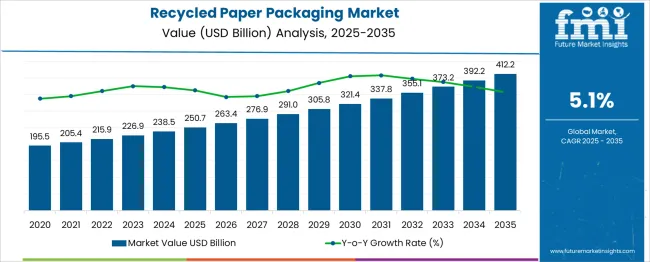

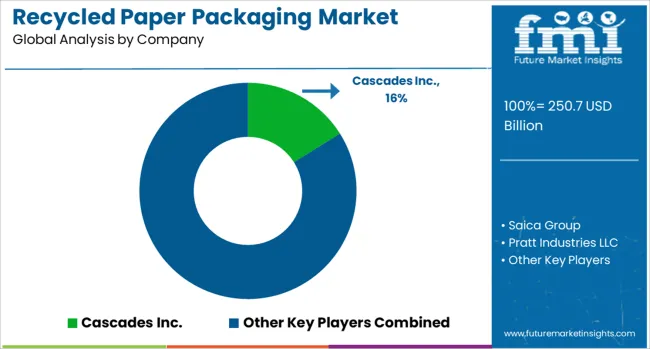

The Recycled Paper Packaging Market is estimated to be valued at USD 250.7 billion in 2025 and is projected to reach USD 412.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

| Metric | Value |

|---|---|

| Recycled Paper Packaging Market Estimated Value in (2025 E) | USD 250.7 billion |

| Recycled Paper Packaging Market Forecast Value in (2035 F) | USD 412.2 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

Corporates and manufacturers across sectors are increasingly adopting recycled materials to meet environmental targets and circular economy commitments. Recycled paper packaging offers a viable solution by reducing landfill waste, lowering carbon footprints, and minimizing raw material dependency. Governments are also promoting recycling initiatives and mandating the use of sustainable packaging across industries, further accelerating demand.

In the coming years, technological advancements in recycling processes and improvements in paper fiber quality are expected to enhance the structural integrity and usability of recycled paper products. The market outlook remains positive as both retailers and brands continue shifting toward biodegradable and recyclable packaging solutions to appeal to environmentally conscious consumers and comply with regulatory frameworks.

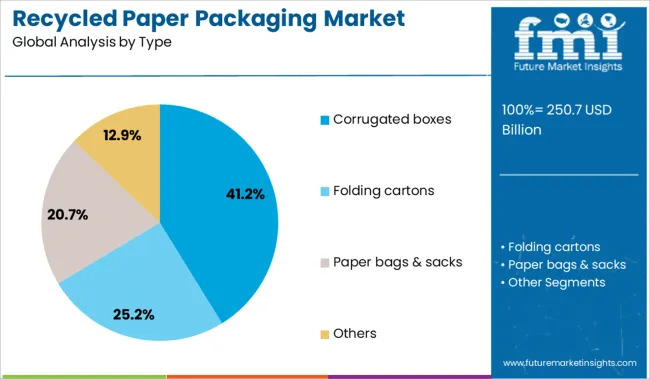

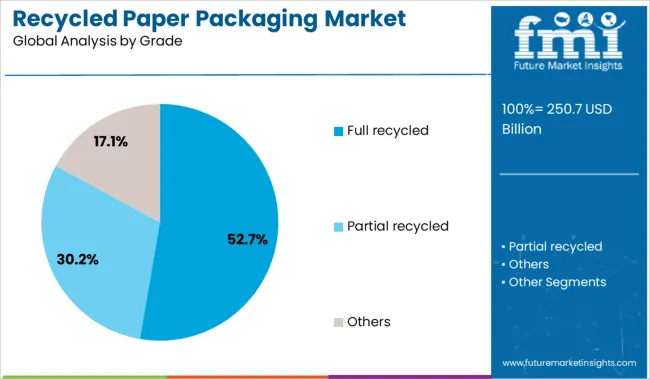

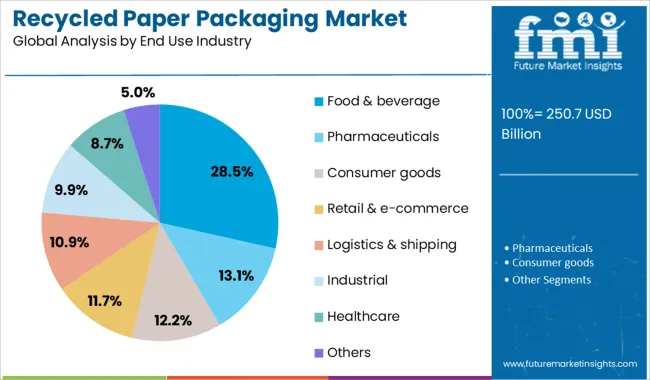

The recycled paper packaging market is segmented by type, grade, and end use industry and geographic regions. The recycled paper packaging market is divided by type into Corrugated boxes, Folding cartons, Paper bags & sacks, and Others. The recycled paper packaging market is classified by grade into Full recycled, Partial recycled, and Others. Based on the end-use industry, the recycled paper packaging market is segmented into Food & beverage, Pharmaceuticals, Consumer goods, Retail & e-commerce, Logistics & shipping, Industrial, Healthcare, and Others. Regionally, the recycled paper packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The corrugated boxes segment leads the type category with a 41.2% market share, supported by its widespread usage across diverse industries for shipping, storage, and retail-ready packaging. The demand for corrugated boxes made from recycled paper has surged due to their strength, lightweight properties, and high recyclability.

E-commerce expansion, coupled with increased product movement in the logistics chain, has further propelled demand for corrugated packaging. Companies are favoring recycled corrugated boxes to align with sustainability goals and reduce operational carbon footprints.

Continuous improvements in box design, printing capabilities, and material resilience are driving preference for this segment. As more brands seek cost-effective, sturdy, and green packaging alternatives, the corrugated boxes segment is expected to maintain its leadership within the recycled paper packaging landscape.

The full recycled segment dominates the grade category with a 52.7% share, showcasing strong preference for materials derived entirely from post-consumer or post-industrial waste. This segment is supported by corporate sustainability strategies aimed at reducing virgin material usage and achieving packaging circularity.

Full recycled grades are widely adopted for their environmental benefits, cost savings, and ability to comply with regulatory mandates. Advancements in sorting and pulping technologies have significantly improved the quality and performance of fully recycled paper, enabling broader adoption across primary and secondary packaging formats.

This segment's growth is further reinforced by consumer expectations for eco-labeled products and increasing retailer requirements for sustainable packaging certifications. With growing investment in recycling infrastructure and rising demand for environmentally responsible packaging, the full recycled segment is expected to retain its dominant position.

The food and beverage industry holds a 28.5% share in the end use category, highlighting its critical role in driving demand for recycled paper packaging solutions. Rising pressure to eliminate plastic use and transition to biodegradable alternatives has led food and beverage manufacturers to adopt paper-based packaging formats for items such as cartons, trays, cups, and wrapping.

Regulatory restrictions on single-use plastics, particularly in Europe and North America, have further fueled this transition. Recycled paper packaging offers the necessary functionality and safety for non-direct food contact applications while meeting sustainability expectations.

Additionally, increased consumption of packaged food and takeaway meals post-pandemic has created new demand for recyclable and compostable packaging. As food brands continue to innovate in packaging presentation and environmental responsibility, the segment is poised to maintain steady growth in the recycled paper packaging market.

Demand for Recycled Paper Packaging is increasing as brands and governments prioritize sustainable alternatives to plastic. Sales of kraft recycled cartons and mono-material fiber trays are expanding across the food, beverage, and electronics sectors. Europe and North America remain growth leaders due to well-developed recycling infrastructure and tightening environmental mandates.

Recycled paper packaging with high post-consumer fiber content saw a 25% rise in demand in 2025, especially for corrugated cartons and retail display boxes. Brands specifying at least 70% recycled content achieved a 30% reduction in carbon footprint per unit. Retailers reported a 21% decrease in waste disposal incidents after introducing new sorting guidelines. Major grocery and e-commerce platforms adopted mono-material trays and molded pulp inserts, supporting cold-chain logistics and dry goods packaging. This shift aligns with circularity objectives and enhances brand credibility with eco-conscious consumers.

Premium recycled paper packaging formats recorded 28% year-on-year growth in 2025, driven by demand for customizable packaging with environmental claims. Corrugated mailer boxes made from high-purity recycled board gained popularity among direct-to-consumer (DTC) brands, leading to 22% longer consumer interaction during unboxing. Beauty and electronics companies adopting hydroformed pulp trays reported a 15% reduction in packaging costs and earned green certifications. Vendors offering design flexibility and local recycling partnerships reported a 19% increase in repeat orders, particularly in extended producer responsibility (EPR) markets.

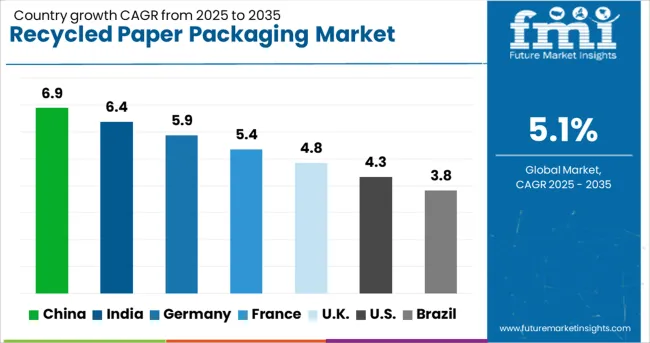

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global market is forecast to expand at a CAGR of 5.1% from 2025 to 2035, driven by sustainability trends and new packaging regulations. China leads with 6.9% CAGR due to national plastic reduction policies, e-commerce growth, and investments in recycled corrugated and molded fiber formats. India follows at 6.4% CAGR, propelled by retail logistics expansion, tax incentives for circular packaging, and growth in tier-II and tier-III markets.

Germany is projected to grow at 5.9% CAGR, supported by EU waste targets, automated recycling systems, and retail-ready paper packaging adoption. The UK is expected to post a 4.8% CAGR as retailers and quick-service restaurants adopt compostable trays and fiber-based containers.

The USA market is set to grow at 4.3% CAGR, where ESG benchmarks are encouraging integration of recycled materials into food, personal care, and consumer product packaging. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is forecast to grow at a 6.9% CAGR, driven by national policies to reduce plastic usage and investments in recycling infrastructure. E-commerce expansion has amplified demand for corrugated boxes, mailers, and molded fiber trays. Domestic manufacturers are upgrading to high-speed recycling lines and adopting water-based inks for compliance with food-contact safety standards. Government incentives for green manufacturing under the 14th Five-Year Plan support R&D in fiber recovery technologies. Partnerships with global FMCG brands are creating opportunities for premium recycled formats in food and beverage sectors. Rising exports of recycled corrugated products to Southeast Asia and Africa further reinforce China’s leadership in this segment.

India is expected to post a 6.4% CAGR, supported by retail logistics growth and increasing consumer preference for eco-conscious packaging. Tax benefits for companies using recycled content are spurring adoption across FMCG and quick-service restaurant chains. Demand for molded fiber trays, corrugated cartons, and paper-based pouches is rising in Tier II and Tier III cities as organized retail penetration expands. Domestic converters are investing in semi-automatic recycling systems to boost capacity. Collaborations between packaging manufacturers and e-commerce platforms enhance supply chain efficiency. Export demand for India-made recycled paper products is growing, particularly for low-cost corrugated formats in Asia-Pacific markets.

Germany is projected to grow at a 5.9% CAGR, driven by EU waste management targets and stringent packaging directives. Automation in recycling facilities and advanced fiber recovery systems enable high-quality output for food and beverage packaging. Retail-ready corrugated packaging and shelf-ready displays dominate demand from supermarkets and discount chains. German converters are focusing on innovation in barrier-coated papers to replace plastic laminates for dry goods. Integration of digital traceability tools into recycling processes enhances supply chain transparency. Strong export orientation supports premium recycled paper solutions for neighboring EU countries requiring compliance with circular economy regulations.

The United Kingdom is forecast to grow at a 4.8% CAGR, fueled by increasing use of fiber-based trays, cartons, and wraps in retail and foodservice sectors. Quick-service restaurants are switching from single-use plastics to molded fiber and recycled board solutions to meet compliance targets. E-commerce packaging providers are introducing lightweight corrugated boxes and mailers optimized for cost and durability. Investments in closed-loop recycling programs with supermarket chains are creating a steady supply of post-consumer waste for reprocessing. Technological advancements in high-strength recycled paper grades enable wider use in frozen food and beverage packaging.

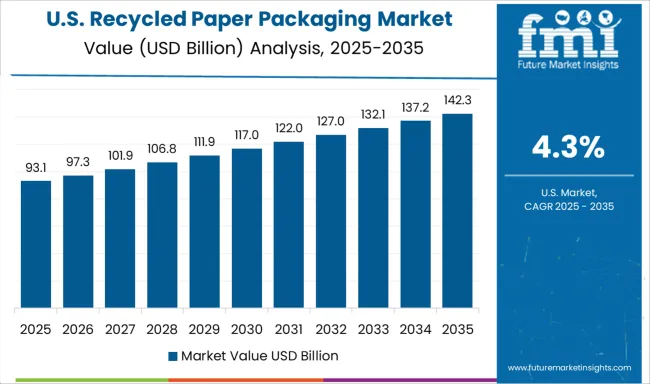

The United States is projected to grow at a 4.3% CAGR, supported by ESG-driven commitments from consumer goods companies and retail chains. Corrugated boxes remain the largest application segment, complemented by rising adoption of molded fiber packaging in personal care and food categories. Brand owners are increasing post-consumer recycled (PCR) content in folding cartons to meet sustainability disclosure requirements. Demand for recycled paper cups and wraps is gaining momentum in quick-service restaurants and cafes. Investment in robotic material sorting and AI-based quality inspection is improving fiber recovery efficiency at recycling plants.

Cascades Inc. holds the largest share, leveraging vertically integrated operations and a strong North American presence. The company serves food, retail, and e-commerce with fiber-based packaging. Saica Group is expanding its presence across Europe, focusing on lightweight recycled formats. Pratt Industries LLC is growing in the USA through mill investments and retail-ready corrugated solutions. WestRock and Sonoco Products are offering recyclable packaging for CPG and industrial applications. DS Smith PLC is active in the UK and EU with closed-loop recycling models. Steinbeis Papier GmbH specializes in 100% recycled paper solutions for European retail and printing clients.

| Item | Value |

|---|---|

| Quantitative Units | USD 250.7 Billion |

| Type | Corrugated boxes, Folding cartons, Paper bags & sacks, and Others |

| Grade | Full recycled, Partial recycled, and Others |

| End Use Industry | Food & beverage, Pharmaceuticals, Consumer goods, Retail & e-commerce, Logistics & shipping, Industrial, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cascades Inc., Saica Group, Pratt Industries LLC, WestRock Company, Sonoco Products Company, DS Smith PLC, and Steinbeis Papier GmbH |

| Additional Attributes | Dollar sales by recycled grade (full vs partial) and packaging type (corrugated boxes, sacks, cartons), demand dynamics across food & beverage, retail/e‑commerce, and healthcare sectors, regional growth leadership in Asia‑Pacific and North America, innovation in AI‑based fiber recovery and waterproof coatings, and environmental impact from waste diversion and CO₂ savings. |

The global recycled paper packaging market is estimated to be valued at USD 250.7 billion in 2025.

The market size for the recycled paper packaging market is projected to reach USD 412.2 billion by 2035.

The recycled paper packaging market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in recycled paper packaging market are corrugated boxes, folding cartons, paper bags & sacks and others.

In terms of grade, full recycled segment to command 52.7% share in the recycled paper packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recycled Concrete Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Pipes Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Metal Market Size and Share Forecast Outlook 2025 to 2035

Recycled Elastomers Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Market Size and Share Forecast Outlook 2025 to 2035

Recycled Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Recycled Asphalt Pavement Market Size and Share Forecast Outlook 2025 to 2035

Recycled Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Recycled Prescription Bag Market Size and Share Forecast Outlook 2025 to 2035

Recycled Fabric Bag Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Recycled Scrap Metal Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Recycled Prescription Bag Industry

Recycled Polyethylene Terephthalate (rPET) Packaging Market Growth and Trends 2025 to 2035

Recycled Plastic Envelope Market

Recycled Envelopes Market

Recycled PET Packaging Market Size, Share & Forecast 2025 to 2035

Recycled Glass Packaging Market Trends & Growth Forecast 2024-2034

Recycled Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Aluminum Packaging Market Trends & Growth Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA