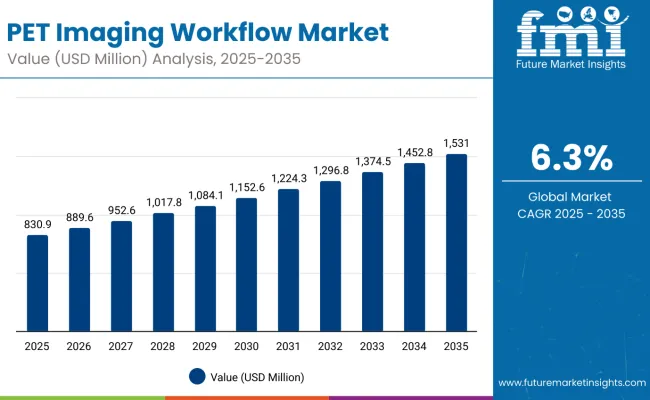

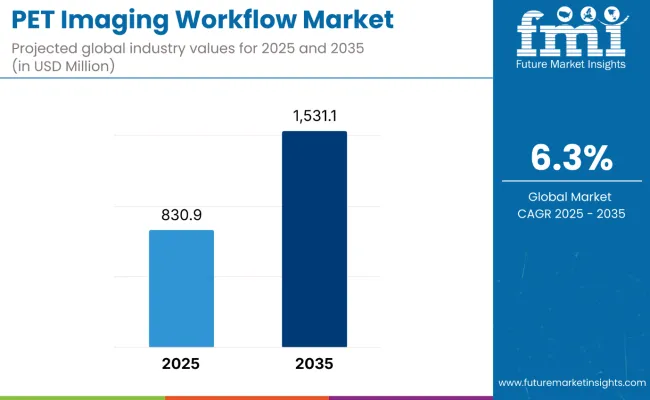

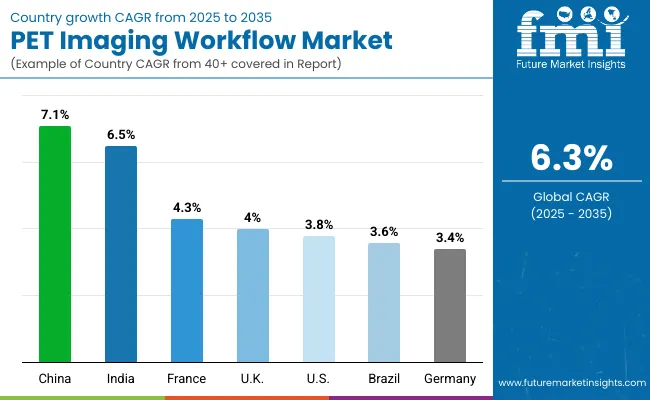

The global PET imaging workflow market is projected to grow from USD 830.9 million in 2025 to approximately USD 1,531.1 million by 2035, recording an absolute increase of USD 700.2 million over the forecast period. This translates into a total growth of 84.3%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.3% between 2025 and 2035.

PET Imaging Workflow Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 830.9 million |

| Forecast Value in (2035F) | USD 1,531.1 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

The overall market size is expected to grow by nearly 1.8X during the same period, supported by increasing prevalence of cancer diagnosis, rising demand for advanced imaging technologies, and growing focus on precision medicine and early disease detection.

Between 2025 and 2030, the PET imaging workflow market is projected to expand from USD 830.9 million to USD 1,100.2 million, resulting in a value increase of USD 269.3 million, which represents 38.5% of the total forecast growth for the decade.

This phase of growth will be shaped by rising awareness about early cancer detection, increasing demand for personalized diagnostic approaches, and growing penetration of advanced imaging technologies in emerging markets. Healthcare providers are expanding their PET imaging portfolios to address the growing demand for effective diagnostic solutions for oncological conditions.

From 2030 to 2035, the market is forecast to grow from USD 1,100.2 million to USD 1,531.1 million, adding another USD 430.9 million, which constitutes 61.5% of the overall ten-year expansion. This period is expected to be characterized by expansion of specialized imaging centers, integration of artificial intelligence platforms with imaging workflow management, and development of personalized diagnostic protocols. The growing adoption of evidence-based medicine and healthcare provider recommendations will drive demand for clinically proven PET imaging workflows with enhanced accuracy and efficiency profiles.

Between 2020 and 2025, the PET imaging workflow market experienced steady expansion, driven by increasing recognition of early cancer detection importance and growing acceptance of advanced imaging approaches. The market developed as healthcare providers recognized the need for comprehensive diagnostic solutions to address complex oncological conditions. Clinical research and regulatory approvals began emphasizing the importance of integrated imaging workflows in achieving better patient outcomes for challenging diagnostic scenarios.

Market expansion is being supported by the increasing prevalence of cancer and the corresponding demand for more effective diagnostic approaches. Modern healthcare providers are increasingly focused on comprehensive imaging workflows that can provide detailed anatomical and functional information simultaneously, improve diagnostic accuracy, and reduce the burden of multiple imaging procedures.

The proven efficacy of PET imaging in detecting various cancers, monitoring treatment response, and staging diseases makes it an essential component of comprehensive oncological diagnostic plans.

The growing emphasis on personalized medicine and precision oncology is driving demand for tailored imaging protocols that address individual patient needs and clinical presentations. Healthcare provider preference for integrated workflow solutions that combine multiple imaging processes in streamlined protocols is creating opportunities for innovative technology development.

The rising influence of clinical guidelines and evidence-based diagnostic protocols is also contributing to increased adoption of proven PET imaging workflows across different patient populations and therapeutic areas.

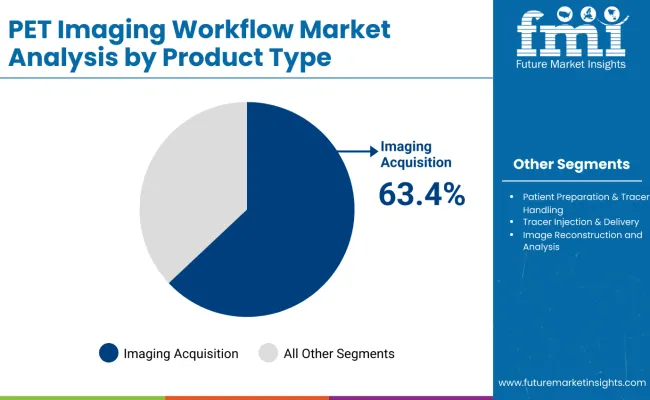

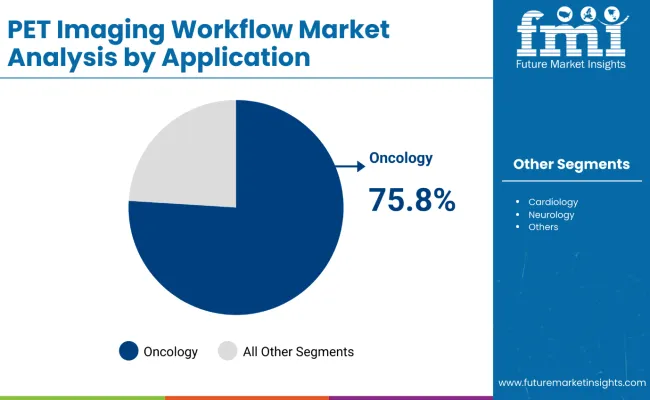

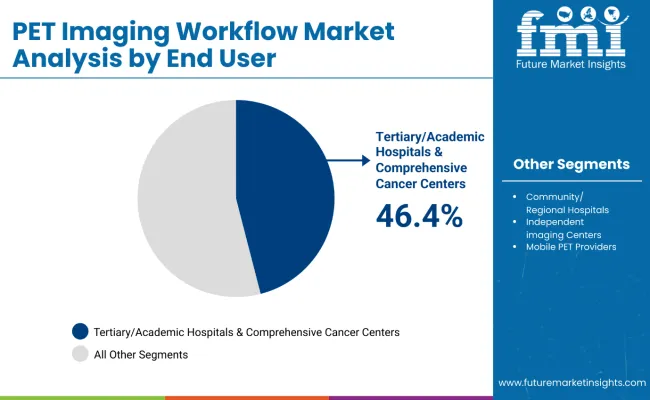

The market is segmented by product type, application, end user, and region. By product type, the market is divided into patient preparation & tracer handling, tracer injection & delivery, imaging acquisition, image reconstruction and analysis, and others. Based on application, the market is categorized into oncology, cardiology, neurology, and others. In terms of end user, the market is segmented into tertiary/academic hospitals & comprehensive cancer centers, community/regional hospitals, independent imaging centers, mobile PET providers, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The imaging acquisition segment is projected to account for 63.4% of the PET imaging workflow market in 2025, reaffirming its position as the category's dominant product type. Healthcare providers increasingly recognize the critical role of advanced imaging acquisition systems in providing high-quality diagnostic images for accurate disease detection and monitoring. This segment represents the core technology that enables the entire PET imaging process, providing the foundation for all subsequent workflow steps.

This product type forms the foundation of most diagnostic protocols for oncological conditions, as it represents the most technically advanced and clinically essential component of PET imaging workflows. Technological innovations and extensive clinical validation continue to strengthen confidence in these systems.

With increasing recognition of the importance of image quality in diagnostic accuracy, imaging acquisition systems align with both immediate diagnostic needs and long-term patient management goals. Their central role in the entire workflow ensures sustained market dominance, making them the primary growth driver of PET imaging workflow demand.

Oncology is projected to represent 75.8% of PET imaging workflow demand in 2025, underscoring its role as the primary application driving workflow adoption. Healthcare providers recognize that cancer diagnosis and monitoring requires sophisticated imaging approaches that can provide both anatomical and metabolic information for accurate staging, treatment planning, and response assessment. PET imaging workflows offer enhanced capabilities in detecting metastases, monitoring treatment efficacy, and identifying disease recurrence.

The segment is supported by the increasing incidence of various cancer types requiring advanced diagnostic approaches and the growing recognition that PET imaging workflows can improve patient outcomes through early detection and accurate staging.

Additionally, healthcare systems are increasingly adopting evidence-based treatment guidelines that recommend PET imaging for optimal cancer management. As clinical understanding of cancer biology advances, integrated imaging workflows will continue to play a crucial role in comprehensive oncological care strategies, reinforcing their essential position within the diagnostic imaging market.

The tertiary/academic hospitals & comprehensive cancer centers segment is forecasted to contribute 46.4% of the PET imaging workflow market in 2025, reflecting the primary role of specialized medical centers in advanced diagnostic imaging and patient care. These institutions handle the most complex cases and require state-of-the-art imaging capabilities for accurate diagnosis, staging, and treatment planning, making them the cornerstone of PET imaging workflow utilization. This segment provides essential services including advanced diagnostic capabilities, research integration, and coordination with multidisciplinary care teams.

The segment benefits from established expertise in complex imaging procedures, comprehensive patient populations, and integration with clinical research programs. Tertiary care centers also offer advantages in terms of specialized staff training, advanced technology implementation, and patient referral networks. With growing emphasis on precision medicine and comprehensive cancer care, these institutions serve as critical centers of excellence for PET imaging workflows, making them fundamental drivers of market growth and technological advancement.

The PET imaging workflow market is advancing steadily due to increasing recognition of precision diagnostics and growing demand for comprehensive imaging approaches. However, the market faces challenges including high equipment costs, complex technical requirements, and concerns about radiation exposure. Innovation in workflow automation and integration technologies continue to influence product development and market expansion patterns.

Expansion of Independent Imaging Centers and Specialized Facilities

The growing adoption of dedicated imaging facilities is enabling more accessible and efficient PET imaging services. Independent imaging centers offer specialized expertise, advanced equipment, and streamlined workflows that are particularly important for high-volume diagnostic imaging. These facilities provide access to imaging specialists who can optimize workflow protocols and image interpretation.

Integration of Artificial Intelligence and Advanced Analytics

Modern healthcare providers are incorporating artificial intelligence technologies such as automated image analysis, workflow optimization systems, and predictive analytics to enhance PET imaging efficiency. These technologies improve diagnostic accuracy, reduce interpretation time, and provide better integration with electronic health records. Advanced AI platforms also enable personalized imaging protocols and early identification of potential technical issues or quality concerns.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.1% |

| India | 6.5% |

| USA | 3.8% |

| France | 4.3% |

| Germany | 3.4% |

| Brazil | 3.6% |

| UK | 4.0% |

The PET imaging workflow market is experiencing varied growth globally, with China leading at a 7.1% CAGR through 2035, driven by expanding healthcare infrastructure, increasing cancer incidence, and growing access to advanced diagnostic technologies. India follows at 6.5%, supported by healthcare system modernization, increasing awareness of early cancer detection, and expanding medical imaging coverage.

The USA shows growth at 3.8%, representing a mature market with established imaging protocols and advanced healthcare infrastructure. France records 4.3% growth, focusing on evidence-based diagnostic protocols and comprehensive oncology care systems. Germany demonstrates 3.4% growth, supported by strong clinical research base and established imaging infrastructure.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from PET imaging workflows in China is projected to exhibit robust growth with a CAGR of 7.1% through 2035, driven by ongoing healthcare system modernization and increasing recognition of cancer as a priority health issue. The country's expanding healthcare infrastructure and growing availability of specialized oncology services are creating significant opportunities for advanced imaging workflow adoption. Major international and domestic medical device companies are establishing comprehensive distribution networks to serve the growing population of patients requiring sophisticated cancer diagnosis across urban and developing regions.

Revenue from PET imaging workflows in India is expanding at a CAGR of 6.5%, supported by increasing healthcare accessibility, growing cancer awareness, and expanding medical device market presence. The country's large patient population and increasing recognition of early cancer detection are driving demand for effective imaging workflow solutions. International medical device companies and domestic manufacturers are establishing distribution channels to serve the growing demand for quality diagnostic imaging systems.

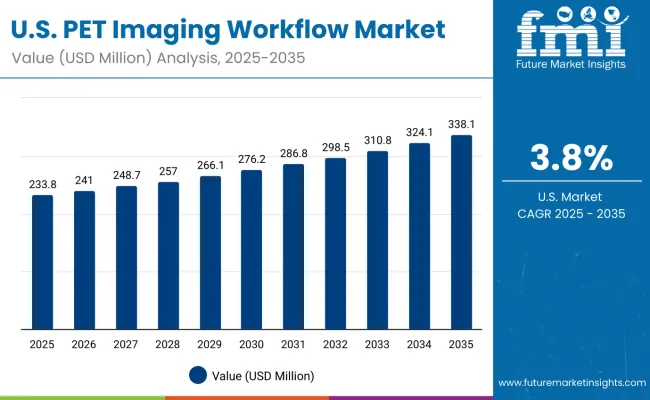

Demand for PET imaging workflows in the USA is projected to grow at a CAGR of 3.8%, supported by well-established oncology care systems and evidence-based diagnostic guidelines. American healthcare providers consistently utilize advanced imaging workflows for cancer staging, treatment monitoring, and research applications. The market is characterized by mature imaging protocols, comprehensive insurance coverage, and established relationships between healthcare providers and medical device companies.

Revenue from PET imaging workflows in France is projected to grow at a CAGR of 4.3% through 2035, driven by comprehensive healthcare system coordination, increasing cancer care emphasis, and growing recognition of advanced diagnostic importance. French healthcare providers are increasingly adopting integrated imaging approaches for oncological conditions, supported by expanding medical device market presence and improved diagnostic accessibility.

Revenue from PET imaging workflows in Germany is projected to grow at a CAGR of 3.4% through 2035, supported by the country's well-established medical infrastructure, comprehensive healthcare coverage, and systematic approach to oncology care. German healthcare providers emphasize evidence-based imaging workflow utilization within structured healthcare frameworks that prioritize diagnostic accuracy and patient safety.

Revenue from PET imaging workflows in Brazil is projected to grow at a CAGR of 3.6% through 2035, driven by healthcare system development, increasing access to oncology care, and growing recognition of advanced diagnostics importance. Brazilian healthcare providers are increasingly adopting comprehensive imaging approaches for cancer care, supported by expanding medical device market presence and improved diagnostic accessibility.

Revenue from PET imaging workflows in the UK is projected to grow at a CAGR of 4.0% through 2035, supported by the National Health Service framework and comprehensive evidence-based diagnostic guidelines that facilitate appropriate use of advanced imaging for oncological conditions. British healthcare providers consistently utilize established protocols for imaging workflow management, emphasizing diagnostic accuracy and cost-effectiveness within integrated care systems.

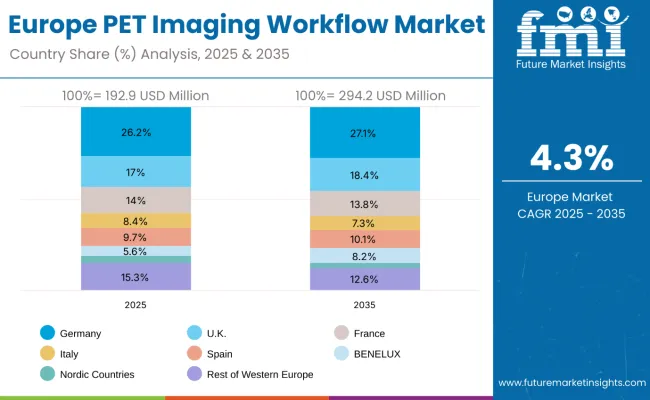

The PET imaging workflow market in Europe is projected to expand steadily through 2035, supported by increasing adoption of advanced diagnostic imaging, rising prevalence of cancer, and ongoing clinical innovation in imaging technologies.

Germany will continue to lead the regional market, accounting for 26.2% in 2025 and rising to 27.1% by 2035, supported by a strong clinical research base, comprehensive reimbursement pathways, and robust oncology care infrastructure. The United Kingdom follows with 17.0% in 2025, increasing to 18.4% by 2035, driven by NHS adoption of advanced diagnostic guidelines, integrated cancer care pathways, and expanding specialist networks.

France holds 14.0% in 2025, slightly decreasing to 13.8% by 2035 as other markets expand more rapidly. Italy contributes 8.4% in 2025, declining to 7.3% by 2035 as larger markets capture greater investment in imaging infrastructure. Spain represents 9.7% in 2025, increasing to 10.1% by 2035, supported by strengthening oncology services and diagnostic capabilities.

BENELUX markets together account for 5.6% in 2025, growing to 8.2% by 2035, supported by innovation-friendly regulatory frameworks and strong healthcare systems. The Nordic countries represent 3.9% in 2025, declining to 2.6% by 2035 as other European markets expand more rapidly. The Rest of Western Europe accounts for 15.3% in 2025, declining to 12.6% by 2035, as core markets capture greater shares of diagnostic imaging investment and utilization.

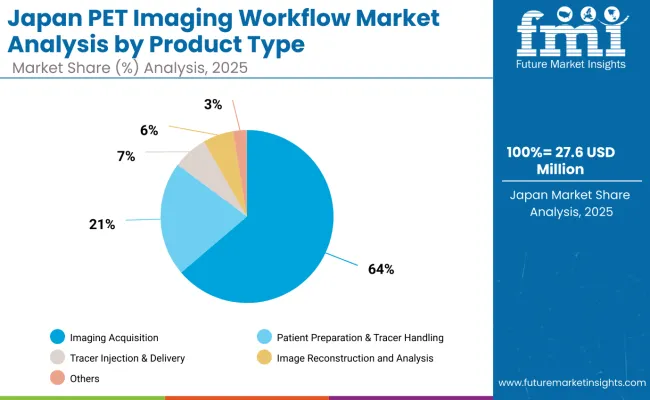

The PET imaging workflow market in Japan is set to remain diversified across several product types in 2025, reflecting clinical preferences in diagnostic imaging and evolving technology adoption patterns. Imaging Acquisition dominates with a 63.8% share in 2025, supported by its central role in providing high-quality diagnostic images and advanced scanner technology integration.

Patient Preparation & Tracer Handling represents 21.4% in 2025, gaining importance from increasing focus on workflow efficiency and patient safety protocols. Tracer Injection & Delivery holds 6.5%, sustained by automation trends and precision dosing requirements in clinical practice.

Image Reconstruction and Analysis accounts for 5.7%, driven by AI integration and advanced post-processing capabilities. Others contribute 2.6%, reflecting emerging technologies and specialized workflow components entering clinical practice.

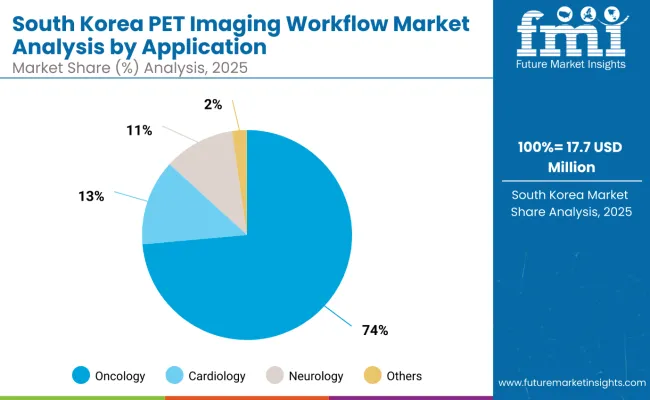

The PET imaging workflow market in South Korea in 2025 is shaped by strong demand across core oncological applications, reflecting both disease prevalence and diagnostic guidelines. Oncology accounts for the largest share at 73.6%, supported by high cancer incidence rates, comprehensive screening programs, and increasing integration of PET imaging in cancer care protocols.

Cardiology follows with 13.2%, driven by growing cardiovascular disease burden, increasing awareness of cardiac PET applications, and wider reimbursement for cardiac diagnostic protocols. Neurology contributes 10.9%, supported by advancing neurological imaging applications and research into neurodegenerative conditions.

Others hold 2.3%, reflecting emerging applications in inflammation imaging, infection detection, and research applications, highlighting opportunities for expanded clinical adoption and specialized diagnostic protocols.

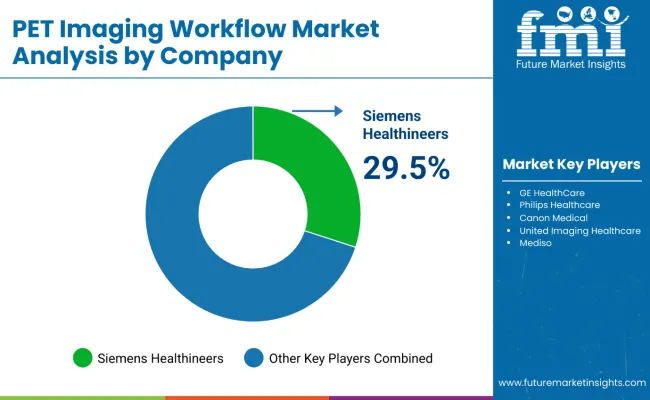

The PET imaging workflow market is characterized by competition among established medical device companies, specialized imaging technology firms, and emerging technology providers. Companies are investing in technological innovation, regulatory compliance, strategic partnerships, and healthcare provider education to deliver effective, reliable, and accessible imaging workflow solutions. Technology development, clinical validation, and market access strategies are central to strengthening product portfolios and market presence.

Siemens Healthineers leads the market with 29.5% global value share, offering comprehensive PET imaging solutions with a focus on workflow integration and diagnostic accuracy. GE HealthCare provides advanced imaging systems with emphasis on efficiency and clinical outcomes. Philips Healthcare focuses on innovative workflow solutions and integrated diagnostic platforms. Canon Medical delivers established imaging products with strong clinical evidence and healthcare provider acceptance.

United Imaging Healthcare operates with focus on advanced technology and cost-effective solutions for diverse healthcare settings. Mediso specializes in dedicated PET imaging systems and molecular imaging applications. Bayer Radiology provides radiopharmaceutical solutions and imaging workflow support services essential for comprehensive PET imaging protocols.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 830.9 Million |

| Product Type | Patient Preparation & Tracer Handling, Tracer Injection & Delivery, Imaging Acquisition, Image Reconstruction and Analysis, Others |

| Application | Oncology, Cardiology, Neurology, Others |

| End User | Tertiary/Academic hospitals & comprehensive cancer centers , Community/Regional hospitals, Independent imaging centers , Mobile PET providers, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Siemens Healthineers , GE HealthCare, Philips Healthcare, Canon Medical, United Imaging Healthcare, Mediso , Bayer Radiology |

| Additional Attributes | Dollar sales by product type and application, regional demand trends, competitive landscape, healthcare provider preferences for specific workflows, integration with specialized imaging centers , innovations in automated systems, patient safety monitoring, and diagnostic accuracy optimization |

The global PET imaging workflow market is valued at USD 830.9 million in 2025.

The size for the PET imaging workflow market is projected to reach USD 1,531.1 million by 2035.

The PET imaging workflow market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key workflow component segments in the PET imaging workflow market are imaging acquisition, image processing & reconstruction, and image analysis & reporting.

In terms of workflow component, imaging acquisition segment is set to command 63.4% share in the PET imaging workflow market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA