The petroleum refining hydrogen generation market is estimated to be valued at USD 65.9 billion in 2025 and is projected to reach USD 126.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

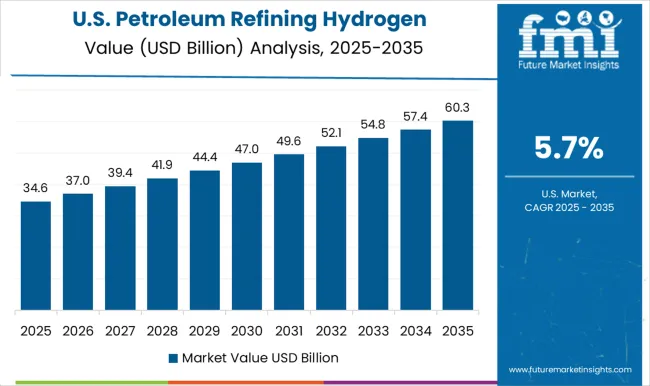

Between 2025 and 2030, the market is expected to rise from USD 65.9 billion to USD 91.2 billion, driven by increasing demand for hydrogen in refining processes and the growing need for cleaner energy alternatives in the oil and gas industry. Year-on-year analysis shows steady growth, with values reaching USD 70.3 billion in 2026 and USD 75.0 billion in 2027, supported by advancements in hydrogen production technologies and stricter environmental regulations. By 2028, the market is forecasted to hit USD 80.1 billion, advancing to USD 85.4 billion in 2029 and USD 91.2 billion by 2030.

This growth will be further fueled by the expansion of hydrogen applications in upgrading refining processes, such as desulfurization, and the increasing focus on decarbonizing industrial operations. Technological innovations in hydrogen production and storage, along with investments in green hydrogen projects, will further enhance market growth. These dynamics position the petroleum refining hydrogen generation market as a key driver in the energy transition and a critical component of sustainable refinery operations.

| Metric | Value |

|---|---|

| Petroleum Refining Hydrogen Generation Market Estimated Value in (2025 E) | USD 65.9 billion |

| Petroleum Refining Hydrogen Generation Market Forecast Value in (2035 F) | USD 126.1 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The petroleum refining hydrogen generation market is advancing steadily due to the increasing demand for cleaner fuel production and enhanced refinery efficiency. Refineries are under rising pressure to reduce sulfur content in fuels and comply with evolving environmental regulations, prompting greater reliance on high purity hydrogen for hydroprocessing and desulfurization.

The integration of hydrogen into existing refinery operations has become central to enabling compliance and boosting yield efficiency. Additionally, the long term strategic focus on low carbon hydrogen production pathways is gradually shaping future investment in reforming technologies and carbon capture systems.

As the global refining sector aligns with decarbonization mandates and energy transition goals, the hydrogen generation segment remains a pivotal operational backbone for sustained refining output and cleaner fuel delivery.

The petroleum refining hydrogen generation market is segmented by delivery mode, process, and geographic regions. By delivery mode, the market is divided into captive and merchant. In terms of process, the market is classified into steam reformer, electrolysis, and others. Regionally, the petroleum refining hydrogen generation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The captive delivery mode segment is projected to account for 57.30% of total revenue by 2025, establishing it as the dominant delivery format. This growth is driven by the need for consistent hydrogen availability, integration with on site refinery operations, and cost efficiencies over external sourcing.

Captive systems allow refiners to maintain control over production parameters, optimize resource utilization, and ensure uninterrupted hydrogen supply critical for hydrotreating and reforming processes. Additionally, captive generation aligns with long term infrastructure planning and provides scalability as refinery capacity increases.

The preference for captive systems is further supported by reduced logistical complexity and enhanced operational predictability, reinforcing their leadership in the delivery mode segment.

The steam reformer process segment is expected to contribute 64.20% of the total market share by 2025 within the process category, making it the leading segment. This dominance is due to the proven efficiency, scalability, and cost effectiveness of steam methane reforming in producing large volumes of hydrogen.

Refineries favor this method for its ability to utilize readily available natural gas feedstock and seamlessly integrate into existing processing infrastructure. Furthermore, the adaptability of steam reforming units to incorporate carbon capture technologies in the future adds to their strategic value.

As hydrogen demand in refining continues to rise, the steam reformer process remains the most viable and widely adopted technology, ensuring reliability and long term operational performance.

The petroleum refining hydrogen generation market is driven by increasing demand for hydrogen in refining processes and opportunities in the petrochemical industry. Emerging trends like the shift toward green hydrogen production are reshaping the market, but challenges such as high generation costs and infrastructure limitations remain. By 2025, overcoming these challenges will require advancements in cost-effective hydrogen production technologies and infrastructure expansion to support the growing demand for cleaner, more efficient hydrogen solutions in petroleum refining and other industries.

The petroleum refining hydrogen generation market is driven by the increasing demand for hydrogen in petroleum refining processes. Hydrogen is essential in various refining operations such as hydrocracking and desulfurization to produce cleaner fuels. As environmental regulations become stricter and the need for cleaner energy grows, hydrogen is increasingly being used in refineries to meet these demands. By 2025, the market is projected to grow as refineries globally continue to adopt hydrogen generation technologies to enhance fuel quality and comply with regulations.

Opportunities in the petroleum refining hydrogen generation market are expanding with the growing use of hydrogen in the petrochemical industry. Hydrogen is crucial in the production of chemicals such as ammonia, methanol, and other petrochemical derivatives. The increasing demand for petrochemicals in various industries, including plastics, agriculture, and automotive, presents significant opportunities for the hydrogen generation market. By 2025, the adoption of hydrogen for petrochemical production will continue to drive the market, creating demand for efficient and cost-effective hydrogen generation technologies.

Emerging trends in the petroleum refining hydrogen generation market include the shift toward green hydrogen production and cleaner processes. Green hydrogen, produced using renewable energy sources, is gaining traction due to its potential to significantly reduce carbon emissions compared to traditional hydrogen generation methods. This shift is influenced by the global push for cleaner energy alternatives. By 2025, the trend toward green hydrogen production will play a significant role in reshaping the market as industries seek environmentally friendly and cost-effective hydrogen solutions.

Despite growth, challenges such as high hydrogen generation costs and infrastructure limitations persist in the petroleum refining hydrogen generation market. The cost of producing hydrogen, especially from green energy sources, remains high, limiting its widespread adoption in refineries. Additionally, the lack of sufficient infrastructure to support large-scale hydrogen production and distribution adds to the complexity of market growth. By 2025, addressing these challenges through technological advancements and infrastructure investments will be crucial for expanding the market and making hydrogen a more accessible and affordable solution.

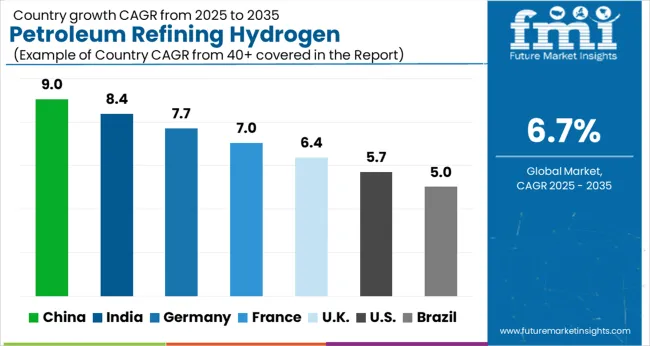

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

The global petroleum refining hydrogen generation market is projected to grow at a 6.7% CAGR from 2025 to 2035. China leads with a growth rate of 9%, followed by India at 8.4%, and France at 7%. The United Kingdom records a growth rate of 6.4%, while the United States shows the slowest growth at 5.7%. These varying growth rates are driven by factors such as the increasing demand for hydrogen in the petroleum refining industry, growing investments in hydrogen production technologies, and the rising focus on cleaner and more sustainable energy solutions. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, increasing energy demand, and government support for clean energy technologies, while more mature markets like the USA and the UK see steady growth driven by regulatory frameworks, technological advancements, and the need for cleaner and more efficient refining processes. This report includes insights on 40+ countries; the top markets are shown here for reference.

The petroleum refining hydrogen generation market in China is growing rapidly, with a projected CAGR of 9%. China’s rapidly expanding petroleum refining sector, combined with the increasing demand for hydrogen as a cleaner and more efficient fuel, is driving the market. The country’s focus on energy transition and reducing carbon emissions in its industrial sectors, including petroleum refining, is accelerating the adoption of hydrogen generation technologies. Additionally, China’s investments in refining infrastructure and its strong regulatory support for clean energy projects continue to contribute to the growing demand for hydrogen in petroleum refining. The increasing push for hydrogen fuel use in other industries, such as transportation and manufacturing, further supports market growth.

The petroleum refining hydrogen generation market in India is projected to grow at a CAGR of 8.4%. India’s growing demand for energy and its expanding petroleum refining sector are driving the adoption of hydrogen generation technologies. The country’s efforts to reduce carbon emissions, improve energy efficiency, and shift to cleaner fuel sources are key factors contributing to the demand for hydrogen in petroleum refining. Additionally, India’s government policies and initiatives to support clean energy technologies, along with the growing use of hydrogen in industrial applications, continue to accelerate the market growth. The rising focus on sustainability and energy efficiency in the refining sector further boosts market demand.

The petroleum refining hydrogen generation market in France is projected to grow at a CAGR of 7%. France’s strong commitment to sustainability and clean energy, combined with its growing need for efficient and cleaner refining processes, is driving steady demand for hydrogen generation technologies. The country’s focus on reducing carbon emissions in industrial sectors, including petroleum refining, continues to support the adoption of hydrogen as an energy source. France’s investments in renewable energy infrastructure and government incentives to promote green hydrogen production contribute to the growth of the market. Additionally, France’s ongoing efforts to meet environmental regulations and energy efficiency goals accelerate the use of hydrogen in its petroleum refining sector.

The petroleum refining hydrogen generation market in the United Kingdom is projected to grow at a CAGR of 6.4%. The UK’s focus on reducing carbon emissions in its industrial sectors and increasing its reliance on cleaner energy solutions is driving steady demand for hydrogen generation technologies in the petroleum refining sector. The country’s strong regulatory support for green energy technologies, particularly hydrogen production, continues to accelerate market growth. Additionally, the increasing investments in hydrogen infrastructure, the transition to renewable energy, and the push for energy efficiency in refining processes contribute to the growing adoption of hydrogen generation solutions in the UK

The petroleum refining hydrogen generation market in the United States is expected to grow at a CAGR of 5.7%. The USA market remains steady, driven by the growing demand for hydrogen as a cleaner fuel in the petroleum refining sector. The country’s strong focus on energy efficiency, reducing carbon emissions, and meeting regulatory targets is driving the demand for hydrogen generation technologies. Additionally, the ongoing shift towards renewable energy solutions and the adoption of hydrogen in industrial applications, including refining, continues to support market growth. The USA government’s initiatives to support clean energy production and the transition to low-carbon fuels further accelerate the adoption of hydrogen generation solutions.

The petroleum refining hydrogen generation market is dominated by Air Products and Chemicals, Inc., which leads with its advanced hydrogen generation technologies used in petroleum refining processes for clean energy production. Air Products’ dominance is supported by its extensive global operations, technological innovation, and strong partnerships with refineries seeking efficient, cost-effective hydrogen solutions to reduce emissions and enhance operational efficiency. Key players such as Linde plc, ExxonMobil, and BP Plc maintain significant market shares by providing high-capacity hydrogen production systems that support refineries in meeting sustainability goals and improving refinery yields. These companies focus on enhancing hydrogen production efficiency, integrating green hydrogen solutions, and advancing carbon capture technologies.

Emerging players like Nel Hydrogen, Reliance Industries Ltd, and Plug Power Inc. are expanding their market presence by offering specialized hydrogen generation solutions tailored for petroleum refineries, including electrolysis and steam methane reforming technologies. Their strategies include improving hydrogen purity, enhancing system scalability, and focusing on renewable energy integration to reduce the carbon footprint of hydrogen production. Market growth is driven by the increasing demand for hydrogen in petroleum refining, the transition toward cleaner energy sources, and the rising adoption of hydrogen in various industrial applications. Innovations in electrolysis, renewable hydrogen production, and storage solutions are expected to continue shaping competitive dynamics and fuel further growth in the global petroleum refining hydrogen generation market.

| Item | Value |

|---|---|

| Quantitative Units | USD 65.9 Billion |

| Delivery Mode | Captive and Merchant |

| Process | Steam Reformer, Electrolysis, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Products and Chemicals, Inc, Air Liquide, BP Plc, ExxonMobil, Cummins Inc, Chevron Corporation, Linde plc, Indian Oil Corporation Ltd, Messer Group GmbH, Nel Hydrogen, Plug Power Inc., Praxair, Inc, Reliance Industries Ltd, Resonac Corporation, and Shell Global |

| Additional Attributes | Dollar sales by generation technology and application, demand dynamics across petroleum refining, chemicals, and energy sectors, regional trends in hydrogen generation adoption, innovation in efficiency and carbon capture technologies, impact of regulatory standards on emissions and safety, and emerging use cases in clean energy production and industrial hydrogen applications. |

The global petroleum refining hydrogen generation market is estimated to be valued at USD 65.9 billion in 2025.

The market size for the petroleum refining hydrogen generation market is projected to reach USD 126.1 billion by 2035.

The petroleum refining hydrogen generation market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in petroleum refining hydrogen generation market are captive and merchant.

In terms of process, steam reformer segment to command 64.2% share in the petroleum refining hydrogen generation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Jelly Market Growth - Trends & Forecast 2025 to 2035

Petroleum Fuel Dyes and Markers Market 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Yellow Petroleum Jelly Market Size and Share Forecast Outlook 2025 to 2035

Captive Petroleum Refinery Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Liquefied Petroleum Gas Storage Market Size and Share Forecast Outlook 2025 to 2035

Refining Additives Market Size and Share Forecast Outlook 2025 to 2035

Oil Refining Market Size and Share Forecast Outlook 2025 to 2035

Anode Refining Furnace Market Size and Share Forecast Outlook 2025 to 2035

Alumina Refining Market Size and Share Forecast Outlook 2025 to 2035

Lead Smelting and Refining Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Telehealth Market Size and Share Forecast Outlook 2025 to 2035

Next-generation neurofeedback device Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Solar Cell Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Intrusion Prevention System (NGIPS) Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Computing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA