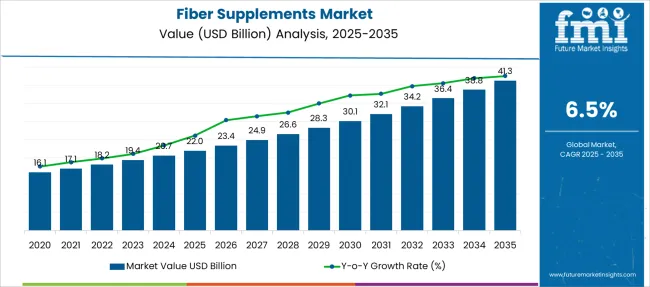

The Fiber Supplements Market is estimated to be valued at USD 22.0 billion in 2025 and is projected to reach USD 41.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Fiber Supplements Market Estimated Value in (2025 E) | USD 22.0 billion |

| Fiber Supplements Market Forecast Value in (2035 F) | USD 41.3 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The fiber supplements market is gaining strong momentum as consumers become increasingly conscious of gut health, cardiovascular well-being, and metabolic balance. The rising intake of processed and low-fiber foods has triggered a growing reliance on supplementary sources of fiber to fulfill daily nutritional requirements.

This trend is being reinforced by clinical recommendations and medical guidelines that emphasize fiber's role in reducing cholesterol, managing blood sugar, and supporting bowel health. The accessibility of various supplement formats, combined with improvements in taste masking, formulation stability, and product availability through e-commerce and pharmacy retail, has enhanced consumer adoption.

Increased product visibility through healthcare practitioner recommendations and the rising inclusion of dietary fiber in wellness and weight management routines are shaping future consumption behavior The market is expected to expand further as innovation in plant-based soluble fibers, prebiotic blends, and targeted formulations for different age groups gains traction in both developed and emerging economies.

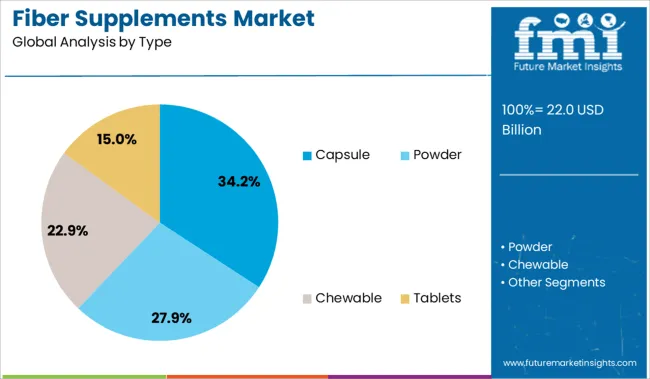

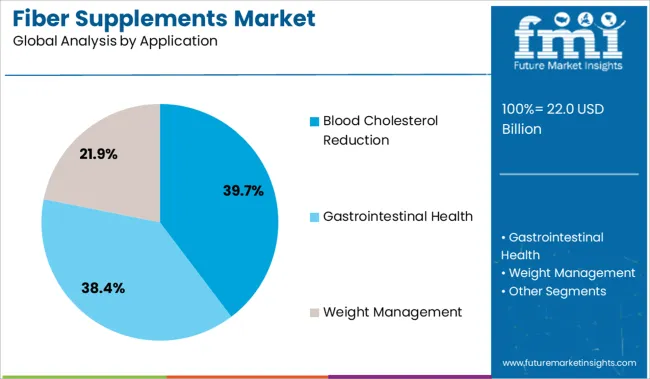

The market is segmented by Type and Application and region. By Type, the market is divided into Capsule, Powder, Chewable, and Tablets. In terms of Application, the market is classified into Blood Cholesterol Reduction, Gastrointestinal Health, and Weight Management. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The capsule segment is projected to account for 34.2% of the fiber supplements market revenue share in 2025, positioning it as the leading format type among consumers. The popularity of capsules is being driven by their ease of consumption, precise dosing, and extended shelf life. Capsules are widely preferred for their tasteless and odorless properties, which address palatability concerns associated with bulkier fiber powders or gritty textures.

The encapsulated format ensures controlled delivery and better bioavailability while reducing the risk of gastrointestinal discomfort. Manufacturers have increasingly introduced plant-based capsules that align with clean-label and vegan preferences, further elevating appeal among health-conscious demographics.

Additionally, the convenience of carrying and consuming capsules without mixing or measuring supports on-the-go lifestyles, particularly for working professionals and older adults The formulation of multi-functional blends within capsules, targeting heart health, digestion, and metabolic support, has also enhanced value perception, contributing to the sustained growth of this segment.

The blood cholesterol reduction segment is expected to represent 39.7% of the overall fiber supplements market revenue share in 2025, establishing itself as the most prominent application. This growth is being influenced by the increasing prevalence of cardiovascular diseases and heightened consumer focus on proactive health management. Soluble fibers such as psyllium husk and beta-glucan have demonstrated clinical efficacy in lowering LDL cholesterol levels, which has driven their inclusion in daily supplementation routines.

Healthcare professionals are recommending fiber supplements as adjunct therapy for individuals with borderline or elevated cholesterol levels, particularly those seeking non-pharmaceutical interventions. The expansion of this segment is further supported by product innovations that blend cholesterol-lowering fibers with other heart-friendly nutrients, enhancing product appeal.

Regulatory backing for health claims related to fiber's role in cholesterol reduction and increased consumer education campaigns have also contributed to rising awareness As the global burden of lifestyle diseases continues to grow, the demand for fiber supplements targeting cardiovascular health is expected to remain strong.

Fiber supplements allow people to boost the amount of fiber in their diet in case they do not have adequate consumption from their daily meals.

There is a significant transition in dietary habits and lifestyles of people, which is driving the traction for fiber-rich supplements. In developing countries and fast-paced economies, people run around the clock to earn their living, which has led to less consumption of nutrients in their day-to-day life.

This is the principal reason driving the fiber supplement market growth at large.

Changes in eating habits and significant deficiency of fiber amongst people is a considerable factor driving the development of the fiber supplements market at a global level. Moreover, dieticians are suggesting the consumption of fiber supplements to help people gain sufficient levels of fiber in the body.

Rising awareness of how fiber is important for the body and how deficiency of necessary fiber can lead to negative effects on the body serves to be a crucial factor driving the fiber supplements market at a rapid pace.

Growing gluten-free intolerance is also creating a lucrative opportunity for the fiber supplements market to grow. Consumer preference for gluten-free products is driving fiber supplement companies increasingly focus on providing gluten-free high-fiber variants.

In addition to this, new and innovative sales strategies are fueling the adoption of fiber supplements. Nutraceutical companies are increasingly experimenting with various fibers to develop fiber supplements that taste good and accelerate the fiber supplements market towards growth.

However, stringent FDA regulations are posing a significant barrier to the entry of fiber supplements into the market. Product testing and approval is a lengthy and costly process, and the manufacturing stage can drive production costs to excessive levels.

Furthermore, an increased number of misbranded and adulterated products coupled with mislabeling claims have hampered the confidence of consumers in fiber supplements. These factors are likely to limit the growth in the fiber supplements market.

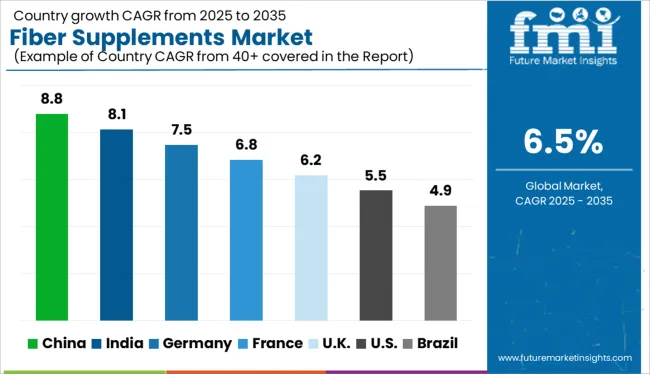

At present, the global market of fiber supplements is majorly occupied by the North American, European, Asia-Pacific (APAC), Middle East, and African regions.

The majority of the fiber supplement-producing manufacturers are present in these regions, which leads to large fiber supplement market shares.

A significant share of the North American fiber supplements market is poised to grow since there has been a rise in the preference for health concerns among the population.

Growth in the consumption of fiber-rich diets, and enlargement of the fitness and health industry have rendered the opportunity for the fiber supplements market to grow in this region.

An overall increase in the per capita income and a surge in disposable income are motivating consumers to spend more money than usual, due to which consumers are ready to pay a good amount for better taste and quality, which is giving the manufacturers in these regions a great opportunity to fuel the fiber supplements market.

A lot of companies provide sugar-free, taste-free fiber supplements, and there is growing adoption of in-trend ingredients in variants, likely to drive the growth. Some of the key players in the global fiber supplements market include Robinson Pharma, Inc., Renew Life, Benefiber, Citrucel, Metamucil, Walgreens, Now, Optimum Nutrition, BarnDad’s, Myogenix, Twinlab, Garden of Life, and SPECIES.

Some of the notable developments in the competitive landscape of the fiber supplements market include:

As consumers are in pursuit of supplements that deliver optimum fiber and protein, Atkins brand has launched Atkins Plus Protein & Fiber shakes in two varieties, Creamy Milk Chocolate, and Creamy Vanilla.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 6.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Kilotons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Type, Source, Nature, Application, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled | Robinson Pharma, Inc.; Renew Life; Benefiber; Citrucel; Metamucil; Walgreens; Now; Optimum Nutrition; BarnDad’s; Myogenix; Twinlab; Garden of Life; SPECIES |

| Customization | Available Upon Request |

The global fiber supplements market is estimated to be valued at USD 22.0 billion in 2025.

The market size for the fiber supplements market is projected to reach USD 41.3 billion by 2035.

The fiber supplements market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in fiber supplements market are capsule, powder, chewable and tablets.

In terms of application, blood cholesterol reduction segment to command 39.7% share in the fiber supplements market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiber to the Home Market Size and Share Forecast Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Collimating Lens Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber-Based Blister Pack Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Testing Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Coding System Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer (FRP) Rebars Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA