The global asset financing platform market would position itself for an enormous increase in the six years from 2025 to 2035 owing to the sectors driven by selection of digital lending amenities, in automation in financial services, the utilization of automation in lending and adoption of new AI-bases credit risk assessment devices.

Asset financing platforms are resources that deliver businesses with more straightforward, more efficient options for getting the funds they need to purchase capital-intensive assets title or lease vehicles and equipment in order to have more operational efficiency.

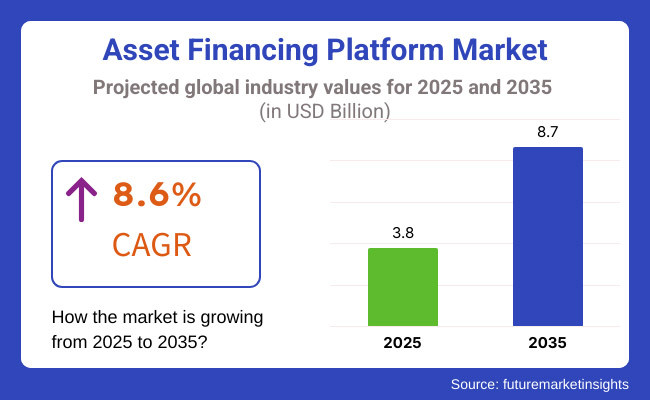

In the forecast period, the market is estimated to grow from USD 3.8 Billion in 2025 to USD 8.7 Billion in 2035, at a CAGR of 8.6%. The increasing adoption of fintech solutions, the increasing penetration of asset-backed lending, and government backing of digital financing programs are major growth drivers.

These are just some examples of how these technologies are being used to support traditional asset financing, and the real world is finding greater adoption as block chain and smart contracts continue to improve transparency and security in asset financing transactions.

North America is anticipated to dominate the asset financing platform market with a well-established financial ecosystem, rising digitalization of lending processes, and high concentration of fintech companies. The USA Tennis Association leads in innovation as many financial institutions have adopted AI-powered credit assessment and block chain-based financing solutions.

The rising number of automation and compliance-based lending solutions significantly contribute to the growth of the market in the region. The market landscape is also getting transformed due to the increasing demand for embedded finance solutions and API-based integrations in lending platforms.

Europe accounts for a large share of the market with strict financial regulations encouraging transparency and security in digital lending. These market leaders include countries like UK, Germany and France adopting cloud-based asset financing solution.

And the region’s strong focus on sustainability has also helped boost green asset financing initiatives, specifically in renewable energy and leasing of electric vehicles. Moreover, the recent initiatives towards open banking frameworks and digital identity verification solutions are also accelerating the transition to automated asset financing processes.

Asia-Pacific is expected to grow at fastest rate, due to the growing adoption of digital financing in developing nations, such as China, India, and nations in Southeast Asia. Market growth is propelled by the high growth of SME financing, progressive government policies supporting financial inclusion, and the emergence of mobile-based lending platforms.

As the region’s fintech boom unfolds, it is also inspiring innovation in asset-backed lending solutions. Furthermore, the growing adoption of AI-based risk analytics and the proliferation of DeFi (decentralized finance) solutions are also improving the asset financing landscape across the Asia-Pacific region.

There is a gradual growth of the asset financing platform market in countries, such as Middle East and Africa and Latin America owing to a more vigorous adoption of digital lending solutions and initiatives led by the government based on financial inclusion programs. In emerging economies, nations like Brazil, South Africa and the UAE are spending to make fintech solutions more accessible for micro and small businesses in need of credit.

Market growth is supported both by increasing demand for infrastructure financing and asset-based lending solutions. Additionally, cross-border fintech industries and developments in digital payment infrastructures are providing novel possibilities for the financing of assets in these locales.

Challenge

Regulatory Compliance and Market Fragmentation

The Asset Financing Platform Market will face challenges due to the complexity of regulatory frameworks, different financial laws depending on the region, and compliance requirements. The financial regulations and the need for compliance with the industry standards can be resource-driven, affecting the expansion of the market.

Cybersecurity and Data Privacy Concerns

As more financial services move online, asset financing platforms need to be aware of cyber threats, data breaches, and issues related to customer privacy. Ensuring secure transactions, preventing fraud, and complying with data protection regulations continues to be a significant challenge.

Opportunity

Rising Demand for Digital and AI-Driven Financing Solutions

The increasing trend of online financing, AI-based risk evaluation, and automated credit decisioning systems will bring major opportunities for market development. Businesses and consumers are looking for increasingly seamless, tech-based ways to finance with interest-free credit options.

Expansion of Embedded and Alternative Financing Models

The market is undergoing dynamic shifts with trends like embedded finance and alternative models of credit like BNPL (Buy now pay later) and asset backed digital lending. Businesses that embrace embedded finance and incorporate financing solutions into current digital ecosystems will have a competitive edge.

The global Asset Financing Platform Market from 2020 to 2024 was characterized by rapid digital transformation, the rise of fintech adoption, and regulatory improvements. Automated asset financing, AI-based credit check, and block chain-based lending solutions emerged on the top.

But the scalability of the platforms was hindered by challenges like market fragmentation, data security risks, and regulatory compliance complexities. In response, companies ramped up cybersecurity, adopted AI for fraud detection, and created finance products compliant with regulations.

Predicting between 2025 and 2035 new innovations in defy, tokenized assets and financing decision-making powered by AI will still be proving to evolve and impact the market. Block chain-based systems will ensure transparent transactions, and smart contract-enabled lending, coupled with cross-border financing solutions, will transform the industry.

Advancements in digital identity verification, biometric authentication, and real-time risk analysis are also likely to shape market trends going forward. The adoption of financial inclusion, AI-adjusted underwriting, and embedded lending solutions will be the key to the evolution of the Asset Financing Platform Market companies.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with regional financial regulations and digital banking policies |

| Consumer Trends | Complying with regional banking regulations and digital banking laws |

| Industry Adoption | Rise of fintech adoption and alternative financing solutions |

| Supply Chain and Sourcing | Greater reliance on AI and automation in assessing risks and approving customers. |

| Market Competition | Reliance on old financial services and legacy infrastructures |

| Market Growth Drivers | Established fintechs, banks, and alternative lending platforms |

| Sustainability and Energy Efficiency | Digital transformation, financial inclusion, and regulatory support |

| Integration of Digital Planning | Early focus on operational efficiencies and digital transformation |

| Advancements in Financing Technology | Use of AI for fraud detection and other financial decision-making is limited |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global financial regulations, AI-driven compliance automation, and cross-border financing advancements |

| Consumer Trends | Expansion of AI-driven financing models, decentralized lending, and real-time credit scoring |

| Industry Adoption | Rise of block chain-based lending, tokenized assets, and DeFi-enabled asset financing |

| Supply Chain and Sourcing | Shift toward decentralized finance, embedded financial services, and cloud-native asset financing platforms |

| Market Competition | Growth of DeFi startups, AI-powered financing platforms, and tokenization of financial assets |

| Market Growth Drivers | Increased investment in decentralized finance, AI-powered underwriting, and real-time asset valuation models |

| Sustainability and Energy Efficiency | Large-scale implementation of green finance initiatives, ESG-based financing models, and sustainable asset leasing |

| Integration of Digital Planning | Expansion of predictive analytics, AI-driven risk analysis, and biometric identity verification |

| Advancements in Financing Technology | Evolution of AI-powered credit modelling, block chain-based lending, and smart contract-enabled financing solutions |

The increasing adoption of digital lending solutions, rising fintech innovations, and demand for automated financing platform drive the growth of the USA asset financing platform market. Robust regulatory frameworks and significant investment in technology-based financial services are also propelling market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| United States | 8.8% |

Factors such as increasing demand for alternative financing by people, the growth of the SME sector, as well as government initiatives to promote digital financial services have made asset financing the market to grow rapidly in the UK The evolution of capital markets through fintech partnerships and AI-based solutions to lending are improving the ecosystem.

| Region | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.4% |

Embedded finance has enabled and scaled up many new markets and approaches in the financial domain in the past few years, for you, how do you see the current demand for asset financing platforms in the European Union given its own rise towards digital transformation due to Banking 3.0 and increasing reliance on AI-powered credit assessment tools? Market growth is also accelerated by the bridging of open banking, regulatory support, and financial technology adoption.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.5% |

The market for asset financing platforms in South Korea is growing, as financial services are rapidly digitizing, the regulatory environment is favourable, the fintech ecosystem is robust and AI-based lending platforms are gaining acceptance.

The growth of the market is also driven by government initiatives that support the digital finance and financial inclusion According to the report, The global digital payments market is also expected to witness a lucrative growth and expand at a CAGR of 9.9% during the forecast period. Verticals.

| Region | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.7% |

The global asset financing platform market is expected to grow significantly due to the rising adoption of digital financing solutions, technological advancements in financial services, and government support for fintech growth.

Global CAGR (2025 to 2035): 8.6%

The Equipment Financing segment generated maximum revenue in Asset Financing Platform Market due to rising capital investments by organizations from different sectors. With the need for equipment but without draining their finances, companies have increasingly turned to equipment financing solutions. Emergence of digital lending platforms has greatly increased access to financing through fast-tracked approvals, credit assessments and fund disbursements.

Moreover, AI-driven credit risk models have also improved lender decision-making, enabling them to provide customized financial products that cater to varying business requirements. In addition, the incorporation of subscription-based financing models and leasing arrangements becomes increasingly popular, allowing startups and SMEs access to capital-intensive assets with limited initial outlay.

With industries adopting digital transformation constantly, the demand for smooth, technology-enabled funding breakdown of equipment acquisition is expected to increase steadily, consequently strengthening the growth of this segment.

Cloud-Based is projected to be the fastest-growing deployment model in the asset financing platforms market. Cloud based solutions provide systems flexibility to financial institutions and enterprises alike, resulting in lower infrastructure costs, improved accessibility, and superior operations.

This allows seamless integration with advanced analytics solutions, AI-driven risk assessment, and automated loan processing systems for faster and streamlined asset financing offerings. In contrast, real-time data sharing abilities help to improve credit scoring accuracy and therefore lower the risks of default.

As the industry gravitates toward utilizing digital lending platforms along with increasing trends of automation, cloud strategy in asset financing is poised for growth. In addition, with the more stringent data privacy regulations, cloud service providers present more robust security protocols and comply with international standards like the GDPR and SOC 2. Increasing demand for remote accessibility, improved security measures, and integrated financial solutions is projected to boost the cloud deployment segment in the market.

When it comes to enterprise sizes, SMEs are the most proactive of asset financing as they need alternate funding solutions. Bank lending is a common practice for traditional banks, some SMEs may have difficulty obtaining bank loans, as they may not have enough collateral, little credit history or strict lending requirements.

And again, this is where asset financing platforms come in - providing SMEs for the financing they need, tailor-made and structured specifically around their requirements. As machine learning algorithms, biometric identity verification and biometrics in loans, block chain technology with its network of verifications has revolutionized the lending markets, Simplifying access to funds, expediting approval processes, and enhancing fairness while minimizing arbitrariness.

In addition, asset financing is gaining favour with SMEs that are looking expand their business, procure new equipment and technology to stay competitive. The growth of the markets will be driven by the rise in the presence of digital financing platforms as well as the government instigated SME lending programs that focus on small and medium business segment.

Finance accounts for the majority of asset financing platform adoption, with companies using digital solutions to improve the efficiency of the lending process, mitigate risk and enhance the customer experience. You are also well-versed in what date up to October 2023. Moreover, the growing trend of embedded financing is reshaping the asset financing landscape, with financing professionals being integrated within digital platforms such as e-commerce stores or mobile applications.

With instant credit approvals, automated loan disbursal, and tailored financial products, these platforms are making financing imkan more accessible to businesses as well as consumers. With the development of regulatory frameworks and growing partnerships with fintech companies, financial institutions are predicted to increasingly adopt distributed ledger technology (DLT) for asset financing solutions.

Integration of AI, automation, and real-time data analytics will be the distinguishing factors for assets financing services as well; going forward we will witness increased digitization and exploration of the latest technologies for enhancing the domain of financial services and increasing the efficiency for the same.

The asset financing platform market is experiencing rapid growth due to the increasing adoption of digital lending solutions, demand for flexible financing models, and advancements in financial technology (FinTech). Key drivers include the rise of AI-powered credit assessment tools, block chain-based financing solutions, and cloud-based asset management platforms.

Market Share Analysis by Key Players & Service Providers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Oracle Corporation | 20-25% |

| SAP SE | 15-20% |

| FIS Global | 12-16% |

| BNP Paribas Leasing Solutions | 8-12% |

| LeaseQuery | 5-9% |

| Other Service Providers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Oracle Corporation | Cloud-based asset financing solutions with AI-driven risk assessment and analytics. |

| SAP SE | Comprehensive asset financing management tools with integration into enterprise ERP systems. |

| FIS Global | Digital lending and leasing platforms with real-time transaction monitoring and automation. |

| BNP Paribas Leasing Solutions | Tailored leasing and financing services for businesses and industries worldwide. |

| LeaseQuery | Specialized asset lease management solutions focusing on compliance and financial reporting. |

Key Market Insights

Oracle Corporation (20-25%)

According to the latest report published by the IBISWorld, Oracle is at the forefront of asset financing platform market with its cloud-native financial solutions enriched with AI and advanced data analytics.

SAP SE (15-20%)

SAP technology focuses on effectively managing asset financing through integrated equipment within the domain of enterprise resource planning and its automation.

FIS Global (12-16%)

FIS provides digital lending and leasing platforms enabling automated workflows and real-time tracking.

BNP Paribas Leasing Solutions (8-12%)

BNP Paribas provides tailored leasing and financing solutions for a broad range of sectors and business requirements worldwide.

LeaseQuery (5-9%)

Lease accounting and asset management solutions focused on compliance.

Other Key Players (30-40% Combined)

The asset financing platform market continues to evolve with contributions from various financial institutions, technology providers, and FinTech companies, including:

The overall market size for Asset Financing Platform Market was USD 3.8 Billion in 2025.

The Asset Financing Platform Market is expected to reach USD 8.7 billion in 2035.

The demand for the Asset Financing Platform Market will rise due to increasing adoption across industries such as finance, manufacturing, and infrastructure. Equipment and vehicle financing will surge with automation and fleet expansions, while cloud-based deployment will drive accessibility for SMEs. Large enterprises will adopt AI-driven financing solutions, and public sector investments in infrastructure will boost market growth. Digital transformation, IoT integration, and flexible financing options will further propel the market forward.

The top 5 countries which drives the development of Asset Financing Platform Market are USA, European Union, Japan, South Korea and UK.

Equipment Financing demand supplier to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Analysis (2018 to 2022) By Asset Type

Table 2: Global Market Value (US$ Million) Forecast (2023 to 2033) By Asset Type

Table 3: Global Market Volume ('000 Units) Forecast (2023 to 2033) By Asset Type

Table 4: Global Market Value (US$ Million) Analysis (2018 to 2022) By Deployment

Table 5: Global Market Value (US$ Million) Forecast (2023 to 2033) By Deployment

Table 6: Global Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 7: Global Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 8: Global Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 9: Global Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 10: Global Market Value (US$ Million) Analysis (2018 to 2022) By Region

Table 11: Global Market Value (US$ Million) Forecast (2023 to 2033) By Region

Table 12: North America Market Value (US$ Million) Analysis (2018 to 2022) By Asset Type

Table 13: North America Market Value (US$ Million) Forecast (2023 to 2033) By Asset Type

Table 14: North America Market Value (US$ Million) Analysis (2018 to 2022) By Deployment

Table 15: North America Market Value (US$ Million) Forecast (2023 to 2033) By Deployment

Table 16: North America Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 17: North America Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 18: North America Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 19: North America Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 20: North America Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 21: North America Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 22: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Asset Type

Table 23: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Asset Type

Table 24: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Deployment

Table 25: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Deployment

Table 26: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 27: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 28: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 29: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 30: Latin America Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 31: Latin America Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 32: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Asset Type

Table 33: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Asset Type

Table 34: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Deployment

Table 35: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Deployment

Table 36: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 37: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 38: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 39: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 40: Europe Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 41: Europe Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 42: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Asset Type

Table 43: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Asset Type

Table 44: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Deployment

Table 45: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Deployment

Table 46: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 47: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 48: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 49: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 50: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 51: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 52: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Asset Type

Table 53: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Asset Type

Table 54: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Deployment

Table 55: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Deployment

Table 56: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 57: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 58: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 59: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 60: East Asia Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 61: East Asia Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 62: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Asset Type

Table 63: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Asset Type

Table 64: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Deployment

Table 65: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Deployment

Table 66: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 67: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 68: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 69: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 70: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 71: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) by Country

Figure 1: Global Market Size (US$ Million) and Y-o-Y Growth Rate from 2023 to 2033

Figure 2: Global Market Size and Y-o-Y Growth Rate from 2023 to 2033

Figure 3: Global Market Value (US$ Million), 2018 to 2022

Figure 4: Global Market Value (US$ Million), 2023 to 2033

Figure 5: Global Market Value Share Analysis (2023 to 2033) By Asset Type

Figure 6: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Asset Type

Figure 7: Global Market Attractiveness By Asset Type

Figure 8: Global Market Value Share Analysis (2023 to 2033) By Deployment

Figure 9: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment

Figure 10: Global Market Attractiveness By Deployment

Figure 11: Global Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 12: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 13: Global Market Attractiveness By Enterprise Size

Figure 14: Global Market Value Share Analysis (2023 to 2033) By Industry

Figure 15: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 16: Global Market Attractiveness By Industry

Figure 17: Global Market Value Share Analysis (2023 to 2033) By Region

Figure 18: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Region

Figure 19: Global Market Attractiveness By Region

Figure 20: North America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 21: Latin America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 22: Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 23: East Asia Market Absolute $ Opportunity (US$ Million), 2018- 2033

Figure 24: South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 25: Middle East & Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 26: North America Market Value (US$ Million), 2018 to 2022

Figure 27: North America Market Value (US$ Million), 2023 to 2033

Figure 28: North America Market Value Share Analysis (2023 to 2033) By Asset Type

Figure 29: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Asset Type

Figure 30: North America Market Attractiveness By Asset Type

Figure 31: North America Market Value Share Analysis (2023 to 2033) By Deployment

Figure 32: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment

Figure 33: North America Market Attractiveness By Deployment

Figure 34: North America Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 35: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 36: North America Market Attractiveness By Enterprise Size

Figure 37: North America Market Value Share Analysis (2023 to 2033) By Industry

Figure 38: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 39: North America Market Attractiveness By Industry

Figure 40: North America Market Value Share Analysis (2023 to 2033) by Country

Figure 41: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 42: North America Market Attractiveness by Country

Figure 43: U.S. Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 44: Canada Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 45: Latin America Market Value (US$ Million), 2018 to 2022

Figure 46: Latin America Market Value (US$ Million), 2023 to 2033

Figure 47: Latin America Market Value Share Analysis (2023 to 2033) By Asset Type

Figure 48: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Asset Type

Figure 49: Latin America Market Attractiveness By Asset Type

Figure 50: Latin America Market Value Share Analysis (2023 to 2033) By Deployment

Figure 51: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment

Figure 52: Latin America Market Attractiveness By Deployment

Figure 53: Latin America Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 54: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 55: Latin America Market Attractiveness By Enterprise Size

Figure 56: Latin America Market Value Share Analysis (2023 to 2033) By Industry

Figure 57: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 58: Latin America Market Attractiveness By Industry

Figure 59: Latin America Market Value Share Analysis (2023 to 2033) by Country

Figure 60: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 61: Latin America Market Attractiveness by Country

Figure 62: Brazil Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 63: Mexico Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 64: Rest of Latin America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 65: Europe Market Value (US$ Million), 2018 to 2022

Figure 66: Europe Market Value (US$ Million), 2023 to 2033

Figure 67: Europe Market Value Share Analysis (2023 to 2033) By Asset Type

Figure 68: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Asset Type

Figure 69: Europe Market Attractiveness By Asset Type

Figure 70: Europe Market Value Share Analysis (2023 to 2033) By Deployment

Figure 71: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment

Figure 72: Europe Market Attractiveness By Deployment

Figure 73: Europe Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 74: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 75: Europe Market Attractiveness By Enterprise Size

Figure 76: Europe Market Value Share Analysis (2023 to 2033) By Industry

Figure 77: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 78: Europe Market Attractiveness By Industry

Figure 79: Europe Market Value Share Analysis (2023 to 2033) by Country

Figure 80: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 81: Europe Market Attractiveness by Country

Figure 82: Germany Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 83: Italy Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 84: France Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 85: U.K. Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 86: Spain Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 87: BENELUX Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 88: Russia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 89: Rest of Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 90: South Asia & Pacific Market Value (US$ Million), 2018 to 2022

Figure 91: South Asia & Pacific Market Value (US$ Million), 2023 to 2033

Figure 92: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Asset Type

Figure 93: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Asset Type

Figure 94: South Asia & Pacific Market Attractiveness By Asset Type

Figure 95: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Deployment

Figure 96: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment

Figure 97: South Asia & Pacific Market Attractiveness By Deployment

Figure 98: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 99: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 100: South Asia & Pacific Market Attractiveness By Enterprise Size

Figure 101: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Industry

Figure 102: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 103: South Asia & Pacific Market Attractiveness By Industry

Figure 104: South Asia & Pacific Market Value Share Analysis (2023 to 2033) by Country

Figure 105: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 106: South Asia & Pacific Market Attractiveness by Country

Figure 107: India Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 108: ASEAN Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 109: Australia& New Zealand Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 110: Rest of South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 111: East Asia Market Value (US$ Million), 2018 to 2022

Figure 112: East Asia Market Value (US$ Million), 2023 to 2033

Figure 113: East Asia Market Value Share Analysis (2023 to 2033) By Asset Type

Figure 114: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Asset Type

Figure 115: East Asia Market Attractiveness By Asset Type

Figure 116: East Asia Market Value Share Analysis (2023 to 2033) By Deployment

Figure 117: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment

Figure 118: East Asia Market Attractiveness By Deployment

Figure 119: East Asia Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 120: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 121: East Asia Market Attractiveness By Enterprise Size

Figure 122: East Asia Market Value Share Analysis (2023 to 2033) By Industry

Figure 123: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 124: East Asia Market Attractiveness By Industry

Figure 125: East Asia Market Value Share Analysis (2023 to 2033) by Country

Figure 126: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 127: East Asia Market Attractiveness by Country

Figure 128: China Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 129: Japan Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 130: South Korea Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 131: Middle East and Africa Market Value (US$ Million), 2018 to 2022

Figure 132: Middle East and Africa Market Value (US$ Million), 2023 to 2033

Figure 133: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Asset Type

Figure 134: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Asset Type

Figure 135: Middle East and Africa Market Attractiveness By Asset Type

Figure 136: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Deployment

Figure 137: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment

Figure 138: Middle East and Africa Market Attractiveness By Deployment

Figure 139: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 140: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 141: Middle East and Africa Market Attractiveness By Enterprise Size

Figure 142: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Industry

Figure 143: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 144: Middle East and Africa Market Attractiveness By Industry

Figure 145: Middle East and Africa Market Value Share Analysis (2023 to 2033) by Country

Figure 146: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 147: Middle East and Africa Market Attractiveness by Country

Figure 148: Saudi Arabia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 149: UAE Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 150: Turkey Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 151: Northern Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 152: South Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 153: Israel Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 154: Rest of Middle East and Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asset Performance Management Market Size and Share Forecast Outlook 2025 to 2035

Asset Tags Market Size and Share Forecast Outlook 2025 to 2035

Asset-Based Lending Market Size and Share Forecast Outlook 2025 to 2035

Asset Integrity Management Market Growth - Trends & Forecast 2025 to 2035

Key Players & Market Share in the Asset Tags Sector

Asset Management System Market

Asset And Liability Management Solutions Market

IT Asset Management Market Size and Share Forecast Outlook 2025 to 2035

AI Asset Management Tool Market Analysis – Growth & Outlook 2024-2034

IT Asset Disposition Market Growth – Trends & Forecast 2024-2034

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Fixed Asset Management Software Market Size and Share Forecast Outlook 2025 to 2035

Media Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Remote Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Crypto Asset Management Market

Marine Asset Integrity Services Market

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Asset Management Market

Hardware Asset Management Industry Analysis in North America Forecast Outlook 2025 to 2035

Aviation Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA