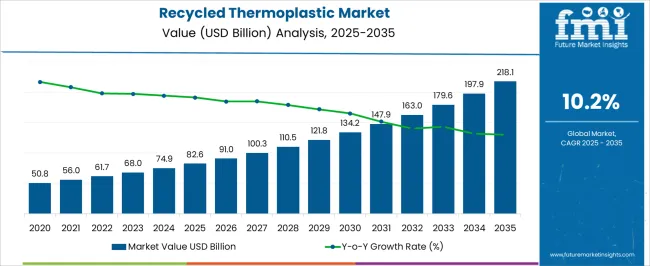

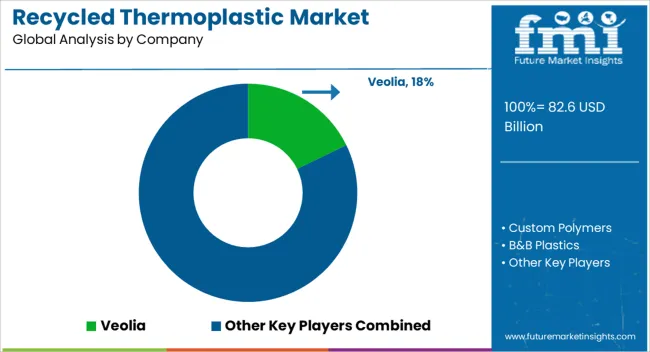

The Recycled Thermoplastic Market is estimated to be valued at USD 82.6 billion in 2025 and is projected to reach USD 218.1 billion by 2035, registering a compound annual growth rate (CAGR) of 10.2% over the forecast period. The recycled thermoplastic market is expected to exhibit and consistent year-on-year (YoY) growth, expanding from USD 50.8 billion in 2020 to approximately USD 218.1 billion by 2035. This significant growth reflects increasing emphasis on sustainable materials, regulatory mandates aimed at reducing plastic waste, and rising demand for eco-friendly alternatives across diverse industries such as packaging, automotive, construction, and consumer goods. From 2020 to 2025, the market will grow steadily from USD 50.8 billion to USD 74.9 billion, driven by greater adoption of recycled plastics due to environmental concerns and advancements in recycling technologies.

Heightened awareness among manufacturers and consumers regarding the environmental impact of virgin plastics further fuels demand for recycled content. Between 2026 and 2030, the market expands from USD 82.6 billion to USD 121.8 billion, supported by favorable government policies, extended producer responsibility regulations, and innovations improving the quality and consistency of recycled thermoplastics, enabling broader industrial applications. Circular economy initiatives and collaboration among industry players enhance supply chain efficiency and material traceability.

From 2031 to 2035, rapid commercialization and scaling of advanced recycling technologies, such as chemical and improved mechanical recycling, push the market from USD 134.2 billion to USD 218.1 billion. Investments in infrastructure and growing consumer preference for sustainable products further accelerate growth. The recycled thermoplastic market’s steady YoY expansion highlights its critical role in addressing global plastic pollution and meeting demand for sustainable materials, driven by regulatory support, technological innovation, and evolving market dynamics through 2035.

| Metric | Value |

|---|---|

| Recycled Thermoplastic Market Estimated Value in (2025 E) | USD 82.6 billion |

| Recycled Thermoplastic Market Forecast Value in (2035 F) | USD 218.1 billion |

| Forecast CAGR (2025 to 2035) | 10.2% |

The recycled thermoplastic market is gaining momentum due to increasing demand for circular economy solutions, rising regulatory emphasis on plastic reuse, and innovations in material processing. Government bans on single-use plastics and extended producer responsibility (EPR) initiatives are compelling manufacturers to shift toward recycled polymers.

Thermoplastics, which retain their physical properties after multiple processing cycles, are increasingly favored by industries seeking sustainable alternatives. Strong institutional and corporate demand for eco-friendly materials in automotive, packaging, and consumer goods has further fueled adoption.

Additionally, advancements in sorting, purification, and additive technologies have enhanced the quality and functional range of recycled thermoplastics. As public awareness around plastic pollution intensifies and infrastructure for collection and reprocessing expands, the market is expected to witness sustained investment and capacity upgrades across global supply chains.

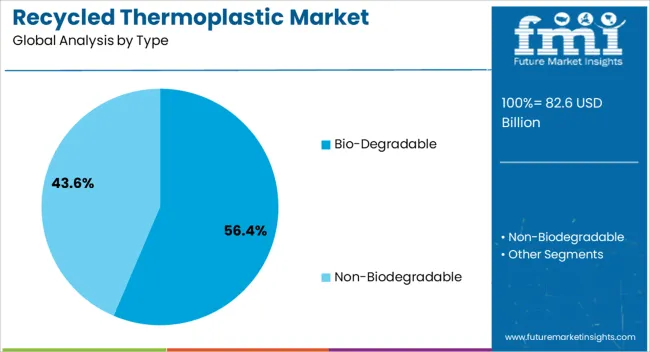

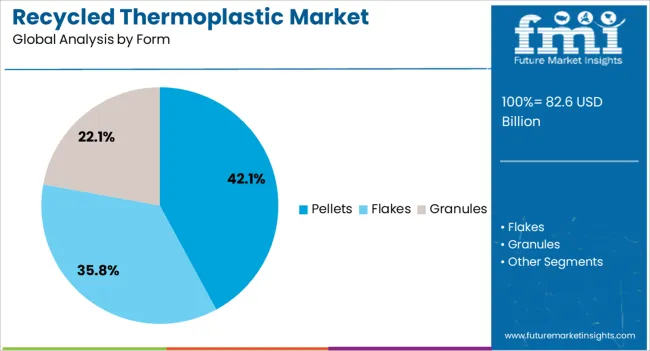

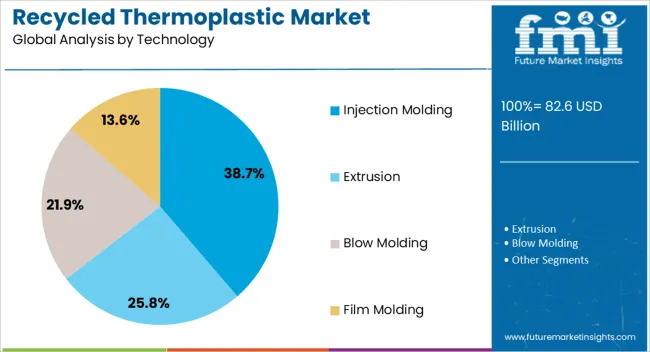

The recycled thermoplastic market is segmented by type, form, technology, product application, and geographic regions. By type of the recycled thermoplastic market is divided into Bio-Degradable and Non-Biodegradable. The recycled thermoplastic market is classified into Pellets, Flakes, and Granules. The recycled thermoplastic market is segmented based on technology into Injection Molding, Extrusion, Blow Molding, and Film Molding.

The recycled thermoplastic market is segmented by product into Polyethylene [PE], Polyethylene Terephthalate [PET], Polypropylene [PP], Polystyrene [PS], and Polyvinyl Chloride [PVC]. The recycled thermoplastic market is segmented into Packaging, Automotive & transportation, Building & Construction, Electrical & Electronics, Agriculture & Horticulture, Furniture & Housewares, and Medical. Regionally, the recycled thermoplastic industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Bio-degradable recycled thermoplastics are expected to account for 56.40% of the market revenue in 2025, positioning them as the leading material type. Their dominance is being driven by increasing environmental compliance mandates and shifting consumer preferences toward naturally decomposable alternatives.

Bio-degradable polymers offer the dual advantage of recyclability and post-use environmental neutrality, making them highly attractive across FMCG, agriculture, and food packaging sectors. Supportive government legislation promoting compostable plastics and labeling transparency has further accelerated the use of such materials.

As brands look to reduce microplastic contamination and improve sustainability certifications, bio-degradable thermoplastics are being increasingly integrated into product development strategies and packaging design.

Pellets are projected to hold 42.10% of the overall market share in 2025, making them the preferred form of recycled thermoplastics. This lead is attributed to their ease of handling, consistent shape, and compatibility with a wide array of processing technologies.

Pelletized recycled thermoplastics allow manufacturers to ensure uniform feedstock quality, optimize melt flow, and maintain mechanical performance across production batches. Their suitability for high-volume applications in injection molding, extrusion, and blow molding has made pellets the standard form for industrial use.

In addition, pellet form enhances logistics efficiency, facilitates storage and transport, and simplifies blending with virgin resins when needed for hybrid formulations.

Injection molding is forecast to contribute 38.70% of the market revenue by 2025, making it the most utilized processing technology in the recycled thermoplastic sector. This position is supported by its widespread use in mass manufacturing of complex and durable components across consumer goods, automotive, and electronics industries.

The ability to maintain tight tolerances, cycle speed advantages, and compatibility with a wide range of recycled thermoplastics has reinforced its industrial relevance. Ongoing improvements in tooling design and filler dispersion techniques have enabled better surface finish and strength retention in molded recycled parts.

As industries aim to close the loop on plastic usage, injection molding continues to offer scalability, repeatability, and minimal material waste, solidifying its status in the recycling value chain.

Recycled thermoplastics are benefiting from expanding end-use adoption and supportive regulatory frameworks. Material performance enhancements and competitive pricing are expected to solidify their role in multiple industries.

The recycled thermoplastic market has gained momentum due to its adaptability across packaging, automotive, construction, and consumer goods. Packaging leads in consumption, supported by the high demand for recycled PET and HDPE in bottles, containers, and flexible wraps. Automotive manufacturers increasingly use recycled polypropylene and polyethylene in non-structural parts to meet cost efficiency and performance standards. Construction applications, such as pipes, profiles, and panels, benefit from material durability and ease of processing. Consumer goods, including furniture, electronics casings, and household items, have also adopted recycled thermoplastics for their balance between performance and affordability. This cross-sector versatility reinforces market expansion by diversifying revenue sources and reducing dependency on a single application segment.

Price positioning has played a decisive role in strengthening recycled thermoplastic adoption. While virgin polymers benefit from established production economies, fluctuating crude oil prices and rising raw material costs have narrowed the price gap. This shift has enabled recycled thermoplastics to compete more effectively in large-volume procurement. The ability to process these materials in existing manufacturing equipment without extensive retooling further enhances adoption. Brand owners and manufacturers are opting for recycled inputs as a means to manage procurement expenses while still delivering quality products. Strategic sourcing from consistent supply streams and improvements in sorting and cleaning processes have also helped address quality concerns, making recycled variants a credible alternative in high-performance applications.

Government policies, extended producer responsibility frameworks, and industry-specific recycling mandates have been pivotal in driving demand for recycled thermoplastics. Many jurisdictions enforce minimum recycled content in packaging, which has accelerated resin demand from FMCG and beverage brands. Automotive industry guidelines increasingly encourage the use of recycled materials to reduce resource dependency. Construction standards have also opened opportunities for recycled thermoplastics in non-load-bearing products. Certifications and material traceability systems provide assurance on quality and safety, further enhancing market credibility. Regulatory measures have shifted recycled thermoplastics from an optional choice to a compliance-driven necessity for several sectors, securing a stable demand base for manufacturers.

Improvements in sorting, compounding, and additive technologies have enhanced the consistency and mechanical properties of recycled thermoplastics. These developments allow for greater retention of tensile strength, impact resistance, and color uniformity, making them viable for demanding applications. Blending with virgin polymers or using compatibilizers has helped overcome limitations such as odor, discoloration, and reduced flexibility. Processing innovations, including melt filtration and odor removal systems, have expanded usability in food-contact packaging and aesthetically sensitive applications. These performance gains not only broaden the end-use scope but also improve brand confidence in adopting recycled variants for premium and mid-tier products, creating a stronger competitive position in the global polymer value chain.

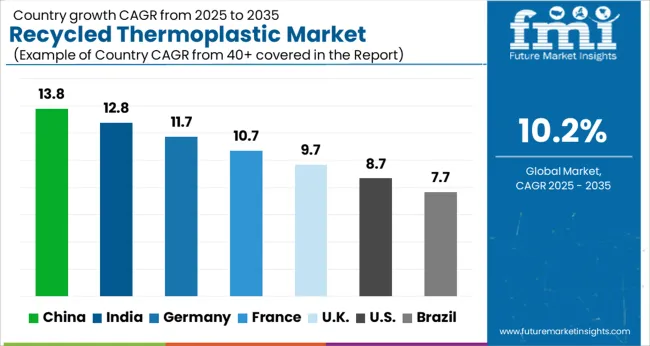

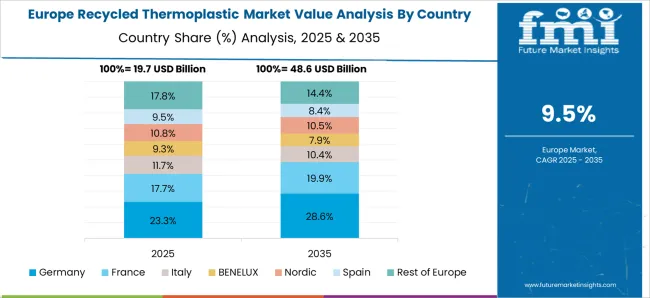

The recycled thermoplastic market is projected to grow globally at a CAGR of 10.2% from 2025 to 2035, with China leading at 14%, driven by strong recycling initiatives and large-scale manufacturing. India follows at 13%, supported by increasing demand in automotive and packaging industries. France records a steady 11%, supported by its robust recycling infrastructure and eco-conscious manufacturing practices. The UK achieves 10% growth, driven by advancements in sustainable materials for construction and automotive sectors. The USA maintains a moderate 9% CAGR, shaped by demand for eco-friendly solutions in packaging and industrial applications, positioning Asia as a key growth center.

The CAGR for the recycled thermoplastic market in the United Kingdom was estimated at 6.1% during 2020–2024 and is expected to rise to 10% for the 2025–2035 period. This increase in growth is attributed to a shift towards eco-friendly solutions in automotive, packaging, and construction industries. The UK’s government initiatives supporting recycling practices, along with consumer demand for sustainable materials, have played a significant role in this market’s expansion. Additionally, regulations promoting the use of recycled materials in manufacturing and construction have further driven the adoption of recycled thermoplastics.

The CAGR for the recycled thermoplastic market in China was recorded at 13.8% between 2020–2024 and is expected to remain strong, with continued growth during the 2025–2035 period. China’s rapid industrialization and focus on circular economy principles have heavily influenced the adoption of recycled materials. Large-scale recycling projects, particularly in packaging and automotive industries, have pushed the market forward. Government support for environmental policies and the push for reduced plastic waste in manufacturing sectors continue to propel the growth of the recycled thermoplastic market in China.

The CAGR for the recycled thermoplastic market in India was estimated at 13% during 2020–2024 and is projected to maintain significant growth throughout the 2025–2035 period. India’s expanding industrial base, coupled with a growing focus on sustainability, has driven this market forward. The increased adoption of recycled materials in packaging, automotive, and construction sectors is further accelerating the market’s development. India’s government incentives for recycling programs and the growing demand for green solutions in various industries have played a vital role in supporting market growth.

The CAGR for the recycled thermoplastic market in France was recorded at 9% during 2020–2024 and is projected to stabilize around 11% during the 2025–2035 period. France’s emphasis on circular economy practices and the use of recycled materials in packaging, automotive, and construction has driven the market’s growth. Strong environmental regulations, along with an increasing demand for sustainable products, have encouraged the adoption of recycled thermoplastics. France’s progressive recycling infrastructure and government incentives further support the market's upward trajectory.

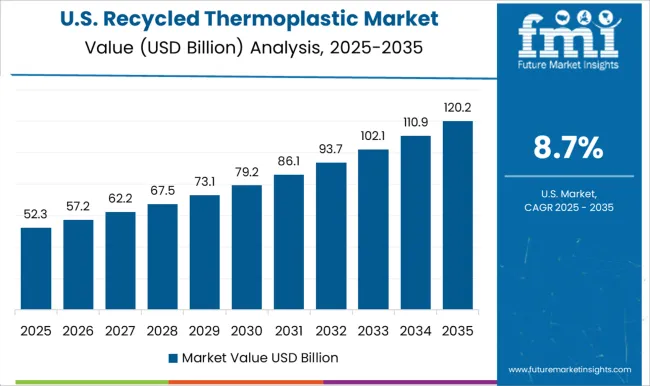

The CAGR for the USA recycled thermoplastic market was estimated at 7.5% during 2020–2024 and is expected to grow to 9% for the 2025–2035 period. This increase is primarily driven by the government’s strong push for waste reduction and sustainability in manufacturing. The market has been heavily influenced by the growing demand for recycled materials, particularly in packaging, automotive, and construction. The USA has implemented regulations to increase the recycling of plastics, which has further stimulated demand for recycled thermoplastics.

The recycled thermoplastic market features a mix of global recycling leaders and specialized polymer recovery companies, each driving material quality enhancement and regional supply chain development. Veolia and Suez maintain extensive collection and processing networks, enabling consistent resin availability for multiple industries. KW Plastics and Custom Polymers are recognized for their large-scale operations in post-consumer and post-industrial recycling, delivering high-grade polyethylene and polypropylene. Clear Path Recycling and Envision Plastics focus on PET recovery for packaging and textile applications, while B&B Plastics and Maine Plastics Incorporation supply diverse polymer types to manufacturers seeking cost-effective alternatives to virgin resins. PARC Corporation and United Plastic Recycling strengthen industrial recycling channels through tailored collection and reprocessing services. Plastipak Holdings leverages its packaging expertise to integrate recycled content into new product lines, while Fresh Pak Corporation addresses sector-specific needs in food-grade packaging. APC Recycling and B. Schoenberg & Co. provide specialized sourcing, trading, and processing capabilities, supporting material flow in domestic and export markets. RJM International Inc. and other niche recyclers enhance market flexibility by supplying custom-processed resins for targeted applications. Competitive positioning in this sector is shaped by advancements in sorting efficiency, resin purity improvements, and partnerships with brand owners to meet recycled content commitments in packaging, automotive, and consumer goods manufacturing.

BASF has been focusing on developing high-performance recycled thermoplastic materials using advanced technologies to improve the quality and properties of recycled plastics. The company is leveraging its chemical recycling processes to convert post-consumer plastics into new thermoplastic materials that can be used in industries like automotive, packaging, and construction.

| Item | Value |

|---|---|

| Quantitative Units | USD 82.6 Billion |

| Type | Bio-Degradable and Non-Biodegradable |

| Form | Pellets, Flakes, and Granules |

| Technology | Injection Molding, Extrusion, Blow Molding, and Film Molding |

| Product | Polyethylene [PE], Polyethylene Terephthalate [PET], Polypropylene [PP], Polystyrene [PS], and Polyvinyl Chloride [PVC] |

| Application | Packaging, Automotive & transportation, Building & Construction, Electrical & Electronics, Agriculture & Horticulture, Furniture & Housewares, and Medical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Veolia, Custom Polymers, B&B Plastics, Clear Path Recycling, KW Plastics, PARC corporation, United plastic recycling, Plastipak Holdings, Maine plastics incorporation, Fresh Pak Corporation, APC recycling, Suez, Envision Plastics, B. Schoenberg & Co., and RJM International Inc. |

| Additional Attributes | Dollar sales, share, demand trends by application, regional growth hotspots, pricing analysis, competitive landscape, raw material supply stability, regulatory impact, customer preferences, end-use adoption forecasts. |

The global recycled thermoplastic market is estimated to be valued at USD 82.6 billion in 2025.

The market size for the recycled thermoplastic market is projected to reach USD 218.1 billion by 2035.

The recycled thermoplastic market is expected to grow at a 10.2% CAGR between 2025 and 2035.

The key product types in recycled thermoplastic market are bio-degradable and non-biodegradable.

In terms of form, pellets segment to command 42.1% share in the recycled thermoplastic market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recycled Concrete Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thermoplastic Adhesive Films Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Pipes Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Ocean Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thermoplastic Prepreg Market Size and Share Forecast Outlook 2025 to 2035

Recycled Metal Market Size and Share Forecast Outlook 2025 to 2035

Recycled Elastomers Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Market Size and Share Forecast Outlook 2025 to 2035

Recycled Asphalt Pavement Market Size and Share Forecast Outlook 2025 to 2035

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Paper Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Recycled Prescription Bag Market Size and Share Forecast Outlook 2025 to 2035

Recycled PET Packaging Market Size, Share & Forecast 2025 to 2035

Recycled Fabric Bag Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Recycled Scrap Metal Market Growth - Trends & Forecast 2025 to 2035

Thermoplastic Tape Market Growth - Size & Trends 2025 to 2035

Thermoplastic Ester Elastomer (TPEE) Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA