options as explosion-proof lighting systems, and especially LED-based solutions, require specialized materials and certifications.

This barrier is mainly cost, so these systems can prove difficult for SMEs (small and mid-sized enterprises) to adopt in volume. Moreover, the need for regular inspections and maintenance checks in compliance with regulatory safety standards adds to the long-term operational expenses.

Another key challenge is the complexity of installation in hazardous environments. Industries such as mining, oil & gas, and offshore drilling require flame proof lighting fixtures to be installed in high-risk areas, where restricted access, harsh environmental conditions, and regulatory constraints make installation and maintenance difficult. Developing modular, easy-to-install lighting solutions can help address this challenge.

Advancements in Smart Lighting and AI-Based Monitoring

The upcoming market potential of intelligent and AI-driven flame proof lighting systems marks for the momentous growth potentiality of the market. The new IoT-enabled lighting systems featured with real-time diagnostics, automatic brightness control, and predictive maintenance are driving the market of hazardous environment lighting applications.

These technologies enable industries to monitor lighting systems remotely, decrease energy consumption, and ensure workplace safety. Companies investing in these areas of AI integrated, Smart explosion-proof lighting are expected to gain a competitive position in the market.

The growth in demand for connected lighting systems is driven by the expansion of smart city projects and automation in industrial safety solutions. In these oil refineries, mining sites and even metro tunnels, cloud-based lighting management platforms are being used to make remote adjustments, track energy and detect faults, which can ultimately enhance safety and efficiency.

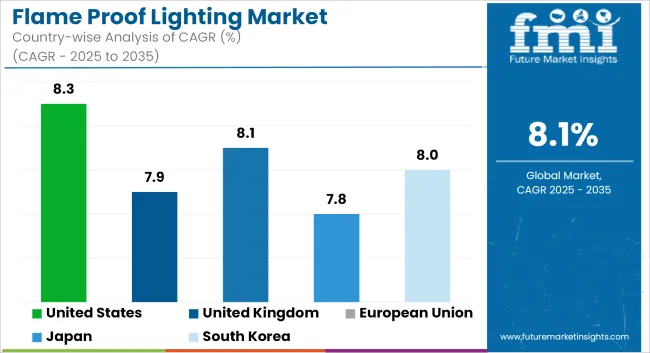

United States flame-proof lighting market is anticipated to grow at a formidable rate due to stringent industrial safety regulations, increasing investments to develop oil & gas infrastructure, and growing adoption of explosion proof lighting in hazardous environment.

Fatigue and performance related accidents have thus led to flame-proof lighting requirements in combustible / explosive atmospheres by OSHA & NEC standards; which are now ubiquitous in petrochemical plants, refineries and underground mining operations.

Further, the growing USA shale gas industry is putting a high demand for energy efficiency and durability flame-proof lighting solutions based on LED technology in such hazardous locations. Market growth is further fueled by the expansion of chemical manufacturing, pharmaceuticals, and wastewater treatment facilities. In addition to this, with hazardous industrial areas moving towards smart lighting solutions that provide IoT-enabled monitoring and automated control features.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 8.3% |

The United Kingdom flame-proof lighting market is witnessing steady growth, fueled by strong health and safety regulations, increasing offshore oil exploration activities, and advancements in industrial lighting solutions. The Health and Safety Executive (HSE) guidelines for hazardous area lighting have created a greater need for the innovative flame-proof lighting fixtures on offer as a greater number of industrial end-users are investing in such solutions across oil refineries, chemical plants, and also underground mining sites.

The UK’s North Sea oil & gas industry also continues to be an important consumer of explosion-proof lighting, as offshore platforms need corrosion-resistant, high-lumen LED fixtures able to withstand the most extreme weather conditions. Urban infrastructure projects, such as subway and railway expansions, are also using flame-proof lighting-- as are underground tunnels and hazardous work zones.

UK’s importance of lowering carbon emissions and improving energy efficiency, sectors have been moving to a flame-proof LED illuminating setting with minimal energy usage. In addition, evolution of wireless control and adaptive dimming technology are providing traction to the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.9% |

Surging ATEX (Atmosphères Explosibles) regulations, growth of renewable energy projects and the rising industrial automation will develop the European Union flame-proof lighting market at a high growth rate. Germany, France, and Netherlands are among the early adopters of flame-proof lighting in dangerous working environments such as chemical plants, manufacturing sites and offshore wind farms.

The EU is committed to driving industrial safety and energy-effective industrial solutions, leading to many smart and explosion-proof lighting systems that include hazard detection and automated lighting control. Moreover, growing investments in hydrogen energy infrastructure and industrial refineries are also augmenting the demand for flame-proof lighting solutions with high durability.

In addition, consequent to new applications in aerospace manufacturing and cleanroom environments, the market is expanding. The incorporation of advanced thermal management systems in explosion-proof LED lighting continues to enhance heat resistance and performance life in severe, industrial environments.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.1% |

The growth of the market is driven by increasing investments in industrial safety solutions, expansion of smart manufacturing, and adoption of advanced explosion-proof lighting in semiconductor and chemical industries across the country. Japan’s strict fire codes require high performance, flame-proof lighting solutions in hazardous working environments.

Industries are focused on integrating sensor-based flame-proof lighting that ensures operational safety while consuming less energy, as Japan, with its emphasis on precision manufacturing and automation, adopts energy-efficient lighting. The quick developments of the country’s robotics and AI-powered factory automation are also driving demand for automated explosion-proof lighting in hazardous production locations.

Besides, Japan’s hydrogen energy sector and smart grids development is driving demand for flame-proof lighting products at hydrogen fuel cell manufacturing and energy storage sites. One more growing trend is the transition to miniaturized, ultra-lightweight explosion-proof LED lighting for small working areas.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.8% |

Industrial safety regulation initiatives, rising investment in offshore liquefied natural gas (LNG) facilities and surging demand for explosion-proof lighting in semiconductor and petrochemical industries are the key factors boosting the South Korea flame-proof lighting market. The acceleration of intelligent, flame-proof lighting solutions is propelled by South Korea's rapid industrialization and increasingly advanced technology in hazardous environment monitoring.

Demand for heavy-duty, water-resistant explosion-proof lighting is also fueled by the growth of South Korea’s shipbuilding and offshore drilling industries. The country is increasingly utilizing AI-oriented and self-diagnostic flame-proof lighting systems for real-time safety monitoring, with an increasing push for digital transformation and smart factory deployment.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.0% |

The flame proof lighting market is moderately consolidated, with key players including Phoenix Products LLC, Dialight Corporation, Nordland Lighting, Warom Technology Inc., Nemalux Industrial Lighting, Cortem Group. These companies are focusing on developing smart, rugged, and energy-efficient lighting solutions designed for hazardous zones, with ATEX, IECEx, and UL certifications. Technological innovations such as wireless controls, motion-activated lighting, and built-in diagnostics are reshaping product offerings.

Strategic initiatives include acquisitions, expansion into emerging markets, and partnerships with EPC contractors and oilfield service companies. Growing demand from Asia-Pacific and the Middle East is prompting manufacturers to establish regional manufacturing hubs and service centers. The competitive edge will depend on a firm’s ability to offer high IP-rated, durable lighting systems that are modular, scalable, and compatible with Industry 4.0 systems.

LED, Fluorescent, Incandescent & Halogen, HID (High-Intensity Discharge).

Wall Mounted, Ceiling Mounted, Pole Mounted, Hand Held.

Mining, Marine & Off shore, Warehouses, Malls & Auditoriums, Airports & Transit Stations, Industrial, Commercial, Others.

North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East & Africa.

The global flame proof lighting market is projected to reach USD 613.9 million by the end of 2025.

The market is anticipated to grow at a CAGR of 8.1% over the forecast period.

By 2035, the flame proof lighting market is expected to reach USD 1,337.7 million.

The LED Flame Proof Lighting segment is expected to dominate due to its superior energy efficiency, longer lifespan, and increasing adoption in hazardous industrial environments such as oil & gas, mining, and chemical processing.

Key players in the flame proof lighting market include Hubbell Incorporated, Larson Electronics, Eaton Corporation, ABB Ltd., and Phoenix Products LLC.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flame Detector Market Size and Share Forecast Outlook 2025 to 2035

Flame Barrier Market Size and Share Forecast Outlook 2025 to 2035

Flame Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Flame Retardant Masterbatch Market Size and Share Forecast Outlook 2025 to 2035

Flame Photometer Market Size and Share Forecast Outlook 2025 to 2035

Flame Ionization Detectors Market Size and Share Forecast Outlook 2025 to 2035

Flame Retardant Chemicals Market Growth - Trends & Forecast 2025 to 2035

Flame Retardant Film Market Analysis & Forecast 2024-2034

Flame Retardant Market Growth – Trends & Forecast 2024-2034

Flame Arrester Market

Flameproof Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aramid Flame Retardant Webbing Market Size and Share Forecast Outlook 2025 to 2035

Bromine Flame Retardant Market Growth – Trends & Forecast 2024-2034

Inorganic Flame Retardants Market

North America Flame Retardant Thermoplastics Market Size and Share Forecast Outlook 2025 to 2035

Non-Halogenated Flame Retardants Market- Growth & Demand 2025 to 2035

Reactive Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Ex Proof Absolute Encoders Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA