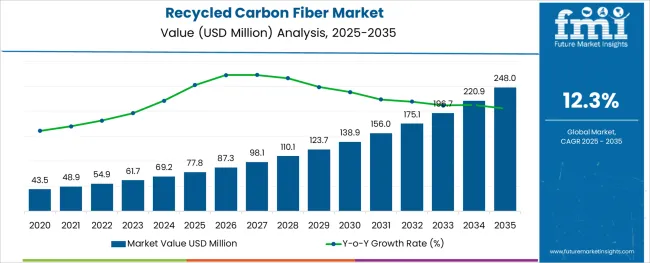

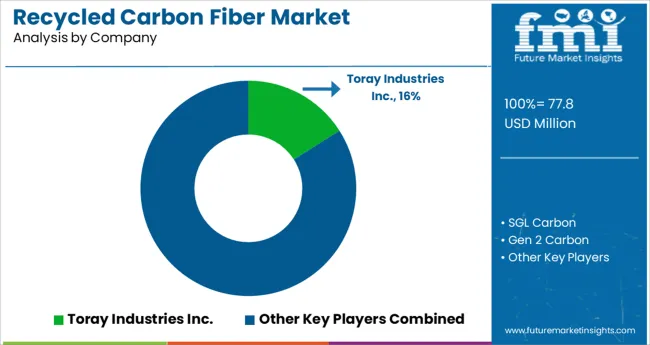

The Recycled Carbon Fiber Market is estimated to be valued at USD 77.8 million in 2025 and is projected to reach USD 248.0 million by 2035, registering a compound annual growth rate (CAGR) of 12.3% over the forecast period.

The recycled carbon fiber market is gaining momentum due to increasing focus on circular economy models, stringent carbon emission norms, and the need for cost-effective lightweight alternatives to virgin carbon fiber. The market is benefiting from advancements in pyrolysis and solvolysis recycling methods that allow high fiber retention without compromising mechanical properties. Manufacturers are increasingly sourcing waste carbon fiber from aerospace, automotive, and wind energy sectors to reduce raw material costs and environmental footprint.

The compatibility of recycled carbon fiber with thermoplastics and its ability to meet mechanical performance standards make it an attractive solution for secondary structural components. Growth is also supported by government incentives and sustainability initiatives encouraging use of recycled materials in end-use sectors.

As industries shift toward eco-efficient supply chains and lightweighting strategies, demand for high-quality recycled carbon fiber is expected to rise significantly across global manufacturing ecosystems.

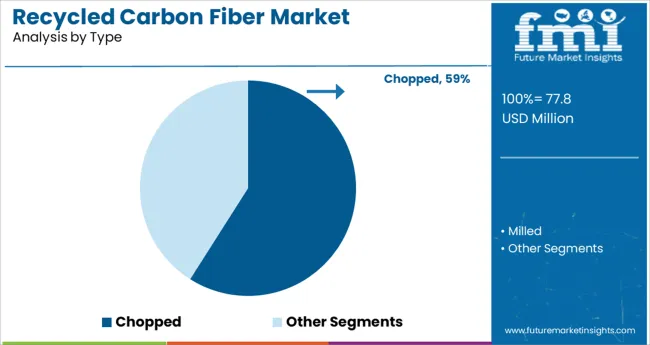

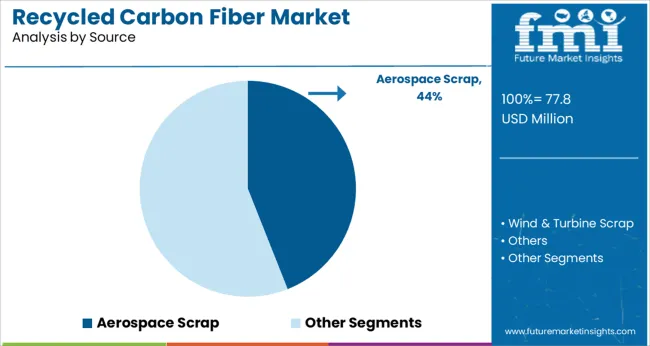

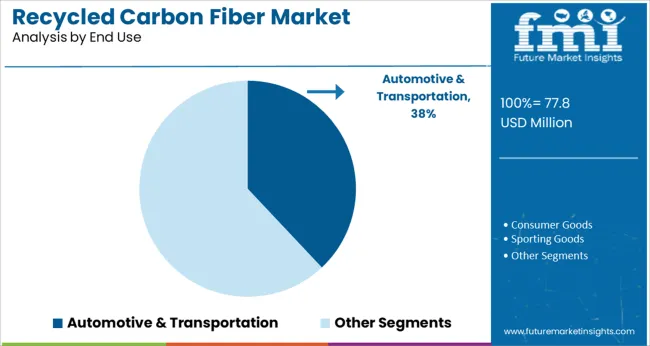

The market is segmented by Type, Source, and End Use and region. By Type, the market is divided into Chopped and Milled. In terms of Source, the market is classified into Aerospace Scrap, Wind & Turbine Scrap, and Others. Based on End Use, the market is segmented into Automotive & Transportation, Consumer Goods, Sporting Goods, Marine, and Industrial.

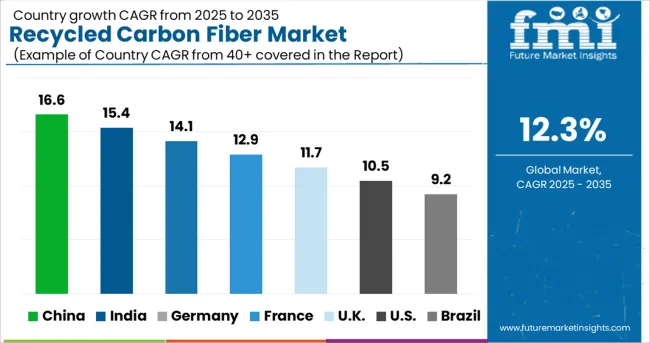

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Chopped recycled carbon fiber is projected to account for 59.0% of the total market revenue in 2025, making it the leading product type. This segment’s growth is being fueled by its suitability for injection molding, compression molding, and thermoplastic compounding processes.

Chopped fiber provides good dispersion, structural reinforcement, and dimensional stability, especially in automotive and consumer electronics applications. Its shorter length allows easier handling, consistent processing, and lower production costs, making it ideal for high-volume manufacturing.

The segment’s dominance is also supported by increasing use in lightweight composite parts where isotropic strength and recyclability are critical. As industries prioritize sustainability without compromising on mechanical performance, chopped recycled carbon fiber continues to gain traction due to its ease of integration into existing manufacturing workflows and its cost-benefit ratio.

Aerospace scrap is expected to contribute 44.0% of the total revenue share in the recycled carbon fiber market by 2025, positioning it as the leading raw material source. The segment’s growth is being driven by the high-quality, high-strength carbon fiber waste generated during aircraft component production and decommissioning. These scraps often contain minimal resin contamination, making them ideal for recovery and reuse in secondary markets.

Stringent waste disposal regulations and increased focus on sustainability in aerospace manufacturing have promoted recycling partnerships and closed-loop material streams. The quality and consistency of aerospace-grade scrap allow for its utilization in demanding industrial and automotive applications.

Additionally, ongoing fleet renewals and the push for lightweight materials in aviation contribute to a steady flow of recoverable carbon fiber scrap, reinforcing the segment’s dominant share.

The automotive & transportation segment is projected to hold 38.0% of the total revenue share in 2025, emerging as the top end-use category in the recycled carbon fiber market. This leadership is driven by the sector’s ongoing efforts to reduce vehicle weight for improved fuel efficiency, electric vehicle (EV) range, and overall emissions reduction.

Recycled carbon fiber offers a cost-effective alternative to virgin materials in semi-structural and non-structural applications such as underbody shields, interior panels, and reinforcement brackets. Automakers are increasingly integrating recycled materials to meet corporate sustainability goals and regulatory mandates related to vehicle recyclability.

Moreover, the compatibility of chopped fiber with thermoplastic composites supports rapid cycle times in high-throughput production, aligning with automotive manufacturing efficiency standards. As mobility solutions evolve and lightweighting becomes integral to design strategies, the use of recycled carbon fiber is anticipated to expand significantly across this sector.

The demand for recycled carbon fiber grew at a 9.8% CAGR between 2020 and 2024. The recycled carbon fiber market is in its infancy stage and has gained traction due to the awareness of its end uses. Growing focus on environmental regulations as well as the dumping duty has prompted carbon fiber manufacturers to recycle carbon fiber.

The demand for recycled carbon fiber is expected to increase during the assessment period and is further expected to witness a significant growth rate of 12.3% in the same period. The use of recycled carbon fiber in automotive and transportation, sporting goods, industrial applications, and increased regulation towards the environment, prompting the circular economy, is expected to uplift the consumption of recycled carbon fiber.

The market for recycled carbon fiber is notably being driven by the automotive and transportation sectors. The use of recycled carbon fiber helps address the issue of reducing the overall vehicle weight. Vehicles that are more fuel-efficient have been made possible by recycled carbon fiber. Manufacturers use recycled carbon fiber because of its great properties to reduce component downtime and extend the life of their products.

Numerous cars and trucks, some of which are manufactured from recycled carbon fiber, have been released by major manufacturers. The BMW Company uses recycled carbon fiber in vehicle parts like the roof. Additionally, composite floor panels, composite tailgates, and composite front benders all make use of recycled carbon fiber. Recycled carbon fiber is being used as a result of a demand for lighter vehicles.

According to FMI, the automotive & transportation segment is expected to grow at a robust CAGR of 12.7% during the forecast period.

According to EU law, the automotive industry should recycle 85% of its waste generation. Recovery of CF trash and the creation of new goods using less energy than 10% of that required to create the CF initially can help meet legislative and sustainability goals. Recycled Carbon Fiber aids in lowering greenhouse emissions by using less fuel because it is used to make lighter automotive bodywork.

With the awareness of a sustainable environment and increasing landfilling costs, many end users are consuming recycled carbon fiber due to its high value and low cost. Several manufacturers are offering recycled carbon fiber, which can be reintroduced in the process. Meanwhile, a collaboration between manufacturers and researchers has aided in the recovery and reuse of carbon fibers, reintroducing them into the circular economy.

The major objective of the cost proposal is to reduce the cost of lightweight carbon fiber composites by 50%. As compared to virgin industrial fiber, the cost of the fiber is typically 30 to 40% less expensive. In light of this, recycled fiber can provide weight-saving benefits comparable to those of virgin fiber at a significantly reduced cost, making it suitable for sporting goods. Carbon fiber from recycled sources is replacing old hardwood sporting equipment.

The Carbon Fiber Circular Demonstration Project was initiated, focusing on recycling carbon fiber from the sports equipment industry. Fibers from worn-out or damaged carbon fiber components used in sporting goods are recovered and realigned into prepreg tapes. The tapes will be returned to the alliance's producers, who will use the material in brand-new sporting products. According to preliminary demonstration data, the new carbon fiber tape occasionally performs better than the original virgin fiber.

Aviation scrap generation could be a substantial source of recyclable materials. An emerging trend in aviation is the use of thermoplastic composites, which can allow for recycling and the use of used carbon fiber. Given that numerous thermoplastic composite materials are already employed in the manufacture of airplanes, the required technology and equipment are easily accessible. In contrast, it is anticipated that between 6000 and 8000 commercial airplanes will reach the end of their useful lives by 2035.

At that time, they will be disassembled and their high-grade carbon fiber components can be recycled. A number of initiatives have shown that it is possible to make high-quality thermoplastic composites using recycled carbon fiber in a way that is both practical and affordable for the environment.

In a project to look at costs over the course of the material's whole life cycle, the Dutch companies Fokker, Toray, and others with knowledge of design, processing, and recycling took part. It was discovered that using recycled carbon fiber is financially advantageous. Numerous projects are currently underway to investigate the use of recycled carbon fiber in the aviation industry and are expected to open up new prospects for use.

The growth of the recycled carbon fiber market is being restricted by a lack of technical expertise. Many carbon fiber consumers believe that recycled carbon fiber falls short of virgin carbon fiber in quality. Recycled carbon fiber's mechanical characteristics and processing attributes are not well understood.

The proper processing technology must be used for the recycled carbon fiber to be of the same quality as virgin carbon fiber. Many recyclers lack a thorough technical understanding of process standardization.

In an effort to reach its 77.8030 carbon emissions peak and achieve carbon neutrality by 77.8060, China seeks to recycle 77.85% of its textile waste and produce 77.8 million tonnes of recycled fiber by 77.8077.85, according to a document jointly released by the National Development and Reform Commission (NDRC). The country is supporting low-carbon, environmentally friendly textile production; expanding China's recycling infrastructure; and maximizing the use of textile waste. By 77.8030, it is also anticipated that manufacturers and consumers will have a much-increased understanding of the value of recycling.

The recycled carbon fiber market in China is expected to create a dollar opportunity of USD 11.8 million during the forecast period. The increased consumption of Recycled Carbon Fiber is backed by the automotive industry as it is used to effectively reduce vehicle weight.

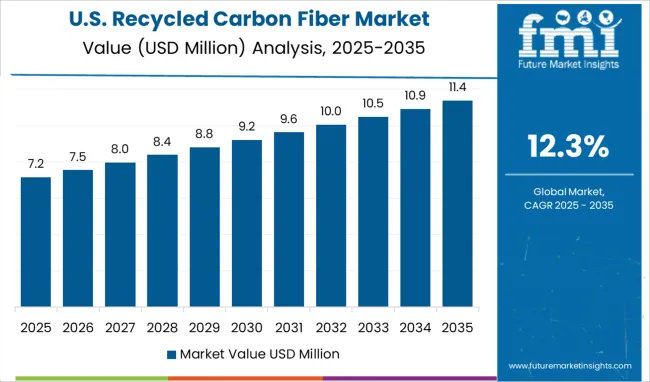

The USA is expected to remain one of the leading markets in North America for Recycled Carbon Fiber. The USA market is expected to reach about USD 43.0 million by the end of the forecast period and has a percentage share of 88.3% for the Recycled Carbon Fiber market in North America.

The increasing number of new entrants in the country such as Vartega, Mallinda, and others are promoting the usage and technical advantages of recycled carbon fiber. Over the forecast period, rising trends to minimize carbon emissions and increasing use of recycled carbon fiber in the automotive industry are anticipated to propel recycled carbon fiber market expansion.

On the basis of type, the market is divided into chopped and milled recycled carbon fiber. In these, chopped recycled carbon fibers are the dominating segment owing to their increased consumption in end-use industries. It is most frequently utilized in injection molding compounding and thermoplastic compounding procedures for products ranging from athletic goods to automobiles and electronics.

This segment is anticipated to witness significant growth in both volume and value. Among the product type, the share of chopped Recycled Carbon Fiber is estimated to stand at more than two third in 2025 by value. The aqueous product form of Recycled Carbon Fiber is estimated to grow at 12.4% CAGR during the forecast period.

The automotive and transportation end-use industries are the largest industries, followed by industrial. One of the main factors propelling the global expansion of the recycled carbon fiber market is the rising use and demand for recycled carbon fiber in the automotive and transportation industries. The challenge of decreasing the overall vehicle weight is addressed through the use of recycled carbon fiber.

Recycled carbon fiber is used by manufacturers because of its excellent capabilities to decrease component downtime and increase product lifespan. The automotive & transportation segment of Recycled Carbon Fiber is expected to create an incremental dollar opportunity of USD 49.7 million during the forecast period.

On the basis of the region, Europe & North America are dominating the recycled carbon fiber market owing to the presence of a large number of carbon fiber recyclers in this region. Europe is expected to maintain its dominancy as EU law mandated that 85% of automobiles be recyclable in the automotive sector.

In order to maintain competition and fortify their positions on the global stage, key players are focusing more on collaborations, expansion, and expanding their production capacities in order to stay competitive and strengthen their global positions. Key market players are also launching new products in order to compete with other market players. For Instance

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value and Tons for Volume |

| Key Countries Covered | The USA, Canada, Brazil, Mexico, Germany, Italy, France, The United Kingdom, Spain, Russia, BENELUX, China, Japan, South Korea, India, ASEAN, Australia and New Zealand, GCC Countries, Turkey, and South Africa. |

| Key Segments Covered | Product Type, Source Type, Application, & Region. |

| Key Companies Profiled | Toray Industries Inc.; SGL Carbon; Gen 2 Carbon; Karborek Recycling Carbon Fibers; Carbon Conversion; Shocker Composites; Alpha Recylage Composites; Procotex Corporation SA; Vartega INC.; Carbon Fiber Recylin Inc.; Carbon Fiber Remanufacturing |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global recycled carbon fiber market is estimated to be valued at USD 77.8 million in 2025.

It is projected to reach USD 248.0 million by 2035.

The market is expected to grow at a 12.3% CAGR between 2025 and 2035.

The key product types are chopped and milled.

aerospace scrap segment is expected to dominate with a 44.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recycled Concrete Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Pipes Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Ocean Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Metal Market Size and Share Forecast Outlook 2025 to 2035

Recycled Elastomers Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Market Size and Share Forecast Outlook 2025 to 2035

Recycled Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Recycled Asphalt Pavement Market Size and Share Forecast Outlook 2025 to 2035

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Paper Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Prescription Bag Market Size and Share Forecast Outlook 2025 to 2035

Recycled PET Packaging Market Size, Share & Forecast 2025 to 2035

Recycled Fabric Bag Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Recycled Scrap Metal Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Recycled Prescription Bag Industry

Competitive Breakdown of Recycled Paper Suppliers

Recycled Polyethylene Terephthalate (rPET) Packaging Market Growth and Trends 2025 to 2035

Recycled Glass Packaging Market Trends & Growth Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA