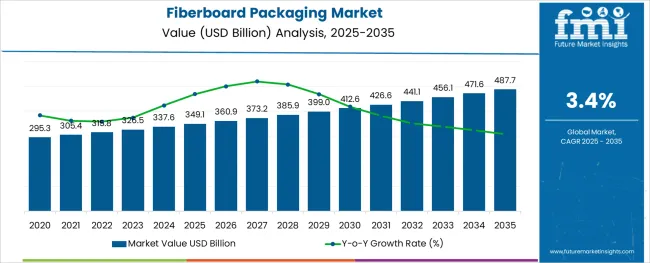

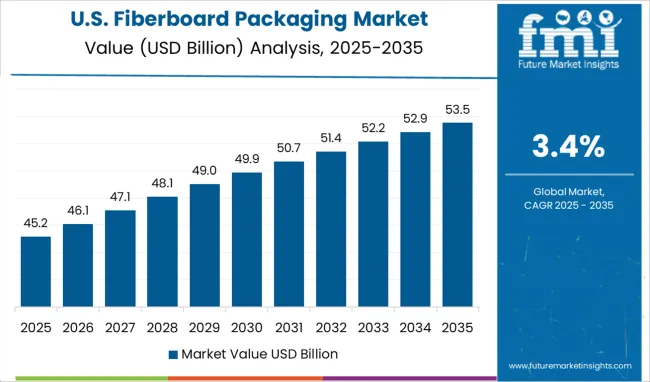

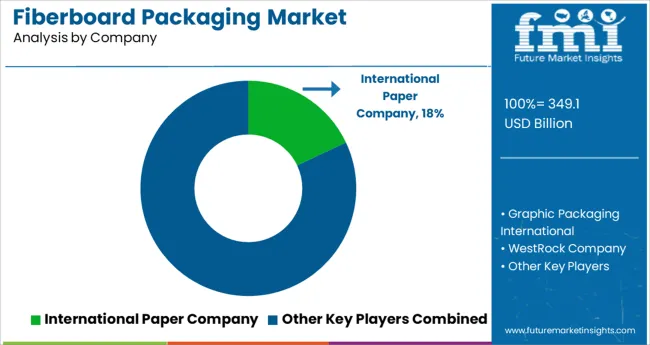

The Fiberboard Packaging Market is estimated to be valued at USD 349.1 billion in 2025 and is projected to reach USD 487.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

The fiberboard packaging market is experiencing sustained growth driven by increasing demand for sustainable and cost-effective packaging solutions across multiple industries. The shift toward recyclable and biodegradable materials has positioned fiberboard as a preferred choice for brands seeking to reduce environmental impact while maintaining product protection.

Advancements in manufacturing processes and material engineering have improved the strength-to-weight ratio of fiberboard, enabling its use in a wider range of applications. Future growth is expected to be supported by stricter regulations on single-use plastics, rising e-commerce volumes, and heightened consumer preference for eco-friendly packaging.

Continuous innovation in design and printing capabilities is enhancing brand visibility and consumer appeal, further cementing the market’s relevance. The interplay of regulatory pressures, operational efficiency gains, and evolving consumer expectations is paving the path for continued market expansion.

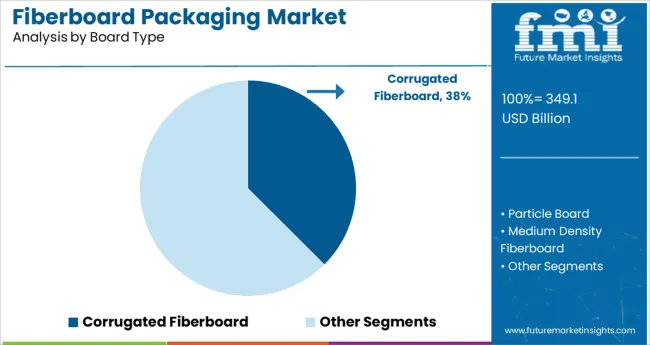

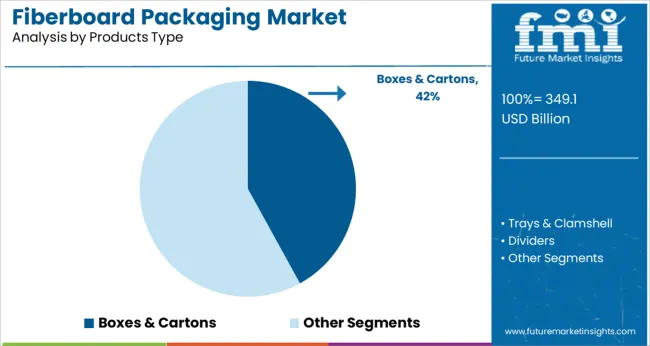

The market is segmented by Board Type, Products Type, and End Use and region. By Board Type, the market is divided into Corrugated Fiberboard, Particle Board, Medium Density Fiberboard, and High-Density Fiberboard. In terms of Products Type, the market is classified into Boxes & Cartons, Trays & Clamshell, Dividers, Drums, Pallets, and Cups & Bowls.

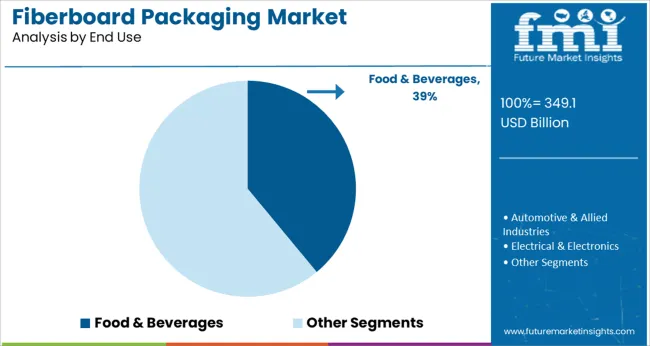

Based on End Use, the market is segmented into Food & Beverages, Automotive & Allied Industries, Electrical & Electronics, Healthcare, Cosmetics & Personal Care, and Other Consumer Goods. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by board type, corrugated fiberboard is projected to account for 37.5% of the total market revenue in 2025, establishing itself as the leading board type. Its dominance is attributed to the superior cushioning, strength, and versatility it provides, making it suitable for both lightweight and heavy-duty packaging needs.

The ability to withstand stacking pressures and protect goods during transportation has reinforced its adoption, particularly in e-commerce and industrial supply chains. Additionally, its compatibility with high-quality printing and customization has enabled brands to enhance product presentation while maintaining sustainability credentials.

Improvements in recyclability and the ability to incorporate post-consumer materials have further strengthened the position of corrugated fiberboard as a preferred solution for businesses seeking a balance between performance, cost efficiency, and environmental responsibility.

In terms of product type, boxes and cartons are expected to command 42.0% of the market revenue in 2025, making them the most prominent segment. This leadership has been driven by their widespread usage across retail, food service, and e-commerce channels due to ease of handling, stacking, and branding opportunities.

Their ability to be tailored to a variety of shapes and sizes while offering strong protection has enhanced their appeal among manufacturers and retailers. Cost effectiveness combined with the ability to use recyclable materials has aligned boxes and cartons with both operational needs and environmental goals.

The segment’s prominence has also been supported by innovations in folding techniques, lightweighting, and aesthetically appealing designs, which have reinforced their position as the packaging format of choice for many high-volume and consumer-facing applications.

Segmenting by end use shows that the food and beverages industry is anticipated to hold 39.0% of the market revenue in 2025, maintaining its status as the leading industry segment. This dominance has been underpinned by the growing demand for safe, hygienic, and eco-friendly packaging that aligns with regulatory and consumer expectations in the food sector.

The ability of fiberboard to provide adequate protection against contamination while supporting extended shelf life has made it an integral choice for food and beverage packaging. Enhanced printability and design flexibility have allowed brands to communicate product information and promote sustainability credentials effectively.

Rising consumption of packaged and ready-to-eat food products, coupled with increasing preference for recyclable and compostable packaging materials, has further strengthened the leadership of this segment. Operational efficiencies gained through standardized packaging solutions and ease of disposal have reinforced its widespread adoption in this industry.

The global fiberboard packaging market witnessed a CAGR of 3.1% during the historic period with a market value of USD 349.1 billion in 2025.

Fiberboard packaging is used in various applications due to its segments like particle board, low-density board (LDB), medium-density board, and corrugated fiberboard. Fiberboard Packaging is majorly used by Construction, Residential & Food & Beverage Industries. Due to its Impeccable properties like strength, heatproof, water resistance & high Porosity have gained popularity in the market.

Fiberboard Packaging is made with innovations like 100% Recyclable, swell proof, and sustainable making it eco-friendlier. Moreover, with the high preference for hygiene packaging, fiberboard packaging is gaining popularity as it reduces the chance of contamination due to the Elimination level of Bacteria & microbes.

The food and beverage industry is expanding due to the rising consumption of carbonated drinks, alcoholic beverages, healthy-packed food items, and others. The increasing food & beverage consumption results in high demand for packaging solutions that are best suitable and convenient as well as self-appealing. This drives the demand for fiberboard packaging.

The demand for liquid cartons augmented due to the rising consumption of beverage items especially milk, carbonated drinks, and others which propelled the demand for fiberboard packaging solutions. Customization is also possible on fiberboard packaging which results in attractive packaging solutions. Thus, the rising demand for convenient and self-appealing packaging solutions in the food & beverages industry propels the demand for fiberboard packaging

On the basis of board type, corrugated fiberboard packaging is anticipated to hold a 31% market share from 2025 to 2035.

The changing consumer purchase pattern results in the shifting packaging need as well. Various sectors opt for sustainable, eco-friendly, protective, durable, and cost-effective packaging solutions keeping in mind the consumer requirement for packaging.

The food & beverages segment is projected to generate hefty demand for fiberboard packaging during the forecast period. The food & beverages segment is estimated to hold around 44% of the market value share by the end of 2035. The increasing consumption of packed food and the trend for rigid sustainable packaging is supplementing the sales of fiberboard packaging in the food & beverage industry.

The USA is expected to hold around 79% of the North American fiberboard packaging market by the end of the forecast period. According to the National Retail Federation (NRF), retail sales in the USA grew by around 6.7% in 2024.

The growing retail sector creates demand for self-appealing, convenient, cost-effective, and lightweight packaging solutions such as fiberboard packaging. Fiberboard trays are easy to display on the shelf without consuming more space which bolsters the demand for the retail sector.

According to the Mexican Online Sales Association, in 2024 the domestic e-commerce in Mexico was valued at USD 295.3 billion, an increase of over 80 percent from 2020. The e-commerce users in Mexico increased by 9% in 2024 from 2020.

The expanding e-commerce sector in Mexico bolsters the demand for fiberboard packaging. Besides this, in 2020 the e-commerce shipment accounts for 67.8% of the overall manufacturing shipment in the USA according to the U.S. Census Bureau, there was an increase in e-commerce shipments in 2020 from 2020. Overall, the jump in e-commerce market growth in the USA and Mexico fuels the demand for fiberboard packaging.

The key players are focusing on innovative packaging solutions for fiberboard packaging. To achieve set goals, companies are merging with big players to increase their market share. The acquisition of small companies is also being done by big packaging giants. Investment in research and development amid strive for innovative packaging is also being done by the companies. Some of those Innovations are as under-

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3.4% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Board Type, Product Type, End-Use |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa |

| Key Countries Covered | Russia, Portugal, United States of America, India, United Kingdom, Germany, Canada, Brazil, France, China |

| Key Companies Profiled | Graphic Packaging International; Westrock Company; Smurfit Kappa Group plc; Stora Enso Oyj; International Paper Company; Huhtamaki Oyj; DS Smith plc; Oji Holding Corporation; Georgia-Pacific LLC; Mondi Group; BillerudKorsnas AB; Sonae Aruco; Kaindl; Dynea; Duratex; DGR Packaging; Flexi-Hex; Creative Corrupack; Grief Inc. |

| Customization & Pricing | Available upon Request |

The global fiberboard packaging market is estimated to be valued at USD 349.1 billion in 2025.

It is projected to reach USD 487.7 billion by 2035.

The market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types are corrugated fiberboard, particle board, medium density fiberboard and high-density fiberboard.

boxes & cartons segment is expected to dominate with a 42.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA