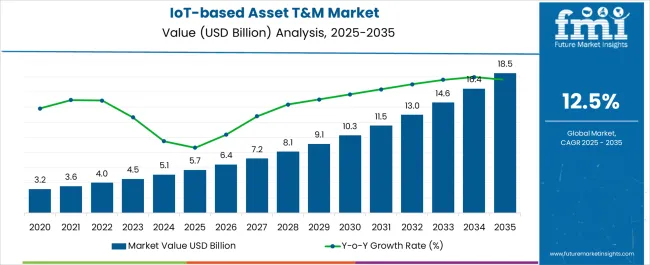

The IoT-based Asset Tracking and Monitoring Market is estimated to be valued at USD 5.7 billion in 2025 and is projected to reach USD 18.5 billion by 2035, registering a compound annual growth rate (CAGR) of 12.5% over the forecast period. This trajectory highlights rapid adoption across logistics, manufacturing, healthcare, and energy sectors where real-time visibility and predictive insights are becoming critical. The market nearly triples in size over the forecast horizon, underscoring rising investments in IoT sensors, cloud platforms, and AI-enabled analytics. By 2030, the value is expected to surpass USD 10 billion, demonstrating mid-term acceleration driven by supply chain optimization and compliance requirements. Long-term growth will be sustained by digital transformation initiatives, the proliferation of connected devices, and demand for higher operational efficiency.

| Metric | Value |

|---|---|

| IoT-based Asset Tracking and Monitoring Market Estimated Value in (2025 E) | USD 5.7 billion |

| IoT-based Asset Tracking and Monitoring Market Forecast Value in (2035 F) | USD 18.5 billion |

| Forecast CAGR (2025 to 2035) | 12.5% |

The IoT-based asset tracking and monitoring market is advancing rapidly as industries increasingly demand real-time visibility, predictive maintenance, and operational efficiency. The integration of sensors, connectivity modules, and cloud platforms has enabled seamless tracking across complex supply chains and remote infrastructure.

Growing adoption of Industry 4.0 practices and expansion of smart logistics networks have further intensified the need for connected asset ecosystems. Cost reductions in IoT hardware and increased availability of scalable software platforms are also fostering adoption across both large enterprises and mid-sized operations.

The outlook remains strong as sectors such as agriculture, logistics, and manufacturing invest in solutions that improve asset utilization, ensure compliance, and enable data-driven decision-making across geographically distributed operations.

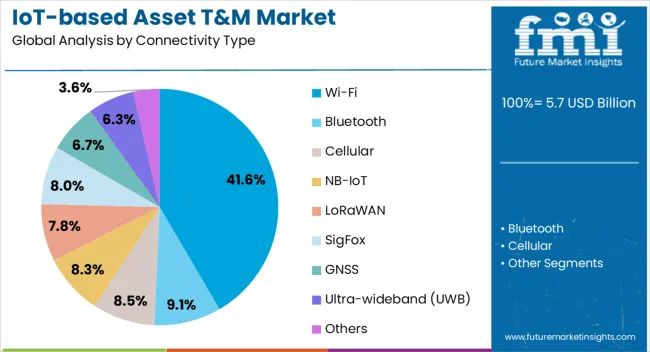

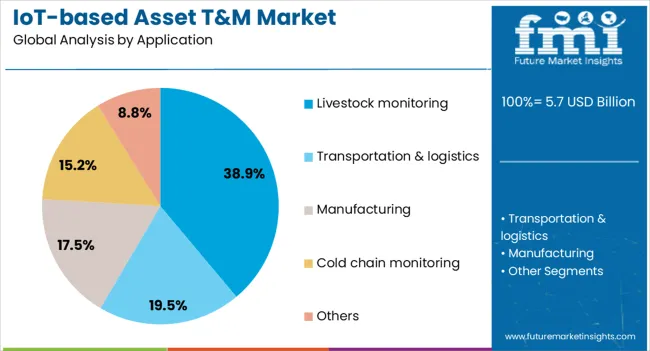

The IoT-based asset tracking and monitoring market is segmented by connectivity type, application, and geographic regions. By connectivity type, the IoT-based asset tracking and monitoring market is divided into Wi-Fi, Bluetooth, Cellular, NB-IoT, LoRaWAN, SigFox, GNSS, Ultra-wideband (UWB), and Others. In terms of application, the IoT-based asset tracking and monitoring market is classified into Livestock monitoring, Transportation & logistics, Manufacturing, Cold chain monitoring, and Others.

Regionally, the IoT-based asset tracking and monitoring industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The WiFi segment is projected to represent 41.60% of the total market revenue by 2025 within the connectivity type category, emerging as the dominant choice. This is attributed to its widespread infrastructure availability, cost-effectiveness, and ability to support high data throughput. WiFi enables seamless integration with existing enterprise networks and facilitates continuous asset visibility within indoor environments such as warehouses, factories, and distribution centers. The technology’s compatibility with mobile and fixed assets, along with reduced latency and enhanced energy efficiency in newer standards, has solidified its role in asset tracking deployments.

As companies prioritize network reliability and data centralization, the adoption of WiFi for IoT based asset tracking continues to expand, reinforcing its leading position in this segment.

The livestock monitoring segment is anticipated to account for 38.90% of total revenue by 2025 under the application category, establishing itself as the leading use case. This is driven by rising global demand for precision livestock farming and the need to improve animal health, traceability, and resource management. IoT based tracking solutions enable continuous monitoring of animal movement, behavior, and vital signs, allowing early detection of illness and optimized breeding strategies. The deployment of GPS collars, biometric sensors, and centralized monitoring platforms has streamlined farm management and minimized economic losses. Increasing focus on food safety, livestock welfare, and sustainable agricultural practices is further accelerating the adoption of these technologies. As a result, livestock monitoring remains at the forefront of IoT based asset tracking applications due to its significant impact on productivity and cost efficiency.

The market has been expanding due to increasing demand for real-time visibility, operational efficiency, and security across logistics, manufacturing, healthcare, and retail sectors. These solutions, which integrate IoT sensors, cloud platforms, and analytics, have enabled precise asset location tracking, condition monitoring, and predictive maintenance. Market growth has been influenced by rising adoption of connected devices, digital transformation initiatives, and the need to optimize supply chain and asset management, making IoT-based monitoring systems essential for modern operational frameworks globally.

The IoT-based asset tracking and monitoring market has been strongly driven by the requirement for real-time visibility and improved operational efficiency. Sensors and connected devices have been employed to provide continuous monitoring of asset location, status, and condition, enabling companies to make informed decisions promptly. Asset movement across warehouses, distribution centers, and transport vehicles has been tracked to reduce losses, theft, and idle time. Predictive alerts generated by monitoring platforms have allowed maintenance scheduling, ensuring minimal downtime and optimized lifecycle management. Industries such as manufacturing and logistics have leveraged these systems to streamline inventory management, track high-value equipment, and comply with regulatory mandates. As supply chains have become more complex, the adoption of IoT-enabled tracking systems has grown significantly, enhancing operational reliability, cost-effectiveness, and overall asset utilization.

Technological innovation has played a critical role in expanding the market. GPS, RFID, BLE, and LPWAN-based devices have provided high accuracy in tracking assets across indoor and outdoor environments. Cloud computing, edge analytics, and AI algorithms have enabled real-time data processing, anomaly detection, and predictive maintenance capabilities. Enhanced battery life, low-power consumption devices, and compact form factors have improved device deployment flexibility. Software platforms have allowed integration with enterprise resource planning (ERP), transportation management, and inventory systems for centralized monitoring. These technological developments have ensured seamless data acquisition, storage, and reporting, allowing organizations to optimize resource utilization and operational workflows. By providing robust, scalable, and connected monitoring solutions, technology enhancements have strengthened market adoption across diverse industry verticals.

The market has been shaped by regulatory and security standards to ensure data integrity and compliance. Data privacy regulations, cybersecurity frameworks, and industry-specific mandates have influenced device design, communication protocols, and storage practices. Safety and compliance monitoring for critical assets such as pharmaceuticals, medical equipment, and sensitive electronics have required adherence to strict standards. Certification requirements for communication modules and secure data transmission have been implemented to reduce vulnerabilities. Governments and industry bodies have promoted standardized interoperability to facilitate seamless integration with enterprise systems. Compliance-driven adoption has ensured reliable, secure, and legally aligned tracking solutions, motivating manufacturers and end-users to deploy robust IoT-enabled monitoring systems across diverse sectors, thereby enhancing operational trust and credibility.

The market has been strengthened by the availability of customizable solutions and advanced analytics services. Sensors and devices have been tailored to support temperature, humidity, vibration, and shock monitoring based on asset type. Predictive analytics and reporting dashboards have allowed organizations to optimize asset utilization, anticipate failures, and reduce maintenance costs. Integration with mobile applications and cloud platforms has provided real-time notifications, route optimization, and historical trend analysis. Subscription-based models and SaaS platforms have enabled scalability and flexibility for small and medium enterprises. Customization has also included modular hardware, multi-device compatibility, and adaptive software interfaces, allowing deployment across industries such as healthcare, logistics, manufacturing, and retail. These services have driven adoption, improved operational transparency, and positioned IoT-based tracking as an essential tool for modern asset management strategies.

![]()

The market is expected to expand at a CAGR of 12.5% from 2025 to 2035, driven by increasing adoption of smart logistics, industrial automation, and predictive maintenance solutions. China leads with a 16.9% CAGR, propelled by large-scale IoT deployment across manufacturing and transportation sectors. India follows at 15.6%, supported by growing adoption in supply chain management and smart warehousing. Germany, at 14.4%, benefits from advanced industrial automation and IoT integration in manufacturing. The UK, growing at 11.9%, focuses on intelligent logistics and connected infrastructure, while the USA, at 10.6%, sees steady growth from fleet management and enterprise asset monitoring applications. This report covers 40+ countries, with the top markets highlighted here for reference.

China’s market is anticipated to grow at a CAGR of 16.9%, driven by rapid adoption of connected technologies and increasing logistics and supply chain digitization. Industrial and commercial sectors are leveraging IoT solutions for real-time asset visibility, predictive maintenance, and operational efficiency. Manufacturers are integrating advanced sensors, cloud-based platforms, and analytics to enhance tracking accuracy. Investments in smart factories, warehouse automation, and intelligent transportation systems are further supporting market growth. Strategic partnerships between IoT solution providers and logistics firms are expanding deployment. The demand for enhanced security, fleet monitoring, and inventory management is accelerating adoption.

India’s market is projected to grow at a CAGR of 15.6%, fueled by expanding logistics, transportation, and manufacturing sectors. Adoption of cloud computing and mobile applications for asset management is increasing. Startups and established IT companies are offering customized IoT solutions to optimize operational efficiency. Government initiatives promoting digital infrastructure and smart city projects are enhancing demand. Integration of real-time tracking, predictive analytics, and IoT-enabled sensors is gaining traction among industrial users. The growing e-commerce sector is also driving deployment across supply chains.

![]()

Germany is forecasted to expand at a CAGR of 14.4%, supported by industrial automation and smart manufacturing initiatives. German manufacturers are implementing IoT-enabled solutions for predictive maintenance, real-time monitoring, and fleet optimization. Adoption of Industry 4.0 technologies is driving integration of sensors, AI analytics, and cloud platforms. Companies are investing in secure and scalable asset tracking networks to enhance operational efficiency. The logistics and warehousing sectors are increasingly utilizing connected systems for inventory and supply chain management. Research and development efforts in advanced sensor technologies are further strengthening market growth.

The United Kingdom market is expected to grow at a CAGR of 11.9%, driven by logistics, transportation, and industrial applications. Adoption of cloud-based tracking platforms and IoT-enabled monitoring systems is increasing across commercial and industrial sectors. Companies are focusing on integrating real-time analytics and secure connectivity for enhanced asset management. Smart warehouse solutions and fleet tracking are gaining traction among logistics service providers. Continuous innovation in IoT sensors and data analytics is strengthening market competitiveness. Partnerships between technology providers and supply chain operators are expanding deployment. Growing emphasis on operational efficiency and risk mitigation is also driving demand.

![]()

The United States market is forecasted to grow at a CAGR of 10.6%, supported by logistics, industrial, and transportation sectors. Adoption of cloud-based and AI-enabled tracking systems is increasing to enhance asset visibility and operational efficiency. Enterprises are implementing IoT platforms for real-time monitoring, predictive maintenance, and risk management. Strategic collaborations between technology providers and end-users are facilitating broader deployment. The growing focus on connected supply chains and intelligent asset management is driving demand. Investment in advanced sensor networks and analytics platforms is enhancing market competitiveness and reliability.

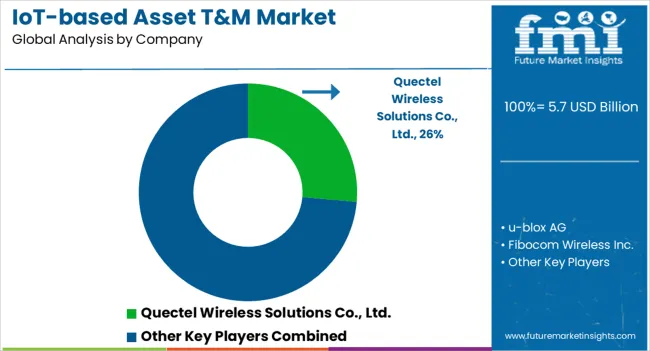

Quectel Wireless Solutions Co., Ltd. delivers robust IoT modules and communication solutions enabling real-time asset tracking across logistics, transportation, and industrial operations. u-blox AG specializes in secure positioning and wireless connectivity solutions, supporting reliable monitoring and seamless integration with cloud-based platforms. Fibocom Wireless Inc. provides cellular IoT modules optimized for low power consumption and high data efficiency, catering to a wide array of tracking applications. Telit Cinterion Group enhances asset visibility through its scalable IoT modules and connectivity platforms, emphasizing global deployment and interoperability.

Semtech Corporation focuses on LoRa-based networking technology, facilitating long-range, low-power tracking for distributed assets. Samsara Inc. combines sensor hardware with advanced analytics, delivering actionable insights for fleet management, supply chain optimization, and equipment monitoring. Nordic Semiconductor ASA offers ultra-low-power wireless solutions for compact and battery-sensitive tracking devices, enabling extended operational life. Collectively, these providers drive the adoption of IoT-enabled asset tracking by improving efficiency, operational control, and data-driven decision-making across industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.7 Billion |

| Connectivity Type | Wi-Fi, Bluetooth, Cellular, NB-IoT, LoRaWAN, SigFox, GNSS, Ultra-wideband (UWB), and Others |

| Application | Livestock monitoring, Transportation & logistics, Manufacturing, Cold chain monitoring, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Quectel Wireless Solutions Co., Ltd., u-blox AG, Fibocom Wireless Inc., Semtech Corporation, Samsara Inc., Nordic Semiconductor ASA |

| Additional Attributes | Dollar sales by device type and industry application, demand dynamics across logistics, manufacturing, and healthcare, regional trends in IoT adoption, innovation in sensor accuracy and connectivity, environmental impact of device lifecycle, and emerging use cases in predictive maintenance and real-time supply chain visibility. |

The global IoT-based asset tracking and monitoring market is estimated to be valued at USD 5.7 billion in 2025.

The market size for the IoT-based asset tracking and monitoring market is projected to reach USD 18.5 billion by 2035.

The IoT-based asset tracking and monitoring market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in IoT-based asset tracking and monitoring market are wi-fi, bluetooth, cellular, nb-iot, LoRaWAN, sigfox, gnss, ultra-wideband (uwb) and others.

In terms of application, livestock monitoring segment to command 38.9% share in the IoT-based asset tracking and monitoring market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asset Performance Management Market Size and Share Forecast Outlook 2025 to 2035

Asset Tags Market Size and Share Forecast Outlook 2025 to 2035

Asset-Based Lending Market Size and Share Forecast Outlook 2025 to 2035

Asset Integrity Management Market Growth - Trends & Forecast 2025 to 2035

Asset Financing Platform Market Growth - Trends & Forecast 2025 to 2035

Key Players & Market Share in the Asset Tags Sector

Asset Management System Market

Asset And Liability Management Solutions Market

IT Asset Management Market Size and Share Forecast Outlook 2025 to 2035

AI Asset Management Tool Market Analysis – Growth & Outlook 2024-2034

IT Asset Disposition Market Growth – Trends & Forecast 2024-2034

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Fixed Asset Management Software Market Size and Share Forecast Outlook 2025 to 2035

Media Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Remote Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Crypto Asset Management Market

Marine Asset Integrity Services Market

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Asset Management Market

Hardware Asset Management Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA