The Aviation Asset Management Market is estimated to be valued at USD 206.6 billion in 2025 and is projected to reach USD 336.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. A rolling CAGR analysis across multiple five-year intervals shows steady, predictable growth with gradual strengthening in later phases. Between 2025 and 2030, the market rises from USD 206.6 billion to 263.7 billion, reflecting a rolling CAGR of approximately 5.0%, supported by increasing aircraft leasing activities, demand for fleet optimization, and digital maintenance platforms.

In the following period (2026–2031), the CAGR remains near 5.0%, as values move from 217.0 billion to 276.9 billion, underpinned by a rise in sale-and-leaseback transactions and lifecycle cost management solutions. Later intervals, including 2028–2033 and 2030–2035, maintain consistent growth near 4.8%–5.0%, driving the market toward USD 336.6 billion by 2035. This stability is attributed to the continued adoption of predictive maintenance technologies, integrated asset monitoring systems, and optimization strategies by airlines seeking cost efficiency amid volatile fuel and financing conditions.

The rolling CAGR trend suggests that investment opportunities will remain strong for firms offering digital platforms, AI-based analytics, and comprehensive asset lifecycle management services as the aviation sector embraces modernization and sustainability-focused practices.

| Metric | Value |

|---|---|

| Aviation Asset Management Market Estimated Value in (2025 E) | USD 206.6 billion |

| Aviation Asset Management Market Forecast Value in (2035 F) | USD 336.6 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The aviation asset management market holds an essential yet varied share across its parent segments. Within the aviation operations and maintenance (O&M) market, it accounts for 15–17%, reflecting its role in optimizing maintenance schedules, parts utilization, and aircraft readiness alongside hands‑on labor. In the aircraft lifecycle services market, which includes leasing, refurbishment, and end‑of‑life asset disposal, aviation asset management captures 12–14%.

Within the fleet management and leasing services market, it comprises 10–12%, as operators increasingly rely on asset-tracking software to monitor utilization and financial performance. In the aerospace aftermarket and spare parts market, the share is 8–10%, since procurement and parts logistics dominate this space. Within the aviation data analytics and predictive maintenance market, aviation asset management contributes 20–22%, given its integration of real‑time health monitoring, predictive forecasting, and performance dashboards.

Adoption is accelerating due to airlines seeking cost-efficiency, extended aircraft life cycles, and improved safety records. Platforms combining digital twins, IoT sensors, and analytics-driven decision-making are enabling smarter scheduling, fuel savings, and regulatory compliance. These factors position aviation asset management as a critical enabler for operational excellence and profitability across modern airline and leasing operations.

The aviation asset management market is witnessing strong momentum as airlines and lessors increasingly adopt professionalized approaches to managing fleets efficiently and profitably. The market is being shaped by the need to optimize aircraft utilization, reduce downtime, and ensure compliance with evolving safety and environmental regulations.

Demand has been further influenced by fluctuating fuel prices, rising passenger traffic, and the need to modernize fleets with more efficient aircraft. Future growth is expected to be supported by the expansion of low-cost carriers, greater leasing activity, and advances in digital asset tracking systems.

Airlines and lessors are increasingly focusing on lifecycle cost management and value maximization, which is paving the way for innovative service offerings and deeper partnerships across the value chain.

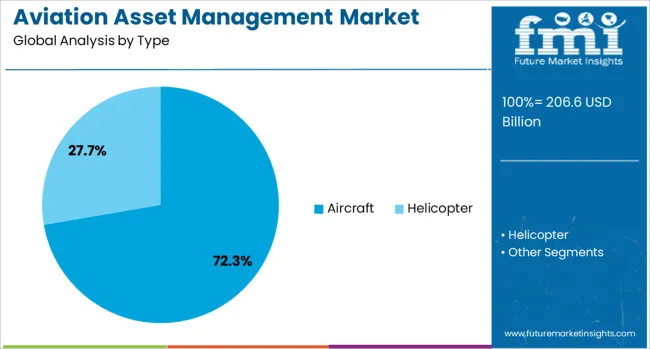

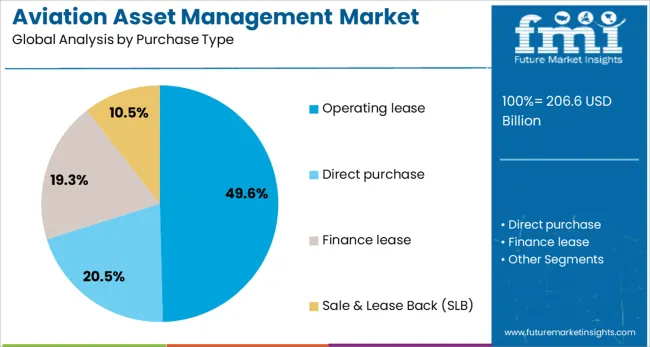

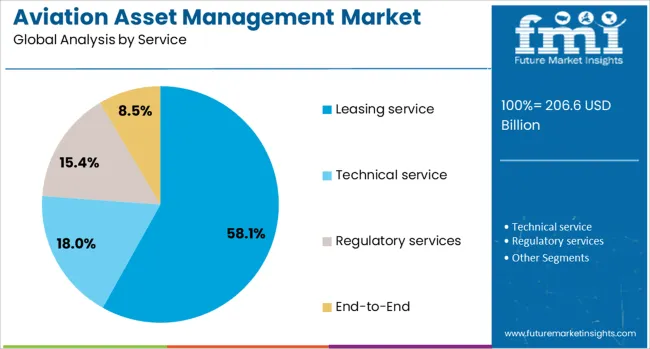

The aviation asset management market is segmented by type, purchase type, service, end-use, and geographic regions. The aviation asset management market is divided by type into Aircraft and Helicopters. The aviation asset management market is classified into operating lease, Direct purchase, Finance lease, and Sale & Lease Back (SLB). The aviation asset management market is segmented into Leasing service, Technical service, Regulatory services, and End-to-End. The aviation asset management market is segmented by end-use into Airline operators, Leasing companies, Cargo operators, MRO service providers, and Commercial platforms. Regionally, the aviation asset management industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, the aircraft segment is expected to hold 72.30% of the total market revenue in 2025, making it the leading type segment. This leadership is driven by the substantial value concentration in aircraft assets compared to ancillary components, which demands rigorous management practices.

The prominence of this segment has been reinforced by the high capital cost of aircraft, their long economic life, and the complexity of maintaining residual value over time. Focus on ensuring airworthiness, optimizing maintenance cycles, and managing ownership transitions has elevated the demand for comprehensive asset management solutions tailored specifically to aircraft.

Airlines and lessors have prioritized aircraft-level asset strategies to align with operational goals, regulatory requirements, and market conditions, ensuring the sustained dominance of this segment.

In terms of purchase type, the operating lease segment is projected to contribute 49.6% of the market revenue in 2025, maintaining its leading position. This prominence is attributed to the growing preference among airlines for flexibility in fleet planning and the ability to preserve capital by avoiding large upfront expenditures.

The operating lease model has allowed carriers to adjust capacity swiftly in response to market fluctuations, while reducing balance sheet liabilities and mitigating residual value risk. Lessors have capitalized on this trend by expanding operating lease portfolios, offering tailored terms, and enhancing asset remarketing capabilities.

The ability of operating leases to support fleet modernization strategies without burdening financials has reinforced its appeal, securing its leadership within the market.

When segmented by service, the leasing service segment is forecast to hold 58.1% of market revenue in 2025, positioning it as the top service segment. This dominance has been supported by the critical role of leasing in meeting airlines’ fleet expansion and renewal objectives efficiently.

Leasing services have enabled carriers to access modern aircraft without significant capital outlay, while benefiting from the expertise and scale of professional lessors. The market has been further strengthened by the growing role of leasing firms in asset maintenance, compliance management, and remarketing, which has enhanced value delivery to airline customers.

The continued expansion of leasing service offerings, combined with competitive financing structures and global reach, has ensured this segment’s leading position in the aviation asset management landscape.

Aviation asset management comprises oversight of aircraft fleets, engines, spare parts inventory, and maintenance scheduling to drive optimal operational availability. This activity spans airlines, leasing firms, MRO providers, and corporate flight operators. Demand is driven by the need to maximize asset utilization, reduce downtime, and control lifecycle cost. Providers offering integrated tracking platforms, predictive maintenance data, and robust inventory planning tools are well-positioned to support operational efficiency. Performance under regulatory scrutiny and cost pressure in competitive aviation sectors has made reliable asset management solutions essential for sustained fleet readiness.

Growth in aviation asset management has been supported by rising emphasis on reducing aircraft ground time and enhancing flight scheduling accuracy. Assets such as engines, landing gear, and avionics must be managed meticulously to prevent delays and maintain safety standards. Pressure to optimize maintenance costs and minimize time out of service has reinforced the adoption of digital tracking and planning tools. Airline fleet expansion and network growth have increased complexity in spare parts logistics and MRO coordination. Demand for real‑time asset health visibility and inventory forecasting has grown among operators seeking to avoid unnecessary expenditures. Aviation stakeholders have prioritized tools that link maintenance plans with parts planning and utilization metrics.

Expansion has been restrained by challenges associated with integrating data from multiple sources such as onboard systems, maintenance logs, and third‑party records. Regulatory requirements for audit trails and compliance reporting add system complexity and demand for documentation tracking. Fragmented data formats across operators and service providers have hindered seamless information flow. High initial investment is often required for software deployment and staff training in analytics‑based asset tracking. Resistance to change from legacy manual methods slows adoption in some organizations. Variability in global regulatory regimes and airspace authorities’ reporting standards introduces difficulties in harmonization. Inconsistent quality of historical maintenance data can reduce predictive modelling accuracy, weakening potential efficiency gains.

Opportunities are available in predictive analytics platforms that can forecast component wear and schedule maintenance proactively. Entire fleet health monitoring, coupled with Spare‑Part‑On‑Demand sourcing models, offers scope for service expansion. Partnerships with MRO providers and leasing firms enable bundled lifecycle contracts that include asset tracking, overhaul planning, and parts provisioning. Modular dashboard solutions that offer visibility into engine cycles, component status, and forecasted removal events are gaining traction. Emerging demand for mobile app‑based asset overview tools supports crew and engineering operational coordination. The provision of managed service marketplaces for aviation spare parts supply and monitoring is enabling recurring business models among operators and service partners.

The shift toward cloud‑based asset management systems has been observed, enabling remote access, platform scalability, and multi‑site coordination. Analytics modules that provide component health trends and maintenance forecasting are being embedded. Interest in solutions offering integration with flight operations, maintenance records and parts inventories is increasing. Dashboards facilitating inventory tracking, component traceability and MRO scheduling in a unified interface have shaped procurement choices. Role‑based access control tools and specialized analytics for engine cycles, airframe usage and component reliability modeling are gaining adoption. Demand for platforms that can be extended through modular upgrades, custom reporting and API connectivity is influencing supplier roadmaps across operators and technical service providers.

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

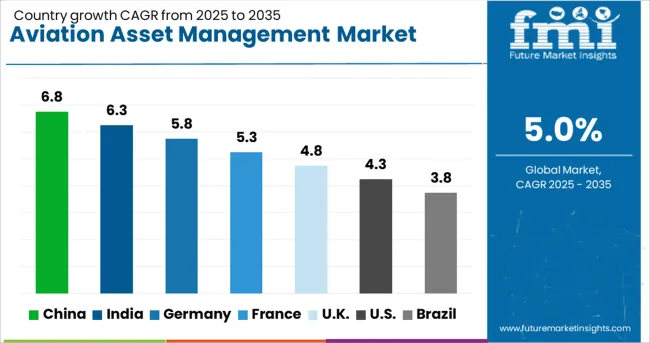

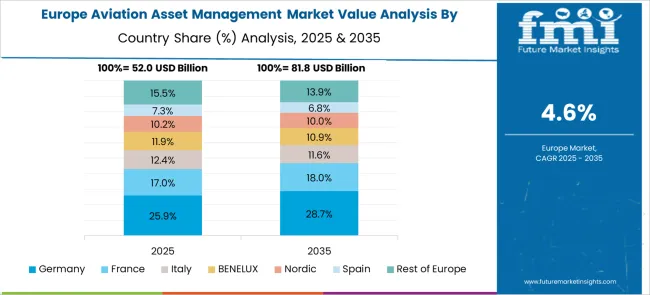

The aviation asset management market is projected to grow at a CAGR of 5.0% between 2025 and 2035, driven by rising fleet modernization, increased aircraft leasing activity, and growing demand for cost optimization in maintenance and operations. China leads with 6.8% CAGR, supported by fleet expansion and strong leasing penetration. India follows at 6.3%, driven by regional connectivity and the growth of low-cost carriers. Among OECD economies, Germany grows at 5.8%, with emphasis on digital asset tracking and maintenance forecasting. France posts 5.3%, focusing on end-of-life asset recycling and remarketing strategies, while the United Kingdom records 4.8%, supported by advanced leasing frameworks and aftermarket service demand. The report covers over 40 countries, with detailed insights for five profiled below.

China is projected to post 6.8% CAGR, the highest among major markets, supported by rapid fleet growth and rising adoption of operating leases by carriers. Domestic airlines are expanding narrow-body aircraft fleets to meet demand for regional connectivity, creating strong requirements for structured asset management solutions. Leasing companies are investing in advanced portfolio management systems with AI-enabled forecasting to optimize asset life cycles. Growth in aftermarket maintenance services, including engine leasing and parts pooling, is further strengthening market prospects. Chinese lessors are also targeting overseas clients through sale-leaseback deals, reinforcing the country’s position in global aviation leasing.

India is expected to achieve a 6.3% CAGR, driven by growing demand for fleet leasing and asset life cycle optimization among domestic carriers. Rising air travel in tier-two cities and increased adoption of sale-leaseback agreements have accelerated the need for structured aviation asset management frameworks. Airlines are prioritizing digital platforms to monitor aircraft health and predict maintenance events, reducing downtime and operational costs. The expansion of engine leasing and component pooling solutions provides cost flexibility for carriers operating under tight margins. Indian lessors are exploring partnerships with global firms to improve access to financing and remarketing expertise.

Germany is forecasted to grow at a 5.8% CAGR, supported by increased emphasis on asset value retention and remarketing strategies. Leasing companies and MRO providers are deploying advanced analytics to monitor residual values and optimize lease terms. The demand for structured asset tracking and automated compliance documentation is rising as airlines transition to sustainable fleet strategies. German lessors are expanding portfolios with a mix of narrow-body and long-haul aircraft to address regional and intercontinental route requirements. The growing adoption of digital platforms for end-of-lease planning and aircraft redelivery processes supports efficiency across leasing operations.

France is projected to expand at a 5.3% CAGR, driven by fleet modernization initiatives and higher demand for flexible leasing solutions among regional carriers. Leasing firms in France are focusing on asset lifecycle extension strategies through optimized maintenance schedules and predictive analytics. Engine and component leasing segments are gaining traction to support airline cost management objectives. The development of digital remarketing platforms is streamlining aircraft placement and secondary market transactions. France’s strong aftermarket infrastructure, coupled with increasing demand for cargo conversions, presents significant opportunities for asset managers targeting end-of-life solutions.

The United Kingdom is forecast to post 4.8% CAGR, supported by advanced leasing practices and robust demand for aftermarket solutions. Airlines and lessors are prioritizing digital solutions for real-time fleet monitoring, end-of-lease compliance, and portfolio optimization. Growth in engine leasing services and green-time utilization strategies is enhancing operational efficiency. The UK market is also witnessing increased adoption of sale-leaseback structures as carriers manage liquidity challenges. Asset managers are leveraging AI-based risk modeling to improve asset valuation accuracy and reduce exposure to volatility in secondary markets.

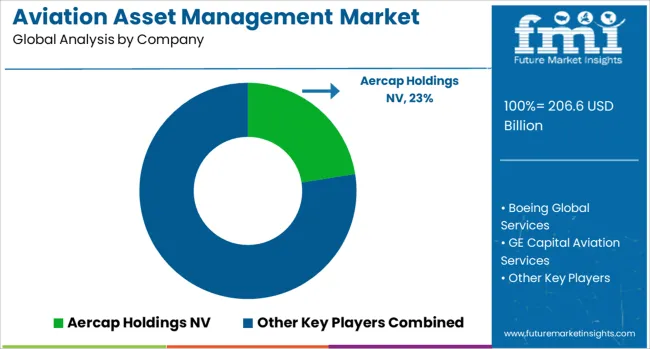

The aviation asset management market is dominated by key players such as Aercap Holdings NV, Boeing Global Services, GE Capital Aviation Services (GECAS), Airbus Group, BOC Aviation, and Avolon, all of which provide leasing, fleet optimization, and lifecycle management solutions to airlines worldwide. Aercap Holdings NV stands as the largest aircraft lessor with a strong global footprint, offering end-to-end asset management including remarketing, lease restructuring, and risk mitigation strategies.

Boeing Global Services and Airbus Group leverage OEM integration to provide asset support, parts supply, and predictive maintenance analytics, enabling operators to optimize aircraft utilization and reduce downtime. GECAS and Avolon maintain competitive advantage through financial strength, flexible leasing structures, and portfolio diversification across narrow-body and wide-body aircraft segments. BOC Aviation focuses on Asia-Pacific expansion, capitalizing on strong demand from emerging airline markets and regional carriers.

The market operates under moderate entry barriers driven by the capital-intensive nature of aircraft acquisition, strict aviation regulations, and reliance on long-term relationships with airlines. Competitive differentiation is shaped by factors such as leasing flexibility, residual value optimization, digital fleet management solutions, and risk-sharing models. Strategic trends include the adoption of AI-powered predictive maintenance, blockchain for contract security, and real-time analytics for fleet performance monitoring.

Future growth will be driven by rising demand for leasing in low-cost carrier segments, increasing preference for asset-light airline models, and expansion of short-term lease products to accommodate dynamic travel patterns. Key performance benchmarks include lease yield, portfolio age, utilization rates, and turnaround time for asset remarketing.

| Item | Value |

|---|---|

| Quantitative Units | USD 206.6 Billion |

| Type | Aircraft and Helicopter |

| Purchase Type | Operating lease, Direct purchase, Finance lease, and Sale & Lease Back (SLB) |

| Service | Leasing service, Technical service, Regulatory services, and End-to-End |

| End-Use | Airline operators, Leasing companies, Cargo operators, MRO service providers, and Commercial platforms |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aercap Holdings NV, Boeing Global Services, GE Capital Aviation Services, Airbus Group, BOC Aviation, and Avolon |

| Additional Attributes | Dollar sales by service type (operating leases, financial leases, asset remarketing, maintenance management) and end-user application (commercial airlines, cargo operators, regional carriers), with demand driven by airline fleet modernization and cost-control strategies. Regional dynamics show North America and Europe dominating long-term leasing programs, while Asia-Pacific experiences rapid growth fueled by expanding airline networks and high passenger traffic. Innovation focuses on digital lease management platforms, predictive analytics for residual value forecasting, and integration of advanced maintenance solutions to extend aircraft lifecycle and maximize asset profitability. |

The global aviation asset management market is estimated to be valued at USD 206.6 billion in 2025.

The market size for the aviation asset management market is projected to reach USD 336.6 billion by 2035.

The aviation asset management market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in aviation asset management market are aircraft, _wide body aircraft, _narrow body aircraft, _private jets and helicopter.

In terms of purchase type, operating lease segment to command 49.6% share in the aviation asset management market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aviation Life Rafts Market Size and Share Forecast Outlook 2025 to 2035

Aviation Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Aviation Compliance Monitoring Software Market Size and Share Forecast Outlook 2025 to 2035

Aviation Analytics Market Size and Share Forecast Outlook 2025 to 2035

Aviation Cloud Market Size and Share Forecast Outlook 2025 to 2035

Aviation Fuel Additives Market Growth 2025 to 2035

Aviation Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Aviation Titanium Alloy Market Analysis by Type, Application, Microstructure, and Region: Forecast for 2025 to 2035

Aviation Connector Market

Aviation IoT Solutions Market

Aviation Cabin Cleaning Chemical Market

Aviation Biofuel Market

Aviation Gas Turbines Market

Aviation Lubricants Market

IoT In Aviation Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Aviation Fuels Market

Sustainable Aviation Fuel Market Growth – Trends & Forecast 2025 to 2035

Adoption Analysis of 5G in Aviation Market Size and Share Forecast Outlook 2025 to 2035

Asset Tags Market Size and Share Forecast Outlook 2025 to 2035

Asset-Based Lending Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA