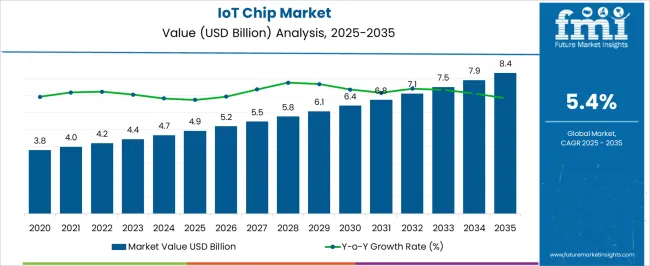

The IoT Chip Market is estimated to be valued at USD 4.9 billion in 2025 and is projected to reach USD 8.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| IoT Chip Market Estimated Value in (2025 E) | USD 4.9 billion |

| IoT Chip Market Forecast Value in (2035 F) | USD 8.4 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The IoT chip market is experiencing rapid expansion supported by widespread adoption of connected devices, advancements in low power semiconductor design, and the increasing integration of artificial intelligence at the edge. Rising demand for real time data collection, efficient connectivity, and compact form factors is accelerating deployment across consumer electronics, industrial automation, and healthcare.

Regulatory emphasis on energy efficiency and data security is further driving innovation in chip architectures that prioritize low latency and extended battery life. Continuous investment by semiconductor manufacturers in system on chip integration and miniaturization is enhancing scalability and affordability for mass adoption.

With smart city projects, automotive digitalization, and healthcare monitoring solutions gaining momentum, the IoT chip market outlook remains highly favorable with significant opportunities for innovation and ecosystem expansion.

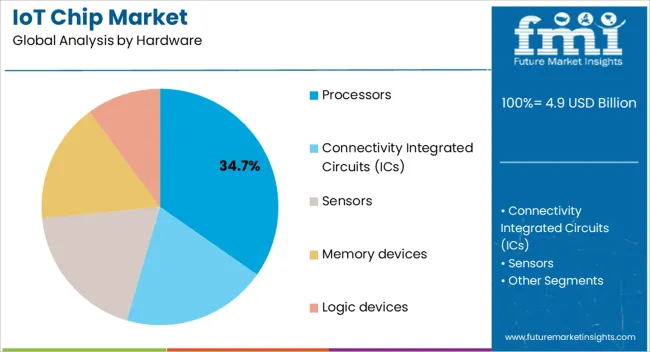

The processors segment within hardware is expected to account for 34.70% of total market revenue by 2025, establishing it as the leading category. Growth in this segment is driven by the essential role processors play in managing computational tasks, enabling device intelligence, and supporting multi protocol connectivity.

Enhanced processing capability allows IoT devices to perform edge analytics, optimize response times, and reduce reliance on cloud infrastructure. The rising integration of AI accelerators and machine learning cores into processors has further reinforced their importance.

As device manufacturers focus on delivering smarter, faster, and energy efficient solutions, processors continue to dominate the hardware landscape in the IoT chip market.

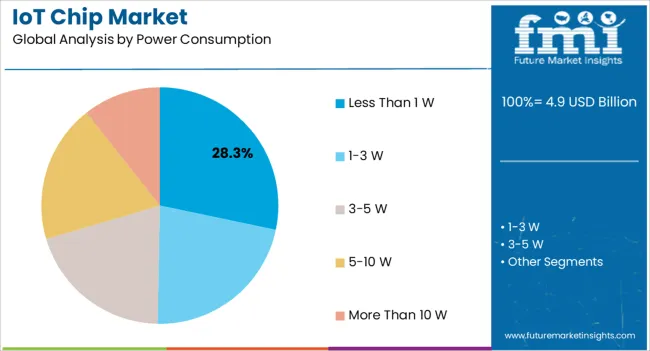

The less than 1 W segment is projected to capture 28.30% of market revenue by 2025 under power consumption, highlighting its significance. This leadership is a result of the growing emphasis on energy efficiency in connected devices where prolonged battery life is critical.

Devices designed for smart homes, healthcare monitoring, and industrial sensors increasingly rely on ultra low power chips to ensure uninterrupted operation. Advances in semiconductor manufacturing processes such as FinFET and 3D stacking are enabling chips that deliver strong computational power with minimal energy draw.

With sustainability and cost efficiency as key priorities, the less than 1 W category is set to remain the preferred power profile for next generation IoT applications.

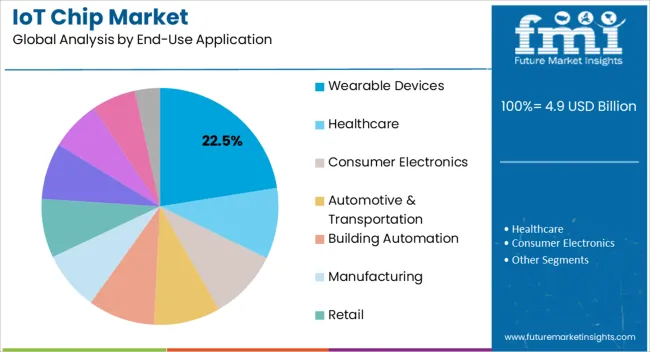

The wearable devices segment is anticipated to contribute 22.50% of total revenue by 2025 under the end use application category, marking it as the most prominent application area. This growth is being fueled by strong consumer adoption of fitness trackers, smartwatches, and healthcare wearables that demand continuous data tracking and wireless connectivity.

IoT chips in this category must balance performance with energy efficiency to maintain compact device designs and long battery cycles. The integration of biometric sensors, GPS modules, and wireless communication technologies is further strengthening reliance on advanced IoT chips.

With rising interest in preventive healthcare, lifestyle monitoring, and personalized digital experiences, wearable devices are projected to maintain a leadership role within the IoT chip market.

Due to the existence of well-established economies in this region, the North American region was predicted to hold the dominant share of 32.5% in 2025 in the global market. This allows them to invest much in research and development.

The growing acceptance of various smart connected devices and rapid digitalization throughout the IoT industry's verticals, and advancements in technological sectors have boosted the IoT industry's growing demand in the North American region.

As per FMI, the market for IoT chips in the United States garnered a 20.3% value share in 2025 on a global level, driven by the widespread adoption of IoT devices across various industries.

The country is home to several prominent players in the semiconductor industry, which fuels technological advancements and innovation in IoT chip design and manufacturing. The United States of America's strong focus on research and development further propels the growth of the IoT chip market.

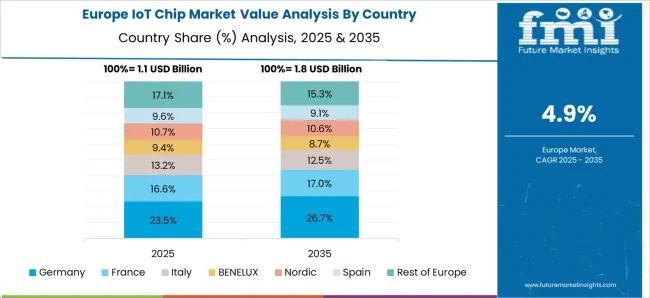

European countries have been actively promoting IoT adoption through supportive policies and initiatives. Government investments in research and development, along with funding programs and collaborations with industry stakeholders, are fostering the growth of the IoT chip industry in Europe.

Following the FMI study, the market for IoT chips in Europe was projected to amass a revenue of 23.4% in 2025.

The United Kingdom is likely to secure the prominent CAGR of 5.9% from 2025 to 2035 owing to the rapid developments of IOTs in this country, auguring well for the European regions, and is expected to witness significant growth.

The region's growing population, rising research and development investments, and international and domestic IT businesses increased focus on the growth of big data analytics and cloud-based services may boost the market's growth.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.9% |

| China | 6.2% |

| India | 6.5% |

Sensors are the leading segment in the market by hardware due to their crucial role in data collection and sensing capabilities. They enable the IoT ecosystem to gather real-time information from the physical world, making them integral to various IoT applications.

The versatility of sensors is another key factor driving their prominence in the IoT chip industry. They find applications across diverse industries and use cases, contributing to the sub-segments' value share of 39.2% in 2025.

In healthcare, sensors are used for remote patient monitoring, wearable devices, and health tracking. In manufacturing, sensors enable predictive maintenance, quality control, and process optimization.

The wide-ranging applications of sensors make them indispensable components in the IoT ecosystem, leading to their status as the leading segment in the market of IoT chips by hardware.

The manufacturing industry extensively utilizes IoT technologies to enable automation and optimize operational processes. IoT chips play a vital role in connecting and controlling various devices and machines in manufacturing environments.

IoT chips facilitate the integration and connectivity of devices along the supply chain, enabling better visibility, tracking, and management of inventory, logistics, and distribution processes. This connectivity helps manufacturers streamline operations, improve inventory management, reduce delays, and enhance overall supply chain efficiency.

Owing to the above-mentioned factors, manufacturing was predicted to capture a value share of 14.8% in 2025 on a global level.

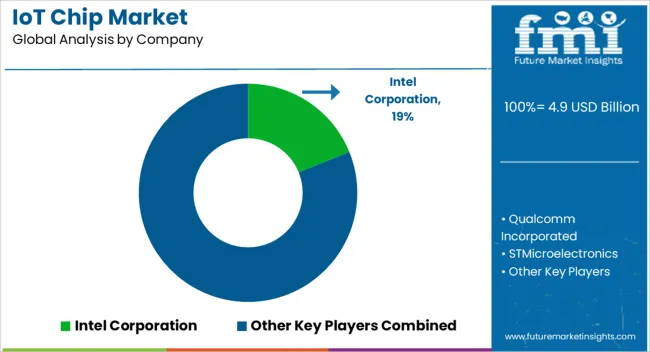

Numerous companies, ranging from established semiconductor giants to specialized IoT chip manufacturers, compete to gain market share and establish their presence in this rapidly evolving industry.

The market is characterized by continuous advancements in technology, increasing demand for diverse IoT applications, and evolving customer requirements. These factors drive intense competition as companies strive to develop cutting-edge IoT chip solutions that offer improved performance, power efficiency, connectivity, and security features.

The global market was led by Intel Corporation. The corporation is perfectly positioned to power the cloud as well as various smart and connected computing devices. Intel provides computing, networking, and communication platforms to a diverse range of clients, including OEMs, ODMs, cloud and communication service providers, and makers of industrial, communications, and automotive equipment.

Client Computing Group (CCG), Data Center Group (DCG), Non-volatile Memory Solutions Group (NVMS), Internet of Things Group (IoTG), Programmable Solutions, and others are the company's six operational segments.

The IoTG business sector creates high-performance computing (HPC) solutions for certain verticals and embedded markets. It focuses on industries such as retail, manufacturing, and smart cities/infrastructure.

Recent Developments:

The global IoT chip market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the IoT chip market is projected to reach USD 8.4 billion by 2035.

The IoT chip market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in IoT chip market are processors, connectivity integrated circuits (ics), sensors, memory devices and logic devices.

In terms of power consumption, less than 1 w segment to command 28.3% share in the IoT chip market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IoT Spend by Logistics Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Enablement Market Size and Share Forecast Outlook 2025 to 2035

IoT In Aviation Market Size and Share Forecast Outlook 2025 to 2035

IoT Processor Market Size and Share Forecast Outlook 2025 to 2035

IoT in Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

IoT For Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Development Services Market Size and Share Forecast Outlook 2025 to 2035

IoT Connectivity Management Platform Market Size and Share Forecast Outlook 2025 to 2035

IoT-based Asset Tracking and Monitoring Market Size and Share Forecast Outlook 2025 to 2035

IoT In Construction Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Platform Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

IoT Development Kit Market Size and Share Forecast Outlook 2025 to 2035

IoT in Utilities Market Size and Share Forecast Outlook 2025 to 2035

IoT in Product Development Market Analysis - Growth & Forecast 2025 to 2035

IoT Communication Protocol Market - Insights & Industry Trends 2025 to 2035

IoT in Healthcare Market Insights - Trends & Forecast 2025 to 2035

IoT Network Management Market – Growth & Forecast through 2034

IoT for Public Safety Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA