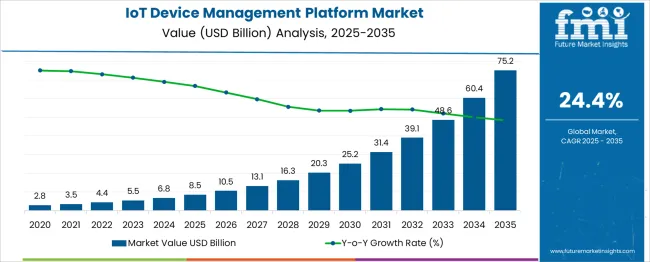

The IoT Device Management Platform Market is estimated to be valued at USD 8.5 billion in 2025 and is projected to reach USD 75.2 billion by 2035, registering a compound annual growth rate (CAGR) of 24.4% over the forecast period.

| Metric | Value |

|---|---|

| IoT Device Management Platform Market Estimated Value in (2025 E) | USD 8.5 billion |

| IoT Device Management Platform Market Forecast Value in (2035 F) | USD 75.2 billion |

| Forecast CAGR (2025 to 2035) | 24.4% |

The IoT device management platform demand is expected to increase at a 24.4% CAGR between 2025 and 2035, in comparison with the 19.5% CAGR registered during 2020-2024.

IoT device management platform permits authentication and provisioning, monitoring and diagnostics, connectivity enablement, software updates and maintenance. It also offers modern analytical capabilities, and improved security, which is expected to boost sales.

A modern network and device management platform helps solution developers reduce development and testing time, thereby improving the go-to-market strategy. When an IoT device management platform is bundled with a connectivity offering, the platform offers everything users require to immediately get the network running.

Due to the growing cyber threats and increasing number of connected devices, demand for IoT device management platforms will increase.

IoT technology and secure wireless connectivity are changing the conventional elements of urban life, such as streetlights into next-generation intelligent lighting platforms with extended capabilities.

A smart city with IoT can more effectively manage maintenance and infrastructure, therefore lowering prices and enhancing the lives of citizens. As many cities continue to integrate IoT technology, demand for IoT device management platforms will increase.

Growing development and circulation of Internet of Things and Internet of Everything (IoE) technologies depict a crucial enabler in the current smart cities landscape, dominating the smart city model to the big data scale.

As per the report by Ericsson, about 8.5 billion IoT devices would be connected to the smart cities in 2025. Therefore, increasing industrialization and adoption of IoT device management platform in smart cities is creating opportunities for growth in the market.

Increasing advancement in AIoT technology and machine learning is enabling IoT software developers to incorporate tools that support organizations to automate repetitive tasks and ease workflows connected to Internet of things device management platform.

For instance, machine algorithms can connect sensors with machines, allowing teams to track qualities like equipment condition autonomously, accelerating to better predictive maintenance approaches and prior identification of problems that could influence production or supply chain logistics.

Technology platform such as PTC ThingWorx, a platform created for industrial IoT (IIoT) management, utilizes ML to enhance manufacturing procedure by examining IoT sensor data gathered from several points.

The platform can then put forward different ways to automate workflow procedures and improves machine maintenance approaches through automation procedure.

High Demand from Large Enterprises in the UK To Steer Sales of IoT Device Management Platform

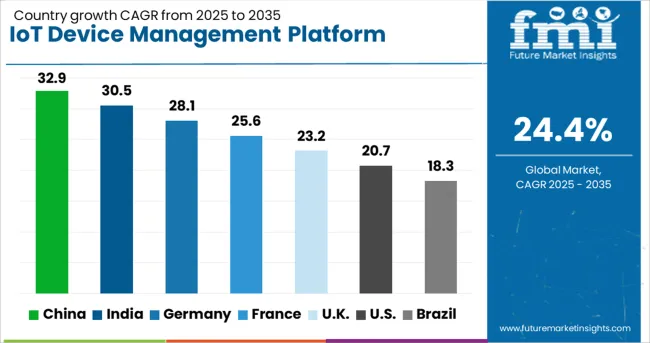

According to the study, UK is predicted to create an absolute $ opportunity of USD 75.2 Billion by 2035. The adoption of the IoT device management platform in large enterprises is higher in the UK as compared to small and mid-sized enterprises.

Large enterprises in the UK are utilizing IoT device management platform to streamline their operations. These platforms help to create optimized workflows through automation. It also reduces repetitive jobs and facilitates exceptional utilization of available machinery and resources. Thus, the benefits offered by the IoT device management platform is driving sales in the UK market.

Rapid Adoption of Wearables in the Healthcare Sector Will Augment Demand for IoT Device Management Platform

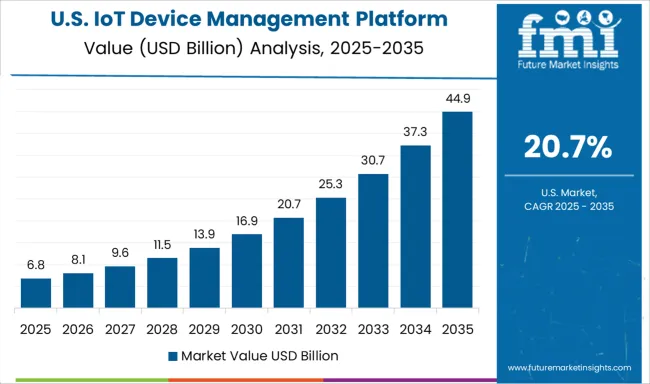

The IoT device management platform demand in the USA is expected to account for nearly 75.1% of North America market share through 2035. Increasing adoption of IoT device management platform in the healthcare sector is expected to fuel growth in the USA market.

In the healthcare sector, wearable IoT (WIoT) technology is widely used to enable patient condition tracking and therapy delivery. As per the Rock Health Digital Consumer Adoption report, nearly 54% of USA adults utilizes digital wearable to monitor at least one health parameter (e.g. body temperature, and heart rate) in the year 2024, compared to 42% in the year 2020.

A 2024 study conducted by Healthcare Information and Management Systems Society, Inc. (HIMSS) declares that more than half of providers consider wearable technology beneficial for patient tracking. The presence of prominent players such as IBM Ltd., Oracle, Google, Microsoft, etc. in the U.S. is anticipated to remarkably drive the market.

Rapid Emergence of Start-Ups in India is Spurring Demand for IoT Device Management Platform

Sales in in India are predicted to grow at an impressive 34.0% CAGR between 2025 and 2035. Increasing adoption of sensor technology across various sectors is driving demand in India.

Several industries such as retail, transportation and logic, manufacturing, among others in India are increasingly utilizing sensor technology to offer centralized connected devices and enhance customer experiences.

The next generation smart sensors are developed on smaller chips that offers efficiency, flexibility, and advanced integration. Thus, growing adoption of sensor technology across various industries in India will augment sales in the market.

Rising Adoption of IoT Device Management Services Will Fuel Growth

Based on solutions, demand in the IoT device management platform services segment is expected to increase at a 54.5% CAGR by the end of 2035.

The IoT device management platform services help in refining business procedures of organizations and are utilized for preparing various strategies, evaluating technologies, and formulating IoT architectures. Providers of IoT consulting services also assists non-IT companies with minimum expertise to understand IoT technology.

Sales of IoT Device Management Platforms in Large Enterprises to Remain High

In terms of enterprise size, the large enterprises segment is expected to grow by 6.6X during forecast period. With the help of IoT device management platform in a business, user can monitor devices and assets remotely. Remote monitoring and diagnostics help an organization to cut down costs and avoid unpredicted operational issues.

The usage of IoT device management platform in the large enterprises offers benefits like operational cost reduction, improved productivity, and increased safety. This is expected to drive sales in this segment over the forecast period.

Integration of IoT Device Management Platform in the Healthcare Sector Will Gain Traction

By industry, the healthcare segment is projected to expand at a 33.1% CAGR during the forecast period. IoT device management platform can automate patient care process flow with the support of healthcare mobility solution and other modern IoT technologies, and modern healthcare facilities.

IoT device management platform in healthcare sector permits interoperability, artificial intelligence machine to machine communication, information exchange, and data movement that makes healthcare service delivery functional.

Remote health monitoring via connected devices can save lives in the case of medical crisis like diabetes, heart failures, asthma attacks, etc. Thus, the benefits offered by IoT device management platform in the healthcare sector will contribute to the growth in this segment.

IoT device management platform market players are concentrating on several strategies for increasing their investments in R&D to support future technologies.

Additionally, various companies are acquiring and entering strategic partnerships with other players to develop their own IoT device management platform to serve their customers and lower the churn rate. For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Billion for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; and the Middle East & Africa |

| Key Countries Covered | The USA, Canada, Germany, the UK, France, Italy, Spain, Russia, China, Japan, South Korea, India, Malaysia, Indonesia, Singapore, Australia & New Zealand, GCC Countries, Turkey, North Africa and South Africa |

| Key Segments Covered | Solution, Enterprise Size, Industry and Region |

| Key Companies Profiled | IBM Ltd; Oracle Corporation; Google; Microsoft; Huawei Services Co., Limited; Bosch.IO GmbH; Amazon Web Services, Inc.; Particle Industries, Inc.; Friendly Technologies; JFrog Ltd.; Mainflux Labs; Ayla Networks, Inc.; Losant; Datadog; Pelion; AVSystem; Software AG; Cumulocity GmbH |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global IoT device management platform market is estimated to be valued at USD 8.5 billion in 2025.

The market size for the IoT device management platform market is projected to reach USD 75.2 billion by 2035.

The IoT device management platform market is expected to grow at a 24.4% CAGR between 2025 and 2035.

The key product types in IoT device management platform market are IoT device management platform, _cloud-based, _on-premise, service, _professional service and _managed service.

In terms of enterprise size, large enterprises segment to command 63.4% share in the IoT device management platform market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IoT Spend by Logistics Market Size and Share Forecast Outlook 2025 to 2035

IoT Chip Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Enablement Market Size and Share Forecast Outlook 2025 to 2035

IoT In Aviation Market Size and Share Forecast Outlook 2025 to 2035

IoT Processor Market Size and Share Forecast Outlook 2025 to 2035

IoT in Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

IoT For Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Development Services Market Size and Share Forecast Outlook 2025 to 2035

IoT-based Asset Tracking and Monitoring Market Size and Share Forecast Outlook 2025 to 2035

IoT In Construction Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

IoT Development Kit Market Size and Share Forecast Outlook 2025 to 2035

IoT in Utilities Market Size and Share Forecast Outlook 2025 to 2035

IoT in Product Development Market Analysis - Growth & Forecast 2025 to 2035

IoT Communication Protocol Market - Insights & Industry Trends 2025 to 2035

IoT in Healthcare Market Insights - Trends & Forecast 2025 to 2035

IoT for Public Safety Market

IoT Data Governance Market

IoT Network Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Connectivity Management Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA