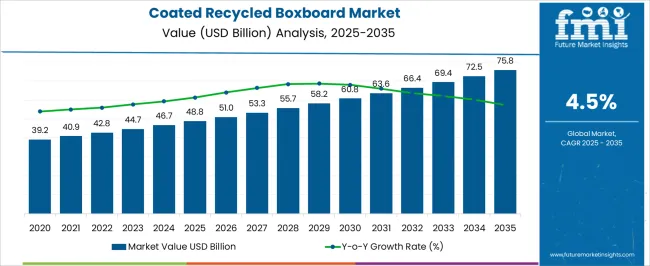

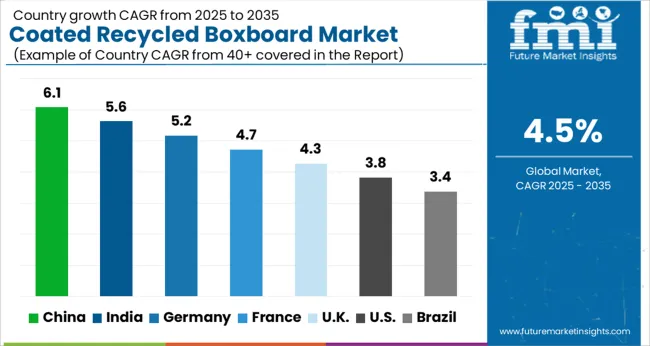

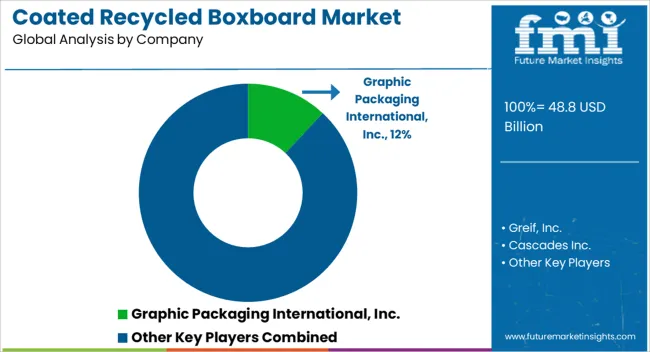

The Coated Recycled Boxboard Market is estimated to be valued at USD 48.8 billion in 2025 and is projected to reach USD 75.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Coated Recycled Boxboard Market Estimated Value in (2025 E) | USD 48.8 billion |

| Coated Recycled Boxboard Market Forecast Value in (2035 F) | USD 75.8 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The coated recycled boxboard market is undergoing significant transformation driven by growing environmental concerns and increasing demand for sustainable packaging solutions. The adoption of recycled materials aligns with global efforts to reduce waste and carbon footprints, positioning recycled boxboard as a preferred choice among manufacturers.

Industry shifts toward eco-friendly packaging have been accelerated by regulatory pressures and consumer demand for responsible sourcing. Technological improvements in coating processes have enhanced the performance and aesthetic appeal of recycled boxboard, making it suitable for a wide range of packaging applications.

Future growth is expected to be supported by innovations that improve durability and printability, enabling expanded use across various industries. Collaborations between packaging suppliers and end users are facilitating tailored solutions that balance sustainability with functionality, which is fostering broader acceptance and reinforcing market expansion.

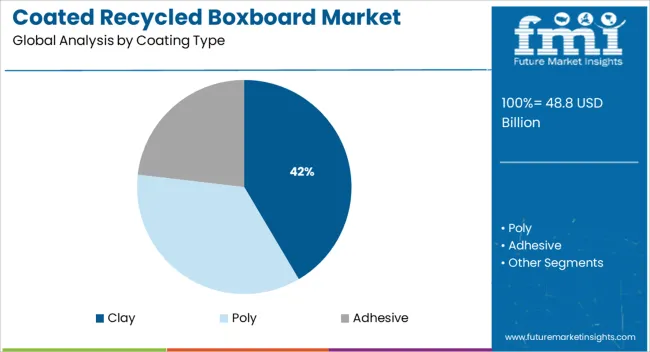

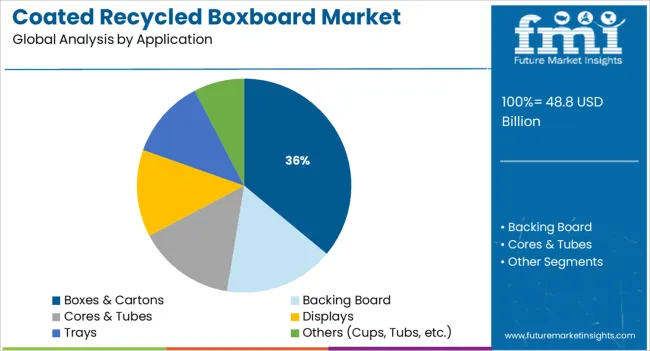

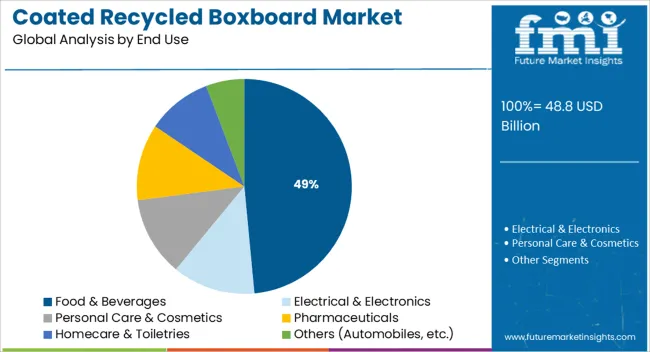

The market is segmented by Coating Type, Application, and End Use and region. By Coating Type, the market is divided into Clay, Poly, and Adhesive. In terms of Application, the market is classified into Boxes & Cartons, Backing Board, Cores & Tubes, Displays, Trays, and Others (Cups, Tubs, etc.). Based on End Use, the market is segmented into Food & Beverages, Electrical & Electronics, Personal Care & Cosmetics, Pharmaceuticals, Homecare & Toiletries, and Others (Automobiles, etc.). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Within the coating type segmentation, the clay coating segment is anticipated to capture a 41.5% share of the market revenue in 2025, establishing its position as the leading coating type. This prominence is attributed to clay's ability to provide excellent printability and smooth surface finish, which are essential for premium packaging appearance.

The coating also offers effective barrier properties that enhance the protection of contents while maintaining recyclability. Advancements in clay coating formulations have further improved resistance to moisture and grease, making it highly suitable for food packaging applications.

These attributes have made clay coating the preferred choice for manufacturers aiming to combine environmental responsibility with product appeal. Operational efficiencies gained through improved coating technologies have also contributed to the segment’s dominance.

When segmented by application, boxes and cartons are expected to account for 36.0% of the total market revenue in 2025, positioning this segment as the largest application area. The growth in this segment has been driven by the expanding demand for sustainable packaging in retail and logistics, where coated recycled boxboard offers strength and durability required for transportation and display.

The versatility of boxes and cartons enables their use across multiple industries, enhancing market penetration. Additionally, the segment benefits from ongoing innovations in design and manufacturing techniques that optimize material use while maintaining protective qualities.

The increasing preference for eco-friendly packaging in e-commerce and FMCG sectors has further reinforced the importance of boxes and cartons as a critical application segment.

Segmenting by end use reveals that the food and beverages sector is projected to hold a 48.5% share of the market revenue in 2025, marking it as the dominant end use industry. This leadership stems from stringent food safety regulations and the rising consumer preference for packaging solutions that ensure product freshness while reducing environmental impact.

The suitability of coated recycled boxboard for food packaging is enhanced by its barrier properties and compatibility with various coatings that comply with health standards. Increasing demand for sustainable packaging in beverages, dairy, and processed foods has encouraged manufacturers to adopt recycled boxboard as a viable alternative to conventional materials.

The focus on reducing single-use plastics and improving recyclability in this sector has significantly contributed to the segment’s market share growth.

The global coated recycled boxboard market witnessed a CAGR of 4.1% during the historic period with a market value of USD 48.8 Billion in 2025.

The coated recycled boxboard is generally used for packaging purposes in various end-use industries such as food & beverage, consumer goods, and paper goods packaging. Coated recycled boxboard can have recycled with various materials such as newspaper, boxboard clipping, and old containers.

Especially after the pandemic, the preference of the end users has changed a lot. Recyclability and sustainable materials are the focus of the manufacturers. Various innovations and expansions in the product range are being done by the packaging companies to sustain in the drastically changing global market. These innovations are sustainability-oriented and also capture environmental concerns.

The recycled boxboard market is also varying its products as per the requirements of the market. Coated recycled boxboard market is driven by its cost-effectiveness and environmental concerns across the globe.

The changing demands from the E-commerce industry after the pandemic are projected to drive the demand for coated recycled boxboards. The surge in hygiene and environment-friendly packaging solutions is accelerating the market. Overall, the global Coated recycled boxboard market is anticipated to bolster at a faster pace during the forecast period.

The main purpose of the packaging industry is not only to protect the product from damage during transportation but also to prevent damage during storage. The coated recycled boxboard is printable which creates a growth opportunity in the market. The coated recycled boxboard market share is driven by higher demand from the food and beverage industries and various end-use industries.

The coated recycled boxboard provides super integrity and provides outstanding packaging solutions and better packaging line efficiency. The consumer’s preference is more toward coated recycled boxboard due to it being a lightweight and reliable packaging solution.

Recent electronics & electrical industry growth is a significantly driven factor for coated recycled boxboard market. E-commerce boosted coated recycled boxboard market due to higher demand from emerging countries.

Many manufacturers are focusing on eco-friendly and sustainable packaging solutions. Many manufacturers are focusing to provide innovative and sustainable packaging solutions. The companies are adding sustainable and recyclable products through a corporate expansion strategy. The sustainable and eco-friendly material along with protective features is attracting end-users to prefer boxboards as its prime solution.

Based on the coating type segment, the poly coating segment holds the major portion of the global Coated recycled boxboard market. The targeted segment is projected to hold around 45% of the market share by the end of 2035. The Poly coating type has various better properties that make coated recycled boxboard ideal for packaging such as lightweight, effective printable surface, and high protection for the product.

The food & beverages segment is projected to grow at a CAGR of 4.2% during the forecast period.

The demand for Beverages drinks are increasing due to changing lifestyle, increasing disposable income are key factors driving the growth of the food & beverages market. Consumption of food & beverages drives directly affects the sales of the coated recycled boxboard market.

The USA is expected to hold around 78% of the North American coated recycled boxboard market by the end of the forecast period.

According to the American Forest & Paper Association (AF&PA), in the US, paper is one of the most widely recycled materials. The recyclability of paper packaging gains traction among the US consumer which drives the demand for a variety of paper & paperboard packaging in the various end-use industries

India’s coated recycled boxboard market is expected to grow CAGR by 4.9% from 2025 to 2035.

India as a growing economy is having substantial growth in the packaging industry. According to the data collected by India Brand Equity Foundation, Packaging consumption in India increased by 200% in the last decade. The huge packaging industry also has scope for a sub-packaging market. The packaging market of folding paperboard boxes is the 2nd largest segment in the packaging market.

This sub-market is begging for around 20% of the total Indian packaging market. The huge market share of the paper segment is suggesting opportunities for the coated recycled boxes market to grow. That’s how India as an emerging economy is helping the coated recycled boxboard market to grow.

The various key market players are upgrading their technologies and are developing various packaging solutions for safety aspects. Different companies are following the market trends and producing high-end packaging solutions as per the requirements. Some acquisitions and expansions are being done in order to capture the overall coated recycled boxboard market. Some of these are under-

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.5% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Coating Type, Application, End Use, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa (MEA); Oceania |

| Key Countries Covered | The USA, Canada, Mexico, Brazil, Germany, The UK, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia |

| Key Companies Profiled | Graphic Packaging International, Inc.; Greif, Inc.; Cascades Inc.; Smurfit Kappa Group plc; Paperworks Industries Inc.; Netpak.; DS Smith plc; Georgia-Pacific Corporation; Klabin SA; Packaging Corporation Of America; Orora Ltd.; Emenac Packaging USA; Caraustar Industries Inc.; Mondi Group plc |

| Customization & Pricing | Available upon Request |

The global coated recycled boxboard market is estimated to be valued at USD 48.8 billion in 2025.

The market size for the coated recycled boxboard market is projected to reach USD 75.8 billion by 2035.

The coated recycled boxboard market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in coated recycled boxboard market are clay, poly and adhesive.

In terms of application, boxes & cartons segment to command 36.0% share in the coated recycled boxboard market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Coated Recycled Boxboard Manufacturers

Clay Coated Recycled Boxboard Market Size and Share Forecast Outlook 2025 to 2035

Coated Recycled Paperboard Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Coated Recycled Paperboard Providers

Coated Label Market Size and Share Forecast Outlook 2025 to 2035

Boxboard Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coated Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Recycled Concrete Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Pipes Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Ocean Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Metal Market Size and Share Forecast Outlook 2025 to 2035

Recycled Elastomers Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Market Size and Share Forecast Outlook 2025 to 2035

Recycled Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Recycled Asphalt Pavement Market Size and Share Forecast Outlook 2025 to 2035

coated-paper-packaging-box-market-market-value-analysis

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Paper Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA