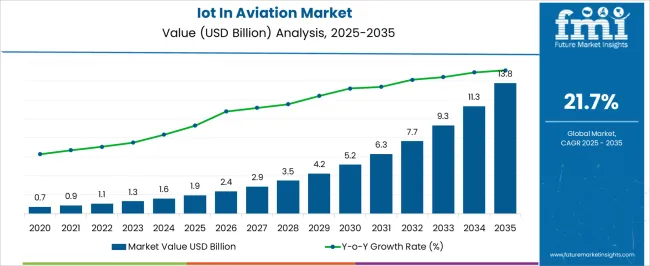

The IoT in aviation market is expected to expand from USD 1.9 billion in 2025 to USD 13.8 billion by 2035, advancing at a CAGR of 21.7%. Evaluating the growth contribution index reveals that incremental gains are not evenly distributed, with stronger contributions occurring in the middle and later phases of the forecast period. From 2021 to 2025, the market moves from USD 1.1 billion to USD 1.9 billion.

This early stage delivers a growth contribution of USD 0.8 billion, shaped primarily by pilot deployments of IoT platforms in predictive maintenance, passenger experience enhancements, and asset tracking. While adoption is notable, its contribution remains limited by smaller-scale implementation. Between 2026 and 2030, the market rises sharply from USD 2.4 billion to USD 7.7 billion. This phase provides the largest contribution, adding USD 5.3 billion. Strong momentum here is driven by large-scale integration of IoT in fleet operations, fuel monitoring, baggage management, and real-time data analytics, marking the sector’s critical inflection point. From 2031 to 2035, the market advances further from USD 9.3 billion to USD 13.8 billion, contributing USD 4.5 billion.

| Metric | Value |

|---|---|

| IoT In Aviation Market Estimated Value in (2025 E) | USD 1.9 billion |

| IoT In Aviation Market Forecast Value in (2035 F) | USD 13.8 billion |

| Forecast CAGR (2025 to 2035) | 21.7% |

The IoT in aviation market is positioned as a fast-evolving segment within multiple parent domains, with its share reflecting the adoption of connected devices and data-driven operations across airlines and airports. In the aviation digitalization market, IoT contributes nearly 9 to 10%, forming a key pillar alongside AI-based analytics and digital twin applications. Within the aviation IT and software solutions market, its share is around 7 to 8%, as IoT platforms integrate with predictive analytics, maintenance scheduling, and data management tools that support operational reliability. The smart airport solutions market sees higher penetration, with IoT making up nearly 12 to 14%, driven by deployments in passenger tracking, baggage handling, and real-time facility management. In the aircraft systems and maintenance market, IoT adoption accounts for close to 6 to 7%, where connected sensors enhance engine health monitoring, avionics tracking, and predictive maintenance planning.

Within the aerospace connectivity and communication market, IoT contributes about 5 to 6%, linking with wireless communication, satellite systems, and integrated networks for seamless real-time data exchange. Its presence is strongest in passenger-centric and airport operations, while its role in aircraft maintenance and connectivity remains supportive but steadily expanding, reinforcing IoT as a critical element in reshaping aviation efficiency, safety, and passenger experience.

The IoT in Aviation market is experiencing accelerated growth, supported by the aviation industry's increasing focus on operational efficiency, predictive analytics, and enhanced passenger experience. The adoption of IoT solutions has been driven by the need for real-time monitoring of aircraft systems, improved asset management, and reduction in operational downtime. Airlines, airports, and maintenance providers are leveraging connected devices and data analytics to enable proactive maintenance, optimize resource allocation, and improve safety compliance.

The growth trajectory is further supported by advancements in wireless communication technologies and the integration of AI-driven analytics into aviation systems. Regulatory emphasis on safety, coupled with the push for sustainable operations, is encouraging the deployment of IoT-based solutions for fuel optimization and emissions monitoring.

With continuous investments from key aviation stakeholders in digital transformation and the modernization of legacy infrastructure, IoT adoption in aviation is expected to expand steadily These developments are laying a strong foundation for long-term market growth, driven by innovation and data-centric decision-making.

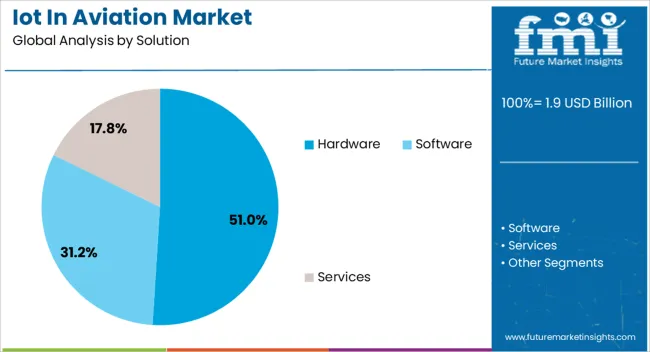

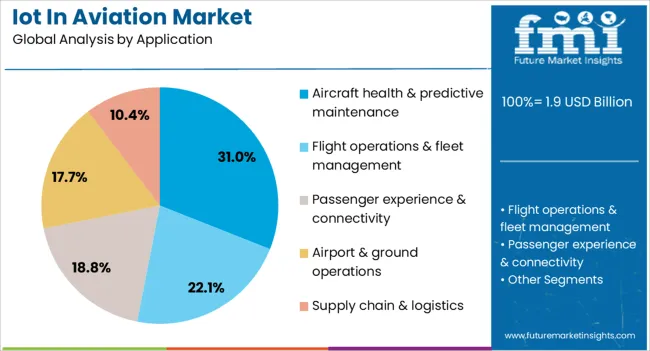

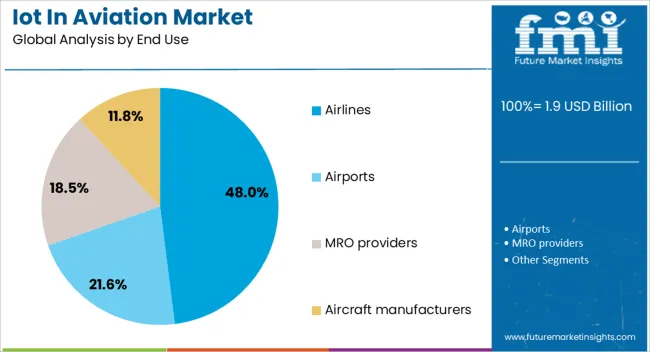

The IoT in aviation market is segmented by solution, application, end use, and geographic regions. By solution, IoT in aviation market is divided into Hardware, Software, and Services. In terms of application, IoT in aviation market is classified into Aircraft health & predictive maintenance, Flight operations & fleet management, Passenger experience & connectivity, Airport & ground operations, Supply chain & logistics, and Aircraft manufacturing & assembly.

Based on end use, IoT in aviation market is segmented into Airlines, Airports, MRO providers, and Aircraft manufacturers. Regionally, the IoT in aviation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment in the solution category is projected to hold 51% of the IoT in Aviation market revenue share in 2025, making it the leading segment. This dominance has been driven by the critical role hardware plays as the foundational layer for IoT deployment, enabling the collection, transmission, and storage of aviation data. High demand for advanced sensors, communication modules, and edge computing devices has been observed in both aircraft and ground-based systems.

The requirement for robust, aviation-grade hardware that can operate reliably under extreme environmental conditions has further strengthened its position. Additionally, hardware investments are often prioritized in aviation modernization programs to ensure compatibility with evolving software platforms and analytics tools.

The segment’s growth is being supported by ongoing fleet upgrades, integration of smart systems in new aircraft, and the replacement of outdated components with connected devices that facilitate real-time data exchange. As IoT applications expand in aviation, the demand for high-performance hardware infrastructure continues to reinforce its market leadership.

The aircraft health and predictive maintenance segment in the application category is expected to account for 31% of the IoT in Aviation market revenue share in 2025, making it the leading application area. The growth of this segment has been attributed to the increasing emphasis on reducing unplanned maintenance events, optimizing operational efficiency, and ensuring flight safety. IoT-enabled monitoring systems provide continuous data on engine performance, component wear, and environmental conditions, enabling proactive maintenance decisions.

This capability minimizes costly downtime, extends asset life, and supports compliance with stringent safety regulations. Predictive analytics powered by IoT data allows maintenance teams to address potential issues before they escalate, reducing the risk of in-flight failures.

Airlines and maintenance service providers are investing heavily in such systems to streamline maintenance schedules and improve operational reliability. The integration of advanced data analytics and AI into predictive maintenance workflows is further enhancing accuracy and efficiency, solidifying the segment’s dominant position in the market.

The airlines segment in the end-use category is projected to hold 48% of the IoT in Aviation market revenue share in 2025, establishing it as the leading end-use sector. This growth has been driven by the extensive adoption of IoT solutions by airlines to improve passenger services, operational performance, and asset utilization. Airlines are implementing IoT-based systems for real-time fleet tracking, baggage management, in-flight connectivity, and fuel optimization.

The ability to integrate IoT data into decision-making processes has enabled better route planning, enhanced crew scheduling, and improved aircraft turnaround times. Furthermore, airlines are leveraging IoT-enabled predictive analytics to reduce maintenance costs and improve safety compliance.

The shift towards digital transformation in airline operations is being supported by strategic investments in connected infrastructure and partnerships with technology providers. As passenger expectations for seamless travel experiences continue to rise, IoT adoption in airline operations is expected to grow further, reinforcing the segment’s leadership in the overall market.

IoT in aviation is being adopted to raise reliability, shorten turnarounds, and improve asset visibility from aircraft to ramp. Gains are realized through predictive maintenance, connected ground fleets, and smarter cabin and cargo monitoring. Scale is limited by certification workload, cybersecurity assurance, legacy integration, and tight retrofit windows. Clear upside exists in edge analytics, private 5G enabled tracking, digital twins, and data services that convert insights into maintenance and operations outcomes. Ecosystem partnerships, open interfaces, and security by design are becoming decisive. Providers proving compliance, uptime benefits, and fast integration are likely to secure preference.

Adoption of IoT across airframes, engines, and airport assets is being driven by clear gains in operational control, turnaround speed, and safety assurance. Sensors on landing gear, environmental control, hydraulics, and engines stream health data through ACARS, satcom, and cellular links to ground platforms. Predictive maintenance models are applied to reduce unscheduled events and stabilize dispatch reliability. On the ground, connected ground support equipment, baggage carts, and catering fleets are tracked to tighten gate operations and crew coordination. Electronic tech logs, smart EFB workflows, and e enabled cabins improve data capture without extra workload. Real time fuel, tire, and brake monitoring supports more precise flight operations decisions. Cargo and ULD tracking with beacons and gateways improves custody and condition visibility. As airlines seek consistent performance across diverse fleets and networks, IoT is being treated as a practical path to higher asset utilization and more reliable daily execution.

Scale is constrained by certification effort, cybersecurity assurance, and the realities of mixed avionics generations. Software approval under recognized aerospace processes requires rigorous artifacts, configuration control, and change management that lengthen schedules. Security risk assessments and protection concepts aligned to accepted aviation guidance raise design and testing scope for connectivity, gateways, and cloud links. Integration with legacy buses such as ARINC 429 and migration toward AFDX add translation layers and timing constraints. Radio approvals, electromagnetic compatibility, and environmental testing under aerospace standards increase cost and complexity. Retrofit downtime windows are limited, so installations compete with heavy checks and cabin work. Data ownership, consent, and retention policies require legal clarity across airline, OEM, and MRO stakeholders. Patch management and key rotation must be synchronized with airworthiness constraints. These factors keep procurement cautious and favor vendors that can prove certification maturity, secure architectures, and dependable long term support.

Opportunities are opening where edge processing and platform approaches compress reaction time and reduce bandwidth needs. Smart gateways on aircraft aggregate sensor feeds, execute anomaly detection at the edge, and forward prioritized events for action by maintenance control. Digital twin models for engines, auxiliary power units, and environmental systems support remaining useful life estimates and part planning. At airports, private 5G and advanced Wi Fi enable real time tracking of GSE, tugs, and belt loaders, improving allocation and reducing idle time. Cold chain cargo monitoring with temperature and shock sensors strengthens pharma and perishables handling. Cabin comfort monitoring, seat occupancy analytics, and galley inventory tracking improve catering accuracy and crew workflows. Subscription based health programs, usage based spares contracts, and outcome priced services are being piloted by OEMs and MROs. Open APIs that connect flight ops, reliability, and finance systems position IoT data for measurable business improvements.

A shift from point solutions to interoperable ecosystems is shaping roadmaps. Airlines seek suppliers that deliver certified hardware, device management, analytics, and integration services under one accountable framework. Standard vocabularies for airport data exchange and cargo records are being adopted to simplify multi party sharing. Cloud to edge splits are becoming clearer, with aircraft performing fast detection while ground platforms handle fleet learning and cross type benchmarking. Zero trust security patterns, hardware root of trust, and secure boot expectations are being baked into avionics adjacent devices. Line fit pathways are being prioritized for new deliveries, while retrofit kits aim to minimize wiring changes and speed approvals. Partnerships among OEMs, avionics vendors, airport operators, and telecom providers are expanding coverage and reducing integration friction. Success is being defined by demonstrable uptime gains, shorter turnarounds, and auditable savings rather than broad claims about digital transformation.

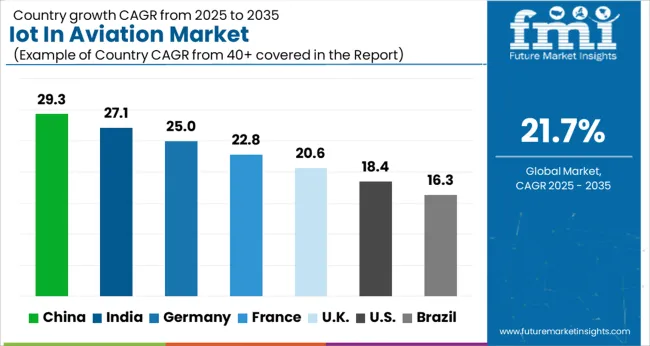

| Country | CAGR |

|---|---|

| China | 29.3% |

| India | 27.1% |

| Germany | 25.0% |

| France | 22.8% |

| UK | 20.6% |

| USA | 18.4% |

| Brazil | 16.3% |

The IoT in aviation market is forecast to grow globally at a CAGR of 21.7% from 2025 to 2035. China leads with 29.3%, followed by India at 27.1% and Germany at 25.0%, while the UK records 20.6% and the USA posts 18.4%. China and India achieve the highest growth premiums of +7.6% and +5.4% above baseline, driven by rapid aviation expansion, airport modernization, and connected fleet programs. Germany anchors Europe with innovation in aerospace and smart airport projects. The UK sustains growth with digital passenger management systems, while the USA., despite lower CAGR, remains the largest market by value due to its vast aviation infrastructure and defense-driven IoT adoption. The analysis spans over 40+ countries, with the leading markets shown below.

The IoT in aviation market in China is projected to grow at a CAGR of 29.3% from 2025 to 2035, the highest among all profiled countries. Growth is being driven by China’s rapidly expanding aviation sector, where smart sensors, predictive maintenance platforms, and connected aircraft systems are being adopted extensively. Airlines are investing in IoT-enabled fleet monitoring to enhance operational efficiency and reduce downtime. Airports across China are deploying IoT-based baggage handling, passenger tracking, and smart security systems to manage rising passenger volumes. Government-backed programs to modernize airports and increase air connectivity are expected to accelerate adoption further, making China a global leader in aviation IoT deployment.

The IoT in aviation market in India is forecasted to grow at a CAGR of 27.1% during 2025–2035. With passenger traffic surging and new airports being built under government programs, IoT-based solutions are being integrated to improve efficiency and safety. Airlines are adopting connected aircraft technologies for real-time engine monitoring, fuel management, and predictive analytics. IoT-enabled passenger service systems, such as biometric boarding and digital kiosks, are improving customer experience across airports. Domestic startups are also entering the aviation IoT ecosystem, offering tailored platforms for airlines and airport operators. The expansion of MRO (Maintenance, Repair, and Overhaul) facilities is further supporting demand, as IoT-based predictive maintenance reduces costs and downtime.

The IoT in aviation market in Germany is expected to expand at a CAGR of 25.0% from 2025 to 2035. Germany’s strong aerospace engineering base and advanced airport infrastructure support rapid IoT adoption. Airlines are deploying IoT platforms to monitor aircraft performance, optimize fuel usage, and improve safety. German airports are integrating IoT solutions for passenger flow management, smart security, and cargo tracking. The country’s role as a hub for European aviation innovation drives continuous research and development in connected systems. Partnerships between German aerospace firms, IoT startups, and global technology companies are enabling integration of AI-driven IoT solutions. Demand is also rising in MRO services, where predictive analytics and connected sensors are revolutionizing maintenance efficiency.

The IoT in aviation market in Germany is expected to expand at a CAGR of 25.0% from 2025 to 2035. Germany’s strong aerospace engineering base and advanced airport infrastructure support rapid IoT adoption. Airlines are deploying IoT platforms to monitor aircraft performance, optimize fuel usage, and improve safety. German airports are integrating IoT solutions for passenger flow management, smart security, and cargo tracking. The country’s role as a hub for European aviation innovation drives continuous research and development in connected systems. Partnerships between German aerospace firms, IoT startups, and global technology companies are enabling integration of AI-driven IoT solutions. Demand is also rising in MRO services, where predictive analytics and connected sensors are revolutionizing maintenance efficiency.

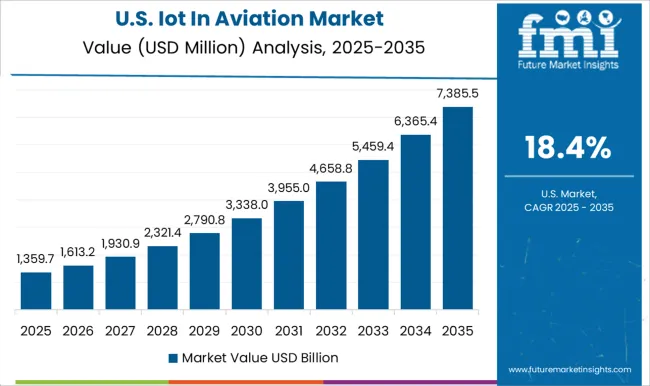

The IoT in aviation market in the United States is expected to grow at a CAGR of 18.4%, slower compared to Asia but significant in scale due to the country’s large aviation ecosystem. USA airlines are leading in connected aircraft adoption, deploying IoT for predictive maintenance, real-time diagnostics, and fuel optimization. Airports across the country are implementing IoT-driven smart systems for baggage handling, passenger flow, and security monitoring. The defense aviation sector is another key contributor, with IoT sensors being deployed in aircraft for mission-critical monitoring. USA-based technology firms are innovating in AI-integrated IoT platforms, making the country a hub for advanced aviation solutions. With federal support for airport modernization and increasing investments by airlines, the USA market continues to dominate global aviation IoT value creation despite moderate CAGR.

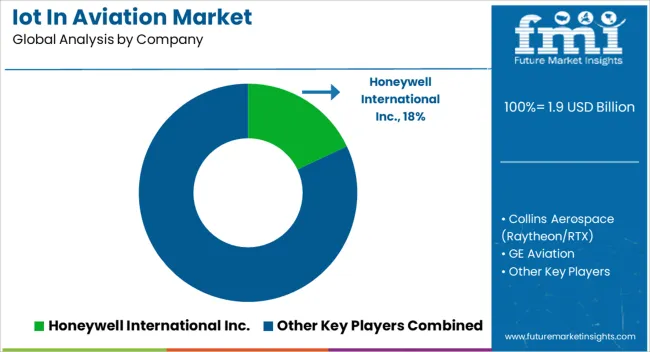

Competition in aviation IoT is decided by safety outcomes, asset uptime, and data monetization at fleet scale. Honeywell is positioned with aircraft health monitoring, connected auxiliary power units, satcom terminals, and analytics that convert flight parameters into alerts and work orders. Collins Aerospace is differentiated through avionics gateways, aircraft interface devices, and cabin connectivity that feed operations control with real time data. GE Aviation is centered on flight data analytics and asset performance for engines and airframes, supporting condition based maintenance across mixed fleets. Cisco Systems is focused on secure networking from aircraft to hangar to airport edge. IBM is engaged on asset management, AI assisted inspections, and digital twins for line and base maintenance. Thales emphasizes secured avionics, data concentrators, and inflight connectivity links. Panasonic Avionics is leveraged for IFEC platforms, cabin sensors, portals, and broadband service. SITA is established as a data transport backbone with airline messaging, ACARS enablement, and edge capture. Strategy has been framed around certification depth, retrofit simplicity, and lifecycle contracts. Edge devices are qualified to aerospace standards, then rolled across fleets through service bulletins and supplemental type certificates. Cloud pipelines are integrated with airline reliability reporting, spares planning, and turnaround optimization. Cyber controls are embedded from device to dashboard. Commercial models are presented per tail, per flight hour, or enterprise subscription. Product brochure content is specific. Aircraft interface devices, quick access recorders, satcom antennas, modems, secure routers, and managed switches are listed with ARINC and DO references. Cabin access points and IoT sensors for seats, galleys, lavatories, and cargo are shown with power, wiring, and environmental envelopes. Analytics modules describe health indicators, exceedance detection, remaining useful life outputs, and automated work package creation. Dashboards present fleet heat maps, delay code drill downs, and root cause trails. APIs and SDKs are offered for integration with MRO and operations systems. Encryption, key management, and audit logging are documented as standard.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Solution | Hardware, Software, and Services |

| Application | Aircraft health & predictive maintenance, Flight operations & fleet management, Passenger experience & connectivity, Airport & ground operations, Supply chain & logistics, and Aircraft manufacturing & assembly |

| End Use | Airlines, Airports, MRO providers, and Aircraft manufacturers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell International Inc., Collins Aerospace (Raytheon/RTX), GE Aviation, Cisco Systems, IBM Corporation, Thales, Panasonic Avionics, SITA, and Others |

| Additional Attributes | Dollar sales by product type (standard, heavy-duty, specialized), load capacity (light, medium, heavy), and chassis compatibility (truck, trailer, multi-axle platforms). Demand dynamics are influenced by logistics expansion, waste management modernization, and construction sector growth. Regional trends indicate strong adoption in Europe and North America, driven by industrial modernization and regulatory emphasis on operational safety and efficiency. |

The global IoT in aviation market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the IoT in aviation market is projected to reach USD 13.8 billion by 2035.

The IoT in aviation market is expected to grow at a 21.7% CAGR between 2025 and 2035.

The key product types in IoT in aviation market are hardware, _sensors, _gateways, _edge devices, software, _analytics platforms, _fleet management sw, _predictive maintenance sw, services, _integration services, _managed services and _consulting.

In terms of application, aircraft health & predictive maintenance segment to command 31.0% share in the IoT in aviation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IoT Network Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Spend by Logistics Market Size and Share Forecast Outlook 2025 to 2035

IoT Chip Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Enablement Market Size and Share Forecast Outlook 2025 to 2035

IoT Processor Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Development Services Market Size and Share Forecast Outlook 2025 to 2035

IoT Connectivity Management Platform Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Platform Market Size and Share Forecast Outlook 2025 to 2035

IoT Development Kit Market Size and Share Forecast Outlook 2025 to 2035

IoT Communication Protocol Market - Insights & Industry Trends 2025 to 2035

IoT for Public Safety Market

IoT Data Governance Market

IoT in Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

IoT In Construction Market Size and Share Forecast Outlook 2025 to 2035

IoT in Utilities Market Size and Share Forecast Outlook 2025 to 2035

IoT in Product Development Market Analysis - Growth & Forecast 2025 to 2035

IoT in Healthcare Market Insights - Trends & Forecast 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

IoT For Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA