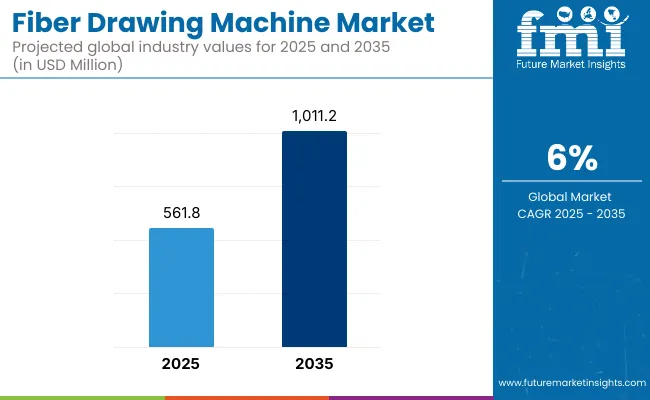

The fiber drawing machine market is estimated to grow at a steady pace, standing at USD 561.8 million in 2025 and forecast to reach around USD 1,011.2 million by 2035, exhibiting a CAGR of 6.0%.

This growth is being fueled by increasing global demand for high-speed data communication and telecommunication networks. Cloud computing and data centers are also driving demand. With hyperscale and edge computing facilities becoming more widespread, fiber connectivity is essential for handling large volumes of data at high speeds and low latency. Fiber production needs to be scaled up by manufacturers to address the increasing density and complexity of server interconnects.

The industry finds uses in military, industrial, and medical uses where specialty optical fibers are used for precision sensing, diagnostics, and secure communications. These machines enable customized manufacture of specialty fibers with demanding tolerances and desirable mechanical or thermal characteristics.

Technological innovation is revolutionizing the space. Automated fiber drawing systems with laser heating, real-time diameter control, and in-line tension management allow for increased throughput and lower defect rates. These developments are improving process efficiency, fiber uniformity, and long-term reliability.

Challenges are high capital outlays and requirements for experienced technicians to run and maintain such advanced equipment. Also, disruptions in global supply chains particularly of rare-earth elements that go into fiber preforms can affect production schedules and utilization rates of the machines. The drive towards green and energy-efficient production is also impacting machine design.

The latest systems are being made to reduce energy consumption during high-temperature fiber drawing and to include intelligent diagnostics that minimize waste and downtime. The Asia Pacific region dominates, followed by China, Japan, and South Korea's fiber-optic manufacturing hubs. North America and Europe follow suit, with large investments in telecom infrastructure modernization and research and development on specialty fibers.

The industry is undergoing great growth, with increased demand coming from major sectors such as the textiles, automobile, and healthcare industries. Sales expansion is accelerated due to the production growth in the high-performance fiber for novel applications, improvement of technology through rising efficiency and output of the machines, and an increase in manufacturing automation uptake.

The textile sector is one of the primary consumers of these machines. It is experiencing growth in the production of synthetic and natural fibers, which is adding a major boost to demand. Additionally, the automotive sector's expanded application of lightweight composite materials requires sophisticated fiber drawing technologies, further driving sales growth.

Europe and North America also hold significant shares based on technological growth and strong industrial production. Industry segmentation by type (polymer, textile, composite, others) and application (textile, automotive, medical, aerospace, others) also offers a nuanced picture of specific drivers of growth.

From 2020 to 2024, the industry developed step by step with the growing demand for high-performance fibers in the automotive, telecommunications, and healthcare industries. The fast pace of development of fiber optic technology and the emerging requirement for light, high-strength materials in the automotive and aerospace sectors stimulated the demand for advanced machines for fiber drawing.

The manufacturing and supply chain were impacted by the COVID-19 pandemic for some time, which hindered it to some extent. But as soon as industries adjusted to new working habits, the industry resumed. Innovation driven by technology in terms of automation, energy efficiency, and precision kept pushing the evolution of new machines.

From 2025 to 2035, the industry will witness more radical developments, with emphasis on the development of more energy-efficient, automatic, and versatile fiber drawing machines. Demand for high-performance fibers in various sectors, such as telecommunications, renewable energy, and automotive, will increase, also propelling the demand for these machines.

Sustainability will be one of the major drivers since the industry takes into consideration equipment that minimizes waste, energy consumption, and material usage. Besides, Industry 4.0 and smart manufacturing will infuse IoT capabilities into fiber drawing machines so that real-time monitoring, predictive maintenance, and process optimization are attainable.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increasing need for high-performance fibers in telecom, automotive, and medical applications. | Continued growth is due to the growing demand for high-performance materials in emerging technologies, especially in green and sustainable technologies. |

| Enhanced automation, precision, and energy efficiency in fiber drawing machines. | Industry 4.0 focus, IoT integration, and smart manufacturing for enhanced productivity and real-time monitoring. |

| Supply chain disruptions due to the COVID-19 pandemic; adaptation of manufacturing processes. | Effective supply chains with a focus on sustainability and waste reduction; energy-efficient production processes. |

| Sustained demand for optical fibers in telecom networks and medical technology. | Development of optical fiber technology in 5G networks, renewable energy technologies, and medical technologies. |

| First steps toward minimizing energy use and waste. | Strong emphasis on environmentally friendly production methods and materials and a commitment to sustainability and energy-efficient processes. |

| Increased utilization in automotive, telecommunications, and healthcare applications for lightweight, high-strength fibers. | Increased use of renewable energy, smart cities, and electric vehicle applications demands newer fiber technologies. |

The fiber drawing machines market is of utmost significance in optical fiber manufacturing, which finds wide applications in telecommunications, data centers, medical equipment, and defense.Moreover, the machines must also be properly calibrated and manned by experienced personnel in order to gain consistent fiber quality, but technical personnel are in short supply within the industry. Therefore, the industries can encounter higher labor costs and efficiency loss if there are human faults.

Introducing new advanced fiber drawing machinery into existing production facilities turns out to be a complex and costly endeavor. Integration problems can occur as well when attempting to mate new systems to old auxiliary equipment, leading to inefficiencies and unplanned infrastructure upgrades.Future regulatory pressure on the industry, specifically on emissions, energy consumption, and sound, will fall on the sector.

Addressing such shifting environmental requirements will require machine redesign or retrofitting expenses, further increasing the cost of operation.Another looming threat is technological obsolescence. As better drawing technology develops, equipment installed can quickly be made obsolete unless manufacturers invest in modular, upgradable equipment.

Fiber Drawing Machine Market (2025 to 2035)

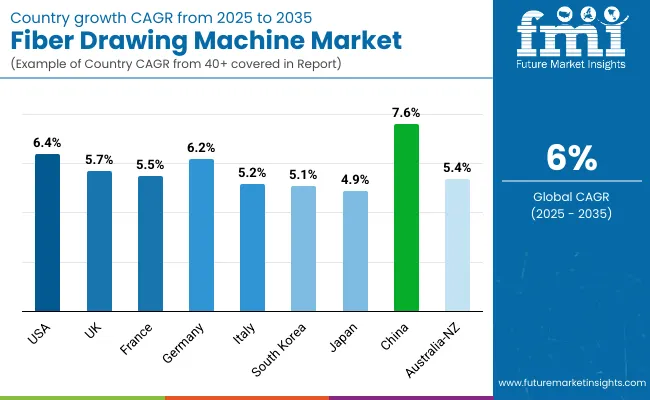

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.4% |

| UK | 5.7% |

| France | 5.5% |

| Germany | 6.2% |

| Italy | 5.2% |

| South Korea | 5.1% |

| Japan | 4.9% |

| China | 7.6% |

| Australia-NZ | 5.4% |

The USA is projected to grow at 6.4% CAGR during the forecast period. The growing installation of high-speed internet infrastructure and greater investment in optical fiber networks are driving growth. Government-backed initiatives to boost broadband penetration in rural and underserved areas are encouraging local production and upgrade of fiber processing facilities.

The presence of leading telecom and data center companies is fueling demand for high-capacity, high-output drawing machines with precise control systems. Additionally, the urgency to roll out 5G deployment is also motivating fiber manufacturers to enhance quality, speed, and efficiency in production, having a direct influence on sales.

The UK will grow at 5.7% CAGR over the forecast period. The growth of fiber-to-the-home (FTTH) services and national digital connectivity objectives is driving growth. Telecommunications companies are investing in high-capacity fiber networks, driving demand for efficient drawing machines that can meet stringent quality requirements.

Emphasis on sustainability and energy efficiency is also driving the use of advanced drawing machines that minimize operational costs and environmental footprint. The existence of niche technology integrators and engineering companies is also improving adoption by providing solutions specifically adapted for smaller quantities of fiber production demand. Government support policies and public-private initiatives also enforce stability in the industry over the long term.

France would register a 5.5% CAGR through the study period. Digitalization of urban and rural spaces, as well as strong demand for smart city infrastructure, is driving demand for fiber-optic components and equipment employed in their production. Telecommunication operators and domestic manufacturers are concentrating on the rollout of high-speed networks, thereby driving investment in fiber drawing machines.

Moreover, industrial automation within manufacturing is inducing the replacement of aged systems with high-precision, digitally controlled equipment. As automation and energy conservation emerge as priorities, producers look for increased throughput capacity in fiber drawing machines, smart controls, and real-time monitoring to meet growing industrial requirements.

Germany will register a 6.2% growth CAGR during the study period. As one of the premier industrial machinery and engineering industries, Germany is still the leader in the production supply chain of fiber optics. The economy is complemented by state-of-the-art R&D in photonics and fiber technology and strong investments in 5G and industrial internet solutions infrastructure.

Local and export-oriented production units require high, enabling constant equipment upgrades. Machine precision, reliability, and Industry 4.0 platform compatibility are priorities for manufacturers, which has increased demand for intelligent, sensor-based fiber drawing machines. Academic-industrial collaborations also encourage innovation and growth.

Italy is expected to see a growth of 5.2% CAGR during the study period. Upgradation and expansion of telecommunication and broadband networks are fueling investment in fiber manufacturing plants, including drawing machines. Italian manufacturers are considering automation to increase the quality and uniformity of fiber drawing, led by increasing demand from local telecom operators.

Export-oriented production of fiber-optic components for the European region also fuels equipment upgrades. Small and mid-sized companies are in demand for basic, low-maintenance systems the most. Industry demand is also being fueled by ongoing digitalization across public utilities and infrastructure, which is compelling suppliers to adhere to global standards.

South Korea would likely grow at 5.1% CAGR throughout the study. South Korea's intense emphasis on 5G technology, smart cities, and connectivity offers a conducive environment for growth. Manufacturers are determined to maximize production efficiency, driving the adoption of high-speed drawing-capable automated systems and real-time diagnostic capabilities.

With significant investments in cloud infrastructure and digital services, fiber production facilities are ramping up capacity to meet increasing domestic demand. Government-backed digital policies and a focus on fiber-optic technology export are also the reasons behind the long-term industry growth, coupled with process engineering innovations.

Japan will expand at a CAGR of 4.9% during the research period. With a well-established telecom infrastructure, Japan is growing primarily through equipment refinements and shutting down of aged fiber-manufacturing plants. Machine purchasing decisions are being driven by high quality, reliability, and process control.

Companies are adopting automation, lower downtime, and high-performance cooling in drawing machines as major features. The focus is also shifting towards the production of ultra-low-loss and high-performance fibers for niche applications such as submarine cables and precision sensors. Collaborations between machinery developers and fiber producers are also increasingly optimizing product designs to meet future bandwidth and speed demands.

China is expected to grow at 7.6% CAGR during the period of study. China is one of the largest producers and consumers of fiber-optic cables globally, and hence, it is in the strongest demand for fiber drawing machines. The development of 5G infrastructure, smart grid deployment, and broadband initiatives are fueling the need for mass production.

Local players are increasing capacity by introducing automated and high-volume machines with reduced cycle times. Government assistance toward technological self-sufficiency and indigenous innovation continues to be a driving force behind investment in the latest-generation equipment. Export demand from emerging economies also fuels continued growth within fiber processing plants, which is inducing healthy, long-term growth for the machine category.

TheAustralia-New Zealand region is expected to grow at a 5.4% CAGR during the period of study. National broadband development, especially in regional and rural areas, is driving investment in fiber manufacturing plants. Manufacturers and utility companies are seeking high-end drawing equipment to promote the reliability, speed, and long-term performance of optical fiber networks.

Demand in Australia for fiber in smart utility and mining applications adds further growth in sales. New Zealand's focus on green infrastructure and technological innovation is driving demand for energy-saving and modular designing machines. Both countries benefit from access to global supply chains and raising international awareness of digitalization's role in economic development.

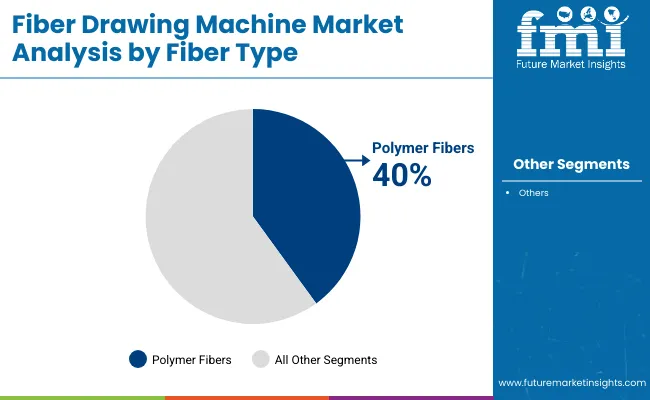

By fiber type, the industry is segmented into polymer fibers and optical fibers. Polymer Fibers account for a revenue share of 40%, while Optical Fibers will have approximately 20% share.

Due to a wide range of applications in the textile, automotive, and consumer goods industries, Polymer fibers are expected to be the market leader. Nylon, polyester, and polypropylene are some fibers used for the making of products such as clothing, ropes, and industrial textiles.

The continued development of the fiber drawing machine by DuPont and Invista to achieve high-performance specifications for polymer fibers with desired specific properties, such as strength, elasticity, and abrasion resistance, renders polymer fibers in high demand.

Consumers have recently started to focus on being price-conscious in terms of colorful, fashionable, yet durable and lightweight products. Also, with the industry's increasing need for automation in order to attain efficient production means, the demand for fiber drawing machines working with polymer materials at fast speeds and higher precision has also grown.

Optical fibers, which only represent 20% of the market, are expected to keep increasing with the demand trends of telecommunication and data transmission. They constitute the backbones of high-speed internet and telecommunication networks since they carry high volumes of data with colossally low losses.

Industry leaders in the production of optical fibers, like Corning Incorporated and Furukawa Electric Co., Ltd., use fiber drawing machines to design fibers with very accurate diameters and optimal flexibility for easier installations, on-site implementation, and long-distance data transmission. The surge in the need for fast internet and dependable infrastructure for communication will only serve to advance the growth of the optical fiber segment.

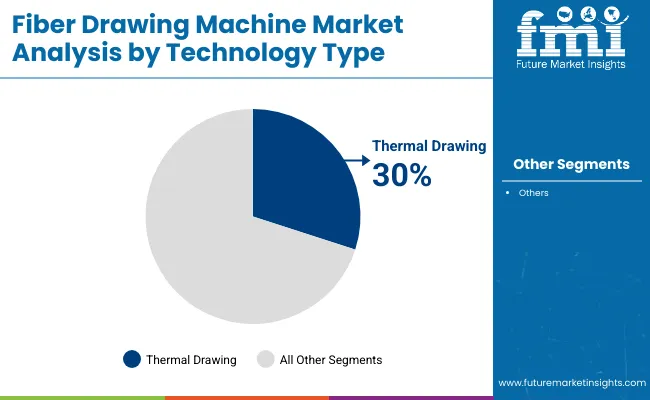

The industry is further sub-segmented into Technology Types such as Thermal Drawing and Vapor Deposition. In 2025, Thermal Drawing technology is projected to hold a share of 30%, while Vapor Deposition technology will take a 25% share.

Whatever the order, Thermal Drawing is the predominant segment as it is used extensively to produce polymer and optical fibers. Thermal drawing heats a fiber preform to a specific temperature and draws it into thin fibers under controlled conditions. The thermal drawing technique is preferred for producing high-quality fibers with consistent diameter and strength.

This makes it suitable for the bulk production of fibers. Some examples of companies in the fiber optic cable industry that employ thermal drawing to make optical fibers for telecommunications, high-speed internet, and data are Corning Incorporated and Prysmian Group. Therefore, the growing demand for high-speed data services and the ever-increasing connected devices spur the regional increase in thermal drawing technology in fiber optic production.

Vapor Deposition technology is increasingly applied in the manufacture of optical and specialty fibers, which involves very thin layers of materials vacuum-deposited onto substrates using vaporized precursors. Vapor deposition excels at making fibers associated with some type of coating or other specialty qualities, such as high strength, durability, or conductivity.

Some of the leading names involved in optical fiber manufacturing through vapor deposition include Furukawa Electric Co., Ltd. and Sumitomo Electric Industries. These companies manufacture fibers that can be incorporated into advanced telecommunication systems and industrial applications. The growing demand for specialized optical fibers with specific desired characteristics continues to fuel this growth in technology.

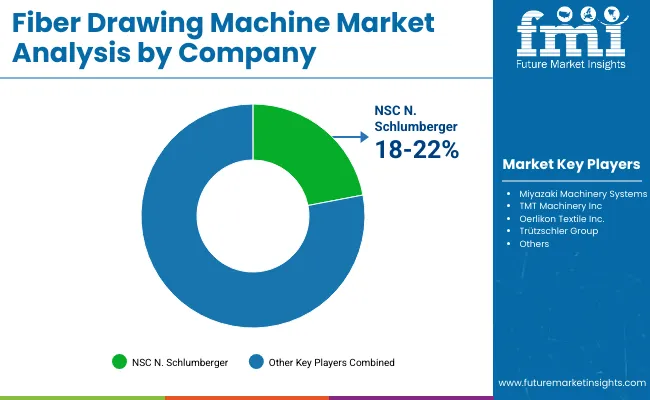

The manufacturers endeavor to develop advanced technology for precision engineering and automation to boost fiber processing efficiency. Some of the current players, such as NSC N. Schlumberger, Miyazaki Machinery Systems, and TMT Machinery, provide cutting-edge machines for high-speed production while supporting high fiber quality. These companies use digital control systems, AI-based configuration adjustments and very tight temperature control to optimize performance and reduce waste.

European and Asian machine manufacturers like Toho International, AikiRiotech, and Niehoff GmbH push for innovations that are accomplished through continuous R&D investments and customized solutions for diverse fiber applications. Japanese and German companies with expertise in precision manufacturing increase the durability of machinery, ensuring stable performance in high-output environments.

Consolidation and strategic alliances are major market strategies. Companies like Oerlikon Textile and Trützschler Group concentrate on the technological portfolio through partnerships and acquisitions while enhancing their position in emerging segments of fiber processing. Moreover, the development of sustainable fiber production solutions is a growing focus for companies such as Bongard GmbH and Saurer AG, which embed energy efficiency within their machine designs.

The industry is also undergoing disruption, with machine manufacturers moving toward automation and IoT-enabled machines. The Addas Group and Texdata International are now integrating real-time monitoring systems linked to the fiber drawing equipment, thus allowing manufacturers to optimize their fiber drawing processes through data-driven decisions, ultimately improving efficiency as well as reducing defect volumes in production output.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| NSC N. Schlumberger | 18-22% |

| Miyazaki Machinery Systems | 14-18% |

| TMT Machinery Inc | 12-16% |

| Oerlikon Textile Inc. | 10-14% |

| Trützschler Group | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| NSC N. Schlumberger | Develops high-speed fiber drawing machines with AI-based control systems. |

| Miyazaki Machinery Systems | Specializes in precision fiber processing equipment for synthetic and natural fibers. |

| TMT Machinery Inc | Focuses on automation-driven machines with real-time monitoring. |

| Oerlikon Textile Inc. | Integrates sustainable solutions into fiber drawing processes, enhancing energy efficiency. |

| Trützschler Group | Offers customizable fiber drawing machines with IoT -enabled performance tracking. |

Key Company Insights

NSC N. Schlumberger (18-22%)

A prominent producer of fiber drawing equipment, NSC N. Schlumberger features AI-driven precision controls for high-speed as well as low-defect fiber production.

Miyazaki Machinery Systems (14-18%)

Miyazaki Machinery Systems specializes in precision fiber processing for high-demanding industries with feature-rich automation.

TMT Machinery Inc (12-16%)

TMT Machinery specializes in data-centric fiber drawing solutions, including real-time performance monitoring for process improvement.

Oerlikon Textile Inc. (10-14%)

Oerlikon Textile saves energy with energy-efficient machines, making investments in sustainable manufacturing processes.

Trützschler Group (8-12%)

Trützschler Group deals in IoT-enabled machines for fiber drawing, providing customized solutions for various fiber applications.

Other Key Players (30-40% Combined)

The market is segmented into polymer, optical, composite/FRP, textile, and other categories.

The market is segmented into Thermal Drawing, Vapor Deposition, Direct Melt Process, Powder Based Process, Pultrusion, and Others.

The market is segmented into Textile Industry, Automotive Industry, Medical Industry, Aerospace Industry, and Others.

The market is segmented into North America, Latin America, Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The industry valuation is estimated to reach USD 561.8 million by 2025.

The industry valuation is projected to grow to USD 1,011.2 million by 2035, fueled by increased demand for polymer-based fibers in textiles, telecommunications, and composites.

China is expected to grow at a rate of 7.6%, driven by strong manufacturing infrastructure and rising investment in fiber production.

Polymer fibers are dominating due to their widespread use in technical textiles and optical fiber cables.

Leading companies include NSC N. Schlumberger, Miyazaki Machinery Systems, TMT Machinery Inc, Oerlikon Textile Inc., Trützschler Group, Toho International Inc., Aiki Riotech Corporation, Niehoff Gmbh, Bongard Gmbh, Saurer AG, Addas Group, and Texdata International.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Collimating Lens Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber-Based Blister Pack Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Testing Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Coding System Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer (FRP) Rebars Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Filters Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Test Equipment Market Outlook - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA