The Asset Tags Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Asset Tags Market Estimated Value in (2025 E) | USD 2.0 billion |

| Asset Tags Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The asset tags market is expanding steadily, driven by increasing demand for accurate asset tracking and inventory management across industries such as manufacturing, healthcare, logistics, and IT. Industry updates and corporate disclosures have emphasized the importance of asset identification solutions for improving operational efficiency, ensuring regulatory compliance, and minimizing losses from mismanagement or theft.

Advancements in printing technology and durable materials have enhanced the longevity and readability of asset tags, even in challenging industrial environments. Organizations are also aligning asset management practices with digital transformation, integrating barcoding and RFID-enabled tags into enterprise software platforms to streamline data capture.

Growing emphasis on workplace automation and smart inventory systems has accelerated adoption of standardized asset tags. Looking ahead, market expansion is expected to be shaped by increased customization demand, rising adoption in small and medium enterprises, and the growing importance of durable materials for long-term asset lifecycle management. Segmental strength is anticipated to be led by metal-based tags, barcode formats, and smaller tag sizes that balance functionality with ease of application.

The metal asset tags segment is projected to contribute 47.8% of the asset tags market revenue in 2025, maintaining its leadership due to superior durability and resistance to harsh conditions. Growth of this segment has been supported by the widespread need for long-lasting identification solutions in sectors such as aerospace, automotive, and industrial equipment.

Metal tags are valued for their resistance to heat, abrasion, and chemicals, ensuring asset information remains intact throughout the product lifecycle. Corporate procurement strategies have favored metal tags for high-value or fixed assets, where long-term identification is critical.

Additionally, engraving and etching technologies have improved readability and customization of metal tags, further strengthening their adoption. With rising emphasis on durability and compliance in asset management practices, the metal asset tags segment is expected to sustain its strong market position.

The barcode label segment is projected to account for 52.6% of the asset tags market revenue in 2025, securing its place as the dominant label type. This growth has been driven by the universal adoption of barcodes as a cost-effective and standardized solution for asset identification.

Barcode labels are compatible with existing scanning infrastructure, making them widely accessible for organizations of all sizes. Industry adoption has been reinforced by the simplicity of implementation, low production cost, and scalability of barcoding systems across diverse asset categories.

Technological advancements in barcode printing have enhanced durability and readability, even on smaller or curved surfaces. Furthermore, barcodes remain a critical element in bridging manual asset management with digital databases, facilitating real-time tracking and efficient audits. These advantages have ensured the continued preference for barcode labels in asset management strategies worldwide.

The 0.75 x 1.5 size segment is projected to capture 28.4% of the asset tags market revenue in 2025, leading the size category due to its versatility and ease of application. This compact size has been preferred for tagging smaller equipment, handheld devices, and office assets where space is limited yet identification remains essential.

Manufacturers have optimized this size to balance legibility of barcodes or serial numbers with minimal interference in asset usage. The segment’s growth has also been supported by strong adoption in IT equipment tagging, where compact tags are essential for laptops, peripherals, and networking devices.

Corporate buyers have increasingly demanded this size for bulk asset labeling programs, reflecting its cost-efficiency and functional adaptability. With the growing emphasis on streamlined asset management in both commercial and institutional settings, the 0.75 x 1.5 size segment is expected to maintain its market leadership.

The demand for asset tags has experienced a steady growth in the past couple of decades. The global asset tags market is expected to be driven by the increasing demand to identify and keep track of the products.

Asset tags eliminate the need to stand in long queues for product identification at retail stores. They can be scanned with lasers to identify the products quickly, which increases the convenience of the consumers.

A rapid shift towards a fast paced lifestyle, fueled by meteoric growth in urbanization around the world means that consumers prefer to carry out their tasks in the minimum possible time.

An increase in E-retail platforms and globalization ensures convenience in purchasing goods from different places, creating a need to track the movement of the product through the distribution channel.

Asset tags therefore are expected to be preferred by most retail stores and manufacturers. OEMs manufacture goods in millions, increasing the need for quicker identification of products for maintenance and repair. All these factors are expected to give the global asset tags market a push.

Despite all the favorable conditions for the growth of the global asset tags market, certain factors are expected to act as restraints. These include an increasing trend among consumers to sell their products after a finite period of usage. Many second-hand buyers hesitate to take products that come with asset tags.

North America, as a mature market, is supposed to be leading the global asset tags market size during the forecast period, owing to a wider customer base and a greater number of retail stores than any other region.

Furthermore, the logistical support industry's strong presence, the expansion of 5G networks, and the penetration of e-commerce sales are all increasingly influencing the market growth.

As a result of the aforementioned factors, North America is anticipated to have a 23% market share for asset tags during the forecast period 2025 to 2035.

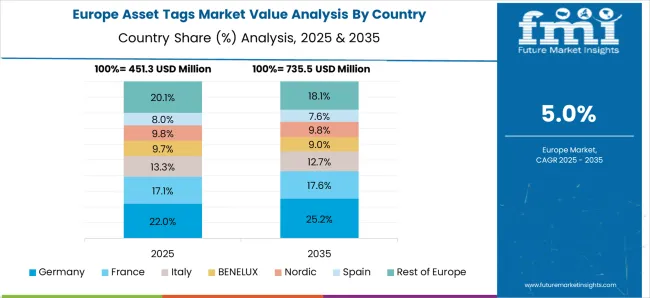

Europe is a hotspot of technological advancement. The wide integration of artificial intelligence, the Internet of Things, and cloud services have made asset tagging easier. Moreover, the automotive industry in Germany largely contributes to the growth of the asset tags market in Europe.

The use of asset tags is increasing in end-user industries present in Spain. This, in turn, is bolstering the demand for asset tags. Thus, owing to the reasons above, Europe is expected to hold a market share of 29% in 2025.

Countries in Asia Pacific, such as China, Thailand, India, and Singapore, are providing numerous growth prospects for the asset tags market. The region's market is anticipated to grow during the forecast years due to rising technological advancements.

Furthermore, the growing adoption of IoT and AI in various end-user industries is expected to spur the studied market forward. Furthermore, small and medium-sized businesses are continuing to invest in increasing the adoption of advanced technological solutions for their business operations.

Established companies are also innovating to provide asset tag solutions to a wide range of end-user industries. As a result, the growing prevalence of advanced technologies is expected to create numerous growth opportunities for the APAC asset tags market.

Due to the rapid growth of the logistics industry in the region, India is expected to become the fastest-growing country in the asset tag market. Furthermore, a strong logistics sector can help India achieve its goal of becoming a manufacturing powerhouse through government initiatives such as 'Make in India.'

However, the slow adoption of new technologies hampered the logistics sector's development. In this case, asset tag solutions are likely to solve such concerns by tracking the transported merchandise and obtaining data insights. This will accelerate the growth of India's asset tags market.

Manufacturers are adopting various marketing strategies such as new product launches, geographical expansion, mergers and acquisitions, partnerships, and collaboration to identify the interest of potential buyers and create a larger customer base.

For instance,

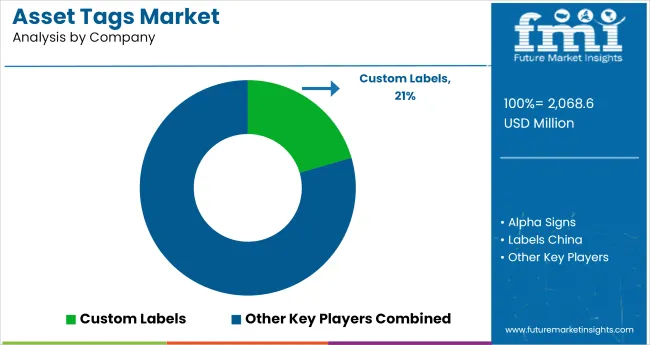

Some major global asset tag market players include Custom Labels, Alpha Signs, Brother International Corporation, Premier Holotech, Labels China, and AB&R.

Recent Developments

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 1,865.6 million |

| Market Value in 2035 | USD 3,217.1 million |

| Growth Rate | CAGR of 5.60% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Raw Material Label Type Size End Use Region |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, China, Japan, South Korea, Malaysia, Singapore, Australia, New Zealand, GCC, South Africa, Israel |

| Key Companies Profiled | Custom Labels; Alpha Signs; Brother International Corporation; Premier Holotech; Labels China; AB&R |

| Customization | Available Upon Request |

The global asset tags market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the asset tags market is projected to reach USD 3.4 billion by 2035.

The asset tags market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in asset tags market are metal asset tags, for flat surfaces, for curved surfaces and plastic asset tags.

In terms of label type, barcode segment to command 52.6% share in the asset tags market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Players & Market Share in the Asset Tags Sector

Asset Performance Management Market Size and Share Forecast Outlook 2025 to 2035

Asset-Based Lending Market Size and Share Forecast Outlook 2025 to 2035

Asset Integrity Management Market Growth - Trends & Forecast 2025 to 2035

Asset Financing Platform Market Growth - Trends & Forecast 2025 to 2035

Asset Management System Market

Asset And Liability Management Solutions Market

IT Asset Disposition Market Forecast and Outlook 2025 to 2035

IT Asset Management Market Size and Share Forecast Outlook 2025 to 2035

AI Asset Management Tool Market Analysis – Growth & Outlook 2024-2034

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Fixed Asset Management Software Market Size and Share Forecast Outlook 2025 to 2035

Media Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Remote Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Crypto Asset Management Market

Marine Asset Integrity Services Market

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Asset Management Market

Hardware Asset Management Industry Analysis in North America Forecast Outlook 2025 to 2035

Aviation Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA