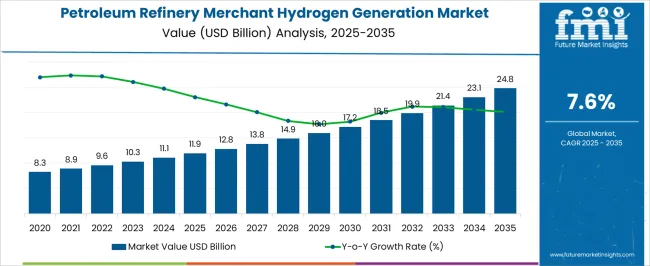

The petroleum refinery merchant hydrogen generation market is projected to expand from USD 11.9 billion in 2025 to USD 24.8 billion by 2035, reflecting a CAGR of 7.6%. Growth is being driven by the rising demand for hydrogen as a clean fuel alternative and as a feedstock in refining processes. Market dynamics are being influenced by the increasing production of petrochemical derivatives and the need for hydrogen in hydrocracking, desulfurization, and ammonia production.

The adoption of advanced reforming techniques and efficient hydrogen separation methods is being observed across refineries, while operational efficiency and cost-effectiveness remain central factors shaping the market. Over the forecast period, the petroleum refinery merchant hydrogen generation market is being reinforced by steady industrial demand and expansion in refinery capacities. Investments in large-scale hydrogen production units and integration with existing refinery operations are being prioritized to meet growing consumption needs.

The development of centralized hydrogen supply networks and contract-based hydrogen trading models are strengthening market value accumulation. Equipment suppliers and service providers are being positioned to capitalize on these opportunities as refineries aim to enhance output reliability, optimize energy use, and improve production economics, ensuring that market momentum continues through 2035.

| Metric | Value |

|---|---|

| Petroleum Refinery Merchant Hydrogen Generation Market Estimated Value in (2025 E) | USD 11.9 billion |

| Petroleum Refinery Merchant Hydrogen Generation Market Forecast Value in (2035 F) | USD 24.8 billion |

| Forecast CAGR (2025 to 2035) | 7.6% |

The petroleum refinery merchant hydrogen generation market is estimated to hold a notable proportion within its parent markets, representing approximately 12-14% of the hydrogen production market, around 8-9% of the industrial gas market, close to 10-11% of the petroleum refining market, about 5-6% of the energy and utilities market, and roughly 4-5% of the chemical process industry market. Collectively, the cumulative share across these parent segments is observed in the range of 39-45%, reflecting a significant presence of merchant hydrogen solutions in refining, industrial, and energy applications.

The market has been influenced by the demand for high-purity hydrogen to support hydrocracking, desulfurization, and other refining operations, where supply reliability, production efficiency, and integration with existing refinery infrastructure are highly prioritized. Adoption is guided by procurement strategies emphasizing consistent output, cost-effectiveness, and compliance with industrial standards. Market participants have focused on optimized generation methods, process monitoring, and scalable production capabilities to maintain performance and operational reliability across refinery operations.

As a result, the petroleum refinery merchant hydrogen generation market has not only captured a substantial share within the hydrogen production and industrial gas segments but has also influenced petroleum refining, energy, and chemical process markets, highlighting its strategic role in ensuring continuous fuel production, operational efficiency, and secure supply of high-purity hydrogen across multiple industrial domains.

The petroleum refinery merchant hydrogen generation market is experiencing steady expansion, driven by the rising demand for cleaner fuels and improved refinery efficiency. As refiners face stricter global regulations on sulfur emissions and carbon intensity, the need for high-purity hydrogen has become critical for hydrocracking, hydrotreating, and desulfurization processes. Merchant hydrogen generation models are gaining prominence as they provide refineries with a reliable hydrogen supply without requiring capital-intensive on-site production.

The flexibility to scale production and the ability to meet fluctuating refinery demands make merchant supply arrangements a preferred option in many regions. The global transition towards low-carbon fuel production, including renewable diesel and biofuel refining, is further driving demand for hydrogen as a feedstock.

Additionally, increasing partnerships between industrial gas companies and refiners are shaping the competitive landscape and enabling more efficient infrastructure deployment With long-term energy transition policies emphasizing decarbonization, the market is expected to witness sustained growth, supported by capacity expansion initiatives, technological improvements in hydrogen production processes, and increased investment in low-emission hydrogen solutions for refinery applications.

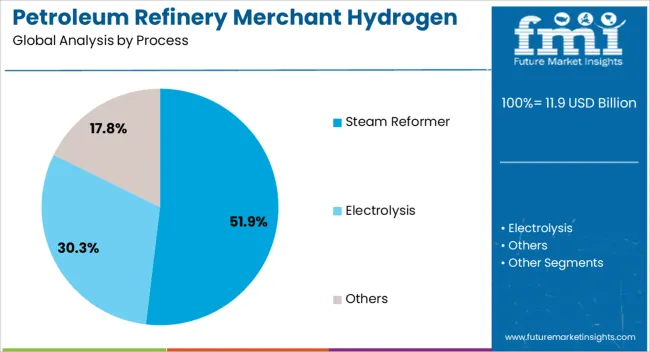

The petroleum refinery merchant hydrogen generation market is segmented by process and geographic regions. By process, the petroleum refinery merchant hydrogen generation market is divided into Steam Reformer, Electrolysis, and Others. Regionally, the petroleum refinery merchant hydrogen generation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The steam reformer process segment is projected to account for 51.9% of the petroleum refinery merchant hydrogen generation market revenue share in 2025, establishing it as the dominant process technology. Its leadership is being supported by high hydrogen yield, operational efficiency, and cost-effectiveness compared to alternative methods. The steam reforming process uses natural gas or other light hydrocarbons as feedstock and enables continuous, large-scale hydrogen production, which aligns well with refinery requirements for uninterrupted hydrogen supply.

Technological maturity and infrastructure readiness are contributing to widespread adoption across both developed and developing refinery markets. In addition to being well-established, steam reforming offers integration compatibility with carbon capture systems, allowing refiners to meet emissions targets without overhauling their existing operations.

The scalability of the process, coupled with relatively low production costs, is reinforcing its preference in merchant hydrogen supply arrangements. As the demand for clean hydrogen continues to rise in refinery operations and environmental mandates become stricter, the steam reformer process is expected to remain central to the industry’s hydrogen generation strategy, ensuring its continued dominance in the market landscape.

The petroleum refinery merchant hydrogen generation market is being driven by growing refinery hydrogen consumption, with opportunities emerging from industrial expansion. Trends in electrolysis and steam methane reforming are shaping production strategies, while high costs and regulatory constraints pose significant challenges. The market is being influenced by the critical role of hydrogen in refinery operations and industrial processes, with merchant supply ensuring reliability, operational flexibility, and efficiency across production facilities globally.

The demand for merchant hydrogen generation is being driven by the increasing consumption of hydrogen in petroleum refineries for hydrocracking, desulfurization, and other upgrading processes. Refiners are being prompted to secure reliable hydrogen supply sources to maintain production efficiency and meet product quality standards. On-site generation is being complemented by merchant hydrogen to balance peak demands and reduce dependency on external suppliers. The rising adoption of hydrogen-intensive processes and the shift toward low-sulfur fuels are being observed as key drivers influencing procurement strategies and fueling overall market growth globally.

Opportunities in the merchant hydrogen generation market are being created by expanding industrial applications beyond refineries, including chemical manufacturing, steel production, and emerging energy storage solutions. Equipment providers are being encouraged to offer scalable, high-purity hydrogen production systems for diverse end-users. Partnerships between hydrogen producers and industrial consumers are being leveraged to secure long-term supply agreements. The growing requirement for flexible hydrogen distribution networks and integration with existing refinery infrastructure is being recognized as a strategic opportunity for market players to enhance revenue streams and strengthen industry presence.

Market trends indicate that electrolysis and steam methane reforming (SMR) techniques are being prioritized to meet varying purity and volume requirements. Merchant hydrogen is being produced using advanced reforming technologies optimized for efficiency and operational reliability. The adoption of modular hydrogen generation systems and automated monitoring solutions is being observed to reduce operational bottlenecks. Process improvements that enable consistent hydrogen quality and cost-effective production are being emphasized to cater to refinery schedules. Integration with pipeline distribution and storage solutions is being recognized as a key trend that enhances accessibility and responsiveness to market demand fluctuations.

Challenges in the merchant hydrogen market are being shaped by high operational costs, feedstock price volatility, and stringent safety and environmental regulations. The capital-intensive nature of hydrogen production facilities is being reported as a barrier for new entrants.

Compliance with emission standards and safety protocols is required to avoid operational penalties. Additionally, infrastructure limitations and transportation logistics are being highlighted as obstacles to efficient hydrogen delivery. Rapidly changing refinery process requirements and the need for consistent, high-purity hydrogen are being observed as technical challenges that necessitate continuous process adjustments and equipment upgrades.

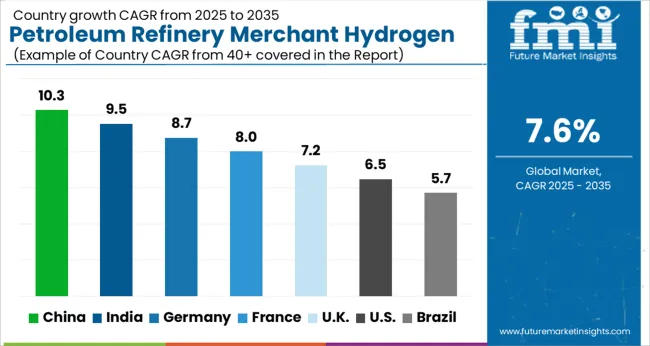

| Country | CAGR |

|---|---|

| China | 10.3% |

| India | 9.5% |

| Germany | 8.7% |

| France | 8.0% |

| UK | 7.2% |

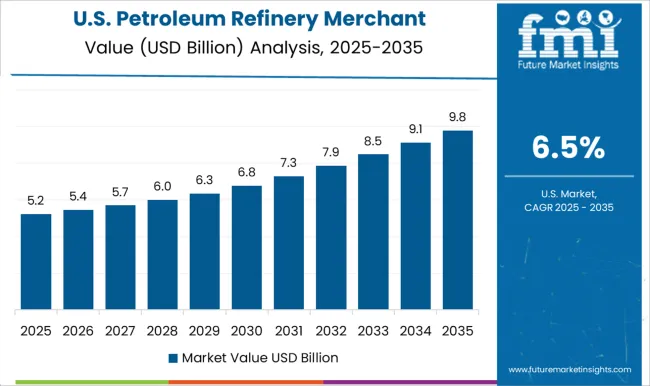

| USA | 6.5% |

| Brazil | 5.7% |

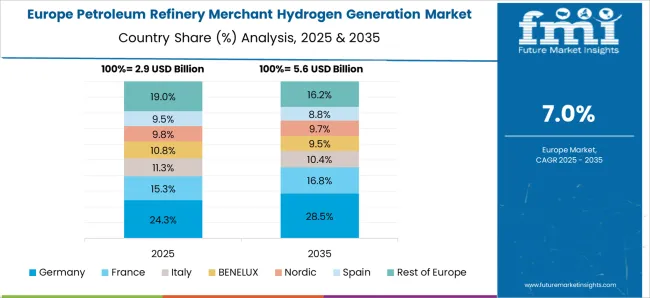

The global petroleum refinery merchant hydrogen generation market is projected to grow at a CAGR of 7.6% from 2025 to 2035. China leads with a growth rate of 10.3%, followed by India at 9.5%, and France at 8%. The United Kingdom records a growth rate of 7.2%, while the United States shows the slowest growth at 6.5%. Market growth is supported by increasing hydrogen demand in refining operations, chemical processing, and industrial applications. Emerging economies like China and India are experiencing higher growth due to expansion of refinery capacity and investments in hydrogen infrastructure, while developed markets focus on efficiency improvements, regulatory compliance, and integrating cleaner hydrogen production technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The petroleum refinery merchant hydrogen generation market in China is expected to grow at a CAGR of 10.3%, driven by increasing refinery capacity, rising demand for hydrogen in chemical production, and government incentives for cleaner energy solutions. Expansion of industrial and petrochemical sectors enhances hydrogen generation demand for refining operations. Adoption of advanced hydrogen production technologies, such as steam methane reforming and water electrolysis, supports efficiency and output. Investments in domestic hydrogen infrastructure and collaborations with international technology providers further strengthen market growth. The push for energy transition and reduction of refinery emissions drives adoption of merchant hydrogen solutions.

The petroleum refinery merchant hydrogen generation market in India is projected to grow at a CAGR of 9.5%, supported by growing refining capacity, rising industrial hydrogen consumption, and adoption of modern hydrogen production technologies. Demand is fueled by chemical manufacturing, petroleum processing, and expanding energy sectors. Investments in domestic hydrogen infrastructure and process optimization improve operational efficiency. Government initiatives promoting cleaner hydrogen production, coupled with international collaborations, encourage adoption. The rising need for low-carbon hydrogen solutions in refineries ensures continuous market expansion, while technology adoption focuses on reducing operational costs and emissions.

The petroleum refinery merchant hydrogen generation market in France is expected to grow at a CAGR of 8%, driven by industrial hydrogen demand, petrochemical processing, and refining operations. Adoption of cleaner hydrogen production technologies, including electrolysis and low-emission reforming, supports sustainability goals. Investments in advanced production units and automation enhance operational efficiency and reduce costs. France's regulatory framework encourages low-emission hydrogen usage, while established industrial infrastructure ensures steady market demand. Focus on optimizing refinery hydrogen consumption and integrating renewable hydrogen solutions supports continuous growth in the sector.

The petroleum refinery merchant hydrogen generation market in the UK is projected to grow at a CAGR of 7.2%, supported by refining and petrochemical sector demands. Adoption of cleaner hydrogen production technologies, coupled with investments in process automation and efficiency, strengthens market expansion. Regulatory compliance for emission reduction encourages modern hydrogen solutions. Growing focus on hydrogen as an industrial feedstock and refinery support fuel steady market demand. Integration of merchant hydrogen into domestic energy strategies and collaboration with technology providers further boosts adoption.

The petroleum refinery merchant hydrogen generation market in the USA is expected to grow at a CAGR of 6.5%, driven by industrial and refinery hydrogen demand. Adoption of advanced hydrogen production methods, such as steam methane reforming and electrolysis, enhances efficiency and reduces emissions. Investments in refinery infrastructure and technology upgrades support operational optimization. The USA focus on domestic hydrogen production, emission reduction, and low-carbon solutions strengthens market expansion. Demand for hydrogen in chemical processing and petroleum refining ensures sustained growth, while regulatory compliance and technological adoption maintain steady market momentum.

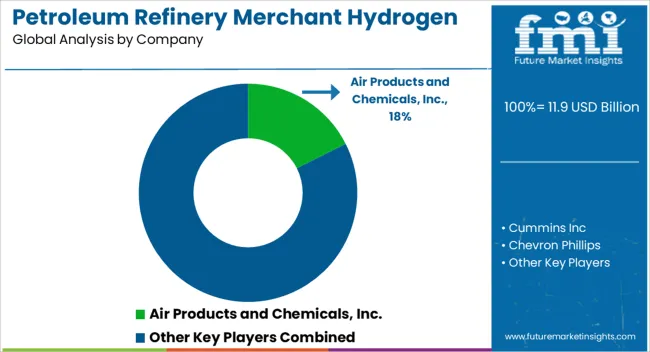

The petroleum refinery merchant hydrogen generation market is highly competitive, with major players like Air Products and Chemicals, Inc., Cummins Inc., and Chevron Phillips leading the way in providing large-scale hydrogen solutions for refining and industrial applications. Companies such as ExxonMobil, ITM Power, and Green Hydrogen Systems focus on delivering high-purity hydrogen via steam methane reforming, electrolysis, and emerging green hydrogen technologies. KBR, Inc., Nel ASA, Thyssenkrupp, and Uniper SE emphasize modular and scalable solutions, aiming to meet global refinery demands efficiently while reducing carbon footprints. Product brochures highlight advanced process control systems, energy-efficient designs, and integration capabilities with existing refinery infrastructure. Innovation in electrolyzer efficiency, modular plant design, and rapid deployment is increasingly showcased to attract refinery operators seeking reliable, cost-effective hydrogen generation. The market is influenced by global energy transition trends, government incentives, and the need to decarbonize traditional refinery operations.

Competition revolves around technology differentiation, service reliability, and strategic partnerships. R&D investments are highlighted in product brochures to improve electrolyzer performance, reduce operational costs, and enhance system longevity. Companies promote global service networks, turnkey solutions, and digital monitoring platforms to improve operational efficiency. Hydrogen purity, plant scalability, and ease of integration are emphasized as key decision factors. Strategic collaborations with refineries and energy companies are frequently showcased to strengthen market presence and ensure project success. Overall, growth in the petroleum refinery merchant hydrogen generation market is driven by demand for cleaner fuel production, operational efficiency, and reliable supply chains, with players maintaining a competitive edge through technological innovation and customer-focused solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.9 Billion |

| Process | Steam Reformer, Electrolysis, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Products and Chemicals, Inc., Cummins Inc, Chevron Phillips, ExxonMobil, ITM Power, Green Hydrogen Systems, KBR, Inc., Nel ASA, Thyssenkrupp, and Uniper SE |

| Additional Attributes | Dollar sales by technology type (steam methane reforming, partial oxidation, electrolysis) and application (refining, chemical production, fuel cells) are key metrics. Trends include rising demand for hydrogen as a feedstock and energy source, growth in petroleum refining operations, and adoption of low-emission hydrogen generation methods. Regional deployment, technological advancements, and regulatory compliance are driving market growth. |

The global petroleum refinery merchant hydrogen generation market is estimated to be valued at USD 11.9 billion in 2025.

The market size for the petroleum refinery merchant hydrogen generation market is projected to reach USD 24.8 billion by 2035.

The petroleum refinery merchant hydrogen generation market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in petroleum refinery merchant hydrogen generation market are steam reformer, electrolysis and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Jelly Market Growth - Trends & Forecast 2025 to 2035

Petroleum Fuel Dyes and Markers Market 2025 to 2035

Petroleum Refining Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Yellow Petroleum Jelly Market Size and Share Forecast Outlook 2025 to 2035

Captive Petroleum Refinery Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Liquefied Petroleum Gas Storage Market Size and Share Forecast Outlook 2025 to 2035

Refinery Process Chemical Market Size and Share Forecast Outlook 2025 to 2035

Refinery fuel additives Market Size and Share Forecast Outlook 2025 to 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Refinery Catalyst Market Growth - Trends & Forecast 2025 to 2035

UK Refinery Catalyst Market Insights – Growth, Applications & Outlook 2025-2035

USA Refinery Catalyst Market Report - Trends & Innovations 2025 to 2035

Japan Refinery Catalyst Market Report – Trends, Demand & Industry Forecast 2025-2035

ASEAN Refinery Catalyst Market Analysis

Germany Refinery Catalyst Market Analysis – Size, Share & Forecast 2025-2035

High Performance Refinery Additives Market Trend Analysis Based on Product, Application, and Region 2025-2035

Next Generation Telehealth Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA