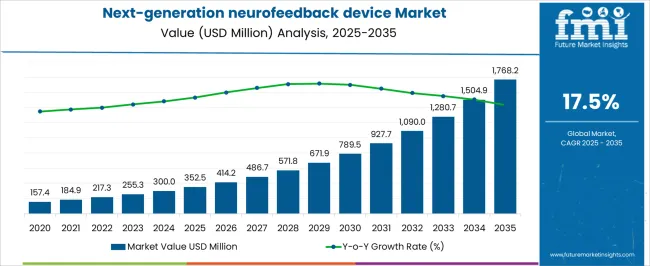

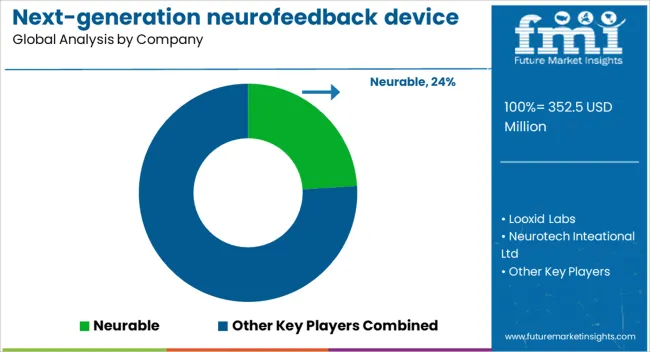

The Next-generation neurofeedback device Market is estimated to be valued at USD 352.5 million in 2025 and is projected to reach USD 1768.2 million by 2035, registering a compound annual growth rate (CAGR) of 17.5% over the forecast period.

| Metric | Value |

|---|---|

| Next-generation neurofeedback device Market Estimated Value in (2025 E) | USD 352.5 million |

| Next-generation neurofeedback device Market Forecast Value in (2035 F) | USD 1768.2 million |

| Forecast CAGR (2025 to 2035) | 17.5% |

The Next-generation Neurofeedback Device market is witnessing accelerated growth as neuroscience, digital health technologies, and personalized medicine converge. Demand is being driven by the rising prevalence of neurological and psychological disorders coupled with the shift toward non-invasive, drug-free therapeutic interventions. Advanced neurofeedback devices are increasingly integrated with AI algorithms, wearable formats, and cloud-enabled data platforms, which are enhancing accuracy and patient engagement.

Growing awareness among clinicians and patients about cognitive performance improvement and mental wellness has further fueled adoption. Hospitals and specialty clinics are adopting these solutions to address conditions ranging from attention disorders to anxiety and depression, while wellness centers and research institutions are exploring applications in cognitive training.

Future opportunities are likely to be shaped by the rapid expansion of home-use neurofeedback systems supported by telemedicine, regulatory encouragement for non-pharmacological therapies, and increasing investment in neurotechnology start-ups As healthcare systems emphasize precision therapies and preventative care, next-generation neurofeedback devices are positioned to gain strong momentum across both clinical and commercial domains.

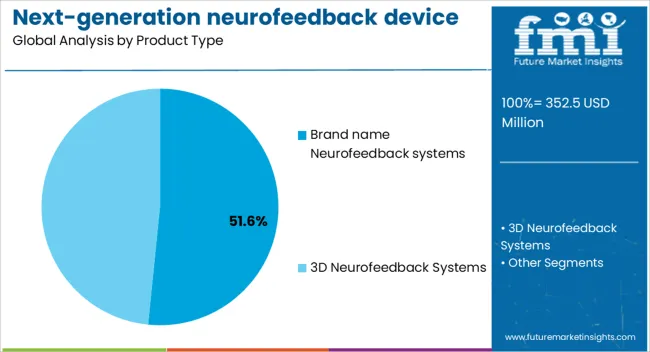

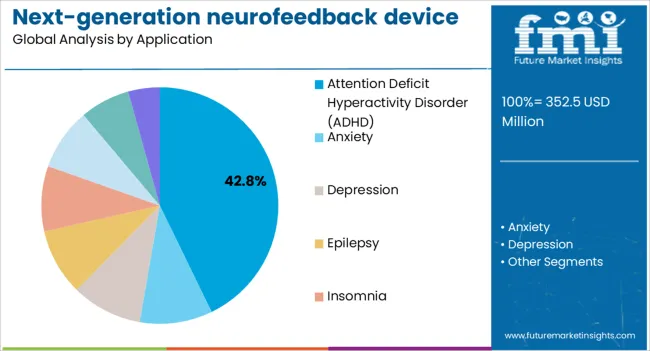

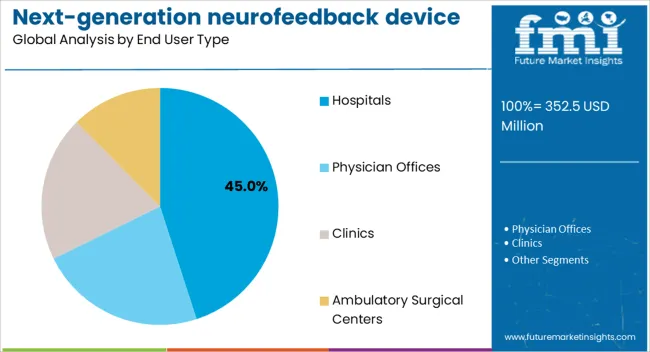

The next-generation neurofeedback device market is segmented by product type, application, end user type, and geographic regions. By product type, next-generation neurofeedback device market is divided into Brand name Neurofeedback systems and 3D Neurofeedback Systems. In terms of application, next-generation neurofeedback device market is classified into Attention Deficit Hyperactivity Disorder (ADHD), Anxiety, Depression, Epilepsy, Insomnia, Drug Addiction, Schizophrenia, and Others. Based on end user type, next-generation neurofeedback device market is segmented into Hospitals, Physician Offices, Clinics, and Ambulatory Surgical Centers. Regionally, the next-generation neurofeedback device industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Brand name Neurofeedback Systems product type is projected to account for 51.60% of the overall Next-generation Neurofeedback Device market revenue in 2025, making it the leading product type. This leadership is being attributed to strong clinical validation, established brand reputation, and proven efficacy in addressing neurological disorders. Brand name systems are widely adopted in hospitals and clinics due to their regulatory approvals, advanced features, and reliability in generating accurate brainwave feedback.

Their integration with advanced sensors and AI-driven analytics has provided healthcare professionals with greater confidence in treatment protocols. The preference for brand name devices has also been reinforced by the availability of comprehensive after-sales support, professional training programs, and continuous software updates that extend product lifespan.

Patients and practitioners alike perceive these systems as safer and more effective, which has translated into higher adoption rates As awareness about brain health increases and medical reimbursement frameworks evolve, the dominance of brand name neurofeedback systems is expected to continue, supported by trust in their clinical outcomes.

The Attention Deficit Hyperactivity Disorder application segment is estimated to hold 42.80% of the total Next-generation Neurofeedback Device market revenue in 2025, positioning it as the largest application area. This prominence is being attributed to the rising prevalence of ADHD among children and adults, alongside growing acceptance of non-drug interventions for behavioral and cognitive management. Neurofeedback devices have gained traction in ADHD treatment because they provide measurable improvements in attention span, impulse control, and learning ability through brainwave training.

Healthcare providers are increasingly turning to these devices as complementary or alternative therapies to stimulant medications, especially due to concerns about side effects and long-term drug dependency. Clinical studies have demonstrated sustained benefits of neurofeedback in ADHD, which has boosted trust among practitioners and caregivers.

With schools, pediatric clinics, and hospitals emphasizing holistic treatment approaches, the adoption of neurofeedback for ADHD is set to expand Furthermore, the growing interest in personalized and precision therapies is supporting this segment’s leadership within the application landscape.

The Hospitals end-user segment is expected to capture 45.00% of the Next-generation Neurofeedback Device market revenue in 2025, making it the leading end-user category. This dominance is being driven by the increasing integration of neurofeedback into mainstream medical practice and the availability of advanced infrastructure within hospital settings. Hospitals are better equipped to adopt cutting-edge neurofeedback systems due to their access to skilled professionals, capital investment, and regulatory compliance frameworks.

The demand for neurofeedback in hospitals has been reinforced by the growing incidence of neurological and psychiatric conditions requiring structured and clinically validated interventions. Additionally, hospitals provide a centralized environment where comprehensive care, including diagnostics, neurofeedback sessions, and follow-up, can be delivered efficiently.

The rising focus on mental health programs within healthcare systems has further increased hospital adoption of these technologies With the expansion of specialized neurology and psychiatry departments, hospitals are expected to remain at the forefront of end-user adoption, positioning this segment as a key driver of long-term market growth.

Next-generation neurofeedback market is attracting investors and medical device manufacture’s interest as a new profitable revenue generation venture. Next-generation neurofeedback devices only help in self-regulating one’s own brain activity by directly altering both cognition and behavioral mechanisms but also as a tool for therapeutic application. Next-generation neurofeedback devices can range from simple machines to complex arrays of devices with deep brain image scanning functionality.

Next-generation neurofeedback devices can be broadly categorized into: EEG neurofeedback device systems, Brand name next-generation neurofeedback device systems, and 3D next-generation neurofeedback device systems. The latter two are the next-generation neurofeedback devices currently operating in the market. Certain manufacturers and companies operating in this market rebrand and sell these next-generation neurofeedback devices as 'brain state training', 'brain conditioning' or 'neural-optimization' devices.

As greater expertise needed for operating EEG neurofeedback devices with many sessions to see results, these devices are making way for next-generation neurofeedback devices in the market which are usually automated and requires pain free operating process.

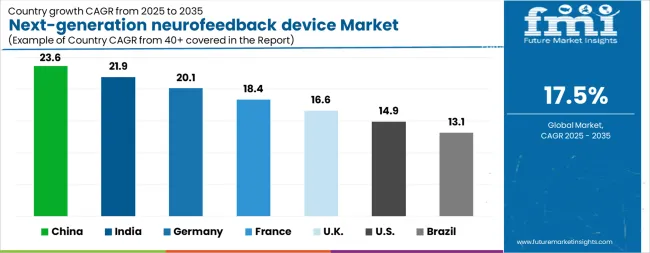

| Country | CAGR |

|---|---|

| China | 23.6% |

| India | 21.9% |

| Germany | 20.1% |

| France | 18.4% |

| UK | 16.6% |

| USA | 14.9% |

| Brazil | 13.1% |

The Next-generation neurofeedback device Market is expected to register a CAGR of 17.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 23.6%, followed by India at 21.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 13.1%, yet still underscores a broadly positive trajectory for the global Next-generation neurofeedback device Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 20.1%. The USA Next-generation neurofeedback device Market is estimated to be valued at USD 131.7 million in 2025 and is anticipated to reach a valuation of USD 527.0 million by 2035. Sales are projected to rise at a CAGR of 14.9% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 18.2 million and USD 12.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 352.5 Million |

| Product Type | Brand name Neurofeedback systems and 3D Neurofeedback Systems |

| Application | Attention Deficit Hyperactivity Disorder (ADHD), Anxiety, Depression, Epilepsy, Insomnia, Drug Addiction, Schizophrenia, and Others |

| End User Type | Hospitals, Physician Offices, Clinics, and Ambulatory Surgical Centers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Neurable, Looxid Labs, Neurotech Inteational Ltd, ANT Neuro, BrainMaster Technologies Inc., Neurogen Ltd, NeurOptimal, and EEG Info |

The global next-generation neurofeedback device market is estimated to be valued at USD 352.5 million in 2025.

The market size for the next-generation neurofeedback device market is projected to reach USD 1,768.2 million by 2035.

The next-generation neurofeedback device market is expected to grow at a 17.5% CAGR between 2025 and 2035.

The key product types in next-generation neurofeedback device market are brand name neurofeedback systems and 3D neurofeedback systems.

In terms of application, attention deficit hyperactivity disorder (adhd) segment to command 42.8% share in the next-generation neurofeedback device market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Neurofeedback Systems Market

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Platform Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

FBAR Devices Market

X-Ray Device Market Size and Share Forecast Outlook 2025 to 2035

Power Device Analyzer Market Growth – Trends & Forecast 2025 to 2035

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Biopsy Device Market Forecast and Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Mobile Device Management Market Analysis by Deployment Type, Solution, Business Size, Vertical, and Region Through 2035

Venous Device Market

Serial Device Servers Market

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Technology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA