By 2025 the asset integrity management market across the globe is expected to witness a meteoric rise to reach unprecedented heights by 2035. Asset integrity management (AIM) is the system used to ensure that industrial assets are reliable, functional and safe; preventing failures and maximizing the financial return of their operational lifetimes.

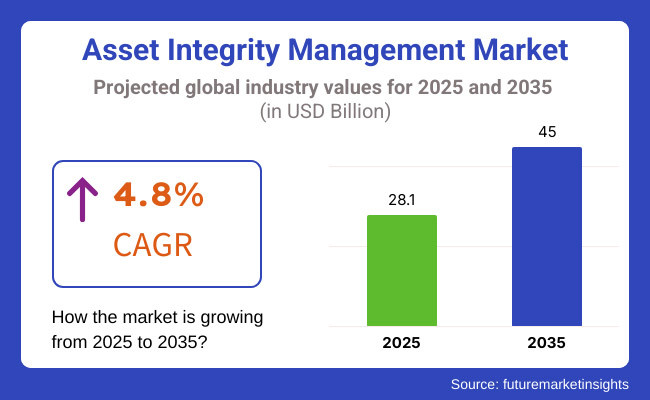

The assessment estimates that the market will achieve an approximate valuation of USD 45.0 Billion by 2035, with a CAGR of 4.8% over the forecast period. Leading factors behind this growth are stringent government regulations related to the safety of workplaces, growing acceptance of solutions related to digital assets management, and the increasing demand for affordable maintenance procedures.

Predictive maintenance capabilities within AIM frameworks are also being bolstered through technologies like artificial intelligence (AI), the Internet of Things (IoT), and digital twins.

The asset integrity management market in North America has the largest share of the global market, due to the stringent regulatory frameworks in place, along with the aging infrastructure of the oil & gas and power industries and the usage of advanced inspection technologies. In terms of digital asset management and real-time monitoring systems, the USA and Canada are ahead.

The European market is driven by growing investments for renewable energy infrastructure, aging industrial assets and stringent environmental and safety regulations. AIM solution is being deployed by the countries like UK, Germany, and France for maintaining operational efficiency and fulfilling the requirements of the EU directives.

Asia-Pacific is projected to register the highest growth due to increasing factors such as rapid industrialization, urbanization, and government-endorsed infrastructure projects. The increasing expansion activities of manufacturing, power generation, and oil & gas industries in China, India, and Southeast Asia are encouraging the utilization of asset information management (AIM) solutions, owing to the need to enhance asset performance and mitigate operational risk.

AIM capabilities are gradually expanding in regions like Latin America, Middle East and Africa. The Middle East oil and gas-rich economies (Saudi Arabia and the UAE) are adopting a range of sophisticated AIM to enhance offshore and onshore asset reliability. On the other hand, the powerful growth of power and mining sectors has been observed in Latin America and Africa, leading to an increased demand for AIM services.

Challenge

Regulatory Compliance and Safety Standards

There is strong growth in the Asset Integrity Management Market as compliance continues to be a challenge and an area for improvement. Firms shall always need to adjust to new policies, audit methods and business directions to stay in line with compliance, adding to costs and intricacy.

Aging Infrastructure and High Maintenance Costs

Oil & gas, power generation, and manufacturing are but some of the industries that deal with aging infrastructure that needs real-time monitoring and maintenance. Asset-intensive industries grapple with a high cost of asset inspections, predictive maintenance, and risk mitigation.

Opportunity

Advancements in Digitalization and Predictive Maintenance

Moreover, the potential of digital technologies like Internet of Things (IoT) and Artificial Intelligence-based predictive maintenance and digital twin solution are expected to be the market opportunities for growth in the forecast period. These innovations improve asset tracking, minimize downtime, and increase operational efficiency.

Growth in Renewable Energy and Sustainable Asset Management

As the global demand for renewable energy accelerates and sustainable asset management practices take hold, the need for integrity management solutions that are forward-looking, innovative, and adaptive is growing. Companies that direct their efforts toward environmentally friendly maintenance strategies, and long-term asset sustainability, will find themselves in a competitive position.

The Asset Integrity Management Market is projected to grow steadily between 2020 and 2024, said to be driven by rising industrial safety regulations, digital transformation, and the adoption of predictive maintenance strategies.

Across industries, there was an explosion in the need for real-time asset visibility, risk management tools, and predictive maintenance solutions. On the other hand, the high implementation costs, complicated integration processes, and skilled workforce shortage hampered market growth. It prompted companies to invest in automation, AI-driven analytics, and regulatory compliance tools to simplify asset management processes.

The market will develop, driven by sophisticated AI driven maintenance strategies, asset block chain-based tracking systems, and enhanced cybersecurity for critical infrastructure. Cross-industry collaboration will enable innovative technologies such as cloud-based asset integrity solutions, real-time data analytics, and autonomous inspection technologies to set new standards.

The increasing focus on ESG (Environmental, Social, and Governance) practice, sustainability, and predictive asset management will also influence future market trends. The evolution of the Asset Integrity Management Market will be driven by companies that will use AI, IoT, and sustainable asset management practices.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Adhering to changing safety and environmental regulations |

| Industrial Trends | Trend toward predictive maintenance and digital inspection technology |

| Industry Adoption | Rise in adoption of condition-based monitoring and risk assessment tools |

| Supply Chain and Sourcing | Reliance on traditional maintenance strategies and periodic inspections |

| Market Competition | Large asset management firms and industrial service providers |

| Market Growth Drivers | Impact of industrial safety regulations, operational costs minimization, and reliability enhancement |

| Sustainability and Energy Efficiency | From operator monitoring, to predictive maintenance and lifecycle management |

| Integration of Digital Planning | Asset lifecycle planning not leveraging AI and IoT |

| Advancements in Asset Management | Conventionally, inspections done manually and risk assessment based on facts |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global safety standards, AI-driven compliance automation, and ESG-based asset management initiatives |

| Industrial Trends | Expansion of autonomous inspection systems, IoT-driven asset tracking, and AI-powered risk analysis |

| Industry Adoption | Rise of block chain-based asset integrity solutions, cloud-integrated asset management, and AI-driven decision-making |

| Supply Chain and Sourcing | Shift toward real-time asset monitoring, automated maintenance scheduling, and sustainable asset lifecycle management |

| Market Competition | Growth of AI-powered integrity management startups, cybersecurity-focused asset tracking, and digital twin solutions |

| Market Growth Drivers | Increased investment in AI-enhanced predictive maintenance, sustainable asset management, and digital transformation |

| Sustainability and Energy Efficiency | Large-scale implementation of green asset management initiatives, carbon-neutral maintenance strategies, and renewable energy asset monitoring |

| Integration of Digital Planning | Expansion of digital twin technology, AI-driven decision-making, and predictive analytics-based maintenance |

| Advancements in Asset Management | Evolution of AI-powered predictive maintenance, autonomous robotics for inspections, and cloud-based asset optimization |

The USA asset integrity management market is in a phase of stable growth as aging infrastructure, compliance with regulatory standards, and the need for digital monitoring solutions become increasingly important. Also, the growth in predictive maintenance and advanced inspection technologies is being used as a booster in the market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| United States | 5.0% |

On the basis of component, the risk assessment market in the UK is growing due to the growing industrial safety and investments in offshore oil & gas infrastructure. The evolution of asset performance monitoring is a key driver of global market growth and the regulatory mandates are driving the global asset performance monitoring market.

| Region | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.6% |

Europe is witnessing steady growth in demand for asset integrity management solutions owing to stringent industry regulations, an aging industrial asset base, and rising adoption of digital inspection technologies.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.7% |

The market for asset integrity management in South Korea is growing as the country has experienced rapid industrialization, compelled industries to seek higher energy efficiency, and pursued advanced technologies for predictive maintenance and risk management solutions.

| Region | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

Global Asset Integrity Management Market: Overview The asset integrity management market is estimated to expand at a significant growth rate due to rising investments in infrastructure maintenance across the globe, regulatory compliance, and advancements in predictive analytics and risk management technologies.

Global CAGR (2025 to 2035): 4.8%

What does the NDT segment do in the Asset Integrity Management Market?

Similarly, machine and NDT (non-destructive testing) techniques such Radiographic testing, Ultrasonic testing, Magnetic particle testing, etc. depends highly on accurate detection of the damaged areas, where there are gigantic data processing logic carried and utilized in various AI techniques which reaches the elimination of correctness metrics from humans in the inspection process along with providing the best efficiency and further automation drive in checking for defects from image recognition and other machine learning analytics.

And these factors have all driven a focus on using new technologies that can be used with little or reduced human participation.

The demand for NDT solutions is growing rapidly as industries are moving towards predictive maintenance to prevent the failure of expensive assets, especially in high-risk sectors such as oil & gas, power generation and aerospace. Moreover, technologies like real-time monitoring and digital twin simulations help continuously cheque the health of the asset, enabling proactive maintenance strategies and reducing unplanned downtimes.

Furthermore, in keeping with the existing regulatory structures along with rigorous safety measures, the upcoming NDT techniques have soon become reputed. Worldwide, the regulating authorities are making it compulsory to have an augmented and periodic asset inspection to enhance the safety of the assets, this leads an organizations to invest heavily in advanced NDT methods.

Besides which contribute to maximize your assets lifespan and prevent costly equipment failures, some non-destructive testing services can also help you reduce risk. Industries are moving toward both operational resilience and technological impact resilience, currently trusted in fields like aerospace and pharmaceuticals - NDT’s role will be to improve maintainability of assets, reduce both total cost of ownership and performance of capital assets.

The Oil and Gas sector is one of the biggest adopters of Asset Integrity Management solutions due to the high risks, equipment failures, and the hazards of its operations. This critical industry sector relies on robust risk-based inspection (RBI), corrosion management, and pipeline integrity management systems to stay up and running.

With the rise of AI-driven predictive maintenance solutions and IoT-based monitoring systems, assets can now be evaluated in real-time, preventing the asset from running at risk and intelligently scheduling maintenance plans.

Digital twin technology is instrumental in simulating how the asset behaves, predicting possible failure modes, and improving decision-making. Finally, next-generation corrosion detection technologies and robotic inspection platforms reduce the risk of structural damage to oil rigs, pipelines, and refineries around the world, both offshore and onshore.

This technology helps oil and gas businesses centralise their data management and bring AI-powered analytics to monitor asset performance through a growing ongoing adoption of cloud-based asset integrity platforms.

The Increasing Stringency of Risk Management Frameworks and Compliance to Risk Based Regulatory Oversight Promotes Spending on Integrity Management Solutions. Furthermore, the landscape is evolving with the adoption of intelligent coatings and corrosion inhibitors that maximize asset longevity and enhance structural durability.

Due to increasing environmental concerns and the transition towards sustainable energy, the oil and gas sector is also utilising integrity management solutions to guarantee safety during new hydrogen and carbon capture storage (CCS) projects. As a result, these rules emphasize the importance of asset integrity management, which is key to sustainability, safety, and compliance, helping organizations minimize risks while maximizing efficiency.

The asset integrity management (AIM) market is experiencing substantial growth due to increasing demand for industrial safety, regulatory compliance, and the need to extend asset lifespan across industries such as oil & gas, power, manufacturing, and transportation. Key drivers include advancements in predictive maintenance, AI-driven monitoring systems, and integration of digital twin technology.

Market Share Analysis by Key Players & Service Providers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Bureau Veritas | 20-25% |

| SGS SA | 15-20% |

| Intertek Group plc | 12-16% |

| Aker Solutions | 8-12% |

| DNV GL | 5-9% |

| Other Service Providers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Bureau Veritas | Comprehensive asset risk management solutions, compliance assessment, and advanced non-destructive testing. |

| SGS SA | Asset condition monitoring, inspection, and certification services with data-driven analysis. |

| Intertek Group plc | AIM solutions with predictive analytics, corrosion management, and reliability assessments. |

| Aker Solutions | Specialized integrity management for offshore and subsea assets with lifecycle optimization. |

| DNV GL | Digital asset integrity solutions, risk-based inspections, and safety assurance services. |

Key Market Insights

Bureau Veritas (20-25%)

With leading asset risk management, compliance, and advanced inspection technologies, Bureau Veritas leads the AIM market.

SGS SA (15-20%)

SGS offers advanced asset surveillance and verified arrangements to secure consistency with guidelines and asset life span.

Intertek Group plc (12-16%)

Intertek focuses on predictive analytics and corrosion management to improve asset reliability and performance

Aker Solutions (8-12%)

Aker Solutions: Wildlife analytics, Aker Solutions, a heavyweight in specialized offshore asset integrity management, was on board to maximize subsea operations, designed to cater for energy companies.

DNV GL (5-9%)

DNV GL focuses on digital transformation in AIM, offering risk-based inspection and asset lifecycle management solutions.

Other Key Players (30-40% Combined)

The AIM market keeps evolving with inputs from multiple tech providers, engineering companies, and service firms, such as:

The overall market size for Asset Integrity Management Market was USD 28.1 Billion in 2025.

The Asset Integrity Management Market is expected to reach USD 45.0 Billion in 2035.

The Asset Integrity Management Market will grow due to the rising focus on energy-efficient solutions, cost-effective alternatives, and increasing demand from residential and commercial sectors. Climate change-driven temperature rise and the adoption of eco-friendly technologies further boost market demand. Additionally, integrating IoT connectivity and hybrid cooling mechanisms enhances efficiency, while the expanding presence of smart air cooling systems fuels growth. The shift toward sustainable cooling solutions and technological advancements will drive market expansion during the forecast period.

The top 5 countries which drives the development of Asset Integrity Management Market are USA, European Union, Japan, South Korea and UK.

Non-Destructive Testing (NDT) demand supplier to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Service Type, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 4: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 5: North America Market Value (US$ Million) Forecast by Service Type, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: Latin America Market Value (US$ Million) Forecast by Service Type, 2019 to 2034

Table 9: Latin America Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 11: Western Europe Market Value (US$ Million) Forecast by Service Type, 2019 to 2034

Table 12: Western Europe Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Service Type, 2019 to 2034

Table 15: Eastern Europe Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Service Type, 2019 to 2034

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: East Asia Market Value (US$ Million) Forecast by Service Type, 2019 to 2034

Table 21: East Asia Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Service Type, 2019 to 2034

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Service Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End-use, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 7: Global Market Value (US$ Million) Analysis by Service Type, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Service Type, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Service Type, 2024 to 2034

Figure 10: Global Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 13: Global Market Attractiveness by Service Type, 2024 to 2034

Figure 14: Global Market Attractiveness by End-use, 2024 to 2034

Figure 15: Global Market Attractiveness by Region, 2024 to 2034

Figure 16: North America Market Value (US$ Million) by Service Type, 2024 to 2034

Figure 17: North America Market Value (US$ Million) by End-use, 2024 to 2034

Figure 18: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Service Type, 2019 to 2034

Figure 23: North America Market Value Share (%) and BPS Analysis by Service Type, 2024 to 2034

Figure 24: North America Market Y-o-Y Growth (%) Projections by Service Type, 2024 to 2034

Figure 25: North America Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 26: North America Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 27: North America Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 28: North America Market Attractiveness by Service Type, 2024 to 2034

Figure 29: North America Market Attractiveness by End-use, 2024 to 2034

Figure 30: North America Market Attractiveness by Country, 2024 to 2034

Figure 31: Latin America Market Value (US$ Million) by Service Type, 2024 to 2034

Figure 32: Latin America Market Value (US$ Million) by End-use, 2024 to 2034

Figure 33: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) Analysis by Service Type, 2019 to 2034

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Service Type, 2024 to 2034

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Service Type, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 43: Latin America Market Attractiveness by Service Type, 2024 to 2034

Figure 44: Latin America Market Attractiveness by End-use, 2024 to 2034

Figure 45: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 46: Western Europe Market Value (US$ Million) by Service Type, 2024 to 2034

Figure 47: Western Europe Market Value (US$ Million) by End-use, 2024 to 2034

Figure 48: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 52: Western Europe Market Value (US$ Million) Analysis by Service Type, 2019 to 2034

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Service Type, 2024 to 2034

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Service Type, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 58: Western Europe Market Attractiveness by Service Type, 2024 to 2034

Figure 59: Western Europe Market Attractiveness by End-use, 2024 to 2034

Figure 60: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 61: Eastern Europe Market Value (US$ Million) by Service Type, 2024 to 2034

Figure 62: Eastern Europe Market Value (US$ Million) by End-use, 2024 to 2034

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Service Type, 2019 to 2034

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Service Type, 2024 to 2034

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Service Type, 2024 to 2034

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 73: Eastern Europe Market Attractiveness by Service Type, 2024 to 2034

Figure 74: Eastern Europe Market Attractiveness by End-use, 2024 to 2034

Figure 75: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 76: South Asia and Pacific Market Value (US$ Million) by Service Type, 2024 to 2034

Figure 77: South Asia and Pacific Market Value (US$ Million) by End-use, 2024 to 2034

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Service Type, 2019 to 2034

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service Type, 2024 to 2034

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service Type, 2024 to 2034

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 88: South Asia and Pacific Market Attractiveness by Service Type, 2024 to 2034

Figure 89: South Asia and Pacific Market Attractiveness by End-use, 2024 to 2034

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 91: East Asia Market Value (US$ Million) by Service Type, 2024 to 2034

Figure 92: East Asia Market Value (US$ Million) by End-use, 2024 to 2034

Figure 93: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 97: East Asia Market Value (US$ Million) Analysis by Service Type, 2019 to 2034

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Service Type, 2024 to 2034

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Service Type, 2024 to 2034

Figure 100: East Asia Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 101: East Asia Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 103: East Asia Market Attractiveness by Service Type, 2024 to 2034

Figure 104: East Asia Market Attractiveness by End-use, 2024 to 2034

Figure 105: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 106: Middle East and Africa Market Value (US$ Million) by Service Type, 2024 to 2034

Figure 107: Middle East and Africa Market Value (US$ Million) by End-use, 2024 to 2034

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Service Type, 2019 to 2034

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Service Type, 2024 to 2034

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service Type, 2024 to 2034

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 118: Middle East and Africa Market Attractiveness by Service Type, 2024 to 2034

Figure 119: Middle East and Africa Market Attractiveness by End-use, 2024 to 2034

Figure 120: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asset Management Services Market Size and Share Forecast Outlook 2025 to 2035

Asset Management System Market

IT Asset Management Market Size and Share Forecast Outlook 2025 to 2035

AI Asset Management Tool Market Analysis – Growth & Outlook 2024-2034

Asset Performance Management Market Size and Share Forecast Outlook 2025 to 2035

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Fixed Asset Management Software Market Size and Share Forecast Outlook 2025 to 2035

Media Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Remote Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Crypto Asset Management Market

Marine Asset Integrity Services Market

Asset And Liability Management Solutions Market

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Asset Management Market

Hardware Asset Management Industry Analysis in North America Forecast Outlook 2025 to 2035

Aviation Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Hardware Asset Management Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enterprise Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Wireless Healthcare Asset Management Market Analysis by Region Through 2035

Asset Tags Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA