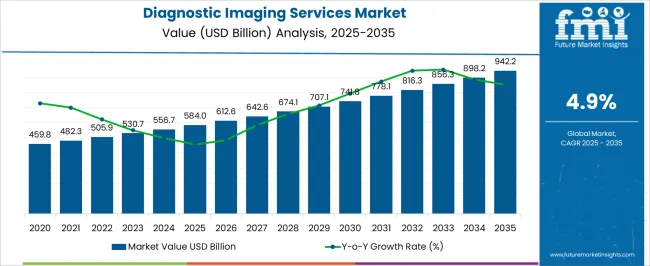

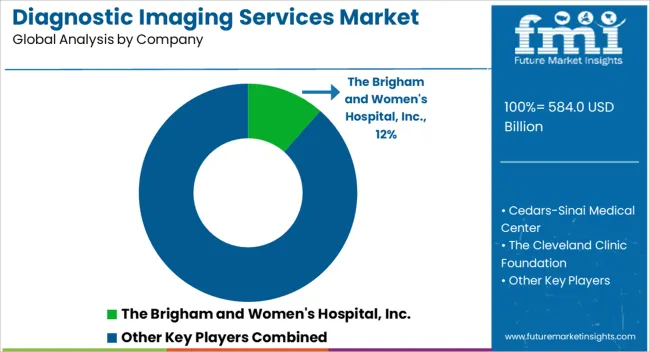

The Diagnostic Imaging Services Market is estimated to be valued at USD 584.0 billion in 2025 and is projected to reach USD 942.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Diagnostic Imaging Services Market Estimated Value in (2025 E) | USD 584.0 billion |

| Diagnostic Imaging Services Market Forecast Value in (2035 F) | USD 942.2 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The diagnostic imaging services market is experiencing consistent growth, supported by the rising demand for early disease detection, improved patient management, and advanced medical imaging technologies. The increasing prevalence of chronic illnesses such as cardiovascular disorders, cancer, and neurological conditions is driving higher utilization of imaging modalities across healthcare systems. Continuous technological advancements, including the integration of artificial intelligence for image interpretation and cloud-based storage solutions, are improving diagnostic accuracy, efficiency, and accessibility.

Expanding healthcare infrastructure in emerging economies and growing investments in medical facilities are further supporting market expansion. Rising awareness among patients regarding the importance of early and preventive care is also contributing to demand.

Regulatory encouragement for the adoption of low-dose and high-resolution imaging systems is reshaping industry standards and reinforcing the need for advanced solutions As patient volumes increase and healthcare providers seek cost-effective yet precise imaging modalities, the market is expected to maintain steady momentum, with providers focusing on service quality, accessibility, and innovation to capture long-term growth opportunities.

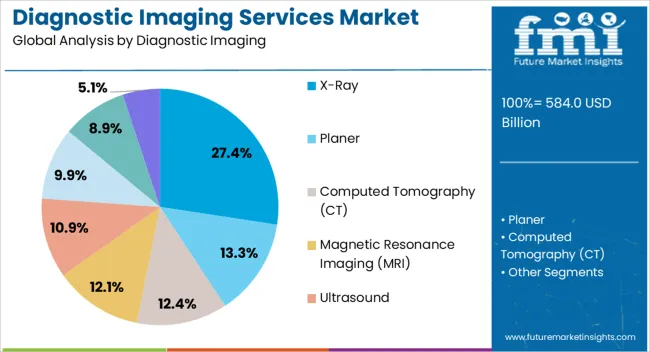

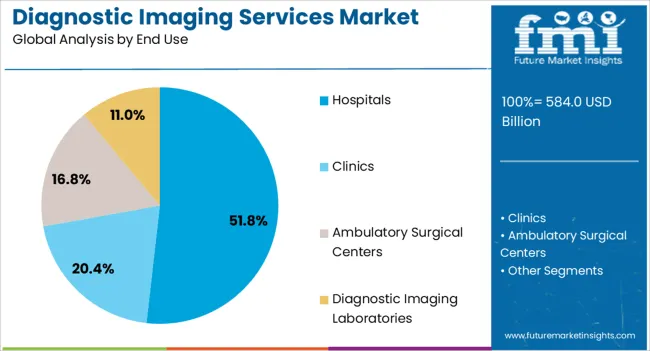

The diagnostic imaging services market is segmented by diagnostic imaging, end use, and geographic regions. By diagnostic imaging, diagnostic imaging services market is divided into X-Ray, Planer, Computed Tomography (CT), Magnetic Resonance Imaging (MRI), Ultrasound, Radionuclide, Single-Photon Emission Computed Tomography (SPECT), and Position Emission Tomography (PET). In terms of end use, diagnostic imaging services market is classified into Hospitals, Clinics, Ambulatory Surgical Centers, and Diagnostic Imaging Laboratories. Regionally, the diagnostic imaging services industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The X-Ray diagnostic imaging segment is projected to account for 27.4% of the diagnostic imaging services market revenue share in 2025, making it the leading modality. Its dominance is being driven by its wide clinical applicability, cost-effectiveness, and established role as the first-line imaging tool across multiple healthcare settings. X-Ray technology offers rapid imaging results, which are critical for diagnosis in emergency care, orthopedics, and routine health screenings.

Continuous improvements such as digital radiography and low-dose imaging are enhancing image quality while reducing patient exposure, further supporting its adoption. The segment is also benefiting from the increasing availability of portable and mobile X-Ray systems, which improve accessibility in hospitals, diagnostic centers, and remote healthcare facilities.

The ability of X-Ray to support a wide range of diagnostic needs, combined with its relatively low operational cost, ensures continued preference among healthcare providers As demand for preventive healthcare and rapid diagnosis increases globally, the X-Ray segment is expected to sustain its leadership, reinforced by its integration with digital platforms and AI-powered image analysis tools.

The hospitals segment is expected to represent 51.8% of the diagnostic imaging services market revenue share in 2025, establishing itself as the dominant end use category. This leadership is supported by the large patient inflows in hospitals, where imaging services are critical for emergency diagnosis, surgical planning, and disease monitoring. Hospitals benefit from advanced infrastructure, skilled radiologists, and the availability of multiple imaging modalities under one roof, which enhances efficiency and patient outcomes.

The ability to integrate diagnostic imaging into broader treatment pathways, including inpatient and outpatient care, has reinforced hospitals as the primary centers for imaging services. Growing investment in hospital-based imaging departments and partnerships with technology providers are further strengthening this segment’s position.

The expansion of tertiary and specialty hospitals in developing regions is also increasing access to high-end imaging services As demand for advanced diagnostic solutions continues to rise, hospitals are expected to maintain their leadership due to their capacity to offer comprehensive care supported by state-of-the-art imaging technologies and integrated diagnostic networks.

Diagnostic imaging is a process of imaging human body with the help of various imaging services. These services includes several technologies, techniques, and equipments to monitor, diagnose, screen, and treat medical conditions for effective medical intervention.

Diagnostic imaging has improved the ability of doctors to treat, diagnose, and detect an injury or disease precisely at an initial stage. In addition, diagnostic imaging services are used to provide information associated with a specific area of the body to be treated or studied.

Various advancements in imaging techniques in the field of modern medicine have facilitated the acquisition of information related to the human body for clinical interventions. In addition, advancement in imaging provides physicians with new tools to improve care in innovative ways. Increasing prevalence of chronic diseases across globe and growing demand for its diagnosis has encouraged diagnostic imaging companies to develop new and improve the existing services.

Increasing geriatric population and prevalence of chronic diseases, rising awareness for early diagnosis of diseases, technological advancement, widening application of diagnostic imaging devices, and increasing funding from government bodies are the factors to fuelling growth of diagnostic imaging services market.

However, increased risk of cancer owing to exposure to radiation, high cost of diagnostic procedures, and shortage of helium for magnetic resonance imaging systems are major concerns for the global diagnostic imaging services market.

Research study conducted by WHO indicates that diagnostic imaging, especially, X-ray based examinations is crucial in variety of medical settings. Thus, X-ray segment of the global diagnostic imaging market is expected to have highest market share over the forecasted period.

Medical and clinical assessment can be done prior to prescribing the treatment, but diagnostic imaging services supports confirmation and correct assessment of disease in calculating responses to particular treatment. Effective and qualitative diagnostic imaging is important for making medical decisions.Thus, improved health care policy and increasing demand for global diagnostic imaging procedures will drive the global diagnostic imaging services market with significant CAGR over the forecasted period.

Geographically, the global diagnostic imaging services market is classified into seven key regions namely, North America, Latin America, Western Europe, Eastern Europe, Asia-Pacific Excluding Japan (APEJ), Japan, and Middle East & Africa (MEA). In the geographical perspective, North America is leading market for global diagnostic imaging services owing to rising prevalence of chronic diseases and injuries, and increase in geriatric population in the region.

In addition, APEJ is expected to show high growth rate in global diagnostic imaging services market owing to increasing familiarity among patients about several diagnostic procedures. The key driving forces fuelling growth of diagnostic imaging services market in developing countries like India and China are the large pool of patients, increasing awareness about the disease, improving healthcare infrastructure and rising government funding in the countries.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

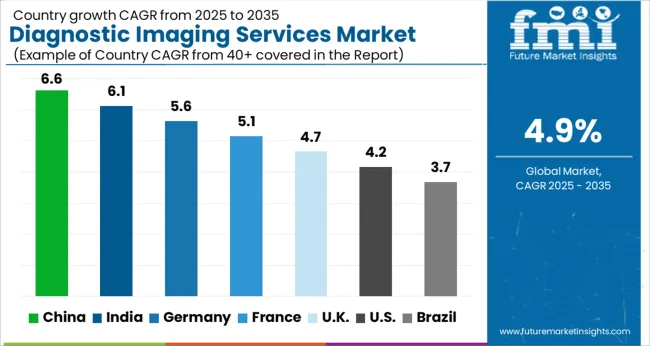

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The Diagnostic Imaging Services Market is expected to register a CAGR of 4.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.6%, followed by India at 6.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.7%, yet still underscores a broadly positive trajectory for the global Diagnostic Imaging Services Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.6%. The USA Diagnostic Imaging Services Market is estimated to be valued at USD 213.8 billion in 2025 and is anticipated to reach a valuation of USD 321.5 billion by 2035. Sales are projected to rise at a CAGR of 4.2% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 30.1 billion and USD 19.8 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 584.0 Billion |

| Diagnostic Imaging | X-Ray, Planer, Computed Tomography (CT), Magnetic Resonance Imaging (MRI), Ultrasound, Radionuclide, Single-Photon Emission Computed Tomography (SPECT), and Position Emission Tomography (PET) |

| End Use | Hospitals, Clinics, Ambulatory Surgical Centers, and Diagnostic Imaging Laboratories |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Brigham and Women's Hospital, Inc., Cedars-Sinai Medical Center, The Cleveland Clinic Foundation, Duke University Health System, Inc., The Methodist Hospital, The Johns Hopkins Health System Corporation, The General Hospital Corporation, Mayo Clinic, The University of Texas MD Anderson Cancer Center, NewYork-Presbyterian Hospital, Northwestern Memorial HealthCare, Stanford Health Care, The Regents of the University of California, The Regents of the University of Michigan, and UPMC (University of Pittsburgh Medical Center) |

The global diagnostic imaging services market is estimated to be valued at USD 584.0 billion in 2025.

The market size for the diagnostic imaging services market is projected to reach USD 942.2 billion by 2035.

The diagnostic imaging services market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in diagnostic imaging services market are x-ray, planer, computed tomography (ct), magnetic resonance imaging (mri), ultrasound, radionuclide, single-photon emission computed tomography (spect) and position emission tomography (pet).

In terms of end use, hospitals segment to command 51.8% share in the diagnostic imaging services market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diagnostic Imaging Markers Market Size and Share Forecast Outlook 2025 to 2035

Food Diagnostics Services Market Size, Growth, and Forecast for 2025–2035

AI-enabled Diagnostic Imaging Market

Diagnostic Shipper Market Size and Share Forecast Outlook 2025 to 2035

Imaging Markers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Diagnostic Vials Market Size and Share Forecast Outlook 2025 to 2035

Diagnostic Exosome Biomarkers Market Trends – Growth & Forecast 2025 to 2035

Diagnostic X-Ray System Market – Trends & Forecast 2025 to 2035

Diagnostic Tools for EVs Market Growth - Trends & Forecast 2025 to 2035

Breaking Down Diagnostic Vials Market Share & Industry Insights

Diagnostic Stopper Market

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

DNA Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

HIV Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Gel Imaging Documentation Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA