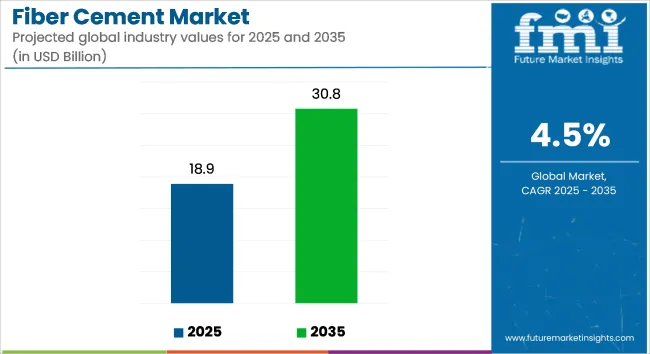

The global fiber cement market is estimated to be valued at USD 18.9 billion in 2025 and is forecast to grow to USD 30.8 billion by 2035, advancing at a CAGR of 4.5% during the forecast period. Market growth is being driven by increasing demand for durable, cost-effective, and environmentally sustainable construction materials across residential, commercial, and industrial infrastructure projects.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 18.9 billion |

| Industry Value (2035F) | USD 30.8 billion |

| CAGR (2025 to 2035) | 4.5% |

Fiber cement is being adopted as a fire-resistant, termite-proof, and moisture-tolerant alternative to traditional wood and asbestos-based construction products. The material is being used in roofing, wall cladding, external facades, siding panels, and structural applications. Its long service life and minimal maintenance requirements are making it a preferred solution among architects, contractors, and regulatory authorities focused on building safety and environmental compliance.

Strict building codes and safety standards are reinforcing the adoption of fiber cement boards and panels, particularly in regions experiencing rapid urbanization and population growth. Applications in affordable housing, modular construction, and disaster-resilient infrastructure are further accelerating demand. As governments implement green building regulations and promote sustainable development, the use of low-VOC, non-toxic materials such as fiber cement is being encouraged.

Adoption challenges include high upfront costs, labor-intensive installation processes, and limited consumer awareness in developing markets. However, ongoing product innovation aimed at improving workability, lightweight construction, and aesthetic design is helping mitigate these barriers. Manufacturers are investing in prefabricated and interlocking fiber cement systems to streamline installation and reduce overall project costs.

Eco-friendly variants of fiber cement, incorporating recycled content and low-emission binders, are being introduced to align with environmental building certifications such as LEED and BREEAM. These advancements are supporting broader use in both new construction and renovation projects.

With infrastructure investment being scaled across urban and semi-urban developments, fiber cement is expected to maintain relevance as a performance-driven and regulation-compliant material. The market is projected to experience sustained growth through 2035, supported by sustainability mandates, construction modernization, and the global shift toward resilient building systems.

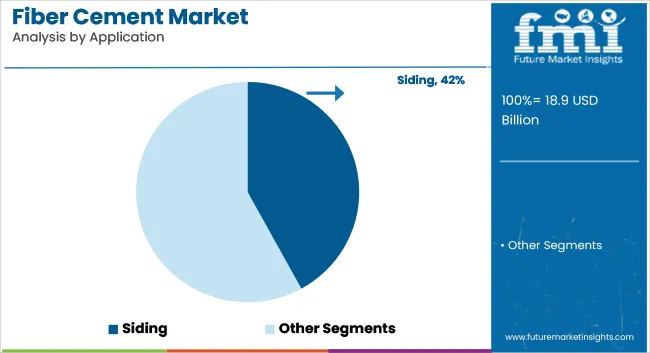

Siding is estimated to account for approximately 42% of the global fiber cement market share in 2025 and is expected to maintain leadership through 2035, growing at a CAGR of 5.7%. Its superior resistance to warping, rotting, pests, and weathering has made it the preferred solution in residential and light commercial projects.

Demand for plank, lap, and vertical siding panels is increasing in both developed and emerging markets due to rising renovation activity and fire-safety concerns. Fiber cement siding also offers a wide range of finishes that mimic wood, stone, or brick, which appeals to architects and homeowners seeking performance with visual appeal.

In addition, growing demand for low-maintenance materials is favoring siding adoption in suburban and coastal regions. Companies such as James Hardie and Nichiha are investing in high-performance textured finishes and factory-painted sidings to boost value-added offerings.

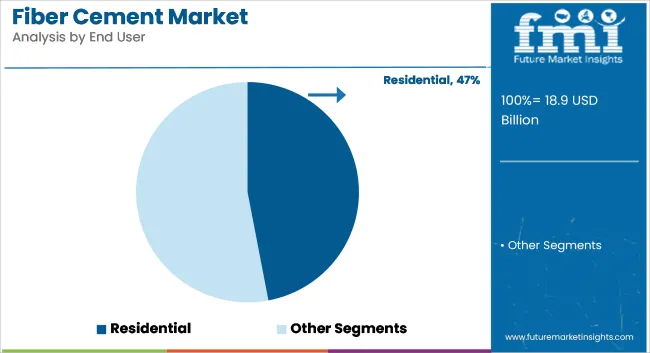

The residential segment is projected to contribute nearly 47% of fiber cement demand in 2025, With CAGR 4.4% led by strong single-family housing construction and increasing renovation spending. Rapid urbanization, rising disaster resilience standards, and a growing middle-class demographic in countries like India, Indonesia, and Brazil are fueling demand for affordable, long-lasting construction materials.

In developed markets, such as the USA and Europe, consumers are choosing fiber cement products for their energy efficiency, aesthetic appeal, and low lifecycle costs. Builders and developers are also integrating these products to meet evolving energy codes and green building certifications such as LEED and BREEAM. The segment is forecast to grow steadily at a CAGR of 5.5% over the forecast period, supported by government-backed affordable housing initiatives and eco-housing policies.

The USA industry is undergoing massive growth in light of escalating demand for hardy, low-maintenance, and fire-resistance building materials. In consideration of greater focus on sustainability and energy efficiency when it comes to building construction, the product is picking up the pace of utilization in both domestic and commercial buildings.

It can resist weathering, is non-flammable, and the material has appearance flexibility. This allows it to stand out as an optimum solution for cladding, roofing, and siding systems all over the country. FMI is of the opinion that the USA fiber cement market is slated to grow at 4.9% CAGR during the study period.

The urban and suburban building boom, which is being driven by increased investments in infrastructure and housing developments, is propelling the market. Further, the trend toward environmentally friendly, or green buildings, and LEED-certified buildings is driving the adoption of sustainable and recyclable building materials such as fiber cement. Also, investment by the USA government in infrastructure renewal and disaster-resistant housing systems is aiding the growth of the market.

The adoption of the product in the renovation and remodelling sector is another key driver, as homeowners look for long-lasting, moisture-resistant, and termite-proof materials for home improvement projects. Furthermore, stringent fire safety regulations-especially in wildfire-prone states like California-are encouraging the use of fire-resistant fiber cement siding and panels.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.9% |

The UK market is growing as urban expansion, green construction trends, and tough building standards propel demand for energy-efficient, fire-resistant, and long-lasting building materials. As housing needs and retrofit projects grow, the product will be used more for roof covering, siding, and facades. FMI is of the opinion that the UK market is slated to grow at 4.2% CAGR during the study period.

Post-Grenfell Tower fire regulations have brought a considerable change in the direction of non-combustible materials, such as fiber cement panels and cladding systems. Building safety standards of the UK (BS 8414 and BS EN 12467) promote the use of fire-resistant materials, thus the product has emerged as a desirable alternative to plastic and wood-based combustible panels.

The nation is emphasizing Net Zero 2050 carbon emissions targets. This increases the use of environmentally friendly and recyclable building materials. The growing emphasis on sustainable, durable building materials in social housing and public infrastructure is also boosting product demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

Japan is growing due to urban expansion, seismic-resistant construction practices, and the government’s focus on sustainable building materials. The country’s high earthquake frequency requires impact-resistant and durable construction solutions, making the product a popular choice in exterior cladding, partition boards, and structural applications. FMI is of the opinion that the Japanese market is slated to grow at 4.3% CAGR during the study period.

Japan's prefabricated and modular housing boom is driving demand for lightweight, easy-to-install fiber cement boards. The government’s Smart City initiatives are further promoting green and energy-efficient building materials like fiber cement.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

The South Korean market is expanding fast with massive government investment in urban infrastructure, growth in smart city projects, and rising use of environmentally friendly building materials. With the rapid urbanization of the country and high population density, demand for long-lasting, fire-resistant, and low-maintenance materials in residential, commercial, and industrial applications is on the rise. FMI is of the opinion that the South Korean market is slated to grow at 4.5% CAGR during the study period.

The government of South Korea has adopted policies that favor sustainable building through the use of non-toxic, recyclable, and energy-efficient materials such as fiber cement. The nation's Green Building Act and Smart City policy aim at minimizing carbon footprints within the construction industry, thus positioning the product as a material of choice because it has low environmental footprints, a long service life, and is recyclable.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.5% |

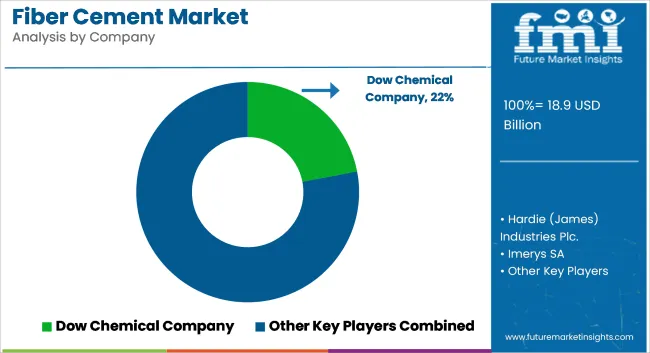

The fiber cement market is growing increasingly competitive, with major players investing in product innovation, capacity expansion, and regional penetration. Companies are focusing on vertical integration to streamline raw material sourcing and ensure consistency in quality and cost structure. Advanced manufacturing processes like autoclaving, hybrid curing, and lightweight formulations are being developed to increase energy efficiency and reduce environmental footprint.

Leading firms are offering a wide range of product formats-boards, panels, sheets, and siding products-tailored to local climates and construction needs. Product differentiation is also expanding through digitally printed textures, anti-fungal coatings, and impact-resistant panels. North American and European companies are entering strategic alliances and joint ventures in Asia and Latin America to tap into fast-growing construction markets.

Sustainability remains central to the competitive strategy, with players integrating recyclable materials and improving end-of-life recovery rates. As performance expectations grow and regulatory standards become more stringent, innovation, cost competitiveness, and localization of production are shaping the next phase of market growth.

Recent Developments

By raw materials, the segmentation is as silica, Portland cement, cellulosic fiber, and others.

By end user, the segmentation is as residential and non-residential.

By application, the segmentation is as cladding, siding, backer boards, molding and trimming, roofing, wall partitions, and others.

By region, the segmentation is as North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The overall market size is slated to reach USD 18.9 billion in 2025.

The fiber cement market is expected to reach USD 30.8 billion in 2035.

The prominent companies include Allura USA, Everest Industries Limited, Hume Cemboard Industries, SCG Building Materials, Toray Industries Inc., Mahaphant Fibre Cement Co., Ltd., CertainTeed (Saint-Gobain), CSR Limited, and Elementia Materiales.

Silica is a widely used raw material.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiber Cement Board Market Growth - Trends & Forecast 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Collimating Lens Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber-Based Blister Pack Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Testing Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Coding System Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer (FRP) Rebars Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA