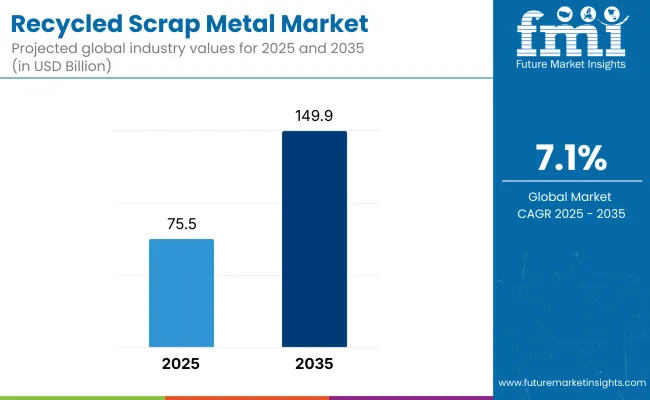

The global sales of recycled scrap metal is estimated at USD 75.5 billion in 2025. Revenue is projected to rise steadily at a CAGR of 7.1% from 2025 to 2035, reaching USD 149.9 billion by the end of the forecast period. The upsurge in metal recycling has been driven by rising industrial demand for sustainable and cost-efficient raw materials, especially within construction, automotive, and consumer electronics.

Strong interest in circular economy practices has supported scrap utilization across key sectors. Steel Dynamics Inc., in its 2025 quarterly update, confirmed higher scrap usage rates in electric arc furnace operations due to volatile iron ore prices and stricter emissions norms globally.

In the automotive sector, recycled aluminum demand surged following the 2024 European Commission directive on vehicle end-of-life recovery targets. Novelis Inc. announced in its 2025 press release a 20% year-on-year rise in recycled content aluminum production, attributing it to elevated demand from electric vehicle producers in Europe and North America.

The construction industry has contributed significantly to scrap metal usage, especially in emerging markets. ArcelorMittal’s 2025 investor communication emphasized its focus on high-strength steel products derived from recycled feedstock for infrastructure projects in India and Southeast Asia. Demand has been further fueled by rising steel consumption in modular housing and prefabricated structures.

Technological upgrades in shredding, sorting, and metallurgy have strengthened supply chain reliability and product quality. As stated in Nucor Corporation’s 2025 sustainability report, AI-based scrap segregation systems and zero-discharge recycling facilities have been implemented across multiple sites to comply with evolving environmental regulations. These innovations are expected to reduce waste loss and enhance yield rates, thereby improving economic feasibility.

Policy incentives and extended producer responsibility (EPR) schemes have also encouraged manufacturers to adopt recycled inputs. The Ministry of Industry and Information Technology in China released updated 2025 guidelines promoting tax credits for manufacturers using certified recycled scrap in production. These developments are expected to improve procurement transparency and traceability.

Challenges remain in achieving material uniformity and overcoming contamination issues. However, continuous R&D is addressing these obstacles. According to a 2024 statement by the CEO of Sims Limited, “Investments in advanced optical sorting and blockchain-based certification are reinforcing customer trust in recycled inputs, particularly among high-end alloy consumers.”

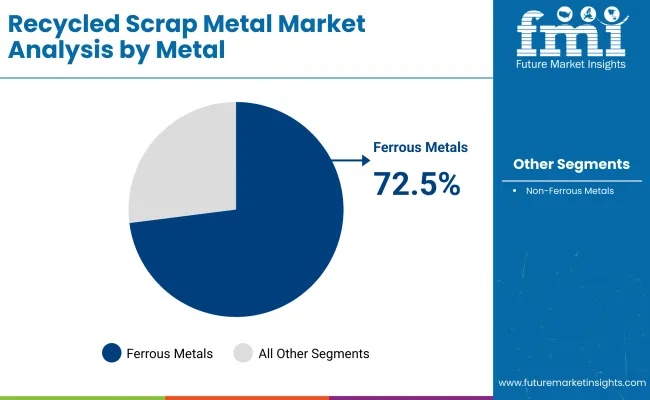

The section contains information about the leading segments in the industry. By metal type, ferrous metals segment is estimated to grow at a CAGR of 6.8% throughout 2035. Additionally, Building & Construction end use is projected to expand at 6.4% by 2035.

| Metal Type | Value Share (2035) |

|---|---|

| Ferrous Metals | 72.5% |

The rising demand for ferrous metals is encouraged by developments in the construction and transportation sectors, where they are needed to build up infrastructure, automobiles, trains, and ships. Apart from this, additional growth will come from a rising production of industrial machinery, components, tools, and equipment, emphasizing the role of ferrous metals in industrial development.

Conversely, the non-ferrous metals segment-which includes materials such as aluminum, copper, and lead-is also experiencing notable growth; however, this growth occurs at a different rate.

Non-ferrous metals have been extensively used in aerospace, electronics, and renewable energy sectors, where such metals are needed for their lightweight properties, corrosion resistance, and high conductivity. Non-ferrous metals account for smaller volume in the market, but their demand is steadily rising owing to the rising automotive applications of aluminum and the electrical infrastructure needs of copper.

Both subsegments are essential to the circular economy, where ferrous metals lead in volume and non-ferrous metals drive innovation in high-tech industries.

| Metal Type | Value Share (2035) |

|---|---|

| Building & Construction | 15.6% |

The building and construction sector is going to experience growth in revenue to 6.4% over the period 2025 to 2035, as people continue to require more infrastructure facilities globally and embrace sustainable construction products. Recycled ferrous metals for use in a construction project mainly include steel and iron, highly sought after on account of lower costs and achievable sustainability goals.

With the rising demand in the construction and building industry for green buildings and energy-efficient structures, it continues to consume large amounts of recycled scrap metal. The growth of the sector will also be driven by the increasing use of recycled steel in commercial and residential construction for structural parts.

While demand from other end-use sectors such as transportation, consumer electronics, and packaging drives demand for recycled metals, these may not necessarily be growing as fast as in the construction sector. The transport sector, for instance, is continuously using large volumes of recycled metals, especially for vehicle production. Aluminum and steel are key materials.

Similarly, consumer electronics and packaging are dependent on non-ferrous metals such as aluminum and copper. Though these sectors are showing good demand, the building and construction industry is more promising in terms of growth, as its demand for recycled metals is increasingly aligned with global sustainability and environmental goals.

Apparatus and hand tools, plus art, décor, and furniture, are all niche markets experiencing steady but somewhat reduced growth, with jewelry and some other areas only seeing a lower demand for their recycled metals.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the recycled scrap metal market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

In the first half (H1) from 2024 to 2034, the business is predicted to surge at a CAGR of 6.1%, followed by a slightly higher growth rate of 7.5% in the second half (H2).

| Particular | Value CAGR |

|---|---|

| H1 | 6.1% (2024 to 2034) |

| H2 | 7.5% (2024 to 2034) |

| H1 | 6.5% (2025 to 2035) |

| H2 | 7.7% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 6.5% in the first half and remain relatively moderate at 7.7% in the second half. In the first half (H1) the market witnessed an increase of 40 BPS while in the second half (H2), the market witnessed an increase of 20 BPS.

Governments’ Stricter Recycling Policies and Incentives Driving Growth in the Global Recycled Scrap Metal Market

Governments of various countries are imposing more stringent recycling policies to boost metal recycling and sustainability. These include some mandatory recycling targets, extended producer responsibility programs, and more stringent emissions standards.

For instance, the European Union's Circular Economy Action Plan sets more stringent recycling rates with specific targets for recycling metals like aluminum and steel. Similarly, the United States has initiated various regulations such as the "Copper-Free Brake Initiative" of California that seeks to reduce copper usage in brake pads of automobiles thereby increasing demand for recycled metals.

Besides regulations, most governments also provide monetary benefits to the businesses involved in metal recycling. Germany, which is at the forefront in the world with its recycling activity, offers waste management companies and recycling infrastructure incentives for the collection and processing of ferrous and non-ferrous metals.

In Japan, the whole recycling system includes financial support to collect and process scrap metals. Such incentives will be helpful for increasing the capacity of recycling and assuring sustainable usage of metals. Thus, they would help promote growth in the global recycled scrap metal market.

Energy Conservation Driving Growth in Recycled Scrap Metal Market

Energy conservation is another major reason why the market for recycled scrap metals is increasing at a significant pace. The extraction and processing of metals from virgin ores consume significantly more energy than the recycling of metals. It thus saves cost, but at the same time, helps in conserving the environment.

For example, recycling one ton of steel conserves 1.1 tons of iron ore, 0.6 tons of coking coal, and 0.05 tons of limestone, while saving energy. Recycling aluminum saves up to 95% of the energy required to produce aluminum from raw bauxite, which shows how much energy is conserved through metal recycling.

As demand for metals is ever increasing in the world, saving energy through recycling is very crucial. In fact, the use of recycled metals such as steel, aluminum, and copper is a major way of saving energy in general. Steel industry alone saves up to 74% of energy compared to primary production, and aluminum recycling cuts energy use by 95%. This is the driving force behind industrial shifts toward metal recycling as a more sustainable and cost-effective alternative to traditional mining processes.

Investment in Recycling Infrastructure by Governments and Companies Fuels Growth in the Recycled Scrap Metal Market

Governments and private companies are making significant investments in expanding and improving recycling infrastructure, which is a major driver of the recycled scrap metal market. Around the world, countries are embracing recycling as part of achieving their sustainability goals and moving away from virgin materials.

In the United States, for instance, private companies like Sims Metal Management announced investment in new expansions to recycle facilities. This has seen the operations of Sims Metal being upgraded by more than USD 100 million, thereby enhancing the recovery of metal.

The European Union has also allocated significant funds, where governments and industries have invested over USD 50 million to develop new advanced recycling technologies and facilities in order to enhance the processing capacity for scrap metals. In China, the government has introduced incentives and funding of USD 5 billion in order to push for the development of an efficient recycling infrastructure as part of its move towards a circular economy.

The quality of recyclable metals will also improve through investments that ensure efficiency in collection and processing systems to match the high demand of scrap metals by the construction, automotive, and electronics industries. This investment is bound to raise scrap metal processing capacities for increased delivery on the demand side while providing means toward sustainable environments.

The global recycled scrap metal system market recorded a CAGR of 6.4% during the historical period between 2020 and 2024. The growth of recycled scrap metal market was positive as it reached a value of USD 70.5 billion in 2024 from USD 54.4 billion in 2020.

The recycled scrap metal market, between 2020 and 2024, was faced with challenges such as raw material price fluctuations, limited recycling infrastructure in some regions, and disruptions caused by the COVID-19 pandemic. Price volatility of scrap metals, heightened by global economic instability, ever-changing scrap prices, all affect profits at recyclers.

Additionally, the pandemic-induced supply chain disruptions slowed down collection and processing activities, leading to temporary declines in recycling rates. The sector was able to cope with all these strains by strategically investing in recycling technologies and collaborations.

For instance, the use of automated sorting and processing systems will allow the recyclers to maximize their efficiency and cut down on their dependence on manual labor. Government incentives and policies that inspire green practices will further prop the industry though this period.

The recycling market of scrap metal is expected to be more than double in terms of value by 2035 compared to the market value during 2025. The automobile, construction, and electronics industries require more sustainable material due to a sharp increase in demand. Hence, companies must comply with rigid environmental regulations.

The incorporation of newer recycling technologies, among them energy-efficient electric arc furnaces and sophisticated material recovery systems, would improve processing and reduce cost. The circular economy drive will also spur further market growth as it drives industries to source more recycled metals to reduce carbon footprints and save natural resources.

This period should see a steady CAGR of 7.1% representing the shift and transition in more sustainable and resource-efficient practices adopted by the industries.

Tier 1 companies comprise market leaders with a market revenue of above USD 50 million capturing a significant market share of 30-35% in the recycled scrap metal market. These market leaders are characterized by extensive expertise in manufacturing across a range of packaging formats and have a wide geographic reach, with a strong foundation of consumers.

They offer an extensive range of series, which includes recycling and manufacturing with the latest technology to meet regulatory requirements and deliver quality. Prominent companies within Tier 1 include American Iron & Metal (AIM), ArcelorMittal, Aurubis AG and DBW Metals Recycling.

Tier 2 and other includes the majority of small-scale companies operating at the local presence and serving niche markets having revenue below USD 50 million. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 2 share segment.

They are small-scale players and have limited geographical reach. Tier 2, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

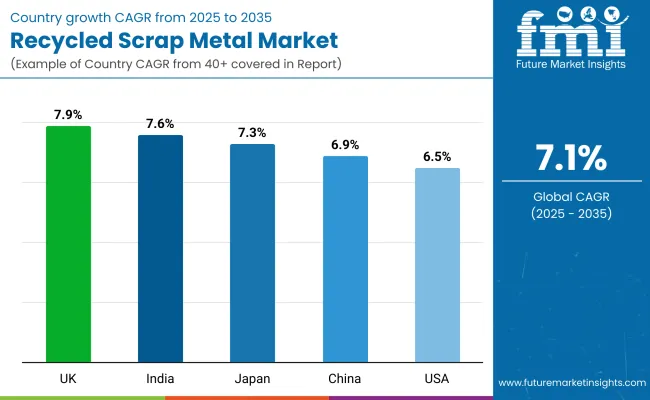

The section below covers the industry analysis for the recycled scrap metal market for different countries. Market demand analysis on key countries is provided. The USA is anticipated to remain at the forefront in North America, with a value share of 65.6% through 2035. In East Asia, China is projected to witness a CAGR of 6.9% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

| UK | 7.9% |

| China | 6.9% |

| Japan | 7.3% |

| India | 7.6% |

Estimated to be USD 19.5 billion in 2023, the total value of domestic purchases of iron and steel scrap decreased from the previous year of USD 24.1 billion in 2022. The Automotive sector, one of the largest consumers of the market, annually recycles more than 15 million tons of steel from cars alone. In addition to conserving iron ore and energy, this recycling reduces the environmental footprint of its steel product.

The USA has a well-developed recycling infrastructure, with an average recycling rate of 80-90% over the last decade, thus providing a consistent supply of scrap metal to manufacturing and construction industries.

The other significant factor driving growth within the market includes innovation in processes of recycling. Companies like Commercial Metals Company and Sims Metal Management are investing more in technologies that make it possible to recover materials efficiently through recycling.

For instance, Sims Metal equipped its facilities with advanced automated sorting technologies, such as the Metso N-Series shredders that increase material recovery rates while optimizing energy consumption. CMC also implemented efficient processing systems in their recycling plants to ensure minimal impact to the environment while ensuring that more material throughput occurs under their CMC Recycling Operations.

These innovations, market demand, as well as ever-changing regulatory frames, have culminated in giving the USA a stronghold in the scrap metal recycled recycling market globally.

Over the next few years, China is expected to continue to dominate the recycled scrap metal industry in the Asia Pacific, the world's fastest-growing metal recycling market. China is a hub for scrap metal recycling businesses due to the country's significant need for recycled e-waste metals in the building and construction industry, which is bolstered by the country's highly developed manufacturing sector and developing construction and automotive sectors.

Based on 2022 data from World Steel, China produced 1,014.5 Million tons of steel or around 54% of global crude steel output. Approximately 22% of China's steelmaking inputs come from recycled e-waste.

Over the next two decades, the variables will likely encourage worldwide purchases of consumer durables and the building and construction industry. As a percentage of total sales, the Chinese recycled scrap metal market is expected to account for 56%.

Germany's recycled scrap metal market is driven by its robust industrial base and stringent environmental policies. As one of the major recyclers in Europe, Germany recycled about 19 million tons of ferrous and non-ferrous scrap in 2022, thereby playing a crucial role in the circular economy.

Recycled metals are mainly used in the automotive and construction industries. More than 90% of steel is recycled from these sectors. With such a recycling rate, it not only reduces dependency on raw material but also on CO₂ emission, which comes in line with the ambitious climate goals.

Technological progress is also playing a very key role in boosting the efficiency of recycling. Organizations such as TRIMET Aluminium SE and Scholz Recycling GmbH are on top, utilizing technologies including Hydro Aluminium Recycling and Scholz Group's Smart Recycling System to boost the recovery of material and energy.

These technologies keep Germany's recycling rates at its high level without compromising environmental regulations, thereby entrenching the country's lead in the scrap metal market across Europe.

The recycled scrap metal market is experiencing rapid growth, driven by technological advancements and increasing demand for sustainable materials. As industries prioritize energy efficiency, resource conservation, and environmental regulations, the market is benefitting from innovations in recycling processes and equipment.

The increasing emphasis on a circular economy is also playing a significant role in driving demand for recycled scrap metal across various sectors, including automotive, construction, and electronics. Furthermore, the growing trend of using recycled metals in manufacturing processes contributes to the reduction of carbon footprints and energy consumption compared to using virgin materials.

Key players in the market are adopting advanced recycling technologies, such as automated sorting systems and energy-efficient processing techniques, to improve recovery rates and reduce production costs. The transition toward a circular economy is fostering further growth, with companies focusing on sustainable and eco-friendly practices to meet rising regulatory demands.

Expansion into emerging markets will continue to be a major strategy, as governments and industries invest in developing recycling infrastructure. Additionally, smaller companies and start-ups are likely to play a pivotal role in driving innovation, helping to shape the future of the recycled scrap metal industry.

Recent Industry Developments

In terms of metal type, the industry is divided into Ferrous Metals and Non-Ferrous Metals. Ferrous Metals is further segmented into Iron and Steel. Similarly, Non-Ferrous Metals is further segmented into Aluminum, Copper, Precious Metal, Tin, Zinc and Others.

In terms of source type, the industry is divided into production scrap and post-consumer scrap.

In terms of End-Use, the industry is divided into automotive, building & construction, consumer electronics, packaging, equipment & tools, art, decor & home furnishings, jewellery and others.

Key regions of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific and Middle East & Africa have been covered in the report.

The global recycled scrap metal industry is projected to witness a CAGR of 7.1% between 2025 and 2035.

The global recycled scrap metal industry stood at USD 75.5 billion in 2025.

The global recycled scrap metal industry is anticipated to reach USD 149.9 billion by 2035 end.

The key players operating in the global recycled scrap metal industry American Iron & Metal (AIM), ArcelorMittal and Aurubis AG.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Tons) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Metal Type, 2017 to 2032

Table 4: Global Market Volume (Tons) Forecast by Metal Type, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Source Type, 2017 to 2032

Table 6: Global Market Volume (Tons) Forecast by Source Type, 2017 to 2032

Table 7: Global Market Value (US$ Million) Forecast by End-Use, 2017 to 2032

Table 8: Global Market Volume (Tons) Forecast by End-Use, 2017 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 10: North America Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Metal Type, 2017 to 2032

Table 12: North America Market Volume (Tons) Forecast by Metal Type, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Source Type, 2017 to 2032

Table 14: North America Market Volume (Tons) Forecast by Source Type, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by End-Use, 2017 to 2032

Table 16: North America Market Volume (Tons) Forecast by End-Use, 2017 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 19: Latin America Market Value (US$ Million) Forecast by Metal Type, 2017 to 2032

Table 20: Latin America Market Volume (Tons) Forecast by Metal Type, 2017 to 2032

Table 21: Latin America Market Value (US$ Million) Forecast by Source Type, 2017 to 2032

Table 22: Latin America Market Volume (Tons) Forecast by Source Type, 2017 to 2032

Table 23: Latin America Market Value (US$ Million) Forecast by End-Use, 2017 to 2032

Table 24: Latin America Market Volume (Tons) Forecast by End-Use, 2017 to 2032

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Europe Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 27: Europe Market Value (US$ Million) Forecast by Metal Type, 2017 to 2032

Table 28: Europe Market Volume (Tons) Forecast by Metal Type, 2017 to 2032

Table 29: Europe Market Value (US$ Million) Forecast by Source Type, 2017 to 2032

Table 30: Europe Market Volume (Tons) Forecast by Source Type, 2017 to 2032

Table 31: Europe Market Value (US$ Million) Forecast by End-Use, 2017 to 2032

Table 32: Europe Market Volume (Tons) Forecast by End-Use, 2017 to 2032

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 34: Asia Pacific Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Metal Type, 2017 to 2032

Table 36: Asia Pacific Market Volume (Tons) Forecast by Metal Type, 2017 to 2032

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Source Type, 2017 to 2032

Table 38: Asia Pacific Market Volume (Tons) Forecast by Source Type, 2017 to 2032

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End-Use, 2017 to 2032

Table 40: Asia Pacific Market Volume (Tons) Forecast by End-Use, 2017 to 2032

Table 41: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 42: Middle East and Africa Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Metal Type, 2017 to 2032

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Metal Type, 2017 to 2032

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Source Type, 2017 to 2032

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Source Type, 2017 to 2032

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-Use, 2017 to 2032

Table 48: Middle East and Africa Market Volume (Tons) Forecast by End-Use, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Metal Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Source Type, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by End-Use, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 6: Global Market Volume (Tons) Analysis by Region, 2017 to 2032

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 9: Global Market Value (US$ Million) Analysis by Metal Type, 2017 to 2032

Figure 10: Global Market Volume (Tons) Analysis by Metal Type, 2017 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Metal Type, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Metal Type, 2022 to 2032

Figure 13: Global Market Value (US$ Million) Analysis by Source Type, 2017 to 2032

Figure 14: Global Market Volume (Tons) Analysis by Source Type, 2017 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Source Type, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Source Type, 2022 to 2032

Figure 17: Global Market Value (US$ Million) Analysis by End-Use, 2017 to 2032

Figure 18: Global Market Volume (Tons) Analysis by End-Use, 2017 to 2032

Figure 19: Global Market Value Share (%) and BPS Analysis by End-Use, 2022 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-Use, 2022 to 2032

Figure 21: Global Market Attractiveness by Metal Type, 2022 to 2032

Figure 22: Global Market Attractiveness by Source Type, 2022 to 2032

Figure 23: Global Market Attractiveness by End-Use, 2022 to 2032

Figure 24: Global Market Attractiveness by Region, 2022 to 2032

Figure 25: North America Market Value (US$ Million) by Metal Type, 2022 to 2032

Figure 26: North America Market Value (US$ Million) by Source Type, 2022 to 2032

Figure 27: North America Market Value (US$ Million) by End-Use, 2022 to 2032

Figure 28: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 30: North America Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 33: North America Market Value (US$ Million) Analysis by Metal Type, 2017 to 2032

Figure 34: North America Market Volume (Tons) Analysis by Metal Type, 2017 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Metal Type, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Metal Type, 2022 to 2032

Figure 37: North America Market Value (US$ Million) Analysis by Source Type, 2017 to 2032

Figure 38: North America Market Volume (Tons) Analysis by Source Type, 2017 to 2032

Figure 39: North America Market Value Share (%) and BPS Analysis by Source Type, 2022 to 2032

Figure 40: North America Market Y-o-Y Growth (%) Projections by Source Type, 2022 to 2032

Figure 41: North America Market Value (US$ Million) Analysis by End-Use, 2017 to 2032

Figure 42: North America Market Volume (Tons) Analysis by End-Use, 2017 to 2032

Figure 43: North America Market Value Share (%) and BPS Analysis by End-Use, 2022 to 2032

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-Use, 2022 to 2032

Figure 45: North America Market Attractiveness by Metal Type, 2022 to 2032

Figure 46: North America Market Attractiveness by Source Type, 2022 to 2032

Figure 47: North America Market Attractiveness by End-Use, 2022 to 2032

Figure 48: North America Market Attractiveness by Country, 2022 to 2032

Figure 49: Latin America Market Value (US$ Million) by Metal Type, 2022 to 2032

Figure 50: Latin America Market Value (US$ Million) by Source Type, 2022 to 2032

Figure 51: Latin America Market Value (US$ Million) by End-Use, 2022 to 2032

Figure 52: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 57: Latin America Market Value (US$ Million) Analysis by Metal Type, 2017 to 2032

Figure 58: Latin America Market Volume (Tons) Analysis by Metal Type, 2017 to 2032

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Metal Type, 2022 to 2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Metal Type, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) Analysis by Source Type, 2017 to 2032

Figure 62: Latin America Market Volume (Tons) Analysis by Source Type, 2017 to 2032

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Source Type, 2022 to 2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Source Type, 2022 to 2032

Figure 65: Latin America Market Value (US$ Million) Analysis by End-Use, 2017 to 2032

Figure 66: Latin America Market Volume (Tons) Analysis by End-Use, 2017 to 2032

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2022 to 2032

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2022 to 2032

Figure 69: Latin America Market Attractiveness by Metal Type, 2022 to 2032

Figure 70: Latin America Market Attractiveness by Source Type, 2022 to 2032

Figure 71: Latin America Market Attractiveness by End-Use, 2022 to 2032

Figure 72: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 73: Europe Market Value (US$ Million) by Metal Type, 2022 to 2032

Figure 74: Europe Market Value (US$ Million) by Source Type, 2022 to 2032

Figure 75: Europe Market Value (US$ Million) by End-Use, 2022 to 2032

Figure 76: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 78: Europe Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 81: Europe Market Value (US$ Million) Analysis by Metal Type, 2017 to 2032

Figure 82: Europe Market Volume (Tons) Analysis by Metal Type, 2017 to 2032

Figure 83: Europe Market Value Share (%) and BPS Analysis by Metal Type, 2022 to 2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Metal Type, 2022 to 2032

Figure 85: Europe Market Value (US$ Million) Analysis by Source Type, 2017 to 2032

Figure 86: Europe Market Volume (Tons) Analysis by Source Type, 2017 to 2032

Figure 87: Europe Market Value Share (%) and BPS Analysis by Source Type, 2022 to 2032

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Source Type, 2022 to 2032

Figure 89: Europe Market Value (US$ Million) Analysis by End-Use, 2017 to 2032

Figure 90: Europe Market Volume (Tons) Analysis by End-Use, 2017 to 2032

Figure 91: Europe Market Value Share (%) and BPS Analysis by End-Use, 2022 to 2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End-Use, 2022 to 2032

Figure 93: Europe Market Attractiveness by Metal Type, 2022 to 2032

Figure 94: Europe Market Attractiveness by Source Type, 2022 to 2032

Figure 95: Europe Market Attractiveness by End-Use, 2022 to 2032

Figure 96: Europe Market Attractiveness by Country, 2022 to 2032

Figure 97: Asia Pacific Market Value (US$ Million) by Metal Type, 2022 to 2032

Figure 98: Asia Pacific Market Value (US$ Million) by Source Type, 2022 to 2032

Figure 99: Asia Pacific Market Value (US$ Million) by End-Use, 2022 to 2032

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 102: Asia Pacific Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Metal Type, 2017 to 2032

Figure 106: Asia Pacific Market Volume (Tons) Analysis by Metal Type, 2017 to 2032

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Metal Type, 2022 to 2032

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Metal Type, 2022 to 2032

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Source Type, 2017 to 2032

Figure 110: Asia Pacific Market Volume (Tons) Analysis by Source Type, 2017 to 2032

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Source Type, 2022 to 2032

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Source Type, 2022 to 2032

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End-Use, 2017 to 2032

Figure 114: Asia Pacific Market Volume (Tons) Analysis by End-Use, 2017 to 2032

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End-Use, 2022 to 2032

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2022 to 2032

Figure 117: Asia Pacific Market Attractiveness by Metal Type, 2022 to 2032

Figure 118: Asia Pacific Market Attractiveness by Source Type, 2022 to 2032

Figure 119: Asia Pacific Market Attractiveness by End-Use, 2022 to 2032

Figure 120: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 121: Middle East and Africa Market Value (US$ Million) by Metal Type, 2022 to 2032

Figure 122: Middle East and Africa Market Value (US$ Million) by Source Type, 2022 to 2032

Figure 123: Middle East and Africa Market Value (US$ Million) by End-Use, 2022 to 2032

Figure 124: Middle East and Africa Market Value (US$ Million) by Country, 2022 to 2032

Figure 125: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 126: Middle East and Africa Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 127: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 128: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 129: Middle East and Africa Market Value (US$ Million) Analysis by Metal Type, 2017 to 2032

Figure 130: Middle East and Africa Market Volume (Tons) Analysis by Metal Type, 2017 to 2032

Figure 131: Middle East and Africa Market Value Share (%) and BPS Analysis by Metal Type, 2022 to 2032

Figure 132: Middle East and Africa Market Y-o-Y Growth (%) Projections by Metal Type, 2022 to 2032

Figure 133: Middle East and Africa Market Value (US$ Million) Analysis by Source Type, 2017 to 2032

Figure 134: Middle East and Africa Market Volume (Tons) Analysis by Source Type, 2017 to 2032

Figure 135: Middle East and Africa Market Value Share (%) and BPS Analysis by Source Type, 2022 to 2032

Figure 136: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source Type, 2022 to 2032

Figure 137: Middle East and Africa Market Value (US$ Million) Analysis by End-Use, 2017 to 2032

Figure 138: Middle East and Africa Market Volume (Tons) Analysis by End-Use, 2017 to 2032

Figure 139: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use, 2022 to 2032

Figure 140: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use, 2022 to 2032

Figure 141: Middle East and Africa Market Attractiveness by Metal Type, 2022 to 2032

Figure 142: Middle East and Africa Market Attractiveness by Source Type, 2022 to 2032

Figure 143: Middle East and Africa Market Attractiveness by End-Use, 2022 to 2032

Figure 144: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recycled Concrete Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Pipes Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Ocean Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Elastomers Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Market Size and Share Forecast Outlook 2025 to 2035

Recycled Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Recycled Asphalt Pavement Market Size and Share Forecast Outlook 2025 to 2035

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Paper Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Recycled Prescription Bag Market Size and Share Forecast Outlook 2025 to 2035

Recycled PET Packaging Market Size, Share & Forecast 2025 to 2035

Recycled Fabric Bag Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Recycled Prescription Bag Industry

Competitive Breakdown of Recycled Paper Suppliers

Recycled Polyethylene Terephthalate (rPET) Packaging Market Growth and Trends 2025 to 2035

Recycled Glass Packaging Market Trends & Growth Forecast 2024-2034

Recycled Aluminum Packaging Market Trends & Growth Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA