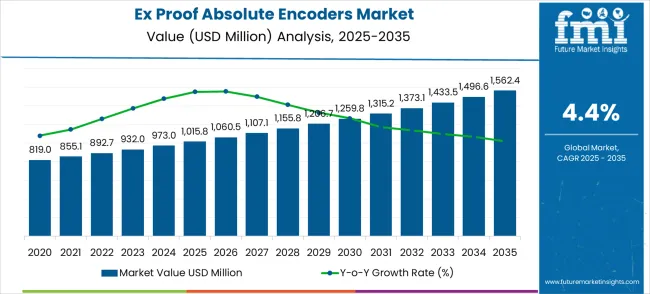

The ex proof absolute encoders market is projected to experience steady growth between 2025 and 2035, with a compound annual growth rate (CAGR) of 4.4%. The market is expected to expand from USD 1,015.8 million in 2025 to USD 1,562.4 million by 2035, driven by rising demand for precise motion control and reliable feedback solutions in hazardous industrial environments. Industries such as oil and gas, chemical processing, and mining require equipment that can operate safely under explosive atmospheres, making ex proof encoders essential. The growing focus on automation and process optimization across these sectors is expected to bolster adoption, as precision measurement and reliable positioning systems are critical for minimizing downtime and enhancing operational efficiency. Manufacturers are increasingly prioritizing encoder solutions that can withstand extreme temperatures, vibrations, and corrosive conditions, ensuring long-term durability and compliance with stringent safety standards.

The growth trajectory of the ex proof absolute encoders market is influenced by the continuous modernization of industrial plants and the need for advanced monitoring and control systems. The demand for encoders that provide accurate positional feedback while maintaining explosion-proof certifications is anticipated to rise as industries increasingly shift toward automated and remote-controlled operations. The market is further supported by the expansion of chemical, oil, and gas facilities in emerging regions, where safety regulations and performance requirements drive the deployment of high-quality encoder solutions. Innovations in materials, sealing techniques, and electronic components have enhanced the reliability and lifespan of ex proof encoders, reinforcing their adoption. The market is expected to maintain a consistent growth pattern, driven by the need for robust, precise, and compliant position sensing solutions across hazardous industrial environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,015.8 million |

| Forecast Value in (2035F) | USD 1,562.4 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The Ex proof absolute encoders market has been recognized as a vital segment across automation and process control industries, particularly where operation in explosive or hazardous environments is required. Within the industrial automation market, this segment holds a share of approximately 9.6%, as these encoders are used to monitor and control motion precisely in critical systems. In the rotary and linear encoder market, the contribution is around 11.2%, reflecting the demand for high-accuracy position feedback in mechanical and electrical systems. The process instrumentation market records a 10.3% share, with encoders being integrated into instrumentation for continuous monitoring and control.

Within the hazardous area equipment market, the share stands at 8.7%, due to stringent requirements for explosion-proof certifications in chemical, oil, and gas industries. The factory automation market contributes roughly 9.1%, as production systems increasingly rely on reliable position sensing in demanding operational conditions. Collectively, these parent markets represent about 48.9%, highlighting the critical influence of Ex proof absolute encoders in supporting operational safety, precision, and reliability across interrelated industrial sectors. The market is viewed as a cornerstone for maintaining control accuracy and safeguarding equipment in high-risk environments, reinforcing its role in modern industrial applications.

Market expansion is being supported by the rapid increase in process automation across hazardous industrial environments worldwide and the corresponding need for safety-certified absolute position feedback systems to ensure operational safety and regulatory compliance. Modern process industries rely on precise absolute encoder systems to provide continuous position information without reference point initialization requirements while maintaining intrinsic safety standards in explosive atmospheres. Explosion-proof absolute encoders enable operators to implement advanced automation systems with reliable position feedback that survives power interruptions and system restarts.

The growing complexity of process automation and increasing focus on operational safety are driving demand for certified ex proof absolute encoder solutions from manufacturers with appropriate safety certifications and technical expertise. Regulatory agencies are increasingly requiring comprehensive hazardous area classification compliance for all electrical equipment installed in explosive environments. Industry standards and safety regulations are establishing stringent certification procedures that require specialized designs and rigorous testing protocols for optimal safety performance and position accuracy.

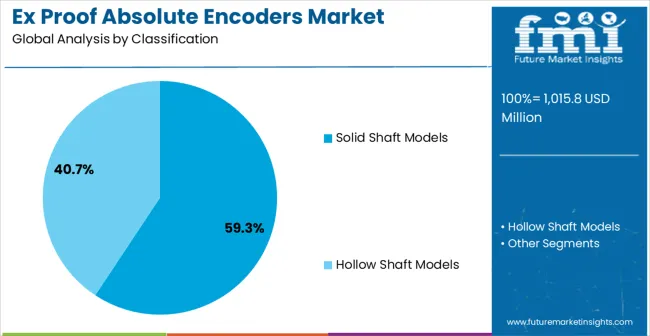

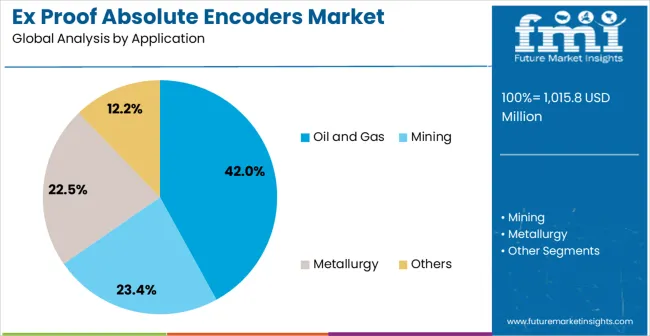

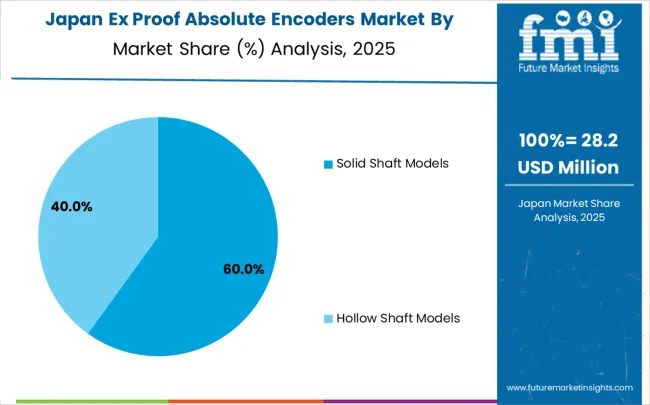

The market is segmented by product type, end-use industry, and region. By product type, the market is divided into solid shaft models and hollow shaft models. Based on end-use industry, the market is categorized into oil and gas, mining, metallurgy, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Solid shaft models are projected to account for 59.3% of the ex proof absolute encoders market in 2025. This leading share is supported by the widespread adoption of direct-coupled encoder configurations in process automation applications, which represent the majority of current installations requiring robust mechanical coupling and reliable position feedback. Solid shaft encoders provide optimal torque transmission capabilities while maintaining explosion-proof certification for most industrial automation applications including valve positioning, rotary equipment monitoring, and process control systems. The segment benefits from established manufacturing procedures and comprehensive product availability from multiple certified suppliers. These encoders offer superior mechanical strength for demanding industrial applications while ensuring consistent safety standards across hazardous environments and maintaining competitive pricing structures for automation system integrators requiring reliable absolute position feedback.

Oil and gas end-use applications are expected to represent 42.0% of ex proof absolute encoder demand in 2025. This dominant share reflects the extensive use of explosion-proof positioning systems in upstream, midstream, and downstream petroleum operations that require certified safety equipment for hazardous location compliance. Modern oil and gas facilities increasingly feature complex process automation that requires coordinated absolute encoder installations for optimal equipment positioning and control system integration across diverse operating environments. The segment benefits from stringent safety regulations and increasing emphasis on operational efficiency optimization supporting advanced automation technology adoption. Market expansion continues as operators seek reliable position feedback solutions for critical rotating equipment and valve positioning applications requiring certified explosion-proof performance and enhanced operational safety capabilities.

The ex proof absolute encoders market is advancing steadily due to increasing industrial automation in hazardous environments and growing recognition of absolute position feedback importance for operational safety and equipment protection. However, the market faces challenges including high certification costs, need for specialized technical expertise, and varying hazardous area classification requirements across different regions and applications. Technology standardization efforts and safety certification programs continue to influence product development and compliance standards across the industry.

The growing deployment of condition monitoring systems is enabling predictive maintenance capabilities through real-time position accuracy monitoring, vibration analysis, and performance trend evaluation for explosion-proof encoder applications. Advanced encoder systems equipped with diagnostic capabilities provide optimal maintenance scheduling while maintaining explosion-proof certification for operators while expanding equipment reliability and operational efficiency. These technologies are particularly valuable for remote processing facilities and offshore platforms that require continuous monitoring without compromising safety requirements and enhanced maintenance planning capabilities.

Modern ex proof absolute encoder manufacturers are incorporating digital communication protocols and advanced networking capabilities that improve system integration and reduce installation complexity through standardized fieldbus communication and remote configuration features. Integration of digital diagnostic systems and cloud-based analytics enables more sophisticated process optimization and comprehensive equipment health monitoring across hazardous industrial facilities. Advanced digital platforms also support safety compliance initiatives while meeting growing demand for data-driven decision making and operational excellence in process industries requiring explosion-proof equipment certification.

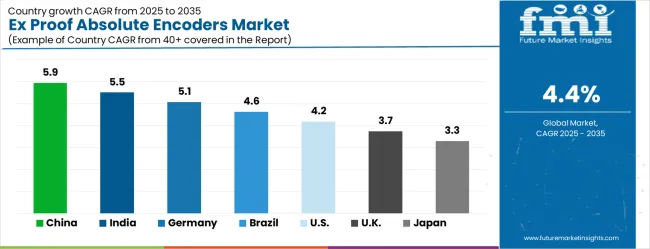

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| Brazil | 4.6% |

| United States | 4.2% |

| United Kingdom | 3.7% |

| Japan | 3.3% |

The ex proof absolute encoders market is growing steadily, with China leading at a 5.9% CAGR through 2035, driven by massive petrochemical industry expansion, growing process automation adoption, and comprehensive safety regulation implementation supporting explosion-proof equipment demand. India follows at 5.5%, supported by expanding chemical manufacturing sector and increasing government initiatives promoting industrial safety and automation technology adoption. Germany records 5.1%, emphasizing precision engineering, advanced safety certification, and stringent hazardous area compliance standards. Brazil grows at 4.6%, integrating explosion-proof automation systems into established oil and gas operations and expanding mining facilities. The United States shows 4.2% growth, focusing on offshore drilling automation and petrochemical facility modernization. The United Kingdom and Japan demonstrate steady growth at 3.7% and 3.3% respectively, driven by industrial safety upgrades and advanced automation system adoption. The report covers an in-depth analysis of 40+ countries; the top-performing countries are highlighted below.

The ex proof absolute encoders market in China is growing at a CAGR of 5.9%, driven by rapid industrialization and increasing adoption in hazardous industrial environments, including chemical, oil and gas, and heavy manufacturing sectors. Chinese manufacturers are investing in high-precision and explosion-proof encoder solutions to enhance safety and operational efficiency. Government regulations on workplace safety and industrial automation further support market adoption. Rising industrial automation and infrastructure expansion in China continue to boost demand for reliable and durable ex proof encoders across multiple applications.

The ex proof absolute encoders market in India is projected to grow at a CAGR of 5.5%, supported by increasing industrial automation in chemical, oil and gas, and manufacturing sectors. India’s focus on improving operational safety and meeting regulatory compliance fuels the adoption of explosion-proof encoder solutions. The country’s expanding industrial infrastructure and rising demand for precise motion control in hazardous environments further drive market growth. Indian manufacturers and system integrators continue to adopt advanced encoders to ensure safety and performance in critical industrial applications.

The ex proof absolute encoders market in Germany is growing at a CAGR of 5.1%, driven by strong adoption in the chemical, manufacturing, and energy industries. Germany’s emphasis on safety, reliability, and precision in industrial operations supports the use of explosion-proof encoders. Investments in industrial automation, predictive maintenance systems, and process monitoring enhance market growth. The country’s established industrial infrastructure, skilled workforce, and focus on technological excellence ensure steady adoption of ex proof absolute encoders.

The ex proof absolute encoders market in Brazil is projected to grow at a CAGR of 4.6%, supported by the increasing demand from industrial sectors such as oil and gas, chemical processing, and energy. Brazil’s focus on industrial safety, compliance with international standards, and adoption of automation technologies boosts the use of explosion-proof encoders. Expanding industrial facilities and modernization projects further accelerate market growth. The country’s need for reliable and durable encoder solutions in hazardous conditions continues to drive adoption.

The ex proof absolute encoders market in the United States is growing at a CAGR of 4.2%, driven by adoption in hazardous environments across the chemical, oil and gas, and heavy manufacturing industries. USA companies are focusing on integrating explosion-proof encoders with industrial automation systems to enhance operational safety and efficiency. Investments in predictive maintenance, precision monitoring, and compliance with safety regulations further support market growth. The demand for reliable and high-performance encoders continues to drive adoption in critical industrial applications.

The ex proof absolute encoders market in the United Kingdom is growing at a CAGR of 3.7%, supported by adoption in chemical, oil and gas, and manufacturing sectors. UK industries are increasingly investing in explosion-proof encoders to comply with safety standards and improve operational efficiency. The country’s focus on industrial automation, hazard prevention, and precise motion control further supports market growth. Steady adoption is observed as businesses prioritize safety and reliability in critical industrial applications.

The ex proof absolute encoders market in Japan is expanding at a CAGR of 3.3%, driven by adoption in chemical, energy, and manufacturing industries requiring explosion-proof solutions. Japanese industries prioritize operational safety, precision, and durability, which supports steady demand for ex proof encoders. Investments in automation, advanced monitoring systems, and industrial safety measures further enhance market growth. Although growth is slower than in emerging markets, Japan continues to adopt high-quality encoders to meet regulatory requirements and ensure reliable industrial operations.

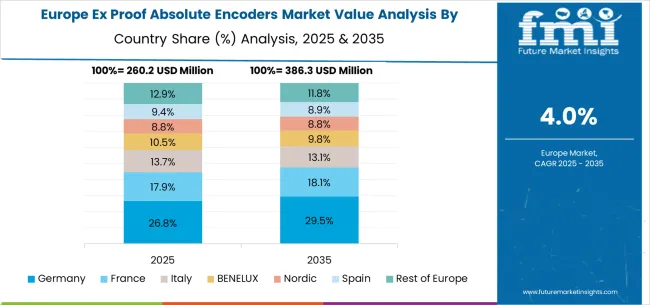

The Ex proof absolute encoders market in Europe is projected to grow from USD 260.2 million in 2025 to USD 386.3 million by 2035, registering a CAGR of 4.0% over the forecast period. Germany is expected to remain the largest national market with 26.8% share in 2025, rising to 29.5% by 2035, supported by its strong process industry infrastructure, automation leadership, and regulatory focus on industrial safety. The United Kingdom follows with 17.9% in 2025, moderating to 16.1% by 2035 as advanced automation and monitoring technologies sustain steady demand. France accounts for 13.7% in 2025, easing to 12.6% by 2035, reflecting gradual modernization across industrial sectors.

Italy holds 11.7% in 2025, softening to 10.8% by 2035, while Spain represents 10.5% in 2025, moderating to 9.8% by 2035 with industrial modernization and automation investments. BENELUX countries contribute 8.8% in 2025, declining to 8.1% by 2035, while the Nordic region accounts for 9.4% in 2025, easing slightly to 8.9% by 2035, reflecting mature adoption in advanced industrial hubs. The rest of Europe (Eastern Europe and other emerging markets) collectively holds 12.9% in 2025, moderating to 11.8% by 2035, supported by growing automation investments and modernization of chemical processing and industrial facilities in emerging European economies.

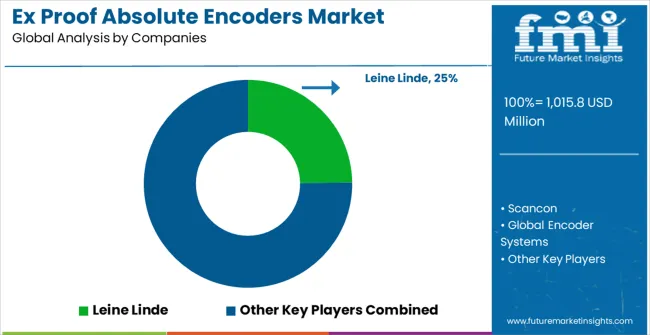

The ex proof absolute encoders market is defined by competition among specialized automation equipment manufacturers, motion control technology companies, and safety certification suppliers. Companies are investing in advanced explosion-proof technologies, safety certification capabilities, digital communication systems, and technical support services to deliver precise, reliable, and safety-compliant encoder solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Leine Linde, Sweden-based, offers comprehensive explosion-proof encoder systems with focus on harsh environment applications, advanced safety certification, and technical expertise for hazardous location installations. Scancon, operating globally, provides specialized encoder solutions integrated with explosion-proof automation capabilities for diverse industrial requirements. Global Encoder Systems and Sensata Technologies deliver technologically advanced encoder manufacturing with standardized safety procedures and certification integration. Gapp Automation emphasizes custom encoder designs and comprehensive coverage for process industry applications.

FLOHR, providing European solutions, offers explosion-proof encoder manufacturing integrated with comprehensive automation engineering services. Dynapar, Hengstler, and POSITAL deliver specialized encoder expertise with advanced technical capabilities and safety validation support. BriterEncoder Technology, Sividi, and Tofi offer specialized ex proof encoder manufacturing expertise, standardized safety certification procedures, and technical reliability across regional and international industrial networks.

Explosion-proof absolute encoders are precision measurement devices designed to operate safely in hazardous environments where flammable gases, vapors, or combustible dust may be present. With the market valued at USD 1,015.8 million in 2025 and projected to reach USD 1,562.4 million by 2035 at a 4.4% CAGR, this specialized sector serves critical applications in oil and gas, mining, and metallurgy where accurate position feedback must be maintained without igniting explosive atmospheres. Success requires coordination between safety certification bodies, precision manufacturers, hazardous area specialists, and end-users to deliver robust solutions that meet stringent intrinsic safety and explosion-proof standards.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,015.8 million |

| Product Type | Solid Shaft Models, Hollow Shaft Models |

| End-Use Industry | Oil and Gas, Mining, Metallurgy, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Leine Linde, Scancon, Global Encoder Systems, Sensata Technologies, Gapp Automation, FLOHR, Dynapar Corporation, Hengstler GmbH, POSITAL |

| Additional Attributes | Dollar sales by product type and end-use industry segments, regional demand trends across Asia-Pacific, North America, and Europe, competitive landscape with established manufacturers and emerging safety technology providers, customer preferences for solid shaft versus hollow shaft encoder configurations, integration with explosion-proof automation systems and digital communication platforms |

The global Ex Proof absolute encoders market is estimated to be valued at USD 1,015.8 million in 2025.

The market size for the Ex Proof absolute encoders market is projected to reach USD 1,562.4 million by 2035.

The Ex Proof absolute encoders market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in Ex Proof absolute encoders market are solid shaft models and hollow shaft models.

In terms of application, oil and gas segment to command 42.0% share in the Ex Proof absolute encoders market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Extracorporeal Membrane Oxygenation Machine Market Size and Share Forecast Outlook 2025 to 2035

External Anthelmintic for Dogs Market Size and Share Forecast Outlook 2025 to 2035

Extra Low Interstitial Titanium Market Size and Share Forecast Outlook 2025 to 2035

Exterior Polyurethane Varnish Market Size and Share Forecast Outlook 2025 to 2035

Exosomes Diagnostic and Therapeutic Market Size and Share Forecast Outlook 2025 to 2035

Extreme Ultraviolet Light Source Market Size and Share Forecast Outlook 2025 to 2035

Executive Coaching Certification Market Size and Share Forecast Outlook 2025 to 2035

Excavator Chassis Market Forecast and Outlook 2025 to 2035

Ex-Employee Verification Market Size and Share Forecast Outlook 2025 to 2035

Exfoliating Scrubs and Peels Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Extrusion Press Market Size and Share Forecast Outlook 2025 to 2035

Expansion Valve Market Size and Share Forecast Outlook 2025 to 2035

Extrusion Coatings Market Size and Share Forecast Outlook 2025 to 2035

External Storage Market Size and Share Forecast Outlook 2025 to 2035

Extruder and Compounding Machines Market Size and Share Forecast Outlook 2025 to 2035

Explosive Detectors Market Size and Share Forecast Outlook 2025 to 2035

External Fixator Market Size and Share Forecast Outlook 2025 to 2035

Extruder Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Explosive Vapour Detector Market Size and Share Forecast Outlook 2025 to 2035

External Anti-infective Preparations Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA