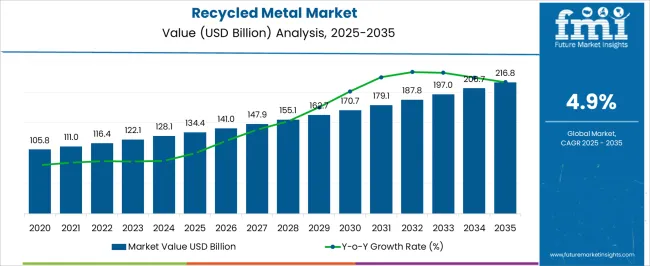

The Recycled Metal Market is estimated to be valued at USD 134.4 billion in 2025 and is projected to reach USD 216.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 134.4 billion to USD 170.7 billion, driven by increasing demand for sustainable and cost-effective raw materials across industries such as construction, automotive, and electronics.

Year-on-year analysis shows steady growth, with values reaching USD 141.0 billion in 2026 and USD 147.9 billion in 2027, supported by enhanced recycling technologies and stricter environmental regulations. By 2028, the market is forecasted to hit USD 155.1 billion, advancing to USD 162.7 billion in 2029 and USD 170.7 billion by 2030.

Growth is expected to be further fueled by the rise in circular economy practices, the increasing use of recycled metals in manufacturing processes, and the growing focus on reducing carbon footprints. These dynamics position recycled metal solutions as a crucial component of the global materials supply chain, offering opportunities for innovation in processing technologies and sustainable resource management.

| Metric | Value |

|---|---|

| Recycled Metal Market Estimated Value in (2025 E) | USD 134.4 billion |

| Recycled Metal Market Forecast Value in (2035 F) | USD 216.8 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The recycled metal market is gaining traction as sustainability initiatives, regulatory mandates, and circular economy frameworks reshape global manufacturing and resource recovery practices. Rising demand for raw materials with reduced environmental impact has led industries to integrate recycled metals into core supply chains, minimizing both cost and emissions.

Governments across major economies have introduced recycling targets and tax incentives for secondary metal usage, driving infrastructure investments in collection, sorting, and refining technologies. Supply chain pressures and geopolitical instability have also made recycled metal a strategic material for reducing import dependency.

As green certifications and life-cycle assessments become critical in sectors like construction, automotive, and consumer goods, the demand for recycled ferrous and non-ferrous metals is expected to surge. Continued advancements in metal separation and alloy recovery are further improving the quality and commercial viability of recycled materials across industrial applications.

The recycled metal market is segmented by metal, end use, and geographic regions. By metal of the recycled metal market is divided into Ferrous and Non-ferrous. In terms of end use of the recycled metal market is classified into Building & construction, Transport, Industrial machinery, Electrical & electronics, Defense, Packaging, Consumer products, Nuclear industry, Military, Jewellery, Coins, Chemical, and Others.

Regionally, the recycled metal industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

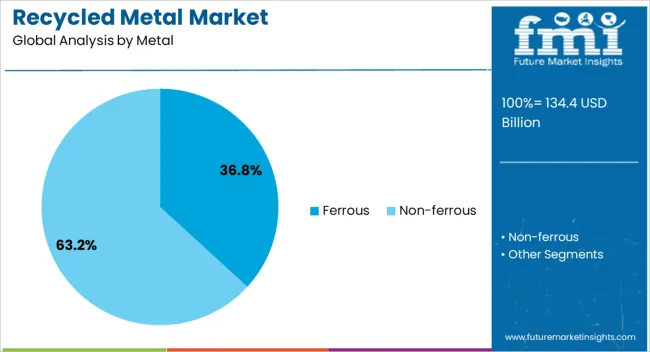

Ferrous metals are projected to contribute 36.8% of total revenue in the recycled metal market by 2025, making them the most significant material segment. This leadership is supported by the widespread availability of ferrous scrap from demolished infrastructure, vehicles, and industrial machinery.

Strong demand from steel producers seeking lower-cost, lower-carbon feedstock has reinforced the recycling loop for iron and steel. The energy efficiency of melting ferrous scrap compared to processing virgin ore has positioned it as a preferred material in environmentally-conscious manufacturing practices.

Modern electric arc furnaces, capable of utilizing high volumes of scrap, have further streamlined its integration into steelmaking. The global focus on carbon neutrality in construction and heavy industries continues to elevate the value of ferrous metals in recycling supply chains.

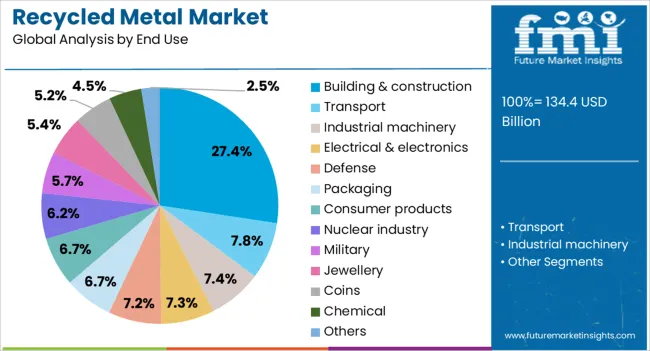

The building and construction industry is expected to account for 27.4% of total market revenue in 2025, making it the largest end-use segment for recycled metals. This dominance is being driven by the construction sector’s growing need for cost-effective, sustainable materials that align with green building certifications and environmental compliance standards.

Structural steel, rebar, aluminum framing, and piping are increasingly sourced from recycled inputs to reduce embodied carbon in large-scale infrastructure projects. Building codes in many regions now mandate or incentivize recycled content in public works, reinforcing demand.

Additionally, the deconstruction and renovation of aging buildings are generating substantial volumes of recoverable metal, supporting localized circular loops. As urban development accelerates and ESG criteria shape procurement, recycled metal use in construction is expected to remain robust.

The recycled metal market is expanding due to increasing demand for environmentally responsible materials and rising raw material costs. In 2024 and 2025, growth drivers include a growing preference for recycled materials in construction, automotive, and electronics industries. Opportunities are found in the growth of circular economies and government policies encouraging recycling. Emerging trends include advanced sorting technologies and automation. However, challenges like inconsistent quality and fluctuating metal prices could limit market growth potential in some regions.

The major growth driver in the recycled metal market is the increasing demand for environmentally responsible materials. In 2024, industries such as construction, automotive, and electronics began integrating more recycled metals into their supply chains. The rising awareness of the environmental benefits of recycling, including reducing the carbon footprint, fueled the demand for recycled metals. As companies seek to meet sustainability goals and reduce production costs, the market for recycled metals continues to grow globally, particularly in environmentally conscious regions.

Opportunities in the recycled metal market are expanding due to the growing adoption of circular economy principles and government policies promoting recycling. In 2025, several governments worldwide introduced incentives and regulations to encourage metal recycling, enhancing market demand. Additionally, the increasing shift towards closed-loop systems, where materials are reused and recycled continuously, provides new market opportunities. The demand for circular solutions in industries like packaging, automotive, and electronics is expected to grow as recycling technologies improve.

Emerging trends in the recycled metal market include advancements in sorting technologies and automation. In 2024, the adoption of AI-driven sorting systems enhanced the efficiency and accuracy of metal recovery, reducing contamination and improving material quality. These innovations allowed for higher yields of high-quality recycled metals, making them more competitive with virgin materials. As automated recycling processes continue to improve, the cost-effectiveness and scalability of metal recycling are expected to drive market expansion.

Key market restraints include inconsistent quality and fluctuating metal prices. In 2024 and 2025, the recycled metal market faced challenges with inconsistent quality, which affected its integration into high-demand applications in industries such as automotive and electronics. Moreover, fluctuating metal prices due to global supply chain disruptions impacted the profitability and stability of recycling operations. These constraints require more efficient sorting processes and price stabilization measures to fully unlock the market’s potential.

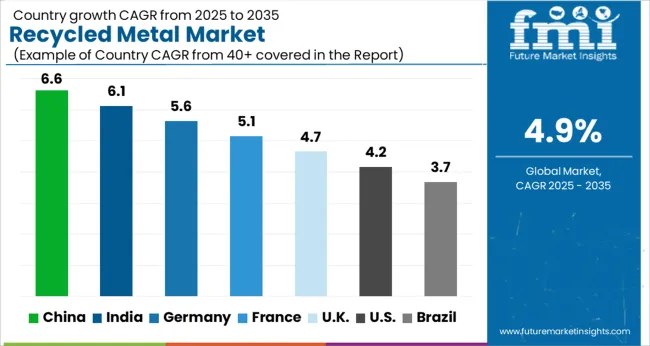

The global recycled metal market is projected to grow at 4.9% CAGR from 2025 to 2035. China leads with 6.6% CAGR, driven by the country's rapid industrialization, growing demand for sustainable metal production, and increased recycling rates in the automotive, construction, and manufacturing sectors. India follows at 6.1%, fueled by the rise of the manufacturing industry and government initiatives promoting recycling practices.

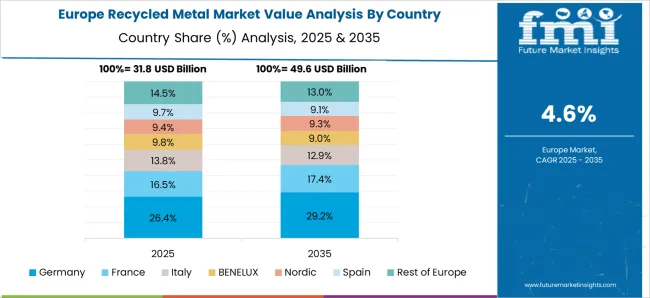

France records 5.1% CAGR, supported by regulations encouraging recycling and sustainability in various industries. The United Kingdom grows at 4.7%, while the United States posts 4.2%, reflecting steady demand in mature markets with a focus on sustainability and resource recovery. Asia-Pacific leads the market growth, while Europe and North America emphasize regulatory compliance and recycling technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The recycled metal market in China is forecasted to grow at 6.6% CAGR, supported by the country’s rapid industrialization and the growing demand for recycled materials across industries such as construction, automotive, and electronics. China’s increasing focus on reducing waste and carbon emissions further accelerates the adoption of recycled metals. The government’s strong policies promoting sustainability and recycling also stimulate the market by encouraging the use of recycled materials in manufacturing processes.

The recycled metal market in India is projected to grow at 6.1% CAGR, driven by the increasing demand for recycled metals in the construction, automotive, and manufacturing sectors. As India’s manufacturing industry continues to expand, the need for raw materials, including recycled metals, rises. Government initiatives to boost recycling rates and support circular economy practices contribute to market growth. Additionally, growing awareness of sustainability and environmental impacts encourages the use of recycled metals in various applications.

The recycled metal market in France is expected to grow at 5.1% CAGR, driven by stringent environmental regulations and increasing demand for sustainable materials in construction, automotive, and industrial sectors. France’s commitment to reducing waste and improving recycling rates strengthens market adoption. The rising focus on reducing carbon footprints and supporting green technologies further drives the demand for recycled metals, particularly in sectors like automotive manufacturing and infrastructure development.

The recycled metal market in the United Kingdom is projected to grow at 4.7% CAGR, supported by increasing demand for sustainable materials and growing regulatory pressure to adopt circular economy practices. The UK’s commitment to reducing landfill waste and adopting recycling standards drives demand for recycled metals in industries such as automotive, construction, and electronics. Furthermore, the country’s focus on reducing environmental impact and enhancing resource recovery strengthens market adoption.

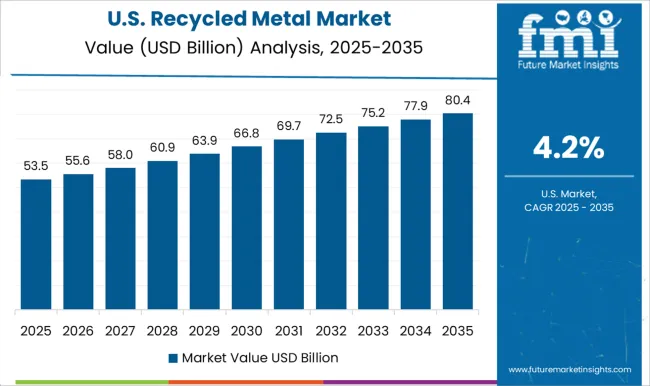

The recycled metal market in the United States is projected to grow at 4.2% CAGR, reflecting steady demand in a mature market. The growing focus on sustainability, carbon footprint reduction, and the circular economy enhances the demand for recycled metals in various industries, including automotive, electronics, and construction. The USA government’s initiatives to support recycling technologies and promote sustainability further stimulate market growth, while the growing emphasis on green manufacturing solutions continues to drive the use of recycled metals.

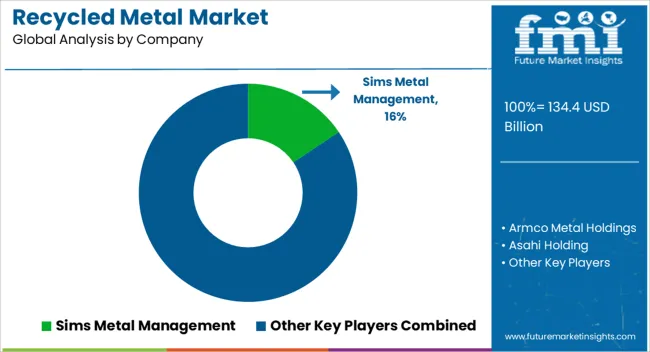

The recycled metal market is dominated by Sims Metal Management, which leads with its comprehensive recycling solutions for ferrous and non-ferrous metals, serving industries such as automotive, construction, and manufacturing. Sims Metal Management’s dominance is reinforced by its strong global footprint, advanced recycling technology, and commitment to sustainability.

Key players such as Novelis Inc., Schnitzer Steel, Steel Dynamics, and Armco Metal Holdings maintain significant market shares by offering efficient metal recycling processes that improve material recovery, reduce environmental impact, and support the circular economy. These companies focus on increasing the purity of recycled metals, improving energy efficiency, and expanding their global operations to meet growing demand from industrial sectors.

Emerging players like Asahi Holding, Befeso, Hawkeswood Metal Recycling Ltd., Hensel Recycling, Kuusakoski Recycling, and Triple M Metal LP are expanding their market presence by providing specialized recycling services for niche applications, including electronic waste, automotive scrap, and aluminum recycling. Their strategies involve increasing processing capabilities, enhancing sustainability practices, and targeting regional markets with tailored solutions.

Market growth is driven by rising industrialization, increasing demand for sustainable manufacturing practices, and government initiatives encouraging metal recycling. Innovations in recycling technologies, such as improved sorting methods and energy-efficient processes, are expected to further shape competitive dynamics and drive future growth in the global recycled metal market.

Companies are focusing on improving metal recycling technologies to enhance efficiency and output quality. Innovations like advanced sorting techniques, automation, and AI-powered monitoring systems have made it easier to separate metals from waste materials, increasing the purity and value of the recycled metals. For example, hydrometallurgical processes are being used for precious metal recycling, making it easier to recover metals like gold and silver from e-waste.

| Item | Value |

|---|---|

| Quantitative Units | USD 134.4 Billion |

| Metal | Ferrous and Non-ferrous |

| End Use | Building & construction, Transport, Industrial machinery, Electrical & electronics, Defense, Packaging, Consumer products, Nuclear industry, Military, Jewellery, Coins, Chemical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sims Metal Management, Armco Metal Holdings, Asahi Holding, Befeso, Hawkeswood Metal Recycling Ltd., Hensel Recycling, Kuusakoski Recycling, Novelis Inc., Schnitzer Steel, Steel Dynamics, and Triple M Metal LP |

| Additional Attributes | Dollar sales by metal type and application, demand dynamics across automotive, construction, and manufacturing sectors, regional trends in recycled metal production and consumption, innovation in sorting and processing technologies, environmental impact of recycling practices, and emerging use cases in sustainable construction and high-performance materials. |

The global recycled metal market is estimated to be valued at USD 134.4 billion in 2025.

The market size for the recycled metal market is projected to reach USD 216.8 billion by 2035.

The recycled metal market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in recycled metal market are ferrous, non-ferrous, _aluminum, _copper, _lead, _precious metals and _others.

In terms of end use, building & construction segment to command 27.4% share in the recycled metal market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recycled Scrap Metal Market Growth - Trends & Forecast 2025 to 2035

Metallurgical Lighting Market Size and Share Forecast Outlook 2025 to 2035

Metal Evaporation Boat Market Size and Share Forecast Outlook 2025 to 2035

Metal Miniature Bone Plates Market Size and Share Forecast Outlook 2025 to 2035

Metal Locking Plate and Screw System Market Size and Share Forecast Outlook 2025 to 2035

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Recycled Concrete Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA