The exosomes diagnostic and therapeutic market is expanding steadily. Growth is being driven by advancements in molecular biology, rising focus on precision medicine, and increasing clinical research exploring exosome-based biomarkers. Current market dynamics are characterized by rapid technological integration, growing application of exosome analysis in oncology and neurology, and expanding collaborations between biotechnology firms and research institutions.

Regulatory agencies are emphasizing standardized protocols to ensure reproducibility and clinical reliability, strengthening market confidence. The future outlook remains positive as innovations in exosome isolation, purification, and quantification technologies enhance diagnostic accuracy and therapeutic potential.

Increasing healthcare investments and the growing shift toward non-invasive testing are supporting broader adoption across clinical and research settings Market growth rationale is supported by the rising need for early disease detection tools, therapeutic delivery platforms, and expanding translational research that bridges laboratory findings with clinical implementation, ensuring consistent revenue generation and long-term market sustainability.

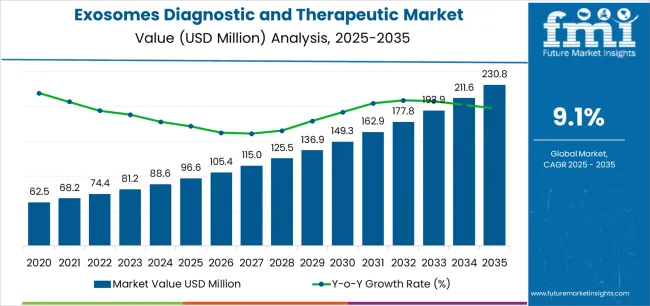

| Metric | Value |

|---|---|

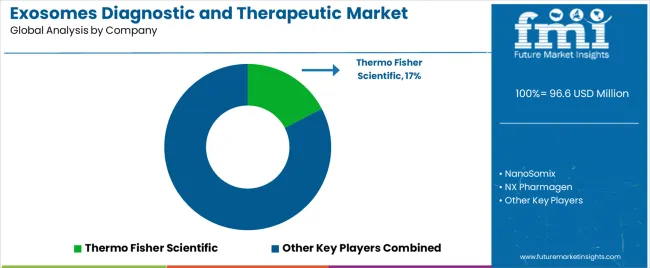

| Exosomes Diagnostic and Therapeutic Market Estimated Value in (2025 E) | USD 96.6 million |

| Exosomes Diagnostic and Therapeutic Market Forecast Value in (2035 F) | USD 230.8 million |

| Forecast CAGR (2025 to 2035) | 9.1% |

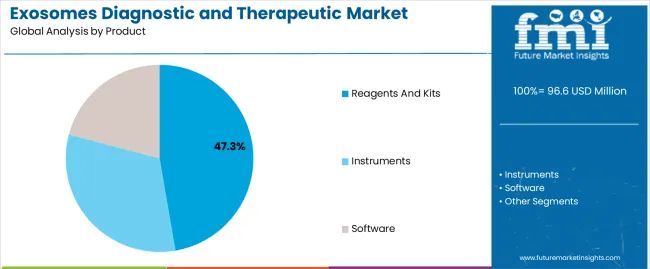

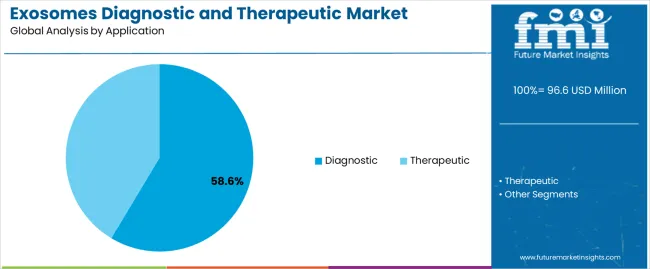

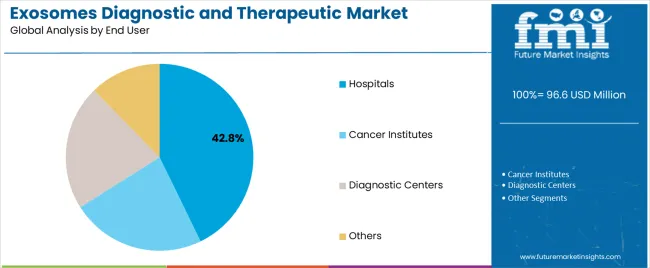

The market is segmented by Product, Application, and End User and region. By Product, the market is divided into Reagents And Kits, Instruments, and Software. In terms of Application, the market is classified into Diagnostic and Therapeutic. Based on End User, the market is segmented into Hospitals, Cancer Institutes, Diagnostic Centers, and Others.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The reagents and kits segment, holding 47.3% of the product category, has emerged as the dominant segment due to its critical role in facilitating exosome isolation, characterization, and analysis. Its high share is attributed to the growing demand for standardized and ready-to-use solutions in both clinical and research laboratories.

Continuous technological refinement in kit sensitivity and specificity has improved reproducibility and reduced analysis time, enhancing laboratory efficiency. Market adoption is being reinforced by the increasing number of diagnostic studies leveraging exosome biomarkers for early disease detection and therapeutic monitoring.

Strategic partnerships between manufacturers and diagnostic developers have accelerated the commercialization of innovative reagent kits As research funding in exosome-based applications continues to rise, the reagents and kits segment is expected to maintain its leadership through sustained demand across academic, biopharmaceutical, and clinical institutions.

The diagnostic segment, accounting for 58.6% of the application category, has maintained dominance owing to its widespread adoption in early disease detection, monitoring, and prognosis evaluation. The integration of exosome-based diagnostics into oncology, neurology, and cardiovascular testing frameworks has enhanced clinical utility and precision.

Demand has been strengthened by the growing focus on liquid biopsy technologies that enable non-invasive screening with high biomarker sensitivity. Healthcare institutions and research centers are increasingly relying on exosome diagnostics for personalized treatment planning and disease progression tracking.

Continuous development of novel biomarkers and analytical platforms is improving diagnostic reliability and cost-efficiency With increasing validation from clinical trials and supportive regulatory pathways, the diagnostic segment is projected to experience sustained growth and remain central to the future of exosome-based medical applications.

The hospitals segment, representing 42.8% of the end user category, leads the market due to its established infrastructure, access to advanced diagnostic technologies, and high patient throughput. Hospitals play a pivotal role in early adoption of exosome-based diagnostic and therapeutic solutions through integration into oncology and precision medicine programs.

The segment’s growth is supported by the presence of multidisciplinary diagnostic facilities and partnerships with biotech firms for pilot clinical implementations. Continuous training of healthcare professionals in exosome technology and integration of diagnostic testing into routine clinical workflows have reinforced adoption.

Additionally, increasing investment in hospital-based research and translational programs has expanded the clinical utility of exosome diagnostics Over the forecast period, the hospital segment is expected to maintain its leadership, driven by continuous infrastructure upgrades and growing patient preference for institution-based advanced diagnostic services.

The healthcare sector is facing pressure to reduce the prices of healthcare services to increase their accessibility among the rising patient population. In this regard, laboratories are adopting solutions that are integrated with informatics. This helps boost productivity with the help of available resources.

Manufacturers are taking an opportunistic approach by offering such healthcare facilities with additional services and support in terms of diagnostic test products. Consequently, contributes to market growth.

Key players are also capitalizing on the growing demand for non-invasive tests to diagnose cancer. For this, they continue to maintain partnerships with academic institutes to develop novel non-invasive diagnostics.

| Leading Application | Diagnostics |

|---|---|

| Value Share (2025) | 68.0% |

Based on application, the exosome-based diagnostics segment acquired a massive value share of 68% in 2025. Significant use of exosomes for diagnostic purposes can be attributed to their effective delivery of specific disease cells like nucleic acids and proteins. Exosome diagnostic tests are presently being developed for several diseases like infectious diseases, cancer, and neurological disorders.

| Leading Product Type | Instruments |

|---|---|

| Value Share (2025) | 25.0% |

By product type, the instruments segment accounts for a prominent share of 25% in the exosomes diagnostic and therapeutic market. The segment is driven by rapid advancements in research and development activities in the healthcare sector. Growth in the count of manufacturers providing instruments for diagnostic and therapeutic is also propelling the segment expansion.

| Countries | Forecast CAGR (2025 to 2035) |

|---|---|

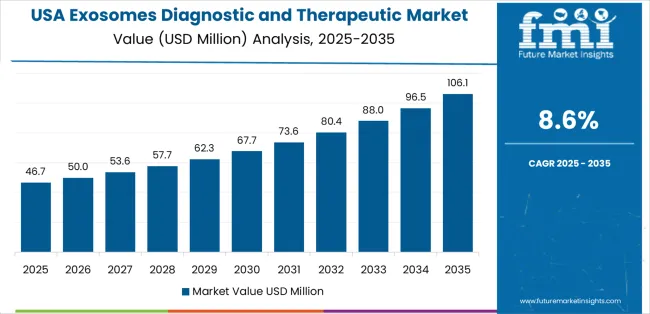

| The United States | 4.50% |

| Canada | 5.0% |

| Germany | 3.80% |

| China | 10.0% |

| India | 9.50% |

Market players are exploiting the potential for the exosome diagnostic and therapeutic industry in the United States, which is estimated to grow at 4.5% CAGR over the forecast period. Exosomes have been receiving significant traction over the past few years due to their remarkable therapeutic possibilities.

They can be harnessed for focused delivery of therapeutic agents, like nucleic acids, proteins, and pharmaceuticals, nucleic acids, throughout biological barriers. This attribute holds a lot of potential in precision medicine applications, especially in cancer therapy.

Numerous cutting-edge technologies and the latest strategies have been developed to harness the capability of exosomes to enhance the efficiency and precision of cancer detection. These approaches can revolutionize cancer diagnostics, offering non-invasive, more precise, and early detection methods.

Liquid biopsies are one such disruptive strategy in cancer treatment, which uses non-invasive collection and investigation of exosomes from body fluids like urine, blood, and saliva.

The rapid increase in cancer patients and surging funding for cancer-related research are expected to continue supporting the exosome diagnostic and therapeutic industry in the United States.

Adoption of exosomes diagnostic and therapeutic in Canada is projected to surge at a CAGR of 5% through 2035. Growth of this industry is increasing as researchers are trying to understand the connection between kidney function and disorders and urinary exosomes since exosomes carry cargo across kidney cells.

The availability, non-invasive nature, and ease of sample collection of urinary exosomes make them remarkable. Non-invasive exosomes offer a cost-effective way to uncover disease causes and therapeutic targets owing to their prognostic and diagnostic sensitivity. Additionally, non-invasive biomarkers have more patient and clinical adoption than their invasive counterparts.

Conveniently distributable and cost-effective distributable urinary indicators are clinically accessible. These factors contribute to the growth of the exosomes diagnostic and therapeutic market.

The scope of exosomes diagnostic and therapeutic in Germany is estimated to expand at a CAGR of 3.80% over the next 10 years. The industry is expected to be propelled by the increasing count of research activities with a focus on applications of exosomes to access the therapeutic effects of stem cells within the country.

Growing demand for advanced diagnostic assays as well as the increasing incidence of cancer in Germany are contributing to exosomes diagnostic and therapeutic market growth. Certain common factors that are compelling growth in the industry include advancements in healthcare systems and surging funding for research and development in Germany.

Investments in the Indian market are projected to rise at a CAGR of 9.5% in the following decade. Increasing cases of diseases like infectious disorders, cancer, and neurological diseases in India are raising the demand for more effective treatment and diagnostic tools offered by exosomes.

Ongoing technological advancements like proteomic analysis and high-throughput techniques are facilitating the characterization and identification of exosomes. Along with this, technological progress is helping in the development of diagnostic therapies and tools based on exosomes.

Surging investments from government agencies, private investors, and pharmaceutical firms are promoting research and growth in exosome diagnostics and therapeutics. With improving regulatory acceptance for exosome-based products, the market is set for significant expansion.

Demand for exosome diagnostic and therapeutic in China is expected to rise at a CAGR of 10% over the forecast period. The market is driven by an increase in clinically researched and perceived applications of exosomes as smart nano-platforms for therapy and diagnosis in the country. Additionally, market players in China are increasing their efforts to exhibit the utility of exosomes in non-invasive testing to accelerate its adoption.

The exosome diagnostic and therapeutic industry is experiencing a high level of competition, thanks to the growing count of companies manufacturing exosome-based products. All known companies in the market are covered below. Along with the companies, the technology that they are working on is also described. The following companies may or may not be working with any regulatory agencies, however, many of them do.

AcouSort AB

It is a Swedish firm that is introducing a revolutionary acoustofluidic technology and working on exosome-based diagnostics. The European Innovation Council (EIC) rewarded AcouSort and its project partners with a total of USD 2.5 million to create acoustofluidic thin-film actuated chip to separate exosomes from blood.

Aethlon Medical, Inc.

It is a United States-based company that focuses on addressing the unmet requirements in the global health and biodefense industry. The firm began its tumor-derived exosome research when the medical community held a view that exosomes are cellular debris.

Fast-forward to the present, a therapeutic to attend to tumor-derived exosomes presents a significant gap in cancer care. Aethlon has shown that Hemopurifier®’s affinity mechanism can detect tumor-derived exosomes behind various forms of cancer, like ovarian, breast, and metastatic melanoma.

AGC Biologics

AGC Biologics came into a service agreement with Japan’s Jikei University in April 2025. This agreement states that AGC Biologics is going to assume a feasibility study and technology transfer for a drug to cure idiopathic pulmonary fibrosis (IPF). Specifically, the ACG scientists are going to focus on recognizing the viability of developing a sample for an exosome-based treatment.

Aruna Bio

The company is leveraging the natural abilities of neural exosomes to pass the blood-brain barrier and elevate the body’s anti-inflammatory, protective, and self-repair mechanisms for neurodegenerative disorders treatment.

Latest Developments in the Exosomes Diagnostic and Therapeutic Market

The global exosomes diagnostic and therapeutic market is estimated to be valued at USD 96.6 million in 2025.

The market size for the exosomes diagnostic and therapeutic market is projected to reach USD 230.8 million by 2035.

The exosomes diagnostic and therapeutic market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in exosomes diagnostic and therapeutic market are reagents and kits, instruments and software.

In terms of application, diagnostic segment to command 58.6% share in the exosomes diagnostic and therapeutic market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diagnostic Shipper Market Size and Share Forecast Outlook 2025 to 2035

Diagnostic Imaging Markers Market Size and Share Forecast Outlook 2025 to 2035

Diagnostic Imaging Services Market Size and Share Forecast Outlook 2025 to 2035

Diagnostic Vials Market Size and Share Forecast Outlook 2025 to 2035

Diagnostic Exosome Biomarkers Market Trends – Growth & Forecast 2025 to 2035

Diagnostic X-Ray System Market – Trends & Forecast 2025 to 2035

Diagnostic Tools for EVs Market Growth - Trends & Forecast 2025 to 2035

Breaking Down Diagnostic Vials Market Share & Industry Insights

Diagnostic Stopper Market

DNA Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

HIV Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Food Diagnostics Services Market Size, Growth, and Forecast for 2025–2035

Rabies Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Tissue Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Sepsis Diagnostics Market Growth - Trends & Forecast 2025 to 2035

Dental Diagnostic and Surgical Equipment Market Analysis - Trends & Forecast 2024 to 2034

Allergy Diagnostic Market Forecast and Outlook 2025 to 2035

Poultry Diagnostic Testing Market Size and Share Forecast Outlook 2025 to 2035

Poultry Diagnostics Market - Demand, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA