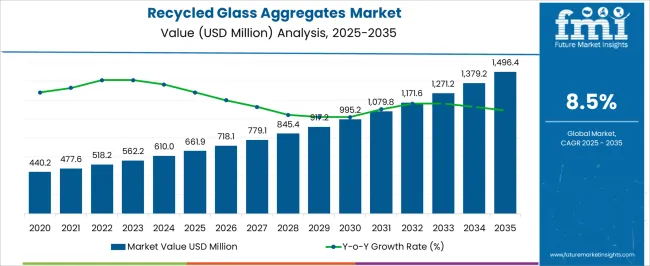

The Recycled Glass Aggregates Market is estimated to be valued at USD 661.9 million in 2025 and is projected to reach USD 1496.4 million by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

| Metric | Value |

|---|---|

| Recycled Glass Aggregates Market Estimated Value in (2025 E) | USD 661.9 million |

| Recycled Glass Aggregates Market Forecast Value in (2035 F) | USD 1496.4 million |

| Forecast CAGR (2025 to 2035) | 8.5% |

The Recycled Glass Aggregates market is demonstrating consistent growth as sustainable construction practices and circular economy models gain widespread adoption across industries. Demand for eco-friendly raw materials has created significant opportunities for recycled glass aggregates, particularly in infrastructure and commercial applications where environmental compliance and cost efficiency are prioritized. The shift toward green building certifications has further amplified adoption, as recycled materials play a key role in achieving sustainability targets.

Additionally, governments and municipalities are increasingly investing in recycling facilities, creating a steady supply of high-quality glass aggregates that can substitute traditional raw materials in construction, landscaping, and industrial processes. Cost advantages in terms of reduced landfill expenses and lower extraction needs for natural aggregates have also supported the market’s expansion.

Looking ahead, advancements in processing technologies are expected to improve product consistency, while the growing focus on waste reduction will reinforce long-term adoption As infrastructure projects continue to align with sustainability goals, recycled glass aggregates are anticipated to secure a strong position in global material supply chains.

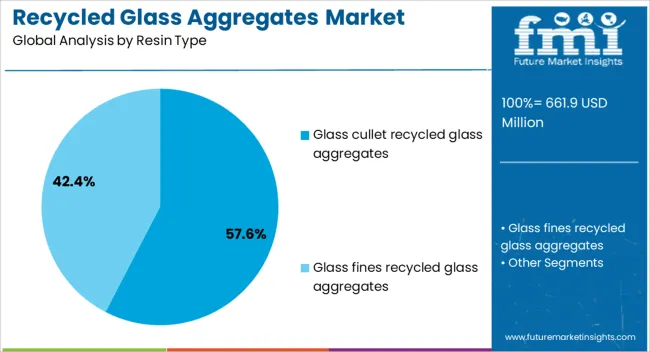

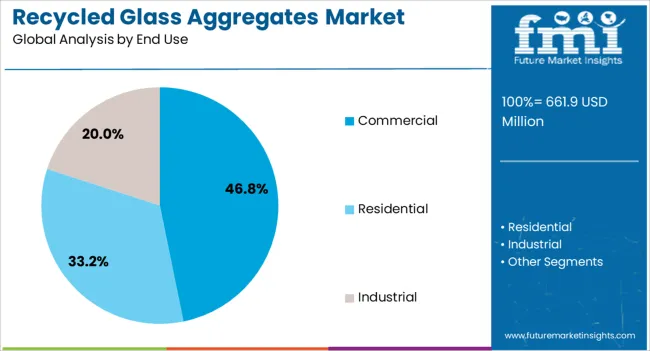

The recycled glass aggregates market is segmented by resin type, end use, and geographic regions. By resin type, recycled glass aggregates market is divided into Glass cullet recycled glass aggregates and Glass fines recycled glass aggregates. In terms of end use, recycled glass aggregates market is classified into Commercial, Residential, and Industrial. Regionally, the recycled glass aggregates industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Glass cullet recycled glass aggregates segment is projected to hold 57.60% of the overall market revenue in 2025, positioning it as the leading resin type. This dominance is being attributed to the high availability of post-consumer and industrial glass waste that can be processed into cullet for aggregate use. The segment has been widely accepted in construction and landscaping due to its versatility, durability, and ability to meet performance requirements comparable to traditional aggregates.

Processing efficiency has allowed recycled glass cullet to become a cost-effective alternative, particularly in urban regions where landfill diversion and material recovery are critical. The increasing emphasis on environmental regulations has further supported the adoption of cullet-based aggregates, as they contribute to reducing carbon footprints and conserving natural resources.

Additionally, the segment has benefited from investments in recycling infrastructure that ensure a reliable supply of quality cullet material The steady integration of cullet recycled aggregates into mainstream building practices has been a key factor behind its dominant share and is expected to drive continued leadership in the coming years.

The Commercial end use industry segment is expected to account for 46.80% of the overall Recycled Glass Aggregates market revenue in 2025, making it the largest consumer category. This leadership position has been influenced by the rising adoption of sustainable materials in retail, hospitality, office complexes, and large-scale commercial developments. The segment has gained traction as businesses increasingly seek to align with environmental regulations, corporate sustainability goals, and green building certification requirements.

The cost benefits of using recycled glass aggregates in flooring, decorative concrete, and landscaping applications have also contributed to strong adoption. Additionally, commercial projects often emphasize aesthetics along with performance, and glass aggregates provide distinctive finishes that enhance design appeal while maintaining functionality.

Government incentives for sustainable construction and the growing number of eco-conscious investors have further reinforced the role of recycled glass aggregates in commercial projects As the demand for modern, environmentally responsible buildings continues to expand, the commercial segment is expected to remain a dominant force in driving the overall market forward.

Over the past few years, the construction industry has shifted its focus to the environmental impact of many construction materials used in the global market. The construction industry have heavy demand from the primary aggregate sources, it is projected that approximately 160 million tons of aggregates are used annually. Hence it is considerable to develop alternate aggregate sources such as recycled glass aggregates in the global market.

The recycled glass aggregates are produces with the use of waste materials such as plastics which can be used as building blocks, hence eliminating the need of disposal and plastic pollution across the globe. Recycled glass aggregates can be used as a replacement for concrete and also the powder form of recycled glass aggregates can be used as a gluing element in the construction industry. Additionally, glass is one of the materials which can be recycled indefinitely, and hence the use of recycled glass for recycled glass aggregates products reduces the use of raw materials and energy.

Recycled glass aggregates have a massive prospect to grow and moderately replace traditional construction aggregates in the global market. The foremost driver of the recycled glass aggregates market is the safety concern for working population, without compromising on the aggregate quality. Recycled glass aggregates are widely used in commercial and industrial buildings, and structures in the global market. The global recycled glass aggregates market is estimated to grow with a prominent CAGR over the forthcoming years.

Recycled glass aggregates has numerous environmental and economic advantages such as; the closed-cell porous structure holds any organic porosity from glass pollution, recycled glass aggregates fines don't require additional energy consuming recycling processes, the drying shrinkage of concrete foams is considerably reduced with the addition of glass fines in recycled glass aggregates, the potential ASR (alkali-silica reaction) traditional concrete glass fines can be organized with a custom-made blended designsand the absorbent structure of light-weight concrete delivers sufficient space for recycled glass aggregates enlargement and significantly reduces the concrete cracking owing to the ASR (alkali-silica reaction).

Market players are focusing on expanding their presence in regions where the recycled glass aggregates industry is growing at a rapid rate. Also, key players are focusing on entering into tie-ups with local vendors, distributors and recycled glass aggregates companies to promote their products this factors are estimated to act as a catalyst for the growth of recycled glass aggregates market in the near future.

The recycled glass aggregates industry is projected to register steady growth due to high rate of urbanization in emerging countries of Asia Pacific, coupled with increasing population. This rapid growth in the residential sector in urban as well as semi-urban areas in the global market contributes significantly to the recycled glass aggregates market growth.

Countries such as United States, Brazil, Russia, China and India are expected to create several jobs over the forecast period, which in turn, will propel the overall demand for recycled glass aggregates in all the end use segment globally.Furthermore, the growing applications of recycled glass aggregates in commercial and industrial sectors are expected to propel the growth of the overall recycled glass aggregates market in the near future.

North American and European countries have presence of all industrial and commercial sectors alongside with the existence of globally prominent players, which is a boon for the recycled glass aggregates market in these regions. Rapid industrialization & construction activities in the Asia Pacific & Latin America region, prominently in China, Brazil, and India, is estimated to fuel the growth of the recycled glass aggregates market.

Increasing consumer eagerness to own a house is estimated to drive the residential construction sector, which in turn, will propel the demand for recycled glass aggregates in the global market over the forecast period. For instance, in 2025, it is estimated that more than a million new households were created but only 620,000 new housing units were completed, creating a shortage of 430,370 units. This gap has pushed up home prices and rents, a trend that will continue for the foreseeable future absent imminent policy changes. Additionally, all construction buildings that were erected in the past have a certain period of operation life, after which the structure is dangerous as it can collapse after prolonged use.

Additionally, the use of recycled glass aggregates can save money for local governments and other purchasers, create additional business opportunities, save energy when recycling is done on site, conserve diminishing resources of urban aggregates and help local governments meet the diversion goals of production. Therefore, it is expected that the recycled glass aggregates market will see rapid growth in all – developed and developing countries in the future.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

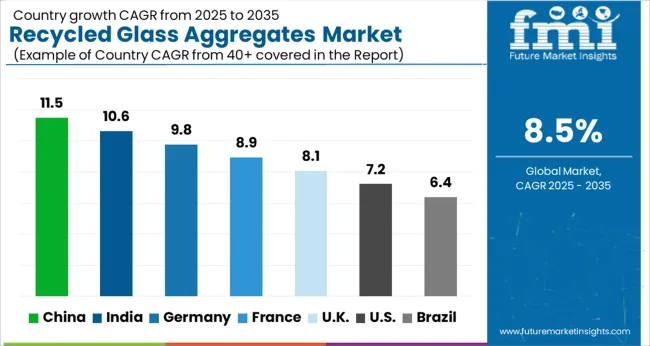

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

The Recycled Glass Aggregates Market is expected to register a CAGR of 8.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.5%, followed by India at 10.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.4%, yet still underscores a broadly positive trajectory for the global Recycled Glass Aggregates Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.8%. The USA Recycled Glass Aggregates Market is estimated to be valued at USD 241.7 million in 2025 and is anticipated to reach a valuation of USD 485.6 million by 2035. Sales are projected to rise at a CAGR of 7.2% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 34.5 million and USD 17.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 661.9 Million |

| Resin Type | Glass cullet recycled glass aggregates and Glass fines recycled glass aggregates |

| End Use | Commercial, Residential, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

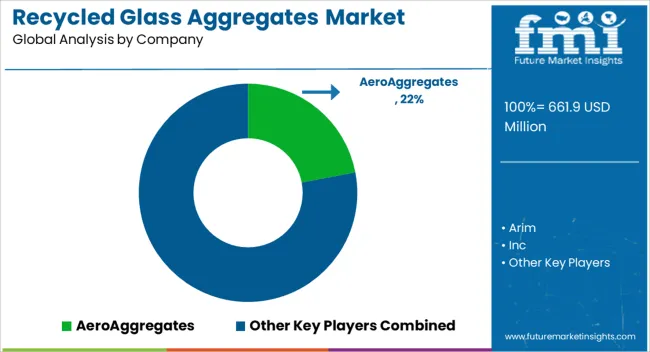

| Key Companies Profiled | AeroAggregates, Arim, Inc, Coloured Aggregates, K&B Crushers, Conigliaro Industries, Heritage Glass, American Specialty Glass, EcoProCote, and Canadian Recycled Glass |

The global recycled glass aggregates market is estimated to be valued at USD 661.9 million in 2025.

The market size for the recycled glass aggregates market is projected to reach USD 1,496.4 million by 2035.

The recycled glass aggregates market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in recycled glass aggregates market are glass cullet recycled glass aggregates and glass fines recycled glass aggregates.

In terms of end use, commercial segment to command 46.8% share in the recycled glass aggregates market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recycled Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Pipes Market Size and Share Forecast Outlook 2025 to 2035

Recycled Ocean Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Metal Market Size and Share Forecast Outlook 2025 to 2035

Recycled Elastomers Market Size and Share Forecast Outlook 2025 to 2035

Recycled Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Recycled Asphalt Pavement Market Size and Share Forecast Outlook 2025 to 2035

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Paper Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Recycled Prescription Bag Market Size and Share Forecast Outlook 2025 to 2035

Recycled PET Packaging Market Size, Share & Forecast 2025 to 2035

Recycled Fabric Bag Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Recycled Scrap Metal Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Recycled Prescription Bag Industry

Competitive Breakdown of Recycled Paper Suppliers

Recycled Polyethylene Terephthalate (rPET) Packaging Market Growth and Trends 2025 to 2035

Recycled Aluminum Packaging Market Trends & Growth Forecast 2024-2034

Recycled Plastic Envelope Market

Recycled Envelopes Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA