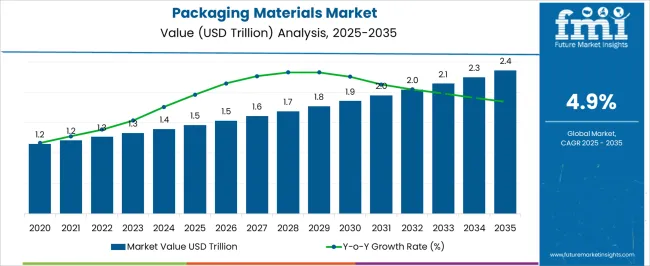

The packaging materials market is estimated to be valued at USD 1463.5 billion in 2025 and is projected to reach USD 2361.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period. The five-year period from 2025 to 2030 highlights gradual compounding, reflecting steady expansion across plastic, paperboard, metal, and glass-based solutions. This steady climb underscores incremental growth supported by e-commerce packaging, retail consumption, and pharmaceutical packaging demand.

In the early stage (2025–2027), gains of USD 0.1 trillion per year emphasize consistent structural demand across FMCG and food packaging. The later stage (2028–2030) captures stronger increments of USD 0.2 trillion in aggregate, marking the influence of digital retail, higher consumption of flexible packaging, and advanced labeling formats.

| Metric | Value |

|---|---|

| Packaging Materials Market Estimated Value in (2025 E) | USD 1463.5 billion |

| Packaging Materials Market Forecast Value in (2035 F) | USD 2361.3 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The packaging materials market is evolving rapidly due to increasing demand for sustainable and functional packaging solutions. Growing consumer awareness about environmental impact has pushed companies to adopt recyclable and biodegradable materials, leading to a rise in the use of paper and cardboard.

Industry developments have highlighted innovations that improve packaging durability while reducing waste and cost. The expansion of e-commerce and food delivery services has further driven the need for reliable packaging that maintains product integrity during transport.

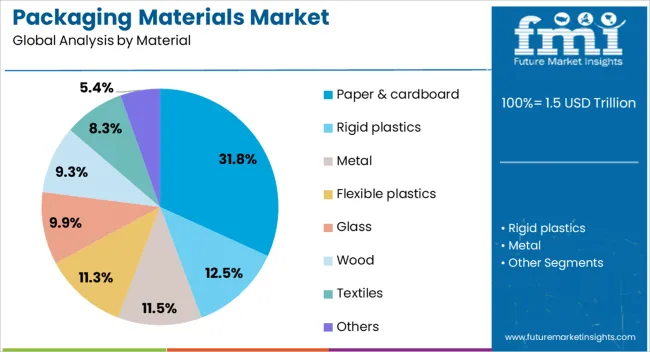

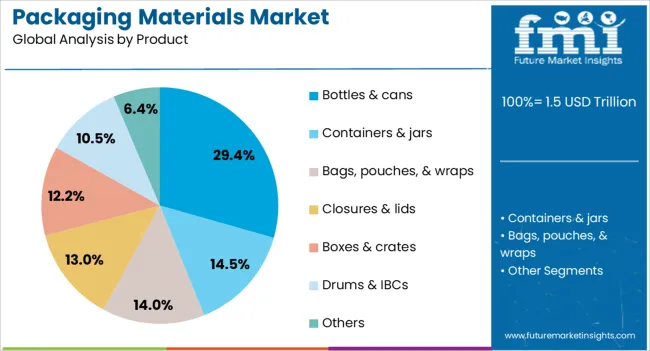

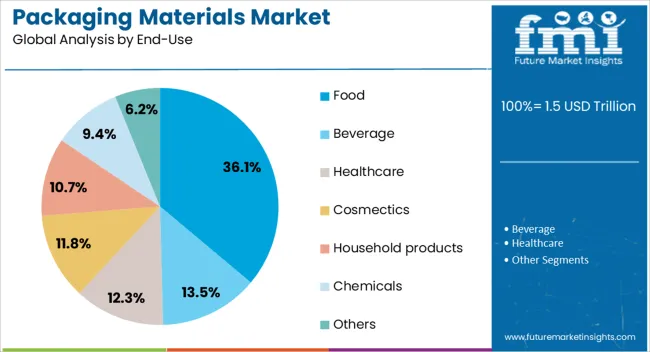

Regulatory pressures and corporate sustainability commitments have accelerated the shift toward eco-friendly materials. Additionally, the food sector continues to dominate packaging demand due to its requirement for safety, freshness, and shelf life extension. Future growth is expected to be supported by advancements in smart packaging and the integration of renewable resources. Segmental leadership is anticipated to come from Paper and Cardboard as the preferred material, Bottles and Cans in the product category, and Food as the largest end-use sector.

The packaging materials market is segmented by material, productend-use, and geographic regions. By material of the packaging materials market is divided into Paper & cardboard, Rigid plastics, Metal, Flexible plastics, Glass, Wood, Textiles, and Others. In terms of product of the packaging materials market is classified into Bottles & cans, Containers & jars, Bags, pouches, & wraps, Closures & lids, Boxes & crates, Drums & IBCs, and Others. Based on end-use of the packaging materials market is segmented into Food, Beverage, Healthcare, Cosmectics, Household products, Chemicals, and Others. Regionally, the packaging materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Paper and Cardboard segment is projected to hold 31.8% of the packaging materials market revenue in 2025, securing its position as the leading material type. Growth in this segment has been fueled by increased demand for sustainable packaging alternatives that are biodegradable and recyclable.

Manufacturers and brand owners have prioritized paper and cardboard due to their versatility, printability, and consumer appeal. The rise of environmentally conscious consumers and stricter regulations against single-use plastics have significantly boosted this segment.

Additionally, technological improvements have enhanced the strength and barrier properties of paper-based materials, making them suitable for a wide range of packaging applications. As sustainability remains a core focus, the Paper and Cardboard segment is expected to maintain strong growth supported by innovation and regulatory trends.

The Bottles and Cans segment is expected to contribute 29.4% of the packaging materials market revenue in 2025, making it a key product category. This segment’s growth has been driven by the packaging needs of beverages, food products, and household items that require durability and preservation.

The convenience and recyclability of bottles and cans have resonated well with both manufacturers and consumers. Packaging innovations such as lightweight cans and refillable bottles have further enhanced product appeal and sustainability.

Additionally, the increasing consumption of ready-to-drink beverages and convenience foods has expanded the demand for this segment. As the packaging industry continues to innovate for functionality and environmental impact, bottles and cans are projected to retain their significance in the market.

The Food segment is projected to represent 36.1% of the packaging materials market revenue in 2025, establishing itself as the dominant end-use category. The segment’s growth is largely driven by the increasing global demand for packaged and processed foods that require safe and effective packaging solutions.

Food safety regulations and consumer expectations for freshness and shelf life have led to innovations in packaging materials that offer enhanced barrier properties and tamper evidence. The growth of food delivery and takeout services has further increased the need for reliable packaging that can maintain product quality during transit.

Moreover, rising health awareness has fueled demand for packaging that preserves nutritional value while reducing waste. The food sector’s continuous innovation and strict quality requirements ensure that it will remain the leading end-use market for packaging materials.

The packaging materials market is driven by increasing demand for efficient, protective packaging solutions across industries like food, e-commerce, and consumer goods. Opportunities in these sectors, combined with emerging trends in lightweight, flexible, and recyclable materials, will continue shaping the market. However, high production costs and supply chain challenges remain barriers. By 2025, overcoming these obstacles through improved manufacturing strategies and resilient supply chains will be key to ensuring sustained market growth.

The packaging materials market is growing due to the increasing demand for efficient, protective, and cost-effective packaging solutions across industries like food and beverages, electronics, and pharmaceuticals. Packaging materials are essential in ensuring product safety, extending shelf life, and providing convenience to consumers. As e-commerce and global trade continue to expand, the need for advanced packaging materials, such as high-performance films and containers, is expected to rise. By 2025, this demand will continue driving market growth in various sectors.

Opportunities in the packaging materials market are expanding with the growth of e-commerce and consumer goods packaging. As online shopping and home deliveries rise, packaging solutions that offer convenience, protection, and branding are in high demand. Additionally, the consumer goods sector continues to drive innovation in packaging design to meet evolving consumer needs. By 2025, the demand for packaging materials in these sectors will increase, presenting substantial growth opportunities for manufacturers providing tailored and efficient packaging solutions.

Emerging trends in the packaging materials market include the increasing demand for lightweight, flexible, and recyclable materials. Manufacturers are focusing on creating packaging solutions that reduce material usage while maintaining strength and durability. Recyclable materials, such as biodegradable plastics and paper-based packaging, are becoming more popular as industries and consumers seek more sustainable options. By 2025, these trends are expected to dominate the market, with companies prioritizing flexibility, reduced environmental impact, and enhanced consumer appeal in their packaging solutions.

Despite market growth, challenges related to high costs and supply chain disruptions persist in the packaging materials market. The production of specialized packaging materials often requires significant investment in manufacturing infrastructure and raw materials, which can drive up costs. Additionally, disruptions in global supply chains, particularly due to geopolitical factors or natural disasters, can delay production and delivery timelines. By 2025, addressing these issues through improved sourcing strategies and cost-effective production methods will be crucial for market stability.

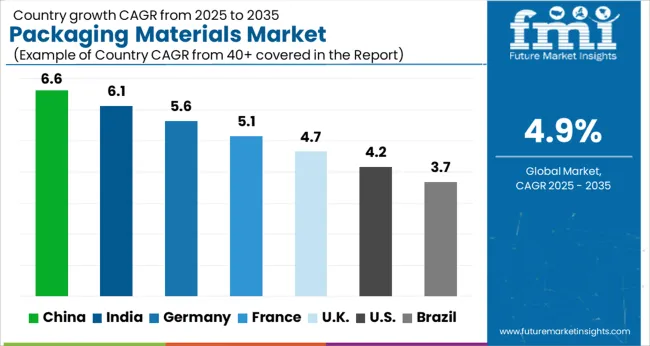

The global packaging materials market is projected to grow at a 4.9% CAGR from 2025 to 2035. China leads with a growth rate of 6.6%, followed by India at 6.1%, and France at 5.1%. The United Kingdom records a growth rate of 4.7%, while the United States shows the slowest growth at 4.2%. These varying growth rates are driven by factors such as increasing demand for packaging solutions across industries like food and beverage, pharmaceuticals, and e-commerce. Emerging markets like China and India are seeing higher growth due to rapid industrialization, expanding consumer markets, and rising demand for packaging materials in consumer goods and retail, while more mature markets like the USA and the UK experience steady growth driven by technological innovations, sustainable packaging trends, and the rising demand for e-commerce packaging solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The packaging materials market in China is growing at a strong pace, with a projected CAGR of 6.6%. China’s rapidly expanding manufacturing and consumer goods sectors, along with the rising demand for packaged products in retail, food and beverage, and pharmaceuticals, are driving the growth of packaging materials. The country’s increasing focus on sustainability, along with its growing e-commerce sector, is further accelerating the demand for innovative and eco-friendly packaging solutions. Additionally, China’s efforts to reduce plastic waste through government policies are prompting manufacturers to adopt sustainable alternatives, fueling the market for eco-friendly packaging materials.

The packaging materials market in India is projected to grow at a CAGR of 6.1%. India’s growing population, rising disposable income, and rapid urbanization are contributing to increased demand for packaged products, particularly in food and beverage, healthcare, and e-commerce sectors. The country’s growing e-commerce market and shift toward online shopping further accelerate demand for packaging materials. Additionally, India’s focus on sustainable and eco-friendly packaging, driven by consumer demand and regulatory pressures, is contributing to market growth as manufacturers increasingly turn to biodegradable and recyclable packaging materials.

The packaging materials market in France is projected to grow at a CAGR of 5.1%. France’s demand for packaging materials is largely driven by the food and beverage industry, followed by pharmaceuticals and cosmetics. The country’s focus on sustainability, coupled with increasing consumer demand for environmentally friendly packaging solutions, is fueling the adoption of eco-friendly materials. Additionally, France’s growing e-commerce market, along with the shift toward online retail and home delivery services, continues to drive demand for innovative packaging solutions that ensure product safety and quality during transportation.

The packaging materials market in the United Kingdom is projected to grow at a CAGR of 4.7%. The UK’s growing demand for packaging solutions in food, beverages, and personal care products is driving steady market growth. The increasing emphasis on sustainability, coupled with the UK’s stringent packaging waste regulations, is pushing manufacturers to adopt eco-friendly materials, such as biodegradable plastics, paper-based packaging, and reusable containers. Additionally, the UK’s strong e-commerce market and online shopping trend continue to drive demand for innovative packaging solutions that can enhance product protection and branding.

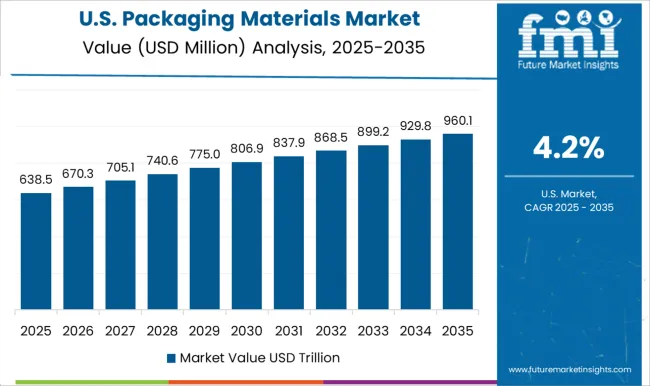

The packaging materials market in the United States is expected to grow at a CAGR of 4.2%. The USA market continues to be driven by demand from food and beverage, pharmaceuticals, and e-commerce sectors. The increasing focus on sustainability, driven by consumer demand and regulatory pressures, is prompting manufacturers to transition toward eco-friendly packaging solutions. Additionally, the USA e-commerce sector’s continued expansion, along with the growing trend of online shopping and home delivery services, continues to fuel demand for packaging materials that ensure product safety and durability during transit.

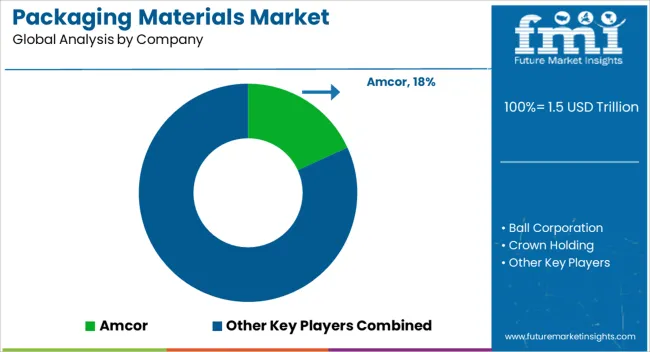

The packaging materials market is dominated by Amcor, which leads with its wide range of innovative, sustainable packaging solutions designed for food, beverage, and consumer goods industries. Amcor’s dominance is supported by its global presence, strong partnerships with leading brands, and commitment to providing environmentally friendly packaging options that meet stringent regulatory standards. Key players such as Ball Corporation, Crown Holding, and International Paper Company maintain significant market shares by offering high-performance packaging materials, including aluminum cans, paperboard, and flexible films. These companies focus on enhancing packaging functionality, improving sustainability, and reducing environmental impact through recyclable and biodegradable packaging materials.

Emerging players like Mondi, Owens-Illinois, and Sealed Air are expanding their market presence by providing specialized packaging materials for niche applications such as e-commerce, healthcare, and specialty foods. Their strategies include offering custom solutions, improving packaging strength and protection, and integrating smart technologies to enhance product safety and traceability. Market growth is driven by the increasing demand for sustainable, eco-friendly packaging solutions, the rise of online retailing, and growing consumer preference for minimalistic and recyclable packaging. Innovations in plant-based packaging, biodegradable films, and multi-functional packaging materials are expected to continue shaping competitive dynamics and fuel further growth in the global packaging materials market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1463.5 Billion |

| Material | Paper & cardboard, Rigid plastics, Metal, Flexible plastics, Glass, Wood, Textiles, and Others |

| Product | Bottles & cans, Containers & jars, Bags, pouches, & wraps, Closures & lids, Boxes & crates, Drums & IBCs, and Others |

| End-Use | Food, Beverage, Healthcare, Cosmectics, Household products, Chemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor, Ball Corporation, Crown Holding, International Paper Company, Mondi, Owens-Illinois, Reynolds Group, Sealed Air, Stora Enso, and Berry Plastics |

| Additional Attributes | Dollar sales by material type and application, demand dynamics across food and beverage, healthcare, and consumer goods sectors, regional trends in packaging material adoption, innovation in sustainable and recyclable materials, impact of regulatory standards on product safety and environmental concerns, and emerging use cases in e-commerce and smart packaging solutions. |

The global packaging materials market is estimated to be valued at USD 1.5 trillion in 2025.

The market size for the packaging materials market is projected to reach USD 2.4 trillion by 2035.

The packaging materials market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in packaging materials market are paper & cardboard, rigid plastics, metal, flexible plastics, glass, wood, textiles and others.

In terms of product, bottles & cans segment to command 29.4% share in the packaging materials market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor & IC Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA