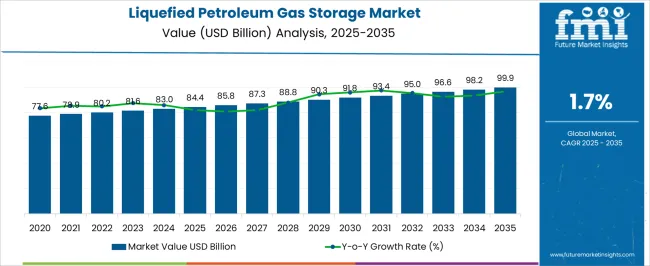

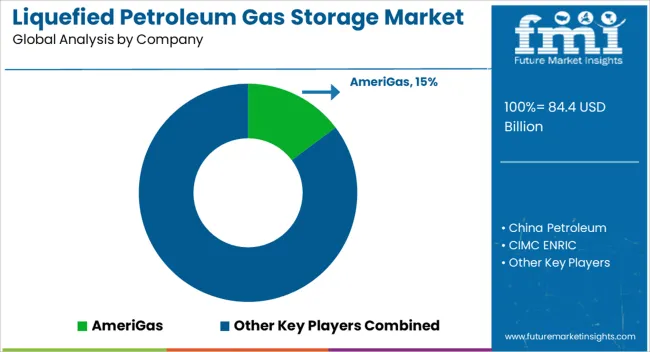

The liquefied petroleum gas storage market is estimated to be valued at USD 84.4 billion in 2025 and is projected to reach USD 99.9 billion by 2035, registering a compound annual growth rate (CAGR) of 1.7% over the forecast period.

The liquefied petroleum gas storage market is forecasted to move from USD 84.4 billion in 2025 to USD 99.9 billion by 2035, reflecting a modest CAGR of 1.7%. Between 2025 and 2030, the value is projected to increase gradually from USD 84.4 billion to USD 91.8 billion, showcasing a relatively steady five-year expansion pattern. This incremental growth reflects a balanced demand curve, with expansion driven by energy consumption patterns, downstream applications, and growing storage safety regulations. The steady trajectory signals that the sector may not see explosive expansion but rather a slow consolidation of capacity that is expected to be influenced by both regional policies and energy trade structures.

The liquefied petroleum gas storage market is also anticipated to witness consistent demand for both above-ground and underground storage facilities, as reliability in storage is regarded as critical to supply chain balance. Industry stakeholders are expected to prioritize investments in large-scale infrastructure to support stable supply, particularly in regions where import dependency remains high. While the CAGR indicates a moderate outlook, the market’s long-term role in meeting household, industrial, and commercial energy needs is not likely to diminish. Instead, its growth pattern underscores stability and resilience, suggesting that stakeholders may favor predictable revenue streams rather than rapid but volatile expansion. This positions the sector as a critical backbone of the broader energy storage landscape.

| Metric | Value |

|---|---|

| Liquefied Petroleum Gas Storage Market Estimated Value in (2025 E) | USD 84.4 billion |

| Liquefied Petroleum Gas Storage Market Forecast Value in (2035 F) | USD 99.9 billion |

| Forecast CAGR (2025 to 2035) | 1.7% |

The liquefied petroleum gas storage market has been positioned as a critical component of the broader oil and gas storage value chain, with its share estimated at nearly 18-20% of the oil and gas storage market, about 10-12% of the midstream infrastructure market, nearly 7-8% of the energy storage market, around 12-14% of the bulk liquid storage market, and close to 9-10% of the petrochemical storage market. Collectively, the aggregated share across these parent categories stands in the range of 56-64%, highlighting the strategic role of LPG storage in enabling uninterrupted supply, meeting domestic and industrial consumption, and maintaining energy security.

The market has been driven by increasing demand for LPG as a clean-burning fuel in residential, commercial, and industrial applications, alongside the need for robust storage systems that can handle pressurized conditions and large-scale inventories. Market adoption has been shaped by the development of pressurized tanks, refrigerated facilities, and cavern storage solutions to meet varying capacity requirements. Industry participants have been compelled to emphasize safety, operational reliability, and cost efficiency while meeting growing energy demand. In practice, the liquefied petroleum gas storage market has secured a notable footprint across the oil and gas logistics and petrochemical storage networks, reflecting its essential contribution to midstream operations and energy distribution strategies.

The liquefied petroleum gas (LPG) storage market is experiencing consistent growth, driven by the rising global consumption of LPG for residential, industrial, and transportation applications. As demand increases, the need for efficient and secure storage infrastructure has become a critical priority for both public utilities and private distributors.

The ability of LPG to serve as a cleaner alternative to conventional fuels has accelerated its adoption, especially in emerging economies where urbanization and energy diversification are progressing rapidly. Market expansion is also supported by government policies encouraging cleaner energy usage and the modernization of energy infrastructure.

Over the coming years, further investments in rural distribution networks and cross-border LPG trade are expected to reinforce storage capacity requirements. The market outlook remains strong as stakeholders focus on safety compliance, energy access, and operational efficiency across LPG supply chains

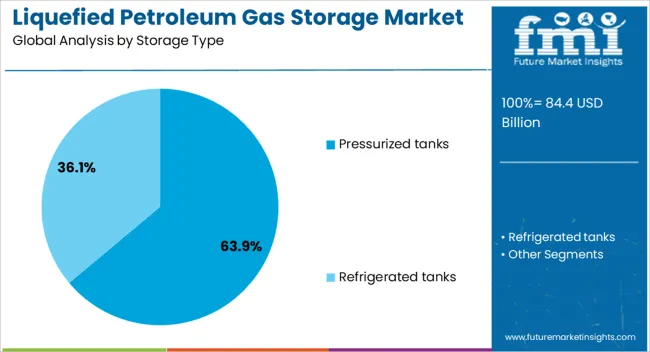

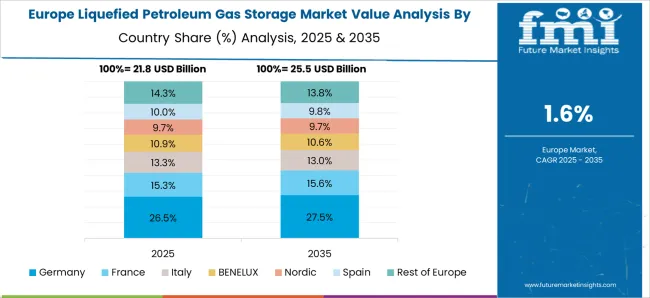

The liquefied petroleum gas storage market is segmented by storage type, and geographic regions. By storage type, liquefied petroleum gas storage market is divided into pressurized tanks and refrigerated tanks. Regionally, the liquefied petroleum gas storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pressurized tanks segment holds a commanding 63.9% share in the storage type category, highlighting its dominance as the preferred method for LPG containment. These tanks are favored for their robust design, operational safety, and ability to maintain LPG in liquid form under moderate pressure without requiring refrigeration.

Their widespread use in both stationary installations and mobile applications has reinforced their presence across residential, industrial, and commercial sectors. The segment's growth is supported by regulatory emphasis on secure storage systems and increasing investments in centralized distribution facilities.

Manufacturers are continuously enhancing tank materials and pressure regulation mechanisms to meet evolving safety and environmental standards. With scalability and ease of transport being key operational advantages, pressurized tanks are expected to remain the backbone of LPG storage infrastructure across both mature and emerging markets

The liquefied petroleum gas storage market is being driven by household adoption, industrial usage, and strategic reserves. Opportunities are arising through large-scale investments in storage infrastructure and expanding global LPG trade. Trends are shaped by underground caverns, modular designs, and advanced monitoring systems that enhance safety and efficiency. Challenges persist in the form of regulatory compliance, infrastructure costs, and operational risks associated with storage safety. Overall, the market remains poised for expansion, as growing LPG consumption and supply chain security needs continue to emphasize the importance of advanced storage facilities.

The liquefied petroleum gas storage market is witnessing significant demand as LPG continues to be used widely in residential households, commercial facilities, and industrial processes. With rising cooking fuel adoption in urban and rural areas, storage infrastructure is being strengthened to ensure a consistent supply chain. Industrial consumption in chemicals, refineries, and power generation is further expanding demand, requiring high-capacity bulk storage systems. Governments promoting clean-burning fuels have accelerated LPG adoption, creating pressure on suppliers to expand both above-ground and underground storage tanks. The market is also benefiting from strategic reserves being created by countries to safeguard energy security and stabilize supplies. The growth in automotive LPG usage and distribution networks is further highlighting the importance of safe and reliable storage systems. Hence, demand is being bolstered by broad applications across multiple sectors, making storage capacity expansions a critical requirement.

Significant opportunities are emerging in the liquefied petroleum gas storage market due to rising investments in large-scale storage facilities and energy infrastructure. Governments and private operators are investing in bulk terminals, import-export hubs, and storage caverns to handle growing LPG consumption. Strategic opportunities are being created in emerging economies where rural and semi-urban populations are transitioning from conventional fuels to LPG, thereby increasing the need for widespread storage points. The oil and gas sector is exploring joint ventures with infrastructure developers to build cross-border and regional storage networks, improving supply flexibility. Demand for advanced pressurized and refrigerated storage tanks provides scope for manufacturers to deliver differentiated products tailored to industrial requirements. Expansion of LPG trade across Asia-Pacific, Africa, and Latin America has opened lucrative prospects for operators to capitalize on growing demand while ensuring safety and compliance. These opportunities strengthen the role of storage as a backbone of global LPG trade.

The LPG storage market is experiencing notable trends with the growing adoption of underground storage caverns, modular tank designs, and improved monitoring systems. Countries are turning to salt caverns and rock caverns to establish long-term reserves while freeing up surface space. Modular storage solutions are gaining attention for their scalability and suitability for smaller distributors and regional hubs. Digital monitoring systems integrated with storage tanks for real-time leak detection, pressure control, and temperature regulation are setting new performance benchmarks. Global energy trade patterns are influencing design choices, with a stronger emphasis on safety and operational efficiency. The market is also witnessing a trend of shifting from small-scale cylinder-based storage toward centralized bulk storage terminals to support rising demand. These evolving practices are transforming LPG storage into a sector defined by reliability, scalability, and improved safety standards.

The liquefied petroleum gas storage market faces challenges arising from high infrastructure costs, stringent safety regulations, and technical complexities in storage construction. Pressurized and refrigerated tanks demand significant investments in materials, insulation, and design engineering, creating barriers for small-scale operators. Regulatory bodies impose strict safety protocols covering construction, installation, and operation of LPG storage facilities, making compliance a time-consuming and resource-heavy process. Risks associated with leakage, fire hazards, and environmental concerns increase the need for continuous inspection and monitoring, adding further operational costs. Geopolitical uncertainties and fluctuating crude oil prices influence LPG availability, impacting storage utilization rates. Moreover, land acquisition challenges for large-scale facilities in urban and industrial areas complicate project development timelines. These challenges create financial and operational strain on operators, though they also encourage innovation in modular storage and improved safety technologies to offset risks.

| Country | CAGR |

|---|---|

| China | 2.3% |

| India | 2.1% |

| Germany | 2.0% |

| France | 1.8% |

| UK | 1.6% |

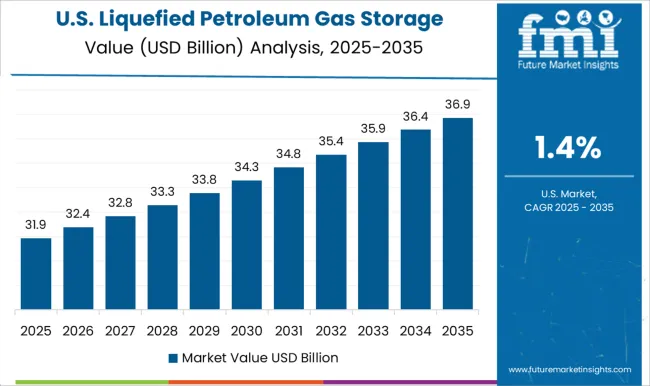

| USA | 1.4% |

| Brazil | 1.3% |

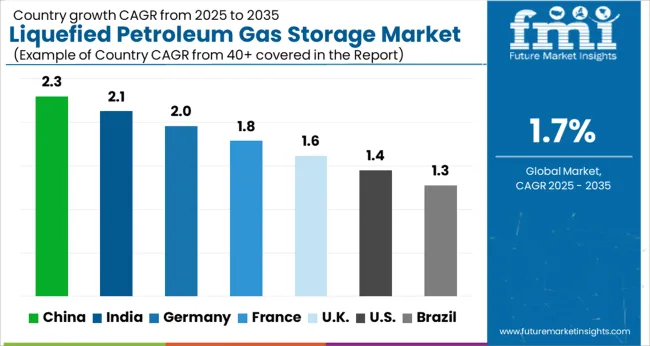

The global liquefied petroleum gas (LPG) storage market is anticipated to expand at a modest CAGR of 1.7% from 2025 to 2035. China leads with a growth rate of 2.3%, followed by India at 2.1%, and Germany at 2%. The United Kingdom is expected to register growth of 1.6%, while the United States remains the slowest among the key markets at 1.4%. The market is influenced by rising demand for LPG as a cleaner fuel alternative, expanding petrochemical industries, and government support for energy security. Growth remains stronger in developing economies like China and India, which are investing in new storage infrastructure, while developed markets such as the USA, UK, and Germany primarily focus on modernization of existing facilities and meeting safety and regulatory standards. This report includes insights on 40+ countries; the top markets are shown here for reference.

The liquefied petroleum gas storage market in China is expanding at a CAGR of 2.3%, reflecting the nation’s growing reliance on LPG as an alternative energy source. Rapid urbanization, coupled with rising household and industrial demand for LPG, is fueling the need for expanded storage infrastructure. China’s petrochemical sector is a key driver, as LPG is a crucial feedstock for several downstream applications. The government is prioritizing energy diversification and security, which has led to increased investments in new terminals and underground storage facilities. Domestic and international players are competing to expand capacity, while safety standards and environmental regulations are being tightened. Overall, the market in China benefits from industrial demand, energy security goals, and significant infrastructure investments in large-scale storage facilities.

The liquefied petroleum gas storage market in India is growing at a CAGR of 2.1%, primarily driven by the rising use of LPG in households and commercial sectors. Government initiatives promoting LPG adoption, particularly in rural areas under schemes such as subsidized connections, are increasing consumption and thereby necessitating more storage infrastructure. India’s petrochemical and refining industries also rely heavily on LPG, further amplifying storage requirements. Investments are being directed toward building new terminals, enhancing port connectivity, and upgrading storage safety standards. The growing population, expanding middle class, and government policies aimed at reducing reliance on biomass fuels ensure steady demand. India’s market outlook remains strong due to a combination of rising consumption, industrial use, and infrastructure expansion plans.

The liquefied petroleum gas storage market in Germany is expanding at a CAGR of 2%, supported by industrial consumption and government efforts to diversify energy sources. LPG is increasingly being adopted in heating, automotive, and chemical applications, which boosts the need for reliable storage infrastructure. The government’s push for energy diversification and reduced dependency on traditional fossil fuels is supporting investments in LPG facilities. Market players are focusing on developing underground caverns and aboveground storage tanks that meet European safety and environmental regulations. Germany’s emphasis on sustainable energy transition ensures that LPG plays a bridging role in the medium term, supporting industries and households alike. Overall, Germany maintains steady demand, driven by industrial uses and regulatory support for diversified fuel storage.

The liquefied petroleum gas storage market in the United Kingdom is growing at a CAGR of 1.6%, with demand supported by residential, industrial, and transport sectors. LPG continues to be an important energy alternative in areas not connected to the natural gas grid, making storage facilities essential. The government’s focus on energy resilience and reducing carbon emissions is driving steady investment in LPG storage modernization. Operators are enhancing safety standards and upgrading facilities to meet strict environmental compliance. While growth remains slower compared to emerging economies, LPG storage retains relevance due to its role in heating, off-grid energy supply, and backup energy systems. The UK market outlook is characterized by moderate growth, infrastructure upgrades, and regulatory-driven modernization.

The liquefied petroleum gas storage market in the United States is expanding at a slower CAGR of 1.4%, shaped by stable demand and the country’s extensive energy infrastructure. While the USA is a major producer and exporter of LPG, domestic consumption in residential, industrial, and petrochemical sectors maintains steady demand for storage capacity. Market activity is centered on upgrading existing storage terminals and ensuring compliance with strict environmental and safety standards. The petrochemical industry, particularly in the Gulf Coast region, remains a key driver of LPG storage needs. Although growth is modest, the USA market remains significant due to its scale, export capacity, and infrastructure modernization efforts.

The liquefied petroleum gas (LPG) storage market has gained prominence as global consumption of LPG continues to increase across residential, commercial, and industrial sectors. Key companies such as AmeriGas, China Petroleum, and Pertamina focus on enhancing safe storage solutions and expanding distribution networks to meet growing demand. Storage infrastructure is being reinforced by players like Royal Vopak, Oiltanking, and TotalEnergies, who are investing in large-scale terminals and underground caverns to ensure uninterrupted supply and operational reliability. Manufacturers such as CIMC ENRIC, CLW Group, and Modern Welding are delivering high-capacity storage tanks with advanced safety mechanisms, corrosion-resistant coatings, and optimized designs for long-term efficiency.

Regional suppliers like Emirates Gas and Omera are addressing local consumption needs by developing customized LPG storage systems and distribution models suited to specific regulatory and climatic conditions. Meanwhile, trading and logistics-focused companies such as Petredec, Vitol, and Energy Transfer play a critical role in ensuring global accessibility by linking producers, storage hubs, and end users. Together, these companies enable the industry to maintain safety standards, manage supply fluctuations, and support the continued adoption of LPG as a clean-burning fuel alternative. The market expansion is strongly supported by rising energy needs, growing reliance on cleaner fuels compared to coal and oil, and government-driven initiatives to promote LPG use in households and industries.

Companies such as Flogas and TransTech Energy are working toward scalable, modular storage systems to improve flexibility and reduce installation costs, thereby widening accessibility for small-scale businesses and residential customers. With increasing investments in smart storage monitoring systems, automation, and digital platforms, operators are focusing on reducing risks such as leaks, overpressure, and fire hazards while enhancing efficiency.

Strategic partnerships and joint ventures between international and regional players are further shaping competitive positioning, enabling capacity expansions and market penetration in high-demand regions like Asia-Pacific, the Middle East, and Africa. As storage requirements evolve alongside consumption patterns, leading companies are expected to strengthen their foothold through innovation in safety systems, expansion of global logistics, and adherence to stringent international storage standards, ensuring steady growth for the liquefied petroleum gas storage market in the coming years.

| Items | Values |

|---|---|

| Quantitative Units | USD 84.4 billion |

| Storage Type | Pressurized tanks and Refrigerated tanks |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AmeriGas, China Petroleum, CIMC ENRIC, CLW Group, Emirates Gas, Energy Transfer, Flogas, Modern Welding, Omera, Oiltanking, Pertamina, Petredec, Royal Vopak, TotalEnergies, TransTech Energy, and Vitol |

| Additional Attributes | Dollar sales by storage type (cylinders, bullets, underground tanks, mounded vessels) and application (residential, commercial, industrial, power generation) are key metrics. Trends include rising demand for safe and efficient LPG storage, growth in residential and industrial consumption, and increasing adoption of bulk storage systems. Regional deployment, regulatory compliance, and technological advancements are driving market growth. |

The global liquefied petroleum gas storage market is estimated to be valued at USD 84.4 billion in 2025.

The market size for the liquefied petroleum gas storage market is projected to reach USD 99.9 billion by 2035.

The liquefied petroleum gas storage market is expected to grow at a 1.7% CAGR between 2025 and 2035.

The key product types in liquefied petroleum gas storage market are pressurized tanks and refrigerated tanks.

In terms of storage type, pressurized tanks segment to command 63.9% share in the liquefied petroleum gas storage market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquefied Hydrogen Storage Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refining Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Jelly Market Growth - Trends & Forecast 2025 to 2035

Petroleum Fuel Dyes and Markers Market 2025 to 2035

Yellow Petroleum Jelly Market Size and Share Forecast Outlook 2025 to 2035

Captive Petroleum Refinery Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Storage Tank Equipment Market Size and Share Forecast Outlook 2025 to 2035

Storage And Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Storage Area Network (SAN) Market Analysis by Component, SAN Type, Technology, Vertical, and Region through 2035

Storage as a Service Market Trends – Growth & Forecast 2020-2030

Storage Virtualization Market

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

LNG Storage Tank Market Growth - Trends & Forecast 2025 to 2035

Toy Storage Market Insights - Trends & Forecast 2025 to 2035

Lab Storage Container Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA