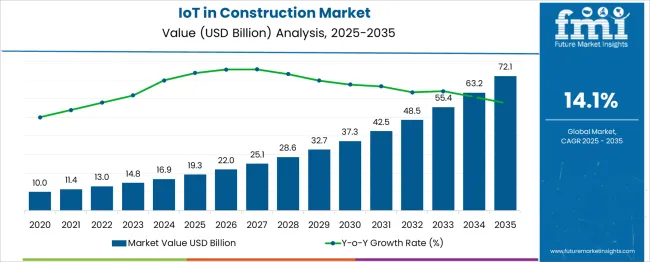

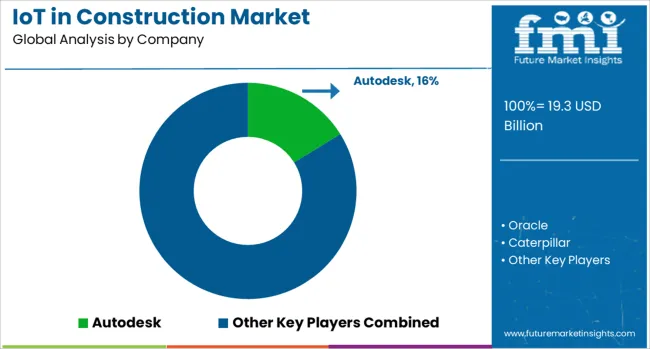

The IoT in construction market is estimated to be valued at USD 19.3 billion in 2025 and is projected to reach USD 72.1 billion by 2035, registering a compound annual growth rate (CAGR) of 14.1% over the forecast period. Between 2030 and 2035, growth momentum is forecast to accelerate further as large-scale construction firms deploy AI-driven IoT ecosystems to enhance real-time decision-making, energy management, and compliance with stricter building regulations. From 2025 to 2030, adoption will be driven by project owners and contractors seeking better asset tracking, predictive maintenance, and workforce safety, with the market expected to surpass USD 37 billion in this period.

With Asia-Pacific leading adoption through megaprojects and North America focusing on smart infrastructure, IoT is set to evolve into a core enabler of productivity, safety, and cost optimization across the global construction sector. The incremental opportunity of USD 52.8 billion over the forecast horizon reflects IoT’s critical role in reshaping efficiency and transparency in construction projects. Competitive intensity will increase as technology providers, equipment manufacturers, and construction firms collaborate on integrated solutions.

Equipment management applications represent the dominant implementation segment where IoT sensors enable real-time tracking of heavy machinery location, utilization rates, fuel consumption, and maintenance requirements across multiple job sites while preventing theft and unauthorized usage through geofencing and access control systems. Fleet managers utilize connected equipment data to optimize deployment schedules, reduce idle time, and coordinate maintenance activities that maximize equipment availability while minimizing operational costs and downtime periods. Predictive maintenance algorithms analyze equipment performance data to anticipate component failures before they occur, enabling proactive interventions that prevent project delays and reduce repair expenses throughout equipment lifecycles.

Worker safety monitoring markets demonstrate substantial adoption of IoT technologies including wearable devices, environmental sensors, and proximity detection systems that track worker location, vital signs, and exposure to hazardous conditions while providing automated alerts for unsafe situations and emergency response coordination. Safety managers implement comprehensive monitoring systems that ensure compliance with occupational health regulations while reducing accident rates through real-time hazard identification and worker behavior analysis. Smart personal protective equipment incorporates sensors that monitor proper usage and environmental conditions while providing communication capabilities that enable immediate assistance during emergency situations.

Technology integration trends emphasize edge computing capabilities and 5G connectivity that enable real-time data processing and low-latency communication necessary for critical safety applications and automated construction equipment coordination. Machine learning algorithms analyze historical project data and current sensor inputs to predict project outcomes, identify potential delays, and optimize resource allocation while providing recommendations for operational improvements. Digital twin technologies create virtual representations of construction projects that integrate IoT sensor data with building information modeling to enable simulation-based planning and real-time project monitoring throughout construction phases.

| Metric | Value |

|---|---|

| IoT In Construction Market Estimated Value in (2025 E) | USD 19.3 billion |

| IoT In Construction Market Forecast Value in (2035 F) | USD 72.1 billion |

| Forecast CAGR (2025 to 2035) | 14.1% |

The IoT in construction market is witnessing accelerated growth, underpinned by the industry’s transition toward digitized and automated job sites. Integration of connected devices, sensors, and AI-driven analytics platforms is enabling real-time tracking of assets, energy usage, structural performance, and worker safety, reshaping operational efficiency and regulatory compliance across the construction lifecycle.

Rising labor shortages and the need for improved productivity and risk mitigation have encouraged the adoption of IoT-enabled systems, especially in infrastructure development, high-rise projects, and equipment-heavy operations. Governments and private stakeholders are increasingly investing in smart construction technologies to reduce downtime, minimize operational waste, and enable remote management of complex projects.

Additionally, sustainability goals and stricter safety mandates are driving the deployment of environmental sensors, smart wearables, and machine diagnostics tools. As cloud connectivity, edge intelligence, and machine learning mature, the IoT in construction market is poised for further expansion, offering scalable, data-rich solutions for planning, monitoring, and post-construction maintenance across global projects.

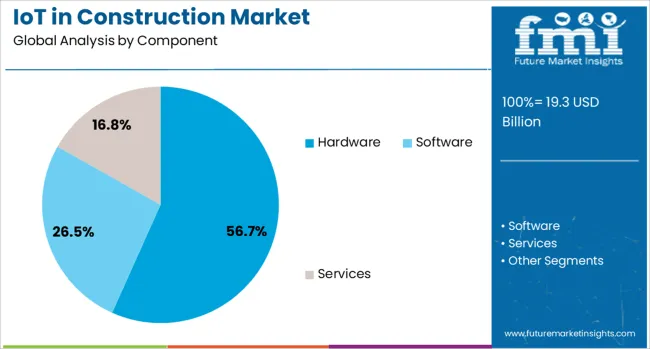

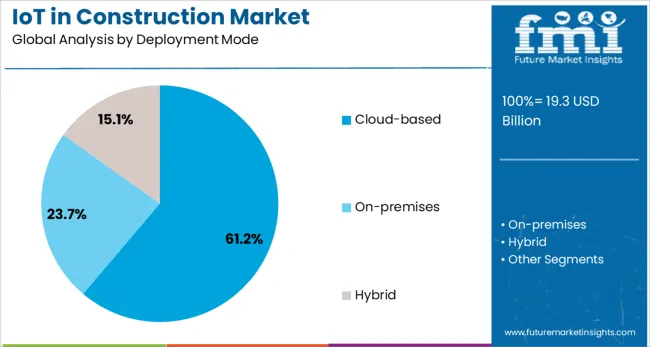

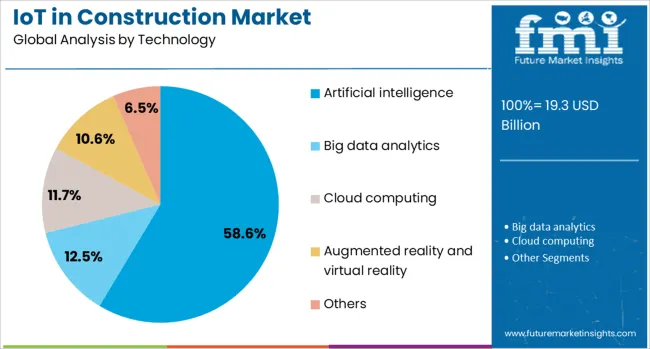

The IoT in construction market is segmented by component, deployment mode, technology, application, end-user, and geographic regions. By component, the IoT in construction market is divided into Hardware, Software, and Services. In terms of deployment mode of the IoT in the construction market, it is classified into Cloud-based, On-premises, and Hybrid. Based on technology, the IoT in construction market is segmented into Artificial intelligence, Big data analytics, Cloud computing, augmented reality and virtual reality. By application, the IoT in construction market is segmented into real-time asset tracking and monitoring, Site and worker safety, Project management, Quality control and compliance, Energy management and smart buildings, Predictive maintenance, and others.

By end-user, the IoT in construction market is segmented into Construction companies, the Government and public sector, Equipment manufacturers, and others. Regionally, the IoT in the construction industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware component segment is projected to account for 56.7% of the total revenue share in the IoT in construction market in 2025, positioning it as the dominant contributor. This leadership is attributed to the growing demand for on-site connected devices including sensors, RFID tags, cameras, and GPS modules that form the physical backbone of IoT ecosystems.

The increasing adoption of asset tracking devices, safety monitoring equipment, and smart environmental sensors has driven the requirement for robust hardware infrastructure across job sites. Construction companies are deploying edge devices and sensor clusters to monitor machine usage, structural integrity, and environmental metrics in real time, enabling proactive decision-making.

The rising need for automation and safety compliance has further intensified the deployment of wearables and monitoring hardware, ensuring operational visibility and incident prevention. The durability and customizability of IoT hardware for rugged outdoor use, along with its scalability across small and large construction projects, continue to reinforce its integral role in digital construction frameworks.

The cloud-based deployment mode segment is expected to capture 61.2% of the IoT in construction market revenue share in 2025, reflecting its growing dominance in digital construction strategies. This prominence is driven by the flexibility and scalability offered by cloud platforms for managing vast volumes of site-generated data. The ability to access real-time analytics dashboards, track equipment remotely, and store historical performance logs has positioned cloud-based systems as an operational imperative.

Construction firms are leveraging cloud infrastructure to integrate multiple project sites into centralized platforms, enhancing coordination, resource management, and project transparency. Security improvements, reduced upfront costs, and seamless over-the-air updates have further propelled the preference for cloud deployment.

Additionally, integration with third-party analytics tools and BIM platforms has been streamlined through cloud-based APIs, enabling faster deployment and broader functionality. The agility to scale operations up or down depending on project size and complexity has made cloud-based models the backbone of connected construction workflows.

The artificial intelligence technology segment is forecast to hold 58.6% of the IoT in construction market’s revenue share in 2025, driven by its transformative impact on predictive insights and automation. AI-enabled systems are being increasingly integrated into IoT architectures to enable real-time analytics, risk forecasting, resource optimization, and anomaly detection on construction sites. Machine learning models are being used to predict equipment failure, analyze project timelines, and ensure worker safety through behavior recognition and hazard identification.

The growing volume of sensor and equipment data has necessitated the use of AI for pattern detection and data-driven decision-making. Construction firms are utilizing AI to enhance operational workflows, reduce project delays, and ensure budget adherence through intelligent resource planning.

The convergence of AI with drone surveillance, wearables, and robotic systems is further enhancing site intelligence and autonomy. As AI algorithms become more refined and training datasets more robust, the segment is anticipated to play an increasingly critical role in elevating the efficiency and precision of modern construction operations.

IoT in construction is evolving through advancements in monitoring, predictive maintenance, project integration, and worker safety. These developments are improving efficiency, reducing risks, and shaping a more data-driven approach to construction operations worldwide.

The adoption of IoT in construction is being strengthened by the increasing integration of real-time monitoring systems across job sites. Connected sensors are being deployed to track equipment utilization, worker safety, and environmental conditions, enabling immediate decision-making and risk mitigation. These systems also facilitate predictive maintenance, reducing downtime and extending machinery lifespan. With the ability to collect and process large volumes of data, contractors can streamline workflows and optimize resource allocation. The integration of IoT with cloud-based platforms allows data sharing between multiple stakeholders, ensuring greater transparency and accountability. This shift toward live operational insights is redefining project management practices and delivering measurable efficiency improvements for both small and large-scale projects.

IoT applications are gaining momentum in predictive maintenance for construction equipment, ensuring that costly breakdowns and delays are minimized. Connected sensors embedded in heavy machinery continuously monitor parameters such as vibration, temperature, and operating hours. This data is analyzed to forecast potential failures before they occur, allowing timely interventions. By reducing unplanned downtime, predictive maintenance improves project timelines and cost efficiency. Equipment rental companies and large contractors are increasingly relying on IoT-enabled service schedules to maximize asset productivity. This proactive approach also supports better allocation of maintenance personnel and inventory planning for spare parts, leading to longer asset lifecycles and higher returns on investment in construction machinery.

The integration of IoT data with digital project management platforms is transforming coordination in construction projects. Field data from sensors and devices can be directly linked to scheduling, budgeting, and compliance systems. This creates a unified information flow that enhances communication between on-site teams and management offices. The ability to visualize sensor data alongside project milestones helps in identifying delays, budget overruns, or safety risks in real-time. Contractors are using these insights to improve decision-making and ensure accountability across the supply chain. Such integration also supports remote project oversight, reducing the need for frequent site visits while maintaining high standards of quality control and operational accuracy.

Worker safety has become a leading focus for IoT deployment in construction. Wearable devices equipped with sensors can monitor vital signs, movement patterns, and proximity to hazardous areas, issuing alerts to prevent accidents. Environmental sensors track air quality, noise levels, and temperature, ensuring compliance with health and safety regulations. This data-driven approach allows safety officers to act quickly in mitigating risks and improving site conditions. Beyond immediate safety benefits, the recorded data serves as valuable evidence in meeting regulatory requirements and in post-incident analysis. As safety expectations increase, IoT solutions are becoming indispensable tools for protecting workers and enhancing the overall operational environment on construction sites.

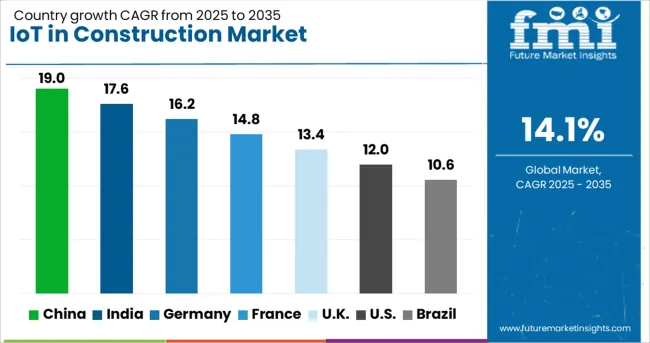

| Country | CAGR |

|---|---|

| China | 19.0% |

| India | 17.6% |

| Germany | 16.2% |

| France | 14.8% |

| UK | 13.4% |

| USA | 12.0% |

| Brazil | 10.6% |

The IoT in construction market is projected to expand globally at a CAGR of 14.1% from 2025 to 2035, driven by rising adoption of connected equipment, predictive maintenance, and site safety monitoring systems. China leads with a CAGR of 19.0%, supported by large-scale infrastructure investments, nationwide 5G rollout, and integration of IoT for real-time project oversight. India follows at 17.6%, fueled by smart city projects, public-private infrastructure partnerships, and increasing deployment of sensor-based monitoring solutions. France achieves 14.8% growth, backed by digital transformation incentives and adoption of IoT in urban infrastructure upgrades. The United Kingdom records a 13.4% CAGR, benefiting from IoT-enabled safety compliance and efficiency-focused construction technologies, while the United States maintains 12.0% growth with strong uptake in commercial and residential projects using IoT-driven asset tracking and performance analytics. This outlook positions Asia-Pacific as the key growth engine, with Europe and North America maintaining consistent expansion through regulatory compliance and productivity-enhancing IoT applications.

The CAGR for the IoT in construction market in the United Kingdom was around 12.2% during 2020–2024 and improved to 13.4% for 2025–2035. The earlier period saw steady but selective adoption, with IoT deployment focused on flagship infrastructure projects and high-value commercial builds. Growth was restrained by limited integration across mid-scale projects and slower sensor adoption in legacy fleets of equipment. In the upcoming decade, expanded 5G coverage, wider interoperability of IoT platforms, and a stronger push for digital safety compliance are expected to accelerate deployment. The increased focus on predictive maintenance and asset tracking across both public and private sector projects is also expected to drive stronger adoption rates. This growth outlook is underpinned by greater awareness among contractors of operational cost savings, along with advancements in cloud-based analytics for real-time project visibility.

China’s IoT in construction market has transitioned from rapid expansion to large-scale standardization. The CAGR during 2020–2024 was estimated at 17.5%, rising to 19.0% for 2025–2035. In the earlier phase, adoption was led by mega infrastructure and smart city projects, with strong government support for digital integration in public works. The next decade’s stronger pace is expected to come from extending IoT deployment into mid-tier cities and large private sector developments. Increased investment in AI-powered analytics, real-time safety monitoring, and 5G-connected equipment fleets is set to enhance operational efficiencies. Local manufacturers are delivering ruggedized IoT hardware adapted for diverse site conditions, improving durability and reducing downtime, which is attracting both domestic and foreign project developers.

India’s IoT in construction market recorded a CAGR of approximately 16.1% during 2020–2024, rising to 17.6% for 2025–2035. The earlier phase was driven by deployment in flagship infrastructure projects and government-led smart city initiatives, with limited penetration in smaller contractors. The projected acceleration is tied to cost declines in IoT devices, improved mobile broadband penetration, and private sector-led adoption in residential and commercial projects. Enhanced site safety compliance, predictive asset management, and the integration of IoT data into building information modeling (BIM) are emerging as primary growth enablers. Domestic startups are also entering the market, offering tailored, cost-effective IoT solutions for India’s diverse construction needs, boosting accessibility and adoption across varied project sizes.

France’s IoT in construction market posted a CAGR of about 13.6% during 2020–2024, increasing to 14.8% for 2025–2035. Initial growth was propelled by adoption in high-value public infrastructure upgrades and regulatory-driven safety projects. The upcoming decade is projected to see broader use of IoT in energy efficiency monitoring, predictive maintenance, and worker safety compliance across both urban and rural developments. Government funding for digital transformation in construction, coupled with the expansion of high-speed connectivity, will help overcome previous adoption barriers. French contractors are increasingly leveraging IoT data for project scheduling and cost control, enabling improved coordination between site teams and project managers.

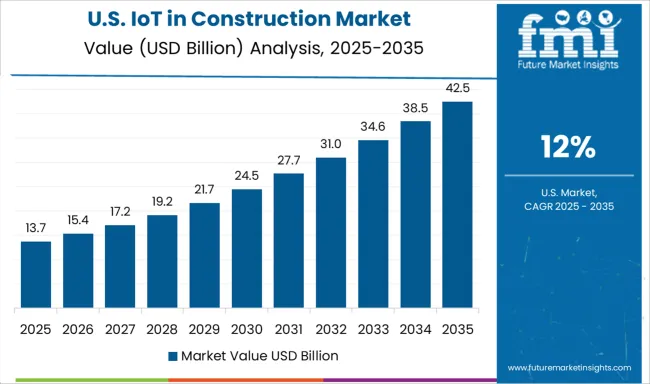

The IoT in construction market in the United States had a CAGR of around 10.9% during 2020–2024, rising to 12.0% for 2025–2035. Early adoption focused on large-scale commercial projects and high-profile infrastructure builds, with slower penetration among smaller contractors. The improvement in growth rate is being driven by rising demand for connected fleet management, worker safety solutions, and real-time site analytics. Adoption is further supported by insurance incentives for IoT-based safety compliance and increasing integration with digital project management systems. The competitive landscape is evolving with tech firms and equipment manufacturers collaborating to offer turnkey IoT solutions tailored for varied USA construction needs.

The IoT in construction market is driven by major technology and equipment providers delivering connected solutions for site automation, safety, and operational efficiency. Autodesk Inc. leads with its cloud-based construction management platforms integrating IoT-enabled data from sensors and machinery to improve project planning, monitoring, and asset utilization. Oracle Corporation supports the market through its construction and engineering cloud suite, offering IoT-driven analytics that enhance project visibility and resource optimization.

Caterpillar Inc. integrates IoT into its heavy machinery and equipment lines, enabling real-time tracking, predictive maintenance, and remote performance management for construction fleets. Hexagon AB focuses on precision measurement and geospatial solutions that connect IoT sensors, drones, and analytics to optimize construction workflows and structural accuracy. Hilti Corporation develops IoT-enabled tools and asset tracking systems that improve equipment utilization and safety compliance across job sites. CalAmp Corporation provides telematics and IoT connectivity platforms designed for asset tracking, equipment monitoring, and site management. Giatec Scientific Inc. specializes in smart concrete testing and monitoring systems that utilize IoT sensors to assess curing, temperature, and strength in real time.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.3 Billion |

| Component | Hardware, Software, and Services |

| Deployment Mode | Cloud-based, On-premises, and Hybrid |

| Technology | Artificial intelligence, Big data analytics, Cloud computing, Augmented reality and virtual reality, and Others |

| Application | Real time asset tracking and monitoring, Site and worker safety, Project management, Quality control and compliance, Energy management and smart buildings, Predictive maintenance, and Others |

| End-User | Construction companies, Government and public sector, Equipment manufacturers, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Autodesk Inc., Oracle Corporation, Caterpillar Inc., Hexagon AB, Hilti Corporation, CalAmp Corporation, and Giatec Scientific Inc. |

| Additional Attributes | Dollar sales, share, competitive positioning, adoption across project types, regulatory drivers, integration trends, key end-user segments, and opportunities in predictive maintenance and safety compliance. |

The global IoT in construction market is estimated to be valued at USD 19.3 billion in 2025.

The market size for the IoT in construction market is projected to reach USD 72.1 billion by 2035.

The IoT in construction market is expected to grow at a 14.1% CAGR between 2025 and 2035.

The key product types in IoT in construction market are hardware, software and services.

In terms of deployment mode, cloud-based segment to command 61.2% share in the IoT in construction market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IoT In Aviation Market Size and Share Forecast Outlook 2025 to 2035

IoT in Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

IoT in Utilities Market Size and Share Forecast Outlook 2025 to 2035

IoT in Product Development Market Analysis - Growth & Forecast 2025 to 2035

IoT in Healthcare Market Insights - Trends & Forecast 2025 to 2035

Biotin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Biotin Gummies Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Biotin Supplement Market Analysis – Size, Share & Forecast 2025 to 2035

IoT in Supply Chain Market Insights – Trends, Growth & Forecast 2023-2033

Biotainer Market

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

AI in IoT Market Size and Share Forecast Outlook 2025 to 2035

Joint Reconstruction Devices Market Size and Share Forecast Outlook 2025 to 2035

Industrial IoT Market Size and Share Forecast Outlook 2025 to 2035

Marine Biotech Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Angiotensin Converting Enzyme Assay Kit Market Size and Share Forecast Outlook 2025 to 2035

Mining & Construction Drilling Tools Market Growth – Trends & Forecast 2024-2034

Intelligent IoT Market

Marine Prebiotics Market Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA