The Recycled Glass Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period. The initial growth phase, spanning from 2020 to 2024, sees the market increase from USD 0.5 billion to USD 1.1 billion, contributing nearly 19.2% of the total projected growth. This period is characterized by increasing environmental regulations, heightened consumer awareness about the benefits of recycling, and growing demand for recycled materials in sectors such as manufacturing and construction.

Incremental gains during these years, including USD 0.8 billion in 2021 and USD 1.0 billion in 2023, underscore a consistent upward trajectory as industries emphasize resource efficiency and reducing carbon footprints. From 2025 to 2030, the market advances from USD 1.2 billion to USD 1.7 billion, driven by investments in recycling infrastructure and technological advancements that improve glass recovery rates and product quality. Expansion in emerging economies, fueled by industrialization and urbanization, further boosts demand. Broader applications of recycled glass in construction, automotive, and consumer goods diversify the market’s growth drivers.

The period from 2031 to 2035 is expected to bring accelerated growth, with the market rising from USD 1.8 billion to USD 2.6 billion, supported by stronger government mandates on recycling, corporate sustainability initiatives, and the adoption of circular economy practices. Enhanced collection systems, consumer participation, and innovative recycling technologies contribute to more efficient supply chains and cost reductions. Overall, the recycled glass market is positioned for sustained expansion through 2035, fueled by environmental priorities, regulatory frameworks, and growing industrial applications.

| Metric | Value |

|---|---|

| Recycled Glass Market Estimated Value in (2025 E) | USD 1.4 billion |

| Recycled Glass Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The recycled glass market is witnessing growing momentum due to rising environmental awareness, regulatory pressure to reduce landfill waste, and increasing investment in circular economy initiatives. Industries are shifting toward closed-loop recycling systems to minimize raw material usage and energy consumption, aligning with carbon neutrality targets.

The availability of post-consumer glass waste and technological advancements in optical sorting and contaminant removal have improved the economic feasibility of recycled glass processing. Public-private collaboration in waste collection infrastructure and deposit-return schemes has further expanded feedstock availability.

The market is poised for long-term growth, supported by strong demand from packaging, construction, and automotive sectors seeking sustainable raw material alternatives. Future opportunities are expected to arise from innovations in cullet processing and greater integration of recycled content in premium glass applications.

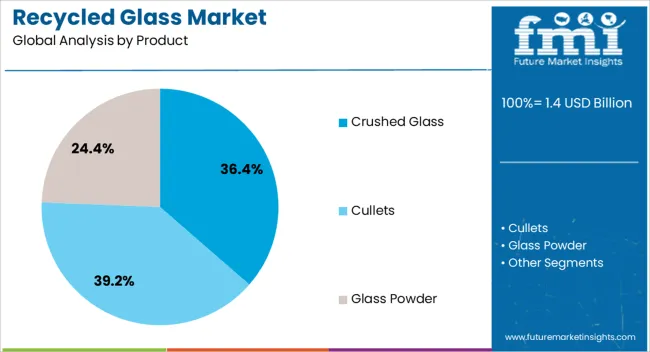

The recycled glass market is segmented by product, application, and geographic regions. By product, the recycled glass market is divided into Crushed Glass, Cullets, and Glass Powder. The recycled glass market is classified into Glass Bottle & Containers, Flat Glass, Fiber Glass, Highway Beads, Abrasives, Fillers, and Others. Regionally, the recycled glass industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Crushed glass is projected to account for 36.40% of the total revenue share in the recycled glass market by 2025, positioning it as the leading product type. This leadership has been driven by its broad utility across multiple downstream industries, including abrasives, filtration media, and construction aggregates.

The material’s high recyclability, inertness, and compatibility with existing processing systems have allowed for cost-effective reuse without performance compromise. Additionally, crushed glass has gained traction as a substitute for sand and gravel in infrastructure and landscaping applications, reducing demand for virgin materials.

With sustainability now a key procurement factor, industrial users are increasingly adopting crushed glass to reduce carbon intensity and qualify for green certifications. Continuous improvements in color separation and particle refinement technologies are further reinforcing its commercial viability.

The glass bottle and containers segment is expected to lead with a 41.70% share of the recycled glass market in 2025. This dominance is being supported by the strong commitment of beverage, cosmetic, and food companies to incorporate recycled content in packaging. Recycled glass cullet reduces furnace energy consumption, lowers CO₂ emissions, and maintains the structural integrity required for high-quality bottles and jars.

Policy incentives and extended producer responsibility (EPR) mandates in various regions are compelling manufacturers to increase recycled input levels. Consumer preference for sustainable and recyclable packaging is also influencing procurement decisions, particularly among premium and eco-conscious brands.

The ease of incorporating cullet in bottle manufacturing processes without significant capital investment is further strengthening this segment’s leadership. As packaging sustainability benchmarks evolve, the demand for recycled glass in container applications is expected to intensify.

Recycled glass demand is driven by packaging, construction, and industrial applications. Processing advancements and market diversification are expected to strengthen its role as a dependable secondary raw material.

The packaging sector remains the largest consumer of recycled glass, with beverage bottles, food jars, and cosmetic containers accounting for a significant share. Producers increasingly incorporate cullet into new container manufacturing to lower energy use and reduce raw material expenses. Color-separated glass enhances compatibility with specific product requirements, ensuring consistent quality and appearance. Regulatory pressures and voluntary industry targets have driven higher cullet ratios, particularly among global beverage brands. The closed-loop nature of glass recycling supports repeat material use without degradation in quality, making it a preferred choice for long-term packaging strategies. This consistent demand has stabilized the supply chain, creating reliable revenue channels for recyclers and manufacturers.

Recycled glass has secured a notable role in the construction sector, particularly as an aggregate substitute in concrete, asphalt, and road base applications. Its use in decorative finishes, terrazzo flooring, and landscaping materials adds aesthetic value while offering performance benefits such as abrasion resistance. The lightweight and inert properties of processed glass make it suitable for insulation, drainage, and filtration purposes. Infrastructure projects increasingly incorporate glass-based aggregates to meet material performance and cost efficiency targets. Specialized applications, such as reflective road marking beads, have created high-value niches. This diversification reduces dependency on packaging demand and broadens market opportunities for processors.

The fiberglass industry is a significant consumer of recycled glass, using cullet to produce insulation materials and composite reinforcements. The consistent composition and purity of processed glass allow for predictable manufacturing outcomes, essential in high-volume production. By substituting virgin raw materials with cullet, manufacturers achieve cost savings while maintaining product integrity. Recycled glass is also integrated into abrasive blasting media, water filtration systems, and ceramic products, expanding its industrial footprint. These specialized uses often command higher margins, encouraging recyclers to invest in advanced cleaning and sizing technologies. Growing acceptance of recycled inputs among industrial buyers ensures stable demand beyond traditional end-user sectors.

Modern recycling facilities employ advanced sorting systems, optical scanners, and automated cleaning processes to enhance the quality of recycled glass. These innovations reduce contamination from ceramics, metals, and organics, ensuring that cullet meets stringent manufacturing specifications. Color separation technologies improve value recovery, allowing for targeted supply to different glass product segments. Upgraded processing capabilities also enable recyclers to serve multiple industries with tailored feedstock specifications. The ability to deliver consistent, high-purity glass has strengthened long-term supply agreements with major manufacturers. Investment in these areas is critical to maintaining competitiveness and meeting the evolving quality standards demanded by diverse end markets.

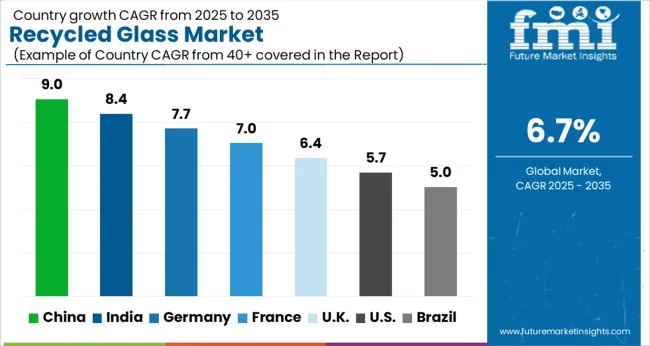

The recycled glass market is projected to grow globally at a CAGR of 6.7% from 2025 to 2035, driven by increasing sustainability initiatives, rising awareness of environmental impacts, and a growing focus on circular economy practices across industries. China leads with a CAGR of 9%, propelled by rapid urbanization, government policies promoting recycling, and its vast manufacturing base. India follows at 8%, supported by rising demand for sustainable building materials, increased waste management capabilities, and a shift towards eco-friendly packaging.

France achieves 7%, driven by regulatory initiatives encouraging waste reduction and circular economy practices in the packaging and construction sectors. The United Kingdom grows at 6%, benefiting from policies promoting recycling within the construction and packaging industries, as well as increasing investments in green technologies. The United States records 6%, with steady demand driven by growing public-private collaborations for waste-to-value initiatives and infrastructure improvements in recycling operations. This growth outlook underscores Asia’s leading role in driving the market, while Europe and North America see consistent adoption driven by regulatory support and the increasing emphasis on sustainable materials in various sectors.

The CAGR for the recycled glass market in the United Kingdom was around 4.8% during 2020–2024, and it is projected to rise to 6.0% during 2025–2035, signaling stronger growth driven by increasing environmental regulations and sustainability initiatives. The initial growth was moderate due to limited adoption of circular economy practices in some sectors and relatively lower recycling efficiency. However, with heightened regulatory pressure and a growing emphasis on reducing waste, the demand for recycled glass surged in the following period.

The push for sustainability in construction, packaging, and consumer goods industries has accelerated the market's expansion. The integration of advanced sorting technologies, alongside the increased use of recycled glass in building materials and packaging, is expected to continue to drive growth.

Government-led initiatives incentivized 30% of glass recycling facility upgrades by 2029.

China’s CAGR for the recycled glass market stood at 7.5% during 2020–2024 and is expected to surge to 9% in 2025–2035, reflecting rapid industrial development, improved waste management systems, and a growing demand for sustainable raw materials. The initial phase saw steady growth, primarily driven by urbanization and expansion of manufacturing capacities, which increased glass production waste. The next decade will see a substantial rise in demand due to significant investments in recycling infrastructure, alongside policies encouraging circular economy practices. Furthermore, the rapid adoption of recycled glass in packaging and building materials is anticipated to significantly contribute to the growth.

India’s CAGR for the recycled glass market was approximately 6% during 2020–2024 and is projected to increase to 8% in 2025–2035. The early growth phase was marked by slow adoption as the country’s recycling infrastructure was underdeveloped, and there was less emphasis on sustainable materials. However, this is expected to change dramatically as India ramps up its waste management initiatives and moves towards a circular economy model. The building and packaging industries will play a central role in this expansion, with growing demand for recycled glass in construction and consumer goods packaging. Supportive government policies encouraging waste recycling and sustainability will further enhance market dynamics.

France’s CAGR for the recycled glass market was 5.2% during 2020–2024 and is forecast to increase to 7% from 2025 to 2035. The early period witnessed a steady adoption of recycled glass, primarily driven by regulations on waste management and glass recycling, which encouraged manufacturers to invest in sustainable practices. As sustainability concerns gained more traction, France’s growing demand for eco-friendly products, particularly in packaging and construction materials, has increased market adoption. The next decade will see stronger growth as the construction sector adopts more sustainable practices, and the packaging industry continues to prioritize recyclable materials.

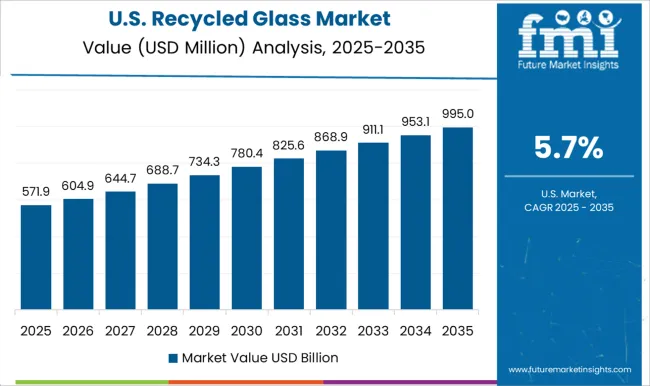

The recycled glass market in the United States exhibited a CAGR of 4.2% from 2020 to 2024 and is expected to grow at 5.6% during 2025–2035. This growth is attributed to the country’s increasing focus on sustainability and government regulations pushing for higher recycling rates. During the initial phase, adoption was relatively slow, with the glass industry focused more on primary production rather than recycled content. However, the expanding demand for environmentally friendly packaging solutions and the integration of recycled materials into building products will spur growth in the coming years. Advancements in recycling technologies and increased awareness will further fuel market dynamics.

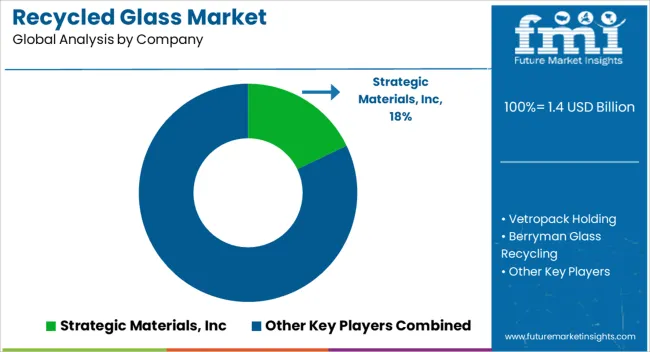

The recycled glass market features a combination of global recycling leaders, regional processors, and specialized material refiners working to strengthen supply chain efficiency and end-market penetration. Strategic Materials, Inc. stands as one of the largest North American cullet processors, serving packaging, fiberglass, and industrial applications. Vetropack Holding focuses on integrating recycled glass into its container production across Europe, maintaining strong relationships with beverage brands. Berryman Glass Recycling and Momentum Recycling LLC specialize in high-purity cullet supply for glass manufacturing and niche industrial uses. Glass Recycled Surfaces and Coloured Aggregates target architectural and decorative markets through value-added glass-based products. Dlubak Glass Company and Vitro Minerals Inc. emphasize processing post-industrial and post-consumer glass for fiberglass, abrasives, and filler applications. Glasrecycling NV and Consol Glass (Pty) Ltd. manage large-scale regional recycling operations to meet domestic and export demand. Harsco Minerals International incorporates recycled glass into construction and abrasive products, while Gallo Glass Company secures internal cullet supply from its container operations. Trivitro Corporation, G.R.L. and other specialized firms focus on processing consistency and custom feedstock solutions. Competitive strategies center on advanced sorting technology, expanding closed-loop partnerships with manufacturers, and diversifying into high-margin applications such as decorative aggregates and filtration media to capture broader market share.

Manufacturers are focusing on improving the quality and efficiency of recycling processes. Companies are investing in advanced sorting and cleaning technologies to enhance the purity of recycled glass, making it more suitable for use in high-quality applications. Some manufacturers are increasing the use of recycled content in production, especially in the construction and packaging sectors, in line with sustainability goals. Additionally, brands are collaborating with recycling facilities and local governments to promote glass collection programs and reduce waste. Companies like Owens-Illinois and Saint-Gobain are pioneering these advancements.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Product | Crushed Glass, Cullets, and Glass Powder |

| Application | Glass Bottle & Containers, Flat Glass, Fiber Glass, Highway Beads, Abrasives, Fillers, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Strategic Materials, Inc, Vetropack Holding, Berryman Glass Recycling, Glass Recycled Surfaces, Momentum Recycling LLC, Dlubak Glass Company, Vitro Minerals Inc, Glasrecycling NV, Harsco Minerals International, Coloured Aggregates, Gallo Glass Company, Trivitro Corporation, G.R.L, and Consol Glass (Pty) Ltd. |

| Additional Attributes | Dollar sales, share, end-use sector demand trends, regional market growth, pricing benchmarks, competitive landscape, supply chain stability, quality standards, regulatory impact, customer adoption rates, technology investment priorities. |

The global recycled glass market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the recycled glass market is projected to reach USD 2.6 billion by 2035.

The recycled glass market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in recycled glass market are crushed glass, cullets, _clear cullets, _amber cullets, _green cullets and glass powder.

In terms of application, glass bottle & containers segment to command 41.7% share in the recycled glass market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recycled Glass Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Packaging Market Trends & Growth Forecast 2024-2034

Glass Rolling Forming Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Liquor Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottles Market Forecast and Outlook 2025 to 2035

Glass Laser Engraving Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Restoration Kit Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottle and Container Market Forecast and Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass Cosmetic Bottle Market Size and Share Forecast Outlook 2025 to 2035

Recycled Concrete Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Market Size and Share Forecast Outlook 2025 to 2035

Glass Container Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Glass Fibre Yarn Market Size and Share Forecast Outlook 2025 to 2035

Glass Cloth Electrical Insulation Tape Market Size and Share Forecast Outlook 2025 to 2035

Glass Bonding Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA