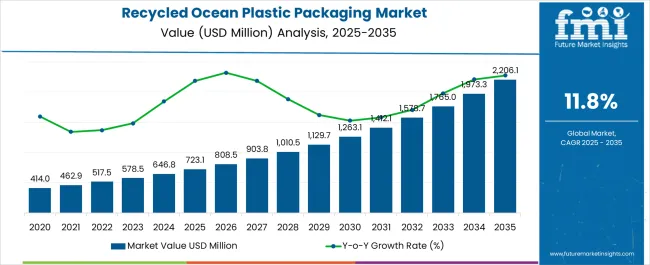

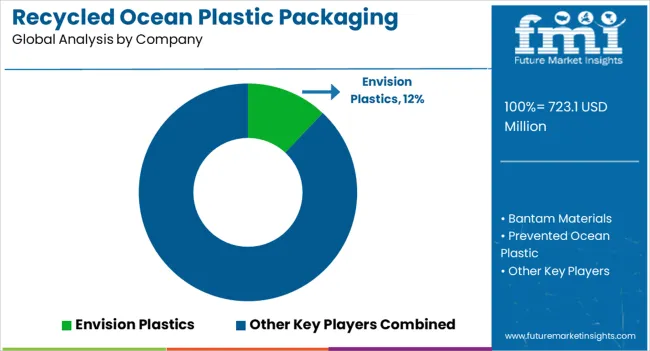

The recycled ocean plastic packaging market is estimated to be valued at USD 723.1 million in 2025 and is projected to reach USD 2206.1 million by 2035, registering a compound annual growth rate (CAGR) of 11.8% over the forecast period.

The market maturity curve shows early adoption during 2020–2024, with annual growth from 414.0 to 646.8 USD million, driven by pilot programs and limited deployment in high-value packaging segments. By 2025, the curve steepens as broader adoption occurs across food, beverage, and consumer goods packaging. Between 2025–2030, the market scales rapidly, growing from 723.1 to 1,263.1 USD million, supported by expanding collection and recycling capacity. From 2030–2035, growth moderates as consolidation occurs, with leading suppliers capturing the majority of market share and standardizing processes. The adoption lifecycle mirrors this progression. During 2020–2024, early adopters validate material quality, packaging performance, and supply chain feasibility, creating reference cases for broader deployment.

From 2025–2030, scaling occurs as mainstream manufacturers increase procurement, production processes stabilize, and distribution channels expand. By 2030–2035, consolidation dominates: late entrants follow proven supply models, partnerships and acquisitions shape competitive dynamics, and procurement focuses on cost efficiency and reliability. The market transitions from experimental adoption through rapid scale-up to a mature phase characterized by predictable demand, standardized supply chains, and established supplier relationships.

| Metric | Value |

|---|---|

| Recycled Ocean Plastic Packaging Market Estimated Value in (2025 E) | USD 723.1 million |

| Recycled Ocean Plastic Packaging Market Forecast Value in (2035 F) | USD 2206.1 million |

| Forecast CAGR (2025 to 2035) | 11.8% |

Seasonality in the recycled ocean plastic packaging market is influenced by production cycles, consumer demand peaks, and product launch schedules. Data indicates that Q3 and Q4 often account for 40–45% of annual procurement, coinciding with peak packaging requirements for beverages, snacks, and consumer goods ahead of holiday seasons. Conversely, Q1 typically records 10–15% lower activity, as manufacturers adjust inventories and plan for new product launches. Seasonal campaigns and promotional packaging often create short-term demand spikes of 10–15% above baseline. Suppliers coordinate collection, recycling, and production schedules to ensure consistent supply during high-demand periods while minimizing overstock in slower quarters.

Cyclicality reflects broader industrial investment and capacity expansion trends. Recycling and packaging operations generally follow 5–7 year upgrade or expansion cycles, producing periodic surges in demand that can increase annual market size by USD 200–300 million. Changes in regulations, import/export policies, or raw material availability can also temporarily accelerate procurement, producing short-term spikes of 5–10% above projected growth. These cyclical patterns overlay the underlying CAGR of 11.8%, creating alternating periods of rapid adoption and moderate stabilization. Recognizing these patterns allows suppliers and manufacturers to optimize production planning, inventory management, and supply chain coordination.

The market is gaining strong momentum as environmental sustainability becomes a priority across industries. Growing regulatory measures to curb marine pollution, combined with rising consumer demand for eco-friendly packaging, are propelling adoption. Technological advances in plastic recovery and recycling processes have improved the quality and durability of recycled materials, enabling their use in a wider range of packaging applications.

Corporations are integrating ocean plastic recovery initiatives into their supply chains to align with sustainability goals and enhance brand reputation. Supportive government policies, extended producer responsibility programs, and partnerships between packaging manufacturers and environmental organizations are creating favorable conditions for market expansion.

Increasing awareness about the harmful impact of ocean plastic waste is driving demand from sectors such as food and beverage, personal care, and consumer goods As supply chain efficiencies improve and recycling infrastructure strengthens, the market is expected to witness continued growth, driven by innovation and collaborative industry efforts.

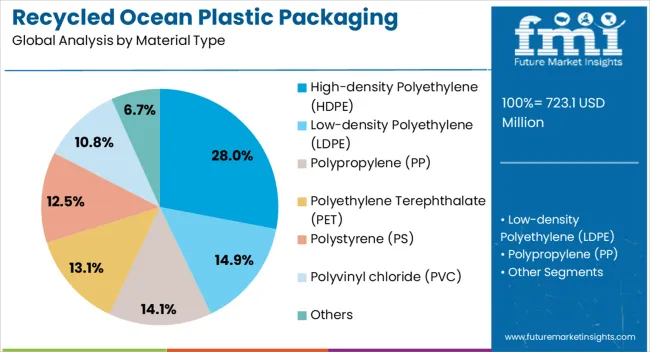

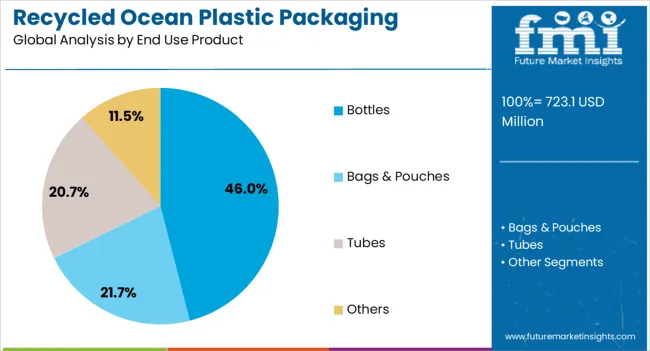

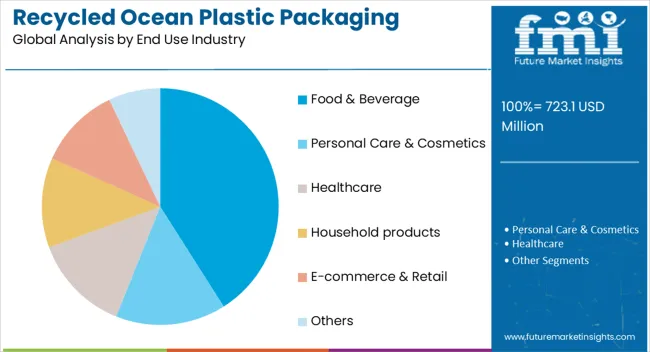

The recycled ocean plastic packaging market is segmented by material type, end use product, end use industry, and geographic regions. By material type, recycled ocean plastic packaging market is divided into high-density polyethylene (HDPE), low-density polyethylene (LDPE), polypropylene (PP), polyethylene terephthalate (PET), polystyrene (PS), polyvinyl chloride (PVC), and others. In terms of end use product, recycled ocean plastic packaging market is classified into bottles, bags & pouches, tubes, and others. Based on end use industry, recycled ocean plastic packaging market is segmented into food & beverage, personal care & cosmetics, healthcare, household products, e-commerce & retail, and others. Regionally, the recycled ocean plastic packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The high-density polyethylene material type segment is expected to hold 28% of the recycled ocean plastic packaging market revenue share in 2025, making it the leading material choice. This dominance is supported by the superior strength, chemical resistance, and versatility offered by HDPE, which make it suitable for a broad range of packaging applications. Its compatibility with existing recycling processes ensures a consistent supply of high-quality recycled HDPE, enhancing its adoption by manufacturers. The material’s ability to maintain performance characteristics even after multiple recycling cycles has reinforced its value in sustainable packaging solutions. Additionally, the lightweight nature of HDPE supports cost efficiency in transportation and logistics, further increasing its appeal The segment’s growth has also been driven by increasing consumer preference for packaging that combines environmental responsibility with durability, enabling brands to meet both functional and sustainability objectives.

The bottles segment is projected to account for 46% of the market revenue share in 2025, establishing its position as the dominant end use product category. The high share has been driven by extensive demand for bottles in beverages, personal care, and household products, coupled with strong industry initiatives to replace virgin plastics with recycled alternatives. Bottles made from recycled ocean plastics offer a sustainable solution without compromising on durability, safety, or design flexibility. The growing emphasis on circular economy practices has encouraged brands to adopt recycled bottles to reduce environmental impact and meet corporate sustainability targets. Advanced molding and processing technologies have improved the aesthetic and functional quality of recycled bottles, further boosting market acceptance Strategic partnerships between packaging producers and recycling organizations have also enhanced supply chain reliability, supporting consistent growth in this segment.

The food and beverage end use industry segment is anticipated to capture 41% of the market revenue share in 2025, making it the leading industry adopter. This strong position is a result of increasing regulatory scrutiny on single-use plastics and the rising demand from consumers for sustainable food and drink packaging. Recycled ocean plastic materials are being used in bottles, containers, and other packaging formats that meet stringent safety and quality standards for food contact applications. The industry’s adoption has been supported by brand commitments to reduce plastic waste and improve environmental footprints, which has accelerated large-scale procurement of recycled materials. The visibility of sustainable packaging in food and beverage products also enhances brand perception and customer loyalty Moreover, the integration of recycled ocean plastics into high-volume production lines has been facilitated by advancements in recycling technology, ensuring consistent quality and compliance, thereby strengthening the segment’s market leadership.

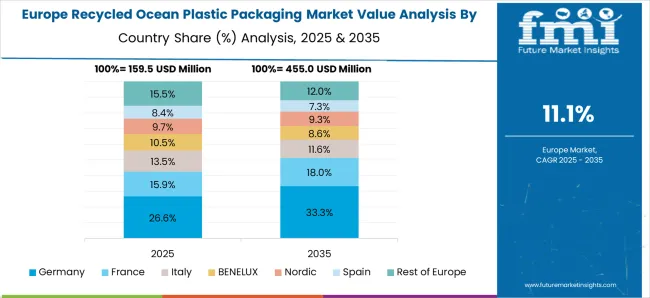

The recycled ocean plastic packaging market is growing as brands and consumers demand sustainable solutions to reduce marine plastic waste. Europe and North America lead adoption due to strict regulations and high consumer awareness, while Asia-Pacific is emerging due to increasing manufacturing and packaging volumes. Key players such as Unilever, Nestlé, Danone, Coca-Cola, and Amcor focus on integrating recycled ocean plastics into bottles, containers, and flexible packaging. The market emphasizes material quality, cost management, and scalability to replace virgin plastics in high-volume applications.

The supply of ocean-recovered plastic directly affects production volumes and quality consistency. Ocean plastics are often contaminated or degraded, requiring rigorous cleaning, sorting, and processing to meet packaging standards. Companies like Amcor and Unilever invest in advanced filtration and pelletizing technologies to ensure consistent polymer properties suitable for bottles, jars, and flexible films. Regional disparities exist: Europe benefits from well-organized ocean cleanup initiatives, while emerging Asia-Pacific markets are still developing collection infrastructure. Ensuring sufficient high-quality recycled ocean plastic is critical for scaling production without compromising packaging durability or regulatory compliance.

Ocean plastic-based polymers must be compatible with existing packaging machinery and processes. Melt strength, viscosity, and color consistency are crucial to avoid defects during extrusion, injection molding, or blow molding. Manufacturers prioritize additives and processing techniques that maintain material performance similar to virgin plastics. Companies like Nestlé and Danone collaborate with recyclers and equipment suppliers to optimize production lines for recycled ocean plastics. Until processing methods reliably match virgin plastic performance, adoption is focused on applications where minor material variability is acceptable, such as beverage bottles or secondary packaging.

Packaging made from recycled ocean plastics must comply with food safety, chemical migration, and labeling regulations in each region. Certifications such as ISO 14021 and third-party verification for recycled content are essential for global distribution. Europe enforces strict labeling and recycled content reporting, while North America follows FDA guidelines for food contact materials. Key players like Coca-Cola ensure traceability and certification to maintain consumer trust. Until global harmonized standards emerge, regulatory compliance remains a major consideration for scaling recycled ocean plastic packaging in high-volume markets.

Major brands adopt recycled ocean plastics to meet sustainability commitments and appeal to environmentally conscious consumers. Bottlers, FMCG companies, and personal care brands promote the use of recycled ocean plastics as part of corporate social responsibility campaigns. Companies such as Unilever and Coca-Cola differentiate products by highlighting recycled content percentages on packaging. Smaller packaging producers leverage niche applications like cosmetic containers or reusable packaging. Until collection and processing infrastructure expand, market adoption will be strongest in premium and environmentally visible segments, while commodity packaging remains slower to transition.

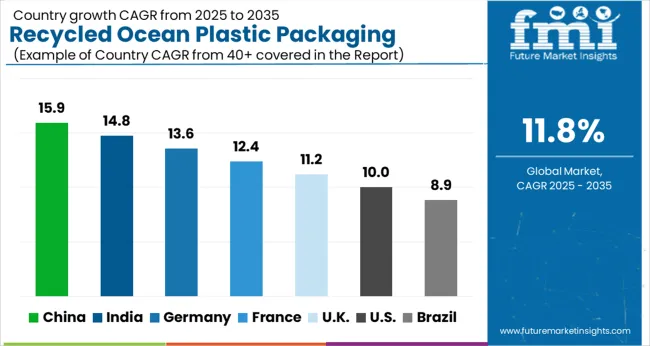

| Country | CAGR |

|---|---|

| China | 15.9% |

| India | 14.8% |

| Germany | 13.6% |

| France | 12.4% |

| U.K. | 11.2% |

| U.S. | 10.0% |

| Brazil | 8.9% |

The global recycled ocean plastic packaging market is projected to grow at a CAGR of 11.8% through 2035, supported by increasing demand across food, beverage, and consumer goods packaging applications. Among BRICS nations, China has been recorded with 15.9% growth, driven by large-scale production and deployment in sustainable packaging solutions, while India has been observed at 14.8%, supported by rising utilization in consumer and food packaging sectors. In the OECD region, Germany has been measured at 13.6%, where production and adoption for packaging applications using recycled ocean plastics have been steadily maintained. The United Kingdom has been noted at 11.2%, reflecting consistent use in food, beverage, and consumer goods packaging, while the U.S. has been recorded at 10.0%, with production and utilization across packaging for food, beverages, and consumer products being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The recycled ocean plastic packaging market in China is growing at a CAGR of 15.9%, driven by rising environmental awareness, sustainability initiatives, and demand for eco-friendly packaging solutions. Companies are increasingly incorporating recycled ocean plastics into bottles, containers, and flexible packaging to reduce plastic pollution and carbon footprint. Government regulations and policies promoting circular economy practices, plastic recycling, and marine conservation further encourage market adoption. Technological advancements in plastic recovery, sorting, and processing enhance material quality and usability in packaging applications. Major end-use sectors, including food and beverage, personal care, and consumer goods, are embracing sustainable alternatives to conventional plastics. Partnerships between brands, NGOs, and recycling companies are facilitating the supply of recycled ocean plastics. With increasing consumer preference for environmentally responsible packaging and stricter regulations on plastic waste, the market for recycled ocean plastic packaging in China is poised for sustained growth.

The recycled ocean plastic packaging market in India is expanding at a CAGR of 14.8%, fueled by increasing environmental awareness, sustainable packaging initiatives, and consumer preference for eco-friendly products. Industries such as food and beverage, personal care, and consumer goods are increasingly adopting recycled ocean plastics to reduce environmental impact. Government policies and regulatory frameworks encouraging plastic waste reduction, recycling, and circular economy practices support market growth. Technological innovations in sorting, cleaning, and processing ocean plastics improve material quality and usability. Collaborations among manufacturers, NGOs, and government organizations facilitate supply chains for recycled ocean plastics. With rising consumer consciousness about sustainability, marine pollution, and climate change, the demand for recycled ocean plastic packaging continues to grow. India’s focus on sustainable development and adoption of eco-friendly materials ensures the market’s strong growth trajectory in the coming years.

The recycled ocean plastic packaging market in Germany is growing at a CAGR of 13.6%, driven by consumer demand for sustainable products and government regulations supporting environmental conservation. Packaging manufacturers are increasingly using recycled ocean plastics in bottles, containers, and flexible packaging to minimize plastic pollution. Germany’s strict environmental policies, focus on circular economy practices, and support for marine conservation encourage the use of recycled materials. Technological developments in collection, sorting, and processing enhance the quality and versatility of recycled ocean plastics. Key industries, including food and beverage, cosmetics, and personal care, are adopting sustainable packaging solutions. Collaborations between businesses, recycling companies, and NGOs facilitate the efficient sourcing of ocean plastics. With increasing consumer preference for environmentally responsible packaging and stringent regulatory measures, Germany’s market for recycled ocean plastic packaging is poised for steady growth.

The recycled ocean plastic packaging market in the United Kingdom is expanding at a CAGR of 11.2%, driven by environmental awareness, sustainability initiatives, and regulatory measures promoting eco-friendly packaging. Manufacturers are adopting recycled ocean plastics for bottles, containers, and flexible packaging to reduce marine pollution and carbon footprint. Government regulations encouraging plastic recycling, waste reduction, and circular economy practices support market growth. Technological advancements in processing, cleaning, and material enhancement improve the performance and quality of recycled plastics. Major end-use sectors, including food, beverage, and consumer goods, are actively incorporating eco-efficient packaging solutions. Rising consumer preference for environmentally responsible products and corporate sustainability commitments strengthen market adoption. Partnerships among recycling firms, NGOs, and brands further facilitate a consistent supply of recycled ocean plastics. The market in the UK is poised for continued growth as sustainability and regulatory compliance remain top priorities.

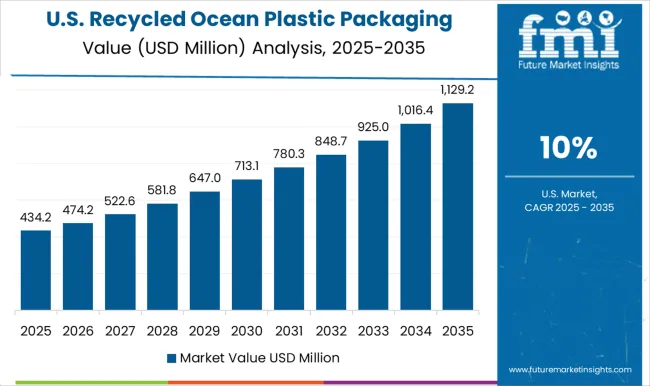

The recycled ocean plastic packaging market in the United States is growing at a CAGR of 10.0%, supported by increasing consumer preference for sustainable products and corporate environmental responsibility initiatives. Adoption of recycled ocean plastics in packaging for food, beverages, and personal care products is rising to reduce marine pollution and carbon footprint. Government policies encouraging recycling, waste reduction, and circular economy practices further boost market expansion. Technological advancements in cleaning, sorting, and material enhancement improve the usability and quality of recycled plastics. Collaboration between brands, NGOs, and recycling companies ensures a steady supply of ocean plastics for industrial applications. Consumer awareness regarding environmental sustainability and corporate commitments to eco-friendly packaging drive consistent demand. With a focus on reducing plastic pollution and adopting sustainable materials, the U.S. market for recycled ocean plastic packaging is expected to experience steady growth.

The recycled ocean plastic packaging market has emerged as a critical segment in the global push toward sustainable packaging solutions, addressing the dual challenges of plastic waste management and ocean pollution. Companies in this sector focus on recovering, processing, and converting post-consumer ocean plastics into high-quality packaging materials suitable for food, beverage, personal care, and consumer goods industries. The market growth is driven by increasing consumer awareness, corporate sustainability goals, and regulatory pressure to reduce virgin plastic usage. Envision Plastics is a prominent player in this space, offering recycled resin solutions that incorporate ocean-bound plastics into high-performance packaging products.

Bantam Materials specializes in transforming recovered marine plastics into durable packaging resins, emphasizing traceability and quality control throughout the recycling process. Oceanworks provides a platform connecting brands with certified ocean-bound plastic materials, enabling large-scale adoption of recycled packaging solutions. Plastix Global converts ocean plastics into market-ready resins, combining environmental responsibility with technical performance. Beyond these leading suppliers, numerous regional and emerging players contribute to the market, providing localized recycling and manufacturing capabilities that strengthen the circular economy for ocean plastics while promoting sustainability across supply chains.

| Item | Value |

|---|---|

| Quantitative Units | USD 723.1 million |

| Material Type | High-density Polyethylene (HDPE), Low-density Polyethylene (LDPE), Polypropylene (PP), Polyethylene Terephthalate (PET), Polystyrene (PS), Polyvinyl chloride (PVC), and Others |

| End Use Product | Bottles, Bags & Pouches, Tubes, and Others |

| End Use Industry | Food & Beverage, Personal Care & Cosmetics, Healthcare, Household products, E-commerce & Retail, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Envision Plastics, Bantam Materials, Oceanworks, Plastix Global |

| Additional Attributes | Dollar sales by material type including PET, HDPE, and polypropylene, application across food & beverages, personal care, and consumer goods packaging, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing sustainability awareness, regulatory support for recycled materials, and rising consumer demand for eco-friendly packaging solutions. |

The global recycled ocean plastic packaging market is estimated to be valued at USD 723.1 million in 2025.

The market size for the recycled ocean plastic packaging market is projected to reach USD 2,206.1 million by 2035.

The recycled ocean plastic packaging market is expected to grow at a 11.8% CAGR between 2025 and 2035.

The key product types in recycled ocean plastic packaging market are high-density polyethylene (hdpe), low-density polyethylene (ldpe), polypropylene (pp), polyethylene terephthalate (pet), polystyrene (ps), polyvinyl chloride (pvc) and others.

In terms of end use product, bottles segment to command 46.0% share in the recycled ocean plastic packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recycled Concrete Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Metal Market Size and Share Forecast Outlook 2025 to 2035

Recycled Elastomers Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Market Size and Share Forecast Outlook 2025 to 2035

Recycled Asphalt Pavement Market Size and Share Forecast Outlook 2025 to 2035

Recycled Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Recycled Prescription Bag Market Size and Share Forecast Outlook 2025 to 2035

Recycled Fabric Bag Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Recycled Scrap Metal Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Recycled Prescription Bag Industry

Competitive Breakdown of Recycled Paper Suppliers

Recycled Polyethylene Terephthalate (rPET) Packaging Market Growth and Trends 2025 to 2035

Recycled Envelopes Market

Recycled PET Packaging Market Size, Share & Forecast 2025 to 2035

Recycled Paper Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Packaging Market Trends & Growth Forecast 2024-2034

Recycled Aluminum Packaging Market Trends & Growth Forecast 2024-2034

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Pipes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA