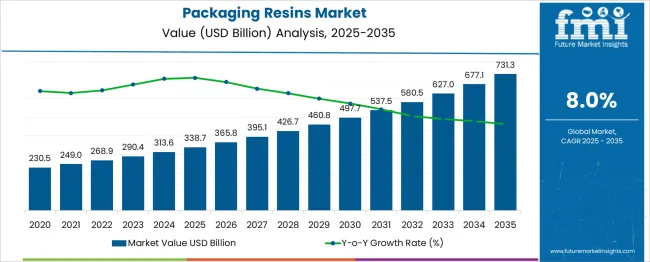

The Packaging Resins Market is estimated to be valued at USD 338.7 billion in 2025 and is projected to reach USD 731.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period. The growth curve exhibits a classic exponential shape rather than a linear slope. From 2025 to 2029, market gains range from USD 27.1 billion to USD 34.1 billion annually, taking the value from USD 338.7 billion to USD 460.8 billion.

This stage reflects steady yet compounding acceleration, indicating the base effect’s influence and growing material demand across FMCG and industrial packaging. The next phase, from 2030 to 2035, sees sharper year-on-year absolute increases, peaking at USD 54.2 billion between 2034 and 2035. The curve gradient steepens consistently across the decade, confirming exponential tendencies rather than exhibiting breakpoints or saturation.

This trend implies uninterrupted resin demand growth, driven by evolving material specifications, multi-layer barrier packaging, and demand shifts in flexible and rigid formats. The curve’s steepness intensifies in the final three years, signaling no flattening effect or demand deceleration. Therefore, the curve shape corresponds to a continuous upward arc with no plateau, characterized by stable acceleration and expanding market base over the entire forecast window.

| Metric | Value |

|---|---|

| Packaging Resins Market Estimated Value in (2025 E) | USD 338.7 billion |

| Packaging Resins Market Forecast Value in (2035 F) | USD 731.3 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The packaging resins market is primarily driven by the flexible & rigid packaging industry (40%), which uses plastics for food, beverage, and consumer goods. The food & beverage sector (25%) relies heavily on resin-based containers and films. Pharmaceutical packaging (15%) demands high-barrier resins for safety. E-commerce packaging (10%) fuels growth with demand for durable, lightweight materials.

The consumer goods sector (7%) uses resins for cosmetics and household products, while industrial packaging (3%) serves chemicals and logistics. Together, flexible packaging and food/beverage applications dominate, accounting for 65% of demand, with sustainability trends shaping future innovation.

The industry is evolving rapidly as demand rises for recyclable, biodegradable, and high barrier materials driven by food, healthcare, and e commerce sectors. Key innovators include ExxonMobil Chemical, Dow Inc, SABIC, LyondellBasell, BASF and Borealis. These companies lead through strategies in circular economy and sustainability including certified renewable PP lines, chemical recycling partnerships and proprietary performance resin technologies.

Asia Pacific dominates production and consumption as China and India expand manufacturing capacity. North America invests in bio based resin and recycled resin innovation while Europe drives mono material packaging and closed loop reuse. Technical trends include HDPE lightweighting, PVC for medical blister packs, smart packaging resins and compostable bioplastics.

Growth momentum is being fueled by rapid urbanization, expansion in the e-commerce sector, and rising consumer awareness around food safety and product integrity. Regulatory shifts encouraging the use of recyclable and sustainable materials are pushing manufacturers to innovate within resin technologies.

Advancements in polymer science have enabled enhanced performance attributes such as improved barrier resistance, tensile strength, and shelf-life extension, all of which are driving adoption across multiple industries. Additionally, economic development in emerging markets and the surge in retail-ready and consumer-friendly packaging are contributing to widespread utilization of packaging resins.

As industries seek materials that can support high-volume production while meeting compliance standards, packaging resins are becoming indispensable across applications. This is expected to pave the way for long-term growth opportunities across both traditional and sustainable packaging domains..

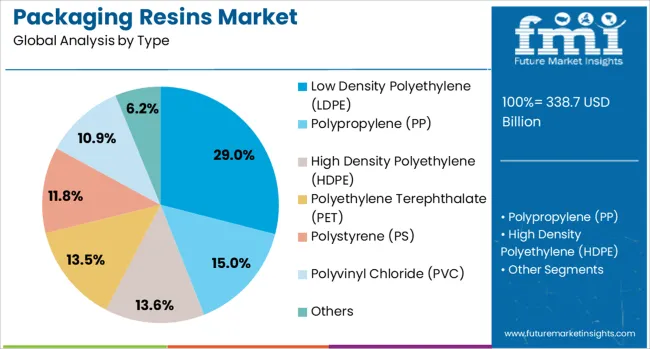

The packaging resins market is segmented by type, end-use industry, and geographic regions. The packaging resins market is divided by type into Low Density Polyethylene (LDPE), Polypropylene (PP), High Density Polyethylene (HDPE), Polyethylene Terephthalate (PET), Polystyrene (PS), Polyvinyl Chloride (PVC), and Others.

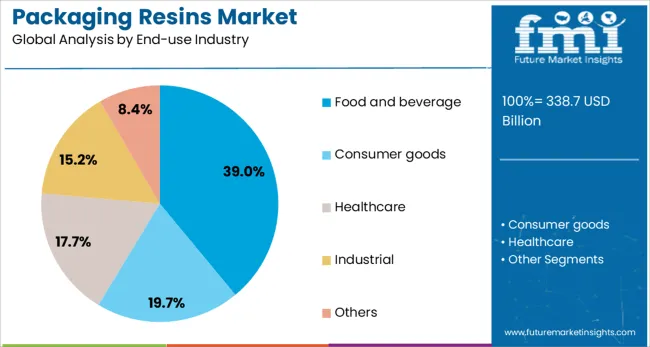

The packaging resins market is classified by end-use industry into Food and beverage, Consumer goods, Healthcare, Industrial, and Others. Regionally, the packaging resins industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Low-Density Polyethylene type segment is expected to account for 29% of the Packaging Resins market revenue share in 2025, making it one of the leading resin types. This dominance has been supported by the high flexibility, transparency, and moisture resistance that LDPE offers, making it ideal for a wide range of flexible packaging solutions. Its use has become widespread in films, bags, and containers used in food, medical, and industrial packaging applications.

The ability of LDPE to withstand extreme temperatures while maintaining product integrity has positioned it as a reliable choice in demanding packaging environments. Furthermore, advances in co-extrusion and multilayer film technologies have allowed LDPE to be combined with other materials, further enhancing its performance.

Its recyclability and low production cost have also made it a preferred material among manufacturers focused on efficiency and sustainability. As demand for lightweight and high-volume packaging continues to grow, the LDPE segment is expected to maintain its competitive position in the market..

The food and beverage end-use industry segment is projected to hold 39% of the Packaging Resins market revenue share in 2025, making it the largest contributor by application. The consistent growth of this segment has been driven by increasing consumer demand for packaged, ready-to-consume, and perishable food items, which require durable and contamination-resistant packaging. Packaging resins have been widely adopted in this sector due to their ability to maintain freshness, extend shelf life, and prevent leakage or spoilage.

The segment has also benefited from strict food safety regulations that have mandated the use of high-performance materials with superior barrier properties. As convenience foods and single-serve packaging continue to dominate consumer preferences, the need for reliable and flexible packaging formats has risen sharply.

Additionally, the rise of online grocery platforms and cold chain logistics has accelerated the adoption of resin-based packaging solutions. These factors combined have ensured that the food and beverage industry continues to lead in resin consumption across global markets..

Demand for packaging resins has been driven by growth in oriented polypropylene, polyethylene, and PET resin formats used in food, beverage, and consumer goods packaging. In 2024, PET accounted for approximately 42% of total packaging resin volume, while polypropylene captured about 37%. Growth was especially strong in the Asia Pacific and Latin America due to evolving e-commerce and foodservice packaging needs. Recycled resin use increased steadily, representing 18% of the resin supply within rigid and flexible packaging. Sustainability labeling and brand pressure have prompted shifts toward high clarity, barrier-enhanced resin grades.

Expansion of FMCG and e-commerce formats has led to increased resin consumption for multi-layer flexible packaging, bottles, and trays. In Asia Pacific and Latin America, nearly 44% of new fast-moving consumer packaged goods launches in 2024 incorporated PET and polyolefin films. Bottled beverage volume demand fueled PET resin uptake, accounting for 38% of unit growth. Blended resin formats such as co-extruded PET/CPP films were used in 21% of snack packaging formats. Retailers and brands requested convenience features such as reclosable zipper films and resealable pouches, driving specialty resin demand. Efficiencies in barrier performance and machine line processing speeds supported transition away from legacy mono-material options toward performance–oriented resin platforms in modern packaging lines.

Packaging resin markets are sensitive to feedstock price fluctuations and regulatory restrictions on single-use plastics. Feedstock volatility resulted in average resin price swings of up to 24% year-over-year in certain regions. Regulatory limits on single-use packaging have reduced virgin resin uptake by 17% in jurisdictions mandating recycled content or refillable systems. Collection and recycling infra require additional system investment, increasing the cost of recycled resin used in flexible formats by approximately 18%. Limited recyclability of multi-layer films has hindered the adoption of high-barrier shell structures in about 12% of product categories. These barriers have slowed resin diversification in lower-margin packaged food and cosmetic sectors.

Momentum has been achieved in the adoption of recycled and bio-based resin formats within packaging markets. Recycled PET (rPET) and post‑consumer PP blends accounted for 23% of new resin contracts in Europe and North America. Biodegradable polyesters such as PLA and PHA gained traction in 16% of branded foodservice packaging launches. Hybrid resin blends with up to 50% renewable content were introduced in skincare and wellness tub formats. Resin-to-resin recycling programs paired with deposit-return systems supported elevated uptake in beverage packaging. OEM partnerships were formed with resin producers to co-develop refillable bottle systems using durable recycled resin. This shift toward regenerative resin models is aligned with systemic packaging waste reduction goals within brand portfolios.

High-barrier resin technologies such as EVOH multilayer films were adopted in 27% of new food packaging lines to extend shelf life. Transparent barrier substrates supporting vacuum-chill and oxygen-sensitive products gained uptake. Resin traceability features, including QR-code resin batch tracking, were embedded in 21% of B2B packaging rollouts to support regulatory compliance and brand transparency. Digital watermarking and IoT-enabled labeling were tested in approximately 14% of premium lines for supply chain validation. Integration of smart packaging sensors within resin layers was piloted in 11% of pharmaceutical packaging formats. Moreover, lightweight monolayer resins enabled 18% weight reduction in rigid packaging formats without sacrificing stiffness or barrier integrity.

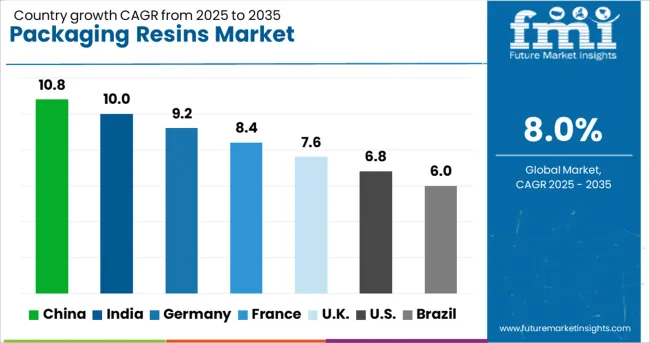

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

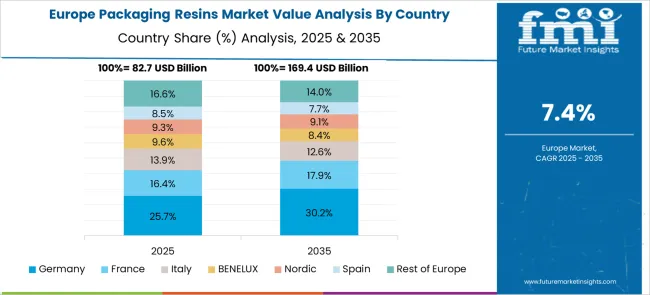

The Packaging Resins Market is projected to grow at a global CAGR of 8% from 2025 to 2035. China leads with a growth rate of 10.8%, performing 1.35 times higher than the global average due to expanded industrial packaging applications and high polymer demand. India follows closely at 10.0%, driven by food packaging innovation and rising e-commerce penetration.

Germany shows 9.2%, supported by regulatory shifts toward lightweight and recyclable resins. The UK exhibits a growth rate of 7.6%, which is slightly below the global average, while the USA stands at 6.8%, hindered by maturity in traditional packaging segments. The report includes insights on 40+ countries, with the top five markets presented here for comparative analysis.

The packaging resins market in China is forecasted to expand at a CAGR of 10.8% from 2025 to 2035. The rise in demand has been attributed to widespread use of flexible packaging formats in processed food and pharmaceutical sectors. Polypropylene and PET resins are increasingly being adopted for pouch films, thermoform trays, and rigid bottles. Co-extruded multilayer films with enhanced barrier properties are gaining traction in logistics and B2B packaging.

Domestic resin suppliers have scaled operations to meet short lead-time demand from contract packaging firms. Stringent quality specifications have also contributed to demand for additive-enhanced and UV-resistant resin grades. Film converters and molders are working closely with FMCG manufacturers to deliver tailor-fitted packaging formats using localized resin variants.

India’s packaging resins market is projected to register a CAGR of 10.0% between 2025 and 2035. Pharmaceutical blister packaging, FMCG sachets, and bulk packaging formats have been primary application areas. HDPE and LDPE grades have witnessed high adoption in rigid bottles, tube laminates, and liner bags. With growing inter-state logistics, demand has increased for durable secondary packaging solutions incorporating layered film structures.

Regulatory approvals for resin safety have resulted in a shift toward food-grade certified compounds. Resin suppliers have launched low-migration and anti-fog variants to support high-speed packaging lines. Rising usage of PET for multilayer thermoformed containers has also contributed to growth among rigid packaging converters.

Germany’s packaging resins market is set to advance at a CAGR of 9.2% through 2035. Growth is centered around thermoforming, high-barrier shrink films, and rigid container manufacturing. Polyethylene terephthalate and ethylene-vinyl alcohol resins have gained prominence in meat and dairy packaging. Industrial players have optimized resin blends for lower processing temperatures to reduce energy costs.

Design standardization in multilayer sheet extrusion has further improved throughput across large-volume packaging operations. Automotive and electronics sectors have also increased the use of high-clarity resin films for protective secondary packaging. Resin manufacturers are offering custom additive packages to improve mechanical and chemical performance for niche applications such as medical device packaging.

The packaging resins market in the United Kingdom is expected to grow at a CAGR of 7.6% from 2025 to 2035. Demand has surged due to growth in on-the-go food packaging and premium cosmetic containers. Polyolefin-based film resins are being adopted for peelable lidding films and easy-tear sachets. Modified PE and copolyester variants are entering new applications such as tamper-evident medical packs.

Packaging solution providers are investing in mono-material film lines designed for high output and print quality. The retail sector has increasingly relied on durable resin-based shelf-ready packs to withstand transit damage. Barrier performance and seal integrity are prioritized by converters serving perishable food segments.

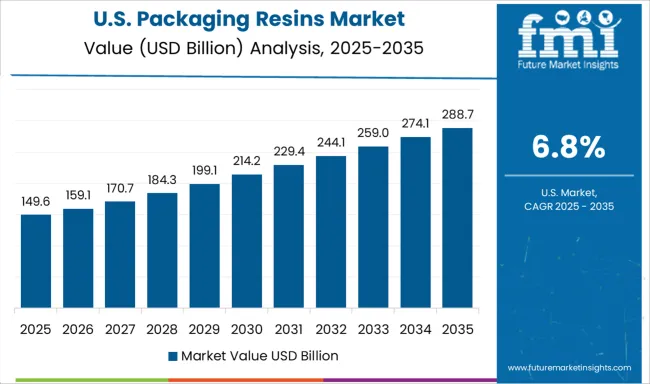

The packaging resins market in the United States is anticipated to record a CAGR of 6.8% through 2035. Demand is led by the foodservice, e-commerce, and pharmaceutical packaging sectors. PET, HDPE, and specialty olefins are dominating multilayer pouch films and rigid container applications. High clarity, heat resistance, and chemical stability remain top selection criteria for medical packaging.

B2B bulk liquid packaging has increased the demand for IBC-compatible resin formats with enhanced crack resistance. Molders and extruders are adopting impact-modified grades to meet high-speed machine requirements. Packaging resins are increasingly being customized based on end-user machinery compatibility and pack geometry optimization.

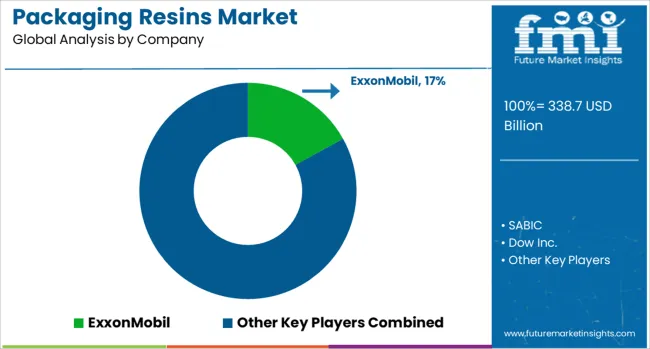

The packaging resins market is shaped by petrochemical companies that provide polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) resins for rigid and flexible packaging formats. ExxonMobil produces high-performance PE resins under its Exceed and Enable brands, used extensively in food wraps and heavy-duty sacks. SABIC maintains integrated resin production across the Middle East and Asia, with a diversified packaging portfolio covering blow molding and film extrusion applications.

Dow Inc. offers its INNATE and ELITE series resins focused on downgauging and strength retention in flexible packaging solutions. These companies invest in product development to address sealing performance and clarity. LyondellBasell supplies advanced PP and PE grades used in caps, closures, and rigid containers, maintaining a strong presence in both developed and emerging markets.

BASF SE supports multilayer packaging needs through its engineering resins and specialty polymers, particularly in Europe. Borealis AG, backed by OMV Group, develops circular resins and value-added polyolefins for form-fill-seal and thermoforming applications.

R&D efforts among key players prioritize material efficiency, while regional suppliers adapt to local packaging norms. Barriers to entry include high capital intensity, feedstock integration, and customer accreditation processes, making the market favorable to firms with large-scale infrastructure and long-standing B2B relationships.

ExxonMobil introduced a high-strength polyethylene grade for thin-gauge films, reducing resin usage while maintaining durability. SABIC and LyondellBasell rolled out PCR polypropylene and bio-PET resins suited for rigid and flexible packaging.

Braskem expanded its green PE offerings for food wrap applications. Indorama Ventures launched a high-clarity recycled PET resin, improving molding speed. Collaborative ventures, such as LyondellBasell’s acquisition of Mepol and Dow’s Mura partnership, scaled circular feedstock access. Asia-Pacific led production and demand, particularly in the food and beverage and e-commerce packaging segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 338.7 Billion |

| Type | Low Density Polyethylene (LDPE), Polypropylene (PP), High Density Polyethylene (HDPE), Polyethylene Terephthalate (PET), Polystyrene (PS), Polyvinyl Chloride (PVC), and Others |

| End-use Industry | Food and beverage, Consumer goods, Healthcare, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ExxonMobil, SABIC, Dow Inc., LyondellBasell, BASF SE, and Borealis AG |

| Additional Attributes | Dollar sales by resin type (polyethylene, polypropylene, PET, biodegradable resins) and application (food & beverage, healthcare, consumer goods, e-commerce packaging), demand dynamics propelled by FMCG, pharma compliance, and sustainable retail packaging, regional trends led by Asia‑Pacific with North America catching up, innovation in bio‑based polymers, mono-material recyclability and lightweight barrier films, and environmental impact through reduced plastic waste, increased circularity, and compliance with extended producer responsibility regulations. |

The global packaging resins market is estimated to be valued at USD 338.7 billion in 2025.

The market size for the packaging resins market is projected to reach USD 731.3 billion by 2035.

The packaging resins market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in packaging resins market are low density polyethylene (ldpe), polypropylene (pp), high density polyethylene (hdpe), polyethylene terephthalate (pet), polystyrene (ps), polyvinyl chloride (pvc) and others.

In terms of end-use industry, food and beverage segment to command 39.0% share in the packaging resins market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Packaging Inserts Market Insights - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA