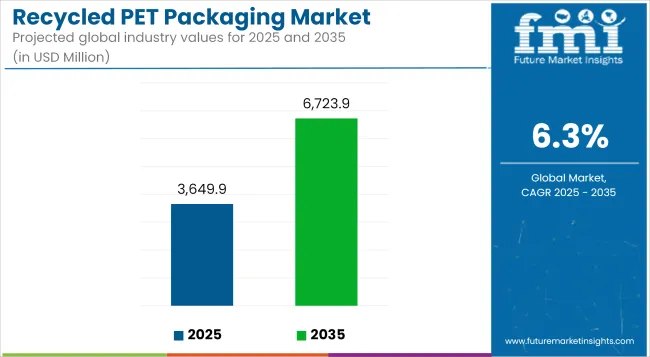

The global Recycled PET packaging market was valued at approximately USD 3,649.9 million in 2025 and is projected to reach USD 6,723.9 million by 2035, reflecting a robust CAGR of 6.3% during this period.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 3,649.9 Million |

| Market Value (2035F) | USD 6,723.9 Million |

| CAGR (2025 to 2035) | 6.3% |

Growth has been supported by increasing environmental awareness, government mandates on recycled content, and consumer preference for sustainable packaging solutions. Stringent regulations, such as the EU’s recycled PET mandates and Extended Producer Responsibility (EPR) programs in APAC, have further propelled market expansion.

Demand has been especially pronounced in food & beverage, personal care, and pharmaceutical sectors where brand reputation and regulatory compliance are essential. Innovations in rPET processing technologies have enabled producers to meet both functional requirements and eco‑friendly KPIs, ensuring that brands remain competitive amid rising sustainability expectations.

In October 2024, PLYMOUTH, Mich., announced Plastipak Packaging, Inc., a wholly-owned subsidiary of Plastipak Holdings, Inc. (Plastipak), has announced that its founder President and CEO William C. Young will transition out of his role and welcome the next generation of leadership, Edward V. Morgan.

The recycled PET packaging market has been significantly shaped by the growing emphasis on sustainability, circular economy practices, and regulatory mandates that encourage the reduction of virgin plastic usage. Advancements in recycling technologies especially synthetic and mechanical reusing methods have allowed for the creation of high-quality rPET suitable for various applications, including bottles & jars, trays, clamshells, and pouches.

These formats are increasingly adopted across the food & beverage industry and personal care segments due to their durability, clarity, and environmental appeal. Consumer goods and healthcare sectors have also shown rising adoption, utilizing rPET-based films, sheets, and tubs for safe, lightweight, and cost-effective packaging. This shift has been supported by consumer demand for low-impact packaging and retailers’ preference for packaging with transparent recycled content certification.

The recycled PET packaging sales is poised for continued expansion, driven by the accelerating adoption of rPET in fast-moving consumer goods, personal care, and retail & e-commerce segments. The market’s trajectory suggests growing demand for customizable, recyclable packaging solutions that meet both corporate sustainability targets and global regulatory benchmarks.

Companies investing in closed-loop systems, mono-material packaging designs, and advanced sorting technologies are expected to gain a competitive advantage. The integration of eco-labels, intelligent tracking systems, and lightweight rPET formats will play a pivotal role in shaping future packaging strategies.

With rPET increasingly replacing virgin plastics across applications from pharmaceutical packs to industrial containers the market is expected to play a critical role in advancing the global shift toward responsible packaging practices.

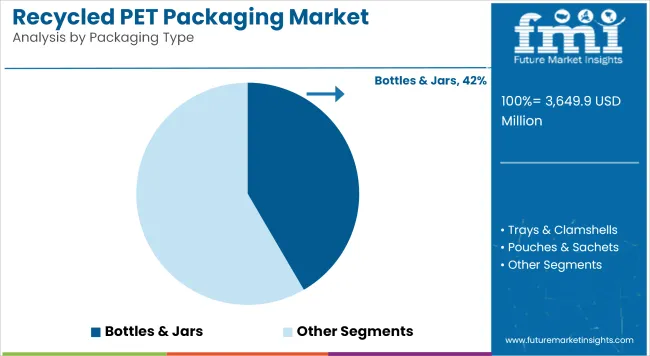

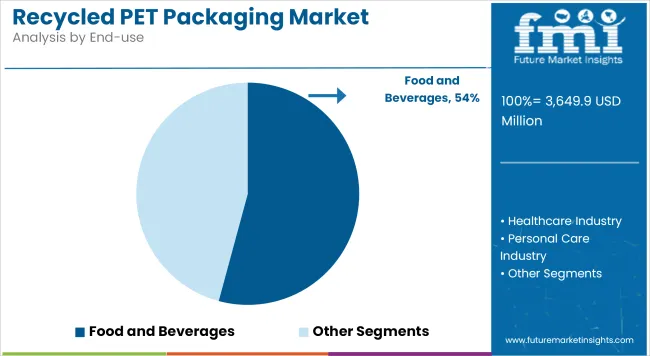

The Recycled PET (rPET) Packaging Market is segmented by packaging type, recycling process, application, and end-use industry. By packaging type, the market includes bottles & jars, trays & clamshells, pouches & sachets, films & sheets, containers & tubs, and others. Among these, bottles & jars represent a dominant investment segment, largely driven by their extensive use in beverages and personal care products. In terms of recycling process, the market is categorized into synthetic recycling and mechanical reusing, with mechanical reusing leading due to its economic feasibility and lower environmental footprint. From an end-use industry perspective, the key sectors include food & beverage, healthcare, personal care, retail & e-commerce, and industrial packaging. The food & beverage industry remains the top investor in rPET packaging solutions, propelled by sustainability mandates, consumer demand for eco-conscious brands, and stringent packaging regulations across developed markets.

Bottles and jars are projected to account for 41.6% of the recycled PET (rPET) packaging market by 2025, solidifying their position as the most dominant packaging format. Their widespread usage is attributed to the inherent properties of PET including high clarity, lightweight structure, barrier performance, and excellent recyclability which are retained even in recycled formats.

Within this category, single-use water bottles and carbonated soft drink bottles form the largest volume of rPET consumption. These formats are critical to the beverage industry, where major global brands such as Coca-Cola, PepsiCo, and Nestlé have pledged to use up to 50-100% rPET content in their primary packaging as part of their sustainable packaging roadmaps. The recyclability of PET bottles makes them a primary feedstock for rPET manufacturing, and their established collection infrastructure supports large-scale recycling efforts across developed and emerging markets.

Beyond beverages, personal care jars and bottles, used for products like creams, shampoos, and body lotions, have seen significant penetration of rPET. With consumers increasingly demanding plastic-free and low-carbon alternatives, brands are adopting transparent and tinted rPET jars that combine aesthetics with eco-credentials.

The food and beverage industry is projected to contribute approximately 54.2% of the global recycled PET (rPET) packaging market value by 2025, driven by rising regulatory mandates, brand sustainability commitments, and consumer demand for environmentally responsible packaging. Recycled PET has become the material of choice for bottling water, carbonated soft drinks, juices, ready-to-drink teas, and increasingly for food trays, clamshells, and flexible films.

Major food and beverage brands are pledging to use 25&-50% rPET content in their packaging by 2025-2030 as part of global plastic reduction goals, with the EU’s Single-Use Plastics Directive and the USA Plastics Pact accelerating adoption. Bottled water alone represents one of the largest rPET applications, with many brands already transitioning to 100% rPET bottles in key markets.

rPET offers excellent clarity, strength, and barrier properties comparable to virgin PET, making it ideal for food-safe applications. Its recyclability and lightweight nature further contribute to reductions in carbon footprint and logistics costs.

Technological improvements in food-grade rPET production-such as enhanced decontamination processes and closed-loop recycling systems-are also boosting confidence among food manufacturers. As a result, rPET packaging is expected to maintain strong momentum in the food and beverage sector, with demand forecast to exceed 2.1 million metric tons annually by 2027, firmly establishing it as the leading end-use industry in the global rPET packaging landscape.

Recycling Contamination and High Processing Costs

One big challenge in the recycled PET packaging market is the contamination in the recycling process. This can harm the quality and use of rPET for food containers. Another issue is the high cost of new PET recycling technology, especially chemical recycling. It makes large-scale production hard and costly.

Also, not having the same global rules on recycled content causes uneven use of rPET in different fields and places.

Chemical Recycling Innovations, Refillable Packaging Models, and Biodegradable rPET

Though there are difficulties, the recycled PET packaging market has big chances to grow. The rise of better recycling methods, which make pure rPET with little damage, is helping the market and making it safe for food use.

The growth of refill models, which support ongoing recycling and longer product life, is building new ways for companies to do business. Also, the rise in use of biodegradable rPET mixes, which give better green benefits and stay strong, is likely to help market growth.

New rPET flexible packs, light bottles, and compost-ready rPET choices, aimed at green-minded shoppers and meeting company green goals, are also set to help the market grow faster.

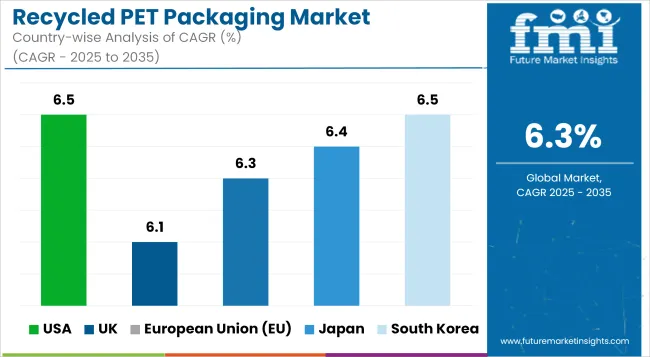

The market for recycled PET (rPET) packaging in the USA is growing steadily. This growth is due to more rules about plastic waste, higher consumer demand for eco-friendly packages, and big investments in recycling facilities. The EPA and FDA set the safety and recycling standards for rPET packages.

Food-grade rPET uses are expanding. More rPET is used in drink bottles and care product packages. Investments are increasing in systems to recycle and reuse materials. Also, new tech in chemical recycling is making rPET better and cleaner. These changes are guiding trends in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

The recycled PET (rPET) packagingmarket in the UK is growing fast. This is because the government has tough rules on using plastics only once, and there is more money going into recycling projects. Stores and retailers are also working hard to use more recycled plastic. Two important groups, the UK Environment Agency and the British Plastics Federation, make sure the packaging rules are followed and recycling goals are met.

The market is seeing more recycled plastic used in food, drink, cosmetics, and medicine packaging. Plans to recycle plastic bottles through return schemes are helping this growth. There are also new, strong, and light recycled plastic packages for shipping and shopping online. These new ideas are shaping the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.1% |

The recycled PET packaging market in the European Union is growing well. This is all because of strict regulation of recycling plastic, increased application of rPET in food, and additional expenditure on new methods of sorting and recycling plastic. The European Chemicals Agency and the European Commission's plans control the application, safety, and recycling of rPET.

Germany, France, and Italy are at the forefront of utilising food-safe rPET. They are also putting more money into recycling factories for PET and expanding brand promises to use rPET. Besides, the rise in rPET use for flexible packaging and shaped containers is helping the market grow.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.3% |

The recycled PET (rPET) packaging market in Japan is growing. This is due to strong efforts by the government to cut down on plastic waste and a rising use of rPET in drink bottles and care products. More money is also being put into high-tech recycling methods. The Ministry of the Environment and the Japan PET Bottle Recycling Association (JPR) oversee the safety and green practices of rPET packaging.

Japanese firms are putting money into recycling PET bottles in a loop and making bio-rPET materials better. They are also working on super-clean ways to recycle for food. On top of that, new uses of rPET in electronics and industry are setting new trends in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

The recycled PET (rPET) packaging South Korea is growing fast. This is due to the government pushing for recycled packaging, a need for eco-friendly options, and more use of rPET in packaging. The Ministry of Environment and the Korea Packaging Recycling Cooperative (KPRC) manage the recycling rules.

More use of clear rPET for food and drinks, more money put into recycling plants, and better tech for collecting waste are key trends. Also, new investments in AI sorting and better cleaning methods are speeding up rPET use. Together, these factors drive market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.5% |

The recycled PET (rPET) packaging market is growing as more people want sustainable packaging. Governments have rules to cut down on plastic waste. Consumers also choose green products more often now. The market benefits from new PET recycling methods. More companies are following circular economy ideas and using rPET in food, drinks, and personal care packages.

Firms aim to make high-quality, safe, and light rPET to help the environment, improve their brand, and meet rules. This market includes top packaging makers, recycling tech firms, and big drink companies. They are all working on better ways to recycle, make biodegradable PET, and produce clear rPET.

Other Key Players

The overall market size for the recycled PET packaging market was USD 3,649.9 Million in 2025.

The recycled PET packaging market is expected to reach USD 6,723.9 Million in 2035.

Growing environmental concerns, increasing government regulations on plastic waste, and rising adoption of sustainable packaging solutions will drive market growth.

The USA, China, Germany, India, and the UK are key contributors.

Bottles are expected to dominate due to their widespread use in the beverage industry and high recyclability.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PET Packaging Market Analysis - Growth & Forecast 2025 to 2035

BOPET Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Pet Care Packaging Market Insights - Growth & Forecast 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of PET Material Packaging Market Share

Recycled Paper Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Packaging Market Trends & Growth Forecast 2024-2034

Recycled Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Aluminum Packaging Market Trends & Growth Forecast 2024-2034

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Ocean Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Post-Consumer Recycled Packaging Market Share & Industry Leaders

Recycled Polyethylene Terephthalate (rPET) Packaging Market Growth and Trends 2025 to 2035

Post-Consumer Recycled (PCR) Plastic Packaging Market Analysis Size, Share & Forecast 2025 to 2035

Assessing Post-Consumer Recycled Plastic Packaging Market Share & Industry Trends

Pet Joint Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Pet Cognitive Supplement Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA