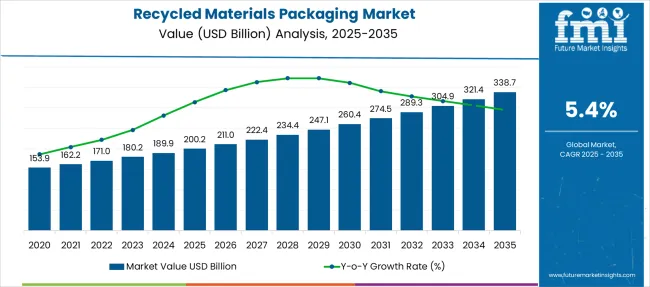

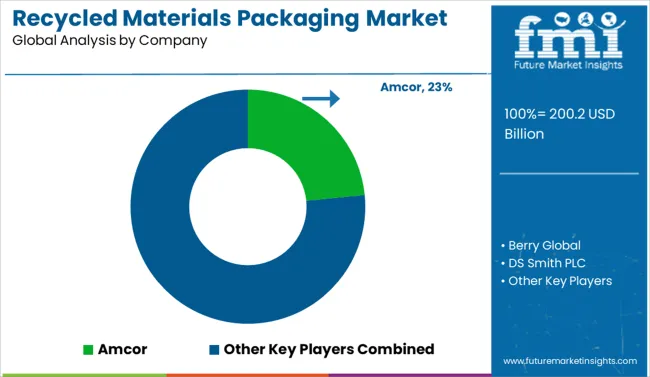

The Recycled Materials Packaging Market is estimated to be valued at USD 200.2 billion in 2025 and is projected to reach USD 338.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Recycled Materials Packaging Market Estimated Value in (2025 E) | USD 200.2 billion |

| Recycled Materials Packaging Market Forecast Value in (2035 F) | USD 338.7 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The recycled materials packaging market is gaining strong traction driven by rising global attention toward circular economy practices, heightened regulatory mandates, and shifting consumer preferences toward environmentally responsible packaging. Increasing restrictions on single use plastics and landfilling are pushing brands to invest in packaging solutions that reduce virgin material dependency and promote recyclability.

Public and private sector partnerships are also encouraging infrastructure development for material recovery and recycling efficiency. Technological advances in processing post consumer waste have enabled the production of high quality recycled packaging that meets performance and aesthetic standards across diverse end use industries.

As sustainability becomes central to corporate strategy and consumer buying behavior, the market outlook remains favorable with long term demand expected to grow across retail, food and beverage, and personal care sectors.

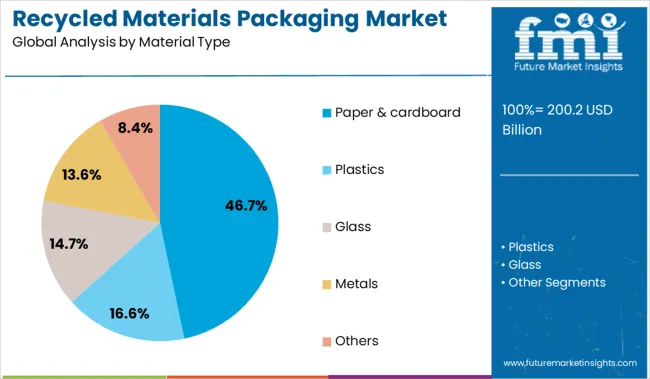

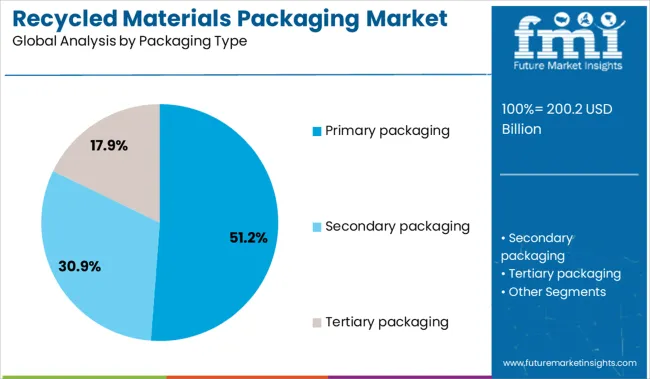

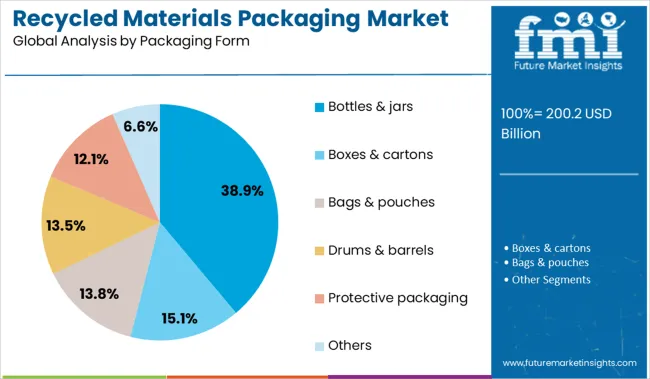

The recycled materials packaging market is segmented by material type, packaging type, packaging form, end use industry and geographic regions. By material type, the recycled materials packaging market is divided into Paper & cardboard, Plastics, Glass, Metals, and Others. In terms of packaging type, the recycled materials packaging market is classified into Primary packaging, Secondary packaging, and Tertiary packaging. Based on the packaging form of the recycled materials, the packaging market is segmented into Bottles & jars, Boxes & cartons, Bags & pouches, Drums & barrels, Protective packaging, and Others. By end use industry, the recycled materials packaging market is segmented into Food & beverage, Personal care & cosmetics, Consumer goods, Retail & e-commerce, Logistics & shipping, Healthcare, and Others. Regionally, the recycled materials packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The paper and cardboard segment is projected to hold 46.70 percent of total market revenue by 2025 within the material type category, making it the leading choice. This growth is driven by the material’s high recyclability, cost effectiveness, and biodegradability which align with both regulatory goals and consumer values.

Paper based materials are widely accepted in recycling systems and are increasingly used to replace plastic in various packaging applications such as cartons, wraps, and trays. The growing adoption of paper and cardboard in e commerce and food packaging due to their lightweight and protective qualities further contributes to this segment’s dominance.

As brands prioritize compostable and recyclable packaging formats, paper and cardboard continue to be the material of choice in driving sustainable packaging practices.

The primary packaging segment is expected to contribute 51.20 percent of total market revenue by 2025, emerging as the largest packaging type. This dominance is attributed to the role of primary packaging in direct product protection, shelf appeal, and compliance with food and pharmaceutical safety standards.

Recycled materials are being increasingly utilized in primary packaging formats such as boxes, containers, and wraps to meet both functional and sustainability criteria. The demand is further supported by consumer facing industries which require branded, tamper evident, and eco friendly packaging at the point of sale.

Regulatory pressure on reducing environmental impact at the primary packaging level is also motivating manufacturers to shift toward recycled inputs. This confluence of compliance, consumer engagement, and material performance makes primary packaging the key contributor to market growth.

The bottles and jars segment is anticipated to account for 38.90 percent of the total market revenue by 2025 within the packaging form category, making it the leading segment. This growth is being supported by the widespread use of recycled content in rigid packaging formats for food, beverages, and personal care products.

Brands are increasingly using post consumer resin and recycled glass to manufacture bottles and jars that meet structural integrity and branding requirements. These formats offer durability, reusability, and visual transparency which appeal to sustainability conscious consumers.

Additionally, advancements in sorting and processing technologies have made it feasible to achieve high recycled content without compromising quality. As product categories continue to adopt circular packaging models, bottles and jars remain central to fulfilling recycled material targets across high volume consumer applications.

Demand for recycled materials packaging is rising due to retail circularity targets and compliance with recycled content mandates. Sales of post-consumer resin (PCR) packaging formats are climbing as converters invest in optical sorting, chemical recycling, and food-grade reprocessing capacity.

Demand for recycled materials packaging rose 24% in 2025, driven by large retail groups pledging 25–50% PCR content across private-label packaging. USA converters installed advanced NIR-based sorting lines that boosted clear PET recovery by 17%, enabling more food-grade loop applications. Major European grocers shifted from virgin polyolefins to 70% PCR laminates in frozen food packs, cutting packaging-related emissions by 28%. Indian FMCG firms piloting mono-material pouches with 60% recycled LDPE achieved 94% mechanical recyclability in drop-off streams. These initiatives are pushing CPG brands to work directly with recyclers to secure supply, lock in feedstock contracts, and reduce landfill liability costs.

Sales of chemically recycled packaging formats grew 36% YoY as supply of food-grade mechanical PCR remained constrained. USA foodservice distributors adopted chemically recycled PET trays that met FDA no-objection criteria, unlocking new demand from deli and ready-meal vendors. Japanese packaging groups leveraged pyrolysis oil-derived PE to make 100% recycled bottle caps with equivalent tensile strength to virgin resin. European pouch suppliers integrated depolymerized nylon-6 into multilayer film formats for premium meat and cheese segments, improving oxygen barrier performance by 23%. As brands seek packaging formats that meet both recyclability and functionality requirements, chemical recycling is emerging as a viable path to scale.

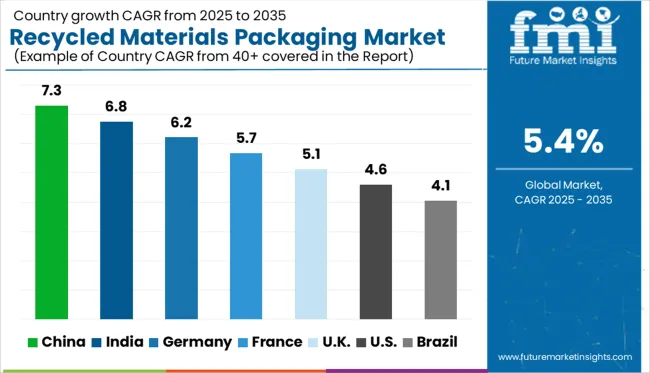

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The global recycled materials packaging market is projected to grow at a CAGR of 5.4% between 2025 and 2035. At the forefront, China (BRICS) leads with a growth rate of 7.3%, outpacing the global average by 1.9 percentage points, supported by national sustainability targets and a large-scale shift toward circular economy practices. India (BRICS) follows with a CAGR of 6.8% (+1.4 pp), driven by rising demand for eco-friendly packaging in FMCG and e-commerce sectors. Among OECD nations, Germany posts 6.2% (+0.8 pp), reflecting strong regulatory backing and innovation in recycled packaging technologies. The UK registers 5.1% (–0.3 pp), while the United States lags at 4.6% (–0.8 pp), reflecting slower policy enforcement and regional disparities in recycling infrastructure. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China’s recycled materials packaging market is expected to grow at a CAGR of 7.3% between 2025 and 2035, driven by circular economy mandates and rising demand for sustainable consumer goods. Between 2020 and 2024, demand fluctuated due to regulatory inconsistencies, but current policies now strongly favor high-recycled-content packaging. Government-led initiatives, such as the “No Waste Cities” program, are accelerating adoption across e-commerce and FMCG sectors.

India is projected to witness a CAGR of 6.8% from 2025 to 2035 in the recycled materials packaging space, supported by producer responsibility schemes and rapid industrialization. In the 2020–2024 period, growth remained modest due to low collection efficiency and infrastructure gaps. However, improved recycling networks and stricter Extended Producer Responsibility (EPR) compliance are now fueling stronger investment in recycled packaging substrates.

Germany’s recycled materials packaging market is anticipated to grow at a CAGR of 6.2% between 2025 and 2035, backed by strict packaging waste reduction laws and high recycling rates. During 2020–2024, the market was already mature but limited by supply-side shortages of food-grade recyclates. Moving forward, policy reforms under VerpackG and demand from premium brands are expected to lift volumes and quality standards.

The UK market is forecast to expand at a CAGR of 5.1% from 2025 to 2035, amid growing consumer pressure and post-Brexit sustainability initiatives. In the 2020–2024 timeframe, inconsistent collection standards hindered packaging recycling progress. The introduction of the Plastic Packaging Tax and deposit return schemes is now generating new momentum for recycled content integration in primary and secondary packaging.

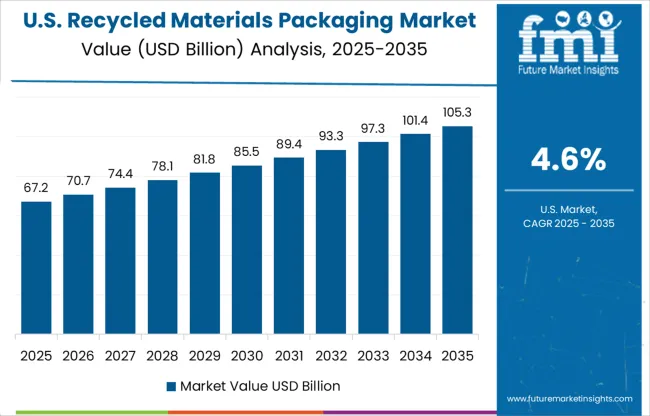

The USA market is projected to grow at a CAGR of 4.6% between 2025 and 2035, fueled by retailer-led sustainability pledges and localized recycling mandates. During 2020–2024, adoption of recycled packaging was fragmented across states. New momentum is emerging as states like California and New York implement recycled content laws that align with national CPG sustainability goals.

Demand for recycled materials packaging is gaining momentum in 2025, driven by regulatory pressures and rising consumer preference for sustainable solutions. Amcor leads the global market with a significant share, driven by its strong presence in PET and paper-based recycled packaging lines. Berry Global and Mondi Group are expanding recyclable flexible film portfolios, targeting food and beverage segments. DS Smith and Smurfit Kappa are increasing investments in corrugated fiberboard production, particularly in Europe. Sealed Air Corp. and Tetra Laval are innovating with closed-loop recycling models to support circular economy initiatives. Meanwhile, International Paper and Kruger Inc. are capitalizing on high post-consumer fiber availability in North America. The competitive landscape is intensifying as brands prioritize ESG-aligned packaging formats across sectors.

Recent Recycled Materials Packaging Industry News In February 2025, Amcor partnered with Tip Top Bakeries in Australia to launch bread bags made with 30% recycled plastic using ISCC mass-balanced content. The rollout cut an estimated 160 tonnes of virgin plastic annually, reinforcing sustainable packaging efforts.

| Item | Value |

|---|---|

| Quantitative Units | USD 200.2 Billion |

| Material Type | Paper & cardboard, Plastics, Glass, Metals, and Others |

| Packaging Type | Primary packaging, Secondary packaging, and Tertiary packaging |

| Packaging Form | Bottles & jars, Boxes & cartons, Bags & pouches, Drums & barrels, Protective packaging, and Others |

| End Use Industry | Food & beverage, Personal care & cosmetics, Consumer goods, Retail & e-commerce, Logistics & shipping, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor, Berry Global, DS Smith PLC, International Paper Company, Kruger Inc., Mondi Group, Packaging Corporation of America, Sealed Air Corp., Smurfit Kappa Group, and Tetra Laval International SA |

| Additional Attributes | Dollar sales by material type and packaging application, demand dynamics across food, personal care, and e-commerce sectors, regional trends in recycled content mandates, innovation in mono-material designs and chemical recycling, environmental impact of waste reduction, and emerging use cases in closed-loop packaging systems. |

The global recycled materials packaging market is estimated to be valued at USD 200.2 billion in 2025.

The market size for the recycled materials packaging market is projected to reach USD 338.7 billion by 2035.

The recycled materials packaging market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in recycled materials packaging market are paper & cardboard, plastics, glass, metals and others.

In terms of packaging type, primary packaging segment to command 51.2% share in the recycled materials packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recycled Concrete Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Pipes Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Metal Market Size and Share Forecast Outlook 2025 to 2035

Recycled Elastomers Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Market Size and Share Forecast Outlook 2025 to 2035

Recycled Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Recycled Asphalt Pavement Market Size and Share Forecast Outlook 2025 to 2035

Recycled Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Recycled Prescription Bag Market Size and Share Forecast Outlook 2025 to 2035

Recycled Fabric Bag Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Recycled Scrap Metal Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Recycled Prescription Bag Industry

Competitive Breakdown of Recycled Paper Suppliers

Recycled Polyethylene Terephthalate (rPET) Packaging Market Growth and Trends 2025 to 2035

Recycled Plastic Envelope Market

Recycled Envelopes Market

Recycled PET Packaging Market Size, Share & Forecast 2025 to 2035

Recycled Paper Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Packaging Market Trends & Growth Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA