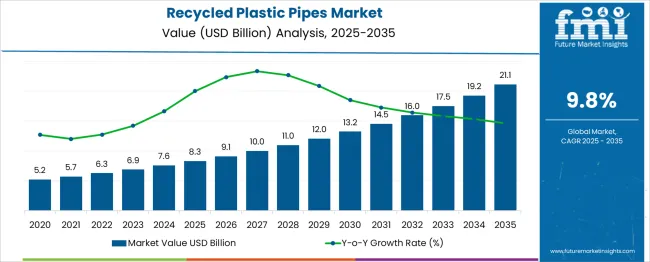

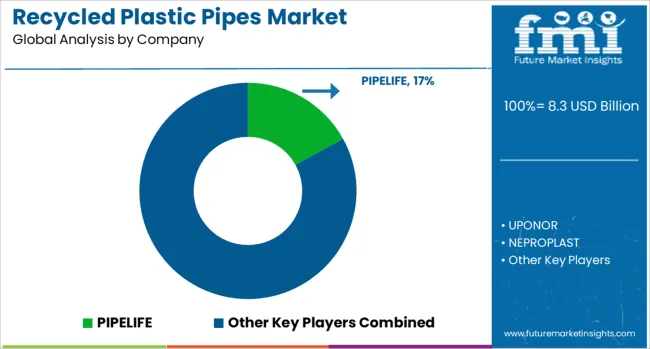

The global recycled plastic pipes market is projected to grow from USD 8.3 billion in 2025 to approximately USD 21.1 billion by 2035, recording an absolute increase of USD 12.82 billion over the forecast period. This translates into a total growth of 154.6%, with the market forecast to expand at a compound annual growth rate (CAGR) of 9.8% between 2025 and 2035. The overall market size is expected to grow by nearly 2.55X during the same period, supported by increasing environmental consciousness, stringent regulations on plastic waste management, growing infrastructure development, and rising adoption of sustainable construction materials.

Quick Stats for Recycled Plastic Pipes Market

Between 2025 and 2030, the recycled plastic pipes market is projected to expand from USD 8.3 billion to USD 13.2 billion, resulting in a value increase of USD 4.9 billion, which represents 38.5% of the total forecast growth for the decade. This phase of growth will be shaped by increasing government initiatives for plastic waste recycling, growing awareness about environmental sustainability, and expanding infrastructure projects in emerging economies. Construction and utility companies are increasingly adopting recycled plastic pipes to meet sustainability goals and reduce carbon footprints.

| Metric | Value |

| Estimated Value in (2025E) | USD 8.3 billion |

| Forecast Value in (2035F) | USD 21.1 billion |

| Forecast CAGR (2025 to 2035) | 9.8% |

From 2030 to 2035, the market is forecast to grow from USD 13.2 billion to USD 21.1 billion, adding another USD 7.9 billion, which constitutes 61.5% of the overall ten-year expansion. This period is expected to be characterized by advancement in recycling technologies, development of high-performance recycled plastic formulations, and integration of circular economy principles in construction practices. The growing emphasis on green building certifications and sustainable infrastructure development will drive demand for premium recycled plastic pipes with enhanced durability and performance characteristics.

Between 2020 and 2025, the recycled plastic pipes market experienced significant expansion, driven by increasing regulatory pressure on plastic waste management and growing awareness of environmental sustainability. The market developed as construction companies recognized the need for eco-friendly alternatives to traditional piping materials while maintaining performance standards. Government incentives and circular economy initiatives began emphasizing the importance of recycled materials in infrastructure development for achieving sustainability targets.

Market expansion is being supported by the increasing environmental awareness among consumers and regulatory bodies demanding sustainable construction practices. Modern construction projects are increasingly focused on reducing environmental impact through the adoption of recycled materials that can provide comparable performance to virgin plastic alternatives. Recycled plastic pipes' proven effectiveness in various applications, combined with their contribution to waste reduction and circular economy principles, makes them a preferred choice in sustainable infrastructure development.

The growing emphasis on green building standards and environmental certifications is driving demand for recycled plastic pipes that meet stringent sustainability criteria. Construction companies are seeking materials that not only perform effectively but also contribute to their environmental, social, and governance (ESG) objectives. The rising influence of sustainability ratings and green building certifications is contributing to increased adoption of recycled plastic pipes across different construction sectors and applications.

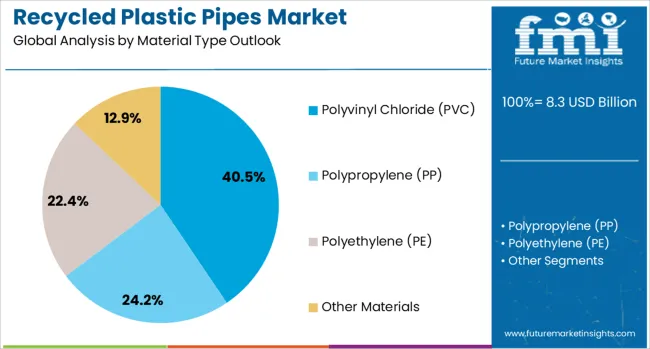

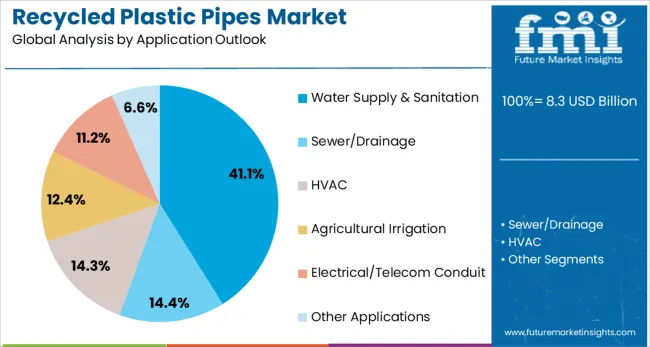

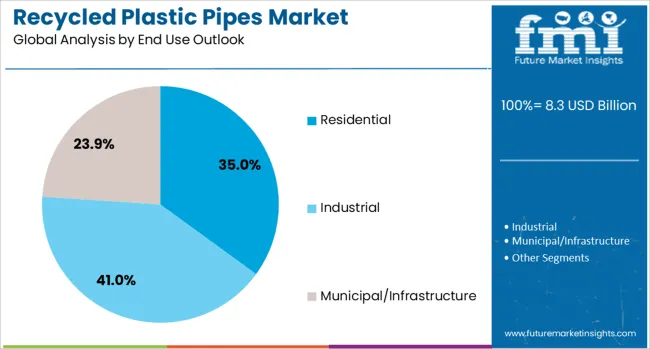

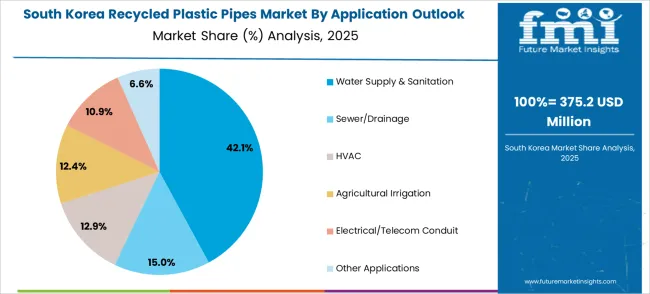

The market is segmented by material type, application, end use, and region. By material type, the market is divided into polyvinyl chloride (PVC), polypropylene (PP), polyethylene (PE), and other materials. Based on application, the market is categorized into water supply & sanitation, sewer/drainage, HVAC, agricultural irrigation, electrical/telecom conduit, and other applications. In terms of end use, the market is segmented into residential, industrial, and municipal/infrastructure. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

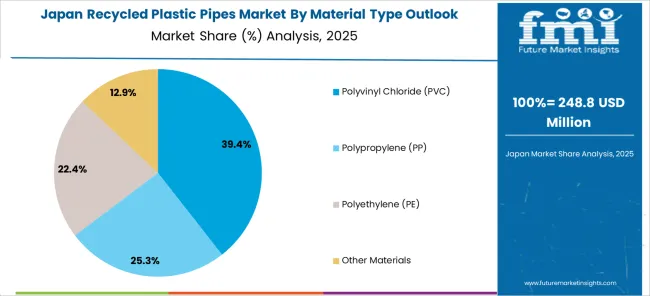

The polyvinyl chloride (PVC) material type is projected to account for 40.5% of the recycled plastic pipes market in 2025, reaffirming its position as the category's leading material. PVC's excellent chemical resistance, durability, and ease of processing make it ideal for recycling into high-quality pipe applications. The material's versatility allows for use in various applications from water supply to drainage systems, making it a preferred choice for sustainable construction projects.

This dominance is supported by well-established recycling infrastructure for PVC materials and proven performance characteristics that match or exceed virgin material standards. The material's long service life and resistance to corrosion ensure that recycled PVC pipes provide reliable performance over extended periods. With increasing availability of post-consumer and post-industrial PVC waste streams, the material continues to be the foundation for most recycled plastic pipe manufacturing, driving sustained market growth.

Water supply & sanitation applications are projected to represent 41.1% of recycled plastic pipes demand in 2025, underscoring their critical role in sustainable infrastructure development. The growing need for water infrastructure upgrades and expansion in developing countries is driving demand for cost-effective and environmentally responsible piping solutions. Recycled plastic pipes offer excellent corrosion resistance and long service life, making them ideal for water distribution and sanitation systems.

This segment benefits from increasing government investments in water infrastructure and growing emphasis on sustainable development goals related to clean water access. Municipal authorities are increasingly specifying recycled plastic pipes for water projects to meet sustainability targets while maintaining system reliability. The segment's growth is further supported by the material's resistance to chemical degradation and its ability to maintain water quality standards throughout its service life.

The residential end-use segment is forecasted to contribute 35.0% of the recycled plastic pipes market in 2025, reflecting the growing adoption of sustainable building materials in residential construction. Homebuilders and developers are increasingly incorporating recycled plastic pipes into plumbing, drainage, and utility systems to meet green building standards and reduce environmental impact. The cost-effectiveness of recycled materials combined with comparable performance characteristics makes them attractive for residential applications.

This segment benefits from growing consumer awareness about environmental sustainability and increasing demand for eco-friendly housing options. Green building certifications and energy-efficient home programs often incentivize the use of recycled materials, supporting market growth in residential applications. The segment's expansion is also driven by the availability of recycled plastic pipes in standard residential sizes and configurations, making adoption straightforward for builders and contractors.

The recycled plastic pipes market is advancing rapidly due to increasing environmental regulations, growing sustainability awareness, and cost advantages over virgin materials. However, the market faces challenges including quality consistency concerns, limited availability of recycled feedstock, and performance perception issues. Innovation in recycling technologies and quality improvement initiatives continue to address these challenges and drive market expansion.

The development of advanced recycling technologies is enabling the production of high-quality recycled plastic pipes that meet or exceed performance standards of virgin materials. Modern recycling processes improve material purity, consistency, and mechanical properties while reducing contamination levels. These technological improvements are expanding the range of applications where recycled plastic pipes can be effectively utilized.

Government initiatives promoting circular economy principles and plastic waste reduction are creating favorable conditions for recycled plastic pipes market growth. Regulations requiring minimum recycled content in construction materials and incentives for sustainable building practices are driving adoption. Extended producer responsibility programs and plastic waste management policies are ensuring steady supply of recycled feedstock for pipe manufacturing.

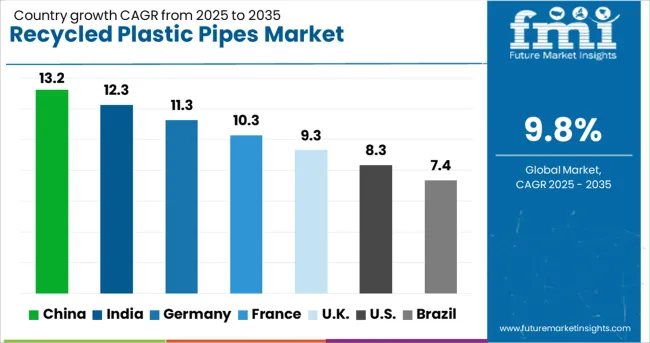

| Country | CAGR (2025-2035) |

| China | 13.2% |

| India | 12.3% |

| Germany | 11.3% |

| France | 10.3% |

| UK | 9.3% |

| USA | 8.3% |

| Brazil | 7.4% |

The recycled plastic pipes market is experiencing robust growth globally, with China leading at a 13.2% CAGR through 2035, driven by massive infrastructure investments, strong government support for recycling, and increasing environmental regulations. India follows closely at 12.3%, supported by expanding water infrastructure projects, growing sustainability awareness, and cost advantages of recycled materials. Germany shows significant growth at 11.3%, emphasizing environmental standards and circular economy principles. France records 10.3%, focusing on sustainable construction practices and green building initiatives. The UK demonstrates 9.3% growth, prioritizing waste reduction and environmental sustainability.

The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from recycled plastic pipes in China is projected to exhibit exceptional growth with a CAGR of 13.2% through 2035, driven by massive government infrastructure spending and strong commitment to circular economy development. The country's expanding urban population and aging infrastructure are creating significant demand for sustainable piping solutions. Major domestic and international manufacturers are establishing comprehensive production networks to serve the growing demand for environmentally responsible construction materials.

Revenue from recycled plastic pipes in India is expanding at a CAGR of 12.3%, supported by ambitious water supply and sanitation programs and growing environmental awareness. The country's massive infrastructure development needs and focus on sustainable development goals are driving demand for cost-effective recycled piping solutions. Government initiatives promoting plastic waste management and circular economy principles are creating favorable market conditions.

Demand for recycled plastic pipes in Germany is projected to grow at a CAGR of 11.3%, supported by stringent environmental regulations and strong emphasis on circular economy principles. German consumers and construction companies prioritize high-quality, certified recycled materials that meet strict performance and environmental standards. The market is characterized by premium positioning and advanced recycling technologies.

Revenue from recycled plastic pipes in France is projected to grow at a CAGR of 10.3% through 2035, driven by strong government support for sustainable construction and circular economy development. French construction companies are increasingly adopting recycled materials to meet environmental targets and green building certification requirements.

Revenue from recycled plastic pipes in the UK is projected to grow at a CAGR of 9.3% through 2035, supported by comprehensive waste management policies and growing emphasis on circular economy principles. British construction companies value environmental responsibility and are increasingly specifying recycled materials for infrastructure projects.

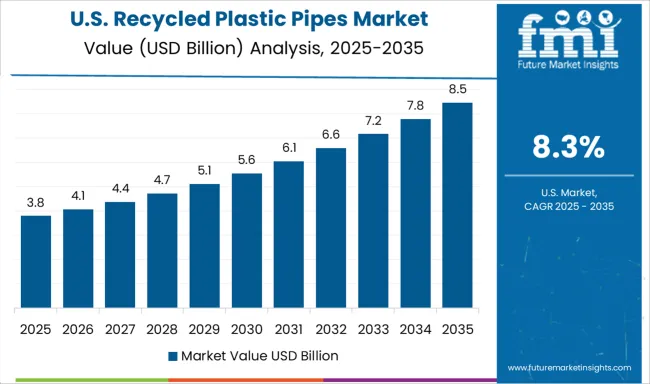

Revenue from recycled plastic pipes in the US is projected to grow at a CAGR of 8.3% through 2035, supported by federal infrastructure investments and state-level sustainability initiatives. American municipalities and construction companies are increasingly adopting recycled materials to meet environmental targets and reduce project costs.

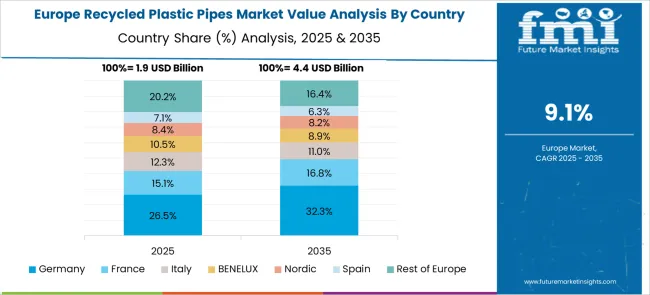

The European recycled plastic pipes market demonstrates sophisticated development across major economies with Germany leading through its precision environmental engineering excellence and advanced circular economy capabilities, supported by companies emphasizing high-quality recycled materials, sustainable construction solutions, and comprehensive waste management systems while maintaining strict quality standards and environmental compliance protocols. The UK shows strength in sustainability initiatives and green building standards, with organizations specializing in certified recycled plastic pipes and circular economy applications that meet rigorous environmental regulations.

France contributes through its strong government support for sustainable construction and circular economy development, delivering comprehensive recycled plastic pipe solutions that combine environmental responsibility with modern infrastructure requirements. Sweden and Nordic countries emphasize advanced recycling technologies and sustainable material innovations. Italy and Spain demonstrate growth in specialized sustainable construction applications and infrastructure modernization projects. The market benefits from stringent EU environmental regulations, established recycling infrastructure, and growing demand for certified recycled plastic pipes that provide superior sustainability credentials.

The Japanese recycled plastic pipes market demonstrates steady growth driven by precision manufacturing focus, advanced recycling technology development, and construction industry preference for high-quality sustainable materials that ensure superior performance and environmental compliance throughout infrastructure applications. Japanese organizations prioritize sophisticated quality control systems and stringent environmental standards, creating demand for recycled plastic pipes featuring advanced material processing, comprehensive quality assurance, and integrated sustainability performance that align with Japanese manufacturing excellence.

The market emphasizes technological innovation in recycling processes, material purity enhancement, and quality consistency systems that reflect Japanese attention to detail in sustainable material development and environmental responsibility. Growing investment in circular economy initiatives and waste management programs supports adoption of premium recycled plastic pipes with advanced performance characteristics, environmental certifications, and long-term reliability for infrastructure applications. Japanese construction companies focus on material quality, consistent performance outcomes, and comprehensive environmental benefits.

The South Korean recycled plastic pipes market shows exceptional growth potential driven by expanding infrastructure development programs, increasing adoption of sustainable construction practices, and growing demand for environmentally responsible materials requiring comprehensive quality assurance and performance verification capabilities. The market benefits from South Korea's technological leadership in manufacturing and increasing focus on circular economy initiatives that drive investment in advanced recycling technologies meeting international environmental standards.

Korean construction organizations increasingly adopt sustainable material specifications, environmental compliance frameworks, and integrated waste management programs to improve infrastructure sustainability and regulatory compliance while ensuring cost-effectiveness requirements. Growing influence of Korean environmental technology companies supports demand for sophisticated recycled plastic pipe solutions that ensure comprehensive performance reliability while maintaining environmental responsibility and operational efficiency. The integration of advanced manufacturing technologies and quality control systems creates opportunities for premium recycled pipe solutions with enhanced sustainability characteristics.

The recycled plastic pipes market is characterized by competition among established pipe manufacturers, specialized recycling companies, and emerging sustainable material producers. Companies are investing in advanced recycling technologies, quality control systems, supply chain optimization, and sustainability certifications to deliver reliable, cost-effective, and environmentally responsible piping solutions. Innovation in material processing, product performance, and circular economy integration are central to strengthening competitive positions.

PIPELIFE leads the market with innovative recycled plastic pipe solutions and strong focus on sustainability and circular economy principles. UPONOR provides advanced plumbing and heating solutions with emphasis on environmental responsibility and energy efficiency. NEPROPLAST focuses on specialized recycled plastic applications with emphasis on quality and performance. Advanced Drainage Systems (ADS) offers comprehensive drainage solutions incorporating recycled materials and sustainable practices.

Pacific Corrugated Pipe Company specializes in large-diameter recycled plastic pipes for infrastructure applications, while Particules Plastiques Inc. focuses on recycled plastic processing and sustainable material solutions. These companies are expanding their recycled content offerings and developing new applications to meet growing demand for sustainable construction materials.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 8.3 Billion |

| Material Type | Polyvinyl Chloride (PVC), Polypropylene (PP), Polyethylene (PE), Other Materials |

| Application | Water Supply & Sanitation, Sewer/Drainage, HVAC, Agricultural Irrigation, Electrical/Telecom Conduit, Other Applications |

| End Use | Residential, Industrial, Municipal/Infrastructure |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | PIPELIFE, UPONOR, NEPROPLAST, Advanced Drainage Systems (ADS), Pacific Corrugated Pipe Company, Particules Plastiques Inc. |

| Additional Attributes | Market analysis by recycled content percentage, regional sustainability trends, competitive landscape assessment, quality standards and certifications, integration with circular economy initiatives, innovations in recycling technology, and sustainable manufacturing practices |

Material Type:

Application:

End Use:

Region:

The global recycled plastic pipes market is estimated to be valued at USD 8.3 billion in 2025.

The market size for the recycled plastic pipes market is projected to reach USD 21.1 billion by 2035.

The recycled plastic pipes market is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types in recycled plastic pipes market are polyvinyl chloride (pvc), polypropylene (pp), polyethylene (pe) and other materials.

In terms of application outlook, water supply & sanitation segment to command 41.1% share in the recycled plastic pipes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recycled Concrete Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Metal Market Size and Share Forecast Outlook 2025 to 2035

Recycled Elastomers Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Market Size and Share Forecast Outlook 2025 to 2035

Recycled Asphalt Pavement Market Size and Share Forecast Outlook 2025 to 2035

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Paper Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Recycled Prescription Bag Market Size and Share Forecast Outlook 2025 to 2035

Recycled PET Packaging Market Size, Share & Forecast 2025 to 2035

Recycled Fabric Bag Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Recycled Scrap Metal Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Recycled Prescription Bag Industry

Competitive Breakdown of Recycled Paper Suppliers

Recycled Polyethylene Terephthalate (rPET) Packaging Market Growth and Trends 2025 to 2035

Recycled Glass Packaging Market Trends & Growth Forecast 2024-2034

Recycled Aluminum Packaging Market Trends & Growth Forecast 2024-2034

Recycled Envelopes Market

Recycled Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA