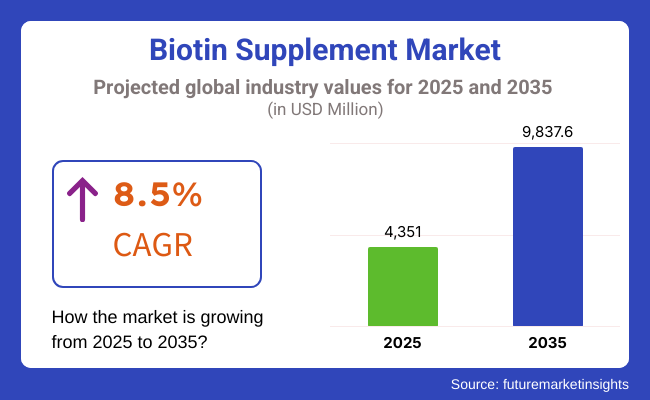

The global biotin supplement market is projected to reach a value of USD 4.3 billion in 2025 and is anticipated to expand significantly to approximately USD 9.8 billion by 2035. This growth reflects a robust CAGR of 8.5% over the forecast period. The demand for biotin supplements is rising globally as consumers increasingly focus on maintaining overall health, wellness, and physical appearance.

The supplement's perceived benefits for hair, skin, and nail health continue to drive consumer purchases, particularly in developed markets such as North America and Europe, where the culture of dietary supplementation is well established. The market’s expansion is also fueled by its growing accessibility through online platforms, offering consumers convenience and a wide variety of product options tailored to specific health needs.

The biotin supplement industry has witnessed increasing attention in recent years due to its critical role in metabolism and energy production, along with neurological functions. Scientific research continues to highlight biotin's importance in various physiological processes, which has positively influenced consumer perception and adoption of the supplement for daily use.

Additionally, the global shift towards holistic health and functional nutrition is making biotin supplements an integral part of the wellness routine for many individuals. Younger consumers, especially women, are increasingly considering these supplements as essential for improving hair growth and nail strength, contributing to the product’s popularity. Social media influence, celebrity endorsements, and health awareness campaigns have further propelled the market’s growth, as individuals seek solutions for visible and preventive health benefits.

However, despite this strong growth potential, the market also faces several challenges that could slightly restrain its expansion. One of the primary concerns is the increasing scrutiny from regulatory authorities over product labeling, ingredient authenticity, and potential side effects due to excessive consumption.

This has prompted manufacturers to focus more on transparency, clinical validations, and quality assurance in their product offerings. In response to evolving consumer demands and regulatory pressures, leading market players such as Nature’s Bounty, Natrol LLC, NOW Foods, Solgar, and Jarrow Formulas Inc. are introducing innovative product formats like biotin-enriched beverages and vegan-friendly supplements.

These innovations are expected to sustain market momentum by offering differentiated products that cater to the rising preference for clean-label, plant-based, and personalized nutrition solutions globally.

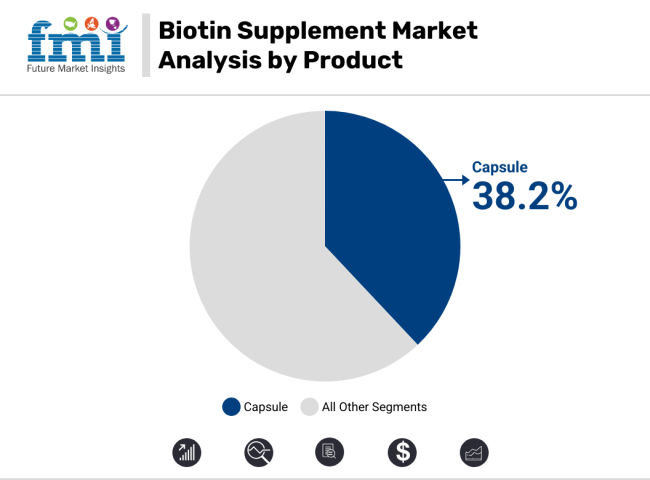

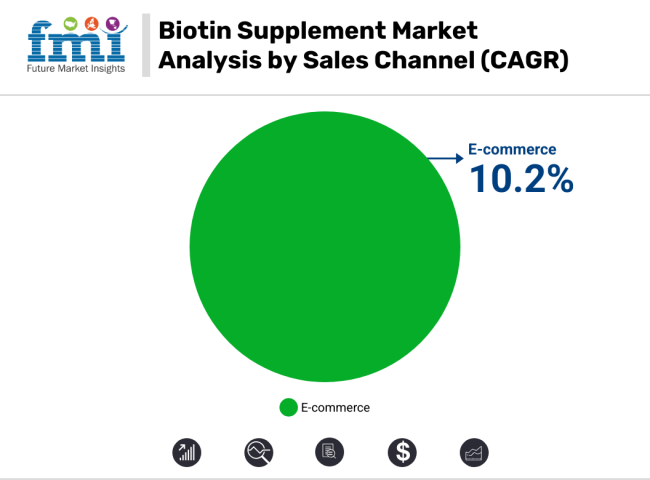

The global biotin supplement market is segmented based on product, sales channel, and region. By product, the market is categorized into capsules, tablets, gels, beverages/drinks, gummies, and powders. Based on sales channel, the market is segmented into supermarkets/hypermarkets, specialty stores, e-commerce, pharmacies, and others (convenience stores and fitness centers). Regionally, the market is classified into North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and Middle East, and Africa.

Capsules dominate the global biotin supplement market, capturing the largest market share of 38.2% in 2025. This product form remains highly preferred among consumers worldwide due to several advantages, including ease of consumption, precise dosage control, and extended shelf life compared to other formats. Capsules are particularly favored in regions like North America and Western Europe, where consumers actively seek reliable and convenient supplement solutions to address concerns related to hair fall, brittle nails, and skin health.

Their widespread availability in both online and offline retail channels further strengthens their position as the leading product segment. The introduction of plant-based and vegan capsule variants has also resonated with health-conscious and ethically driven consumers, enhancing market penetration in key developed economies.

Meanwhile, the gummies segment has emerged as a popular alternative to traditional supplement forms, particularly among the younger generation and millennial consumers who prioritize taste, texture, and overall consumption experience.

The demand for flavored, chewable, and sugar-free gummy supplements is rising rapidly, with many manufacturers innovating to launch clean-label, vegan, and organic biotin gummy products. The appeal of gummies also extends to individuals who have difficulty swallowing pills or capsules, expanding the potential consumer base in both emerging and mature markets.

Other product forms, such as tablets, gels, beverages/drinks, and powders, remain a cost-effective choice and continue to hold relevance among price-sensitive consumer groups, especially in developing regions. Gels and powders are increasingly sought after by fitness enthusiasts and consumers integrating supplements into daily smoothies, shakes, or protein mixes.

E-commerce is projected to witness the fastest growth, registering a CAGR of 10.2% from 2025 to 2035. The rapid expansion of digital platforms, increasing consumer preference for convenient shopping, and the availability of a wide range of biotin supplement products with customer reviews and personalized recommendations are major drivers fueling the growth of this channel.

Additionally, the rise in direct-to-consumer (DTC) brands and subscription-based supplement services is further propelling online sales globally, especially in North America, Europe, and parts of Asia Pacific.

Supermarkets/hypermarkets continue to hold a significant share in the biotin supplement market due to their widespread presence and the ability to offer trusted brands under one roof. Consumers prefer these outlets for in-person product evaluation and instant purchase, particularly in developing regions where online penetration remains moderate. Specialty stores, focusing on health and nutrition products, remain relevant by providing expert advice and premium supplement options to informed buyers seeking quality assurance.

Pharmacies maintain their importance as reliable distribution points, especially for consumers who require healthcare professional recommendations before supplement intake. Meanwhile, the 'others' segment, which includes convenience stores and fitness centers, contributes a small but steady share to the overall market, addressing impulse and need-based purchases in urban areas.

Complications Related to the Biotin Supplement Hinders the Market

As many of consumers were found mired in misunderstandings coupled with stringent regulations, ambiguous dosage recommendations, and deceptive marketing by some brands that complicate matters, they suffer more from issues like ineffectiveness, counterfeits, or low-quality products.

Continued controversy as to whether biotin does any good for patients beyond deficiency treatment causes reluctance. Very high prices for highly valued plant-made or organic biotin supplements also reduce availability in some areas. Opportunities: Biotin-enriched functional foods and beverages are creating new markets.

Increasing Demand for Organic and Environment Friendly Supplements Expands the Opportunities in the Market

Firms are now investing heavily in research and development to produce better, more convenient supplements based on health needs. Brands are now responding to consumers' growing awareness of sustainability and ingredient transparency by offering biotin from organic and environmentally friendly sources.

Those investing in clinical research and collaborating with health care providers build trust with consumers and differentiate from others. Meanwhile, biotin blends with synergistic vitamins and minerals are gaining traction, as more consumers want all-in-one supplements for overall health.

Plant-based Formulation

Increased demand for cruelty-free and sustainable supplements has encouraged manufacturers to produce plant-based biotin from organic sources. Vegan options derived from natural sources such as sunflower and algae are being more sought after. This trend fits into the larger clean-label movement whereby consumers are looking into products that are ethically sourced, free from chemicals, and sustainable from the environment viewpoint.

Subscription-based Supplement Model

Personalized supplement plans are emerging as a preferred option, whilst subscriptions have made it easier for consumers to adhere to their health regimes. Brands that offer customized biotin supplements according to individual health needs and lifestyles are experiencing heightening demand.

The companies that are engaged in AI health assessments to create personalized supplement packs are gaining momentum in the market. As convenience for wellness routines continues to be a huge catchphrase, offering automated refill services is gaining traction for direct-to-consumers.

People interested in better hair, skin, and nail health began utilizing biotin supplements, and this interest made the biotin supplement market grow rapidly. Social media trends, endorsement from celebrities, and e-commerce-enabled accessibility made it easier for consumers to access biotin products.

Brands have also launched plant-based and vegan-friendly options to embrace a wider audience. However, this also raised safety concerns about misleading health claims, biotin's potential interference with lab tests, and the oversaturation of the market, which all added to regulations and calls for further scientific research to back claims by products.

The prospective advancements of personalized nutrition will include the market being developed into one that has more bioavailable biotin formulas and AI-driven applications to track supplement effectiveness. Regulatory agencies will tighten the reins with labels and marketing claims about products.

That will ensure transparency and consumer trust. On their part, sustainability will take center stage, with brands adopting plant-based biotin, biodegradable packaging, and eco-friendly production processes.

Market Outlook

With more people in the USA focusing on health and wellness, especially with regard to hair, skin, and nail care, the USA market for biotin supplements is growing rapidly. The increasing awareness of biotin deficiency and rising interest in dietary supplements are driving many consumers to integrate biotin into their daily routines.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.3% |

Market Outlook

Germany's market for biotin supplements is thriving as a result of a robust healthcare system and a population passionate about nutrition health. Many incorporate biotin into their everyday lives with a preventive healthcare regimen and a trend toward the use of natural products.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5.8% |

Market Outlook

India's biotin supplements industry is booming due to growing health awareness and growing disposable incomes. As individuals are now inclined towards perceiving well-being as an important aspect, the growing middle-class get exposure to receive health knowledge and biotin supplements have emerged as a dominant factor.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.5% |

Market Outlook

The Japanese biotin supplement market is booming based on its advanced healthcare technology and robust preventive health system. People are relying on biotin supplements to help with well-being, given the aging population and high medical standards.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.0% |

Market Outlook

With rising healthcare services and increased awareness of health and wellness, Brazil's market for biotin supplements is gradually claiming a huge space. With increasing awareness regarding beauty and self-care trends, biotin supplements have become popular with people looking to support their hair, skin, and health in general.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 5.0% |

Nature's Bounty (21.4%)

Nature's Bounty is a company in the supplement industry globally with a line of biotin products that caters to nearly all consumer choices while keeping up its brand of quality and price.

Natrol (14.5%)

Natrol offers very strong biotin supplements and is found to be effective in maintaining the well-being of nails, skin, and hair using the technology for rapid dissolution which ensures highest effect.

NOW Foods (11.2%)

NOW Foods advocates for natural ingredients with various choices available in its portfolio of biotin supplements that are most ideal for consumers who want non-GMO and allergen-free choices.

Sports Research (8.5%)

While after a health-focused audience, Sports Research brings together biotin and coconut oil in the soft gel formula for better absorption of nutrients and the appeal to the fitness-conscious group.

Solgar (5.8%)

Solgar biotin supplements focus on purity and are free from coeliac, nut, and dairy allergens, thereby catering to the consumers with special dietary needs.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2024) | USD 4.3 billion |

| Projected Market Size (2035) | USD 9.8 billion |

| CAGR (2025 to 2035) | 8.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion / volume in million units by product type and sales channel |

| Product Types Analyzed | Capsules, Tablets, Gels, Beverages/Drinks, Gummies, Powders |

| Sales Channels Analyzed | Supermarkets/Hypermarkets, Specialty Stores, E-commerce, Pharmacies, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Spain, China, India, Japan, South Korea, Australia, Brazil |

| Key Players | The Nature's Bounty Co., Natrol LLC, NOW Foods, Sports Research, Solgar, Church & Dwight Co. Inc., LifeGarden Naturals, Pure Research Products, Jarrow Formulas Inc., Doctors Best |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

| Customization and Pricing | Available upon request |

The overall market size for biotin supplement market was USD 4.3 billion in 2025.

The Biotin Supplement Market is expected to reach USD 9.8 billion in 2035.

The widespread availability of biotin supplements across supermarkets, pharmacies, online platforms, and specialty stores is making them more accessible to a larger consumer base.

The top key players that drives the development of biotin supplement market are Sports Research The Nature's Bounty Co., Solgar, Natrol LLC and NOW Foods

Capsules in product type of biotin supplement market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Unit Pack) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Distributional Channel, 2018 to 2033

Table 4: Global Market Volume (Unit Pack) Forecast by Distributional Channel, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Unit Pack) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 8: Global Market Volume (Unit Pack) Forecast by Product Form, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Distributional Channel, 2018 to 2033

Table 12: North America Market Volume (Unit Pack) Forecast by Distributional Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Unit Pack) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 16: North America Market Volume (Unit Pack) Forecast by Product Form, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Distributional Channel, 2018 to 2033

Table 20: Latin America Market Volume (Unit Pack) Forecast by Distributional Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Unit Pack) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 24: Latin America Market Volume (Unit Pack) Forecast by Product Form, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Distributional Channel, 2018 to 2033

Table 28: Western Europe Market Volume (Unit Pack) Forecast by Distributional Channel, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Unit Pack) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 32: Western Europe Market Volume (Unit Pack) Forecast by Product Form, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Distributional Channel, 2018 to 2033

Table 36: Eastern Europe Market Volume (Unit Pack) Forecast by Distributional Channel, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Unit Pack) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 40: Eastern Europe Market Volume (Unit Pack) Forecast by Product Form, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Distributional Channel, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Unit Pack) Forecast by Distributional Channel, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Unit Pack) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Unit Pack) Forecast by Product Form, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Distributional Channel, 2018 to 2033

Table 52: East Asia Market Volume (Unit Pack) Forecast by Distributional Channel, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Unit Pack) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 56: East Asia Market Volume (Unit Pack) Forecast by Product Form, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Distributional Channel, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Unit Pack) Forecast by Distributional Channel, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Unit Pack) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Unit Pack) Forecast by Product Form, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Distributional Channel, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Unit Pack) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Distributional Channel, 2018 to 2033

Figure 10: Global Market Volume (Unit Pack) Analysis by Distributional Channel, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Distributional Channel, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Distributional Channel, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Unit Pack) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 18: Global Market Volume (Unit Pack) Analysis by Product Form, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 21: Global Market Attractiveness by Distributional Channel, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Product Form, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Distributional Channel, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Distributional Channel, 2018 to 2033

Figure 34: North America Market Volume (Unit Pack) Analysis by Distributional Channel, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distributional Channel, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distributional Channel, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Unit Pack) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 42: North America Market Volume (Unit Pack) Analysis by Product Form, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 45: North America Market Attractiveness by Distributional Channel, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Product Form, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Distributional Channel, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Distributional Channel, 2018 to 2033

Figure 58: Latin America Market Volume (Unit Pack) Analysis by Distributional Channel, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Distributional Channel, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Distributional Channel, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Unit Pack) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 66: Latin America Market Volume (Unit Pack) Analysis by Product Form, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Distributional Channel, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Product Form, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Distributional Channel, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Distributional Channel, 2018 to 2033

Figure 82: Western Europe Market Volume (Unit Pack) Analysis by Distributional Channel, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Distributional Channel, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Distributional Channel, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Unit Pack) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 90: Western Europe Market Volume (Unit Pack) Analysis by Product Form, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Distributional Channel, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Product Form, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Distributional Channel, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Distributional Channel, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Unit Pack) Analysis by Distributional Channel, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Distributional Channel, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Distributional Channel, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Unit Pack) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Unit Pack) Analysis by Product Form, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Distributional Channel, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Product Form, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Distributional Channel, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Distributional Channel, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Unit Pack) Analysis by Distributional Channel, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distributional Channel, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distributional Channel, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Unit Pack) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Unit Pack) Analysis by Product Form, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Distributional Channel, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Product Form, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Distributional Channel, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Distributional Channel, 2018 to 2033

Figure 154: East Asia Market Volume (Unit Pack) Analysis by Distributional Channel, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Distributional Channel, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Distributional Channel, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Unit Pack) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 162: East Asia Market Volume (Unit Pack) Analysis by Product Form, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Distributional Channel, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Product Form, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Distributional Channel, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Distributional Channel, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Unit Pack) Analysis by Distributional Channel, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Distributional Channel, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distributional Channel, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Unit Pack) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Unit Pack) Analysis by Product Form, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Distributional Channel, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Product Form, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biotin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Biotin Gummies Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Supplements And Nutrition Packaging Market

Supplementary Protectors Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

Food Supplement Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

PDRN Supplements Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Industry Analysis in Europe - Size, Share & Forecast 2025 to 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Sleep Supplement Market Size and Share Forecast Outlook 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Supplements Market Analysis by Ingredient Type, Form, Customer Orientation , Sales Channel and Health Concer Through 2035

Analysis and Growth Projections for Green Supplement Business

Andro Supplements Market

Custom Supplement Formulation Service Market Size and Share Forecast Outlook 2025 to 2035

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Herbal Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beauty Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA